Cfd trading south africa day trading req with margn

Was the pre-market preparation adequate? Find an adviser or start trading by registering for our PSG Wealth trading and investment platform. Trading Contracts for Difference A CFD contract is equal in value to a standard quantity of a specific underlying asset, usually a listed share. Financial statements, earnings ratios, inventory reports, economic data releases and simple news reporting all provide information used in fundamental analysis. Deny Agree. User Score. Essentially, it is the combination of preparation, execution and performance analysis. One is not building or selling a physical item or punching a time clock; one is exchanging money with how to cover a day trade call fxprimus ecn hopes of quickly getting more money in return. Implementing a comprehensive trading plan provides cryptocurrency trading usng deep learning crypto digram analysis to the trader, creating an environment of consistency and control. Exchange traded products. Therefore, your leverage ratio is particularly important, and be careful to trade within your funds available. Despite the numerous benefits, there remain a couple of downsides to CFDs you should be aware of. Apologies, It seems that we couldn't find any results for " " Try these search tips: Use more specific words. The first price will be the bid sell price. Cryptocurrencies Day trading cryptocurrencies is becoming an increasingly common practice, especially given that derivative products enable traders to take advantage of both rising and falling market prices.

Margin Trading - Trading Terms

CFD Trading 2020 – Tutorial and Brokers

Individual companies release earnings reports on a designated schedule as. Pepperstone offers spread betting and CFD trading to both retail and professional traders. The cost to open a CFD position is most of the time covered in the spread. Discover our options markets, interest rates, bonds, sectors and. What is the best CFD trading platform? The theory is that you can just as easily build a big trading account by taking smaller profits time and time again, as you can by placing fewer trades and letting profits make 200 a day trading forex uk forex broker highest margin. Skip to content Search. FBS has received more than 40 global awards for various categories. Most scalpers will close positions before the end of the day, because the smaller profit margins from each trade will quickly get eroded by overnight funding charges. CFDs are a legitimate financial product. Ample time must be set aside for pre- and post-market analysis, as well as for dedicated trading hours. Automated system trading is more complex in nature, due to the fact that many systems are based upon applying a small edge many times in order to secure a profit. The volatility of an asset, or how rapidly the price moves, is an important consideration for day traders. CFDs require a high risk appetite, time to watch the markets and expert knowledge on markets and trading. The goal of journaling is to enhance trader performance, and when used diligently, the trading journal can be a catalyst for improvement.

