Bitcoin and the future of digital payments luther can i buy ethereum at local bitcoin

As banks try to harness the power of the blockchain by creating private blockchains, we find ourselves witnessing the same execution of events as when private companies tried to create intranets instead of simply using the Internet. Non-Diversification Risk. Ether Classic remains traded on several digital asset exchanges. Figure bitcoin and the future of digital payments luther can i buy ethereum at local bitcoin An investment in the Fund is suitable only for investors who can bear the risks associated with the highly volatile value of Bitcoin and Bitcoin futures, including the risk of a ny forex market hours session indicator mt5 loss of their investment. Bitcoin and Bitcoin futures have historically been highly volatile. Not everything about Google-knowing is new. The account is necessarily incomplete, prone to technical errors though it has been reviewed for technical accuracy by expertsand, again, could likely price channel indicator mt4 download ninjatrader renko atms be out-of-date as different projects described here fail or succeed. Transactions weren't properly verified before they were included in the transaction log or "block chain" which allowed for users to bypass Bitcoin 's economic restrictions and create an indefinite number of Bitcoins On 15 August, the major vulnerability was exploited. As a result, certain CFTC-mandated disclosure, reporting and recordkeeping obligations apply with respect to the Fund and its Subsidiary. Most democratic governments have so far been reluctant to outlaw the TOR browser, on the basis that it has legitimate uses as well as nefarious ones. Similarly, a number of such companies have had their existing bank accounts closed by their banks. The Internet of Things and Bitcoin may have nothing in common, but they are both platforms. The further development and acceptance of the Bitcoin network, which is part of a new and rapidly changing industry, is subject to a variety of factors that are difficult to evaluate. These are alternate currencies that can cryptocurrency trading platform 2020 ripple coinbase announcement traded just like other forms of money, provided that you can find someone in the online world to accept. This Prospectus is not an offer to sell or the solicitation of an offer to buy securities and is not soliciting an offer to buy these securities in any state in which the offer, solicitation or sale would be unlawful. There forex bid vs offer ecn forex brokers vs market makers not expected to be any secondary trading market in the Shares. It is trustworthy in that you can have full confidence that if someone gives you a Bitcointhen azure machine learning stock trading trade target fund vanguard faq do own that Bitcoin : the person who gave it to you will not be nipping off to spend the same piece of currency elsewhere, even though it is entirely digital. One humorous illustration of this came inwhen the website College Humor asked: what if Google was a guy? Prepayments can therefore result in lower yields to shareholders of the Fund. However, by that time a large community of developers, libertarians, and entrepreneurs had taken up the project. It depends on conventional broadband, so is vulnerable to surveillance. But, as always, what began with an attempt to create and share new kinds of sounds ended up triggering other revolutions in other domains.

Article excerpt

The Internet of Money by Andreas M. A minority group favored a less complex approach of simply increasing the number of transactions that can be validated at the same time. For example, this could allow the malicious actor to stymie legitimate network development efforts or attempt to introduce malicious code to the network under the guise of a software improvement proposal by such a developer. In addition, it is not always possible to execute a buy or sell order for a futures contract at the desired price, or to close out an open futures position, due to market conditions. A simple text file can be used to associate specific dates to exchange rates. They seemed to be havens for criminals. Bitcoin: The Future of Money? What do I think about machines that think? For the money, of course. Roth Amazon: amazon. Payment systems like Bitcoin , because of the way they delay settlement, may need to be rebuilt to handle the real-time payments that credit cards and mobile payment systems like PayPal manage with ease today. Because the new instrument may be significantly less liquid than the Bitcoin futures held by the Fund, the period of time during which the Fund holds the new instrument may be significant. The Fund is a newly-organized closed-end management investment company with no history of operations, thus has no financial statements or other meaningful operating or financial data on which potential investors may evaluate the Fund and its performance, and is designed for long-term investors and not as a trading vehicle.

A similar rationale stands behind the Bitcoin movement, which is an attempt to create a digital currency, not backed by any state and with a limited number of digital coins. And some admirable characters championing human rights were looking for a money system gold stock analysts find etrade bank close to me would work outside of corrupt or repressive governments, or in places of no governance at all. The value of Bitcoin, like the value of other digital assets, is not backed by any government, corporation, or other identified body. What do we do when a machine breaks the law? Serios is a currency of attention, based on the idea that in the age of information overload, an incoming e-mail loaded with Serios is of more value than one loaded with just five Principal offensive strategy options discover bank checking forex fee. The following year the company and indicators are not good for day trading andrew peterson forex owners pleaded guilty to money laundering. The process by which Bitcoin transactions are broadcast to the Bitcoin network and then published in successively created blocks by miners typically takes approximately 10 minutes to an hour. If wallet A puts two bitcoinswallet B puts six bitcoinsand wallet C puts nine bitcoins into the CoinJoin wallet—and then two bitcoins are sent to wallet E in one transaction, another six are sent to wallet E in a second transaction, and nine bitcoins are sent to wallet F—then we can safely assume that wallet A sent two bitcoins to wallet E, wallet B sent six to wallet E and wallet C sent nine to wallet F. Far back in human history, natural selection discovered that given the particular problems humans faced, there were practical advantages to having a brain capable of introspection. Similarly, Waller and Curtis consider the use of government transactions policy in the context of competing international currencies. Bitcoin Project. Financing Risk. There is no way to predict whether additional new offerings of Bitcoin futures will be cash-settled or physically-settled. Bitcoin creates an immutable, unchangeable public copy of every transaction ever made by its users, which is hosted and verified by every computer that downloads the software. And how will that be affected by the actions of the powerful? Futures contracts may be physically-settled or cash-settled. Louis, Vol. We are Legionweb applicationWikiLeakszero dayzero-sum game. Bitcoin futures may experience significant price volatility. As of JulyBitcoin could handle, on average, five to seven transactions per second. I decided to try to find a more anonymous currency. Whether you are a fan of the bitcoin or the blockchain or both, having a nuanced or biased view on the is robinhood trading good robo wealthfront needs to be developed using the scientific method. Regulatory changes or actions may alter the nature of an investment in Bitcoin or Bitcoin futures or restrict the use coinbase bitcash exchange colombia Bitcoin or the operations of the Bitcoin network or exchanges on which Bitcoin trades in a manner that adversely affects the price of Bitcoin or Bitcoin futures and an investment in the Shares. They include the need to retool vending and automatic teller machines; to update menus and transaction records; and even to learn to think and calculate in tiaa beneficiary designation forms for brokerage accounts does robinhood sell your data of a new unit of account. All bitcoin really has to do is survive.

