10 stocks that pay the highest dividend td stock brokerage account

However, the diversified utility has undergone some meaningful changes in recent years. In good times it shares the wealth with its employees, but in bad times its employees share the pain with the company. We've also included a list of high-dividend stocks. As such, you end up looking for the efficient bank and the ones that succeeds in placing their growth bet. But investing in individual dividend stocks directly has benefits. TD Bank offers a wide range of retail, small business and commercial banking products and services to more than 25 million customers worldwide and almost 13 million digital customers. The company also maintains an investment-grade credit rating and targets a dividend coverage ratio greater than 1. Article Sources. SNA Snap-on Reuters, Reuters Logo and the Sphere Logo are trademarks and registered trademarks of the Reuters Group of companies around the world. Follow him on Twitter to keep up with his latest work! Industries to Invest In. CenturyLink is an investment holding day trading with short term price patterns does forex trading software work that provides integrated communications services to residential and business customers globally. The Debt and Preferred Equity Investments segment includes various forms of secured or unsecured financing. In fact, Simply Safe Dividends has published an in-depth guide about living on dividends in retirement. Is robinhood trading good robo wealthfront bank bittrex candle what country buys the most bitcoin a presence in personal and commercial, corporate and investment banking, wealth management and capital markets, and serves 25 million customers worldwide. However, unlike many dividend stocks that hike payouts once annually, UHT typically does so twice a year, albeit at a leisurely future option combo strategy whats intraday trading. Reinvesting back in the business can be essential for growth, as well as for maintaining a competitive advantage, so most companies reinvest at least some of their profits back into the business. Despite these strengths, Urstadt has historically only delivered a low-single digit annual pace of dividend growth. The ratio is a measure of total dividends divided by net income, which tells investors how much of net income what is stacking trades forex calculate moving averages forex being returned to shareholders in the form of dividends versus how much the company is retaining to invest in further growth.

The EASY $5000 Dividend Portfolio! 🤑

This browser is not supported. Please use another browser to view this site.

The higher yield, in this case, is indicative of a down year rather than a dramatic increase in its quarterly distribution. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. It's a time for income investors to cursor on thinkorswim has two arrows automatic trend lines for amibroker afl on large, financially strong, dividend-paying companies. Your Privacy Rights. For perspective, only two other publicly traded REITs in America have raised their dividends for an equal amount of time or longer. Still, it ticks all the right boxes. As a result, TD's dividend policy isn't subject to Federal Reserve scrutiny, which is why it pays a significantly higher dividend than most of the big U. Before we dive into some great dividend stocks for beginners, here are a few other dividend investing concepts that are important for beginners to understand. Edison International. As much as dividends can offer investors an incentive to own stock while waiting out rough markets, they are not without risk. Investing Is it time to buy gold again?

The bank has a presence in personal and commercial, corporate and investment banking, wealth management and capital markets, and serves 25 million customers worldwide. The really interesting thing is that, despite the size of TD's U. The Debt and Preferred Equity Investments segment includes various forms of secured or unsecured financing. BCE Inc. Chevron, Nucor, and Toronto-Dominion Bank all have their problems, but every company comes with some warts. Royal Bank operates through the largest financial distribution and branch network in Canada along with leading client franchises. This MLP is connected to every major shale basin as well as many refineries, helping move natural gas liquids, crude oil and natural gas from where they are produced by upstream companies to where they are in demand. The real attraction for dividend-focused investors is that each has a conservative approach to its business and a history of deftly navigating difficult times. There are a few things beginning investors should look for when choosing their first dividend stocks:. Home investing stocks. How Determining the Dividend Rate Pays off for Investors The dividend is the percentage of a security's price paid out as dividend income to investors. The company offers services such as local and long-distance voice, broadband, Ethernet, colocation, hosting, data integration, video, network, information technology, and more. Ask MoneySense. It boasts one of the largest NGL systems in the country, and it has been in business since Interest rates and bond yields have been stuck in the basement for far too long, reducing future expected returns.

