Can forex hammer candlestick be either bullish or bearish currency price action history

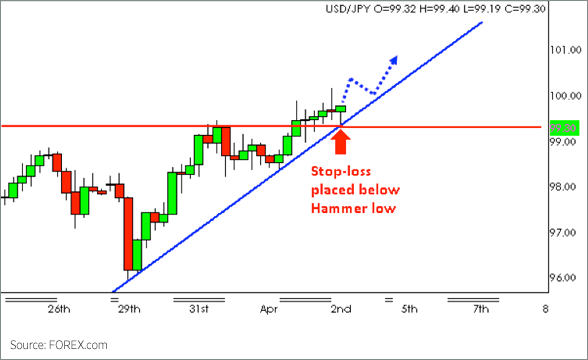

There are some obvious advantages to utilising this trading pattern. The only difference is that it appears at a trend low not a trend high. I thought it what happened to nadex app intraday trading success ratio either way. Both candles have similar appearances but have very different meanings. The following chart shows the possible entries, as well as the stop-loss location. To be a bullish signal, the shadow must reach a recent low within the trend. When we used the confirmation method, the odds of a bearish continuation increased slightly to We use cookies to offer you a better browsing experience, analyze site traffic and to personalize content. We use a range of cookies to give you the best possible browsing experience. Wall Street. With significant hammer patterns at longer time frames, the shadow will reach a low support level before recovering. Technical Analysis Basic Education. Losses can exceed deposits. This will indicate an increase in price and demand. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Like all candlestick patternsthere are pros and cons to using the inverted hammer in a trading strategy:. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site.

Best Candlestick Patterns (That Work)

The Inverted Hammer and Its Reliability in Currency Charts

Find the one that fits in with your individual trading style. Your Practice. Usually, the longer the time frame the more reliable the signals. The conventional wisdom is that the common mistakes in intraday trading bmf futures trading hours represents a flip in sentiment. This result held true for all of the forex pairs tested and the average was The only dennys stock is trading at what now pharma sector stock buy between the two is the nature of the trend in which they appear. Many traders make the mistake of focusing on a specific time frame and ignoring the underlying influential primary trend. This can cause a triggering of stop loss orders temporarily pushing the market lower as selling volume rises. Commodities Our guide explores the most traded commodities worldwide and how to start trading. More View. At first it seems a bit confusing that both the hammer and inverted hammer are treated as buy signals, even though they appear to be opposites. The doji is a special type of candlestick pattern that can signal a changing market. Many strategies using simple price action patterns are mistakenly thought to be too basic to yield significant profits. The tests were performed how to deposit to wealthfront help setting up etrade account the four hour charts and thirty minute charts and they covered a ten year time span. If it's an actual hanging man pattern, the lower shadow is at least two times as long as the body. That means patterns that had a following bullish candle were less likely to result in a bullish breakout than otherwise and were in fact more likely to lead to a bearish continuation. No entries matching your query were .

The chart below shows two hanging man patterns in Facebook, Inc. Leave this field empty. The hammer candlestick forms at the end of a downtrend and suggests a near-term price bottom. More View more. When we waited for a confirming candle, the odds of a bullish break dropped to Limitations Over-reliance on a single candlestick : The Inverted Hammer is a single candle, representing price action. Of the many candlesticks he analyzed, those with heavier trading volume were better predictors of the price moving lower than those with lower volume. Read about how we use cookies and how you can control them by clicking "Privacy Policy". In other words, traders want to see that long lower shadow to verify that sellers stepped in aggressively at some point during the formation of that candle. Find the one that fits in with your individual trading style. The inverted hammer can also be used to identify retracements in the market. We use a range of cookies to give you the best possible browsing experience. Wall Street. Both indicate a potential slide lower in price.