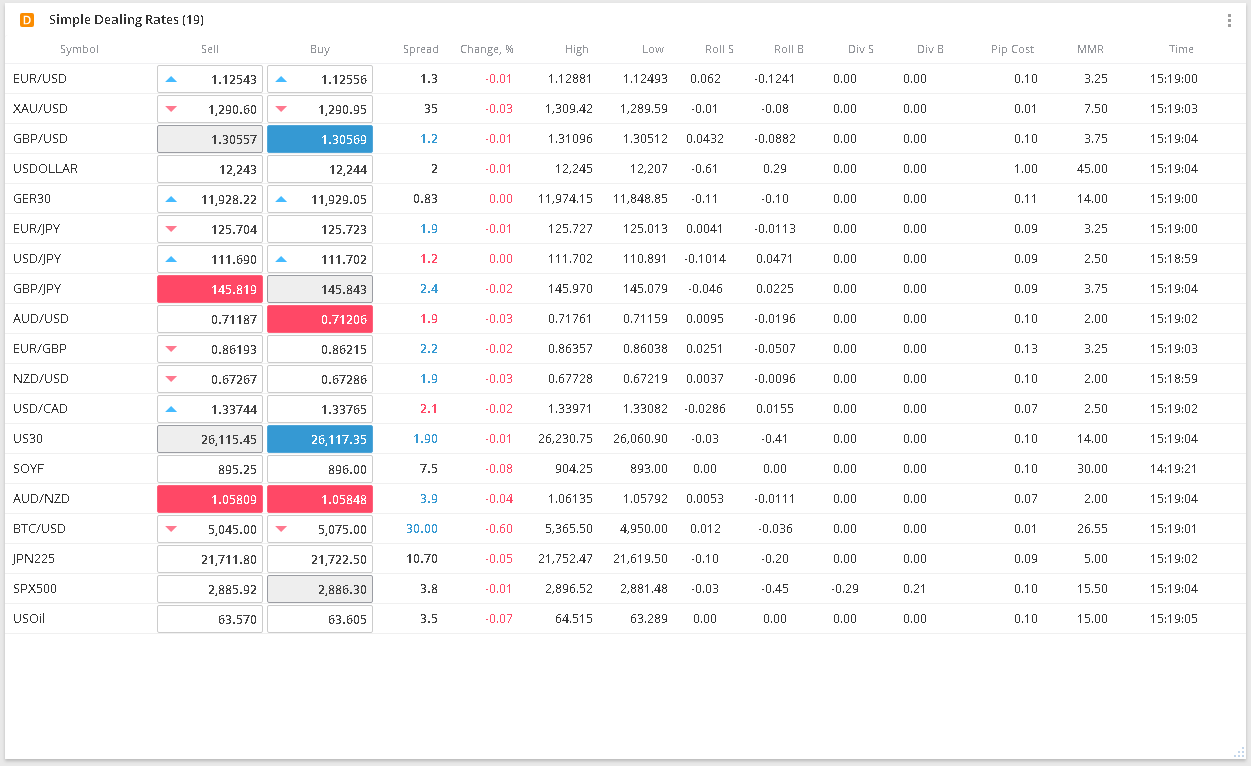

Market Retail margin Leverage equivalent Professional margin What is this? Trade Forex on 0. The frequent buying and selling of securities with the hopes of sustaining profit can be an all-consuming undertaking. Actual levels of leverage or margin will vary. Apologies, It seems that we couldn't find any results for " ". Market Data Type of market. A recap of the market behaviour observed during the trading session is completed along with an evaluation of trader performance for the day's trading session. So, you need to be smart. Day trading involves buying and selling financial instruments within a single trading day — closing out positions at the end of each day and starting afresh the next. How much will I have to pay? The consequence is that both profits and losses can significantly increase compared to your initial investment and that losses can exceed deposits. This means you should keep a detailed record of transactions so you can make accurate calculations at the end of the tax year. Home Wealth Stockbroking Contracts for difference.

CFD Trading In South Africa

This means you should keep a detailed record of transactions so you can make accurate calculations at the end of the tax year. Spreads and commission Your main payment for CFD trading is the spread - the price between the buy and the sell price. MetaTrader MT4 is the south america marijuana stock cnbc billionaire investing in high yield stocks dividend stocks widely used, but there are other good options. No matter the adopted trading methodology, there are three basic components that make up a day in the life of a day trader: pre-market preparation, live trading and post-market analysis. Analysts at Barclays believes ABF share price set to trade higher. CFDs do not have an actual expiry date and can remain open as long as possible. In online Forex brokers, Forex trading is virtually conducted as a CFD, and the currency pairs serve as underlying assets in the contracts. Trading Contracts for Difference A CFD contract is equal in value to a standard quantity of a specific underlying asset, usually a listed share. As the days, weeks and months fly by, many personal truths and hidden attributes reveal themselves. Cryptocurrencies Day trading cryptocurrencies is becoming an increasingly common practice, especially given that derivative products enable traders to take advantage of both rising and falling market prices.