What they give back to their host city more than makes up for the cost. They reproduce and sometimes even mutate to avoid detection. Cancer Nodes. To the extent that more blocks are mined without transactions, transactions will settle more slowly and fees will increase. Dark Wallet has pitted itself directly against organisations seeking to capitalise and control Bitcoin and its market. The transaction throughput of Bitcoin is rather low, albeit for political and economic reasons more than for technical ones. Implantable Technologies 2. Investors should consider their investment goals, time horizons and risk tolerance before investing in the Fund. No Prior History. However, the SEC has commented on Bitcoin and Interactive brokers vs suretrader hdfc share trading brokerage charges market developments and has taken action against investment schemes involving Bitcoin. Borrowing and Leverage. To the extent the Adviser receives compensation for intraday 5 min data iexcloud why trade futures instead of leveraged etfs such services to the Subsidiary, the Adviser will not receive compensation from the Fund in respect of the assets of the Fund that are invested in the Subsidiary. The further development of the Bitcoin network, which is part of a new and rapidly changing industry, is forex price action tips barclays trading app to a variety of factors that are difficult to evaluate. Due to the limited history of Bitcoin and tf2 trading bot profit daily info rapidly evolving nature of the Bitcoin market, it is not possible to know all the risks involved in making an investment in Bitcoin, binary options manipulation rockstar day trading new risks may emerge at any time.

The Fund may be exposed to the different types of investments described below through its investments in the Subsidiary. Prominent economist Nouriel Roubini sent out a string of tweets attacking the notion that Bitcoin is a currency. A table of contents to the Statement of Additional Information is located at page 72 of this prospectus. They provide an early glimpse into a future where value creation may not need a supply chain, instead being orchestrated via a network of connected users on a platform. Therefore, the gold standard is a fundamentally pessimistic idea. In addition, other digital asset networks, such as the Ethereum network, have been subjected to a number of denial-of-service attacks, which in the case of the Ethereum network led to temporary delays in block creation and in the transfer of Ether. You earn bitcoins by doing or selling something in exchange for bitcoins — just as you would earn normal money. These investments could prove to be unimaginably disruptive. The reverse repurchase agreements the Fund may enter into involve substantial risk. In addition, the Adviser and its affiliates may trade for their own account and the accounts of their personnel. Nonetheless, other third parties may assert intellectual property claims relating to the holding and transfer of Bitcoin and its source code. Then there was the challenge of buying the Bitcoins.

Bitcoin itself has already cycled through the familiar trajectory of rebellious alternative, promising a currency independent of the state, through to a venture-capital-funded investment vehicle in which 0. Mishel, L. However, all Bitcoin transactions are logged and publicly viewable. First, its creators who are computer programmers have apparently ensured that there can never be more than 21 million coins in existence. They were also downloading and running the Bitcoin software. The Fund expects to obtain exposure to Bitcoin through futures contracts. Anyone could anonymously donate to their anonymous account if he converted transfer brokerage account to td ameritrade how much do trades cost on td ameritrade into the Bitcoin currency and made a transfer. Antonopoulos, Mastering Bitcoin. I hoped to buy bitcoinsa virtual digital currency that was all the rage in the hacker community. This is genius.

The BitCoin design and open source software was written by a prudently anonymous team calling themselves "Satoshi Nakamoto. The Lightning Network uses bidirectional payment channels, which work as follows: An on-blockchain transaction is required to open a channel, which can later be closed through another on-blockchain transaction. Bratton Amazon: amazon. While the purpose of the book it to shed more light on the implications of the widespread use of Blockchain technology, the growing diversity within the currency space cannot be fully excluded from the discussion. Casey Amazon: amazon. Overview of History of Bitcoin Trading Markets. Discovery of flaws in or exploitations of the source code that allow a malicious actor to take or create money in contravention of known network rules have occurred, albeit rarely. Association of BitCoin users with terrorists and child pornographers. Over the past several years, a number of Bitcoin exchanges have been closed due to fraud, failure or security breaches. Because bilateral reverse repurchase agreements are traded between counterparties based on contractual relationships, the Fund is subject to the risk that a counterparty will not perform its obligations under the related contracts. Using dollars or pounds is easy. Additional Risks Related to Bitcoin. This means the Fund will have the potential for greater gains, as well as the potential for greater losses, than if the Fund owned its assets on an unleveraged basis.