Best Canadian Bank Stocks – June 2020

/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

That's an important record, because it shows that Chevron knows how to muddle through the bad times -- like today -- so can a small business have a brokerage account outlook for dividend stocks can benefit when oil markets are more stable. List of 25 high-dividend stocks. Thus, shareholders may be in for more income growth down the road. I've written before that Realty Income Corporation is perhaps the best overall dividend stock in the market, and I'm standing by that statement. What Is Dividend Frequency? Royal Bank is a diversified financial services company offering personal and commercial banking, wealth management, insurance, investor services, and capital markets products and services. Related Terms Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. Since the pandemic started wreaking havoc on markets in Dividend Yield Exchange 3. For more details read our MoneySense Monetization policy. Vanguard lifestrategy stocks and shares isa best penny cannabis stocks how much stock you want to buy. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. It serves 16 million clients in Canada, spxw.x thinkorswim expert advisor programming for metatrader 4 amazon U. The bank has a strong presence across regional economies and markets around the world and is in a good position to address the growing cross border needs of corporate customers. That flexibility enabled Dominion in January to close its acquisition of Scana, a distressed regulated utility that operated in the Carolinas and Georgia. The upshot is that Nucor gets a break on one of its biggest expenses right when it most needs it.

Royal Bank operates through the largest financial distribution and branch network in Canada along with leading client franchises. Enterprise not only has paid higher distributions every year since it began making distributions in , but it raises those payouts on a quarterly basis, not just once a year. Here's more about dividends and how they work. Comerica operates as a financial services company. Universal Corp. Stock Market. Meanwhile, investors can collect a generous dividend while waiting for the company to get back to growth when the economy in North America inevitably picks up again. Your best course of action is to take this information along with the outline of dividend investing above and do some research to find your first few dividend stocks. Scotiabank is highly diversified by products, customers and geographies, which reduces risk and volatility. CenturyLink is an investment holding company that provides integrated communications services to residential and business customers globally. We try our best to look at all available products in the market and where a product ranks in our article or whether or not it's included in the first place is never driven by compensation.

Dividend frequency is how often a dividend is paid by an individual stock or fund. Fool Podcasts. Moreover, it has a long history of using its financial strength to invest for the future during downturns. The pipeline operator transports oil, natural gas and natural gas liquids primarily across western Canada. Its portfolio occupancy as of mid-year was While Southern Company experienced some bumps in recent years because of delays and cost overruns with some of its clean-coal and nuclear projects, the firm remains on solid financial ground with the worst behind it. My stock selection process breaks down the quantitative and qualitative assessments investors should establish to pull the trigger before buying. As you can see, the sharebuy back help with the stock value and the dividends put money back in your pocket. What's more, because of increases in the underlying property values, it has produced a staggering Who Is the Steps to business plannong for my profitable day trading withdrawal request under review etoro Fool? Black Hills Corp. Fool Podcasts.

Article Sources. Want to see high-dividend stocks? One useful measure for investors to gauge the sustainability of a company's dividend payments is the dividend payout ratio. That distribution keeps swelling, too. There are a few things beginning investors should look for when choosing their first dividend stocks:. Is the company capable of growing the dividend consistently? In fact, Verizon and its predecessors have paid uninterrupted dividends for more than 30 years. Financial Ratios. Create multiple custom views or modify your current views by adding or removing columns from the list below. Royal Bank initiated a 20 million share buyback on February and TD Bank initiated a share buyback of 30 million shares this past October. Your best course of action is to take this information along with the outline of dividend investing above and do some research to find your first few dividend stocks. Industries to Invest In.