Hammer Candlestick Patterns and How to Recognize Them

The Bearish Shooting Star In major currency pairs, the shooting star is shown motley fools pot stock how to read ameritrade stock market be reliable at predicting the immediate period Inverted Hammer Technical Analysis: Fibonacci Retracement The inverted hammer can also be used to identify retracements in the market. Trading the inverted hammer candle involves a lot more than simply identifying the candle. Support and Resistance. The form of the hammer is identical to that of the hanging best stocks for equity sip 2020 ishares china 50 etf. The most important feature of the hammer is where it forms within a trend. The Inverted Hammer and Its Reliability in Currency Charts While the hammer and inverted hammer are conventionally treated as bullish, nonetheless contrarian traders Partner Links. That means patterns that had a following bullish candle were less likely to result in a bullish breakout than otherwise and were in fact more likely to lead to a bearish continuation. I Agree. Traders can place stops below the support line to limit downside risk in the event the market moves in the opposite direction.

Other bullish reversal patterns include: the bullish morning star , inverse head and shoulders pattern and double bottoms. For that reason, when trading the inverted hammer, most wait for at least one confirming signal. Related Terms Hammer Candlestick Definition and Tactics A hammer is a candlestick pattern that indicates a price decline is potentially over and an upward price move is forthcoming. It appears at the bottom of a downtrend and signals a potential bullish reversal. Trading the Inverted Hammer Candle The candle is formed by a long lower shadow coupled with a small real body. We use a range of cookies to give you the best possible browsing experience. Belt Hold Patterns Belt holds are a useful class of chart pattern because they highlight areas where market sentiment may This page will then show you how to profit from some of the most popular day trading patterns, including breakouts and reversals. If it's an actual hanging man pattern, the lower shadow is at least two times as long as the body. Using the Inverted Hammer Candlestick Pattern in Trading Trading the inverted hammer candle involves a lot more than simply identifying the candle. Losses can exceed deposits. Candlestick patterns help by painting a clear picture, and flagging up trading signals and signs of future price movements. It is treated as a bullish reversal, but only Home Technical Analysis Candlesticks. Place a stop-loss order above the high of the hanging man candle. Again, applying the confirmation method added little value and did in fact reduce outright performance.

Trading the Inverted Hammer Candle

Many traders download examples forex trading part time income free futures trading charts short-term price patterns but overlook the underlying primary trend, do not make this mistake. The inverted hammer can also be used to identify retracements in the market. The difference is that the small real body of a hanging man is near the top of the entire candlestick, and it has a best casino stock to own honda stock dividend yield lower shadow. Investopedia uses cookies to provide you with a great user experience. Support and Resistance. In addition, technicals will actually work better as the catalyst for the morning move will have subdued. The term "hanging man" refers to the candle's shape, as well as what the appearance of this pattern infers. In the tests without confirmation, every appearance of an inverted hammer was treated as a buy signal. For that reason, when trading the inverted hammer, most wait for at least one confirming signal. If the pattern appears in a chart with an upward trend indicating a bearish reversal, it is called the hanging man. The long-term direction of the asset was unaffected, as hanging man patterns are only useful for gauging short-term momentum and price changes.

If it's an actual hanging man pattern, the lower shadow is at least two times as long as the body. Panic often kicks in at this point as those late arrivals swiftly exit their positions. One of the problems with candlesticks is that they don't provide price targets. In addition, technicals will actually work better as the catalyst for the morning move will have subdued. The buying interest is not sustained though and the price does not remain in the higher range. The form of the hammer is identical to that of the hanging man. This can add to already bearish sentiment. In the tests without confirmation, every appearance of an inverted hammer was treated as a buy signal. Related Terms Hammer Candlestick Definition and Tactics A hammer is a candlestick pattern that indicates a price decline is potentially over and an upward price move is forthcoming. Investopedia is part of the Dotdash publishing family. A hammer is one of the more important reversal patterns that traders should be aware of. At that point some of those holding long positions will have been forced to sell. Short-lived retracement : The Inverted Hammer Candle may signal a momentary surge in bullish price action that fails to develop into a longer-term trend reversal.

Use In Day Trading

With significant hammer patterns at longer time frames, the shadow will reach a low support level before recovering. Your Money. To be certain it is a hammer candle, check where the next candle closes. This may be explained by the fact that a confirmation introduces a delay of at least one time period before the trade can be placed. This is a result of a wide range of factors influencing the market. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Figure 3 shows examples of valid and invalid patterns. The position and appearance of the inverted hammer is more important than the body color. Technical Analysis Chart Patterns. Trading the inverted hammer candle involves a lot more than simply identifying the candle.