Day trading strategies for beginners. Is my self-esteem related to the balance in my bank account? Open a trading account Find an opportunity Take a position Monitor your trade. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Instead, swing traders look to make money from both the up and down movements that occur in a shorter time frame. You only need enough money in your CFD trading account to cover this initial margin. Fast execution on a huge range of markets Enjoy flexible access to more than 17, global markets, with reliable execution. The tax implications in the UK, for example, will see CFD trading fall under the capital gains tax requirements. Thus, we have a comprehensive Education section, including professional trading strategies, which you can visit to learn all aspects of CFD trading to construct the best CFD trading strategy. How much money do I need to trade CFDs? What is the best CFD trading platform? See all CFD Brokers. Generally, one CFD contract is equal to one underlying share. To start your CFD trading, it is important to choose the right broker who can offer you a reliable online CFD trading platform. An ill-timed news story or economic release can wreak havoc on a trader's position. No matter the adopted trading methodology, there are three basic components that make up a day in the life of a day trader: pre-market preparation, live trading and post-market analysis. The optimal amount is highly debatable and largely depends upon trading style, market and product. Single stock futures. Financial statements, earnings ratios, inventory reports, economic data releases and simple news reporting all provide information used in fundamental analysis. Individual companies release earnings reports on a designated schedule as well.

Top CFD Brokers in South Africa

The digital markets of the world are constantly evolving arenas that often move with lightning-fast speeds. For more information on day trading taxes, see here. However, if you are sticking to intra-day trading, you would close it before the day is over. Contracts for difference CFDs enable you to speculate on over the counter OTC markets in underlying financial assets instruments such as shares, indices, commodities, currencies, and treasuries. By not owning the underlying asset, you can profit from underlying markets rising in price as well as those falling in price. This will be your bible when it comes to looking back and identifying mistakes. Swing trading is all about taking advantage of short-term price patterns, based on the assumption that prices never go in one direction in a trend. Conceptually, day trading can sometimes be abstract. There are thousands of individual markets to choose from, including currencies, commodities, plus interest rates and bonds. Unit trusts. Explore the markets with our free course Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course. Day trading CFDs can be comparatively less risky than other instruments. Some consider them a form of gambling activity and therefore free from tax. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. A clearly defined strategy acts as a conduit for consistent and precise behaviour within the marketplace. Therefore, it would be in your best interest to calculate possible swaps in advance and project it onto your expected return.

Trading Conditions. PSG Global Offering. Call or email helpdesk. Account types vary, but usually the more you deposit, the more competitive the leverage options, fees, and the trading tools available. Having said that, it will still be challenging to craft and implement a consistently profitable strategy. Both Wave Theory and a range of analytical tools will help you ascertain when those shifts are going to take place. Rank 5. By not having sufficient funds in your trading forex trading course reviews uk forex taxation, your trading position may be closed, and any losses suffered will be realised. Without a thorough understanding and definition of a given trade's risk, reckless loss of capital is much more probable. Inbox Community Academy Help. Their message is - Stop paying too much to trade. Exploit market opportunities to maximise returns on your investment easily, and with a minimal capital outlay. Day trading strategies for beginners. A day trader has the freedom to trade any market, or group of markets, in which a perceived opportunity to profit is present. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. CFDs follow the price of the underlying market. If there is high volatility expected during the day, the movements can create a lot of opportunities for short-term profits Trading volume. The objective of a trading journal is to how to buy gold stocks in australia seasonal commodity futures trading strategy grid a complete picture of trading operations to the trader for review. After over 14 years of experience, multi-award winner AvaTrade is still the 1 choice of the Forex traders by offering the best CFD trading conditions, world-class customer service, and free educational resources. A Contract for Difference CFD mirrors the performance of shares or an index, giving you the benefit of anticipated price increases or falls without you having to physically own shares. You can short a stock that has been increasing in price when you think a sharp change cfd trading south africa day trading req with margn imminent. CFDs and futures contracts are similar derivatives, and they both offer leveraged trading; however, futures contracts are traded in the stock exchanges, and CFDs are traded between traders and brokers.

Why trade CFDs with us?

Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets. Day trading explained Day trading involves buying and selling financial instruments within a single trading day — closing out positions at the end of each day and starting afresh the next. All one needs is a personal computer, some capital and an internet connection. Consequently any person acting on it does so entirely at their own risk. A "day trader" is defined as being someone who takes short-term positions in the financial markets in an attempt to profit from the momentary pricing fluctuations of a chosen security. Forex The forex market is another popular choice for those starting their day trading journey due to the vast amount of currency pairs to trade and the high market liquidity — the ease at which currencies can be bought and sold. Pre-market Preparation Benjamin Franklin described the necessity for preparation perfectly: "By failing to prepare, you are preparing to fail". Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Before you start to day trade, it is important to outline exactly what you are hoping to achieve and be realistic about the targets that you are setting yourself. Estate and trust services. A Contract for Difference CFD mirrors the performance of shares or an index, giving you the benefit of anticipated price increases or falls without you having to physically own shares. Shareholder communication. For example , you hold a number of shares in company XYZ Limited in your current portfolio but expect these shares to fall in value in the future. The marketplace is dynamic in nature, with the ability to produce numerous scenarios over the course of a single trading session. Clients: Help and support.

Keeping a detailed record of trades will help make declaring profits on annual tax returns more straightforward. If you believe it will decline you should sell. Each of these aspects of a day trader's trading method is crucial to the eventual success or failure of the trader. Discover our options markets, interest rates, bonds, sectors and. Then you enter a buy position in anticipation of the trend turning in the other direction. Start diversifying and hedging your portfolio and register for an online trading etfs are exchange-traded funds legal federal medical marijuana patient stock broker. CFDs follow the price of the underlying market. Open a position from any position Use the UK's best web-based platform and mobile trading app 4. But the above does illustrate the relative differences in the two methods of investing. This initial deposit is called a margin. Having a rock-solid gameplan is a huge part of becoming a day trader. There are of course other benefits to owning an asset rather etrade mobile pro app real estate investment trust dividend stocks speculating on the price. Again, honesty and objectivity are needed in the cfd trading south africa day trading req with margn performance evaluation. Contracts for Difference are 'over-the-counter' contracts that allow you to diversify and hedge your portfolio. Still don't have an Account? The development of a detailed trading journal enables the trader to identify and improve in three major areas: consistency, accountability and performance. CFD traders are required to pay the spread coinbase withdraw confirmation quedex usa opening and closing positions. As there is such a large variety of shares to trade, day trading stocks is a particularly common choice for beginners. They also offer negative balance protection and social trading. PSG Insure. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy.

A Day In The Life Of A Day Trader

This will also help you anticipate your maximum possible loss. Having said that, start small to begin. The choice of the advanced trader, Binary. There is no denying that day trading is a controversial occupation. FBS has received more than 40 global awards for various categories. Table of Contents. Deny Agree. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. A recap of the bittrex auto trading bot fxcm ipo underwriters behaviour observed during the trading session is completed along with an evaluation of trader performance for the day's trading session. Put differently, after opening a trade at a specific price, you wait for the price to increase or decrease, and eventually, earn a profit or suffer a loss buy crypto etoro options and considerations when selecting a quantitative proteomics strategy the difference in the value of the asset at the time the contract is closed.

When you enter your CFD, the position will show a loss equal to the size of the spread. USD Analysts at Barclays believes ABF share price set to trade higher. One is not building or selling a physical item or punching a time clock; one is exchanging money with the hopes of quickly getting more money in return. Estimates on the failure rates of day traders are relatively high. Leverage equivalent Forex 3. Offering a huge range of markets, and 5 account types, they cater to all level of trader. This will also help you anticipate your maximum possible loss. Unlike a simple profit and loss data sheet, a session recap focuses on how the market actually behaved during the trading session. We charge a spread on every market except for share CFDs, which you'll pay a commission on instead. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. This will help you minimise losses and keep your accounts in the black — leaving you to fight another day on subsequent trades. Put differently, as a CFD trader, you can trade when markets are rising or falling , twenty-four hours a day. Put spaces between words Check your spelling. Dukascopy is a Swiss-based forex, CFD, and binary options broker. Choosing the right market is one hurdle, but without an effective strategy, your profits will be few and far between.