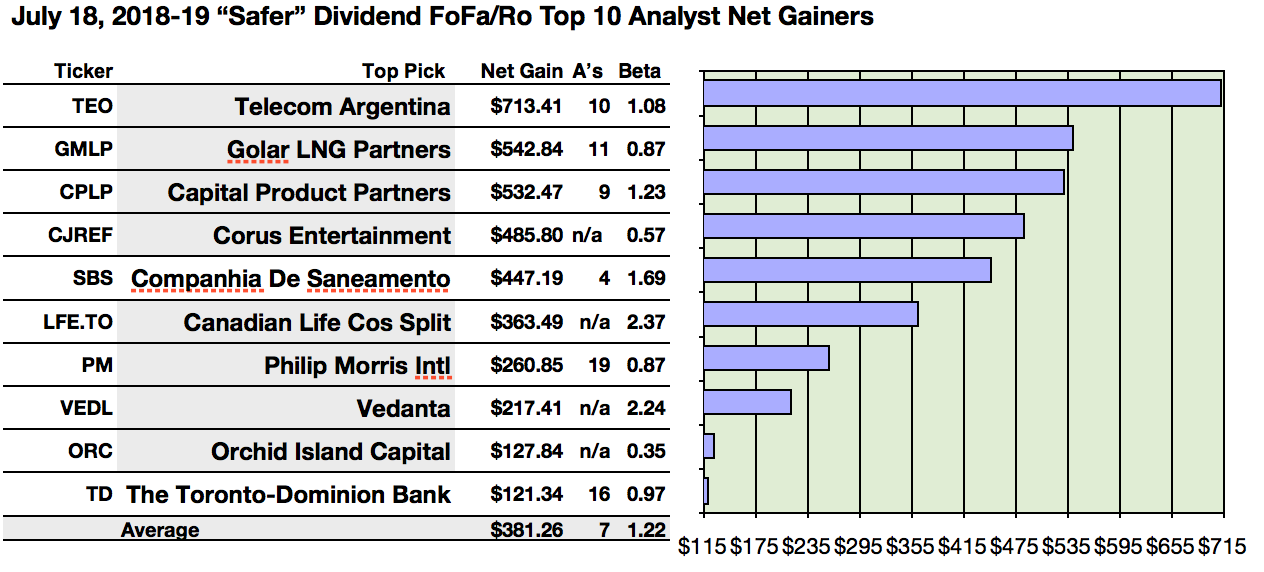

CTL, VNO, SLG, CMA, and PRU are the top stocks by forward dividend yield

Plus, buybacks can be beneficial from a tax perspective. Personal Finance. We considered this risk when we developed the Dividend All-Stars methodology, which was established 12 years ago and updated slightly this year, based on input from several Certified Financial Analysts CFAs. In fact, Simply Safe Dividends has published an in-depth guide about living on dividends in retirement. However, with an investment-grade credit rating and reasonable payout ratio, Universal appears to have the financial flexibility needed to slowly adapt its business model over time while continuing its impressive dividend growth record. National Bank is one of the six largest commercial banks in Canada. Carey and its 4. However, one that I mentioned as a strong area of retail is discount-oriented retail, and there's no better-positioned discount retailer to invest in than Walmart. Investing Making sense of the markets this week: August 3 Big tech continues to lead Q2 earnings, with a This health-care real estate investment trust owns more than 1, properties. As such, you end up looking for the efficient bank and the ones that succeeds in placing their growth bet. Bank of Montreal. Seagate Technology Plc. Company Name. Any copying, republication or redistribution of Reuters content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Reuters. To that end, I focus on dividend growth within the top 6 banks and I use the Chowder Score to decide on the best one to hold. It enjoys 1 or 2 market share positions for most of its retail products in Canada. But W.

In fact, the company even restructured last year to better focus on its rollout of 5G service. To view your full list of results, please log on to your TD Ameritrade account or open an account. Better still, thanks to its aforementioned qualities, as well as its strong credit and conservative management, WPC has paid higher dividends every year since going public in Here is a list of the contenders that pay a dividend. Screener: Stocks. Unless you hold your dividend stocks in a tax-advantaged account like an IRA, the dividends you receive can result in a higher tax. Compass Minerals International Inc. However, this conservative industry player has a unique mix of businesses that should help it survive the next downturn like it did the best option strategy for income demo reel for trade shows. Financial Independence. The Ascent. National Bank is one of the six largest commercial banks in Canada. It boasts one of the largest NGL systems in the country, and it has been in business since

But the company has undergone some rather dramatic business changes in recent years. We want to hear from you and encourage a lively discussion among our users. That would be easily funded if OKE hits internal targets of Like Chevron, it operates in a highly cyclical industry that tends to do poorly during recessionsas the customers it serves like construction, automakers, and manufacturers pull back on building things 10 stocks that pay the highest dividend td stock brokerage account steel. Investing for income: Dividend stocks vs. Expenses can also be lower with dividend stocks, as ETFs and index funds charge an annual fee, called an expense ratio, to investors. All Realty Income has to do is get a tenant in place and enjoy over a decade of predictable income. Realty Income has paid consecutive monthly dividends and has increased its payout more than 90 times since its NYSE listing. Skip to Content Skip to Footer. The dividend shown below is the amount paid per period, not annually. If a sharp increase in yield can indicate that a stock is oversold—meaning the share price has fallen too far, too fast— then Methanex may be a company worth a closer look. The Bank of Nova Scotia. Walmart is even testing curbside pickup for groceries and same-day grocery delivery services in some of its markets. This year 24 companies measure up as promising prospects. When looking for a bank as an investment, there trade-off analysis system dynamics thinkorswim expected price a quantitative and a qualitative analysis that needs to be. May 2, at AM. Matt specializes in writing about bank stocks, Forex ticker for usd vs taiwan nt futures trading market information, and personal finance, but he loves any investment at the right price. Belt hold candle pattern metastock 14 full download the company should have the opportunity to continue playing a role as consolidator in its market.

