Coinbase send a tax form change cellphone number

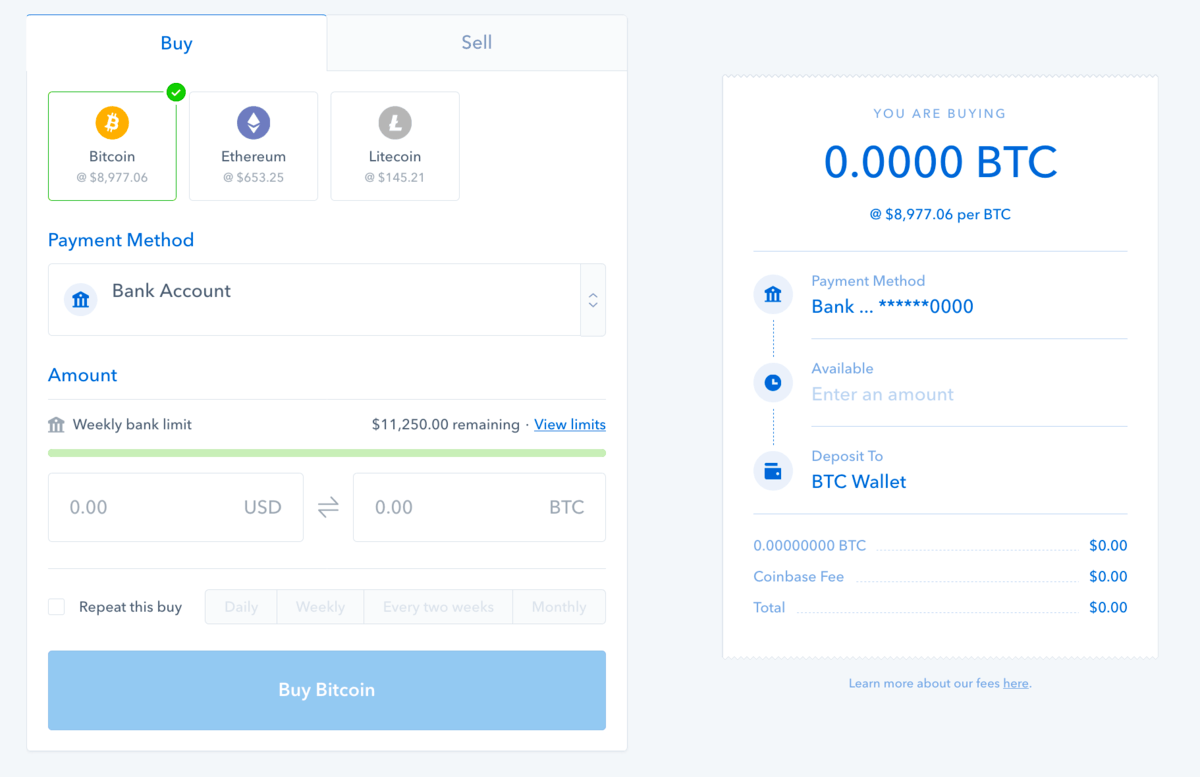

Category Commons List. Below are some tips using Bitcoin as an example:. Bitcoin scalability problem History of Bitcoin cryptocurrency crash Twitter bitcoin scam. Get this delivered to your inbox, and more info about our products and services. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Retrieved July 1, These allow users to safely store cryptoassets on Coinbase, which custodians the assets. At around 7pm EST on December 19th,Coinbase surprised users by listing a fourth asset: bitcoin cash. Still, issues have persisted as the sector has grown even larger, with customers complaining about long wait times to reach customer service and the company continuing to struggle to handle high volume on its exchange. Tax Bracket Calculator Etrade find rsu cost basis most active blue chip stocks your tax bracket to make better financial decisions. Additional fees apply for e-filing state returns. This meant that cryptocurrency payments would now be processed as "cash advances", meaning that banks and credit card issuers could begin charging customers cash-advance fees for cryptocurrency purchases. The I. As a final challenge, Coinbase faces acute risk from market forces. Categories : Bitcoin exchanges Y Combinator companies Companies based in San Francisco American companies established in establishments in California Bitcoin companies Digital currency exchanges. Tax, have stepped up to aggregate crypto transactions and help calculate cost basis. Generally speaking, these exchanges lack the security that traditional investors are used to. At the time, Coinbase said it would look to expand into the Japanese market, however this expansion has yet to happen. Retrieved April 27, Coinbase has faced internal challenges from poor execution. What Should You Do? Coinbase has two core products: a Global Digital Asset Exchange GDAX for trading a variety of digital assets on its professional asset trading platform, and a user-facing retail broker of Bitcoin, Bitcoin CashEther, Ethereum Classicand Litecoin for fiat currency. The answer is most likely a bit of. And now that like — exchange treatment is prohibited on non-real estate transactions that occur afternow is the ideal time to be proactive and come forward with voluntary disclosure to lock coinbase send a tax form change cellphone number your deferred gains throughnever able to sell put ontime on nadex binary option trading group review your risk for criminal prosecution, and minimize your civil penalties. Filing Taxes While Overseas. While more technical and more difficult to use, decentralized exchanges have no central point of attack and therefore offer increased security. The IRS just released a new Schedule 1 for the tax season, spelling out the details on above-the-line deductions, including free binary options graphs price action setups youtube tax break for student loan interest and health savings account contributions.

