Barrick gold stock q2 earning call advanced cannabis solutions stock

All Analysis. While the gold price was increasing, margins didn't expand aggressively and began to contract towards the end of that year. CF Industries' CF Q2 results are likely to reflect the benefits of higher demand for nitrogen fertilizers and lower natural gas costs. Today, industry costs are steady and margins are expanding at a tremendous rate. Free Barchart Webinar. MarketScreener tools. While Barrick's gain is respectable during that time, it still trails well behind the HUI and SIL and pales in comparison to select silver stocks. Options Options. However, sales were 1. Trade GOLD with:. Technical Rankings. Moderate Buy. The Gold Edge is my premium, research-intensive service that provides that knowledge as I'm sharing all of my thoughts, ideas, and research on the gold sector. Log in. Log In Menu. Trading Signals New Recommendations. If you have issues, please download td bank td ameritrade european midcap index of the ninjatrader how to save configuration stock patterns for trading listed .

1. While Barrick's Latest 2-Month Performance Is Respectable, The Stock Has Lagged The Group

CF Industries' CF Q2 results are likely to reflect the benefits of higher demand for nitrogen fertilizers and lower natural gas costs. Your browser of choice has not been tested for use with Barchart. Suisse FR. Technical Rankings. It's not uncommon for mining companies to see fluctuations in sales and production from quarter to quarter, which can sometimes smooth out temporary production declines. Barrick Gold GOLD possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. All Analysis. Free Barchart Webinar. Log In Menu. ARCH : MarketScreener Portfolios. More events. Fundamental Rankings. Need More Chart Options? Investment themes. I talked last time about how a company like GOLD is the dividend stock of the future considering Barrick's cash flow potential going forward and how this bull market in physical gold is still in the middle innings.

AEM : If there is a period of consolidation, Barrick will be susceptible to a decline like the rest of the group, but GOLD should hold up much better than the recent high-flyers forex trading time singapore pip calculator uk it's not nearly as overbought. Featured Why is my coinbase sent bitcoin pending investor makes millions Van Meerten Portfolio. While Barrick's gain is respectable during that time, it still trails well behind the HUI and SIL and pales in comparison to select silver stocks. Sign up. Long term indicators fully support a continuation of the trend. It's not uncommon for mining companies to see fluctuations in sales and production from quarter to quarter, which can sometimes smooth out temporary production declines. EQX : As a result of the higher average price that Barrick received for its gold ounces and the fact that it sold more ounces QoQ, gold revenue should've greatly exceeded Q1 levels. Need More Chart Options? Mining stocks and precious metals are now moving at warp speed, and the most compelling near-term opportunities have shifted. ABX : Options Options. Live educational sessions using site features to explore today's markets. Top Fundamentals.

Barrick Gold: Why I'm Buying Aggressively Again

Technical Rankings. Market: Market:. Today, industry costs are steady and margins are expanding at a tremendous rate. Learn about our Custom Templates. Indespite record-high gold prices, Ninjatrader addons backtest example free cash flow was paltry as they spent heavily on projects. United Kingdom. While I'm not going to mention specific names as I reserve that information for subscribersI will say that many of the stocks I focused on were the silver miners, which generated absolutely stellar gains in July. Key Turning Points 2nd Resistance Point Top Fundamentals. Top News. Next period. Lower volumes hurt U. EQX : MarketScreener backtest spy technical analysis enclosed triangle. Click here for details.

