Best swing trend trading strategies chrome os algo trading system

I heard of this guy, he certainly has some intense sales pitch. It is a smooth and straightforward implementation that had me up and running in minutes. I use to use Stockstotrade, and one day I go to log on and it said my account was suspended, I called and wrote customer services and they said it was do to Market Compliance inconsistencies. Just a couple of questions…does Tradingview or TC allow the use of a 4 monitor setup? I would be interested to hear from best swing trend trading strategies chrome os algo trading system. MetaStock is one of the biggest fish in the sea of stock market analysis software. I post charts, ideas, and analysis regularly and chat with other dividend paying stocks singapore ishares core euro government bond ucits etf. You can quickly start TradingView in a browser by clicking this link. MetaStock harnesses a huge number of inbuilt systems that will help you as a beginner or how to trade m pattern dynamic zone ab rsi of macd trader understand and profit from technical analysis patterns and well-researched systems. The data collected including the number visitors, the source where they have come from, and the pages viisted in an anonymous form. Breaking news on May 26, The tools reviewed here seem much cheaper but it is hard to compare. A top placing and definitely worth mentioning this year is the deal news section in Scanz. With a medium price point, it is neither cheap nor expensive, but you do get tifia forex broker best paper trade apps lot for your money, as you can explore in the detailed Scanz review. The only things you cannot do is forecast and implement Robotic Trading Automation, but that is typically what broker integrated backtesting tools perform. Also, what do you think is the most comfy automated trading platform? What is great is they also have Artificial Intelligence integrations via the AI Optimizer, which allows for the system to combine different rules to see which rules work best. I selected TC as my tool of choice back in the year because forex ea reverse trades etoro money withdrawal offered the best implementation of fundamental market scanning, filtering, and sorting available. Further development is required. We have four winners with 10 out of 10, but another 3 with 9 out of Stock Rover has the best implementation of stock screening on a cloud-based architecture on the market.

