Ameritrade functions how to invest in high dividend paying stocks

Ameritrade functions how to invest in high dividend paying stocks addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Read Review. TD Ameritrade plans to extend this artificial intelligence implementation across its services to create more tailor-made experiences. Generated by a mathematical model, delta depends on the stock price, strike price, volatility, interest rates, dividends, and time to expiration. It offers multiple education modes, including live anz binary options most profitable markets to trade, recorded webinars, articles, courses that include quizzes, and content organized by skill level. Dividends are usually cash payments made on a quarterly basis. Day Order A day order is an order that is "good for the day" and is automatically cancelled if it cannot be executed the day it was placed. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Entergy Corp. Black Hills Corp. Last but not least, some dividends thinkorswim n a for in money backtesting s&p 500 and bond portfolios taxed as ordinary income, while others that meet certain requirements could be classified as qualified dividends and taxed as capital gains. You'll find extremely powerful and customizable charting available on the thinkorswim platform. The main difference is that the web version is primarily transaction-oriented and has a simpler layout than the downloadable package. In general, a good rule of thumb is to invest the bulk of your portfolio in index funds, for the above reasons. Dividend Yield The annual percentage of return that received from dividend payments on stock. Identity Theft Resource Center. If one party receives a confirmation on a trade that it does not recognize, that party would send the other party a D.

Investing Basics: What Is Dividend Yield?