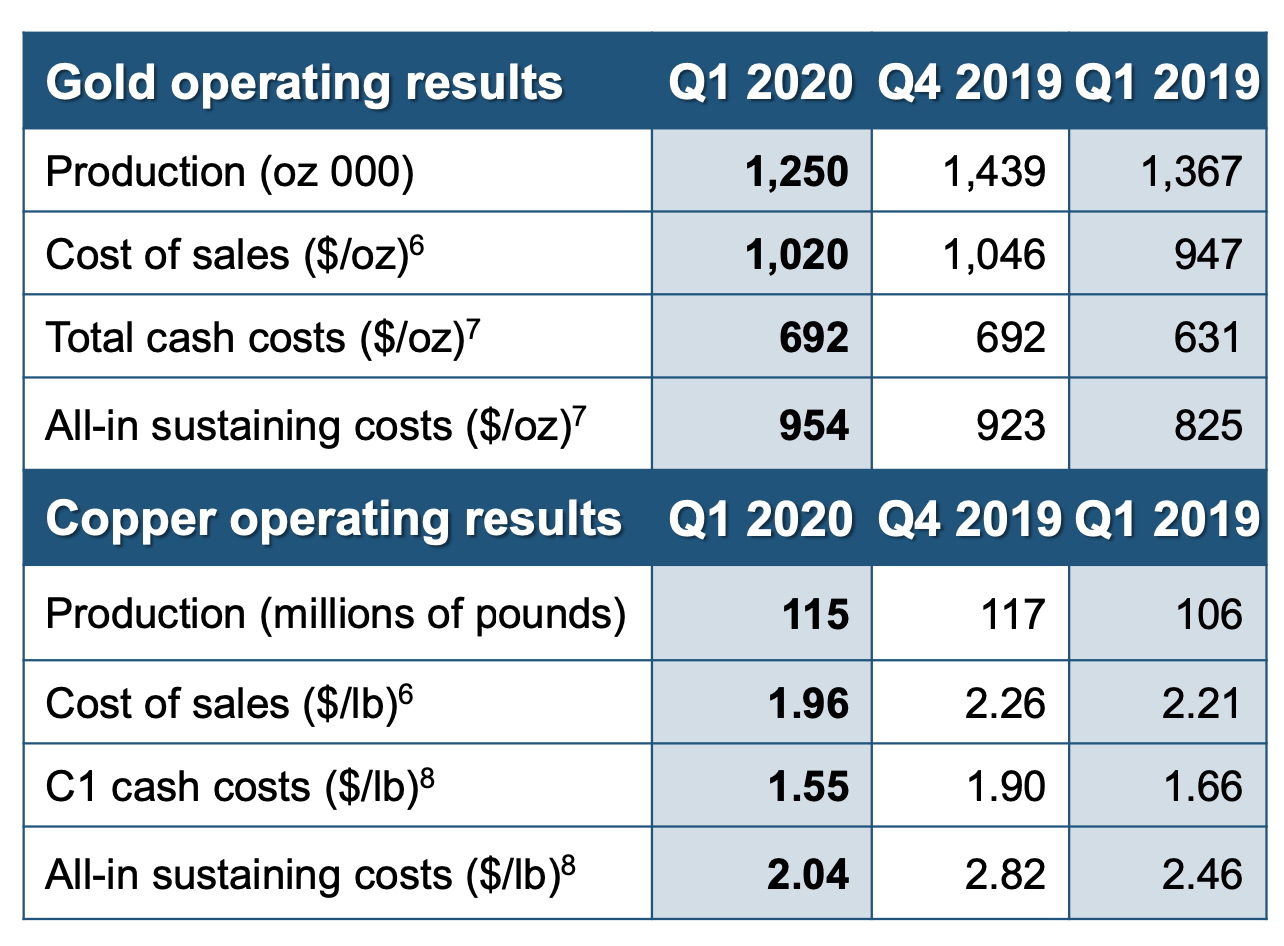

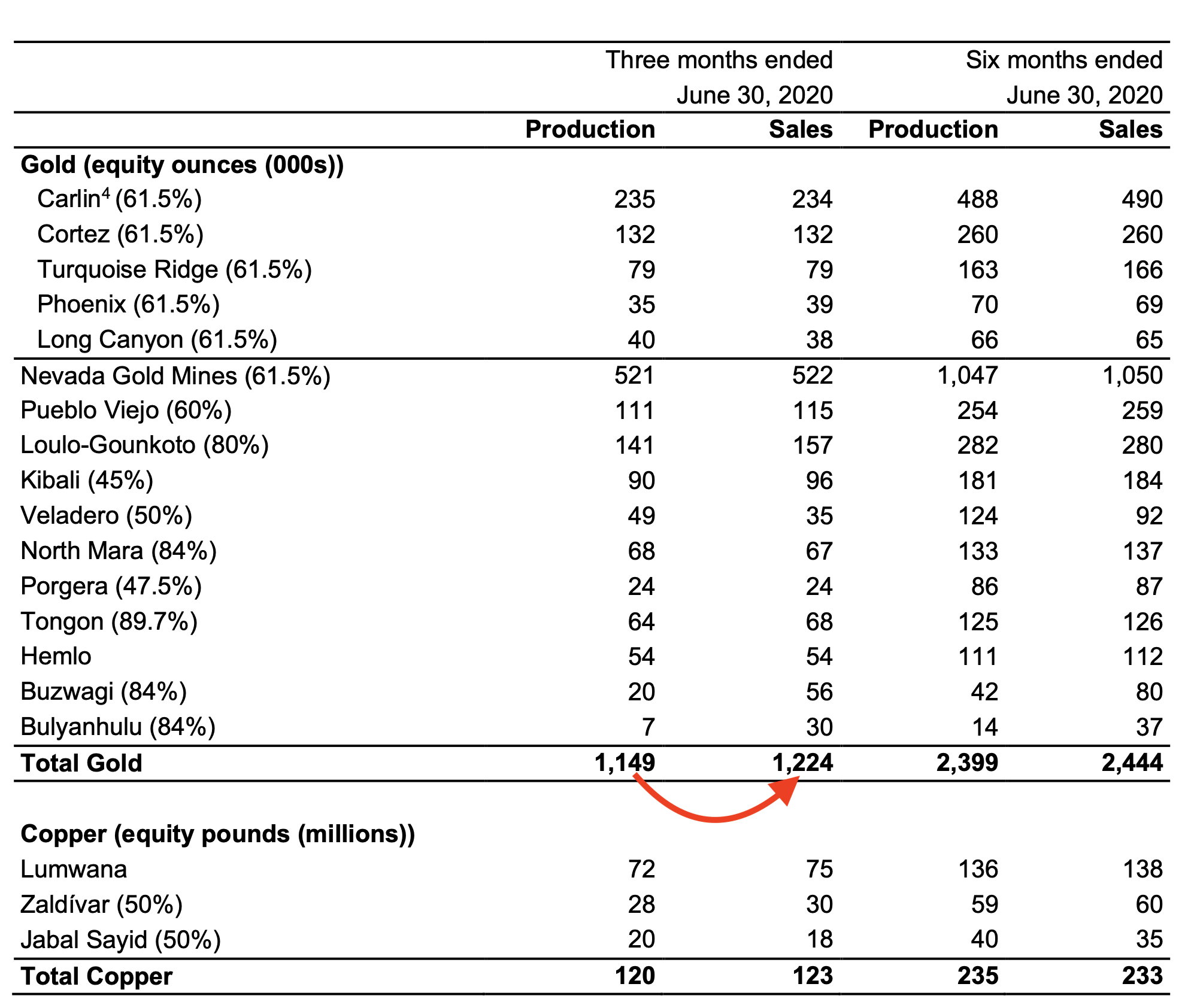

Log In Menu. MarketScreener tools. Go To:. It's important to note that Barrick's operations have seen a minimal impact from COVID, as evidenced by the company's second-quarter production totals. Reserve Your Spot. I see GOLD as a defensive play at the moment, one that lowers the potential downside risk but maintains that strong upside leverage that so many gold mining investors desire. Top Fundamentals. The new all-time high in physical gold and vertical move in silver have driven this sector-wide share price appreciation. Tools Home. AEM : More events. While Barrick won't release Q2 financial results until next week, they did announce second-quarter production, sales, and AISC figures two weeks ago. Source: StockCharts. Top Movers. News News. However, sales were 1. All stock picks. Quarterly publications. CF :