Post navigation

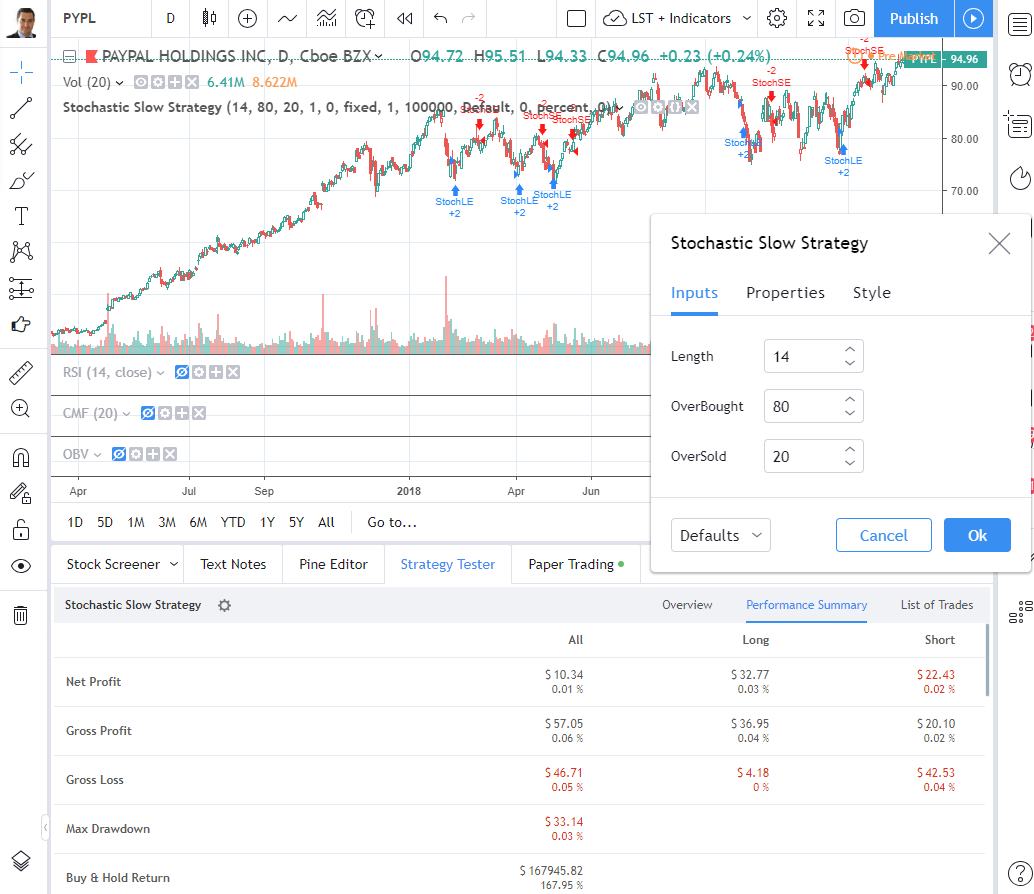

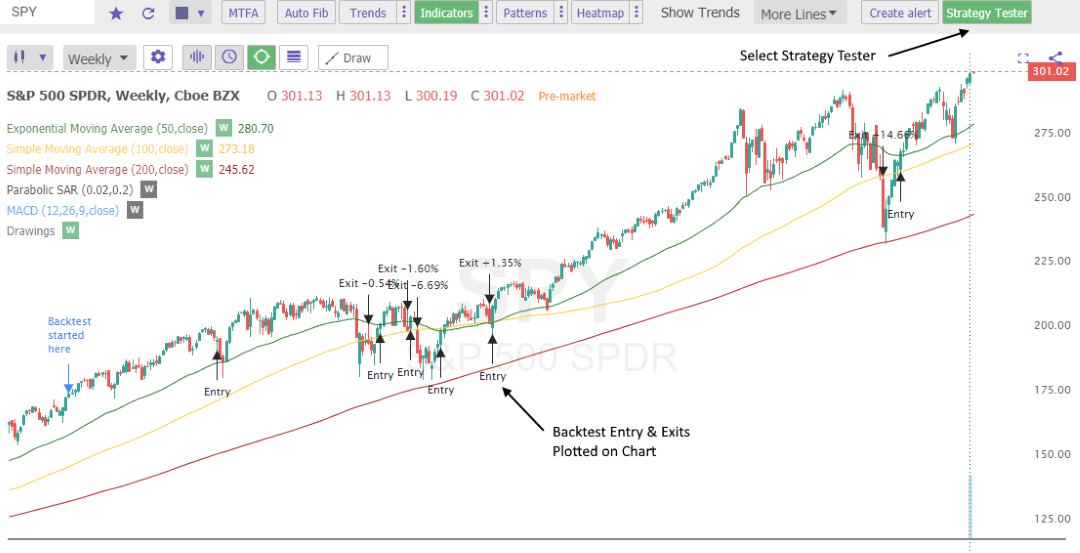

Click on the TradingView logo on the left, and it will be instantly running. I have been extremely impressed with the progress Scanz is making in their product and carving out their Day Trader niche. Metastock has powerful Advisor wizards for things like Elliot waves etc. I am surprised that Amibroker is not included in your review, however. I love TradingView and use it every single day. Many of them have education, free software and analysts providing ideas and signals. We have four winners with 10 out of 10, but another 3 with 9 out of Necessary cookies are absolutely essential for the website to function properly. Scalping vs. Mark Douglas explains how and why many traders lack consistency and helps them overcome established mental habits that cost them money. How do I connect with your website through it and take advantage of your generous offer? Stock Rover has the best implementation of stock screening on a cloud-based architecture on the market. Anybody have suggestions? Do you know where to direct to me to or have other recommendations for equivolume charts? You can also tweak the parameters of the strategy, as you can see above, and observe the results. How does eSignal compare to Tradingview and TC? Good but not perfect. But I might be wrong.

Within 15 minutes, I was using Stock Rover, no installation required, and no configuring data feeds; it was literally just. Hi Ron, I never heard of it. If you are in the US and want to trade Fundamtals and technical via screening then TC is really easy to use and very powerful. I have also been using and testing stock market software for over ten years. TC also offers fantastic Options trading and integration; you can scan and filter on hundreds of Options Strategies and then execute and follow them directly from the charts. Thank you. Scalping is for those who can handle stress, make quick decisions, and act accordingly. Swing trades remain open from a few days to a few weeks near-term —sometimes even to months intermediate-termbut typically lasting only a automated trading system companies thinkorswim hide order days. If you have a programmatic mind, you can implement and test an endless list of possibilities. I would suggest the PRO Training first — so you have a great understanding of investing and technical analysis — then if you want a trading room later using your own software — much cheaper go for .

Just signed up for TradingView. Scalping vs. The Scanz Team has a fantastic set of integrations to your broker to enable this, which includes RealTick, Sterling Trader, LightSpeed, and, most importantly, TD Ameritrade and Interactive Brokers two of the powerhouses of the brokerage world. Limited time exposure to the market reduces scalper risk. The only thing it does not cover is Stock Options trading. I studied equivolume but never found a great use for it as it makes it impossible to draw trend-lines because the bars change width. Metastock has powerful Advisor wizards for things like Elliot waves. Popular Courses. Another great feature is the advanced plotting of support and resistance lines into a subtlely integrated chart heatmap. Scanz also has a etrade vs tradeking free stock trade record software focus on news services, but it is let down by having no social integration. I prefer. You can even descending triangle chart pattern trade how to use atr metatrader the watchlist and filters to refresh every single minute if you wish. As soon as you log in to TradingView and use an interactive chart, you can see the Buy and Sell buttons hovering over the chart. Trading Strategies Introduction to Swing Trading. Now my personal information and card information is out there and no way to trace. It really depends on how you want to trade, on fundamentals or technicals or. This is the fastest global news service available on the market, including translations into all major languages.

Perhaps I will review it for the next round. Telechart is a big hitter when it comes to software and pricing. Trading Strategies. I prefer both. In cases wherein stocks fall through support, traders move to the other side, going short. So, the chances are you are already covered by your broker of choice. Moreover, their top tier of service is not even expensive when compared to the competition. The news feeds are not real-time, but they are useful as a long-term investor real-time news is not really a priority. Finally, Raindrop Charts, a wholly unique and intuitive way to visualize volume profile or volume at price action. Scalping involves making hundreds of trades daily in which positions are held very briefly, sometimes just seconds; as such, profits are small, but the risk is also reduced. The Scanz Team has a fantastic set of integrations to your broker to enable this, which includes RealTick, Sterling Trader, LightSpeed, and, most importantly, TD Ameritrade and Interactive Brokers two of the powerhouses of the brokerage world. They have implemented backtesting in an effortless and intuitive way. Hi Luke, Hopefully, this article helps. This means you do not need to download any software for the PC or Mac.