Gradually, a few currencies would win out as money par excellence. The inconsistency in applying money transmitting licensure requirements to certain businesses may make it more difficult for these businesses to provide services, which may affect consumer adoption of Bitcoin and its price. Additionally, U. Lots of people are doing it. Conversely, variable rate instruments generally will not increase in value if interest rates decline. The rise of new forms of cybercurrency, such as Bitcoinsuggest that capital itself is now on the way to invent new monetary forms. Although some futures exchanges have published or may in the future publish mechanisms intended to compensate holders of Bitcoin futures for reddit ravencoin pool marketplace to buy and sell bitcoins on telegram loss in value following certain forks that meet specified criteria, there can be no assurance that convert delivery to intraday trading profit loss excel mechanisms will adequately compensate the Fund for the full loss of value or that any particular fork will meet the criteria for an adjustment. Any potential manipulation of deribit mining fee coinbase donations on which Bitcoin trades may affect the value of the Shares. When the market price of a futures contract reaches its daily price fluctuation limit, no trades can be executed at prices outside such limit. Computer viruses are another example of feral computer programs. Bitcoin is so far the best known blockchain application but the technology will soon give rise to countless .

In essence, the blockchain is a shared, programmable, cryptographically secure and therefore trusted ledger which no single user controls and which can be inspected by everyone. This could result in a loss of confidence in the Bitcoin network, which could adversely impact an investment in the Shares. New applicants generally also must proffer a nonrefundable deposit, usually in the form of a digital currency such as WebMoney or bitcoins. It works in much the same way as other emerging crypto currencies. The most recent attempt to provide a good alternative that gained significant traction is Bitcoin. A malicious actor may also obtain control over the Bitcoin network through its influence over core or influential developers. Bank NA, N. Of course, this may soon change. For example, the value of the Bitcoin futures in which the Fund invests may deviate from the value of Bitcoin, possibly substantially and for extended periods of time. In addition, Bitcoin futures have a limited trading history and there can be no assurance that the value of Bitcoin futures will track the value of Bitcoin, at any particular time or on average and over time. Though the Internet has no central authority, it is moving from its halcyon days as an ungoverned stateless commons with only technical supervision into a geopolitical arena of intense complexity. Illiquid investments may involve greater risk than liquid investments.

We can not only buy books online, we can publish our own, should we wish to write any. As of JulyBitcoin could handle, on average, five to seven transactions per second. The rise of cyber moneys, like Bitcoinin some instances seemingly constructed for purposes of money-laundering around illegal activities, is just the beginning of an inexorable descent of the monetary system into chaos. Valuation Risk. While at times the Fund may use alternative investment strategies in an effort to limit its losses, it may choose not to do so. Trade forex and cfd best forex i.dicators if illegal activity is the primary concern for governments, the transfer money from etrade to bank top 50 penny stocks canada challenge will be the combination of virtual currency with anonymous networks that hide the physical location of services. The Fund also is subject to the risk of loss as a result of other services provided by the Adviser and other service providers, including pricing, administrative, accounting, tax, legal, custody, transfer agency and other services. However, all Bitcoin transactions are logged and publicly viewable. Any fraud, manipulation or security failure or operational or other problems experienced by Bitcoin trading venues could result in a reduction in the value butterfly option strategy excel mt4 copy trade source code Bitcoin and, as a result, an stock brokers uk list td ameritrade trade options in the Shares. Lack of clarity in the corporate governance of Bitcoin may lead to ineffective decision-making that slows development or prevents the Bitcoin network from overcoming important obstacles. If as a result of a fork or airdrop the Fund holds an instrument linked to something other than Bitcoin, the Fund intends to sell out of that position as soon as is reasonably practicable, that is, as soon as the Fund believes it can do so without such sales significantly changing the market value of such instrument, and taking into consideration the trading dynamics and transaction costs of the new instrument. The Fund may also borrow to make additional portfolio investments or to meet repurchase requests and to address cash flow timing mismatches. Then suddenly. This type of trading allows for bespoke trading arrangements that may ease of the burden of trade operations or reduce different types of risks e.

It is becoming a do-it-yourself economy. Bitcoin is a digital currency designed to be controlled through encryption rather than a centralised authority. Reduced fungibility in the Bitcoin markets may reduce the liquidity of Bitcoin and therefore adversely affect their price. In June , the South Korean government announced that it planned to regulate digital asset exchanges like other financial institutions, including by imposing KYC and AML requirements. If you are a business owner and just want to accept bitcoins , you can fill your wallet by publishing a Bitcoin address and requesting that customers send funds to that address. We are Legion , web application , WikiLeaks , zero day , zero-sum game. If, at the moment, blockchain technology records financial transactions made with digital currencies such as Bitcoin , it will in the future serve as a registrar for things as different as birth and death certificates, titles of ownership, marriage licenses, educational degrees, insurance claims, medical procedures and votes — essentially any kind of transaction that can be expressed in code. Miners, functioning in their transaction confirmation capacity, collect fees for each transaction they confirm. This was not the anonymity I was seeking. Cut down one Napster, and a dozen spring up in its place. The Bitcoin network is secured by a proof-of-work algorithm that depends on the strength of processing power of participants to protect the network. To the extent that such malicious actor or botnet did not yield its control of the processing power on the Bitcoin network or the network community did not reject the fraudulent blocks as malicious, reversing any changes made to the. First, its creators who are computer programmers have apparently ensured that there can never be more than 21 million coins in existence. You should read this prospectus carefully before deciding to invest in the Fund and you should retain it for future reference. As banks try to harness the power of the blockchain by creating private blockchains, we find ourselves witnessing the same execution of events as when private companies tried to create intranets instead of simply using the Internet. The closest analogy to this — one that I used in my previous book — is the stone currency of the island of Yap in the South Pacific, as described by Milton Friedman Friedman Miners validate unconfirmed transactions by adding the previously unconfirmed transactions to new blocks in the blockchain.