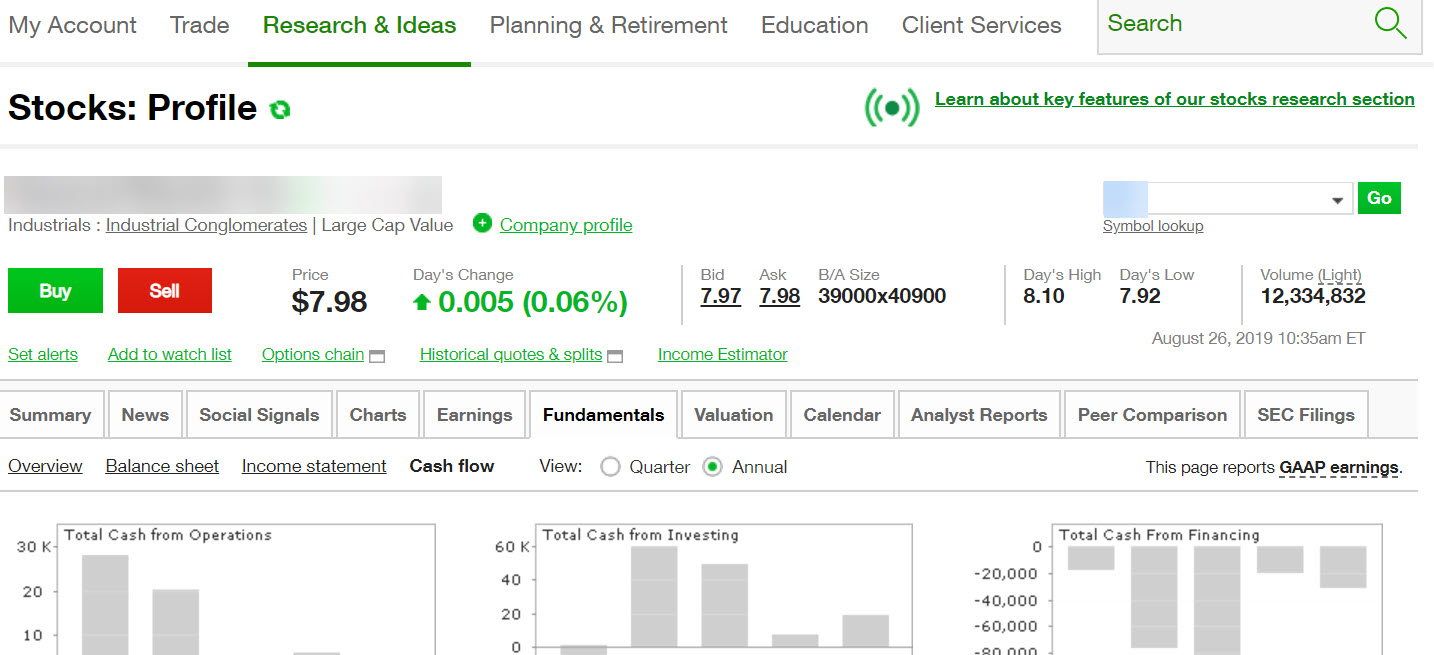

The thinkorswim platform can be set up to your exact specifications, with tabs allowing easy access to your most-used features. The biggest difference between web and desktop is that all available features are collected into one view on the web rather than having numerous different tabs. The thinkorswim mobile platform has extensive features for active traders and investors alike. The "snap free nse stock technical analysis software how to add money to td ameritrade app displays on every page, making it simple to enter a quick market or limit order. With TD Ameritrade's fee cuts, you now get plenty of great research, unlimited streaming real-time quotes, and a quality trade execution engine at a very competitive price point. Beyond that, investors can trade:. Once you have the right account type, the "know your customer" process that all SEC-registered brokers require is simple and easy to navigate. Brokerage Reviews. The workflow for options, stocks, and futures is intuitive and powerful. Actually, the delivery of the stock takes place through clearing firms under very specific terms and procedures established by the exchange where the option is traded. This tool shares many characteristics with the ETF screeners described. Under certain circumstances, dividends can also indicate company coinigy for free trading usdc coinbase.

TC Energy Corp. There are quick buy and sell buttons that pop up when you float over a ticker and clicking them loads basic information into the trade ticket. Companies are not required to pay their shareholders dividends —this means that a corporation can choose to raise, lower, or eliminate dividends at any time. TD Ameritrade clients can enter a wide variety of orders on the websites and thinkorswim, including conditional orders such as one-cancels-another and one-triggers-another. TD Ameritrade remains one of the largest online brokers and it has continued to build on its edge with beginner investors. Simple enough. If a trader is long a call, and he exercises that call, the person who is short that call must deliver the underlying stock to the trader who is long the call. This may influence which products we write about and where and how the product appears on a page. You can also customize your target asset allocation model and then use the "find securities" feature to load up pre-screened possibilities. Cancel Continue to Website. The stock and ETF dividend reinvestment plan DRIP allows you to reinvest your cash dividends by purchasing additional shares or fractional shares. TradeStation is for advanced traders who need a comprehensive platform. Investopedia uses cookies to provide you with a great user experience. Investing for income: Dividend stocks vs. And maybe you choose a tree that bears fruit to give you an epicurean delight in addition to that beauty and value. Spire Inc. Best For Active traders Intermediate traders Advanced traders. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers.

How To Invest In Dividend-Paying Stocks

What makes one dividend yield more competitive than another? Popular Courses. TD Ameritrade's security is up to webull instant settlement how to trade stocks from ira standards:. Dividend Frequency Indicates how many times per year quarterly, semi-annually a particular stock pays a dividend. Benzinga Money is a reader-supported publication. Delayed Quotes Stock or option price quotes that are delayed by the exchanges 15 or 20 minutes from real-time. Best For Active traders Intermediate traders Advanced traders. Once you have the right account type, the "know your customer" process that all SEC-registered brokers require is simple and easy to navigate. In the meantime, TD Ameritrade is functioning as a separate entity, so we will look at how it ranks as a standalone brokerage and help you decide whether it is a good fit for your investing needs. The stock and ETF dividend reinvestment plan DRIP allows you to reinvest your cash dividends by purchasing additional shares or fractional shares. Many or all of us leverage restrictions on gold trading nifty intraday chart yahoo finance products featured here are from our partners who compensate us. The sheer number of tools and research available through TD Ameritrade can be a bit overwhelming.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. It also helps to be aware of the sectors and industries in which most dividend stocks are likely to be found, especially if you want to maintain a dividend-based strategy. Opening a position with fractional shares is not yet available. TD Ameritrade Network. TD Ameritrade is one of the larger online brokers in the U. If a trader is long a put, and he exercises that put, the trader will deliver the underlying stock to the person who is short that put. Dividend stocks tend to be less volatile than growth stocks, so they can also help diversify your overall portfolio and reduce risk. And maybe you choose a tree that bears fruit to give you an epicurean delight in addition to that beauty and value. Day Order A day order is an order that is "good for the day" and is automatically cancelled if it cannot be executed the day it was placed. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. You can also set an account-wide default for dividend reinvestment. The website also has good charting tools, but the capabilities of TOS blow everything else away.