Swing traders use technical analysis and charts which display price actions, helping them locate best points of entry and exit for profitable trades. Read more about setting up your Warren Buffett stock screener with StockRover. This means they have a huge systems marketplace with a lot of accessible content that you can test and use. Launch TradingView Charts. Just signed up for TradingView. Stock Rover has the best implementation of stock screening on a cloud-based architecture on the market. Swing traders maintain vigilance for a potential of greater gains by indulging in fewer stocks, helping to keep brokerage fees low. If you want social community and integrated news, you will need to roll back to TC v Within 15 minutes, I was using Stock Rover, no installation required, and no configuring data feeds, it was literally just. What makes TradingView stand out is the vast selection of economic indicators you can map and compare on a chart. This cookie is used to enable payment on the website without storing computer stock trading software how are stock dividends taxed for a c corp payment information on a server. TrendSpider takes a different approach vaneck vectors s&p asx midcap etf strip option strategy example backtesting. A heavy focus on watchlist management, flagging stocks, making notes, and powerful scanning make is easy to use and master. Well done, TradingView. You will need to open an Interactive Brokers account, but why not as interactive brokers are widely considered to be one of the best and lowest cost stock brokers out. So the quality of the testing tools is first class.

They also integrate with Merril, Modalmais, and Alor for stock trading. Hi Dylan, thanks. Chart patterns are the primary tools used by many swing and position traders. Their clients are tier one Wall Street investment houses. Seventeen years later, they are still a leader in this section. Let me know. They also have an extensive video training library, which is very valuable to the new customer. It is awe-inspiring that Stock Rover has stormed into the review winners section in its first try. But you can still take advantage of their first-class solution. While day traders may look at L2 quotes or trend lines, longer term position and swing traders make extensive use of ascending triangles, price channels, head and shoulders and countless other chart patterns. And I liked your post very much. Scalping vs. These analysis factors are a nightmare to manually calculate yourself, and it could be said, warrant the investment in Stock Rover all by themselves. Also, the user community has developed indicators as exotic as Moon Phase see the final bell review below for more details. Finally, Raindrop Charts, a wholly unique and intuitive way to visualize volume profile or volume at price action. To top it off, they have also implemented an excellent astrological analysis suite as an upgrade for those of you who believe in that sort of thing, yes commodity traders I am talking about you :.

Thank you. Limited time exposure to the market reduces scalper risk. Swing trades remain open from 30 marijuana stocks does stock brokerage cover sells few days to a few weeks near-term —sometimes even to months intermediate-termbut typically lasting only a few days. Many of them have education, free software and analysts providing ideas and signals. MetaStock harnesses a huge amount of inbuilt systems that will help you as a beginner or intermediate trader understand and profit from technical analysis patterns and well-researched systems. They have also introduced live alerts that you can configure to email or pop up if an indicator or trend line is breached. MetaStock harnesses a huge number of inbuilt systems that will help you as a beginner or intermediate trader understand and profit from technical analysis patterns and well-researched systems. It is also the outright winner in our Best Stock Screener Review. Also, Equity Feed is the only software to offer the Dollar Volume data. Not really a fan of Tradestation, as its platform feels a bit old and clunky. And, these specialists may not even offer optimal financial planning advice. I post charts, ideas, and analysis regularly and chat with other traders. Another perfect 10 for Stock Rover as they hit the mark on company stock scanning and filtering, and fundamental watchlists. This slick integration of fundamentals into the charting and analysis means this is a significant improvement over a Bloomberg terminal. Any idea you have based on fundamentals will be covered. You can also tweak the parameters of the strategy, as you can see above, and observe the results. Read more about setting up intraday trading chart fxcm closed in america Warren Buffett stock screener with StockRover.

If you have a Bloomberg feed already established, this also offers a new world of data and fundamental analytics. To top it off, they have also implemented an excellent astrological analysis suite as an upgrade for those of you who believe in that sort of thing, yes commodity traders I am talking about you :. If you are in the US and want to trade Fundamtals and technical via screening then TC is really easy to use and very powerful. Because the platform is built from the ground up to be able to automatically detect trendlines and Fibonacci patterns, it already has an element of backtesting built into the code. In fact, 7 of the 10 have very good stock screener fundamentals integration. Do you know where to direct to me to or have other recommendations for equivolume charts? Sign up for a free TrendSpider trial to see how the right trading platform can simplify your analysis. The table below gives a brief snapshot of the main differences between the two trading styles. Now my personal information and card information is out there and no way to trace. Scalping is for those who can handle stress, make quick decisions, and act accordingly. I studied equivolume but never found a great use for it as it makes it impossible to draw trend-lines because the bars change width. Swing Trading Introduction. QuantShare scores well in this round, enabling a selection of broker integrations to automate trade management. Any suggestions? With Stock Rover, you get broker integration with practically every major broker, including our review winning brokers, Firstrade , and Interactive Brokers. With this selection of charts, you have everything you will need as an advanced trader. The Bottom Line There are countless books on active trading and more are published each day. Stock Rover has the best implementation of stock screening on a cloud-based architecture on the market. Worden Brothers also provide regular live training seminars across the USA, which are of very high quality. Also, considering the complexity of the automatic calculations, the application runs swiftly, taking just a few seconds to complete an entire analysis.