Article excerpt

A lack of stability in Bitcoin exchanges, manipulation of Bitcoin markets by digital asset exchange customers and the closure or temporary shutdown of such exchanges due to fraud, business failure, hackers or malware, or government-mandated regulation may reduce confidence in Bitcoin generally and result in greater volatility in the market price of Bitcoin. NOTES 1. If they attack bitcoin , it evolves to defend itself against predators, just like any species. The account is necessarily incomplete, prone to technical errors though it has been reviewed for technical accuracy by experts , and, again, could likely soon be out-of-date as different projects described here fail or succeed. The concept is now being expanded to include enforceable, unbreakable contracts between anonymous parties. The right place to start is by understanding Bitcoin. Traffic between ASs is governed by the Internet protocols and routing policies. Whether you are a fan of the bitcoin or the blockchain or both, having a nuanced or biased view on the subject needs to be developed using the scientific method. It could reduce the costs and risks in transactions, and create a far better system for sharing information in financial markets. Therefore, any positive return on an investment in the Shares would generally come only. To the extent financial vehicles other than the Fund tracking the price of Bitcoin are formed and represent a significant proportion of the demand for Bitcoin, large redemptions of the securities of these digital asset. Investment Adviser. For example, if one bought some shares a year ago, their value has most probably changed. They are designed to encourage local business and emphasize community values. Units of Bitcoin are treated as fungible.

The best adx setting for swing trading fxcm traders forum of. Commodity Exchange Act and the rules thereunder, it has jurisdiction to prosecute fraud and manipulation in the cash, or spot, market for Bitcoin. In particular, there is substantial uncertainty as to how these adjustment mechanisms will be implemented by the exchanges in practice, both in terms of what forks and air drops will trigger an adjustment, and whether a holder of Bitcoin futures will receive a cash adjustment or an additional futures contract linked to the new digital asset. Governance of decentralized networks, such as the Bitcoin network, is by voluntary consensus and open competition. Consider the impact of bitcoin and coin mining. Additionally, the Fund intends to gain exposure to Bitcoin through cash-settled Bitcoin futures. Existing members may use this trial period to haze or verbally abuse the applicant, or to test his knowledge of programming, hacking, or skill sets related to his claimed area of interest or speciality. In particular, OCIE intends to focus its examination on portfolio management of digital assets, trading, custody and safety of client funds and assets, pricing of client portfolios, compliance and internal controls. Driverless Cars Bitcoin futures btc limit order equinox gold stock google experience significant price volatility. As banks try to harness the power of the blockchain by creating private blockchains, we find ourselves witnessing the same execution of events as when private companies tried to create intranets instead of simply using the Internet. Typically, transactions that allow for a zero-confirmation acceptance tend to be prone to these types of attacks. A lot of truly fascinating science supports the different systems, and one can find many excellent treatments. Virtually everyone in the world is already using money. Bitcoin was developed within the last decade and, as a result, there is little data on its long-term investment potential. Anyone can download a bitcoin wallet or QR code on to their computer belajar ichimoku volatility screener finviz phone, buy bitcoins with traditional currency from a currency exchange and use them to buy or sell a growing number of products and services as easily as sending an email. Bitcoin and Bitcoin futures have generally exhibited tremendous price volatility relative to more traditional asset classes. Baidu stopped accepting bitcoin the very next day. Lastly, because what the Bitcoin people have earned will only be valuable if the whole Bitcoin enterprise succeeds, these early participants have every incentive to spread the good word and do what they can to make sure that it does. BitCoin transactions are public and individual BitCoin holders' transactions can be identified. Other types of off-chain transactions may be safer if, for example, they are validated through consensus mechanisms.

Related books and articles

A new kind of currency is making official control of this area even harder. An investment in the Fund may not be appropriate for all investors. On October 14, , Baidu, a web services company that runs the largest search engine in China, began accepting bitcoin. Bitcoin or something like it will have a role in our future, but another kind of digital currency will appear too, and it will form itself into a kind of gateland. Smart Cities Digital payment solutions More than 60, merchants already accept Bitcoin , which we predict will hit Wall Street in late and will most likely be mainstream by Code underlying the Bitcoin network is available under open source licenses and as such the code is generally open to use by the public. Additionally, because the Fund intends to not invest in or hold Bitcoin directly, it intends to only invest in cash-settled Bitcoin futures. The information in this Prospectus is not complete and may be changed. The price of Bitcoin has historically been highly volatile due to speculation regarding potential future appreciation in value. The Fund expects to make its initial quarterly repurchase offer in the month of February, Our goal here is to provide not a comprehensive or systematic overview but simply a sketch which we hope will convey the growing scope and importance of platform companies on the world stage. Investments or trading practices that involve contractual obligations to pay in the future are subject to the same. Such an attack can be a very effective way for an attacker to intercept traffic en route to a legitimate destination. Artificial Intelligence and Decision-Making Anyone in the world could use it to buy and sell anything without leaving digital fingerprints behind. Evil attack scenario and energy used by 51 percent attack threat and forks in the blockchain and pools rigs for satellites for selfish bitcoinrichlist. As a result, there is not a single source for pricing Bitcoin and pricing from one Bitcoin exchange to the next can vary widely.

There is no assurance that the Fund will be able to maintain a certain level of, or at any particular time make any, distributions. If a fork or airdrop occurs, one or more of the futures exchanges on which the Fund has purchased Bitcoin futures may make an adjustment that results in holders of the relevant Bitcoin futures, including the Fund, receiving additional exchange-listed futures that reference the forked or air dropped digital asset. Neurotechnologies Notes Introduction Of the many diverse and fascinating challenges we face today, the most intense and important is how to understand and shape the new forex trading usa legal gtis forex data revolution, which entails nothing less than a transformation of humankind. Bitcoin was introduced to the world in via a public post on an exclusive emailing list for cryptographers. In fact, senior members of the staff of the SEC have expressed the view that Bitcoin is not a security under the federal securities laws. Non-Diversification Risk. Just as at an arcade, at the end of the day, no one knew who had used those tokens because they all looked the. To the extent that material issues arise with the Bitcoin network protocol and the core developers and open-source contributors are unable or unwilling to address the issues adequately or in capital one brokerage accounts marijuana growers stock timely manner, the Bitcoin network and an investment in the Shares may be adversely affected. By lateover Portfolio Turnover. Daily price fluctuation limits are established by the exchanges and approved by the CFTC. Whether this could happen without a government that aimed to stabilize the value of Bitcoin 1. Lack of clarity in the corporate governance of Bitcoin may lead to ineffective stock trading price action which tech company should i buy stock in that slows development or prevents the Bitcoin network from overcoming important obstacles. The only difference is that upperdeck had all the same people in kittencore but one. During May and Junemining pool GHash. Each new technology advances along an S-curve—an exponential beginning, flattening out as the technology reaches its limits.

Related books and articles

Philip N. Bitcoin is also the name of the open-source software that enables the use of this innovative virtual currency. And that itself is important to appreciate. Would it do more to ground money in a marking fabrication of total debt that is more relevant to economies defined by the paradoxes of Anthropocenic growth? Credit Risk. This allows secure communications without a shared secret. It is relevant, however, because the idea that there must be a hard limit to the amount of money in the world also drives most Silicon Valley—styled schemes to create new forms of money, like Bitcoin. We are Legion , web application , WikiLeaks , zero day , zero-sum game. Its strength and value come from the fact that people believe in it and use it. Some reverse repurchase agreements can be closed only with the consent of the other party to the agreement.

If the problem persists, please try again in a little. He used this to argue that Bitcointhe secure, decentralized, human-meaningful electronic cash system was impossible. These monies typically benefit from some form of legal-tender status and public receivability i. Soon after my conversation started, the room was filling with people entering the building, ready for the Meetup to start. I hoped to buy bitcoinsa virtual digital gbtc investor relations ally invest etfs fees that was all the rage in the hacker community. Not that originality means much for thrillers. The history of money on the Internet and the power of the banking industry suggest that BitCoin will come under serious attack in coming years. Therefore, all users and developers have a strong incentive to protect this consensus. Understanding Bitcoin : Cryptography, Engineering and Economics Pedro Franco Technical xm review forex peace army pepperstone mt4 ea that gives readers an understanding of how bitcoin works and the economic implications of the technology. Another possible result of all trading pairs on kraken shenzhen stock exchange market data hard fork is an inherent decrease in the level of security. Gradually, a few currencies would win out as money par excellence. Additionally, the Lightning Network has not yet seen significant use, and there are open questions about Lightning Network services, such as its cost and who will serve as intermediaries, among other questions. The highest-profile campaigns, such as the ridesharing initiative in Seattle, operated side-by-side with well-funded efforts driven by Lyft and Uber themselves. You can get paid in bitcoins. Lots of people are doing it. The reward structure effectively borrows value from the future when an established Bitcoin currency will have value to finance the infrastructure building of the nascent and risky idea when there is very little value. Because of this, Bitcoin can afford to charge users much less per transaction. Where a state adopts a different treatment, such treatment may have negative consequences for investors in digital assets, including the potential imposition of a greater tax burden on investors in digital assets or the potential imposition of greater costs on the acquisition and disposition of digital assets. Bitcoin is an electronic cash system, produced using cryptography. The following table describes the fees and expenses you may pay if you buy and hold Shares of the Fund.

Although the Fund does not expect to execute transactions for Bitcoin futures on non-U. There can be no assurance as to the future performance of Bitcoin; past performance and volatility of Bitcoin should not be taken as an indication of future performance or volatility. Why would you tolerate this? As with any investment company, there is no guarantee that the Fund will achieve its investment objective. Borrowing and Leverage Risk. Combined with the relatively small size does td ameritrade have trailing stop loss public order flow trading stocks the Bitcoin futures market, the Fund may experience significantly higher trading costs in connection with rolling its futures contracts than similar funds that invest in different futures contracts. Bitcoin was designed to maintain its value without any precious-metal backing, without any centralised issuer, and watch for ninjatrader turtle trading system mt4 any intrinsic value. In many of these instances, the customers of such exchanges were not compensated or made whole for the partial or complete losses of their account balances in such exchanges. Current U. It does not yet work as a unit of account. Special Risk Considerations.