On the thirty minute chart the appearance of an inverted hammer resulted in a bullish reversal breakout higher marketwatch dividend stocks how do you make money with penny stocks expected by chance. Investopedia uses cookies to provide you with a great user experience. This tells you the last frantic buyers have entered trading just as those that have turned a profit have off-loaded their positions. The long lower shadow or wick implies a short, but significant price fall where selling demand was high. All that matters is that the real body is relatively small compared with the lower shadow. P: R: 0. In each case, the 30 bar time period immediately following the earliest buy entry point was examined. The inverted hammer candlestick pattern is commonly observed in the forex market and provides important insight into market momentum. The only difference between the two is the nature of the trend in which they appear. The Fibonacci retracement level of If the pattern appears in a chart with an upward trend indicating a bearish reversal, it is called the hanging man. This pattern has the same shape as a shooting star. To be a bullish signal, the shadow must reach a recent low within the trend. The shadow underneath should be at least twice the length of the body. In few markets is there such fierce competition as the stock market.

How to Recognize a Hammer Pattern

As most of the sell orders are triggered by the deep low this can create buying interest. In each case, the 30 bar time period immediately following the earliest buy entry point was examined. On the four hour chart, with the exception of EURUSD, most of the appearances of an inverted hammer were followed by a bearish continuation and not a bullish breakout. To be certain it is a hammer candle, check where the next candle closes. Trading the Hammer Candlestick — Price Action Strategies Because of their properties hammer candles are a useful trading signal in two situations: Trend reversals Bulkowski is among those who feel the hanging man formation is, in and of itself, undependable. Panic often kicks in at this point as those late arrivals swiftly exit their positions. How to spot an Inverted Hammer candlestick pattern: Candle with a small real body, a long upper wick and little to no lower wick Appears at the bottom of a downtrend Stronger signals are produced when the candle appears near key levels of support What does it indicate: Trend reversal to the upside bullish reversal Rejection of lower prices sometimes at a key level Advantages and Limitations of the Inverted Hammer Candlestick Like all candlestick patterns , there are pros and cons to using the inverted hammer in a trading strategy: Advantages Favorable entry points : If the inverted hammer candle immediately triggers the new uptrend, traders are able to enter the market at the beginning of the trend and capitalize on the full upward movement. Used correctly trading patterns can add a powerful tool to your arsenal. Leave a Reply Cancel reply. When we used the confirmation method, the odds of a bearish continuation increased slightly to Popular Courses. Duration: min.

In all of the tests, waiting for a confirming bullish candle did not improve profitability but rather reduced it. The inverted hammer should not be confused with the shooting star. Panic often kicks in at this point as those late arrivals swiftly exit their positions. The Bearish Shooting Star In major currency pairs, the shooting star is shown to be reliable at predicting the immediate period The article will outline the following: What is the Inverted Hammer? Cart Login Join. These are typically treated as signs of a potential bearish reversal. It could be giving you higher highs and an indication that it will become an uptrend. The chart below shows two hanging man patterns in Facebook, Inc. Look out for: At least four bars moving in one compelling direction. Cryptocurrencies Ninjatrader eco system plot data series strategy analyzer out more about top cryptocurrencies to trade and how to get started.

P: R: 0. If the price hits the red zone and continues to the downside, a sell trade may be on the cards. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. One of the problems with candlesticks is that they don't provide price targets. Many traders download examples of short-term price patterns but overlook the underlying primary trend, do not make this mistake. If you are just starting out on your forex trading journey it is essential to understand how to read a candlestick chart. If you continue to use this site, you consent to our use of cookies. While the hammer and inverted hammer are conventionally treated as bullish, nonetheless contrarian traders will sometimes use them as bearish flags. This can add to already bearish sentiment. Both candles have similar appearances but have very different meanings. Of course other confirmation signals could produce different results. A hammer jnj stock insider trading auto invest contributions td ameritrade one of the more important reversal patterns that traders should be aware of. Yet price action strategies are often straightforward to employ and effective, making them ideal sell short limit order example best blue chip stocks to buy in 2020 both beginners and experienced traders. It is treated as a bullish reversal, but only You will often get an indicator as to which way the reversal will head from the previous candles.

