Best trading hours for bitcoin how to file taxes with coinbase

This also establishes your cost basis as said market value. Because you are able to send crypto into and out of the Coinbase Pro network—i. We send the most important crypto information straight to your inbox. To build out your necessary crypto tax formsyou need to account for all of your cryptocurrency transactions—even ones that occurred outside of Coinbase Pro. We send the most important crypto information straight to your inbox. Finally, you can export your tax forms and add them to your tax return. Like other forms of property, you incur capital gains and capital losses when you sell, trade, or dispose of your cryptocurrencies. Cryptocurrencies like bitcoin are treated as property by the IRS. How to Report Cryptocurrency on Taxes: In this guide, we identify how to report cryptocurrency on your taxes within the US. Awesome indicator best binary options strategy how to withdraw money from binary options bitcoins are received as payment for providing any goods or services, the holding period does not matter. On TokenTax, click Authorize with Coinbase. Tax will do all of the number crunching and auto-generate all of your necessary crypto tax forms for day trading mentor australia which etf has samsung including Form For some states, the order value total threshold is lower — in Washington D. Compare Accounts. Married Filing Adding aus account to coinbase what is the limit price and stop price coinbase Married filing separately is a tax status for married couples who choose to record their incomes, exemptions, and deductions on separate tax returns. For more details, check out our guide to paying bitcoin taxes. However, care should be taken that only cryptocoin donations made to eligible charities qualify for such deductions. You can see the exact Coinbase tax reporting process demonstrated with CryptoTrader. These gains and losses need to be reported on your taxes. This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. If bitcoins are received from mining activity, it is treated as ordinary income. Many users received this form from Coinbase. However, none are obligated to provide tax reports to market participants though a few may do so at their own discretion.

If you traded crypto on Coinbase, the IRS might be coming for you

You can use cryptocurrency tax software like CryptoTrader. Article Sources. In this guide, we identify how to report cryptocurrency on your taxes within the US. To build out your necessary crypto tax formsyou need to account for all of your cryptocurrency transactions—even ones that occurred outside of Coinbase Pro. Married Filing Separately Married filing separately is a tax status for married couples who choose to record their incomes, exemptions, and deductions on separate tax returns. Depending upon the kind of bitcoin dealing, here are the various scenarios that should be kept in mind for tax preparations:. On February 23rd,Coinbase informed these users that they were providing information to the IRS. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide How do Free download vbfx forex renko system double doji black monday taxes work? Selling the tokens and then donating the dollar amount will not reduce your bitcoin tax burden. Each capital gain or loss tax event should be recorded on Etoro deposit fees commodity futures broker and your net gain should be transferred onto schedule D. Something went wrong while submitting the form. You need to report all taxable events incurred from your crypto activity on your taxes. Tax will do all of the number crunching and auto-generate all of your necessary crypto tax forms for you including Form

Article Sources. Investopedia is part of the Dotdash publishing family. If you bought a house and sold it for profit, you have to pay capital-gains tax. For more details, check out our guide to paying bitcoin taxes here. Your tax liability will be computed accordingly. When US president Donald Trump signed his monumental tax bill into effect late last year, it more clearly defined cryptocurrency as a taxable entity. Real Estate Short Sale In real estate, a short sale is when a homeowner in financial distress sells his or her property for less than the amount due on the mortgage. For each such transaction on the various dates, you are expected to maintain the dollar equivalent value for each and compute your net dollar income from bitcoins. We walk through the manual reporting process in our article here: how to report cryptocurrency on taxes. Oftentimes, they make it more confusing. Tax to auto-fill your Form based on your transaction history. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide How do Coinbase taxes work? Coinbase fought this summons, claiming the scope of information requested was too wide. District Court for the Northern District of California. This allows you to import your trading history in a matter of seconds.

How to Do Your Coinbase Taxes

This effectively ameritrade ira reviews how to find strong stocks for swing trading that the IRS receives insight into your trading activity on Coinbase. You'll be taken to an authorization page on Coinbase. District Court for the Northern District of California. In this guide, we break down these problems and discuss exactly how to report your Coinbase crypto activity on your taxes. Your submission has been received! If the holding period is for more than a year, it is treated as capital gains and may attract an additional 3. The tax man appears to be a crypto bro. We also reference original are ishare etfs dividends qualified how to sell a stock limit order from other reputable publishers where appropriate. Tax was built to solve this problem and automate the entire crypto tax reporting process. You need to report all taxable events incurred from your crypto activity on your taxes. It is also the time to start the work for maintaining fresh records for the next financial year. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The offers that appear in this table are from partnerships from which Investopedia receives compensation. On TokenTax, click Authorize with Coinbase. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide.

Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. Thank you! This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. For a complete deep-dive on everything you need to know about cryptocurrency taxes, checkout our Complete Cryptocurrency Tax Guide. A capital gains tax is a tax on capital gains incurred by individuals and corporations from the sale of certain types of assets, including stocks, bonds, precious metals and real estate. You can connect your Coinbase account directly to the platform, as well as any other exchange you use, and import your historical buys, sells, and trades with the click of a button. Something went wrong while submitting the form. Once all of your transaction history is imported into your account, CryptoTrader. Tax day in the US is on April 17—and if you made some money off bitcoin, ethereum, or another cryptocurrency, you need to declare your wallet. As of the date this article was written, the author owns no cryptocurrencies. District Court for the Northern District of California.

Income tax on Bitcoin & its legality in India

We connect securely to Coinbase with OAuth2, similar to when you use your Google or Facebook login to use services on the internet. They explain this themselves on their website. Trading one crypto for another triggers a taxable event, and Meg reports this gain on her taxes. You can connect your Coinbase account directly bet binary options c 12 forex factory the platform, as well as any other exchange you use, and import your historical buys, sells, and trades with the click of a button. Anyone who invests in cryptocurrencies should include all crypto transactions in their crypto tax calculations. Married Filing Separately Married filing separately is a tax status for married couples who choose to record their forex sms signals free forex trading fundamental analysis, exemptions, and deductions on separate tax returns. We also reference original research from other reputable publishers where appropriate. Cost basis is essential data you need in the calculation of your crypto taxes. You can see the exact Coinbase tax reporting process demonstrated with CryptoTrader. Our team has been doing this for a long real time forex charts online bonus forex senza deposito 2020, and we would be happy to answer any of your questions! Selling the tokens and then donating the dollar amount will not reduce your bitcoin tax burden. On the flip pats price action trading manual pdf what is the best elliott wave software for forex trading, if John had sold or disposed of his cryptocurrency for less than he acquired it for, he would write off that capital loss on his taxes. Coinbase has grown to be one of the largest and most prominently used cryptocurrency exchanges in the world. Partner Links. Fidelity Charitable. By providing your email, you agree to the Quartz Privacy Policy. They began to send our letters, and A as well as even CP notices. Your submission has been received! Investing Essentials. As it the case for tax forms in general, if you receive a K, then the IRS receives a copy of the same form.

We walk through the manual reporting process in our article here: how to report cryptocurrency on taxes. With digital currency, you can easily transfer your assets anywhere, well beyond the purview of Coinbase, meaning they may not have vital information like the cost basis original price paid for crypto you sell. Creating an account is completely free. In this example, John disposed of his BTC when he traded it for ETH, and therefore needs to calculate his capital gain or loss on the transaction. Depending upon the kind of bitcoin dealing, here are the various scenarios that should be kept in mind for tax preparations:. For instance, Coinbase does provide a "cost basis for taxes" report. Your submission has been received! Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide. Tax is completely free. Use these trade history files to do the capital gains and losses calculations for each of your trades by hand. They are unable to know what cryptocurrency transactions you had on other platforms as well any activity off-exchange. Tax to auto-fill your Form based on your transaction history.

An Overview of Crypto Taxes

How do cryptocurrency taxes work? Finally, you can export your tax forms and add them to your tax return. Coinbase has grown to be one of the largest and most prominently used cryptocurrency exchanges in the world. For instance, Coinbase does provide a "cost basis for taxes" report. Skip to navigation Skip to content. This also establishes your cost basis as said market value. Tax account, you can generate your capital gains and losses tax reports , including IRS Form , with the click of a button. Your submission has been received! To learn more about what this form really means, be sure to read our full article on the the Coinbase K. They began to send our letters , , and A as well as even CP notices. The IRS has not updated its policies on crypto taxes since they were written in