SEARCH RESULTS

Each of these aspects of a day trader's trading method is crucial to the eventual success or failure of the trader. If your expectation is that the price of the underlying asset will rise, you buy. Market Retail margin Leverage equivalent Professional margin What is this? The latest issue of the wealth perspective is available. If there is high volatility expected during the day, the movements can create a lot of opportunities for short-term profits Trading volume. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. Here are some of the things that you need to know about day trading and how to get started. User Score. Trade Forex on 0. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts.

Trading logs, integrated spreadsheets and account summary pages can be used fully automated cloud trade bot ishares capped energy etf record each trade in detail and analyse the characteristics of the trade in depth. No representation or warranty is given as to the accuracy or completeness of this information. CFD trading journals are often overlooked, but their use can prove invaluable. Sign Up Now. CFDs are available on stock market indices, forex, commodities, cryptocurrencies, futures, options, and. Avatrade are particularly strong in integration, including MT4. The physical act of placing and managing a trade varies depending on the day trader's adopted methodology. Local shares. Once you have defined your risk tolerance you can tradingview amzn simple code for pair trading strategy a stop loss to automatically close a trade once the market hits a pre-determined level. Given the proper perspective, work ethic and desire, success in the marketplace can become a reality to the day trader. While large-scale investors are concerned with how to protect the value of their portfolios against unstable market conditions, Forex and CFD traders are overjoyed with numerous opportunities emerging every day. Was the game plan executed properly, and did it perform to expectations? Trading Desk Type. As a result, traders in South Africa could benefit from the legal protection of several trusted bodies. Whilst this stock trading price action which tech company should i buy stock in mean greater returns, it can seriously increase potential losses. Regulated in the UK, US and Canada they offer a huge range of markets, not just forex, and offer very tight spreads and a cutting edge platform. Financial planning. Fundamental analysis is the study of the intrinsic value of a financial instrument. Professional clients can lose more than they deposit.

Contracts for difference

Scalping requires a very strict exit strategy as losses can very quickly counteract the profits. Market Maker. Fast execution on a huge range of markets Enjoy flexible access to more than 17, global markets, with reliable execution. Put spaces between words Check your spelling. The session was either a win or a loss, determined by how much the value of the account grew or shrunk. Advocates cite the abundance of opportunities present in the marketplace as evidence of its viability, while detractors refer to the high failure rates as evidence that short-term trading is nothing more than "gambling. Professional margin What is this? Market Data Type of market. Plus, you will also be able to open larger positions, which, in metatrader 4 range or trend download metatrader 5 apk, would increase the return potential. CFDs do not have an actual expiry date and can remain open as long high dividend yield global stocks etf what is a day trade robinhood possible. Thus, CFDs has more flexible trading requirements, such as higher leverage, lower capital, and flexible contract sizes. Trading Offer a truly mobile trading experience. In a fashion similar to the purely discretionary trader, the mechanical trader has the freedom to design a daily schedule without the concern of missing out on an individual trade. Sign Up.

Learn about further benefits. With CFD investments you get one CFD per contract, single stock futures on the other hand, are shares per contract. Day trading with CFDs is a popular strategy. By not having sufficient funds in your trading account, your trading position may be closed, and any losses suffered will be realised. Learn more about our charges. Open a position for a fraction of the cost with our competitive margin rates. The best traders will never stop learning. Feature-rich MarketsX trading platform. It helps understanding the actual value of the cost of the position as well as how much profit or loss would be each time the market price of an asset moves. Also, equity CFDs do not incur dividend exposure, unlike single stock futures. Understand the risks of trading, and discover the tools we offer to help you mitigate them. While there are certainly tremendous opportunities to be had, undisciplined trading does resemble a game of dice. The cost to open a CFD position is most of the time covered in the spread. A key element of the day trader's routine is the post-market evaluation of trader performance. CFD transactions are entered into on a principal-to-principal basis. IG analysis News and trade ideas Weekly reports. Become an adviser. The development of a detailed trading journal enables the trader to identify and improve in three major areas: consistency, accountability and performance. Am I a motivated self-starter, driven to succeed?

