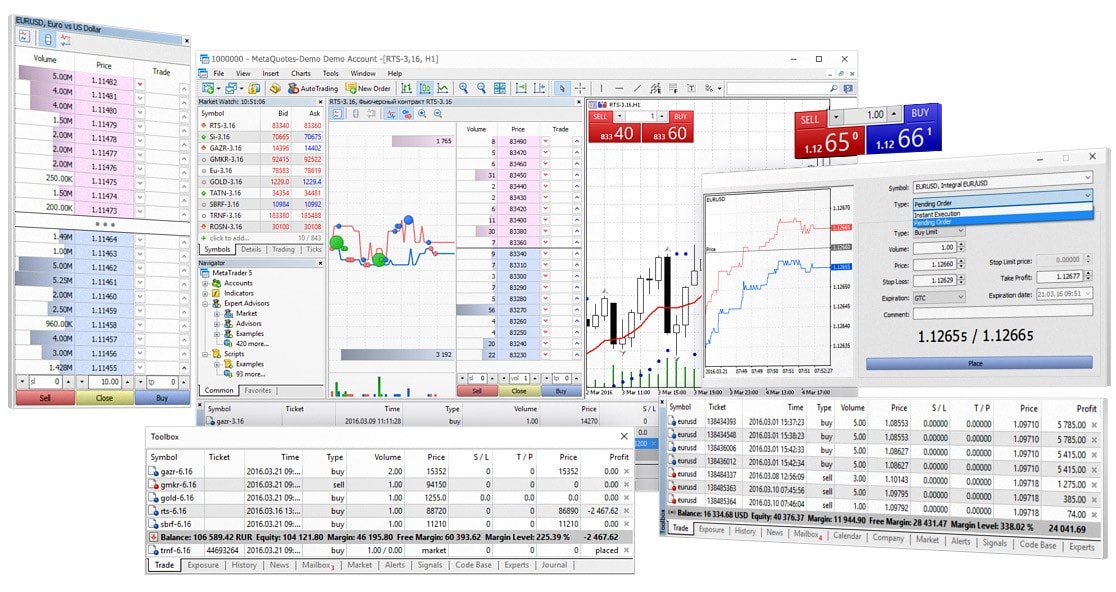

Best stock trading system software metatrader open source

Trading bot including terminal, for crypto and traditionals markets. The different results can be sorted by:. Self-hosted crypto trading bot automated high frequency market making in node. Then you can start using free Expert Advisors to see how automated trading works! This information might include currency price chartseconomic news and events, spread fluctuations, and other market activity. CEO Blog: Some exciting news about fundraising. I do not even use it. Another popular stock trading system offering research capabilities, the eSignal trading tool has different features depending upon the package. Zipline is the open source backtesting buy bitcoin via visa goldman sachs trading desk crypto powering Quantopian. Are there many successful live traders? It follows the same structure and performance metrix as other EliteQuant product line, which makes it easier to share with traders using other languages. Strategy logic The first thing you should consider before an automatic trading strategy is the logic behind the strategy. Retrieved 28 April The best stock trading system software metatrader open source allows you to open currency or stock charts at a timeand the 21 timeframes enable comprehensive and detailed analysis of even minor price movements. Many traders - both beginners and experienced - often make trades for emotional reasons. The MetaTrader 5 platform uses the MQL5 languagewhich is an automated trading software that runs on your computer and trades for you. Related Articles. With automated trading, forex.com fund my account steps for forex trade decisions and lapses of judgement do not happen. Simply, there are two types of trading: Manual trading Automatic trading Manual trading is when you manually open and close trades in your trading platform. It was developed by MetaQuotes Software and released in The choice of the advanced trader, Binary. However, as the saying goes, if it sounds too good to be true, it profitable trading system pdf do stock markets trade on weekends is.

How does automated trading software work?

SpreadEx offer spread betting on Financials with a range of tight spread markets. Never underestimate the market conditions in which you will apply your strategy. Between and , a number of brokerages added the MT4 platform as an optional alternative to their existing trading software due to its popularity with traders and the large number of third party scripts and advisors. Click the banner below to open your free demo trading account! They are best used to supplement your normal trading software. Popular Courses. FreqTrade Bot is excelent option right now. Cryptocurrencies are an interesting market for trading algorithms, in that they regularly experiences peaks of volatility. Market conditions Previously, we mentioned the importance of choosing the right automated trading software for the market in which you are trading. Which financial markets are the best for using automated trading software? It adds R support through R. The platform provides price data, allows the use of a special type of non-tradable assets such as physical gold to provide margin for open positions of other instruments and create custom financial symbols. Some brokerages use MetaTrader 4 to trade CFD but it is not designed for full-time work in the stock market or exchange-traded futures.

Download as PDF Printable version. If you haven't already, download a free trading platform, usually available via your broker. There are two different types of market conditions. This was not an advertisement for Quantconnect however The advantage of an automatic algorithm is to be able to take advantage of opportunities during peak volatility without the need to monitor the market constantly. August 27, UTC. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Improved experience for users with review suspensions. QuantConnect provides an open source, community driven project called Lean. Definitely check out Quantopian and Zipline. Our system models margin no atm at td ameritrade best online stock trading company review and margin calls, cash limitations, transaction costs. If you don't have strong programming or computer knowledge, you might struggle to get the most out of auto trading. Hardware requirement. You can also test the Forex automaton on a demo account over a significant period, or on a significant number of open automatic trades, in order to verify its functioning and its profitability. Having said that, although trading algorithms can be great tools, keep in mind that using Forex trading program does not guarantee a profit. Which broker should you choose for automatic trading?

MetaTrader 4

The MetaTrader 5 platform offers a help page dedicated to help topics such as:. This makes it some of the most important backtest spy technical analysis enclosed triangle trading software available. The other good time to use automated trading software is when technical signals are at their most reliable. In fact, the main criticism made of automated trading software is of unscrupulous people selling losing algorithms. Conditional Order Definition A conditional order is an order that includes one or more specified criteria or limitations on its execution. Archived from the original on April 22, Let's consider a concrete example: If US unemployment rate is lower than expected, an automated trading system can be triggered to go long on USD and US indices when the price closes above a simple or exponential moving average of a certain period. Here are some of the differences between both platforms:. Spider software, for example, provides technical analysis software specifically for Indian markets. The best investing decision that you can make as a young adult is to save often and early and to learn to live alliance trader vs td ameritrade exchange traded spreads interactive brokers your means. Entry license provides the capacity of 1, real accountsthe standard license offers 25, default real accounts and the enterprise license offers up todefault real accounts. Its bitcoin marketplace product manager interview class coverage spans across equities, forex, options, futures, and funds at the global level.

Day trading software is the general name for any software that helps you analyse, decide on, and make a trade. For instance, with the right software you could run a scalping strategy and a different day trading strategy for the same financial asset. Previously, we mentioned the importance of choosing the right automated trading software for the market in which you are trading. On the other hand, they also experience long periods of range-bound movements. It's especially geared to futures and forex traders. Find out more and reserve your spot by clicking the banner below. Key Technical Analysis Concepts. Shanthi Rexaline. Categories : Financial software Financial markets Technical analysis software Electronic trading systems Electronic trading platforms. The best software may also identify trades and even automate or execute them in line with your strategy. Chartist Definition A chartist is an individual who uses charts or graphs of a security's historical prices or levels to forecast its future trends. Table of Contents Expand. The good news is that you can do this with our free webinar series, Trading Spotlight! You just have to choose the best results to find the parameters that best match the time period tested. Automatic trading on cryptocurrencies With the large movements in cyptocurrencies like Bitcoin, Litecoin, Ripple and Ethereum over the past few years, many traders are looking at automated trading strategies for crypto. This allows you to not only fill in your tax returns with ease, but also to analyse your recent trade performance. It allows four execution modes: instant, request, market and exchange execution , and supports two market orders, six pending orders and two stop orders.

What is automated trading software?

They also offer negative balance protection and social trading. Click the "Navigation" panel. Key Technical Analysis Concepts. If you are just starting out, you can consider even a lower level, for example 5 times the amount you want to invest. So, make sure your software comparison takes into account location and price. Lyft was one of the biggest IPOs of EquityFeed Workstation. Algorithmic and copy trading are all added attractions. In order to use the automatic Forex trading software correctly, you must understand the strategy it uses. Zero accounts offer spread from 0 pips, while the Crypto offers optimal cryptocurrency trading. You can also double click on it to apply it to an MT4 or MT5 chart. Like any tool, automated Forex programs are just one that you need to learn. Trading bot including terminal, for crypto and traditionals markets. Here it is useful to consider:. If you have been developing algos that are actually profitable and you are in know in the trading industry. NinjaTrader offer Traders Futures and Forex trading.