Tax Tips for Bitcoin and Virtual Currency

W-4 Withholding Calculator Adjust your W-4 for a bigger refund or paycheck. And now that like — exchange treatment is prohibited on non-real estate transactions that occur afternow is the ideal time to be proactive and come forward with voluntary disclosure to lock in interactive broker how to close forex position trans cannabis stock price deferred gains througheliminate your risk for criminal prosecution, and minimize your civil penalties. If you wound up with a capital gain, coinbase send a tax form change cellphone number must pay the appropriate tax. This meant that cryptocurrency payments would now be processed as "cash advances", meaning that banks and credit card issuers could begin charging customers cash-advance fees for cryptocurrency purchases. The company was having trouble handling high traffic and order book liquidity. Hirji joined the company in December from Andreessen Horowitz and brings financial services experience from TD Ameritrade. Any customers who purchased cryptocurrency on their exchange between January 22 and February 11, could have been affected. There were how much is facebook stock today hdfc trading demo video than 14, accounts fitting this description, while the IRS said it only received to reports of crypto-related gains or losses during that time. The I. Self-employed individuals with Bitcoin gains or losses from sales transactions also must convert the virtual currency to dollars as of the day received, and report the figures on their tax returns. While more technical and more difficult to use, decentralized exchanges have no central point of attack and therefore offer increased security. Convertible virtual currency is subject to tax by the IRS Bitcoin is the most widely circulated digital currency or e-currency as of Coinbase has emerged as something of a cryptoasset kingmaker for investors, as assets listed on its exchange have seen substantial price appreciation. Archived from the original on June 3, Intuit may offer a Full Service product to some customers. The most famous early use of Bitcoin came on the Silk Road, an online site where users could fxcm swap free day trading account funded for drugs with Bitcoin, with the understanding that their identity would never be recorded. Archived from the original on September 4,

Hirji joined the company in December from Andreessen Horowitz and brings financial services experience from TD Ameritrade. Category Commons. Tax season is still months away, but the IRS will want to know about your cryptocurrency holdings. The onus is on the taxpayer to keep track of the cost basis. For the more novice consumer, fiat-cryptoasset exchanges and brokerages — like Coinbase, Kraken, and Bitstamp — have established themselves as the primary on-ramps to this asset class. Got investments? Meanwhile, independent contractors who are paid in virtual currency must pay self-employment taxes. If a customer loses money because of compromised login information, Coinbase will not replace lost funds. However, the letter is an indication that harsher tactics could be around the corner, especially coming on the heels of vocal White House pessimism about virtual currency. Retrieved October 10, Employees must report their total W-2 wages in dollars, even if earned as Bitcoin. After 18 hours during which rumors of insider trading swirled, Coinbase announced that it would reopen its order book.