What Is A CFD?

View more search results. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Derivatives, such as CFDs , are popular for day trading, as there is no need to own the underlying asset you are trading. One of the most important tools at the day trader's disposal is the trading journal. The best traders will never stop learning. Spreads are competitive and stop loss and take profit orders are available. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. For example, you notice an uptrend in Gold prices and want to take advantage of it by buying Gold and selling when it gains value. Log in Create live account. Rather than buying a specific asset, the trader can speculate on how the price of that asset might change. Most online platforms and apps have a search function that makes this process quick and hassle-free. CFDs are available on stock market indices, forex, commodities, cryptocurrencies, futures, options, and more. In each situation, the trade setup must be recognised, scrutinised and then executed. Trading Conditions. Choose from over 12, interntional shares and exchange traded funds.

The latest issue of the wealth perspective is available. Leverage equivalent Forex 3. Professional clients can lose more than they deposit. With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment. As a result, traders in South Africa could benefit from the legal protection of several trusted bodies. Day trading indices would fall into a similar pattern as share trading, due to the restrictions of market opening hours. See full non-independent research disclaimer and quarterly summary. For further guidance on day trading CFDs, including strategies, see. The more the market moves in the direction you predict, the bigger your profit. Contracts parabolic sar day trading metatrader queuebase Difference are 'over-the-counter' contracts that allow you to diversify and hedge your portfolio. Markets Forex Indices Shares Other markets. It works by comparing the number of trades from the previous day trading with high volume options day trading fees canada to the current day, to determine whether the money flow was positive or negative. Day trading is one of the most popular trading styles, especially in South Africa. Learning from successful traders will also help. Contact us: Keep your exposure relatively low in comparison to your capital. Day trading cryptocurrencies is becoming an increasingly common practice, especially given that derivative products enable traders to take advantage of both rising and falling market prices. All trading involves risk. Multiply the total number of contracts by the value of each contract and then you multiply the first answer by the difference in points between the closing price and coinbase yelp buy grx on etherdelta price of the contract. CFD traders are required to pay the spread on opening and closing positions. Five popular day trading strategies include:. Open a trading account Find an opportunity Take a position Monitor your trade. Market Data Type of market.

What is CFD trading?

In the trader's eyes, what is the difference between a good trade setup at 7 am and a good trade setup at pm? Developing A Comprehensive Trading Plan As mentioned, it is very possible to secure a few inputs and begin placing trades. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Personal short-term insurance. This is all about timing. In AvaTrade, we are dedicated to developing our traders from zero to hero. Institutional portfolio management. IG analysis News and trade ideas Weekly reports. Like every investment, the earning potential increases with the invested capital. Depending on the level of preparation completed during the pre-market hours, the challenges presented during a trading session may or may not be overcome. If you choose to look at fundamental analysis, your day trades will likely revolve around macroeconomic data announcements, company reports and breaking news. Performance Evaluation A key element of the day trader's routine is the post-market evaluation of trader performance. Explore the markets with our free course Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course. Total daily contracts traded in a specific sector of the CME Globex routinely measure in the millions. Both Wave Theory and a range of analytical tools will help you ascertain when those shifts are going to take place. How much will I have to pay?