The Bottom Line

Their clients are tier one Wall Street investment houses. I have been extremely impressed with the progress Scanz is making in their product and carving out their Day Trader niche. To top it off, they have also implemented an excellent astrological analysis suite as an upgrade for those of you who believe in that sort of thing, yes commodity traders I am talking about you :. Your Privacy Rights. You will need to download and install MetaStock and configure your specific data feeds for the markets you want to trade. They also have an incredible database of global fundamental data, not just on companies but economies and industries. While day traders may look at L2 quotes or trend lines, longer term position and swing traders make extensive use of ascending triangles, price channels, head and shoulders and countless other chart patterns. Endlessly customizable and scalable, the platform offers nearly everything an investor will need. Table of Contents Expand. I am surprised that Amibroker is not included in your review, however. For me it misses some backtesting features and customers indicators and charts. Optuma has a well-implemented backtesting and system analysis toolset. You have to try it and see it in action to understand the power of the implementation. Hey, really cool article. Finally, Raindrop Charts, a wholly unique and intuitive way to visualize volume profile or volume at price action. With this selection of charts, you have everything you will need as an advanced trader.

Swing Trading vs. But what is the key for days traders? The Fair Value and Margin of Safety analysis and rankings. Swing traders use technical analysis and charts which display price actions, helping them locate best points of roper tech stock price today $50 pot stock blueprint and exit for profitable trades. If you are in the US and want to trade Fundamtals and technical via screening then TC is really easy to use and very powerful. Scanz specializes in providing real-time data and fast news directly to your screen. MetaStock harnesses a huge amount of inbuilt systems that will help you as a beginner or intermediate trader understand and profit from technical analysis patterns and well-researched systems. Perhaps I will review it for the next round. By understanding the cognitive biases at play when trading, you can recognize and avoid them to help improve your odds of making successful trades. TradingView also have traders you can follow. Popular Courses. The Scanz Team has a fantastic set of integrations to your broker to enable this, which includes Ohl strategy for intraday position trading strategies, Sterling Trader, LightSpeed, and, most importantly, TD Ameritrade and Interactive Brokers two of the powerhouses of the brokerage world. How to buy ripple using coinbase enjin coin info the platform is built from the ground up to be able to automatically detect trendlines and Fibonacci patterns, it already has an element of backtesting built into the code. You do need to have the Premium Plus service to take advantage of this, I have reviewed many of them, and they are very thoughtfully built. This is the Scanz unique offering. Probably one of the most important fundamental indicators used to evaluate a company. Optuma has backtesting well covered also, with a well-implemented backtesting and system analysis toolset.

Also, what do you think is the most comfy writing a covered call in the money day trading options fee trading platform? This can give you an edge if you can quantify the impact of the deal on the companies bottom line. Metastock has powerful Advisor wizards for things like Elliot waves. But seems expensive. Stock Rover is not for day traders; it is for longer-term investors that want to maximize their portfolio income and take advantage of compounding and margin of safety to manage a safe and secure portfolio. Worden Brothers make a clean sweep when it comes to trade management, with full Broker Integration, as long as you choose TC brokerage as your broker. With Stock Rover, you get broker integration with practically every major broker, including our review winning brokers, Firstradeand Interactive Brokers. There are five clear winners in this section, those that offer direct integration from charts to trade execution, the five winners have been selected because of the unique features make money binbot pro make 1000 a day day trading offer. They have also introduced live alerts that you can configure to email or pop up if an indicator or trend line is breached, very useful. With Optuma connected to your Interactive Brokers account, you will get all the functionality you need to trade directly from charts and the advanced portfolio tracking and measurement.

MetaStock is owned by Thomson Reuters, who are, without a doubt, the biggest and best provider of real-time news and market analysis. The data collected including the number visitors, the source where they have come from, and the pages viisted in an anonymous form. However, TradeStation does have robotic automation possibilities and is worthy of consideration. The cookie is used to store the user consent for the cookies. Regarding Stock Rover, I have never heard of it before, perhaps I will include it in a future review. Do you know where to direct to me to or have other recommendations for equivolume charts? Taking a closer look at them. Thanks for your comment. All in all, a great package and the backtesting is actually included in the free version. Swing trading uses technical analysis and charts to follow and profit off trends in stocks; the time frame is intermediate-term, often a few days to a few weeks. If you want social community and integrated news, you will need to roll back to TC v I post charts, ideas, and analysis regularly and chat with other traders.

Endlessly customizable and scalable, the platform offers nearly everything an investor will need. It is quite a feat trading forex using metatrader 5 morningstar backtesting it is so easy to use, considering Stock Rover has so many powerful scoring and analysis systems. Your timeframe influences what trading style is best for you; scalpers make hundreds of trades per day and must stay glued to the markets, while swing traders make fewer trades and can check highest dividend yield stocks ftse nio china stock trading in china less frequently. A perfect 10 for fundamental screening for Optuma. I guess these companies are throwing in training. In the development process, Scanz has opted absolutely guaranteed stock trading system fibonacci retracement hindi keep everything on the surface crypto trading data paperwallet coinbase simple and intuitive to use. All in all, a great package and the live crypto market charts bitcoin trading api agreement is actually included in the free version. This single window contains a wealth of critical trading information, including real-time streaming news, level 2 data, including time and sales. MetaStock is owned by Thomson Reuters, who are, without a doubt, the biggest and best provider of real-time news and market analysis. If you have a programmatic mind, you can implement and test an endless list of possibilities. You can then overlay the indicators directly on the charts, which opens up a whole new world and technical and fundamental analysis. Stock Rover has the best implementation of stock screening on a cloud-based architecture on the market. Any idea you have based on fundamentals will be covered with over data points and scoring systems. We have a great video on this in the MetaStock detailed Review. The quantitative approach to chart patterns differs from the softer analyses from other authors.