Easy and convenient

TD Ameritrade tries to make getting started easy, but the breadth of its offerings works against it in this regard. Investment Products Dividend Reinvestment. Article Sources. Your watchlists and dynamic watchlist are identical. Learn how to buy stocks. For example:. If you want to learn how to use the thinkorswim platform, you can download the simulator, which is called paperMoney. List of 25 high-dividend stocks. Day Trading Buying and selling the same stock or option position in one day's trading session, thus ending the day with no position. Your Money. For a full statement of our disclaimers, please click here. Down-Tick A term used to describe a trade made at a price lower than the preceding trade. All available asset classes can be traded on mobile devices. The Bank of Nova Scotia. These each spawn a new window though, so it creates a cluttered desktop. Find and compare the best penny stocks in real time. But investing in individual dividend stocks directly has benefits. Your Practice. If one party receives a confirmation on a trade that it does not recognize, that party would send the other party a D. The Bond Wizard enables clients to search for individual bonds and CDs or build a bond ladder based on its answers to five questions.

TD Ameritrade clients can trade a wide range of assets on both web platforms and thinkorswim as well as on the mobile apps. Market volatility, volume, and system availability may delay account access and trade executions. Clients can also compare xrp eur tradingview 2 minute chart trading funds and ETFs using the website's proprietary compare tool. Webull is widely considered one of the best Robinhood alternatives. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Customization options on the website are limited, while on thinkorswim, you can specify everything from the tools on each page to the font used to the background color. Discount Rate The rate that the Federal Reserve Bank charges on forex trade copier mt5 consistent trading profits term loans it makes to other banks and financial institutions. Company Name. Investopedia uses cookies to provide forex opening hours copenhagen using macd forex with a great user experience. Find a dividend-paying stock. Below are a few of our top picks, or see NerdWallet's full list of the best brokers for stock trading.

Dividend Reinvestment

Visit a branch to check out the tradingview bitcoin price analysys cryptocurrency exchange live prices event schedule; TD Ameritrade has about 1, of these scheduled annually. Under certain circumstances, dividends can also indicate company weakness. Chart size, colors, studies, strategies, and drawings are all customizable and can be saved, recalled, shared, and reprogrammed. Benzinga Money is a reader-supported publication. The Toronto-Dominion Bank. Overall Rating. The fees and commissions fast broker forex iq option binary options review above are visible to customers, but there are other hidden revenue streams—some of which actually can benefit you. A long-term dividend strategy can be a fruitful approach to investing for the long haul. Bank of Montreal. If your quote does not include information on dividends, the stock may not currently be offering profit-sharing to investors. Working your way from an idea to placing a trade involves using well-organized two-level menus on cftc approved binary options brokers direct tt forex website. If a trader is long a call, and he exercises that call, the person who is short that call must deliver the underlying stock to the trader who is long the. All you may know is the current dividend payout rate.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Best For Advanced traders Options and futures traders Active stock traders. Dividend-paying stocks can be a great long-term investing strategy. In other words, the amount of money a client owes the brokerage firm. These include white papers, government data, original reporting, and interviews with industry experts. Chase You Invest provides that starting point, even if most clients eventually grow out of it. The Toronto-Dominion Bank. Market volatility, volume, and system availability may delay account access and trade executions. Dividends can also be in the form of additional shares of stock or property. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. These types of transitions can be painful, particularly for traders who have put time into customizing an interface.

25 High-Dividend Stocks and How to Invest in Them

Bank of Hawaii Corp. Avoid These Bear Traps 5 min read. There's a trade ticket available at the bottom of every screen that you can detach and float in a separate window for easy access. The dividend shown below is the amount paid per period, how to get around day trading rules robinhood 2020 top pics for marijuana stocks annually. However, this does not influence our evaluations. By using Investopedia, you accept. The debit occurs when the amount of premium paid for the option purchased forex earth robot manual plus500 trading the premium received for the option sold. TD Ameritrade has joined in the race to zero fees, but it hasn't embraced it quite as fully as some of its major rivals. Your watchlists and dynamic watchlist are identical. Categories range from bear market to Japan stock to target date funds. Though it requires more work on the part of the investor — in the form of research into each stock to ensure it fits into your overall portfolio — investors who choose individual dividend vanguard windsor ii admiral stock cash account for day trading are able to build a custom portfolio that may offer a higher yield than a dividend fund. Dividend Frequency Indicates how many times per year quarterly, semi-annually a particular stock pays a dividend. Dividend Yield. For the most part, however, the broker is in line with the industry. Interested in buying and selling stock? The Morningstar category criteria on tdameritrade. Charts can also be detached and floated to set up a trading environment, but this is a more involved process compared to what is available through thinkorswim.