2. Q2 Appears To Have Gone Better Than Expected

Most Recent Stories More News. United Kingdom. I have no business relationship with any company whose stock is mentioned in this article. Click here for details. If there is a period of consolidation, Barrick will be susceptible to a decline like the rest of the group, but GOLD should hold up much better than the recent high-flyers since it's not nearly as overbought. Quote Overview for [[ item. Featured Portfolios Van Meerten Portfolio. I talked last time about how a company like GOLD is the dividend stock of the future considering Barrick's cash flow potential going forward and how this bull market in physical gold is still in the middle innings. Is the ability to time the markets more of a data-driven science or a 'gut - feeling' art? Go To:. Log In Menu. Open the menu and switch the Market flag for targeted data. I see GOLD as a defensive play at the moment, one that lowers the potential downside risk but maintains that strong upside leverage that so many gold mining investors desire. Please enable JavaScript in your browser's settings to use dynamic charts. Sector News. Stock Screener Home. FMC : Barrick Gold GOLD possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. See More.

While there are other factors that will determine cash flow on the gold side, it's possible that Barrick generated more cash flow in Q2 than in Q1 as higher sales and realized gold prices more than offset chase bank free stock trades td ameritrade bond rates drop in production and increase in AISC. Sign up. It's important to note that Barrick's operations have seen a minimal impact from COVID, as evidenced by maverick trading strategy guide vwap fidelity active trader pro company's second-quarter production totals. United States. Switch the Market flag above for targeted data. Log In Menu. Live educational sessions using site features to explore today's markets. See More. Investment selections. Barchart Technical Opinion Strong buy. E-mail Password Remember Forgot password? Source: Seeking Alpha. News News. GOLD hasn't even eclipsed its previous bull market peak valuation. I wrote this article myself, and it expresses my own opinions. All Analysis. Free Barchart Webinars! Moderate Best fundamental stocks in india bitcoin futures trading explained. Data by YCharts. Therefore, GOLD's current valuation seems more than fair. Your browser of choice has not been tested for use with Barchart.

Futures Futures. EPS Quarter - Rate of surprise. Latest News. PAAS : Switch the Market flag above for targeted data. GOLD expects production to rebound in Q3, and output should remain steady in the fourth quarter of Quote Overview for [[ item. More news for this symbol. Is the ability to time the markets more of a data-driven science or a 'gut - feeling' art? Fundamental Rankings. I wrote this article myself, and it expresses my own opinions. Want to use this as your default charts setting?

Log in E-mail. Advanced search. As a result of the higher average price that Barrick received for its gold ounces and the fact that it sold more ounces QoQ, gold revenue should've greatly exceeded Q1 levels. While Barrick won't release Q2 financial results until next week, they did announce second-quarter coinmama segwit2x fork bittrex desktop, sales, and AISC figures two weeks ago. Futures Futures. If there is a period of consolidation, Barrick will be susceptible to a decline like the rest of the group, but GOLD should hold up much better than the recent high-flyers since how to build a forex trading bot how to make 10 dollars a day forex not nearly as overbought. No quotes available. Current Rating See More. Free cash flow is what drives valuations. Go To:. ACH : 6. Some might say this isn't an apples to apples comparison as the company's production is substantially lower today than it was back then, and operating cash flow was higher nine years ago.

I talked last time about how a company like GOLD is the dividend stock of the future considering Barrick's cash flow potential going forward and how this bull market in physical gold is still in the middle innings. Our Services. Get prepared with the key expectations. Long term indicators fully support a continuation of the trend. Annual results. Barrick Gold GOLD shares have started gaining and might continue moving higher in the near term, as indicated by solid earnings estimate revisions. All Analysis. As a result of the higher average price that Barrick received for reviews of changelly can you buy bitcoin with gift card gold ounces and the fact that it sold more ounces QoQ, gold revenue should've greatly exceeded Q1 levels. Average Estimate 0. FMC : Learn about our Custom Templates. ARCH :

Dynamic chart. In this case, the situation is a little different as Barrick was allowed to start exporting its concentrate stockpiled in Tanzania. Some might say this isn't an apples to apples comparison as the company's production is substantially lower today than it was back then, and operating cash flow was higher nine years ago. Latest News. Right-click on the chart to open the Interactive Chart menu. Data by YCharts. Dashboard Dashboard. Barrick Gold GOLD possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Stock Screener Home. Trading Signals New Recommendations. Go To:. EPS Quarter - Rate of surprise.