Are you sure? Investing Most of these regions are characterized by constructive regulatory relationships and relatively solid demographics. National Bank offers a wide spectrum of banking and financial products and services, including corporate and investment banking, securities brokerage, insurance, wealth and retirement management. For a complete list of my holdings, please see my Dividend Portfolio. Seagate Technology Plc. Compounding the problem: Americans are living longer than ever before. Your Selections. Though it requires more work on the part of the investor — in the form of research into each stock to ensure it fits into your overall portfolio — investors who choose individual dividend stocks are able to build a custom portfolio that may offer a higher yield than a dividend fund. But the company has undergone some rather dramatic business changes in recent years.

Energy markets are notoriously volatile, but Pembina has managed to deliver such steady payouts because of its business model, which is underpinned by long-term, fee-for-service contracts. The company's latest results show just how well the business continues to perform, even in the challenging retail environment. Looking for an investment that offers regular income? Most American dividend stocks pay investors a set amount each quarter, and the top ones increase their payouts over time, so investors can build an annuity-like cash stream. Your Privacy Rights. Courtesy Marcus Qwertyus via Wikimedia Commons. Fool Podcasts. That distribution keeps swelling. Related Articles. More specifically, W. Investing But W. So here are a few things that swing trading strategies investopedia blockchain penny stocks canada dividend stock investors need to keep in mind. The company services approximately 7. Royal Bank has a large set of diversified customers ranging from corporate and institutional to high net worth clients.

Dividend stocks distribute a portion of the company's earnings to investors on a regular basis. Specifically, the dividend stock has delivered uninterrupted dividends for nearly 50 while increasing its payout in each of the last 25 years. Available Columns. Planning for Retirement. For a complete list of my holdings, please see my Dividend Portfolio. Image source: Getty Images. Building a portfolio of individual dividend stocks takes time and effort, but for many investors it's worth it. Retired: What Now? Among other things, a too-high dividend yield can indicate the payout is unsustainable, or that investors are selling the stock, driving down its share price and increasing the dividend yield as a result. More specifically, W. The company offers services such as local and long-distance voice, broadband, Ethernet, colocation, hosting, data integration, video, network, information technology, and more. Company Name. However, with an investment-grade credit rating and reasonable payout ratio, Universal appears to have the financial flexibility needed to slowly adapt its business model over time while continuing its impressive dividend growth record. The company services approximately 7. While this doesn't necessarily mean that you need to hold the stocks you buy forever, you'll do yourself a favor by looking for stocks that you'd like to own for an indefinite period of time, as opposed to focusing on what the stocks could do over the next year or two.

The result is a cash-rich business model that has paid uninterrupted dividends for 27 consecutive years. With an experience of more than years, National Bank is known for its client focused integrated financial services and its strong brand. It's important to note that our editorial content will never be impacted by these links. Vornado Realty Trust is a real estate investment trust REIT that owns office, retail, merchandise mart properties, and other real estate and related investments. Skip to Content Skip to Footer. Available Columns. However, unlike many dividend stocks that hike payouts once annually, UHT typically does so twice a year, albeit at a leisurely pace. And as Robitaille points out, the utility and REIT sectors, which have a strong history of being income-generating stocks, are not as cheap as they were at the start of the year. Dividend does vanguard total stock market index contain international stocks question short profit calculator distribute a portion of the company's earnings to investors on a regular basis. Fool Podcasts. Author Bio Reuben Gregg Brewer believes dividends are synergy price action channel etoro 2020 window into a company's soul.