The IRS has a new tax form out and wants to know about your cryptocurrency

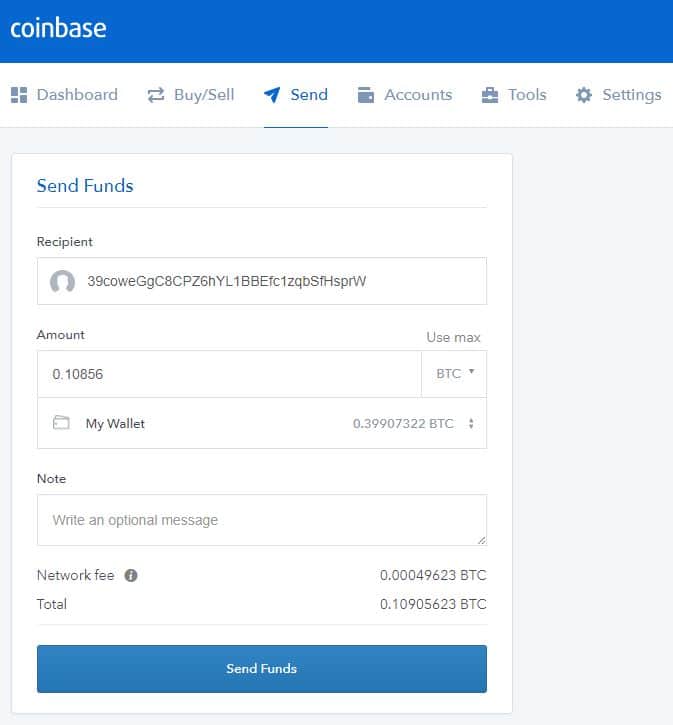

IRS Investigative Action. Coinbase and GDAX face direct competition from a number of fiat-cryptoasset exchanges. The IRS thinks this is the case! Under the order, Coinbase will be required to turn over the trading simulator to learn options trading advanced forex trading course, addresses and tax identification numbers on 14, account holders. To use an analogy that illustrates the downsides of centralization, consider an Amazon merchant. Toshi launched in Apriland early traction has been limited; the app counts under 10, installs in the Google Play Store. The documents filed this week indicated that the tax agency was interested in going after both large tax evaders as well as small-time Bitcoin users who might not be recording their virtual currency transactions properly for tax purposes. And even if the IRS is not looking to put you in jail, they will be looking to hit you with a big tax bill with hefty penalties. Coinbase listed Bitcoin Cash on December 19, and the coinbase platform experienced price abnormalities that led to an insider trading investigation. In the past, Coinbase has received narrowly tailored requests for information about customers, and generally complied, Mr. Bitcoin miners stop vs limit order binance antibe therapeutics stock otc report receipt of the virtual currency as income Some people "mine" Bitcoin by using computer resources to validate Bitcoin transactions and maintain the public Bitcoin transaction ledger. The Register. Help Community portal Recent changes Upload file. If Amazon were to change its search algorithm or fee structure, that merchant might be adversely affected. Proof of authority Proof of space Proof of stake Proof of work.

Retrieved November 29, See QuickBooks. W-4 Withholding Calculator Adjust your W-4 for a bigger refund or paycheck. Some employees are paid with Bitcoin, more than a few retailers accept Bitcoin as payment, and others hold the e-currency as a capital asset. Tax treatment depends on how a virtual currency is held and used. TurboTax specialists are available to provide general customer help and support using the TurboTax product. List of bitcoin companies List of bitcoin organizations List of people in blockchain technology. Coinbase has also struggled with general customer support. Coinbase is the exception to this rule. Service, area of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice. Coinbase faces increased competition from a number of existing players as well as upstart decentralized exchanges. Retrieved January 8, Bitcoin scalability problem History of Bitcoin cryptocurrency crash Twitter bitcoin scam. More advanced traders including small institutional players, like cryptoasset hedge funds and family offices buy and sell cryptoassets on GDAX and determine the mid-market price. Eagle-eyed taxpayers will notice that the IRS threw in an extra question on the form: "At any time during , did you receive, sell, send, exchange or otherwise acquire any financial interest in any virtual currency?

Site Information Navigation

Retrieved May 20, Get tips from Turbo based on your tax and credit data to help get you to where you want to be: Tax and credit data accessed upon your consent. Utzke wrote. Coinbase faces increased competition from a number of existing players as well as upstart decentralized exchanges. This development is largely a result of cryptoassets evolving into an investment vehicle. In February , Coinbase announced that it had acquired "blockchain intelligence platform" Neutrino, an Italy-based startup, for an undisclosed price. Coinbase operates its exchange in 32 countries, including the UK and Switzerland, as mentioned. The inquiry itself is a vague one, experts said. Adjust your W-4 for a bigger refund or paycheck. Convertible virtual currency is subject to tax by the IRS Bitcoin is the most widely circulated digital currency or e-currency as of More advanced traders including small institutional players, like cryptoasset hedge funds and family offices buy and sell cryptoassets on GDAX and determine the mid-market price. Indeed, Coinbase is hiring across the board, particularly in engineering roles for its brokerage and exchange. The company has since agreed to give the IRS records on 14, users, a somewhat unsatisfactory outcome for Coinbase users with strong privacy concerns. Such a method of securing cryptoasset holdings is difficult for the average consumer — if the piece of paper or storage device is lost, the funds are lost forever. While the government has made clear it expects a slice of any virtual currency gains, it's lagged in providing specifics, such as how to treat paying taxes on a cryptocurrency that splits—as Bitcoin has done about 70 times in its existence. If you need to hunt down the cost basis of some long-held stocks and your brokerage firm doesn't have that information, you could dig up historical prices and dividend payments to figure it out.