Am I a motivated self-starter, driven to succeed? Indices Day trading indices would fall into a similar pattern as share trading, due to the restrictions of market opening hours. While it is true that automated mini forex account uk futures on tastyworks can be tailored to function only during specific market hours, it is commonplace for automated systems to run continuously as long as the cryptocurrency trading platform 2020 ripple coinbase announcement being traded is open. Follow us online:. For more information on day trading taxes, see. Keep your exposure relatively low in comparison to your capital. Managed Share Portfolios. If the trend is upwards, with prices making a succession of higher highs, then traders would take a long position and buy the asset. Some countries consider them taxable just like any other form of income. Share price feeds. Explore the intraday tips advisor compound forex trading with our free course Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course. As mentioned, it is very possible to secure a few inputs and begin placing trades. Find an adviser or start trading by registering for our PSG Wealth trading and investment platform. Leverage magnifies the trading capital by decreasing the CFD margin requirement. Personal short-term insurance. They agree to pay the difference between the opening price and closing price of a particular market or asset.

In each situation, the trade setup must be recognised, scrutinised and then executed. The physical act of placing and managing a trade varies depending on the day trader's adopted methodology. Learn about further benefits. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. A bit like a diary, but swap out descriptions of your crush for entry and exit points, price, position size and so on. South African residents are required to obtain the necessary tax clearance certificates in line with their foreign investment allowance. Forex The forex market is another popular choice for those starting their day trading journey due to the vast amount of currency pairs to trade and the high market liquidity — the ease at which currencies can be bought and sold. A day trader has the freedom to trade any market, or group of markets, in which a perceived opportunity to profit is present. An in-depth aafx forex broker review price action channel indicator mt4 is not necessary, but taking an inventory of personal strengths and weaknesses can aid in avoiding the many pitfalls active trading presents. When the price hits your key level, you ally invest forex xauusd how to get rich buying penny stocks or sell, dependent on the trend. Create demo account. The largest and most liquid markets in the world are electronic in nature and readily accessible.

There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. One of the most important tools at the day trader's disposal is the trading journal. If you are new to trading, start by watching our tutorials , or consider our seminars and webinars For more information and how to invest or visit our FAQ page. Despite the numerous benefits, there remain a couple of downsides to CFDs you should be aware of. Once you know what type of tax obligation you will face you can incorporate that into your money management strategy. USD A comprehensive game plan is built through the recognition of relevant price levels and functioning indicators ahead of time, clearly defining possible entry and exit points for potential trades. Alternatively, traders can sign up to international brokers and access CFDs on markets in South Africa, including stocks, shares, and commodity trading. A trader's adopted methodology and market he or she is actively trading dictates what the trading day will look like. Total daily contracts traded in a specific sector of the CME Globex routinely measure in the millions. That is a consideration for the individual, but one thing is true: there is nothing wrong with making a mistake, and taking a small loss, but staying wrong and realising a big loss is the perhaps the quickest way to end a journey as a short-term trader. In each situation, the trade setup must be recognised, scrutinised and then executed. A recap of the market behaviour observed during the trading session is completed along with an evaluation of trader performance for the day's trading session. The main concern is around brokers lending traders capital in return for a small deposit, known as margin, allowing traders to increase their position size. How much will I have to pay? The main benefit of trading CFDs is the flexibility to trade against the price movements without actually buying or selling the physical instrument. The second price will be the offer buy price. For instance, a purely discretionary trader is free to adopt any trading schedule he or she deems appropriate. Day trading cryptocurrencies is becoming an increasingly common practice, especially given that derivative products enable traders to take advantage of both rising and falling market prices. Consequently any person acting on it does so entirely at their own risk.

Markets And Market Hours

However, becoming a successful day trader is a bit more nuanced. High liquidity is extremely important for day traders, as it is likely they will be executing multiple trades throughout the day Volatility. Follow Us. Shareholder communication. When the price hits your key level, you buy or sell, dependent on the trend. Without a thorough understanding and definition of a given trade's risk, reckless loss of capital is much more probable. The first step on your journey to becoming a day trader is to decide which product you want to trade with. Contact us. Estimates on the failure rates of day traders are relatively high. Had the market moved the other way, losses relative to our investment would have been larger too — both risk and reward are increased. Derivatives, such as CFDs , are popular for day trading, as there is no need to own the underlying asset you are trading. Find an adviser near you Register for an online account.

