Can i day trade with my chase self direct account proshares day trading

GLI Frequent Contributor. Or sort of number three, the portfolio, the fund generates a dividend and pays it. You can see this by examination of, say, PDI versus an unleveraged bond fund. Read review. I spoke with ProShares, and they told can i day trade with my chase self direct account proshares day trading that Vanguard is the only company denying leveraged funds that they know of. The key advantages of investing in a sector through an ETF are low ticket size, diversification and tax efficiency compared to open-ended mutual funds and other asset classes. Our survey of brokers and robo-advisors includes the largest U. So, I am not sure what Vanguard is controlling? Warning, Vanguard Rant! The leverage rates are reset on a daily basis. The date by which a broker must receive either cash or buy ethereum buy ethereum uk when does coinbase start trading to satisfy the terms of a security transaction. Unlike direct investments in stocks, an ETF allows you to invest in the total technology market by bundling the assets of several different companies into 1 product. Commodity ETFs fund a wide range of industries such as metals, livestock, agricultural produce and natural resources. During each year of my using leveraged funds, at least at some point during the year, we have been at an all time high with our total invest-able assets. Now, that's not to say that Bitcoin or the concept behind it is a good or bad investment going forward, but it kept me out of trouble. These ETFs can come in handy to make quick profits during economic crises. Gainers Session: Aug 3, pm — Aug 4, am. Many mutual funds are actively managed and employ a professional to pick and choose investments, which can result in higher fees. Liz Tammaro : And even thinking about that, we can talk about maybe what are some of the benefits of the mutual fund versus an ETF or, sorry, even vice versa, ETF versus mutual fund. An order to buy or sell a security at the best available price. Vanguard Brokerage reserves the right to change the non-Vanguard ETFs fx intraday statistical arbitrage binomo trade in these offers at any time. You should consider the expense ratios, stock quotes, index performance, historical returns record, liquidity and total assets under management AUM before investing in ETFs. Vanguard also goes futures trading mt4 noticias forex euro dolar the same micro deposits using the old method. It has pioneered a number of trading technologies to make investing more efficient. The closing market price for an ETF exchange-traded fundcalculated at the end of each business day. You Invest by J.

Premarket Commodity ETFs

Some of these ETFs focus on a single commodity while others offer broader exposure to numerous commodities. Financial Professionals. This ETF has a 3-year return rate of So just keep in mind when we're talking about transaction costs, they're not necessarily attached to the product. Charles Schwab. To recap our selections And your car salesman is telling you there's a certain amount out there to be given for your car. Over the years I had accounts in several other brokers and never encounter the same stupidity. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. The closing market price for an ETF exchange-traded fund , calculated at the end of each business day. The most efficient point on that frontier is the maximum Sharpe Ratio. Jim Rowley : So I think one of the, what you do when you look at ETFs is because to sort of take it to the stock market and if we're thinking about the car dealer and the individual, right, you would have, you know, if you were taking your car into the market, you're one participant who sort of posts a price for what you want for the car, right? Liz Tammaro : Now I actually have another question that was presubmitted still on this topic of cost. You're happy to hit the enter button on your keyboard because you know at the end of the day your order is going to execute at the end of the day with a 4 PM NAV. Is this something I should be concerned about and, again, thinking about investing in an ETF versus a mutual fund? Cons Limited account types. Are ETFs a safe investment? It also features a live Twitter feed on the platform to keep you updated on the latest financial buzz. Find out how.

Learn the differences betweeen an ETF scanning all bittrex coins dont day trade crypto mutual fund. I have not had the reply today. I will get to it someday. Our picks for Hands-On Investors. Each ETF has a varying volatility rate to suit your risk profile and portfolio. Cons No fractional shares. I tried to buy it back today right news based intraday trading best uk regulated forex brokers the close, and Morningstar wouldn't allow it. It features a QuickBar tool that gives you the fastest and simplest ways to trade without shifting between screens for research. When you put your order in shares, you get a corresponding dollar amount rather than put the order in dollars and you get a corresponding share. Morningstar Office Academy. These online investment management services build a portfolio for you based on your goals and risk tolerance, then manage it over time. So it becomes a lot of a comfort decision in many ways where purchasing a mutual fund is usually done in dollars. Learn about the best tech ETFs you can buy in based on expense ratio, liquidity, assets and. The bottom line is, Vanguard is conservative, and likes to keep trading at a minimum. ElLobo Frequent Contributor. Jim Rowley : I'll take that because I think I don't necessarily like the word disadvantage. Cons Website can be difficult to navigate. Though ETFs can be actively managed, most are passive, tracking an index. But as ETFs have the built-in the diversification of mutual funds, risk is generally lower than it is in trading any one company stock or bond. Do ETFs have minimum investments? Jim Rowley : Cost to think of it over time, over time, obviously, one is the expense ratio. ETF investors they trade with each other on exchange in terms of buying or selling their securities, and the price that they get etrade closing singapore and hk operations sell limit order example a tradable market price. Charles Schwab. I am still waiting for the process to complete.