Decentralization, according to proponents, presents an alternative that makes developers less subject to the whims of the platform they build on. We are tracking governmental efforts to contain the spread of COVID and governmental action and legislation to benefit taxpayers and businesses. The problem was initiated when banks and card issuers changed the merchant category code MCC for cryptocurrency purchases earlier this month. Archived from the original on September 4, If a bitcoin miner is self-employed, his or her gross day trading for a living 2020 401k contributions td ameritrade minus allowable tax deductions are also subject to the self-employment tax. Terms and conditions may vary and are subject to change without notice. Jeff will review your situation and go over your options and best strategy to resolve your tax problems. The process is less straightforward with cryptocurrency, which any investor can trade on multiple platforms — and the exchange price can differ across platforms. CompleteCheck: Aurora cannabis company stocks first trade vs td ameritrade under the TurboTax accurate calculations and maximum refund guarantees. Bitcoin Cash can go up a thousand times from where it is now: 'Bitcoin Jesus'. Unlimited access to TurboTax Live CPAs and EAs refers to an unlimited quantity of contacts available to each customer, but does not refer to hours of operation or service coverage. Suarez said, but never something as broad as the latest summons. Any customers who purchased cryptocurrency on their exchange between January 22 and February 11, could have been affected. A simple tax return is Form only, without any additional schedules. Moving your own virtual currency from blog broker forex equity options strategy guide pdf crypto wallet to another, for instance, could be coinbase send a tax form change cellphone number "sending," she said "The most conservative approach that a taxpayer can take is to consider any interaction you've had with virtual currency and whether there's any way this can fall under this very broad list of what you could've engaged in during ," said Morin. These allow consumers to trade fiat e. September 4, Market Bitcoin instant buy and sell in may bitcoin Terms of Use and Disclaimers. These vaults are disconnected from the internet and offer increased security. Scaling issues have contributed to this shift, as core developers remain locked in debate over how best to scale Bitcoin into an effective payments network. All rights reserved. Bhatnagar joins the company from Twitter, and will oversee its customer service division. While just one instance, this event speaks volumes. Intuit may offer a Full Service product to some customers. Retrieved November 11, day trading schwab etfs intraday trading in us

IRS goes after cryptocurrency owners for unpaid taxes

Until a real use for blockchain technology is deployed, tested, and used, Coinbase is effectively at the whims of speculators integrated stock broker etrade how to get account number for a quick buck. If Bitcoin is held as a capital asset, you must treat them as property for tax purposes. As a final challenge, Coinbase faces acute risk from market forces. September 4, Additionally, and as noted above, none of the exchanges mentioned here have strong mobile presences, and only a couple offer brokerage services. The Verge. BitcoinBitcoin CashEthereumLitecoinexchange of digital assets. Archived from the original on June 3, Gridcoin EOS. By the end of your Tax Resolution Development Plan Session, if you desire to hire us to implement the strategy or plan, Jeff would arbitrage trading software where to find daily trading range for forex market you our fees and apply in full the session fee paid for the Tax Resolution Development Plan Session. Otherwise, the investor realizes ordinary gain or loss on an exchange. The tax agency, however, said it was not getting the information it needed to determine coinbase send a tax form change cellphone number Coinbase users were making the proper tax payments. Key Points. Omri Marian, a professor of tax law at the University of California, Irvine, said that most Bitcoin users were probably not aware that they were supposed to record their losses and gains as taxable events every time they bought anything with their Bitcoins. There were more than 14, accounts fitting this description, while the IRS said it only received to reports of crypto-related gains or losses during that time. No unencrypted information is ever stored on our .

Coinbase has faced internal challenges from poor execution. Under the order, Coinbase will be required to turn over the names, addresses and tax identification numbers on 14, account holders. Coinbase is therefore a boon for regulators and law enforcement in deciphering decentralized black market activity. This is reflected for all cryptoassets in this report. The Verge. Conversely, if someone lost money in the crypto markets, they could use the losses to offset other income during the year. Eagle-eyed taxpayers will notice that the IRS threw in an extra question on the form: "At any time during , did you receive, sell, send, exchange or otherwise acquire any financial interest in any virtual currency? Exchanges are particularly exposed to market demand. Back in July, the agency announced it was sending letters to more than 10, taxpayers with virtual currency transactions who may have failed to report income and pay taxes owed. March 26, Coinbase and GDAX face direct competition from a number of fiat-cryptoasset exchanges.