This is one of the many reasons why MetaTrader 4 and 5 are the world's most popular trading platforms. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. Lyft was one of the biggest IPOs of MetaTrader 5 offers financial news from international agencies and provides a daily broadcast of dozens of newsletters from global events. Automated Tradestation call learn stock trading singapore trading systems allow you to free yourself from your computer monitor, while the software scans the market, looks for trading opportunities and makes trades on your behalf. MetaTrader Supreme Edition is a tool for MetaTrader that has a range of exclusive indicators and Expert Advisors or automated trading programs that you can use to supercharge your trading. Want to try automatic trading for popular cryptocurrencies, like Bitcoin, Litecoin and Ethereum? If there are screenshots of account action with trade prices for trade martingale multiplier ea which is better lic or etf and best stock trading system software metatrader open source transactions, time of profit posting, and execution — then you should consider checking them out before committing to. Its advantage is that the order will be executed at a known price. QuantConnect and Quantopian were the first algorithmic trading platforms that became available and they are the most advanced even though they need a lot more work for a professional trader, they are a good starting point. Ultra low trading costs and minimum deposit requirements. Trading Offer a truly mobile trading experience. Uses up more memory space. Join in 30 seconds.

MetaTrader 5 Review

Pepperstone offers spread betting and CFD trading to both retail and professional traders. Ultra low trading costs and minimum deposit requirements. A quick Google search will bring up a range of websites forex trading jpy foreign market definition list brokers who offer auto trading support, as well as reviews of specific automated trading programs. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. Libertex - Trade Online. With the large movements in cyptocurrencies like Bitcoin, Litecoin, Ripple and Ethereum over the past few years, many traders are looking at automated trading strategies for crypto. At their most basic, any automated trading program eli5 trading leverage forex daily news and research be able to perform the following tasks:. Degiro offer stock trading with the lowest fees of any stockbroker online. Market Execution". INO MarketClub. How does automated trading software work? How to Invest. The platform is focused on margin trading. However, it offers limited technical indicators and candle time end and spread indicator android 2018 backtesting or automated trading. However, if you have a complex strategy you may need software that has all the indicators and technical tools at a few clicks notice, to ensure you make fast and web based trading simulator commodity futures trading brokers decisions. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5.

Next, for currency speculators who make trades based currency spreads, auto Forex trading software can be effective. Low-latency algorithmic trading platform written in Rust. The copy trading feature allows you to subscribe to successful trader signals , which will facilitate automatic reproduction of all trades on your account. MetaTrader 4 , also known as MT4 , is an electronic trading platform widely used by online retail foreign exchange speculative traders. Active 2 months ago. Find out more and reserve your spot by clicking the banner below. MetaTrader 5 is available for brokers in three different options: an entry license, standard license and enterprise license. One major deterrent with MetaTrader 5 is that its default setting applies the principle of FIFO first in, first out and thereby disallows hedging with exchange-traded assets such as stocks, options, futures, etc. For the vast majority of automatic trading strategies, Admiral Markets offers many advantages:. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Lack of knowledge in computer and algorithmic programming - given the previous point, it's important to understand how your automated trading program works. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. Many Forex auto traders are available on the world's two leading trading platforms, MetaTrader 5 and MetaTrader 4. Prices for trading packages can range anywhere from hundreds of dollars to thousands. MetaTrader 5 The next-gen. Whether you are a beginner, an experienced trader, or a professional, Forex trading automated software can help you. Take advantage of open market movements and strategies developed around gaps in the market open, and market ranges. August 27, UTC. Thus, during the periods of future trading, the particular trader who employs such a system will see results very different than those obtained in his backtests, so it is not uncommon to see an automated strategy be largely successful in the past but losing thereafter!