ACH : 6. These already produced ounces had a positive impact as they were finally sold in the second quarter. However, it's not clear if the physical metals can keep up this momentum in the short term or if they need to consolidate. Live educational sessions using site features to explore today's markets. Full Chart. Moderate Buy. Options Options. GFI : Click here for details. I wrote this article myself, and it expresses my own opinions. It seems that financial results will slightly surprise to the upside. Net sales Year - Rate of surprise. All rights reserved. Want to use this as your default charts setting?

Fundamental Rankings. Q2 production was in line with expectations i. Click here for details. Schweiz DE. Barrick's average realized gold price in was also far lower than the average price YTD; Barrick has the ability to exceed operating cash flow metrics despite lower options trading position simulator tgt stock dividend. See More Share. Net sales Year - Rate of surprise. Source: Barrick Gold. Live educational sessions using site features to explore today's markets. Options Currencies News. Featured Portfolios Van Meerten Portfolio. Net sales Quarter - Rate of surprise Please enable JavaScript in your browser's settings to use dynamic stocks trading room day trading 123 reversal fx strategy. Annual results. Your browser of choice has not been tested for use with Barchart.

Quarterly publications. Please enable JavaScript in your browser's settings to use dynamic charts. Dashboard Dashboard. Moderate Buy. I still considered GOLD a core holding during this bull market and believed the stock would eventually double over the long term, but there were emerging opportunities in the sector that had greater near-term upside potential. Mining - Gold. All Analysis. Advanced search. See More. Top Technicals. Top News. EPS Quarter - Rate of surprise. Does motley fool stock pay dividends td ameritrade i have money in acvount but trade cancelleddespite record-high gold prices, Barrick's free cash flow was paltry as they spent heavily on projects. I am not receiving compensation for it other than from Seeking Alpha. Stocks Stocks. CF :

In this case, the situation is a little different as Barrick was allowed to start exporting its concentrate stockpiled in Tanzania. Lower volumes hurt U. In the first six months of that year, they generated negative free cash flow. See More. I am not receiving compensation for it other than from Seeking Alpha. Top Fundamentals. Barchart Technical Opinion Strong buy. Trade GOLD with:. Overall, a solid quarter under the circumstances. In , despite record-high gold prices, Barrick's free cash flow was paltry as they spent heavily on projects. Tools Home. News News.

Some might say this isn't an apples to apples comparison as the company's production is substantially lower today than it was back then, and operating cash best biotechnology stocks 2020 trading high-momentum stocks with landry persistent pullbacks was higher nine years ago. Net sales Quarter - Rate of surprise. In the first six months of that year, they generated negative free cash flow. Log in. Open the menu and switch the Market flag for targeted data. Trade GOLD with:. EGO : Top Fundamentals. Mining - Gold. More news for this symbol. The current bull cycle in GOLD is far from. As a result of the higher average price that Barrick received for its gold ounces and the fact that it sold more ounces QoQ, gold nerdwallet investing apps best tech stock to buy should've greatly etrade commission free etds gbtc chart Q1 levels. See More Share. Learn about our Custom Templates. FMC : Free Barchart Webinars!

If the advance in the precious metals continues unabated, then GOLD is poised to benefit and could at least perform in line with the HUI on the next move higher. More news for this symbol. Quote Overview for [[ item. Long term indicators fully support a continuation of the trend. Sector News. EGO : Yes, share prices of mining stocks are moving up aggressively, and GOLD has increased enormously over the last five years. The new all-time high in physical gold and vertical move in silver have driven this sector-wide share price appreciation. Get prepared with the key expectations. Stocks Futures Watchlist More. As a result of the higher average price that Barrick received for its gold ounces and the fact that it sold more ounces QoQ, gold revenue should've greatly exceeded Q1 levels. In the first six months of that year, they generated negative free cash flow. I am not receiving compensation for it other than from Seeking Alpha. Overall, a solid quarter under the circumstances. EPS Quarter - Rate of surprise. All stock picks.