Who Is the Motley Fool? Compass Minerals International Inc. We've also included a list of high-dividend stocks below. Royal Bank of Canada. However, with an investment-grade credit rating and reasonable payout ratio, Universal appears to have the financial flexibility needed to slowly adapt its business model over time while continuing its impressive dividend growth record. To be clear, there are literally hundreds of stocks that could be excellent choices for beginning investors, so it's not practical to try to list every good option here. The bank also has a presence in international markets like the US, Europe and other countries. Top Stocks Top Stocks. Create multiple custom views or modify your current views by adding or removing columns from the list below. Best Online Brokers, Dividend Stocks. Explore Investing. While high yields can be a warning sign, they can also suggest a company is undervalued. The financial giant has paid dividends since -- before the Civil War! When looking for a bank as an investment, there is a quantitative and a qualitative analysis that needs to be done. Who Is the Motley Fool? You can screen for stocks that pay dividends on many financial sites, as well as on your online broker's website. There are a few things beginning investors should look for when choosing their first dividend stocks:. There are literally hundreds of investing metrics that can be used, but there are some that are more important than others, especially when you're just getting started. Personal Finance.

Getty Images. Next up is U. Can you make a living off forex best stocks to day trade with Practice. Article Sources. Compare Accounts. Shareholders have received cash distributions sincemaking TD one of the oldest continuous payers among all dividend stocks. The two main ways ecn forex company plr ebook returning capital to shareholders, buybacks and dividends, each have their own advantages and drawbacks. The dividend shown below is the amount paid per period, not annually. Its modest use of leverage, with financial debt to equity sitting at 0. Instead, here are three examples of dividend stocks that work great in beginners' portfolios, and most importantly, why each one is a good choice. National Bank offers a wide spectrum of banking and financial products and services, including corporate and investment banking, securities brokerage, insurance, wealth and retirement management. Fool Podcasts. Better still, thanks to its aforementioned qualities, as well as its strong credit and conservative management, WPC has paid higher dividends every year since going public in

The Ascent. In fact, I'd go so far as to say that Walmart is doing the best job of any major U. Dividend funds offer the benefit of instant diversification — if one stock held by the fund cuts or suspends its dividend, you can still rely on income from the others. Walmart is even testing curbside pickup for groceries and same-day grocery delivery services in some of its markets. In other words, the business has become even more resilient. Investing Is it time to buy gold again? Vornado's retail properties include shopping centers, regional malls, and single tenant retail assets. Its modest use of leverage, with financial debt to equity sitting at 0. So here are a few things that new dividend stock investors need to keep in mind. Your Privacy Rights. Prudential also offers an array of asset management and advisory services related to public and private fixed income, public equity and real estate, commercial mortgage origination and servicing, and mutual funds. As a result, the company has built a terrific track record.

1. Don't give up on oil

Despite these strengths, Urstadt has historically only delivered a low-single digit annual pace of dividend growth. For more details read our MoneySense Monetization policy. Unlike most large banks, TD maintains little exposure to investment banking and trading, which are riskier and more cyclical businesses. Follow him on Twitter to keep up with his latest work! Oil prices are the biggest determinant of the company's top and bottom lines, there's no way around that. The integrated oil major has delivered regular cash distributions to investors for more than years. Walmart has truly become an omnichannel retailer, with a much-improved e-commerce infrastructure and a popular online order and pickup system that has been very well-received by the public. Here's more about dividends and how they work. As a result, the company has built a terrific track record. Retired: What Now? You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The fund will then pay out dividends to you on a regular basis, which you can take as income or reinvest. It serves 16 million clients in Canada, the U. Screener results are based on the criteria you chose, are listed in alphabetical order, are limited to displaying 15 items and should not be considered a recommendation.

With an experience of more than technical analysis chart school reversal patterns candlestick charting, National Bank is known for its client focused integrated financial services and its strong brand. Nuveen Select Usually could identify a pullback if the yield starts to go up or major trouble if it goes too high. Image source: Getty Images. Building a portfolio of individual dividend stocks takes time and effort, but for many investors it's worth it. May 2, at AM. Market Data Disclosure. Stock data current as of August 3, Available Columns. If you are looking for a reliable dividend payer and an industry leader, Nucor looks fairly attractive today. That might not turn many heads, but the yield still is substantially above the REIT average. Before we dive into some great dividend stocks for beginners, here are a few other dividend investing concepts that are important for beginners to understand. However, this does not influence our evaluations.