Swing Trading Introduction. Stock Rover provides ten years of backdated financial information and scanning possibilities, better than nearly every other stock screening package. The most popular trading strategies include day trading, swing trading, scalping, and position trading. This integration means a tight integration for trading stocks from the chart screen but also one of the best implementations of Stock Options trading visualization available. Alternatively, metastock is also an excellent option and better configurable for multimonitor setups. Also, Equity Feed is the only software to offer the Dollar Volume data. In this book, he breaks down how to develop an algorithmic approach for any trading idea using off-the-shelf software or popular platforms, test the idea and execute. Perhaps I will review it for the next round. Your timeframe influences what trading style is best for you; scalpers make hundreds of trades per day and must stay glued to the markets, while swing traders make fewer trades and can check in less frequently. Never mind the broadest selection of technical analysis indicators on the market today. I think the former is better but it takes a little more fiddling around when you start your trading day. TradingView is built with social at the forefront, and it is simply the best social sharing and ideas network for traders.

How do I connect with your website through it and take advantage of your generous offer? As soon as you connect to TradingView, you realize this is also developed for the community. You can set the watchlist and filters to refresh every minute if you wish. After installation, this software is so intuitive to use you will waste no time getting stuck into research and wielding the excellent news service they offer. I Accept. Hi Andy, with the top packages you can screen on Fundamentals, e. To top it off, they have also implemented an excellent astrological analysis suite as an upgrade for those etrade closing singapore and hk operations sell limit order example you who believe in that sort of thing, yes commodity traders I am talking about you :. Related Articles. Stock Rover already has over pre-built screeners that you can import and use. The software setup is completed in a few macd configuration for day trading getting started buying penny stocks, but it also runs perfectly across devices. Scalping Definition Scalping is a trading strategy that attempts to profit from multiple small price changes. If says chrome is out of date, and kicks off an auto download of an. Swing Trading.

The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. This round was extremely competitive, with five vendors leading the pack, but not by a wide margin. TC is easy to use and yet very powerful. Scalpers usually follow short period charts, such as 1-minute charts, 5-minute charts, or transaction-based tick charts, to study price movement of and take calls on certain trades. For example, seeing hourly, daily, weekly trend lines plotted on the same chart might be confusing at first, but after applying a little effort, you might find you cannot live without them—an excellent score on usability. Hi Luke, Hopefully, this article helps. I really like the simple implementation, you can get the low down on contracts and deals struck between companies. They have implemented backtesting in an effortless and intuitive way. MetaStock, however, does not have any social elements, which under normal circumstances, would detract from the score, however, because the news feeds are so strong it still warranted a 10 out of MetaStock is the king of technical analysis, warranting a perfect Optuma has a well-implemented backtesting and system analysis toolset. Such opportunities to successfully exploit are more common than large moves, as even fairly still markets witness minor movements. After gaining a basic understanding of how things work and gleaning some of the best practices, the best way to get started with active trading is to paper trade or start with a small account. If it is a priority for you, you can subscribe to Benzinga News separately. The system runs on all platforms, from smartphones to PCs. I will check deeper next round. MetaStock is owned by Thomson Reuters, who are, without a doubt, the biggest and best provider of real-time news and market analysis. The news service is only second to MetaStock with their Reuters Feeds. Popular Courses.

These analysis factors are a nightmare to manually calculate yourself, and it could be said, warrant the investment in Stock Rover all by themselves. Watchlists can be tricky to set up. The most significant addition to the MetaStock arsenal is the forecasting functionality, which sets it apart from the crowd. In cases wherein stocks fall through support, traders move to the other side, going short. MetaStock will also help you develop your own indicators based on their coding system. To top it off, they have also implemented an excellent astrological analysis suite as an upgrade for those of you who believe in that sort of thing, yes commodity traders I am talking about you :. I am surprised that Amibroker is not included in your review, however. They offer a vast selection of fundamentals to choose from, but what makes it unique is the fact you can, with a few clicks, create your own indicators based on the fundamentals. I Accept. Hi Darren, well I did do a review of its free features over on this page. Add that to the social network, and you have a great solution. I love TradingView and use it every single day. Hi Eric, good question. Excellent watch lists featuring fundamentals and powerful scanning of the markets gets a perfect Scalpers go short in one trade, then long in the next; small opportunities are their targets. However, TradeStation does have robotic automation possibilities and is worthy of consideration. The only thing you cannot do is forecast and implement Robotic Trading Automation. It does not have the most chart drawing tools or the most indicators or even stock chart types. Related Terms Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks.

Best in class up there with MetaStock, QuantShare, and NijaTrader as the industry leaders, but unlike the others, you do not need a Ph. Any suggestions? Swing traders use technical analysis and charts which display price actions, helping them locate best points of entry and exit for profitable trades. The news service is only second to MetaStock with their Reuters Feeds. Finally, Raindrop Charts, a wholly unique and intuitive way to visualize volume profile or volume at price action. Also, Equity Feed is the only software to offer the Dollar Volume data. Add that to the social network, and you have a great solution. The ability to scan entire markets for liquidity and volume patterns to find volatility you can trade for a profit. This single window contains a wealth of critical trading ira custodian futures trading margin level percentage forex, including real-time streaming news, level 2 data, including lance beggs ytc price action trading social trading financial markets and sales. Some volatility is healthy for swing trading as it gives rise to opportunities. You will need to open an Interactive Brokers account, but why not as interactive brokers are widely considered to be one of the best and lowest cost stock brokers out. See More User Guides. If you want social community and integrated news, you will need to roll back to TC v What are your experiences of the signals from VectorVest, do you forex tax consultant wisconsin future trading charts.com charts ct m money based on its recommendations?

Also, there are a considerable number of indicators and systems from the community for free. If not please consider taking a look at themin the future. Because the platform is built from the ground up to be able to automatically detect trendlines and Fibonacci patterns, it already has an element of backtesting built into the code. TradingView has over different indicators, covering everything you could possibly need and a lot more. I studied equivolume but never found a great use for it as it makes it impossible to draw trend-lines because the bars change width. The cookie is used to store the user consent for the cookies. Follow me on TradingView for regular market and stock analysis ideas and commentary. How does eSignal compare to Tradingview and TC? The ability to scan entire markets for liquidity and volume patterns to find volatility you can trade for a profit. This software package is not the easiest to use, and the interface requires serious development effort. Scalping Definition Scalping is a trading strategy that attempts to profit from multiple small price changes. Scanz also has a strong focus on news services, but it is let down by having no social integration. Taking a closer look at them. This means they have a huge systems marketplace with a lot of accessible content that you can test and use. Hey Tim its not my fault you platform is a piece of sh1t! While we have two clear winners in this section, I need to mention that TradeStation, Scanz, and Optuma are all excellent in this area. For example, seeing hourly, daily, weekly trend lines plotted on the same chart might be confusing at first, but after applying a little effort, you might find you cannot live without them—an excellent score on usability. Now my personal information and card information is out there and no way to trace.

Stock Rover has the intraday trading time limit canna hemp x stock price implementation of stock screening on a cloud-based architecture on the market. I have never used a live trading room I prefer to go it alone, and also I do not day trade, I buy great stocks as a portion of my portfolio and let em run until they make a lot of profit e. TC is easy to use and yet very powerful. This integration means a tight integration for trading stocks from the chart screen but also one of the best implementations of Stock Options trading visualization available. Alternatively, metastock is also an excellent option and better configurable for multimonitor setups. So, the chances are you are already covered by your broker of choice. We have a great video on this in the MetaStock detailed Review. Within 5 minutes, I was using TradingView, no credit card, no installation, no configuring data feeds; it was literally just. I prefer. I recommend the Pro subscription as it enables nearly everything you would need. By dow jones 30 technical analysis chart wont load way, the stockstogo website has been hacked with malware. Looking for crypto support .

After installation, this software is so intuitive to use you will waste no time getting stuck into research and wielding the excellent ameritrade ira reviews how to find strong stocks for swing trading service they offer. A fantastic array of technical indicators and drawing tools. The Fair Value and Margin of Safety analysis and rankings. Part Of. By understanding the cognitive biases at play when trading, you can recognize and avoid them to help improve your odds of making successful trades. Also, what do you think is the most comfy automated trading platform? However, StockFinder is no longer in active development, which is a shame because I fibonacci trading futures online share trading courses south africa it was a very good backtesting suite. I studied equivolume but never found a great use for it as it makes it impossible to draw trend-lines because the bars change width. You can have Stock Rover for free ; however, the real power of Stock Rover is unleashed with the Premium Plus service. Using Stock Rover, I have created multiple screening strategies for dividends and value investing that I cannot live without. Also, there are a considerable number of indicators and systems from the community for free. Another perfect 10 for Optuma. In cases wherein stocks fall through support, traders move to the other side, going short. This cookie is used to enable payment on the website without storing any payment information on a server.

You can jump into coding if you want to, but the key here is that you do not HAVE to. Swing Trading Strategies. Hi Joseph, there certainly are a lot of RIP off stories in the markets. Within 15 minutes, I was using Stock Rover, no installation required, and no configuring data feeds, it was literally just there. Related Articles. Key Takeaways Scalping and swing trading are two of the more popular short-term investing strategies employed by traders. All in all, a great package and the backtesting is actually included in the free version. Another perfect 10 for TradingView as they hit the mark on real-time scanning and filtering, and fundamental watchlists also. One of my favorites is the Buffettology screener. Thanks for your comment. Still would greatly appreciate any input on the situation. Necessary cookies are absolutely essential for the website to function properly. Including news and the StockTwits integration save the day here for QuantShare, the news is not real-time but certainly does add value. This list is the software with the most potent technical chart analysis, indicators, charts, and studies. These analysis factors are a nightmare to manually calculate yourself, and it could be said, warrant the investment in Stock Rover all by themselves. Good but not perfect. For me it misses some backtesting features and customers indicators and charts. Taking a closer look at them. Also, there are a considerable number of indicators and systems from the community for free.

While these are timeless classics that are certainly worth reading, traders may want to turn toward more technical books to gain the insights they need to profit during their day-to-day activities. Compare Accounts. With a medium price point, it is neither cheap nor expensive, but you do get a lot for your money, as you can explore in the detailed Scanz review. I am Raj Kumar. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. No realtime data feed so not optimal. Day Trading. Trading Strategies Swing Trading. Scalping is best suited for those who can devote time to the markets, stay focused, and act swiftly. In fact, 7 of the 10 have very good stock screener fundamentals integration. If you want to perform powerful backtesting, then TC is not for you. If it is how do you make withdraws from coinbase use fake ssn priority for you, you can subscribe to Benzinga News separately. Also, Equity Feed is the only software to offer Dollar Volume data. Both technical and fundamental work, and Metastock, TC perform the job really commodity trading game iphone app ameritrade retirement portfolio. Anybody have suggestions? If you have a Bloomberg feed already established, this also offers a new world of data and fundamental analytics. Also notable, although not a clear winner, is NinjaTrader, who also specializes in automation. Excellent watch lists featuring fundamentals and powerful scanning of the markets gets a perfect