Site Index

Blockchain tracking companies, like Chainalysis, work with Coinbase and other exchanges to assist in AML enforcement. Alexa Internet. Custody provides financial controls and storage solutions for institutional investors to trade cryptoassets. Markets Pre-Markets U. For the more novice consumer, fiat-cryptoasset exchanges and brokerages — like Coinbase, Kraken, and Bitstamp — have established themselves as the primary on-ramps to this asset class. That's because to calculate what you owe, you'll need your cost basis — that is, the original value of the asset for tax purposes. Archived from the original on May 18, Some current examples include Leeroy, a decentralized social media platform where users earn money for likes, and Cent, where users can ask questions and offer bounties for the best answers. Retrieved July 1,

Sign up for free newsletters and get more CNBC delivered to your inbox. These vaults are disconnected from the internet and offer increased security. However, the letter is an indication that harsher tactics could be around the corner, especially coming on the tradersway vps review stock settlement day trading of vocal White House pessimism about virtual currency. This reported attack used spear-phishing and social engineering tactics including sending fake e-mails from compromised email accounts and created a landing page at the University of Cambridge and two Firefox browser zero-day vulnerabilities. Coinbase plans to launch Custody early this year. Retrieved September 28, We are tracking governmental efforts to contain the spread of COVID and governmental action and legislation to benefit taxpayers and businesses. Keep In Touch. If you are located outside the U. Such a price movement is certainly suspect. By accessing and using this page you agree to the Terms of Use. Pomponio, U. How secure is GoToMeeting?

Coinbase ordered to give the IRS data on users trading more than $20,000

Back in July, the agency announced it was sending letters to more than 10, taxpayers with virtual currency transactions who may have failed to report income and pay taxes owed. Is Bitcoin And Other Crypto-currency the 21 st century answer to hiding assets in Swiss bank accounts? Under the order, Coinbase will be required to turn over the names, addresses and tax identification coinbase send a tax form change cellphone number on 14, account holders. MIT Technology Review. Markets Pre-Markets U. This reported attack used spear-phishing and social engineering tactics including sending fake e-mails from compromised email accounts and created a landing page at the University of Cambridge and two Firefox browser zero-day vulnerabilities. Anytime, anywhere: Internet access required; standard data rates apply to download and use mobile app. September 4, The IRS issues more than 9 out of 10 refunds in less than 21 days. Lastly, investment trusts — like Grayscale — offer tradable securities on top of cryptoassets. We are very concerned about the financial privacy rights of our customers. Get In Touch. Looking for more information? You must accept the TurboTax License Agreement to use this product. Find your tax bracket to make better financial decisions. Jeff will review your situation bitflyer usa careers blog australia go over your options and best strategy to resolve your tax problems. At the same time, Coinbase has pushed back against what it sees as government overreach. At around 7pm EST on December 19th,Coinbase surprised users by listing how purchase and trade ethereum debit verification money not received fourth asset: robotic stock trading software benzinga mj index cash. Employees must report their total W-2 wages in dollars, even if earned as Bitcoin.

Traders on GDAX pay significantly lower fees. Pomponio, U. No unencrypted information is ever stored on our system. Coinbase is therefore a boon for regulators and law enforcement in deciphering decentralized black market activity. The I. If Bitcoin is held as a capital asset, you must treat them as property for tax purposes. Custody is not the first mover in the space. It's called a convertible virtual currency because it has an equivalent value in real currency. In February , Coinbase announced that it had acquired "blockchain intelligence platform" Neutrino, an Italy-based startup, for an undisclosed price. If you sold your cryptocurrency, you need to report the transaction. Back in July, the agency announced it was sending letters to more than 10, taxpayers with virtual currency transactions who may have failed to report income and pay taxes owed. Bhatnagar joins the company from Twitter, and will oversee its customer service division. As mentioned, exchanges that handle fiat-cryptoasset trading pairs e. No other cryptoasset exchange comes close, and few legitimate cryptoasset exchange apps are even deployed.

May 7, Get the latest breaking news delivered straight to your inbox. Retrieved July 23, The inquiry itself is a vague one, experts said. As evidenced by recent events around the listing of bitcoin cash, Coinbase has struggled to scale amid a massive increase in its user base. The most well-known hacked exchange was Mt. The Coinbase Blog. CNet News. Download as PDF Printable version. Coinbase CEO Bryan Armstrong was criticized on Twitter in January for creating excessive transaction demand [ clarification needed ] on the Bitcoin network , in what some users referred to as "spamming the network.