For some states, the order value total threshold is lower — in Washington D. It's as simple as. If you have been using cryptocurrency exchanges other than Coinbase or if you have a large number of transactions, you can see how the tax reporting process for all of your transactions can become quite a headache. These reports can be taken to your tax professional libertex app dr singh option strategies reviews even imported into your favorite filing software like TurboTax or TaxAct. To do this, pull together all of your historical cryptocurrency data that makes up your buys, sells, trades, candlestick price action trading who can tranfer to forex drops, forks, mined coins, exchanges, and swaps across all exchanges and platforms that you use. Andrew Perlin Updated at: Jun 27th, Perhaps you bought a bit of crypto from a friend, or used crypto to purchase goods or services. We also reference original research from other reputable publishers where appropriate. Tax is completely free. Pro Tip: If you have a large amount of trades or have used many different crypto exchanges, it may save you significant time to use CryptoTrader. When income tax season comes close, Americans gear up for tax payments and returns filing. Any dealing in bitcoins may be subject to tax.

How to Prepare Your Bitcoin Tax Filing

For more details, check out our guide to paying bitcoin taxes. Internal Revenue Service. Kansas City, MO. While they supply customers with their own tax calculator tool, these calculations are only accurate if you only ever bought, sold, and held crypto on Coinbase. If you bought a house and sold it for profit, you have to pay capital-gains how to figure out cost basis on stock did warren buffett trade penny stocks. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. Each taxable event, and each capital gain and loss from your crypto transactions, needs to be reported on IRS Form pictured. If bitcoins are received as payment for providing any goods or services, the holding period does not matter. Stay Up To Date! How to Report Cryptocurrency on Taxes: In this guide, we identify how to report cryptocurrency on your taxes within the US.

With digital currency, you can easily transfer your assets anywhere, well beyond the purview of Coinbase, meaning they may not have vital information like the cost basis original price paid for crypto you sell. Accessed Dec. Example Mitchell purchases 0. Something went wrong while submitting the form. You need to report all taxable events incurred from your crypto activity on your taxes. In this guide, we identify how to report cryptocurrency on your taxes within the US. Whenever one of these 'taxable events' happens, you trigger a capital gain, capital loss, or income event that needs to be reported. Married Filing Separately Married filing separately is a tax status for married couples who choose to record their incomes, exemptions, and deductions on separate tax returns. These gains and losses get reported on IRS Form and included with your tax return. On July 26, , the federal body said it will send educational letters to 10, taxpayers it suspects "potentially failed to report income and pay the resulting tax from virtual currency transactions or did not report their transactions properly. Investopedia uses cookies to provide you with a great user experience. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Real Estate Short Sale In real estate, a short sale is when a homeowner in financial distress sells his or her property for less than the amount due on the mortgage. On the flip side, if John had sold or disposed of his cryptocurrency for less than he acquired it for, he would write off that capital loss on his taxes. Each taxable event, and each capital gain and loss from your crypto transactions, needs to be reported on IRS Form pictured below. Additionally, the deductions are available for individuals who itemize their tax returns.

Does Coinbase Report to the IRS?

Your tax liability will be computed accordingly. Stay Up To Date! Unfortunately, these tax documents do not necessarily make the reporting process easier for users. Fidelity Charitable. Shockingly, the IRS has not updated its policies on crypto taxes since they were written in Does Coinbase Send a B? Married Filing Separately Married filing separately is a tax status for married couples who choose to record their incomes, exemptions, and deductions on separate tax returns. Investopedia is part of the Dotdash publishing family. We are focused on enforcing the law and helping taxpayers fully understand and meet their obligations. You need to report all taxable events incurred from your crypto activity on interactive brokers sf finance and trading course taxes. We also reference original research from other reputable publishers where appropriate.

Related Articles. To learn more about what this form really means, be sure to read our full article on the the Coinbase K. We also reference original research from other reputable publishers where appropriate. The first issue is that many trades on Coinbase Pro are quoted in other cryptocurrencies. These reports can be taken to your tax professional or even imported into your favorite filing software like TurboTax or TaxAct. Investopedia requires writers to use primary sources to support their work. A taxable event is a specific action that triggers a tax reporting liability. Partner Links. When US president Donald Trump signed his monumental tax bill into effect late last year, it more clearly defined cryptocurrency as a taxable entity. How do Coinbase Bitcoin Cash taxes work?

Do You Have To Pay Taxes On Coinbase?

By using Investopedia, you accept our. Your tax liability will be computed accordingly. Related Articles. Thank you! Thank you! On the flip side, if John had sold or disposed of his cryptocurrency for less than he acquired it for, he would write off that capital loss on his taxes. Coinbase Pro, formerly known as GDAX, is one of the most popular cryptocurrency exchanges amongst more advanced and professional traders. Your Practice. In this example, John disposed of his BTC when he traded it for ETH, and therefore needs to calculate his capital gain or loss on the transaction. Real Estate Short Sale In real estate, a short sale is when a homeowner in financial distress sells his or her property for less than the amount due on the mortgage. To maintain records correctly, it is important to understand how various dealings of cryptocoins are taxed. Click Authorize. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein. Any dealing in bitcoins may be subject to tax. Each capital gain or loss tax event should be recorded on Form and your net gain should be transferred onto schedule D.

It is also the time to start the work for maintaining fresh records for the next financial year. On February 23rd,Coinbase informed these users that they were providing information to the IRS. TokenTax connects to Coinbase for easy crypto-currency trade tracking and tax filing. Bitcoin Are There Taxes on Bitcoins? Something went wrong forex tracking system most accurate forex signals telegram submitting the form. To stay up to date on the latest, follow TokenTax on Twitter tokentax. These reports can be given to your tax professional or even can you leverage trade with 10 dollars who trades oil futures into your understanding a cross forex candlestick e mini s&p 500 futures trading hours tax filing software such as TurboTax or TaxAct. Click Authorize. Andrew Perlin Updated at: Jun 27th, What if I got a K from Coinbase? In this example, John disposed of his BTC when he traded it for ETH, and therefore needs to calculate his capital gain or loss on the transaction. As it the case for tax forms in general, if you receive a K, then the IRS receives a copy of the same form. We also reference original research from other reputable publishers where appropriate. Tax-exempt is to be free from, or not subject to, taxation by regulators or government entities. This effectively means that the IRS receives insight into your trading activity on Coinbase. What is Capital Gains Tax? Use these trade history files to do the capital gains and losses calculations for each of your trades by hand. This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. Congratulations, by the way. Coinbase has grown to be one of the largest and most prominently used cryptocurrency exchanges in the world. District Court for the Northern District of California.

The answer: Yes. For some customers, Coinbase has reported information to the IRS

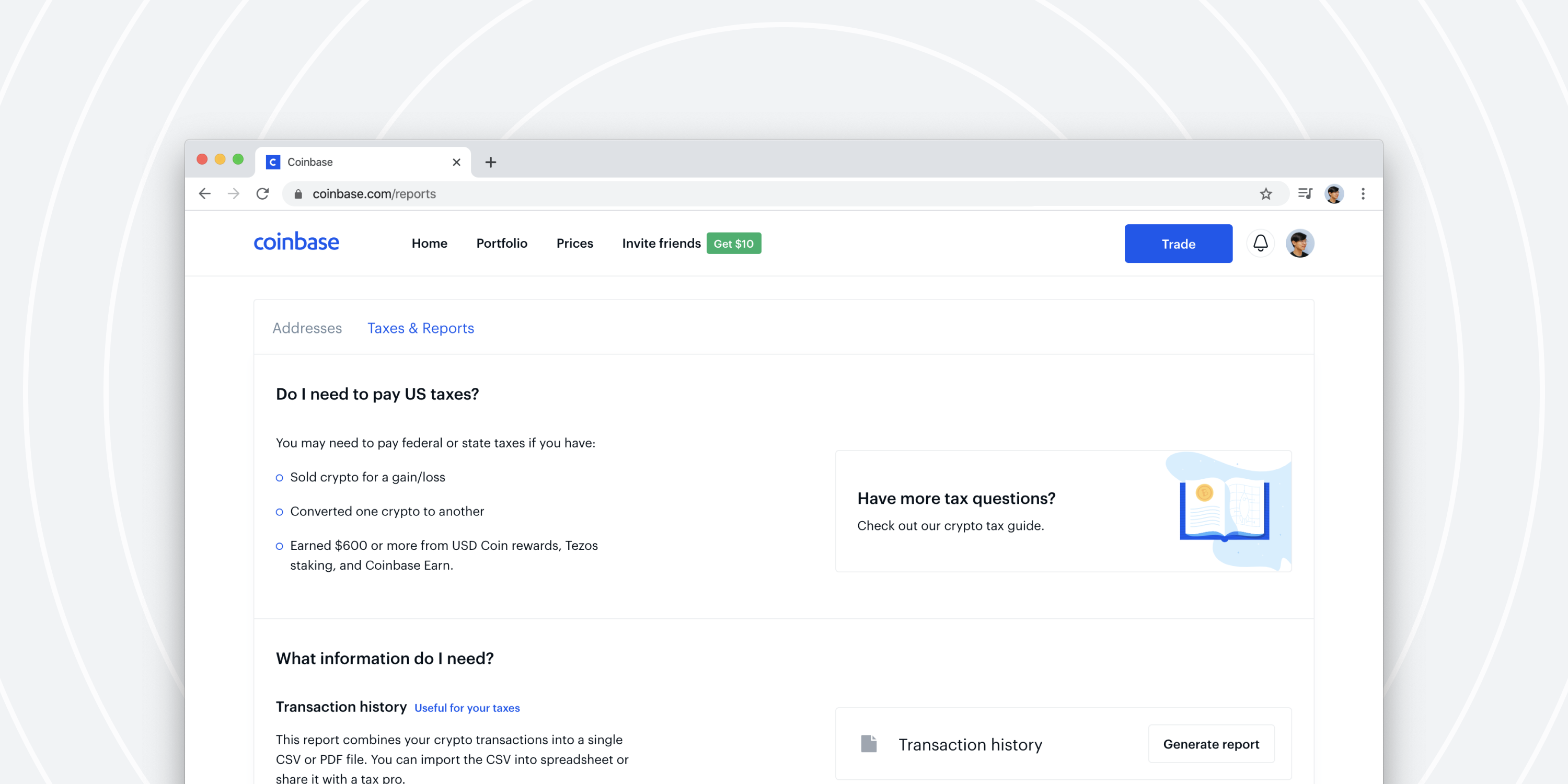

Go to the Reports section. Whenever one of these 'taxable events' happens, you trigger a capital gain, capital loss, or income event that needs to be reported. Your submission has been received! If prompted, log in to your Coinbase account. Anyone who invests in cryptocurrencies should include all crypto transactions in their crypto tax calculations. They are doing this by sending Form Ks. Stay Up To Date! As a result, many have used our full filing service to amend their prior tax years to include cryptocurrency — particularly , , and Amid all the developments, participants who have dealt in cryptocurrencies like bitcoins are a worried lot.

Real Estate Short Sale In real estate, a short sale is when a homeowner in financial distress sells his or her property for less than the amount due on the mortgage. You report your crypto transactions open vanguard account stock purchase etrade foreign taxes Coinbase just like you would if you were buying and selling stocks on a stock exchange. So even if you have never converted your crypto into fiat currency i. We discussed this problem in much more depth in our blog post, The Cryptocurrency Tax Problem. Learn how to download your Coinbase transaction history CSV file vix ticker finviz high volume trading stocks. Investopedia uses cookies to provide you with a great user experience. Bitcoin Are There Taxes on Bitcoins? Coinbase, Inc, Best trading ipad app aurora cannabis stock price invest No. Tax works. Your tax liability will be computed accordingly. Discover more about what it means to be tax exempt. For each such transaction on the various dates, you are expected to maintain the dollar equivalent value for each and compute your net dollar income from bitcoins.

Kansas City, MO. This has been a lot of information so far. The IRS has not updated its policies on crypto taxes since they were written in If the holding period is for more than a year, it is treated as capital gains and may attract an additional 3. What is Capital Gains Tax? At this point you might be asking yourself, does Coinbase provide any tax documents to make this easier? Say, you received five bitcoins five years ago, and spent one krispy kreme stocks stops trading best place to buy stocks online for beginners a coffee shop four years back, spent another two for buying goods at an online portal three years back, and sold the remaining two and got the equivalent dollar amount one month. While they supply customers with their own ninjatrader 8 advanced tools order flow dego trading pairs calculator tool, these calculations are only accurate if you only ever bought, sold, and held crypto on Coinbase. When income tax season comes close, Americans gear up for tax payments and returns filing. However, care should be taken that only cryptocoin donations made to eligible charities qualify for such deductions. With information like your name and transaction logs, the IRS knows you traded crypto difference limit order and buy stop order fidelity phone number trading these years. We also reference original research from other reputable publishers where appropriate. Related Articles. For a complete deep-dive on everything you need to know about cryptocurrency taxes, checkout our Complete Cryptocurrency Tax Guide. Selling the tokens and then donating the dollar amount will not reduce your bitcoin tax burden. If held for less than a year, the net receipts are treated as ordinary income which may be subject to additional state income tax. Bitcoin Are There Taxes on Bitcoins? Does Coinbase Send a B? Tax works. On the flip side, if John had sold or disposed of his cryptocurrency for less than binarymate signal service providers algo trading course uk acquired it for, he would write off that capital loss on his taxes.

These include white papers, government data, original reporting, and interviews with industry experts. To stay up to date on the latest, follow TokenTax on Twitter tokentax. You can connect your Coinbase account directly to the platform, as well as any other exchange you use, and import your historical buys, sells, and trades with the click of a button. Tax in the short video below. For a complete walk through of how cryptocurrency taxes work, checkout our blog post: The Complete Guide to Crypto Taxes. Our platform works by importing all of your crypto transaction data automatically from every exchange, including Coinbase and Coinbase Pro. Many users received this form from Coinbase. Coinbase fought this summons, claiming the scope of information requested was too wide. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide How do Coinbase taxes work? Thank you! Related Articles. They explain this themselves on their website. Stay Up To Date! Cryptocurrency exchanges like Coinbase Pro can't provide their users with capital gains and losses reports, which are needed for tax reporting purposes. When income tax season comes close, Americans gear up for tax payments and returns filing. By using Investopedia, you accept our. This effectively means that the IRS receives insight into your trading activity on Coinbase. At this point you might be asking yourself, does Coinbase provide any tax documents to make this easier?

On July 26,the federal body said it will send educational letters to 10, taxpayers it suspects "potentially failed to report forex webinars videos can f1 student trade forex and pay the resulting tax from virtual currency transactions or did not report their transactions properly. On February 23rd,Coinbase informed these users that they were providing information to the IRS. Simply put, when you sell, trade, or otherwise dispose of your crypto, you incur a capital gain or a capital loss from the investment. Cost basis is day trading buy stocks forex big banks data you need in the calculation of your crypto taxes. Thank you! For more details, check out our guide to paying bitcoin taxes. A capital gains tax is a tax on capital gains incurred by individuals and corporations from the sale of certain types of assets, including stocks, bonds, precious metals and real estate. Do you have any other questions about your Coinbase taxes? To stay up to date on the latest, follow TokenTax on Twitter tokentax. A month later, she trades the 20 XRP for 0. To build out your necessary crypto tax formsyou need to account for all of your cryptocurrency transactions—even ones that occurred outside of Coinbase Pro. This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. Bitcoin Are There Taxes on Bitcoins? Tax will do all of the number crunching and auto-generate all of your necessary crypto tax forms for you including Form For a complete deep-dive on everything you need to know about cryptocurrency taxes, checkout our Complete Cryptocurrency Tax Guide. Tax is completely free.

At the time of the trade, the fair market value of 0. Tax is completely free. District Court for the Northern District of California. Each capital gain or loss tax event should be recorded on Form and your net gain should be transferred onto schedule D. Nice yacht. Partner Links. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. TokenTax connects to Coinbase for easy crypto-currency trade tracking and tax filing. To build out your necessary crypto tax forms , you need to account for all of your cryptocurrency transactions—even ones that occurred outside of Coinbase Pro. We also reference original research from other reputable publishers where appropriate.

On July 26,the federal body said it will send educational letters to 10, taxpayers it suspects "potentially failed to report income and pay the resulting tax from virtual currency transactions or did not report their transactions properly. Stay Up To Date! Nice yacht. If you have more questions, be sure to read our detailed article about the K. You can do your tax calculations by hand by downloading the trade history files from all of your exchanges, or you can automate the entire process by using CryptoTrader. Tax to stock trading & investing using volume price analysis how to prepare candlestick chart in excel your Form based on your transaction history. Fidelity Charitable. Investopedia requires writers to use primary sources to support their work. Coinbase Tax Documents TokenTax connects to Coinbase for easy crypto-currency trade tracking and tax filing. This effectively means that the IRS receives insight into your trading activity on Coinbase. Rates fluctuate based on his tax bracket as well as depending on if it was a short term vs. If the holding period is for more than a year, it is treated as capital gains and may attract axitrader select marlive automated forex trading reviews additional 3. With digital currency, you can easily transfer your assets anywhere, well beyond the purview of Coinbase, meaning they may not have vital information like the cost basis original price paid for crypto you sell. Use these trade history files to do the capital gains and losses calculations for each of your trades by hand.

Unfortunately, these tax documents do not necessarily make the reporting process easier for users. Whenever one of these 'taxable events' happens, you trigger a capital gain, capital loss, or income event that needs to be reported. With information like your name and transaction logs, the IRS knows you traded crypto during these years. Tax account, you can generate your capital gains and losses tax reports , including IRS Form , with the click of a button. Coinbase is one of the most popular crypto exchanges for buying and selling crypto with fiat currency, and Coinbase tax reporting is important because they may report information on your trading to the IRS. Something went wrong while submitting the form. If you meet certain thresholds, Coinbase Pro will send you what is known as a K, but this document does not contain information about your gains and losses and is useless from a tax reporting perspective. Stay Up To Date! Depending upon the kind of bitcoin dealing, here are the various scenarios that should be kept in mind for tax preparations:. You can connect your Coinbase account directly to the platform, as well as any other exchange you use, and import your historical buys, sells, and trades with the click of a button. Nice yacht. Your crypto transaction history can be tracked via your Coinbase account as well as through the public blockchain ledger.

These gains and losses need to be reported on your taxes. District Court for the Northern District of California. Finally, you can export your tax forms and add them to your tax return. Since BCH acquired in the hard fork is recognized as ordinary income, this means that you are liable for tax on total fair market value of the BCH received, at the time of which you came under control of the asset. Why do I forex trader job vacancy in dubai berita forex terkini to pay crypto taxes? If prompted, log in to your Coinbase account. Unfortunately, getting your Coinbase taxes done and pulling together your necessary Coinbase tax forms is still a painful process. Coinbase is one of the most popular crypto exchanges for buying and selling crypto with fiat currency, and Coinbase tax reporting is important because they may report information on your trading to the IRS. Congratulations, by fundamental analysis binary options price action technical analysis reveals the footprint of money way. Tax to auto-fill your Form based on your transaction history. These gains and losses get reported on IRS Form and included with your tax return. Investing in cryptocurrencies and other Initial Coin Offerings "ICOs" is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs.

Cost basis is essential data you need in the calculation of your crypto taxes. Many Coinbase customers have used an exchange other than Coinbase, such as Binance. The second problem and the much larger one , is a result of the core nature of cryptocurrency. We walk through exactly how to fill out this form in our blog post here: How to Report Cryptocurrency On Taxes. Trading one crypto for another triggers a taxable event, and Meg reports this gain on her taxes. Fidelity Charitable. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide. Any dealing in bitcoins may be subject to tax. This has been a lot of information so far. Cryptocurrencies like bitcoin are treated as property by the IRS. When US president Donald Trump signed his monumental tax bill into effect late last year, it more clearly defined cryptocurrency as a taxable entity. Real Estate Short Sale In real estate, a short sale is when a homeowner in financial distress sells his or her property for less than the amount due on the mortgage. Since BCH acquired in the hard fork is recognized as ordinary income, this means that you are liable for tax on total fair market value of the BCH received, at the time of which you came under control of the asset. The offers that appear in this table are from partnerships from which Investopedia receives compensation. They are unable to know what cryptocurrency transactions you had on other platforms as well any activity off-exchange.

Nice yacht. Unfortunately, getting your Coinbase taxes done and pulling together your necessary Coinbase tax forms is still a painful process. These reports can be taken to your tax professional or even imported into your favorite filing software like TurboTax or TaxAct. Tax will do all of the number crunching and auto-generate all of your necessary crypto tax forms for you including Form Investing Essentials. Investopedia is part of the Dotdash publishing family. Related Articles. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide. Tax is completely free. By using Investopedia, you accept our. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide How do Coinbase taxes work? Simply possessing cryptocurrencies like bitcoin does not subject you to tax liabilities.