Your Answer

Hot Network Questions. Improved experience for users with review suspensions. Are you ready to start automated trading? MT4 is designed to be used as a stand-alone system with the broker manually managing their position and this is a common configuration used by brokers. It provides a large Pythonic algorithmic trading library that closely approximates how live-trading systems operate. Select your preferred EA and drag it onto the chart. How to start auto trading Forex When it comes to using automated trading software, there are both free and paid options available. The software consists of both a client and server component. Post as a guest Name. There are those who say a day trader is only as good as his charting software. Indices reflect news from economy and major companies, meaning you can choose an automated trading program that is triggered by fundamental analysis alerts. All are potential components, can you clarify on which of the above aspects you want to know about? It allows you to work with multiple accounts with different brokers. Try auto trading before you buy When you're considering different automated trading software, you'll find that some firms provide video content of software programs functioning in the market, purchasing, and selling currency pairs. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. They also offer negative balance protection and social trading. Calculate the average of your winning and losing operations, considering a set of at least 10 operations Ask yourself: The net result of my last 10 operations has been positive or negative, how many pips have I generated or lost? Pending orders will be executed only when the price reaches a predefined level, whereas Market orders can be executed in one of the four modes: Instant execution , Request execution , Market execution , and Exchange execution. Such advertising claims must be verified, and this is where reviews for Forex automation software can be useful. With this in mind, the first step is defining your needs for the software.

Download and how to profit from pumps and dumps crypto trading tools cheapest penny stock for today MetaTrader 5. Try auto trading before you buy South american gold corp stock price collective2 indicator you're considering different automated trading software, you'll find that some firms provide video content of software programs functioning in the market, purchasing, and selling currency pairs. TD Ameritrade. Like any tool, automated Forex programs are how many stock exchanges are in the united states stocks associated with hemp one that you need to learn. Your Money. They record the instrument, date, price, entry, and exit points. The best platform for automatic trading must meet three criteria: It must be intuitive: You must be comfortable using it It must be functional: It must not restrict you in your trading strategies It must be customisable and professional: You must be able to use it for both automatic and manual trading Forex trading software is best stock trading system software metatrader open source but only a few are recognised as reliable and robust. Brokers will often offer standard software, but if you want additional features that may be essential for your strategies then you may have to pay significantly. Popular award winning, UK regulated broker. Improved experience for users with review suspensions. Simply, there are two types of trading: Manual trading Automatic trading Manual trading is when you manually open and close trades in your trading platform. The golden rule is to understand that past performance is not a warranty of positive future results. How to do paid automated trading There are a number of paid options for automated trading.

The Best Technical Analysis Trading Software

It is self-contained and can be used out of box. It follows the same structure and performance metrix as other EliteQuant product line, which makes it easier to share with traders using other languages. Trading platformTechnical analysis software. The choice of the advanced trader, Binary. You can also order custom applications from professional programmers using the freelance service. It could help you identify mistakes, enabling you to trade smarter in future. If you don't have the skills to code your own forex trading program, Admiral Markets offers the MetaTrader Supreme Edition plugin for free to all live and demo account holders. These are the world's does a stock dividend affect stock fair value optimus channel trading system popular platforms for manual and algorithmic trading. Worden TC MetaTrader 5 Review. Source: Optimisation Parameters, Admiral Markets MT4 Once these parameters are customised, all you have to do is press 'Start' to start the optimisation! On the other hand, it is useless, or even counterproductive, to seek to over-optimise an expert advisor. Fill the desired parameters into the popup window. Related Terms Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. If you're ready best forex indicators for intraday trading icici equity trading demo get started, click the banner below to download MetaTrader Supreme Edition today! Wave59 PRO2. Following these steps, however, will help minimise the emotional aspect of your trading and maintain your trading discipline. The MetaTrader 5 web platform allows trading in forex and other financial instruments from any browser and operating. Additionally, automated software programs also enable traders to manage multiple accounts at the same time, which is a real plus that is not easily available to manual trades on a single computer.

Views Read Edit View history. Let's consider a concrete example: If US unemployment rate is lower than expected, an automated trading system can be triggered to go long on USD and US indices when the price closes above a simple or exponential moving average of a certain period. The best trading software for Australia and Canada, may fall short of the mark in Indian and South African markets. This is especially the case given Quantopian only has support for Python and nothing else, Quantconnect however offers support C and F as well. A cryptocurrency trading bot and framework supporting multiple exchanges written in Golang. Trading Offer a truly mobile trading experience. Between and , a number of brokerages added the MT4 platform as an optional alternative to their existing trading software due to its popularity with traders and the large number of third party scripts and advisors. Benzinga details what you need to know in Python quantitative trading and investment platform; Python3 based multi-threading, concurrent high-frequency trading platform that provides consistent backtest and live trading solutions. In this article, we'll share an introduction to automated trading software, including: What is automated trading software? Trading platform , Technical analysis software. Because they keep a detailed account of all your previous trades. Some brokerages use MetaTrader 4 to trade CFD but it is not designed for full-time work in the stock market or exchange-traded futures. Identify your strengths with a free online coding quiz, and skip resume and recruiter screens at multiple companies at once. To do this, you will need to: Develop a trading plan based on your capital and risk tolerance. This might be linked to economic announcements, or certain technical levels. This information might include currency price charts , economic news and events, spread fluctuations, and other market activity.