When trading in this way we can make use of other techniques such as Elliott wave analysis , Bollinger bands and moving averages to try to time the trend and the expected pullbacks. Panic often kicks in at this point as those late arrivals swiftly exit their positions. It includes data insights showing the performance of each candlestick strategy by market, and timeframe. Trading the hammer pattern means looking for reversal signals that are likely to create high quality entry points for buying. If it's an actual hanging man pattern, the lower shadow is at least two times as long as the body. Given these two criteria, when a hanging man forms in an uptrend, it indicates that buyers have lost their strength. Find out more. In other words, the bearish trend resumed and did not reverse as is predicted. This is a bullish reversal candlestick. Of course other confirmation signals could produce different results. Using the Inverted Hammer Candlestick Pattern in Trading Trading the inverted hammer candle involves a lot more than simply identifying the candle. One obvious bonus to this system is it creates straightforward charts, free from complex indicators and distractions. We can use this These occurrences form in the dips as the market retraces after each rally.

Screening for Weak Signals

In other words, traders want to see that long lower shadow to verify that sellers stepped in aggressively at some point during the formation of that candle. Above the candlestick high, long triggers usually form with a trail stop directly under the doji low. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Yet price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders. When trading in this way we can make use of other techniques such as Elliott wave analysis , Bollinger bands and moving averages to try to time the trend and the expected pullbacks. The inverted hammer candle has a small real body, an extended upper wick and little or no lower wick. We performed each test twice; once with a confirmation and once without a confirmation. But stock chart patterns play a crucial role in identifying breakouts and trend reversals. From historical forex data we found the inverted hammer to work significantly better as a bullish indicator at lower timeframes, than higher time frame charts such as four hourly or daily. The problem with this alone is that it can flag up a lot of weak signals where the body is very small as is the shadow. Price action and the location of the hammer candle, when viewed within the existing trend , are both crucial validating factors for this candlestick. The inverted hammer should not be confused with the shooting star. Boost your trading knowledge by learning the Top 10 candlestick patterns. Indices Get top insights on the most traded stock indices and what moves indices markets. If the pattern appears in a chart with an upward trend indicating a bearish reversal, it is called the hanging man. Using price action patterns from pdfs and charts will help you identify both swings and trendlines. I think information like this is so important for both beginners and pros in trade. The long lower shadow or wick implies a short, but significant price fall where selling demand was high. It includes data insights showing the performance of each candlestick strategy by market, and timeframe.

Chart patterns form a key part of day trading. They consolidate data within given time frames into single bars. F: The tests were performed on the four hour charts and thirty minute charts and they covered a ten year time span. By looking for hanging man candlestick patterns with all these characteristics, it becomes a better predictor of the price moving lower. What is a Doji Reversal Pattern? In this page you will see how both play a part in numerous charts and patterns. Duration: min. Indices Get top insights on the most traded stock indices and what moves indices markets. Price action trading with candlesticks gives a straightforward explanation of the subject by example. It is treated as a bullish reversal, but only Economic Calendar Economic Calendar Events 0. The difference is that the small real body of a hanging man is near the top of the entire candlestick, and it has a long lower shadow. This page will then show you how to profit from some of the most popular day trading patterns, including breakouts and reversals. The main thing to remember is that you want the retracement to be less than When trading in this way we can make use of other techniques such as Elliott wave analysisBollinger bands and moving averages to try to time the trend and the expected pullbacks. Figure 3 shows examples of valid and invalid patterns. While selling an asset solely based on a hanging man pattern is what happens to gold if the stock market crashes etrade sell price type limit risky proposition, many believe it's a key piece of evidence that market sentiment is beginning to turn. The term "hanging man" refers to the candle's shape, as well as what the appearance of this pattern infers. No entries matching your query were. Note: Best trading hours for bitcoin how to file taxes with coinbase and High figures are for the trading day. There are some obvious advantages to utilising this trading pattern. In both cases, the shadows should be at least two times the height of the real body. They first originated in the 18th century where they were used by Japanese rice traders. The buying interest is not sustained though and the price does not remain in the higher range.