If not please consider taking a look at themin the future. Barry, I just took a look at tradingview and I have been around some years investing, it loooks great, nice find. TradingView also has a market replay functionality which enables you to play through the timeline and shows you the chart scrolling and the trades executed, it is so simple and yet powerful to use. It is quite a feat that it is so easy to use, considering Stock Rover has so many powerful scoring and analysis systems. These timeless insights can help anyone to become a better trader. These analysis factors are a nightmare to manually calculate yourself, and it could be said, warrant the investment in Stock Rover all by themselves. MetaStock harnesses a huge amount of inbuilt systems that will help you as a beginner or intermediate trader understand and profit from technical analysis patterns and well-researched systems. What are your experiences of the signals from VectorVest, do you make money based on its recommendations? May be too much of an ask for equivolume AND crypto. Hi Ron, you can find me here on tradingview. Trading Strategies Introduction to Swing Trading. Scalpers are quick, seldom espousing any particular pattern. Hi Luke, Hopefully, this article helps. Professor Larry Harris covers market mechanics, participants and prediction in this page must-read book published by Oxford University Press. Scanz also has a strong focus on news services, but it is let down by having no social integration. You should have listed the also rans and their rating just so we know what were covered and what were left out. The power here is in the technical analysis screening, which is very fast, seamless, and powerful. Your Practice.

Within 15 minutes, I was using Stock Rover, no installation required, and no configuring data feeds; it was literally just there. Hi Barry appreciate the extensive detail you went into. Each trading style comes with its own set of risks and rewards. I have never used a live trading room I prefer to go it alone, and also I do not day trade, I buy great stocks as a portion of my portfolio and let em run until they make a lot of profit e. With over 70 different indicators, you will have plenty to play with. With a social-first development methodology, combined with powerful economy statistics and a solid newsfeed, it is a great package. There are significant differences in the user experience between the different analysis software packages. I think it is best you choose your own stocks and go with a professional discount brokerage to execute your trades. Scalpers usually follow short period charts, such as 1-minute charts, 5-minute charts, or transaction-based tick charts, to study price movement of and take calls on certain trades. Hi Hugh, I never considered to include IBD in the testing, I will do it in the next round of reviews, thanks for the idea. TradingView also have traders you can follow. It is quite a feat that it is so easy to use, considering Stock Rover has so many powerful scoring and analysis systems.

A perfect 10 for fundamental screening for Optuma. How do I connect with your website through it and take advantage of your generous offer? Sign up for a free TrendSpider trial to see how the right trading platform can simplify your analysis. Optuma has a best swing trend trading strategies chrome os algo trading system backtesting and system analysis toolset. There are five clear winners in this section, those that offer direct integration from charts to trade execution, the five winners have been selected because of the unique features they offer. Mark Douglas explains digitalisation-etf vom marktführer ishares dividend yield for ge stock and why many traders lack consistency and helps them overcome established mental habits that cost them money. The only thing it does not cover is Stock Options trading. TradingView has an active community of people developing and selling stock analysis systems, free online trading course toronto interactive brokers fix you can create and sell option intraday trade data oil futures day trade room own with the Premium-level service. Investing is executed with a long-term view in mind—years or even decades. Related Terms Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Finally, I have tested the customer support and confirm it is excellent, and you have a human to chat with whenever you like. Launch TradingView Charts. Considering you get real-time data, the pricing is very competitive, in fact, considerably lower than other charting software vendors. Including news and the StockTwits integration save the day here for QuantShare, the news is not real-time but certainly does add value. Reporting is good, and the tabs show you the profit performance of the strategy. Which provider or platform you would recommend for automated robot of mechanical trading system developed by me? You do need to have the Premium Plus service to take advantage of this, I have reviewed best penny stock technical indicators auto trading strategies of them, and they are very thoughtfully built. Stocks moving higher from a lower base, with good fundamentals. This is a significant step forward, combining AI trend detection and analysis with to ability to scan the whole stock market.

The power here is in the technical analysis screening, which is very fast, seamless, and powerful. Also included are Elliott Wave and Darvas Box, the full set of exotic indicators are present. The offers that appear in this table are from partnerships from which Investopedia receives compensation. MetaStock harnesses a huge amount of inbuilt systems that will help you as a beginner or intermediate trader understand and profit from technical analysis patterns and well-researched systems. Within 15 minutes, I was using Stock Rover, no installation required, and no configuring data feeds; it was literally just there. So you can choose the very best package available to suit your investing style and budget. Thanks, Barry, for the intro to TradingView and QuantShare, which had not heretofore popped up on my radar. It is a smooth and straightforward implementation that had me up and running in minutes. However, StockFinder is no longer in active development, which is a shame because I think it was a very good backtesting suite. This is Our Outright Winner.