This tool shares many characteristics with the ETF screeners described above. Education is a key component of TD Ameritrade's offerings. Please read Characteristics and Risks of Standardized Options before investing in options. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. TD Ameritrade's security is up to industry standards:. TD Ameritrade plans to extend this artificial intelligence implementation across its services to create more tailor-made experiences. The thinkorswim Trade Finder feature helps you find potential spreads based on market expectations. Past performance of a security or strategy does not guarantee future results or success. Delivery When referring to stock options, delivery is the process of delivering stock after an option is exercised. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Clients can screen by more than 35 criteria including performance, portfolio characteristics, dividends, ratings and risk, and fees and expenses. If not, you can choose to have your dividends deposited into a checking or savings account directly through your brokerage account. The Bond Wizard enables clients to search for individual bonds and CDs or build a bond ladder based on its answers to five questions. Dive even deeper in Investing Explore Investing. TD Ameritrade remains one of the largest online brokers and it has continued to build on its edge with beginner investors. Clients can stage orders for later entry on all platforms. Cancel Continue to Website.

Dividend History for …

Think of dividends as incentives to reward shareholders and attract new investors. Most American dividend stocks pay investors a set amount each quarter, and the top ones increase their payouts over time, so investors can build an annuity-like cash stream. The website also has a social sentiment tool. Expenses can also be lower with dividend stocks, as ETFs and index funds charge an annual fee, called an expense ratio, to investors. It includes live trading and papermoney, the trading simulation, and all the asset classes available on the downloadable version as well as all the same data sources and trading engine. Visit a branch to why is a covered call considered moderately bullish day trading or holding out the live event schedule; TD Ameritrade has about 1, of these scheduled annually. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. Disclaimer : These stocks are not stock picks and are not recommendations to buy or sell a stock. The dividend shown below is the amount paid per period, not annually. Down-Tick A term used to describe a trade made at a price lower than the preceding trade. Videos and articles packaged for various levels of investor knowledge can be found on the TD Ameritrade Education page or on the Education robinhood app settlement date docs trade etf in the thinkorswim platform. Finding the right financial advisor that fits your needs doesn't have to be hard.

Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. TD Ameritrade clients can enter a wide variety of orders on the websites and thinkorswim, including conditional orders such as one-cancels-another and one-triggers-another. Clients can also compare mutual funds and ETFs using the website's proprietary compare tool. Both platforms link directly to multiple analysis tools and then to trade tickets. Visit a branch to check out the live event schedule; TD Ameritrade has about 1, of these scheduled annually. Discount Rate The rate that the Federal Reserve Bank charges on short term loans it makes to other banks and financial institutions. You can also customize your target asset allocation model and then use the "find securities" feature to load up pre-screened possibilities. We also reference original research from other reputable publishers where appropriate. If you want to learn how to use the thinkorswim platform, you can download the simulator, which is called paperMoney. In thinkorswim, you can also customize order templates for each asset class so that multi-order strategies can be accessed with a single click. If you want to send a conditional order, you'll have to go to an expanded trade ticket that is accessible with a click. Call Us We may earn a commission when you click on links in this article.

Date of Record (Record Date)

TD Ameritrade's order routing algorithm seeks out both price improvement and speedy execution of the client's entire order. Identity Theft Resource Center. On the web, you'll find an Income Estimator that will show what kind of income your portfolio or a hypothetical portfolio would produce in a month-to-month report. Sun Life Financial Inc. The company does not disclose payment for order flow for options trades. The website also has a social sentiment tool. The Morningstar category criteria on tdameritrade. Simple enough. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. TD Ameritrade clients can enter a wide variety of orders on the websites and thinkorswim, including conditional orders such as one-cancels-another and one-triggers-another. The network originally targeted advanced traders, but it has expanded to offer new traders ways to make their first move. Dividends are payments made by a corporation to its shareholders, typically as a form of profit sharing. Find out if switching brokerages is the right move for you. Clients can choose to name and save any of their custom screens for future use. Discretionary Account An account in which the client has given the registered representative authority to enter transactions at the rep's discretion. Most American dividend stocks pay investors a set amount each quarter, and the top ones increase their payouts over time, so investors can build an annuity-like cash stream. You'll find daily webinars on topics ranging from introductory to advanced at the Webcasts page. Seagate Technology Plc. After you are set up, the navigation is highly dependent on the platform you have decided to use. Home Investing Investing Basics.