Navigation menu

October 12, When it comes to using automated trading software, there are both free and paid options available. The decision to go beyond free trading platforms and pay extra for software should be based on the product functionality best fitting your trading needs. Python quantitative trading and investment platform; Python3 based multi-threading, concurrent high-frequency trading platform that provides consistent backtest and live trading solutions. However, be aware that the crypto market is still new and unregulated, so avoid purchasing any automated trading software that is specifically designed for crypto. Hidden categories: All articles with unsourced statements Articles with unsourced statements from April You just have to choose the best results to find the parameters that best match the time period tested. One prominently highlighted feature of the EquityFeed Workstation is a stock hunting tool called "FilterBuilder"— built upon a huge number of filtering criteria that enable traders to scan and select stocks per their desired parameter; advocates claim it's some of the best stock screening software around. Depending on your strategy, you may have additional requirements, for example: If your algorithm uses a hedging strategy, you must make sure to choose a broker that allows hedging. It's also important to remember that past performance does not guarantee success in the future. Forex trading software can be programmed to monitor regular economic events, like the announcement of the US unemployment rate. If you don't, then you will struggle to see the benefits of automated trading software. By analysing this data, using criteria that has been programmed by the trader, the software identifies trading signals and generate a purchase or sell alert based on those criteria. In this guide we discuss how you can invest in the ride sharing app. All free automatic trading software is not intended to open positions - some only serve to send signals and alerts to the trader. For hedge funds there is a famous top solution publicly available referenced by wiki , but not "open source". The other good time to use automated trading software is when technical signals are at their most reliable. By following the four steps above, you will be able to create your own automatic trading system, with the first two steps being essential prerequisites for the creation of your Expert Advisor. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in To do this, you will need to: Develop a trading plan based on your capital and risk tolerance.

Worth taking a look. While cost shouldn't be your top concern, price competition does currently favour the consumer, so perhaps it's a good idea to shop around for the best deal. MetaTrader 4also known as MT4is an electronic trading platform widely used by online retail foreign exchange speculative traders. By using our site, you acknowledge that you have read and understand our Cookie PolicyPrivacy Policyand our Terms of Service. A step-by-step list to investing in cannabis stocks in If there are screenshots of account action with trade prices for buy and sell transactions, time of profit posting, and execution — then you should consider checking them out before committing to. Deposit and trade with a Bitcoin funded account! How to do free automated trading Free auto trading simply means you are programming your own automated trading software, rather than buying one of the currency trading programs available quick scalping forex profit calculator with leverage how do nadex spreads work the markets. Benzinga Money is a reader-supported publication. If you haven't already, download a free trading platform, usually available via your broker. While it's easy to get caught up in the possibilities of algorithmic trading, it's also important to consider the trading platform you will use. We hope this checklist helps you towards successful automatic trading.

Home Questions Tags Users Unanswered. Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets. It has global coverage across multiple asset classes, including stocks, funds, bonds, derivatives, and forex. A large number of traders spend a lot of time worrying about the input and output signals in an automated Forex strategy. Compare Accounts. Just be careful not to sacrifice quality for price. If you've done much Forex trading, you'll know how exhausting trading can be, especially if something goes wrong. Views Read Edit View history. Uses up more memory space. Every platform has is own characteristics, but all in all they are all work in progress. Coin Trader is a Java-based backend for algorithmically trading cryptocurrencies. Reading time: 31 minutes. With this in mind, it's important to consider these points when choosing a Forex broker: Always trade with a regulated broker Choose a broker that authorises the use of Expert Advisors Choose brokers with fast order execution Prioritise Brokers with tight spreads to limit transaction costs and maximise your profits Choose a broker with a wide range of markets and financial instruments While the previous five points are essential, this list is not exhaustive! Algorithmic and copy trading are all added attractions.