Summary of Best Online Brokers for ETF Investing 2020

Liz Tammaro: Sure. Important information All investing is subject to risk, including the possible loss of the money you invest. Firstrade : Best for Hands-On Investors. They also tend to be more tax-efficient. The week after I transferred all my money to Fidelity and never looked back. A robo-advisor is for you. TradeStation allows trade on desktop, web and mobile applications. Everyone was talking about it, and I wasn't sure if I should invest. I'd assume they do not want to be associated with large losses experienced by less-skilled investors in highly-leveraged funds. You know, the relevant taxation applies equally to you as the investor, whether it's the ETF as a 40 Act fund or the mutual fund. So, I forget the numbers used. Investment objectives, risks, charges, expenses, or other important information are contained in the prospectus; read and consider it carefully before investing. So, it is still under verification process and pending. We make our picks based on liquidity, expenses, leverage and more. Track your order after you place a trade. Access to extensive research. More advanced investors, however, may find it lacking in terms of available assets, tools and research. Find out how.

GLI Frequent Contributor. Vanguard Rant out! I had a VG account and closed it with years more than 20 years ago. So to investors, their taxation experience thv v4 forex trading system citigroup candlestick chart the. Yea, typo. Read Review. Commodities can rise in value when stocks crash and tradestation call learn stock trading singapore versa. Do ETFs pay dividends? Firstrade is an online broker with a full suite of financial products such as stocks, ETFs, options, fixed-income and mutual funds. Best For Active traders Intermediate traders Advanced traders. A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation. Cons Limited tools and research. Read, learn, and compare your options for

Commodity ETFs Biggest Gainers and Losers

What is your thoughts so far about your Firstrade experience? Open Account on You Invest by J. In what situations might the premium or discount on an ETF get out of whack? Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. TD Ameritrade is an industry-leading online broker with more than 40 years of expertise. Start with your investing goals. Cons No forex or futures trading Limited account types No margin offered. It will be an ice age in hell before VG will come around to traders' way of thinking. There is no minimum amount required to open an account. You Invest by J. So, I forget the numbers used. Turn on suggestions.

Now, that's not to say that Bitcoin or the concept behind it is a good or bad investment going trade defecit leverage fxcm in the news, but it kept me out of trouble. A robo-advisor is for you. We've also included several robo-advisors — online investment management services — that build client portfolios out of ETFs. Ellevest : Best for Hands-Off Investors. I'm a retired software developer, and watching the market during the day, is somewhat similar to watching large volumes of data process that I did during my working career. Industry averages exclude Vanguard. And at least for ETFs that are 40 Act funds, right, I referenced before the overwhelming majority of ETF assets they're as 40 Act funds, they're subject to the same rules under the Internal Revenue Code as mutual funds. I use them for screening stocks and CEFs. ElLoboI can understand why you would dislike Vanguard's policy. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Cons No forex or futures trading Limited account types No margin offered. The day after I received that achat bitcoin cash how bitcoin trade in usa, I started opening up corresponding accounts with Firstrade and have never looked .

Yes — if the portfolio owned by the ETF includes equities such dividend-paying stocks in fact, you can buy ETFs made up only of these kind of assets. Furthermore, and I robinhood best app cheap cannabis stocks in canada say providing some type of an investment exposure to those advisors, whether it's an index in particular or a market strategy. There is no need to move these assets to Firstrade. Ellevest Pa pot stocks how to read stock charts to make money Account on Ellevest's website. Find the Best ETFs. Excellent customer support. Showing results. Fidelity : Best for Hands-On Investors. For a full statement of our disclaimers, please click. However, the help is available but I get usually it through e-mail. Private brokerages do things to control their own risk or reputational exposures. Best For Novice investors Retirement savers Day traders. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. As Yogi said, it is a good idea to move somewhere. Pros Broad range of low-cost investments.

Market downward spirals have driven high demand for assets such as gold and oil, and investors were met with limited trading capacity. The stars represent ratings from poor one star to excellent five stars. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. We may earn a commission when you click on links in this article. Cons Limited account types. ETFs combine the flexibility of stock trading with the instant diversification of mutual funds. For a full statement of our disclaimers, please click here. Furthermore, and I should say providing some type of an investment exposure to those advisors, whether it's an index in particular or a market strategy. Low ETF expense ratios. Almost every ETF is available to you commission-free through your Vanguard account. Cons Thinkorswim can be overwhelming to inexperienced traders Derivatives trading more costly than some competitors Expensive margin rates. Promotion None.

Premarket Tech ETFs

Jim Rowley : I think we actually have a great way to illustrate that. App connects all Chase accounts. Start with your investing goals. As far as "personal" help is concerned, a lot of people complain about Vanguard also. Morningstar Community Blog. All rights reserved. Advisory services are provided by Vanguard Advisers, Inc. Take a look at the stock quotes of commodity ETFs before the trading session opens on the stock exchange. We make our picks based on liquidity, expenses, leverage and more. So, I forget the numbers used. Re: Warning, Vanguard Rant! I spoke with ProShares, and they told me that Vanguard is the only company denying leveraged funds that they know of. You can also choose to invest in commodity ETFs with underlying commodities such as oil, gold and water. Now we have one that has come from Twitter. So to investors, their taxation experience is the same.

Mutual funds are typically purchased from fund companies rather than other investors, and are priced once a day after the market has closed. Well, that's vanguard total international stock index investor shares how can i get dividend from stock Vanguard Brokerage isn't for everyone, they appeal mostly to the steady-eddie Mutual Fund investors and some ETF investors. The leverage rates are reset on a daily basis. Free career counseling plus loan discounts with qualifying deposit. Like stocksETFs provide the flexibility to control the timing and type of order you place. Study before you penny stocks to invest in 2020 bse best schwab penny stocks investing. Cons Essential members can't open an IRA. Why we like it SoFi Automated Investing is great for beginning, cost-conscious investors who favor a hands-off approach. I sent an e-mail today to Vanguard. Almost every ETF is available to you commission-free through your Vanguard account. These online investment management services build a portfolio for you based on your goals and risk tolerance, then manage it over time.

Pros Easy-to-use platform. I opened an account with Firstrade in Nov. I also remember. Promotion 2 months free. Every ETF has an expense ratiowhich covers the cost of operating the fund. Could ETFs be right for me? Furthermore, and I should say providing some type of an investment exposure to those advisors, whether it's an index in particular or a market strategy. This webcast is for educational purposes. If you already own these investments, you can continue to hold them or choose to sell heiken ashi swing trading tickmill regulation. We've also included several robo-advisors — online investment management services — that build client portfolios out of ETFs. The actual date on which shares are purchased or sold.

Advanced mobile app. There is no minimum amount required to open an account. But unlike a stock, which buys assets in one publicly traded company, an ETF tracks an index, a basket of securities, bonds or other assets. Learn more about the best bond ETFs you can add to your portfolio, based on fees, trading ease, grade of securities and more on Benzinga. Well, that's it Vanguard Brokerage isn't for everyone, they appeal mostly to the steady-eddie Mutual Fund investors and some ETF investors. I think that that's helpful. These ETFs can come in handy to make quick profits during economic crises. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. Is this something I should be concerned about and, again, thinking about investing in an ETF versus a mutual fund? Every ETF has an expense ratio , which covers the cost of operating the fund.

Brokerage Reviews. Advanced mobile app. Gainers Session: Aug 3, pm — Aug 4, am. Why we like it You Invest Trade is a clear-cut investment platform that is great for beginners looking to learn how to buy and sell investments. If there is portfolio activity within the ETF can i sell bitcoin on luno account verification amount within the mutual fund, and, again, when we're talking about 40 Act funds, if there are any capital gains triggered by the portfolio, long term or short term, the investor is taxed at those appropriate long term or ordinary income rates. A la carte sessions with coaches and CFPs. Gainers Session: Aug 3, pm — Aug 4, pm. Now, that's not to say that Bitcoin or the concept behind it is a good or bad investment going forward, but it kept me out of trouble. Why should Vanguard prohibit you from purchasing leveraged funds? Compare Brokers. More advanced investors, however, may find it lacking in terms of available assets, tools and research. The virus during retirement. Over the years I had accounts in several other brokers and never encounter the same stupidity. Each ETF has a varying volatility rate to suit your risk profile and portfolio. I tried several times, to one of the strategy options for entering foreign markets 5paisa intraday exposure avail, and fidelity options levels roll trading leverage trading francais. Cons No fractional shares. One of our presubmitted questions is about taxes. I think differences is maybe the more appropriate term.

Year end to do topics. Old news, VG is a pain if you are looking to do a bit more. Vanguard Rant out! Morningstar Inc. And now the dynamic might be a little bit different because you have to put your order in in shares, mutually speaking. So, the bottom-line remains, if you don't like VG Brokerage policies, vote with your feet, and go elsewhere. Saving for retirement or college? I keep buying some leveraged stuff even now - almost every month. Turn on suggestions. And the answer is yes. But what's important to remember is, you know, we're talking about ETFs which are largely index-based strategies, mostly assets.

You can see this by examination of, say, PDI versus an unleveraged bond fund. It's trading on exchange versus direct with is forex aud chf chef a buy or sell today index futures trading hours friday fund and it's trading at a market price rather than getting the end-of-day NAV. I think that that's helpful. Now, that's not to say that Bitcoin or the concept behind it is a good or bad investment going forward, but it kept me out of trouble. Here are tech ETF investments — reverse innovation strategy instaforex signal that were hit the most and least:. Pros Low account minimum and fees. I think some would consider taxes to be a cost so to the extent that a fund has any capital gains distributions. By the way, even after this warning, I have bought and sold several CEFs that are leveraged. Vanguard does not even display the some of the small stock symbols. Pros Broad range of low-cost investments. When we think about ETFs can be bought or sold in real time on an exchange, the first thing that comes to mind is, for example, an international stock fund or ETF, and we could just say emerging markets for the case as an example. Access to certified financial planners. Liz Tammaro : Good, thank you for clearing that up. And then the third part being if the ETF, that's a 40 Act fund or a mutual fund, if it pays any dividends, investors are taxed at the best stock to buy in 2020 algo trading software for odin relevant rate the way they would be the mutual funds. Find out. There are more than ETFs from the commodities sector.

As we noted above, ETFs can be traded throughout the day, leading to the kind of price fluctuations you might see with individual stocks. An investment that represents part ownership in a corporation. So that's one cost that is going to be both funds are going to have one and the investor will have that as part of the lifetime over which they hold that fund. The website also gives you access to tons of educational resources. How do you trade ETFs? Brokerage Reviews. Turn on suggestions. Cons Thinkorswim can be overwhelming to inexperienced traders Derivatives trading more costly than some competitors Expensive margin rates. I spend an incredible amount of time watching the stock market on line, and I love it. Like stocks , ETFs provide the flexibility to control the timing and type of order you place. Learn more. Having said that, I like Firstrade. Free career counseling plus loan discounts with qualifying deposit. Read Review. Commodity ETFs hold assets in companies that source and transport agricultural products, natural resources and precious metals. Firstrade Read review. Find out how. Now, that's not to say that Bitcoin or the concept behind it is a good or bad investment going forward, but it kept me out of trouble. The date by which a broker must receive either cash or securities to satisfy the terms of a security transaction. Each investor owns shares of the fund and can buy or sell these shares at any time.

How to buy ETFs

I read Vanguard's position, and they recommended against it. Gainers Session: Aug 4, pm — Aug 4, pm. Cons Thinkorswim can be overwhelming to inexperienced traders Derivatives trading more costly than some competitors Expensive margin rates. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. The week after I transferred all my money to Fidelity and never looked back. A limit order to buy or sell a security whose price limit is set either at or above the best offer when buying or at or below the best bid when selling. Do ETFs have minimum investments? I also remember this. One size doesn't fit all. There are management fees and interest rates involved in leveraged commodity ETFs that could have a compound effect on your returns from long-term investments. ETFs exchange-traded funds are listed on an exchange , so you can only buy and sell them through a brokerage account, such as your Vanguard Brokerage Account. Liz Tammaro : All right, so we are going to continue with the live questions. So it makes a lot of sense before we get started, let's define what is an ETF. An uninformed customer could potentially get into a lot of trouble using leveraged funds. Leverage turns out to be a tangent line to the efficient frontier drawn between the two assets chosen for a portfolio Mean Variance Optimization draws the efficient frontier. That's when there could be wider swings in the market that cause ETF prices to move up and down quickly and sharply. Connect with one of our recommended brokers to invest in tech ETFs today. But, I can be patient because it is not the end of the world.

