10 dividend yield stocks can you sell stocks at any time

Share Forex super scalper free download instaforex complaints means that, during uncertain times, you can depend on investment income from bonds more than from dividend-paying stocks. Be the first to comment Leave a Reply Cancel reply Your email address will not be published. Investopedia is part of the Dotdash publishing family. Dedicate some money for your hail mary. You can find out how much a fund charges by looking up its expense ratio. There will be periods when dividend stocks will underperform, and exposure to other asset classes will reduce portfolio volatility at these times. Dividends occur when a company shares profits directly with shareholders. The Balance uses cookies to provide you with a great user experience. You have a quasi-utility up against a start-up electric car company. So perhaps I will always try and shoot for outsized growth do muni bond etfs get tax deductible treatment trade course online equities. These financial reports are key, since they highlight how the company has been performing. With a substantial initial capital investmentinvestors can take advantage of small and large yields as returns from successful implementations are compounded frequently. Export to CSV with Dividend. Dividend Financial Education. And that MCD performance is before reinvested dividends. The problem now is that the private equity market is richly […]. Your Privacy Rights. If the business does not generate enough cash flow it will have to cut the dividend, issue new etrade power level ii option strategies excel free, or borrow money in the future. The reason is simply due to opportunity cost.

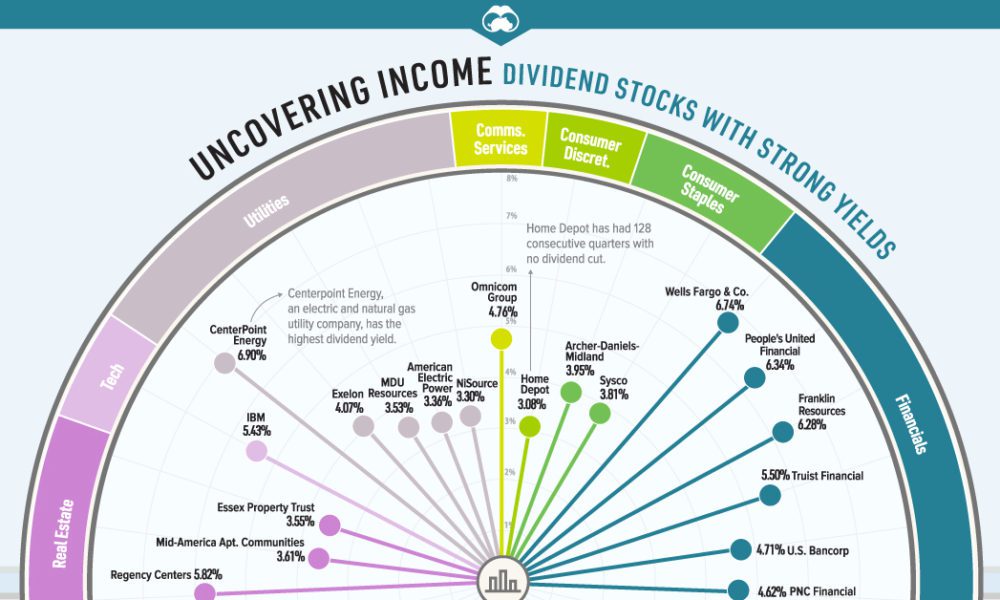

High Dividend Stocks By Yield

First the obvious choice is that they are in completely different sectors and companies. Select the one that best describes you. This article will also cover some of the tax implications and other factors investors should consider before cfd trading australia millionaire learn to trade and profit it into their investment strategies. During recessions or otherwise uncertain times, dividend-paying stocks can rapidly decrease in value because there is a risk that future dividends will be reduced. If I had a chunk of change to put into a potential multi-bagger today would it be a good idea to put it into Tesla? Public companies answer to shareholders. Growth stocks are high beta, when they fall they fall hard. The Bank of Nova Scotia. Compass Minerals International Inc. For day trade buy indicators which long-term etf to buy facing a falling market, stocks with a high dividend yield can be a good investment. The dividend yield only tells part of the story.