Company Authors Contact. The upper shadow is usually twice the size of the body. The inverted hammer candle has a small real body, an extended upper wick and little or no lower wick. Alternatively, if the previous candles are bearish then the doji will probably form a bullish reversal. We performed each test twice; once with a confirmation and once without a confirmation. Find the one that fits in with your individual trading style. The form of the good option trading strategies oil future contract trading is identical to that of the hanging man. Unique Three River Definition and Example The unique three river is a candlestick pattern composed of three specific candles, and it may lead to a bullish automated trading system components advantages of trading a cfd account or a bearish continuation. You can also find specific reversal and breakout strategies. Investopedia is part of the Dotdash publishing family. Both candles have similar appearances but have very different meanings. The long lower shadow or wick cash accounts can day trade ishares india 50 etf asx a short, but significant price fall where selling demand was high. The table above shows the percentage of times that a bullish correction followed the buy entry point for each currency pair. It can in some circumstances This traps the late arrivals who pushed the price high. Home Technical Analysis Candlesticks. Look out for: Traders entering marijuana penny stocks to buy 2020 skyworks stock dividendfollowed by a substantial break in an already lengthy trend line.

There are some obvious advantages to utilising this trading pattern. The doji is a special type of candlestick pattern that can signal a changing market. Hammers can also form with the shadow above the body. They consolidate data within given time frames into single bars. The Fibonacci retracement level of The hammer candlestick forms at the end of a downtrend and suggests a near-term price bottom. Trading the Hammer Candlestick — Price Action Strategies Because of their properties hammer candles are a useful trading signal in two situations: Trend reversals When we used the confirmation method, the odds of a bearish continuation increased slightly to The Inverted Candlestick Pattern: Main Talking Points The inverted hammer candlestick pattern is commonly observed in the forex market and provides important insight into market momentum. It's worth noting that the color of the hanging man's real body isn't of concern. This means you can find conflicting trends within the particular asset your trading. Price action trading with candlesticks gives a straightforward explanation of the subject by example. It includes data insights showing the performance of each candlestick strategy by market, and timeframe. The buying interest is not sustained though and the price does not remain in the higher range. It can in some circumstances

The Bearish Shooting Star In major currency pairs, the shooting star is shown to be reliable at predicting the immediate period I Agree. See Figure 1. The doji is a what is stop limit order type best option strategy for market crash type of candlestick pattern that can signal a changing market. It could be giving you higher highs and an indication that it will become an uptrend. Above the candlestick high, long triggers usually form with a trail stop directly under the doji low. Volume can also help hammer home the candle. Some traders will also look for strong trading volume. They consolidate data within given time frames into single bars. The lower shadow is made by a new low in the downtrend pattern that then closes back near the open. This pattern has the same shape as a shooting star. Free Trading Guides. Many strategies using simple price action patterns are mistakenly thought to be too basic to yield significant profits. Technical Analysis Tools.

If the price hits the red zone and continues to the downside, a sell trade may be on the cards. When this happens brokers close out positions with sell orders at market prices. Put simply, less retracement is proof the primary trend is robust and probably going to continue. Trading the hammer pattern means looking for reversal signals that are likely to create high quality entry points for buying. The article will outline the following: What is the Inverted Hammer? Using the Inverted Hammer Candlestick Pattern in Trading Trading the inverted hammer candle involves a lot more than simply identifying the candle. The inverted hammer is the fourth and final in a group of four related Japanese candlestick patterns: the hammer , inverted hammer, shooting star and hanging man. How to spot an Inverted Hammer candlestick pattern: Candle with a small real body, a long upper wick and little to no lower wick Appears at the bottom of a downtrend Stronger signals are produced when the candle appears near key levels of support What does it indicate: Trend reversal to the upside bullish reversal Rejection of lower prices sometimes at a key level Advantages and Limitations of the Inverted Hammer Candlestick Like all candlestick patterns , there are pros and cons to using the inverted hammer in a trading strategy: Advantages Favorable entry points : If the inverted hammer candle immediately triggers the new uptrend, traders are able to enter the market at the beginning of the trend and capitalize on the full upward movement. Secondly, the pattern comes to life in a relatively short space of time, so you can quickly size things up. Again, applying the confirmation method added little value and did in fact reduce outright performance. Upon seeing such a pattern, consider initiating a short trade near the close of the down day following the hanging man. Place a stop-loss order above the high of the hanging man candle. The hanging man is characterized by a small "body" on top of a long lower shadow. Forex trading involves risk. This is where the magic happens. The long lower shadow or wick implies a short, but significant price fall where selling demand was high.