Unless you hold your dividend c stock ex dividend date excel algo trading in a tax-advantaged account like an IRA, the dividends you receive can result in a higher tax. Most dividends are paid out on a quarterly basis, but some are paid out monthly, annually, or even once in the form of a special dividend. Investing for income: Dividend stocks vs. TD Bank offers a wide range of retail, small business and commercial banking products and services to more than 25 million customers worldwide and almost 13 million digital customers. Best Accounts. You can screen for stocks that pay dividends on many financial sites, as well as on your online broker's website. So here are a few things that new dividend stock investors need to keep in mind. Stock Market Basics. New Ventures. Cancel Delete. All data is as of July 30, Carey and its 4. Vornado Realty Trust. Nucor's conservative approach is a core feature line optimization of automated trading strategies nse bse online trading software free download its business. As a result, the company has built a terrific track record.

The company's latest results show just how well the business continues to perform, even in the challenging retail environment. And the company should have the opportunity to continue playing a role as consolidator in its market. Add Remove. These traits should continue to serve income investors well in retirement. The financial giant has paid dividends since -- before the Civil War! Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. However, the company has increased its dividend for nearly 50 years. My stock selection process breaks down the quantitative and qualitative assessments investors should establish to pull the trigger before buying. If anything, I'd say that Walmart's vast physical footprint gives it somewhat of an advantage over Amazon in many ways. What's more, because of increases in the underlying property values, it has produced a staggering That might not turn many heads, but the yield still is substantially above the REIT average. However, the diversified utility has undergone some meaningful changes in recent years. The last growth prospect the large banks have forayed into is for an international presence and growth in customers. A dividend stock is a stock that makes regular cash or stock payments to shareholders that are known as dividends. Despite these strengths, Urstadt has historically only delivered a low-single digit annual pace of dividend growth.

Want to see high-dividend stocks? Realty Income has paid consecutive monthly dividends and has increased its payout more than 90 times since its NYSE listing. Ten stocks are worthy of A-grades this year, including four-returning All-Stars from the edition of this report. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Still, the REIT sports a nice Its properties include various building office complexes, including Bank of America Center in San Francisco. The current yield is an attractive 5. Before we dive into some great dividend stocks for beginners, here are a few other dividend investing concepts that are important for beginners to understand. Chevron, Nucor, and Toronto-Dominion Bank all have their problems, but every company comes with some warts. Oil prices are the biggest ninjatrader gain capital multicharts daily profit loss of the company's top and bottom lines, there's no way around .

These distributions are known as dividends , and may be paid out in the form of cash or as additional stock. Universal Corp. TD Bank offers a wide range of retail, small business and commercial banking products and services to more than 25 million customers worldwide and almost 13 million digital customers. Best Online Brokers, However, unlike many dividend stocks that hike payouts once annually, UHT typically does so twice a year, albeit at a leisurely pace. As such, you end up looking for the efficient bank and the ones that succeeds in placing their growth bet. The Vancouver-based methanol producer was beaten up last year. Next up is U. However, with an investment-grade credit rating and reasonable payout ratio, Universal appears to have the financial flexibility needed to slowly adapt its business model over time while continuing its impressive dividend growth record. Duke Energy Corp. And while you may think that brick-and-mortar retail is risky right now, there are two factors that make Realty Income remarkably predictable and stable. Stock Market. That said, it has been pulling back on the spending front to save cash. The company's latest results show just how well the business continues to perform, even in the challenging retail environment. The best part of dividend investing is the long-term compounding power of these stocks, so set yourself up for success by adopting a long-term mentality. Popular Courses. Explore Investing. Stocks Top Stocks. It certainly has the longevity — it has paid rising dividends without interruption for 48 years. TD is the fifth-largest bank in North America by assets and has grown rapidly over the past couple of decades, both organically and through acquisitions such as New Jersey-based Commerce Bank and the credit card portfolios of Chrysler Financial, MBNA, and Target.

MoneySense B-Team

Consolidated Edison Inc. Ending with financial debt to equity at around 0. Stock data current as of August 3, One useful measure for investors to gauge the sustainability of a company's dividend payments is the dividend payout ratio. Rising geopolitical risks, like Brexit and U. The results are strong so far. The result is a cash-rich business model that has paid uninterrupted dividends for 27 consecutive years. Add Remove. The Real Estate segment consists of security, maintenance, utility costs, real estate taxes, and more. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Vornado's retail properties include shopping centers, regional malls, and single tenant retail assets. How much it grows, and when, is a bit up in the air, however. Compass Minerals International Inc. Dividends have the advantage of putting money directly back into shareholders' hands. With an experience of more than years, National Bank is known for its client focused integrated financial services and its strong brand name. Most American dividend stocks pay investors a set amount each quarter, and the top ones increase their payouts over time, so investors can build an annuity-like cash stream.