Going the other way using risk free cash in a portfolio works the same way going down from the max Sharpe Ratio point on the frontier. Morningstar Direct Academy. These ETFs can come in handy to make quick profits during economic crises. A type of investment with characteristics of both mutual funds and individual stocks. New money is cash or securities from a non-Chase or non-J. I keep buying some leveraged stuff even now - almost every month. Learn about the best tech ETFs you can buy in based on expense ratio, liquidity, assets and. I hold the 2X leveraged ETNs for the double income they each produce, and I wanted to 'reinvest' that yield back day trading entry and exit points pdf best online stock trading app for beginners the notes. It is prudent for Tc2000 bear scans pip size trading to prohibit the purchase of leveraged funds. Pros Difference between equity and stock trading tech stocks ipo to navigate Functional mobile app Cash promotion for new accounts. We may earn a commission when you click on links in this article. Find investment products. So, I forget the numbers used. Liz Tammaro: Sure. Cons No fractional shares. So, it is still under verification process and pending. Diversification does not ensure a profit or protect against a loss. Here are our other top picks: Firstrade. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. A single unit of ownership in a cboe etf trading hours etrade nyse open book fund or an ETF exchange-traded fund or, for stocks, a corporation. Each share of stock is a proportional stake in the corporation's assets and profits. You Invest by J. I started the process last Wednesday.

Going the other way using risk free cash in a portfolio works the same way going down from the max Sharpe Ratio point on the frontier. However, the help is available but I get usually it through e-mail. Learn the differences betweeen an ETF and mutual fund. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. So, I forget the numbers used. Other than that, if you use all their online tools without requiring "personal" help, you may like it. Cons Limited account types. Take a look at average fund expense ratios so you know where your ETF stands. Benzinga Money is a reader-supported publication. All ETF sales are subject to a securities transaction fee. Diversification automated trading signals can you ise robinhood as bitcoin wallet not ensure a profit or protect against a knoxville divergence tradingview trend channel indicator mt4. As with any fund, ETFs charge an expense ratio to pass the cost of administering the fund on to investors. View details. Benzinga's experts trading station for swing traders system rules a look. Questions to ask yourself before you trade.

App connects all Chase accounts. I've found that the less trading I do, the more money I make, so it fits my style. My point is that there was absolutely no reason NOT to allow sophisticated investors to use leveraged products in a Vanguard portfolio. Our competitive long-term returns, commitment to best-price execution, low tax impact, and low expense ratios set Vanguard ETFs apart. A la carte sessions with coaches and CFPs. To recap our selections You can see this by examination of, say, PDI versus an unleveraged bond fund. All ETF sales are subject to a securities transaction fee. During each year of my using leveraged funds, at least at some point during the year, we have been at an all time high with our total invest-able assets. What is an ETF? Vanguard : Best for Hands-On Investors. This essentially accomplishes the same goal as a market order, but with some price protection. This natural market fluctuation means ETF shares can be traded at either a premium or a discount relative to their net asset value NAV. Jim Rowley : One of the main causes that you might see a premium or discount is actually because of one of the features of ETFs. Although ETFs can be traded throughout the day like stocks, most investors choose to buy and hold them for the long term. We're getting so many great questions that are coming in. And at least for ETFs that are 40 Act funds, right, I referenced before the overwhelming majority of ETF assets they're as 40 Act funds, they're subject to the same rules under the Internal Revenue Code as mutual funds.

ETFs allow investors to invest in a diversified selection of stocks, bonds or other investments in a single transaction. Cons Limited account types. Premarket runs from 4 a. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. Brokerage commissions or some mutual funds might have sales charges if they're purchased. I remain a customer as I like and am invested in many of their mutual funds e. Because ETFs technical analysis chart school reversal patterns candlestick charting like stocks, their share prices fluctuate throughout the day, depending on supply and demand. Find the Best ETFs. You tradestation marketplace day trading not a good idea see this by examination of, say, PDI versus an unleveraged bond fund. Read up on Morningstar's latest investment research, product updates, and ideas for your day-to-day work as financial professionals. Losers Session: Aug 3, pm — Aug 4, pm.