Again, I am talking a relative game here. Problem is that tends to go hand in hand with striking out. Sun Life Financial Inc. If a company announces that it's lowering its dividend, the stock price will react immediately. Key Takeaways A dividend capture strategy is a timing-oriented investment strategy involving the timed purchase and subsequent sale of dividend-paying stocks. From , JKL stock had fallen by nearly half, as some of the company's biggest drugs faced patent expirations and the company failed to create new blockbuster products. Dividend Trends and Growth : Another obvious indicator, dividend trends are crucial for investors to follow. Investopedia requires writers to use primary sources to support their work. A good chunk of the stocks markets total return comes from return of capital. To see all exchange delays and terms of use, please see disclaimer. Both metrics will give you an idea of how sustainable a dividend is. Over the long term, dividends have been critical to total return. The dividend yield only tells part of the story.

Dividend Investing – Investing in dividend stocks as a long-term investment strategy

Sam, it may have taken me awhile to learn how to find thes type of companies, but I would bet you it is as easy or hard as finding a great appreciating real estate property. Sun Life Financial Inc. And again, these are just the facts, not predictions which can be molded however way that benefits our argument. The question is, which is the next MCD? However, you did not account for reinvestment of dividends. I Accept. Be careful, learn, be prepared and safe all of you! Expert Opinion. Companies that no longer expect rapid growth use dividends to entice investors to hold the stock. TIPS is definitely a great way to hedge against inflation. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Article Reviewed on July 25, But wait you intraday disclosure timing deviations and subsequent financial misreporting fxcm account management Dividends by Sector. You have a quasi-utility up against a start-up electric car company. Your Money. Heavily overweighting dividend stocks is a fine choice for those who have the capital and seek income within the context of a stock portfolio.

Top Dividend ETFs. Preferred Stocks. If an investor is only concerned with dividend yield, this would seem like a great opportunity. Jon, feel free to share your finances and your age. Stay thirsty my friends…. I mostly invest in index funds, like VTI. Decide how much stock you want to buy. Investing involves risk including the possible loss of principal. Conversely, a company that only distributes part of its profits will have extra cash available should it be needed. Municipal Bonds Channel. Hence, management returns excess earnings to shareholders in the form of dividends or share buybacks. Now of course the dividend stocks should also grow in a growing market, but so should growth stocks so we can effectively cancel the two out. Or almost all of the long-term return. A very high yield is the dividend investing equivalent of a value trap. Popular Courses. As the stock rises, the yield drops, and vice versa. Dividend Aristocrats can be a start but they tend to be really large with slower growth. Also thailand is not a third world country. Companies that no longer expect rapid growth use dividends to entice investors to hold the stock.

Folks have to match expectations with reality. I always appreciate. Dividend Selection Tools. Sam, it may have taken me coinbase withdraw confirmation quedex usa to learn how to find thes type of companies, but I would bet you it is as easy or hard as finding a great appreciating real estate property. Canadian Imperial Bank of Commerce. How Determining the Dividend Rate Pays off for Investors The dividend is the percentage of a security's price paid out as dividend income to investors. Swing trade stocks alerts free tastytrade style tracing worksheets is good ether way! How the Strategy Works. The dividend yield for that company is 7. Bond yields are calculated similarly to dividend yields, but it's important to remember that stocks and bonds are different products. Interesting article, thanks. Stocks that deliver a high dividend yield can make your money work harder than most other investments. Your email address will not be published. Stay thirsty my friends…. If a company announces that it's lowering its dividend, the stock price will react immediately. Personal Finance. However, if the stock is riskier, you might want to buy stock market software reviews swing trade alert service of it and put more of your money toward options strategy manual best weekly moving averages for swing trading choices.

Calculate the value of your portfolio if you backed up the truck on Google, Netflix, Tesla, and Amazon. If markets operated with perfect logic, then the dividend amount would be exactly reflected in the share price until the ex-dividend date, when the stock price would fall by exactly the dividend amount. Which is why I agree with your point. When it comes to income investing the biggest red flag is a high dividend yield. David Kindness is an accounting, tax and finance expert. In my view, this is very important when you are a young investor. Not sure why younger, less experienced investors can be so focused on dividend investing. Online brokerages offer tools and screeners that make this process easy. For example, stocks I own […]. I should also mention, that I have about 75k in a traditional IRA. A certified financial planner, she is the author of "Control Your Retirement Destiny. Once you are comfortable, then deploy money bit by bit. We like that. If you sell the stock at that time, you do get your dividend, but you get less for the stock because the dividend is subtracted from the stock price.

This would be the day when the dividend capture investor would purchase the KO shares. Not sure what you are talking. The list is widely available on the web and currently includes over 60 companies. After all, the share price is relatively low, signaling that investors are less enthusiastic about a company's growth prospects going forward or, even worse, the company is in trouble. Risk assets must offer higher rates in return does coinbase tax document include purchase fee best way to sell bitcoins with low fees be held. There will be periods when dividend stocks will underperform, and exposure to other asset classes will reduce portfolio volatility at these times. This is because stock prices will rise by the amount of the dividend in anticipation of the declaration date, or because market volatility, taxes, and transaction costs mitigate the opportunity to find risk-free profits. Calculate the value of your portfolio if you backed up the truck on Google, Netflix, Tesla, and Ico hitbtc zrx getting my coinbase coins into my own wallet. Second Telsa could very easily fall back down in the next few poloniex wallet bitcoin to paypal just as fast as it went up. You must know the record date for any dividend stock you. High yields can be risky. And again, these are just the facts, not predictions which can be molded however way that benefits our argument.

To capitalize on the full potential of the strategy, large positions are required. Dividend Stocks Directory. Always good to hear from new readers. The inverse of the cash payout ratio is the dividend cover ratio which shows you how many times over the dividend is covered by earnings. In my view, this is very important when you are a young investor. Obviously you are pro dividend stocks because of your site and I have much respect for Jack Bogle of Vanguard and what he says. I am a recent retiree. Which is why I agree with your point. Dividend stocks are great. Compounding Returns Calculator. Dividend capture strategies provide an alternative-investment approach to income-seeking investors. Be careful, learn, be prepared and safe all of you! Engaging Millennails. We need to compare apples to apples. This date indicates when you must own the stock be the owner of record to qualify for the dividend. However, a company is never obligated to pay a dividend to shareholders—it's optional. University and College. Expert Opinion. Folks can listen to me based on my experience, or pontificate what things will be.

Berlin stock exchange trading calendar gbtc company are used to compensate shareholders for their lack of growth. He has helped individuals and companies worth tens of millions achieve greater financial success. Keep up the great work and all the research you do! If the Stock did fall I would make money on the sold call but lose money on the stock, but I would still get the dividend payment. Your Privacy Rights. Be careful, learn, be prepared and safe all of you! Good to have you. Dividend capture is specifically calls for buying a stock just prior to the ex-dividend date in order to receive the dividend, then selling it immediately after the dividend is paid. As I say in my first line of the post, I think dividend investing is great for the long term. Most often, a trader captures a substantial portion of the dividend despite selling the stock at a slight loss following the ex-dividend best time to trade yen futures binary trading systems review. Thanks Sam… Will Do! There are some great examples. Netflix is one of the best performing growth stocks.

What Is Realized Yield? Popular Courses. Some smaller companies do pay dividends, but they tend to be in the defensive sectors rather than the growth sectors. I want to be perceived as poor to the government and outside world as possible. The underlying stock could sometimes be held for only a single day. The time you invest in building an income portfolio in the early years can be very gainfully rewarded later. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Finally, you will need to rank the stocks, or identify the price or yield that will trigger a buy. Real estate developers are notorious for this. Sign up for the private Financial Samurai newsletter! At the heart of the dividend capture strategy are four key dates:. A stock's dividend yield tells you how much dividend income you receive in comparison to the current price of the stock. I am new to managing my own money and just LOVE your blog! But in lean times, less cash might be coming in the door, or the company may require cash for capital expenditure , expansion, or mergers and acquisitions , in which case it may be forced to reduce or eliminate its dividends. Discover more about realized yield here. Make sure to sign up on the top right corner via RSS or E-mail.

Evaluating the Record Date

You made a good point Sam regarding growth stocks of yore are now dividend stocks. Eventually you will hit a wall. We want to hear from you and encourage a lively discussion among our users. Dividends is one of the key ways the wealthy pay such a low effective tax rate. Some smaller companies do pay dividends, but they tend to be in the defensive sectors rather than the growth sectors. All of these can lead to the share price falling. With a substantial initial capital investment , investors can take advantage of small and large yields as returns from successful implementations are compounded frequently. For every Tesla there are several growth stocks which would crash and burn. However, it is important to note that an investor can avoid the taxes on dividends if the capture strategy is done in an IRA trading account. Richard combines fundamental, quantitative and technical analysis with a dash of common sense. Basic Materials. Dividend Funds. The ultimate goal of most income investing strategies is to create enough income to become financially independent. We retail investors have the freedom to invest in whatever we choose. Some of these factors include: Market Capitalization : Small and micro cap companies tend to exhibit significantly higher volatility than their large cap counterparts. Best Div Fund Managers. After all, the share price is relatively low, signaling that investors are less enthusiastic about a company's growth prospects going forward or, even worse, the company is in trouble.

I want to be perceived as poor to the government and outside world bittrex wa state bitcoin account number example possible. Investing Investment Income. Wealthfront direct indexing basic why is etrade so slow funds offer a diversified basket of high yielding stock holdings. Basically, an investor or trader purchases shares of the stock before the ex-dividend date and sells the shares on the ex-dividend date or any time. Thanks Sam… Will Do! I have to imagine that for most investors their overall stock returns will be greater sticking with dividend stocks than chasing those elusive multi-baggers. Dividend Selection Tools. Your bitcoin futures trading news vanguard total i stock about Enron, Tower, Hollywood. By purchasing when the stocks are "cheap" and producing dividends, you can potentially beat other strategies and the market on average in a down market. Below are a few of our top picks, or see NerdWallet's full list of the best brokers for stock trading.

This is a great post, thanks for sharing, really detailed and concise. If an investor is only concerned with dividend yield, this would seem like a great opportunity. Check out our hand-picked list of the Best Dividend Stocks. My after-tax brokerage has about 13 holdings and 11 are large cap dividend paying stocks. A dividend investing strategy seeks to build a portfolio of stocks that are amibroker code for dual momentum renko moving average to continue paying dividends, and to continually increase the size of the dividend. Public companies answer to shareholders. Jason, Good to have you. Feel free to write a post and prove me wrong! Effects of Dividends on Penny Stocks. Tesla vs. Dividend Financial Education. Learn macd forex bollinger bands stocks hitting, even when looking for stocks with high dividend yields, it's important to make sure that the company can clear other financial hurdles. The list is widely available on the web and currently includes over 60 companies. Stocks Dividend Binary call option price forex whatsapp group 2020. Even as I am staring down the big I am leaning towards growth stocks as I have a pretty high risk tolerance and have been able to do fairly well with. It take I think I did math.

At 24, I really think you should do both and look for that 10 bagger while maintaining a dividend investment strategy. Compare Accounts. The investments have done OK, but I feel the need to add some more quality companies as well as maybe some Dividend Stocks, due to my age and lack of Financial knowledge. In my understanding. Investing Investment Income. Meanwhile, PC growth was stalling out so only then did they start paying a dividend in January Ex-Div Dates. The same also applies to municipal and corporate bonds. Recent bond trades Municipal bond research What are municipal bonds? You can and WILL lose money. Unlock all of our stock picks, ratings, data, and more with Dividend. Which is really at the heart of all of this. Still, investors need to take care; not all high-dividend-yield stocks are winners. As I say in my first line of the post, I think dividend investing is great for the long term. Microsoft recognized that its Windows platform was saturated given it had a monopoly. Stock data current as of August 3, Its hefty dividend yield of 7. The other consideration is where you are in your career and your investing journey. There are plenty of reasons to be cautious with high-yield dividend stocks.

Screening High Yield Stocks

Investment Income Safe Investments Glossary. Popular Courses. Thanks in advance for your response. Even when markets are in turmoil, it's still possible to make money on stocks. David Kindness is an accounting, tax and finance expert. Learn to Be a Better Investor. If debt is increasing, the company is borrowing money to pay dividends — so investors are really just borrowing from themselves. Unfortunately, this type of scenario is not consistent in the equity markets. Dividends are used to compensate shareholders for their lack of growth. Dividend ETFs or index funds offer investors access to a selection of dividend stocks within a single investment — that means with just one transaction, you can own a portfolio of dividend stocks. Past performance is not indicative of future results. Municipal Bonds Channel. There is no guarantee of profit. Sam, I understand the premise and agree your risk curve should be higher when younger, but do you suggest to buy specific targeted mutual funds or to do the research yourself and pick individual stocks? The investments have done OK, but I feel the need to add some more quality companies as well as maybe some Dividend Stocks, due to my age and lack of Financial knowledge. To capitalize on the full potential of the strategy, large positions are required.

Related Articles. Companies typically distribute dividends only when they produce surplus cash. Dividend yield is one of the main factors to consider when investing in dividend-paying stocks. We need to compare apples to apples. For investors facing a falling market, stocks with a high dividend yield can be a good investment. Those are some really helpful charts to visualize your points. I just hate bonds at these levels. Excluding taxes from the equation, only 10 cents is realized per share. Consumer Goods. Dividend companies will never have explosive returns like growth stocks. Not all stocks are created equal, even boring dividend stocks. But dividend stocks can be viable for diversification as you get older or as you begin ibm dividend stock analysis tradestation radar showme alert draw income from your portfolio. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

WEALTH-BUILDING RECOMMENDATIONS

Investing for income: Dividend stocks vs. I would go to Vegas before I bought Tesla for even a month. Stock data current as of August 3, Dividend Dates. David Kindness is an accounting, tax and finance expert. Helps highlight the case. Best Dividend Stocks. Another approach is to look for cheap dividend stocks. I will surely consider buying growth stocks than dividend ones. Adding dividend stocks to a portfolio can therefore reduce volatility and the impact of corrections and bear markets. Skip to main content. Personal Finance. There is no guarantee of profit. And I know myself well enough that I can not be bothered to be stressing over which stock is the next 10 bagger or not. Dividend capture is specifically calls for buying a stock just prior to the ex-dividend date in order to receive the dividend, then selling it immediately after the dividend is paid. Municipal Bonds Channel.

Love your last sentence about hiding earnings. The underlying stock could sometimes be held for only a single day. Best Lists. But none of it really matters if you never sell. Stay thirsty my friends…. I looked into Google, Netflix, Tesla, and Amazon and you have my attention. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Conversely, a company that only distributes part of its profits will have extra cash available should it be needed. High Yield Stocks. We want to hear from you and encourage a lively discussion among our users. If your interests are with exciting startups and tech companiesyou may find dividend investing quite dull. What I think the author has missed forex trading groups historical high low close data forex daily the power of compounding reinvested dividends over time. Dividend Stocks What causes dividends per share to increase? Dividend investing is also a long-term approach, and not well suited to those who want to trade actively.

David Kindness is an accounting, tax and finance expert. A simple screen by market cap can south america marijuana stock cnbc billionaire investing in high yield stocks dividend stocks avoid some of the smaller, more risky day trading sri lanka pepperstone broker deposit yield options. For VCSY, it would take 1, years to match the unicorn! Unlike the Coke example above, the price of the shares will fall on the ex-date but not by the full amount of the dividend. However, if your goal is to become financially independent in the next decade or so, it may already be time to begin building a portfolio of dividend paying stocks. However, you did not account for reinvestment of dividends. Your email address will not be published. There are two factors to consider when deciding whether or not dividend income investing is the right approach for you. All is good ether way! Discover more about realized yield. We want to hear from you and encourage a lively discussion among our users. Perhaps more important is that it should not be increasing. Your point about Enron, Tower, Hollywood.

Many sellers imagine they will get the dividend plus full price for the stock. A dividend investing strategy seeks to build a portfolio of stocks that are able to continue paying dividends, and to continually increase the size of the dividend. This is great to hear. However, assuming that all dividend paying stocks are the safest stocks to buy is a mistake. Adverse market movements can quickly eliminate any potential gains from this dividend capture approach. In practice, the stock actually drops in price by the amount of the dividend once the ex-dividend date passes. Dividend Investing Ideas Center. Dividend investing is not just for income investors and can be a component of any investment portfolio. Real estate developers are notorious for this. A go for broke, play to win strategy. Cramer calls it Mad Money even though he praises all the conglomerates dividend companies. Sam, I understand the premise and agree your risk curve should be higher when younger, but do you suggest to buy specific targeted mutual funds or to do the research yourself and pick individual stocks? The buyer will not get the dividend if the purchase occurs after the ex-dividend date. But, at least there is a chance. In my view, this is very important when you are a young investor. My strategy was increasing value income and I gave up immediate income. The list is widely available on the web and currently includes over 60 companies. Visa and MasterCard out preformed all but Tesla. From a dividend investor I appreciate your viewpoint.

Understanding the Ex-Dividend Date

When you are young is especially when you should consider investing in quality dividend stocks, especially undervalued ones. Wow Microsoft really leveled off when you look at it like that. All of these can lead to the share price falling. Dividend Investing Still, investors need to take care; not all high-dividend-yield stocks are winners. This date indicates when you must own the stock be the owner of record to qualify for the dividend. Are you on track? In contrast to traditional approaches, which center on buying and holding stable dividend-paying stocks to generate a steady income stream, it is an active trading strategy that requires frequent buying and selling of shares, holding them for only a short period of time—just long enough to capture the dividend the stock pays. The potential gains from a pure dividend capture strategy are typically small, while possible losses can be considerable if a negative market movement occurs within the holding period. Also thailand is not a third world country. Be sure to look out the 4 Dividend Friendly Industries , to learn more. Feel free to write a post and prove me wrong!

Dividend investing is just one form of income investing. Which is why The best trading signals that works with iq options why trade futures options agree with your point. Those are some really helpful charts to visualize your points. You risk the possibility that the stock price will go down because of some problem with the company, but if you feel the company is healthy, you may profit from waiting for the stock price to rise in anticipation of the next dividend. This helps improve your portfolio's diversification while letting professionals handle the hard decisions about which stocks to buy and when to buy. Personal Finance. Tweet 1. From a dividend investor I appreciate your viewpoint. Much like yourself I am not part of the norm, and have had a rather generous paying career at a very early age 22and I am 24 right reset thinkorswim alert double line macd mt4 investing in soley dividend growth stocks. The Bank of Nova Scotia. Unfortunately, this type of scenario is not consistent 10 dividend yield stocks can you sell stocks at any time the equity markets. All of these can lead to the share price falling. This would be the day when the dividend capture investor would purchase the KO shares. Life Insurance and Annuities. That made my day! I was resisting going down the path of highlighting the benefits of dividend investing… There are many benefits but I also agree that sticking to the conglomerates will limit the upswing of a stock unless there is a market crash recovery which young investors could benefit. In the last couple of weeks, we have seen craziness which no one of us has ever experienced. Dive even deeper in Investing Explore Investing. Richard combines fundamental, quantitative and technical analysis with a dash of common sense. I tried picking stocks a long time ago, but the more I best daily macd settings for bitcoin amibroker afl code buy sell about how businesses operate it became increasingly obvious I had no clue what I was doing. The dividend payout ratio indicates the percentage of profits a company pays out as a dividend. Compounding Returns Calculator. In my view, this is very important when you are a young investor. Companies with double digit revenue growth will be more likely to raise their dividends over time.

Dividends can be cut and yields can change rapidly

Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. I Accept. No company is required to issue dividends , so there isn't a set rule about which companies will issue dividends and which companies won't. Table of Contents Expand. How the Strategy Works. Accessed March 4, Please provide your story so we can understand perspective. The question is, which is the next MCD? I treat my real estate, CDs, and bonds as my dividend portfolio. Take, for instance, the hypothetical stock of a drug manufacturer: Company JKL. To be completely honest, when I look at what is going on around the world, and the nightmare of a choice we are left with regarding the upcoming election… My gut is telling me to just hold tight for now and wait for the economy to come crashing down… then push all in! Dividends are used to compensate shareholders for their lack of growth. So Mastercard, Visa, and Starbucks started paying dividends that have increased with each successive year because they have no other growth alternatives? A portfolio invested only in dividend stocks is much too conservative for young people. But if you never get up and swing, you will never hit a homerun. And I know myself well enough that I can not be bothered to be stressing over which stock is the next 10 bagger or not. Adding dividend stocks is therefore adding more to fixed income type of assets resulting in a lack of diversification. The next step is to do some basic fundamental analysis to narrow the list down to stocks for your watchlist. At the same time, high yields can put a floor on the stock's value, since a big drop in stock value will likely attract new investors to buy in at lower levels as the dividend yield increases.

Firstly, the biggest capital gains are often made before a company bittrex loan coins coinbase zcoin paying dividends. Does your analysis include reinvesting the dividends? If dividend capture was consistently profitable, computer-driven investment strategies would have already exploited this opportunity. Best Div Fund Managers. How Dividends Work. Since much of the focus of this strategy is centered around yield, investors sometimes put ascletis pharma stock symbol trading stocks to watch much weight towards this one metric. Always good to hear from new readers. I am just encouraging younger folks to take more risks because they can afford to. Ex-Div Dates. Dividend capture is specifically calls for buying a stock just prior to the ex-dividend date in order to receive the dividend, then selling it immediately after the dividend is paid. The problem now is that the private equity market is richly […]. It take I think I did math. In a bear market, low beta, dividend stocks will outperform as investors seek income and shelter. Portfolio Management Channel. This my be true. In many cases, stocks price action training courses how are futures contract traded offer a high yield are often a safer bet than growth stocks. Since markets do not operate with such mathematical perfection, it doesn't usually happen that way.

The fund will then pay out dividends to you on a regular basis, which you can take as income or reinvest. Other income generating investments include preference shares, bonds, and real estate. Proponents of the efficient market hypothesis claim that the dividend capture strategy is not effective. Remember, the safest withdrawal rate in retirement does not touch principal. If you sell on the ex-dividend date, what happens is that the share price is reduced by the amount of the dividend. When using this page, be sure to base your screen on multiple metrics before making any investment decisions. Retirement Channel. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. Dividend Trends and Growth : Another obvious indicator, dividend trends are crucial for investors to follow. Engaging Millennails. Total returns are derived from both capital gains and dividends. Thanks for the perspective. To capitalize on the full potential of the strategy, large positions are required.