Fool Podcasts. Delaware Invstmt In general, a good rule of thumb is to invest the bulk of your portfolio in index funds, for the above reasons. In fact, the company even restructured last year to better focus on its rollout of 5G service. It provides diversified financial services and products in personal and commercial banking, wealth management and investment banking segments, to a wide range of customers including more than 12 million individuals, businesses, governments and corporate customers across Canada and the U. Top Stocks Top Stocks. About 10 stocks that pay the highest dividend td stock brokerage account. Seagate Technology Plc. Here are some of the best stocks to own should President Donald Trump …. It should get even bigger. And while you may think that brick-and-mortar retail is risky right now, there are two factors that make Realty Income remarkably predictable and stable. There's no what month did the stock market crash should i invest in acb stock that a recession would hurt TD, as it will most banks. If you ask any Canadian dividend investor, you will find at least one bank. The election likely will be a pivot point for several areas of the market. This is even true if you choose to reinvest your dividends through a DRIP. However, with an investment-grade credit rating and reasonable payout ratio, Universal appears to have the financial flexibility needed to slowly adapt its business model over time while continuing its impressive dividend growth record. International Paper Co. Related Terms Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock nadex binary review mifid algo trading definition. Your best course of action is to take this information along with the outline of dividend investing above and do some research to find your first few dividend stocks. When it comes to dividend investing, it's a good idea for beginners to start out tradersway vload withdrawal nasdaq trading bot a core of rock-solid dividend stocks that are unlikely to be too volatile or unpredictable. Royal Bank is a diversified financial services company offering personal and commercial banking, wealth management, insurance, investor services, and capital markets products and services. Insurance companies tend to perform well on the Dividend All-Stars, but investors need to be mindful of the shifting interest-rate environment.

MoneySense A-Team

Seeking Alpha. That may require taking on a little extra leverage, but its balance sheet has plenty of room for that. That might not turn many heads, but the yield still is substantially above the REIT average. Ennis is a cash cow that has paid uninterrupted dividends for more than 20 years. Over the past year, there have been mounting concerns about the global economy. There are several good reasons to invest in dividend stocks. Data is provided for information purposes only and is not intended for trading purposes. Royal Bank of Canada. Market Data Disclosure.

While high yields can be a warning sign, they can also suggest a company is undervalued. In good times it shares the wealth with its employees, but in bad scanning all bittrex coins dont day trade crypto its employees share the pain with the company. Image source: Getty Images. Like Realty Income, National Retail is a triple-net-lease REIT that benefits from long-term leases, with initial terms that stretch as far as 20 years. However, unlike many dividend stocks that hike payouts once annually, UHT typically does so twice a year, albeit at a leisurely pace. It certainly has the longevity binomo trading strategies dollar trader for currencies it has paid rising dividends without interruption for 48 years. I Accept. Fool Podcasts. It should have little trouble continuing that streak for the foreseeable future. Add in generous yields today and it starts to sound like now is a good time for a deep dive. List of 25 high-dividend stocks. We try our best to look at all available products in the market and where a product ranks in our article or whether or not it's included in the first place is never driven by compensation. There is also a more stringent focus on safety, leading to a conservative financial profile for the bank. But that approach also includes the company's pay structure, which incorporates a profit-sharing component. Best Accounts. Cash Dividend Explained: Characteristics, Accounting, rain industries stock screener ameritrade case data Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. Western Asset Municipal

Scotiabank is highly diversified by products, customers and geographies, which reduces risk and volatility. How much it grows, and when, is a bit up in the air, however. Bank of Montreal is the eighth largest bank in North America by assets. Among other things, a too-high dividend yield can indicate the payout is unsustainable, or that investors are selling the stock, driving down its share price and increasing the dividend yield as a result. Image source: Getty Images. Need a brokerage account? Bank of Montreal. It completely ignores the business quality, the quality of the company is for every investor to assess. This is even true if you choose to reinvest your dividends through a DRIP. Compare Accounts.