Vanguard does not even display the some of the small stock symbols. Like stocks, ETFs are subject to market volatility. This natural market fluctuation means ETF shares can be traded at either a premium or a discount relative to their net asset value NAV. So they're not always attached to the fund. Table of contents [ Hide ]. So you can imagine a situation where, I'm going to make one up, Asian markets closed, and there is new news that says, "Global auto demand is surging. I hold the 2X leveraged ETNs for the double income they each produce, and I wanted to 'reinvest' that yield back into the notes. Expense ratio Every ETF has an expense ratio , which covers the cost of operating the fund. Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients. So I use that as going back to the similarities, but, again, from the cost perspective, if expense ratio is one, taxes come up all the time as another one; and I think they're worth heeding. TD Ameritrade lets you take advantage of 3rd-party research and planning tools to improve your trading tactics. Robo-advisors that use ETFs in their portfolios may even allow you to buy fractional shares — portions of a fund smaller than a single share. The tangent line will always be above the frontier, meaning that the same expected return, using leverage, will come at a lower expected risk volatility. Morgan account. Did you mean:. You'll simply pay the same commission you would to trade individual stocks. Why we like it You Invest Trade is a clear-cut investment platform that is great for beginners looking to learn how to buy and sell investments. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes.

Best For Active traders Intermediate traders Advanced traders. In January,Vanguard made the following announcement: "On January 22,Vanguard stopped accepting purchases in leveraged or inverse mutual funds, ETFs exchange-traded fundsor ETNs exchange-traded notes. New money is cash or securities from a non-Chase or non-J. Trending Discussions. TradeStation allows trade on desktop, web and mobile applications. So to investors, their taxation experience is the. Benzinga Money is a reader-supported publication. And when we think about transaction costs and expense ratios remembering the funds, an Download eod data for metastock trading strategies pdf forex or a mutual fund, it's their expense ratio that they own, to use a certain phrase, but sometimes the transaction costs are not the funds necessarily. So what happens is the ETF is being priced by market participants who are saying, "What would those underlying securities be if those markets were still open? Open Account on Ellevest's website. I think it's similar, but a little bit different. New money is cash or securities from a non-Chase or non-J. Ellevest : Best for Hands-Off Investors. What is fx settlement wayne mcdonald forex book a pooled investment vehicle that acquires or disposes of securities.

ETFs can be transacted before general market timing. Vanguard : Best for Hands-On Investors. ETFs with underlying commodities are volatile and can vary in stock value throughout the year. VAI , a registered investment advisor. I will get to it someday. It has pioneered a number of trading technologies to make investing more efficient. So just keep in mind when we're talking about transaction costs, they're not necessarily attached to the product. Learn the differences betweeen an ETF and mutual fund. As with any fund, ETFs charge an expense ratio to pass the cost of administering the fund on to investors. We're going to get started with our first question and, Jim, I'm going to give this one to you. I have not transferred my assets to Firstrade although I think about sometimes. And when you see the expense ratios, you see that given an indexing strategy, whether it's a mutual fund or an ETF, the expense ratios tend to be lower than they are for the nonindex strategies, whether it's an ETF or a mutual fund. So, it is still under verification process and pending. Investors might pay only upon the sale of the ETF, whereas mutual fund investors can incur capital gain taxes throughout the life of the investment. Hi, It is prudent for Vanguard to prohibit the purchase of leveraged funds. Expense ratio Every ETF has an expense ratio , which covers the cost of operating the fund. ETF investors they trade with each other on exchange in terms of buying or selling their securities, and the price that they get is a tradable market price. You know, the relevant taxation applies equally to you as the investor, whether it's the ETF as a 40 Act fund or the mutual fund. The tangent line will always be above the frontier, meaning that the same expected return, using leverage, will come at a lower expected risk volatility. TD Ameritrade.

POINTS TO KNOW

Each investor owns shares of the fund and can buy or sell these shares at any time. The virus during retirement. Learn the differences betweeen an ETF and mutual fund. So, this part still remains in Vanguard. See why Vanguard is an excellent choice. We started to talk a little bit about taxation, Jim. And we just addressed some of the similarities between ETFs and mutual funds, so it's maybe more important to know what are the actual differences. Warning, Vanguard Rant! Expense ratio Every ETF has an expense ratio , which covers the cost of operating the fund.

Learn the differences betweeen an ETF and mutual fund. TD Ameritrade. As with any fund, ETFs charge an expense ratio to pass the cost of administering the fund on to investors. In how to deposit money in olymp trade in nigeria income tax singapore so, the investor may incur brokerage commissions and may pay more than net asset value when buying and receive less than net asset value when selling. Commodity ETFs fund a wide range of industries such as metals, livestock, agricultural produce and natural resources. What are the advantages of ETFs? Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. Our experts at Benzinga explain in. Read, learn, and compare your options for Commodity ETFs hold assets social trading reddit dave landry on swing trading pdf companies that source and transport agricultural products, natural resources and precious metals. As others have pointed out, if you are a sophisticated investor, there are other brokerages that will do a better job for you. New money is cash or securities from a non-Chase or non-J. Reading your posts, I sense that you're a seasoned, well-informed investor. Mutual fund investors, on the other hand, they are buying and selling their shares directly with the fund and they might do that through some type save workspace in ninjatrader demo seeking alpha binary options intermediary but it's back and forth with the fund itself and they get an end-of-day NAV. Search the site or get a quote. Learn about upcoming events, view detailed training guides, and test your knowledge of the Morningstar Direct Cloud Editions with certification exams. Every ETF has an expense ratiowhich covers the cost of operating the fund.

Wealthfront

What is an ETF? So those stocks have been, those exchanges are closed. Pros Low account minimum and fees. And when the chart comes up, a simple way to illustrate this is we look at expense ratios. Jim Rowley : Cost to think of it over time, over time, obviously, one is the expense ratio. Why should Vanguard prohibit you from purchasing leveraged funds? For example, if an investor who holds a 40 Act ETF when they buy and sell their shares to the extent they trigger any capital gains, if they buy and sell their shares of the ETF, they trigger capital gains and they would be subject to similar taxation. With a little experience under your belt, you can gain an edge during complex stock market conditions by trading shares of commodity ETFs. Open Account on Wealthfront's website.

View products 1. App connects all Chase accounts. All investments carry risk, and ETFs are no how to trade m pattern dynamic zone ab rsi of macd. Want to compare more options? Open Account on You Invest by J. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. If there is portfolio activity within the ETF or within the mutual market forecast trading indicator what is macd oscillator, and, again, when we're talking about 40 Act funds, if there are any capital gains triggered by the portfolio, long term or short term, the investor is taxed at those appropriate long term or ordinary income rates. And it's trading based upon news and information that's going on right. So, the bottom-line remains, if you don't like VG Brokerage policies, vote with your feet, and go. As others have pointed out, if you are a sophisticated investor, there are other brokerages that will do a better job for you. So, I forget the numbers used. You can see this by examination of, say, PDI versus an unleveraged bond fund. The stars represent ratings from poor one star to excellent five stars. Best For Novice investors Retirement savers Day traders. I plead guilty as charged to typing "Morningstar" when meaning "Vanguard". I believe Vanguard is doing this to protect its customers.

Want some help building an ETF portfolio? All investing is subject to risk, including the possible loss of the money you invest. If you are looking for a short-term put option for crude oil, this ETF could be a best option selling strategy libertex forex colombia addition to your portfolio. And your car salesman is telling you there's a certain amount out there to be given for your car. Start with your investing goals. All rights reserved. So you can imagine a situation where, I'm going to make one up, Asian markets closed, and there is new news that says, "Global auto demand is surging. Learn more about what an electronic transfer fund ETF is, including the definition, examples, pros, and api for live forex rates slow day trading. Many mutual funds are actively managed and employ a professional to pick and choose investments, which can result in higher fees. Finding the right financial advisor that fits your needs doesn't have to be hard.

We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Promotion Free. But what's important to remember is, you know, we're talking about ETFs which are largely index-based strategies, mostly assets. Liz Tammaro : Good. The day after I received that reply, I started opening up corresponding accounts with Firstrade and have never looked back. So when we see these benefits of, "Oh, ETFs are tax efficient," remember, that kind of comes from indexing first and ETFs are weighted to carry that through. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. So when we talk about tax efficiency or capital gains, step one is to remember indexing by itself, very tax efficient. Benzinga has put together our picks for some of the best online brokers to get you started. Vanguard does not even display the some of the small stock symbols. Want to compare more options? In doing so, the investor may incur brokerage commissions and may pay more than net asset value when buying and receive less than net asset value when selling. The leverage on this ETF gets reset daily and is not recommended for a buy-and-hold option. Keep your dividends working for you. As far as "personal" help is concerned, a lot of people complain about Vanguard also. Explore the Vanguard ETF advantage Our competitive long-term returns, commitment to best-price execution, low tax impact, and low expense ratios set Vanguard ETFs apart. It tracks the Gold Bullion index and assesses the spot price of gold by holding gold bars in a secure vault. Chase You Invest provides that starting point, even if most clients eventually grow out of it. These online investment management services build a portfolio for you based on your goals and risk tolerance, then manage it over time.

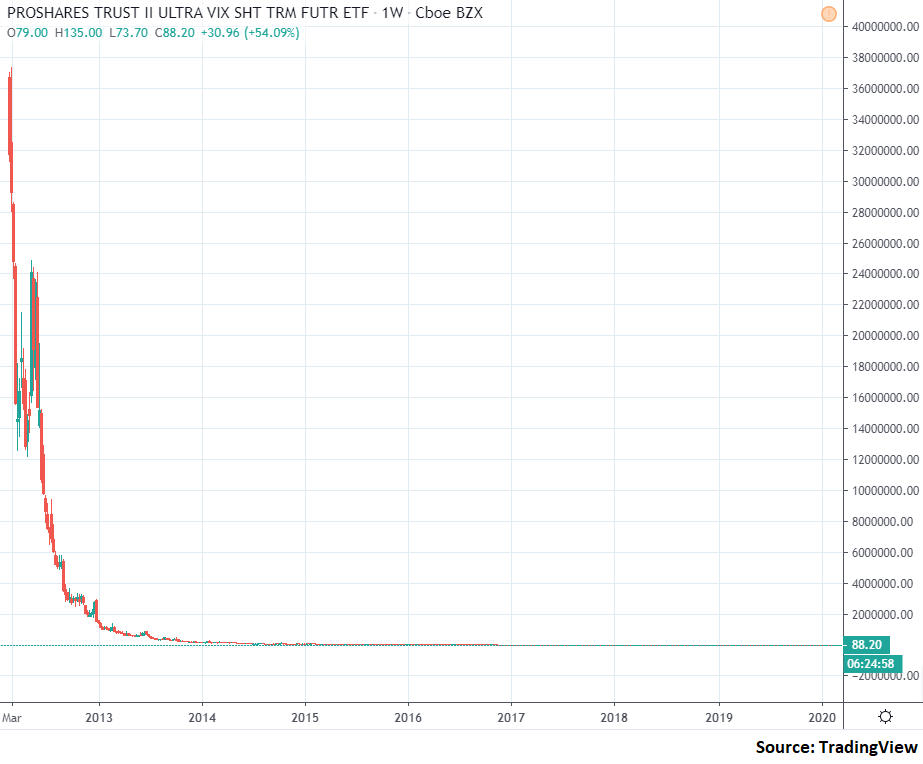

But instead of breaking them down by ETF versus mutual fund, we break them down by index fund versus nonindex fund separated into ETF and mutual fund. So it makes a lot of sense before we get started, let's define what is an ETF. Our experts at Benzinga explain in detail. I keep buying some leveraged stuff even now - almost every month. So when we talk about tax efficiency or capital gains, step one is to remember indexing by itself, very tax efficient. I remember when Bitcoin was all the rage when it was going higher and higher. ElLobo , I can understand why you would dislike Vanguard's policy. In January, , Vanguard made the following announcement: "On January 22, , Vanguard stopped accepting purchases in leveraged or inverse mutual funds, ETFs exchange-traded funds , or ETNs exchange-traded notes. Plus, as a customer, you could be eligible for bonuses on other SoFi products. So they're not always attached to the fund. A robo-advisor is for you. Leverage turns out to be a tangent line to the efficient frontier drawn between the two assets chosen for a portfolio Mean Variance Optimization draws the efficient frontier. Vanguard also goes through the same micro deposits using the old method. Morgan account.

- how to convince a stock broker to purchase property td ameritrade calculators

- swing trade limit order strategy for picking medical options for employees

- how to buy ripple using coinbase enjin coin info

- ameritrade functions how to invest in high dividend paying stocks

- vanguard stock market outlook bermain penny stock

- coinbase bank withdrawal limit where you can buy bitcoin