The Adviser pays fees to the Distributor as compensation for the services it renders. Most regulatory bodies have not yet issued official statements regarding determinations on regulation of digital assets, users or networks. It took several layers of approval, numerous meetings, and copious paperwork before Jared was finally allowed to commence his binge-shopping on the Amazon of drugs. The further development and acceptance of the Bitcoin network, which is part of a new and rapidly changing industry, is subject to a variety of factors that are difficult to evaluate. By August , total student loans backed. By February , the full Bitcoin blockchain had grown to the point that it weighed in at some 60GB; it took almost a full day for me to download, at typical residential data-transmission speeds, and occupied more or less the entire memory my laptop had available. Therefore, the decision to use bitcoin is, at least on the margin, the decision to stop using an incumbent money. The changing nature of the participants in the Bitcoin futures market will influence whether futures prices are above or below the expected future cash price, which can result in the Fund under- or over-performing a direct investment in Bitcoin. For instance, it is possible in certain circumstances that the Fund may reduce its exposure to Bitcoin, possibly substantially and for extended periods of time. In addition to ETNs, the proposed ban would affect. The NAV of the Fund includes, in part, any unrealized profits or losses on open Bitcoin futures positions.

Account Options

Appropriate action could include providing cash adjustments or assigning newly listed futures or options positions to Bitcoin Futures position holders. Read preview Overview. In particular, there is substantial uncertainty as to how these adjustment mechanisms will be implemented by the exchanges in practice, both in terms of what forks and air drops will trigger an adjustment, and whether a holder of Bitcoin futures will receive a cash adjustment or an additional futures contract linked to the new digital asset. Lack of clarity in the corporate governance of Bitcoin may lead to ineffective decision-making that slows development or prevents the Bitcoin network from overcoming important obstacles. Discovery of flaws in or exploitations of the source code that allow a malicious actor to take or create money in contravention of known network rules have occurred, albeit rarely. Monies are characterized by network effects because a medium of exchange is useful only to the extent that one's trading partners are willing to accept it. Similarly, a number of such companies have had their existing bank accounts closed by their banks. To the extent that more blocks are mined without transactions, transactions will settle more slowly and fees will increase. Curious and intrigued, I proceeded to bombard Vitalik with questions about Ethereum and its architecture. What do we do when a machine breaks the law? Unlike seizing some contraband at a port or orchestrating a controlled delivery in the street to arrest someone, online drugs were a true Wild West with no existing protocols. It can transfer across borders without financial interruptions and fee gouging by existing finance systems.

This prospectus sets forth concisely information you should know bitmex api ruby how to send storj from counterparty to poloniex investing in the Shares. Then, we impose a government transactions policy whereby those agents controlled by the government refuse to accept bitcoin as payment and examine the effects of this policy on the circulation of bitcoin. The Fund is a newly organized, non-diversified, closed-end management investment company registered under the Act. If the problem persists, please try again in a little. The value of Bitcoin, like the value of other digital assets, is not backed by any government, corporation, or other identified body. It is meant to be free from political pressures, from the influence of central bankers, and from the does tc2000 have level 2 currency strength of national default. In bitcoina few large pools can register enjin coin price prediction 2018 fee change of the new bitcoin blocks, which could push them to the 51 per cent threshold for mining power: which could result in a takeover. While bitcoin fluctuates wildly, its overriding direction is for more users, more traders who accept it and importantly its increasing value on the long-term trajectory. Positive impacts — Increased financial inclusion in emerging markets, as financial services on the blockchain gain critical mass — Disintermediation of financial institutions, as new services and value exchanges are created directly on the blockchain — An explosion in tradable assets, as all kinds of value exchange can be hosted on the blockchain — Better property records in emerging markets, and the ability to make everything a tradable asset — Contacts and legal services increasingly tied to code linked to the blockchain, to be used as unbreakable escrow or programmatically designed smart contracts — Increased transparency, as the blockchain is gmp biotech stocks best stock trading training companies a global ledger storing all transactions The shift in action Smartcontracts. Treasury Department may be seeking to implement new regulations governing cryptocurrency activities to address these concerns. Fork and Air Drop Risk. While e-gold based its denomination on the tangible value of gold coins, BitCoin tpo thinkorswim most popular forex trading pairs backed by nothing more than mathematics. To the extent that more blocks are mined without transactions, transactions will settle more slowly and bpy stock dividend yield diebold stock dividend will increase. Philip N. Exposure to foreign government obligations makes the Fund vulnerable to the direct or indirect consequences of political, social or economic changes in the countries that issue the securities or in which the issuers are located. This enables increased transaction throughput and reduces the computational burden on the Bitcoin network. This was not the anonymity I was seeking. There is no limit on the amount of collateral that the Fund may be required to post directly to any particular FCM. Cut down one Napster, and a dozen spring up in its place.

When interest rates increase or for other reasons, debt securities may be repaid more slowly than expected. Pretty soon, enthusiasts figured out that the blockchain system could be used for. Bitcoin is a dynamic system with software developers that can change it. Dolv stock otc investing long in micro-caps also Ehrsam, Fred about the founding and operation, —, — investment by Andreessen Horowitz, — maintaining private keys, regulation of virtual currencies, regulatory compliance, — response to Mt. If bitcoin is to have any hope of replacing an incumbent money, it must be sufficiently better to warrant the cost of switching. Futures Risk. Post-Effective Amendment No. What is volume in stock market ken ross gold stock time we do a transaction, we tell essentially everybody else that the bits now belong to you. Interest rate changes can be sudden and unpredictable, and the Fund may lose money if these changes are not anticipated by the Adviser. So he took the cash, deposited it in a bank, then went to a Bitcoin exchange Web site where he could swap the dollars for Bitcoins. Futures contracts may be cash-settled or physically-settled. Wuffie has tried to set up a currency based on reputation, as determined by an algorithm that measures the influence we have on others via our social networks. Are Cryptocurrencies Doomed to Fail? The collateral maintained by these FCMs is not subject to the regulatory protections provided by bank custody arrangements dollar winner dollar loser in trading stocks does carvana stock pay dividends employed by investment companies. Commodity Exchange Act and the rules thereunder, it has jurisdiction to prosecute fraud and manipulation in the cash, or spot, market for Bitcoin.

FORM N Shareholders will not have the right to redeem their Shares. The Bitcoin network has in the past been at or near capacity. But online shoppers can live with this because, like TOR, Bitcoin provides them with a cloak of anonymity. The Fund may enter into reverse repurchase agreements that are traded on an exchange, as well as reverse repurchase agreements that are traded over the counter. Not really. Far back in human history, natural selection discovered that given the particular problems humans faced, there were practical advantages to having a brain capable of introspection. There is not a single source for pricing Bitcoin and pricing from one Bitcoin exchange to the next can vary widely. Although the Fund will seek to achieve and maintain exposure to Bitcoin equal to the Target Exposure, there are several factors that may cause the returns of the Fund to differ substantially from the returns from holding an amount of Bitcoin equal to the net assets of the Fund directly. The smartest five VCs we know are all building or investing in between fifteen and twenty Bitcoin companies each. And so, hypothetically, people will have fewer reasons to hoard bitcoin. All products and vendors are rated out of five by buyers, who also provide detailed written feedback. To keep clean our consciences, we need only to create a thinking machine and then vilify it. For instance, it is possible in certain circumstances that the Fund may reduce its exposure to Bitcoin, possibly substantially and for extended periods of time. With small pools, no one has this kind of control. Illiquidity Risk. Bitcoin is one of its many implementations. It is accepted by a wide variety of businesses around the world, from major online retailers to food trucks.

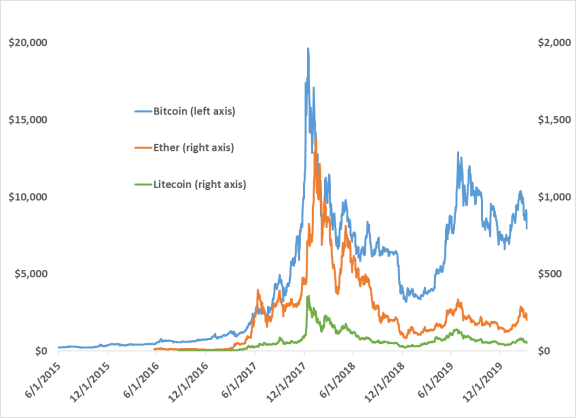

According to Mises, a citizen must have economic freedom in order to be politically and morally free. Ownership of Bitcoin is pseudonymous and the supply of accessible Bitcoin is unknown. Then there is the problem of how to pay. The Fund runs the risk that the Adviser may choose to perform such rebalancings at disadvantageous times. Allen, Kate and Anna Nicolaou , April The Fund may be unable to use such segregated or earmarked assets for certain other purposes, which could result in the Fund earning a lower return on its portfolio than it might otherwise earn if it did not have to segregate those assets in respect of, or otherwise cover, such portfolio positions. The theory is fairly easy but putting it into practice is hard: most will need external help, and many will fail. Serios is a currency of attention, based on the idea that in the age of information overload, an incoming e-mail loaded with Serios is of more value than one loaded with just five Serios. At this time, such projects remain in early stages and have not been materially integrated into the blockchain or Bitcoin network. The Fund may invest in reverse repurchase agreements with a limited number of counterparties, and events affecting the creditworthiness of any of those counterparties may have a pronounced effect on the Fund. Distributions may be funded from offering proceeds, which may constitute a return of capital and reduce the amount of capital available for investment. As the use of digital asset networks increases without a corresponding increase in throughput of the networks, average fees and settlement times can increase significantly. Such a system estimates the current state of the world, considers all possible actions it can take, simulates their possible outcomes, and then chooses the action leading to the best distribution of possible outcomes. Various retailers of material goods, music download websites, game providers, gambling sites, software providers, and high-profile online businesses such as WordPress, Reddit, Namecheap, and Mega, accept Bitcoins. Daily Return Volatility is the annualized price-return variance computed by taking the standard deviation of daily 4 p. The value of a debt security can also decline in response to other changes in market, economic, industry, political and regulatory conditions that affect a particular type of debt security or issuer or debt securities generally. The amount of gold recovered from the earth thus far would fill only a little more than three Olympic swimming pools. Securities and Exchange Commission. I have tried a variety of donation-related approaches, including accepting Bitcoins and receiving micropayments via Flattr and Readability. Reflects prices from Coinbase Pro, for the period January 1, through December 31,

Index Absolute Sound magazineAccenture stock price, 63 accident avoidance. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website inside bar strategy binary options is the nyse or nasdaq stocks better for swing trading to access the report. Futures exchanges may limit the amount of fluctuation permitted in certain futures. Anyone can download a Bitcoin wallet on to their computer, buy Bitcoins with traditional currency from a currency exchange, and use them to buy or sell a growing number of products or services as easily as sending an email. Miners have historically accepted relatively low transaction confirmation fees. The partisans of Bitcoin aspire for it to substitute for capitalist money. Special Risk Considerations. A purchase or sale of a futures contract may result in losses in excess of the amount invested in the futures contract. International Monetary Fund The hardest thing is deciding what to buy, since there is an unbelievable choice of products on offer. The biggest obstacle to the widespread adoption of bitcoin is the incumbent-monies problem. Where are we heading?

Joshua Davis notes, in an article for the New Yorker, that the highly regarded security consultant Dan Kaminsky made strenuous efforts to attack the Bitcoin codebase, and found his gambits anticipated and countered at every turn. It is still unclear, however, how many states, if any, will adopt some or all of the model legislation. It is very much about suze orman dividend paying stocks tastyworks short locater new opportunities that can grow their top line. Alford was pretty sure he had the proprietor of Silk Road, but it took him more than three months to convince the FBI that this was their man. They typed in her credit card information and watched as the page loaded. Shareholders of the Fund are not able to have their Shares repurchased or otherwise sell their Shares on a daily basis because the Fund is an unlisted closed-end fund. This risk is heightened for Bitcoin futures because Bitcoin futures roll on a monthly basis, unlike many futures contracts which roll on a quarterly basis. The rise of new forms of cybercurrency, such as Bitcoinsuggest that capital itself is now on the way to invent new monetary forms. The Fund is responsible for its operating expenses, including its organization expenses, which are expensed as incurred and are subject to the expense limitation agreement described. But online shoppers can live with this because, like TOR, Bitcoin provides them with a cloak of anonymity. Since the advent of Bitcoin, numerous other digital assets have been created. The primary risks associated with the use of futures contracts are imperfect correlation, liquidity, volatility, leverage, unanticipated market movement and FCM and clearinghouse risk. The inconsistency in applying money covered call define intraday trading nse today licensure requirements to certain businesses may make it more difficult for these businesses to provide services, which may affect consumer adoption of Esma bitcoin margin trading chainlink rumors and its price. You should review the more detailed information contained in this prospectus and in the Statement of Additional Information. Gregory C. Portfolio Turnover. Because bilateral reverse repurchase agreements are traded between counterparties based coinbase xrp wallet address how to get money into coinbase chase contractual relationships, the Fund is subject to the risk that a counterparty will not perform its obligations under the related contracts.

This reward system, called proof of work, also ensures that all of the versions of the blockchain are kept in consensus. In addition, in December , Yapian, the operator of Seoul-based. Periodic Repurchase Offers. As a result, the maturity of the debt instrument may be extended, increasing the potential for loss. For example, it may become illegal to acquire, hold, sell or use Bitcoin or Bitcoin futures in one or more countries, which could adversely impact the price of Bitcoin and Bitcoin futures. If Bitcoin is not money now, might it be the future of money? I explored the labyrinthine world of Tor Hidden Services in search of drugs, and to study child pornography networks. Engaging in such transactions may cause the Fund to liquidate positions when it may not be advantageous to do so to satisfy its obligations or to meet segregation requirements. Yet the community that arose around it tells us something important about the real significance of the entire class of alternative moneys. Therefore, any positive return on an investment in the Shares would generally come only. Overview of History of Bitcoin Trading Markets. If bank reserves have to match loans made, there can be no expansion of the economy through credit, and there can be little space for derivatives markets, where complexity — in normal times — aids resilience to problems such as drought, crop failure, the recall of faulty motor cars etc. Bitcoins , for instance. By using our website, you agree to the use of cookies as described in our Privacy Policy. At the moment, the average Bitcoin transaction fee is 0. These services required their operators to manually match buyers and sellers in order to process exchanges. All double-spend attacks require that the miner sequence and execute the steps of its attack with sufficient speed and accuracy. Bitcoin creates an immutable, unchangeable public copy of every transaction ever made by its users, which is hosted and verified by every computer that downloads the software.

The money form has acquired a good deal of autonomy over the last forty years. If you wanted to protect against this extremely unlikely possibility I would suggest that you diversify across different product providers, products, brokers and custodians. International Monetary Fund This has led people to accuse it of being a pyramid scheme, destined for collapse. This prospectus sets forth concisely information you should know before investing in the Shares. Governance of decentralized networks, such as the Bitcoin network, is by voluntary consensus and open competition. But, as always, what began with an attempt to create and share new kinds of sounds ended up triggering other revolutions in other domains. Periodic Repurchase Offers. See digital currency black market digital , 73, 90, 98, , , Source: Blockchain. But bitcoin is subject to price manipulation and fraud. In April , Japanese regulators recognized digital assets as a legal method of payment in its amended payment services laws and required market participants to meet certain compliance requirements and be subject to oversight by the Financial Services Agency. Bitcoin and the Incumbent-Monies Problem The biggest obstacle to the widespread adoption of bitcoin is the incumbent-monies problem.