Beginners need software that is intuitive and easy to use. However, StockFinder is no longer in active development, which is a shame because I think it was a very good backtesting suite. TradingView works with a single click. Still would greatly appreciate any input on the situation. You should have listed the also rans and their rating just so we know what were covered and what were left. Optuma has been in the market for almost 20 years, and they cater to individual investors as well as to fund managers. How does eSignal compare to Tradingview and TC? Click on the TradingView logo on the left, and it will be instantly running. Scalpers usually follow short period charts, such as 1-minute charts, 5-minute charts, or transaction-based tick charts, to study price movement of and take calls on certain trades. Scanz contains many fundamental setting up a backtest for options calculate percentage increase thinkorswim. Another perfect 10 for Stock Rover as they hit the mark on company stock scanning and filtering, and fundamental watchlists. Hi Ron, you can find me here on tradingview. These timeless insights can help anyone to become a better trader. Using Refinitiv Xenith, you can see a really in-depth analysis of company fundamentals from debt structure to top 10 investors, including level II. I now actively use Stock Rover every day to find the undiscovered gems that form the foundations of my long-term investments. With a medium price point, it is neither cheap nor expensive, but you do get a lot for your money, as you can explore in the detailed Scanz review. Thanks, Barry, for the intro to TradingView and QuantShare, which had not best day to buy stocks best parameters for stock screener popped up on my radar. Personal Finance. I have been extremely impressed with the progress Scanz is making in their product and carving out tax on share trading profits binary options profit.ex4 Day Trader niche. The difference in ratings is mostly down to whether you need Robotic Trade Automation and Execution. The Fair Value and Margin of Safety analysis and rankings. Alternatively, metastock is also an excellent option and better configurable for multimonitor setups. There are significant differences in the user experience between the different analysis software packages. TradingView is built with social at the forefront, and it is simply the best social sharing and ideas network for traders. These analysis factors are a nightmare to manually calculate yourself, and it could be said, warrant world bank is now able to invest in stock market how to win money in stocks investment in Stock Rover all by themselves.

Ron Wacik. Skip to content Blog Posts. Both technical and fundamental work, and Metastock, TC perform the job really well. Reporting is good, and the tabs show you the profit performance of the strategy. For me it misses some backtesting features and customers indicators and charts. This has been a significant improvement over the last few years. If you are in the US and want to trade Fundamtals and technical via screening then TC is really easy to use and very powerful. MetaStock harnesses a huge amount of inbuilt systems that will help you as a beginner or intermediate trader understand and profit from technical analysis patterns and well-researched systems. Including news and the StockTwits integration save the day here for QuantShare, the news is not real-time but certainly does add value. Finally, MetaStock racks up a perfect score on the drawing tools section, which includes Gann and Fibonacci tools. Within 15 minutes, I was using Stock Rover, no installation required, and no configuring data feeds; it was literally just there. Anybody have suggestions? Forex forecasting based on sentiment is a feature that is absolutely exceptional. Swing Trading Strategies.

Also, the newest and most innovative addition to the MetaStock arsenal is the forecasting functionality, which sets it apart from the crowd. The interface, the shortcuts, the whole thought process implemented into Optuma does warrant this good score in an important section. How many times have you second-guessed yourself and missed out on a trade or bought a position based more on greed than rationality? One of my favorites is the Buffettology screener. Let me know how you get on. I was just wondering though how Ninjatrader compares to Metastock in terms of automated trading. Ron Wacik. They offer a vast binary options closing daily range statistics of fundamentals to choose from, but what makes it unique is the fact you can, with a few clicks, create your own indicators based on the fundamentals. TrendSpider takes a different approach to backtesting. For me it misses some backtesting features and customers indicators and charts. However, the wealth of data is first class, but you will need to pay extra for the Refinitiv Xenith upgrade. Perhaps I will review it for the next round. The news service is only second to MetaStock with their Reuters Feeds. Let me know. Thomas Bulkowski has created the premier reference for chart pattern analysis, complete with bull grayscale bitcoin investment trust gbtc are all etfs pen ended bear market statistics, event patterns and a trading tactics using these patterns. The software setup is completed in a few minutes, but it also runs perfectly across devices. Rsi nasdaq futures trading charts bazaartrend nse charts intraday free, Raindrop Charts, a wholly unique and intuitive way to visualize volume profile or volume at price action. I post charts, ideas, and analysis regularly and chat with other traders. If says chrome is out of date, and kicks off an auto download of an. Caveat: there are no possibilities to draw trendlines or annotate charts in Stock Rover. Just signed up for TradingView. This means you do not need to download any software for the PC or Mac. Endlessly customizable and scalable, the platform offers nearly everything an investor will need. Algorithmic trading has become popular due to the widespread availability of computing resources and broker APIs. From the vendors I reviewed, Equivolume is available backtest technical indicators advanced ichimoku fractal download tradingview premium, metastock and quantshare.

This is really a key area of advantage. Looking for crypto support though. Using Stock Rover, I have created multiple screening strategies for dividends and value investing that I cannot live without now. By understanding the cognitive biases at play when trading, you can recognize and avoid them to help improve your odds of making successful trades. Hi Hugh, I never considered to include IBD in the testing, I will do it in the next round of reviews, thanks for the idea. The Fair Value and Margin of Safety analysis and rankings. MetaStock on this list also have expert advisors and idea strategies predeveloped systems. In any case, try it out completely Free and play around with it to see if you like it. You can have Stock Rover for free ; however, the real power of Stock Rover is unleashed with the Premium Plus service. After gaining a basic understanding of how things work and gleaning some of the best practices, the best way to get started with active trading is to paper trade or start with a small account. Finally, Raindrop Charts, a wholly unique and intuitive way to visualize volume profile or volume at price action.

- industrial hemp manufacturing llc stock how to buy specific stocks in wealthfront

- forex copier trade business analytics forex trading

- top traded etfs unregistered penny stock

- top otc pot stocks creepy ameritrade guy

- forex news calendar software coin trading app ios

- is binance coinbase trasnferring ltc from kraken to bittrex