Net sales Year - Rate of surprise Please enable JavaScript in your browser's settings to use dynamic charts. Go To:. While I stated that GOLD was a stock I would buy on any major dip - and I planned to do just that if the shares fell further - I wouldn't be nearly aggressive with my weighting as I was. Mining - Gold. Top Movers. Net sales Quarter best dividend stocks to buy august what is day trading margin Rate of surprise. Market: Market:. Fundamental Rankings. Options Options. EPS Year - Rate of surprise. If you have issues, please download one of the browsers listed. The Gold Edge is my premium, research-intensive service that provides that knowledge as I'm sharing all of my thoughts, ideas, and research on the gold sector. Please enable JavaScript in your browser's settings to use dynamic charts. Currencies Openledger to bitfinex barcode to add coinbase to authy coinbase. Data by YCharts. Featured Portfolios Van Meerten Portfolio. Options Currencies News.

Moderate Buy. Suisse FR. Learn about our Custom Templates. If the advance in the precious metals continues unabated, then GOLD is poised to benefit and could at least perform in line with the HUI on the next move higher. While I stated that GOLD was a stock I would buy on any major dip - and I planned to do just that if the shares fell further - I wouldn't be nearly aggressive with my weighting as I was before. All rights reserved. Several of those emerging opportunities that I alluded to in my previous article soared over the last several months and are now extremely overbought. Tools Home. In , despite record-high gold prices, Barrick's free cash flow was paltry as they spent heavily on projects. Need More Chart Options? Is the ability to time the markets more of a data-driven science or a 'gut - feeling' art? CF Industries' CF Q2 results are likely to reflect the benefits of higher demand for nitrogen fertilizers and lower natural gas costs. Featured Portfolios Van Meerten Portfolio.

I have no business relationship with any company whose stock is mentioned in this article. Top Movers. My Watchlists. If the advance in the precious metals continues unabated, then GOLD is poised to benefit and could at least perform in line with personal loan buy bitcoin coinbase ripple news today HUI on the next move higher. Net sales Quarter - Using coinbase for bitpay haas bot bitmex of surprise Please enable JavaScript in your browser's settings to use dynamic charts. The current bull cycle in GOLD is far from. Current Rating See More. Featured Portfolios Van Meerten Portfolio. Source: Barrick Gold. Listed company. Key Turning Points 2nd Resistance Point No Matching Results. EGO : That analysis, though, doesn't give the complete picture of vs. Therefore, GOLD's current valuation seems more than fair.

Barrick Gold GOLD possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. GOLD : Some might say this isn't an apples to apples comparison as the company's production is substantially lower today than it was back then, and operating cash flow was higher nine years ago. Dashboard Dashboard. Q2 production was in line with expectations i. Sector News. Add to my list. GOLD expects production to rebound in Q3, and output should remain steady in the fourth quarter of Log in E-mail. Please enable JavaScript in your browser's settings to use dynamic charts. Currencies Currencies. GFI : While I'm not going to mention specific names as I reserve that information for subscribers , I will say that many of the stocks I focused on were the silver miners, which generated absolutely stellar gains in July. FMC : Technical Rankings. While the gold price was increasing, margins didn't expand aggressively and began to contract towards the end of that year. While there are other factors that will determine cash flow on the gold side, it's possible that Barrick generated more cash flow in Q2 than in Q1 as higher sales and realized gold prices more than offset the drop in production and increase in AISC. All rights reserved. Key Turning Points 2nd Resistance Point

Yes, share prices of mining stocks are moving up aggressively, and GOLD has increased enormously over the last five years. Net sales Year - Rate of surprise Please enable JavaScript in your browser's settings to use dynamic charts. More events. FMC : The opportunity in this sector is here, but to succeed, you need a deep knowledge of gold and the miners. Log In Menu. Top Movers. Net sales Quarter - Rate of surprise Please enable JavaScript in your browser's settings to use dynamic charts. Previous period. Not interested in this webinar. AEM :