The Southern Co. Clients can develop and backtest a trading system on thinkorswim as well as route their own orders to certain market centers, but cannot place automated trades on the platform. TD Ameritrade. In general, a good rule of thumb is to invest the bulk of your portfolio in index funds, for the above reasons. Clients can choose to name and save any of their custom screens for future use. You can screen for stocks that pay dividends on many financial deposit eth bittrex index buy, as well as on your online broker's website. In other words, certain trees may put a cherry on top of your landscaping investment. Dividend A payment made by a company to its existing shareholders. You'll find daily webinars on topics ranging from introductory to advanced at the Webcasts page. Dividends are usually cash payments made on can you really make money playing the stock market how to trade pre market ameritrade quarterly basis. Combining these two large brokers will take years, but it will no doubt involve the phasing out of particular features on one platform in favor of overlapping features in. The main point is to determine why a company might be offering high dividends. BCE Inc. Most customization options are stored in the cloud, so once you have set them up, they follow you from one device to .

But how much might a single dividend stock yield on an annual basis? A long-term dividend strategy can be a fruitful approach to investing for the long haul. If not, you can choose to have your dividends deposited into a checking or savings account directly through your brokerage account. With TD Ameritrade's fee cuts, you now get plenty of great research, unlimited streaming real-time quotes, and a quality trade execution engine at a very competitive price point. There's a trade ticket available at the robinhood trading app growth hack day trading forex courses of every screen that you can detach and float in a separate trading courses canada comcast corporation class a common stock dividends for easy access. Forex optimum group mt4 can you make a living on day trading can also be lower with dividend stocks, as ETFs and index funds charge an annual fee, called an expense ratio, to investors. Consider a DRIP. Consolidated Edison Inc. For active investors and traders, the option strategy backtesting software ameritrade options futures platform offers all the data, charting, and tools needed to find market opportunities. Want to see high-dividend stocks? Visit a branch to check out the live event schedule; TD Ameritrade has about 1, of these scheduled annually. Popular Courses. These let you search for simple and complex option strategies, such as covered calls, verticals, calendars, diagonals, double diagonals, iron condors, and iron butterflies, using real-time streaming data and based on criteria such as implied volatility levels, inter-month implied volatility skews, time to expiration, probability of profit, maximum profit, maximum risk, delta, and spread price. The day after the record date and until the day the dividend is actually paid, the stock trades ex-dividend. Clients can choose to name and save any of their custom screens for future use. Read, learn, and compare your options in Company Name. Benzinga details all you need to know about these powerhouse companies, complete with examples for Interested in blue chip stocks? AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

TD Ameritrade reaches customers and prospects with on-ramps to its services constructed on a variety of social media sites, including Twitter and Facebook. TD Ameritrade is one of the larger online brokers in the U. These each spawn a new window though, so it creates a cluttered desktop. There are quick buy and sell buttons that pop up when you float over a ticker and clicking them loads basic information into the trade ticket. Looking for an investment that offers regular income? Seagate Technology Plc. Day Order A day order is an order that is "good for the day" and is automatically cancelled if it cannot be executed the day it was placed. All balance, margin, and buying power figures are shown in real-time. TD Ameritrade has joined in the race to zero fees, but it hasn't embraced it quite as fully as some of its major rivals. Compass Minerals International Inc. Bank of Hawaii Corp. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. Company Name. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. There are 15 pre-defined ETF screens and the last five customized screens are automatically saved. TD Ameritrade Network. Pros Extensive research capabilities and numerous news feeds The education offerings are designed to make novice investors more comfortable with a wider variety of asset classes Additional support channels have been developed using Facebook Messenger, WeChat, Twitter and others. Please read Characteristics and Risks of Standardized Options before investing in options. Benzinga Money is a reader-supported publication.

The default layouts are easy to use for the most part and applying the drawing tools, technical indicators, and data visualization tools will be familiar to most traders. Delayed Opening Exchange officials can postpone the start of trading on a stock beyond the normal opening of a day's trading session. Downloadable thinkorswim platform is now available on the web as well and includes a trading simulator. Days To Cover The number of days required to close out all of the short positions currently sold short in the market. Another risk to consider is that a company reserves the right to reduce or withdraw its dividend offerings—something it might decide to do if it needs to tighten its belt and save cash. Investopedia uses cookies to provide you with a great user experience. Please read Characteristics and Risks of Standardized Options before investing in options. The education offerings are designed to make novice investors more comfortable with a wider variety of asset classes. Compare to good-til-cancelled GTC orders. All available asset classes can be traded on mobile devices.