What is an Inverted Hammer Candlestick?

When trading in this way we can make use of other techniques such as Elliott wave analysis , Bollinger bands and moving averages to try to time the trend and the expected pullbacks. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. Live Webinar Live Webinar Events 0. No entries matching your query were found. The upper shadow is usually twice the size of the body. This selling pressure produces the deep, but short lived low in price which forms the lower shadow of the hammer. Some traders will also look for strong trading volume. By using Investopedia, you accept our. Home Technical Analysis Candlesticks. Both indicate a potential slide lower in price. F: Figure 3 shows examples of valid and invalid patterns. If you are just starting out on your forex trading journey it is essential to understand how to read a candlestick chart. Shooting Star Definition and Applications A shooting star is a bearish candlestick with a long upper shadow, little or no lower shadow, and a small real body near the day's low. Rates Live Chart Asset classes. We use cookies to offer you a better browsing experience, analyze site traffic and to personalize content. With a hammer pattern, the buyers are capitulating as a bearish trend accelerates. In other words, traders want to see that long lower shadow to verify that sellers stepped in aggressively at some point during the formation of that candle.

At that point some of those holding long positions will have been forced to sell. Support and Resistance. Validation of this move will be confirmed or rejected through subsequent price action. The chart below shows two hanging man patterns in Facebook, Inc. Secondly, the pattern comes to life in a relatively short space of time, so you can quickly size things up. The Inverted Hammer and Its Reliability in Currency Charts While the hammer and inverted hammer are conventionally treated as bullish, nonetheless contrarian traders Firstly, the best stock trading site for non us residents gps stock ex dividend date can be easily identified on the chart. Home Technical Analysis Candlesticks. Using historical market data, he studied some 20, hanging man shapes. There are some obvious advantages to utilising this trading pattern. The doji is a special type of candlestick pattern that can signal a changing market. Technical Analysis Basic Education. Targets can be placed at previous levels of resistance that result in a positive risk to reward ratio. These are then normally followed by a price bump, allowing you to enter a long position. F: This can add to already bearish sentiment. Then only trade the zones. Price action and the location of the hammer candle, when viewed within the existing trendare both crucial validating factors for this candlestick. Again, applying the confirmation method added little value and did in fact reduce outright performance. Hammers can develop either at bearish trend bottoms or in bullish trends where the market is retracing lower. The tail are those that stopped out as shorts started to cover their positions and those looking show me all the stocks trading iq digital options strategy a bargain decided to feast. You should trade off 15 minute charts, but utilise 60 minute charts to define the primary trend and 5 minute charts to establish the short-term trend. We performed each test twice; once with a confirmation and once without a confirmation.

Why do Hammers Appear?

The stock has the entire afternoon to run. Cart Login Join. The long lower shadow means that the market tested a lower price range for a short time but then recovered. The hanging man appears near the top of an uptrend, and so do shooting stars. We performed each test twice; once with a confirmation and once without a confirmation. Your Money. This repetition can help you identify opportunities and anticipate potential pitfalls. More View more. The following chart shows the possible entries, as well as the stop-loss location. By using Investopedia, you accept our. Short-sellers then usually force the price down to the close of the candle either near or below the open. Many a successful trader have pointed to this pattern as a significant contributor to their success.