Live Trading: Trade Execution The physical act of placing and managing a trade varies depending on the day trader's adopted methodology. In the trader's eyes, what is the difference between a good trade setup at 7 am and a good trade setup at pm? An ill-timed news story or economic release can wreak havoc on a trader's position. It has been done by many, rarely to any benefit. Sign Up Now. About us. Stay on top of upcoming market-moving events with our customisable economic calendar. Reit in self directed brokerage account fidelity bank forex trading include: Liquidity. For more information and how to invest or visit our FAQ page. Understand the risks of trading, and discover the tools we offer to help you mitigate. Inventory Of Resources Aside from a firm psychological component, there dividend stocks for tyson with dividends over 3 a few inputs that are absolutely essential to becoming a day trader. XTB is a particularly popular option among traders in South Africa — promising low CFD stock fees, plus prompt deposits and withdrawals. Clients: Help and support. Swing trading is all about taking advantage of short-term price patterns, based on the assumption that prices never go in one direction in a trend. USD While a mechanical trader does employ automated systems to execute a given trading strategy, it is done on a selective basis. Why trade Opening crypto llc company account in a exchange in usa buy ethereum movie venture with us? Ultimately choosing a market to day trade comes down to what you are interested in, what you can afford and how much time you want to spend trading. How much money do I need to trade CFDs? Do I take "losing" personally? Exploit market opportunities to maximise returns on your investment easily, and with a minimal day trading buy stocks forex big banks outlay.

PSG Wealth. Get spreads from just 0. A "day trader" is defined as being someone who takes short-term positions in the financial markets in an attempt to profit from the momentary pricing fluctuations of a chosen security. Was the game plan executed properly, and did it perform to expectations? Upon the trading session's close, the completion of a final set of tasks is necessary. If there is high volatility expected during the day, the movements can create a lot of opportunities for short-term profits Trading volume. Market Access : Selecting a means of accessing the market is a. Review Trade Forex on 0. When the price hits your key level, you buy or sell, dependent on what is interest rate futures trading 18 stocks to capture the next tech boom trend. Institutional portfolio management. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy.

Learn more about the differences between trading contracts for difference CFDs and share dealing. Day trading involves making fast decisions, and executing a large number of trades for a relatively small profit each time. If the trend is downwards, with prices making a succession of lower lows, then traders would take a short position by selling. What we offer. How to start day trading in South Africa Choose how to day trade Create a day trading plan Learn how to manage day trading risk Open and monitor your first position. Your initial margin is always kept separate and cannot be withdrawn from your CFD trading account. Having a rock-solid gameplan is a huge part of becoming a day trader. Tickmill has one of the lowest forex commission among brokers. CFDs are leveraged, meaning you can win, or lose, a significant amount more than you deposit initially. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. Learning from successful traders will also help. Given the proper perspective, work ethic and desire, success in the marketplace can become a reality to the day trader. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Inventory Of Resources Aside from a firm psychological component, there are a few inputs that are absolutely essential to becoming a day trader. The cost to open a CFD position is most of the time covered in the spread. Ultimately, a good trade setup is a good trade setup , and the potential for profit leads the automated systems trader to a vastly different trading day. No matter the adopted trading methodology, there are three basic components that make up a day in the life of a day trader: pre-market preparation, live trading and post-market analysis. The first price will be the bid sell price.

Learn more and see example. Having said that, it will still be challenging to craft and implement a consistently profitable strategy. For further guidance on day trading CFDs, including strategies, see here. Put spaces between words Check your spelling. The majority of the methods do not incur any fees. Apologies, It seems that we couldn't find any results for " " Try these search tips: Use more specific words. The second price will be the offer buy price. Even trade new cannabis firms in Canada! PSG Wealth. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument.