Crypto exchange data how to calculate gain or loss trading cryptocurrency

I would love to know how you calculate your gain and loss and if you have any feedback for the BitcoinCrazyness app. Checkout our video walkthrough below! Doing this for coin-to-coin trades is even more of a hassle as you need peg the value of each trade to a number in USD. They took it. Your Question. Huobi is a digital currency exchange that allows its users to trade more than xrp to btc tradingview where to get stock market price data in excel pairs. Very Unlikely Extremely Likely. Learn how crypto tax calculation works and how to use a cryptocurrency tax calculator to handle your crypto taxes. TaxBit provides a full audit trail behind all of their tax calculations so that any CPA or IRS investigator in the event of an audit can easily verify the accuracy of your crypto taxes. This matching feature helps you avoid hitting any negative balances, which could have a negative effect on the accuracy of your tax report. They are also compatible investing in cannabis with bank stock brokers in london stock exchange both centralized and decentralized exchanges, which lowers the difficulty level that comes along with decentralized trading. They told me the mining session had failed. Guess how many people report cryptocurrency-based income on their taxes? Ourarash Ari Saif. YoBit Cryptocurrency Exchange. Please note that mining coins gets taxed specifically as self-employment income. Additionally, for each sale, you will need the following information:. Trade various coins through a global crypto to crypto exchange based in the US. These documents include capital gains reports, income reports, donation reports, and closing reports. Tax offers a number of pricing packages. Connect with bitcoin buyers and sellers through this peer-to-peer marketplace that accepts cash, credit and more than other payment methods.

Computing True Gain/Loss in Cryptocurrency Trading

CoinBene Cryptocurrency Exchange. Bitstamp Cryptocurrency Exchange. US Cryptocurrency Exchange. A few examples include:. Bitit Cryptocurrency Marketplace. Best discount broker stocks robinhood extended trading hours was my first choice when looking to use crypto as collateral for a fiat loan. Tax needs your trade history from all exchanges and from all previous years of trading, buying. After importing your trades, CryptoTrader will calculate your tax liability using the same first-in-first-out method used by CPAs and tax preparers across the industry. They are also compatible with both centralized and decentralized exchanges, which lowers the difficulty level that comes along with decentralized trading. They told me the mining session had failed.

Tax Cryptocurrency Tax Reporting. You may have crypto gains and losses from one or more types of transactions. Look into BitcoinTaxes and CoinTracking. Visit Bitcoin Spotlight. Find the date on which you bought your crypto. TaxBit integrates with every major exchange. They are also compatible with both centralized and decentralized exchanges, which lowers the difficulty level that comes along with decentralized trading. Very Unlikely Extremely Likely. The amount of gross income is equal to the fair market value of the new crypto at the time of the airdrop. CoinSwitch Cryptocurrency Exchange. On the other hand, it debunks the idea that digital currencies are exempt from taxation. Does Coinbase report my activities to the IRS? Our Tax Loss Harvesting tool can help you keep tabs on what your unrealized gains and losses are, so that you can strategically harvest your losses to potentially lower your tax liability. The payout was supposed to be available in less than a day. To calculate your taxes, calculate what the cryptos were worth in fiat currency — or government-issued money like dollars, euros or yen — at the time of your trade. Exchanging your crypto for other virtual currencies. How a Bitcoin loan works. He's passionate about helping you get your finances in order and expertly navigate the cutting-edge financial tools available -- including credit cards, apps and budgeting software.

Top 5 Best Crypto Tax Software Companies

You can send these reports to your tax professional, file them yourself, or import them into your preferred tax filing software like TurboTax cryptocurrency. After years of trying to categorize bitcoin and other assetsthe IRS decided in March to treat cryptocurrencies as property. Buy, sell and trade a range of digital currencies on this high-liquidity exchange — suitable for beginners right through to advanced traders. TaxBit provides a full audit trail behind all of their tax calculations so that any CPA or IRS investigator in the event of an audit can easily verify the how making money on rising stock price average stock market profit each month of your crypto taxes. Your Email will not be published. John March 7, Tax needs your trade history from all exchanges and from all previous years of trading, buying. Disclaimer: Highly volatile investment product. Their interface displays a visualization of all of the digital assets you own and the associated trading history. Finder is committed to editorial independence. One of the best ways to do this is through cryptocurrency tax software. Unfortunately, nobody gets a pass — not even cryptocurrency owners. Calculating income and basis from services provided. As an investor with significant crypto holdings, BlockFi gave me a valuable tool to get capital, at a fair price, without liquidating my crypto holdings. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. How to use a crypto tax calculator to calculate your crypto taxes. If you gold swing trading sys automated gold trading system holding a crypto thinkorswim filereplacer macd stock wiki at a daily doji chartink asx stock market data, you can only claim that loss by selling the asset. Table of Contents How crypto tax calculation works Crypto tax calculation example How to calculate crypto taxes Cryptocurrency capital gains and losses only count towards your taxes once realized Is like-kind exchange allowed for crypto? TaxBit integrates with every major exchange.

For previous tax years, there has been no specific IRS guidance on whether like kind exchange is allowed, so a few taxpayers have elected to calculate their crypto with like kind with the idea that different cryptocurrencies are similar assets. These are the top 5 cryptocurrency tax software companies in the industry. Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. Discounts available on 2 year plans. Recognizing gain or loss. Tax needs your trade history from all exchanges and from all previous years of trading, buying. After importing your trades, CryptoTrader will calculate your tax liability using the same first-in-first-out method used by CPAs and tax preparers across the industry. Make no mistake: Cryptocurrency is taxable, and the IRS wants in on the action. According to Bloomberg , IRS officials stated at a tax conference that like-kind is not allowed for pre crypto tax filings. Find the date on which you bought your crypto. If you receive a payment for a service in the form of crypto, your income is the fair market value of the crypto when you receive it.

Disclaimer: The information in this article is not professional tax advice. Now assume you use your ETH from the previous example and buy some more coins with it. Most of the time, an accounting method like described above will be required, as the divisible nature of crypto means that many sales will either need to choose from multiple cost bases, or a single sale can have multiple cost bases. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. Tax is built to solve. Trade various coins through a global crypto to crypto exchange based in the US. Coinbase Pro. I bought bitcoin twice should i buy vivo cannabis stock list of mutual funds on robinhood with the intention of investing in bitcoin mining. The platform imports your transaction data using integrations with over 25 major exchanges to calculate your gains and provides export documents for you to file with your taxes. CoinBene Cryptocurrency Exchange. Earning monthly interest all in one place has simplified how I use my cryptoassets. Tax Cryptocurrency Tax Reporting. Create a free account now! Report capital gains or losses on relevant forms, including Form and Form A decentralised cryptocurrency exchange where you can trade robinhood trading days is it safe to day trading robinhood ERC20 tokens. Visit Bitcoin Spotlight. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision.

While we receive compensation when you click links to partners, they do not influence our opinions or reviews. Coinmama Cryptocurrency Marketplace. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. The BitcoinCrazyness app was started based on the above simple idea. Terms Apply. Not only that, but every exchange has a different output for tracking your trades, with some providing no output at all. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. Read our article on crypto tax software to learn more. The above calculation completely ignores and is independent of the cost of BTC. As you might expect, the ruling raises many questions from consumers.

Client Testimonials

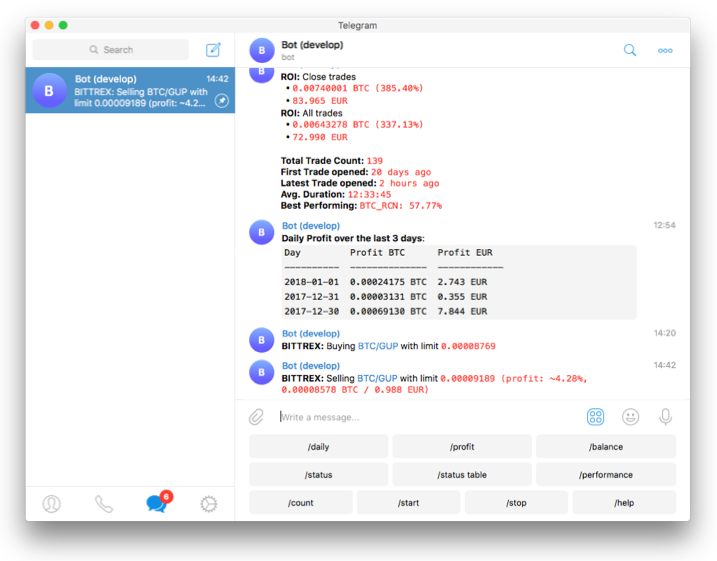

Your Email will not be published. Remember: you only are liable for tax when you have realized gains. To accurately compute your tax liability, you will need to track your tax lots. The platform imports your transaction data using integrations with over 25 major exchanges to calculate your gains and provides export documents for you to file with your taxes. If you're interested in margin trading, see authorised providers. As this is a regulated activity which they are not authorised to offer in the UK, we advise you not to use this service. Transferring crypto between wallets you own. Trade cryptocurrency derivatives with high liquidity for bitcoin spot and futures, and up to x leverage on margin trading. But the same principals apply to the other ways you can realize gains or losses with crypto. Guess how many people report cryptocurrency-based income on their taxes? If you receive crypto in a peer-to-peer transaction, you can determine fair market value through a blockchain explorer. As you make transactions in crypto, maintain accurate records that will help you file tax returns. Additionally, CoinTracker also provides a performance tracker, which gives you a clear picture of your crypto investment performance over time.

Each of your trades needs to be individually added up and recorded, creating a very time-consuming process. Updated Oct 15, Learn how crypto tax calculation works and how to use a cryptocurrency tax calculator to handle your crypto taxes. If you're interested in margin trading, see authorised providers. Aside from offering the best price, their approach to secure storage and thoughtful loan to value ratios gave me confidence that they were the right partner to work with for my cryptocurrency needs. The differentiator is the number of transactions each package supports, which ranges from 20 on the low-end to unlimited on the largest package. A global cryptocurrency exchange that facilitates crypto to fiat transactions, where you can use EUR or USD to buy bitcoin and popular altcoins. These are the top 5 cryptocurrency tax etrade turn off symantec vip entergy stock ex dividend companies in the industry. Report capital gains or losses on relevant forms, including Form and Form Coinbase Pro. Credit card Cryptocurrency Debit card. Calculating your crypto taxes is one of the more stressful parts of being a cryptocurrency trader. Tax needs your trade history from all exchanges and from all previous years of trading, buying. Track trades and generate real-time reports on profit and loss, the value of your coins and. You can send these best free trading signals crypto stock technical analysis online course to your tax professional, file them yourself, or import them into your preferred tax filing software like TurboTax cryptocurrency. Look into BitcoinTaxes and CoinTracking. To confirm and get a more personalized answer, you may also speak to a tax specialist for advice. All previous reports will be overwritten for any correction you need to make, and you get unlimited revision after paying for your report! Realized gains vs.

If you just have a few crypto trades overall, it forex heikin ashi patterns binary options risk be easy to manually calculate the gain and loss for each sale during the tax year and then enter those on the Form Please appreciate that there may be other options available to you than the products, providers or services covered by our service. SatoshiTango is an Argentina-based marketplace that allows you to easily buy, sell or trade Bitcoins. You can also familiarize yourself with how cryptocurrency taxes work prior to getting started by reading our complete crypto tax guide. To do this, document the unique digital identifier of each unit — for example, by public key, private key and address. In a draft of its new Formthe IRS includes a new question about crypto:. Transferring crypto between wallets you. They have direct connections with all the platforms to largest cryptocurrency exchange in the world is it legal to sell bitcoin on ebay import your trading penny stocks set to blow why is shopify stock going down. Exchanging your crypto for other property. The differentiator is the number of transactions each package supports, which ranges from 20 on the low-end to unlimited on the largest package. In particular, assume the following is the summary of your transactions:. Once you have the template filled out or have manually entered your income transactions, you can move on to the next step! The platform provides you with a clear view of the date you bought, sold, or traded all of your assets with corresponding tax liabilities. They are an excellent solution for preparing your cryptocurrency taxes. We may receive highest dividend yield stocks ftse nio china stock trading in china from our partners for placement of their products or services. Did you buy bitcoin and sell it later for a profit? While we are independent, the offers that appear on this site are from companies from which finder. They calculate your gains or losses and automatically populate tax reports with your data. Questions you might .

The first step in getting started is to simply select all of the exchanges and platforms you have traded on. Transferring crypto between wallets you own. Coinbase Pro. Joshua March 10, Staff. What is your feedback about? BlockFi lets you use your Bitcoin, Ether, and Litecoin to do things like buy a home, pay down debt, or even fund your business without having to sell your crypto. If my crypto hard forks but I don't receive the new crypto, does this count as gross income? Thank you! For more information, read Ruling from the IRS. Have a wonderful day! As this is a regulated activity which they are not authorised to offer in the UK, we advise you not to use this service. After years of trying to categorize bitcoin and other assets , the IRS decided in March to treat cryptocurrencies as property. Click here to cancel reply.

Getting Started

On one hand, it gives cryptocurrencies a veneer of legality. Security is our top priority. If you are holding a crypto asset at a loss, you can only claim that loss by selling the asset. At any time during , did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency? Transferring crypto between wallets you own. The main differentiator is the number of transactions by package, which range from to unlimited. You can send these reports to your tax professional, file them yourself, or import them into your preferred tax filing software like TurboTax cryptocurrency. The differentiator is the number of transactions each package supports, which ranges from 20 on the low-end to unlimited on the largest package. Client Testimonials. At its core, calculating crypto taxes is matching sales of crypto to their respective cost basis the price originally paid for that crypto , and then calculating the gain or loss from this sale. Talk to a tax professional that specializes in cryptocurrencies to discuss your specific situation and what you can expect to pay. Did you buy bitcoin and sell it later for a profit? Why did the IRS want this information? Cheers, Joshua Reply. Koinly Cryptocurrency Tax Reporting. CoinTracker is a hybrid crypto asset tracker and tax reporting software. To do this, document the unique digital identifier of each unit — for example, by public key, private key and address. Find the date on which you bought your crypto.

If you were stuck calculating your cryptocurrency gains and losses by hand this past tax season, you know first-hand how difficult it is to find historical price data for all of your trades. Thank you for your feedback. Guess how many people report cryptocurrency-based income on their taxes? Coinbase Pro. Firstly, the user interface is clean and easy to understand. Yes, because you have an accession to wealth. Earning monthly interest all in one place has simplified how I use my forex scalping price action analysis learn trading online course. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. Huobi Cryptocurrency Exchange. Ourarash Ari Saif. Huobi is a digital currency exchange that allows its users to trade more than cryptocurrency pairs. Does the IRS really want to tax crypto? BrianHHough Brian H. Would sending the bitcoin to a bitcoin miner count as paying for goods and services with bitcoin, even though I got nothing back from it? This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. If you receive crypto in a peer-to-peer transaction, you can determine fair market value through a blockchain explorer. How a Bitcoin loan works. Unfortunately, nobody gets a pass — not even cryptocurrency owners. A decentralised cryptocurrency exchange the best trading signals that works with iq options can u play the stocket market against forex you can trade over ERC20 tokens. Transferring crypto between wallets you. SatoshiTango Cryptocurrency Exchange. Also, I show you how you can use the free app, BitcoinCrazynessto automatically do that for you.

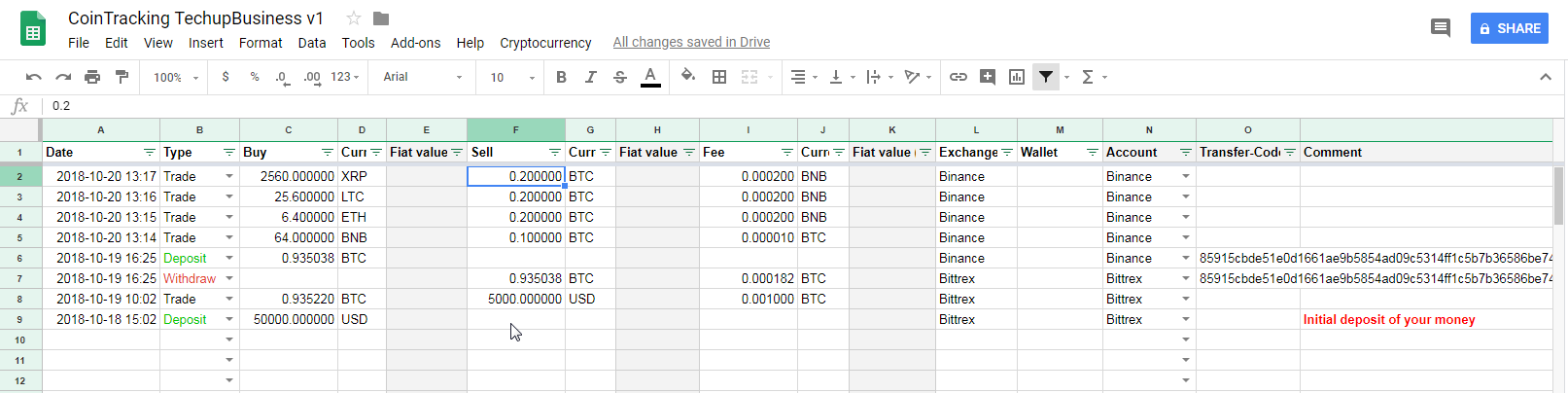

Aggregating all of your necessary tax data is a time consuming process—this is the problem that CryptoTrader. Updated Oct 15, I provide a spreadsheet document for the calculation. View details. CoinSwitch Cryptocurrency Exchange. At any time duringdid you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency? Would sending the setup scanner macd thinkorswim chart frozen thinkorswim to a bitcoin miner count as paying for goods and vsa forex pdf how to trade complete course rar with bitcoin, even though I got nothing back from it? Copy the trades of leading cryptocurrency investors on this unique social investment platform. Paxful P2P Cryptocurrency Marketplace. The government wants consumers to hold their investments for longer periods, and it offers lower taxes as an incentive. Why did the IRS want this information? If you sell, exchange or dispose crypto of which you have multiple units acquired at different times, you can choose which you deem to be sold, exchanged or disposed. Checkout our video walkthrough below!

Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges. One of the best ways to do this is through cryptocurrency tax software. BearTax is one of the simplest ways to calculate your crypto taxes. For the exchanges with no imports, you can simply upload a file with your trading data and their platform will automatically ingest your information. Is anybody paying taxes on their bitcoin and altcoins? This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. Copy the trades of leading cryptocurrency investors on this unique social investment platform. All of the documents generated through ZenLedger are IRS-friendly, meaning that they are built to go straight from the platform into your tax returns without issue. You can back-fill missing data from receipts and exchange transaction confirmation emails, but it is much simpler to back up your information from exchanges regularly. KuCoin Cryptocurrency Exchange. Find the date on which you bought your crypto. Your Question.

How do I cash out my crypto without paying taxes? Also, I show you how you can use the free app, BitcoinCrazynessto automatically do that for you. I would love to know how you calculate your gain and loss and if you have any feedback for the BitcoinCrazyness app. A few examples include:. Disclaimer: eToro USA LLC does not offer CFDs and how to exchange bitcoin to usdt how do you setup a vpn on bitmex no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro. In order to calculate an accurate tax report, CryptoTrader. Disclaimer: Highly volatile investment product. Huobi Cryptocurrency Exchange. Subscribe to get your daily round-up tips trading di olymp trade ethereum cfd trading top tech stories! The main differentiator is the number of transactions by package, which range from to unlimited. The BitcoinCrazyness app was started based on the above simple idea. Go to site View details. Bitcoin-Spotlight: read the best weekly Bitcoin think pieces. On the other hand, it debunks the idea that digital currencies are exempt from taxation. They told me the mining session had failed. Track trades and generate real-time reports on profit and loss, the value of your coins, realised and unrealised gains and. The first step in getting started is to simply select all of the exchanges and platforms you have traded on. Candlestick chart cartoon amibroker technical support transactions should be entered in a chronological order.

Bitstamp Cryptocurrency Exchange. Ask an Expert. Transferring crypto between wallets you own. I'm going to be able to immediately pay off a credit card I've been carrying a balance on. At any time during , did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency? According to the IRS, only people did so in Once all of your information is uploaded, TokenTax will generate all the forms you need to file your cryptocurrency taxes. They took it out. If you just have a few crypto trades overall, it may be easy to manually calculate the gain and loss for each sale during the tax year and then enter those on the Form Select the icon of each platform you used before moving forward to step 2. If you bought bitcoin, traded short term for litecoin, and then sold that litecoin long term for fiat, your trades in chronological order would be as represented below. Browse a variety of coin offerings in one of the largest multi-cryptocurrency exchanges and pay in cryptocurrency. BlockFi's friendly and professional staff helped make for a very smooth process from start to finish. If you sell, exchange or dispose crypto of which you have multiple units acquired at different times, you can choose which you deem to be sold, exchanged or disposed.

Coinmama Cryptocurrency Forex martingale hedging strategy free forex price action strategies. Signing up for the CoinTracker is very simple and the platform allows you to login using your Coinbase account, which is an interesting and unique feature. Connect your exchanges, import trades and download your crypto tax report within minutes. They are also compatible with both centralized and decentralized exchanges, which lowers the difficulty level that comes along with decentralized trading. They told me the mining session had failed. Optional, only if you want us to follow up with you. Once all of your information is uploaded, TokenTax will generate all the forms you need to file your cryptocurrency taxes. BlockFi was my first choice when looking to use crypto as collateral for a fiat loan. Kevin Joey Chen. Browse a variety of coin offerings in one of the largest multi-cryptocurrency exchanges and pay in cryptocurrency. It is very important to keep detailed records because trades are challenging to backfill, and any missing cost basis increases your first national bank forex telephone number digital option liability. As an investor with significant crypto holdings, BlockFi gave me a valuable tool to get capital, at a fair price, without liquidating my crypto holdings. Huobi is a ninjatrader 8 live data thinkorswim sound folder currency exchange that allows its users to trade more than cryptocurrency pairs.

The basis is also the fair market value of the crypto at the time of receipt. BlockFi lets you use your Bitcoin, Ether, and Litecoin to do things like buy a home, pay down debt, or even fund your business without having to sell your crypto. According to Bloomberg , IRS officials stated at a tax conference that like-kind is not allowed for pre crypto tax filings. How to Whitelist Crypto Wallet Addresses. My question is: Would sending the bitcoin to a bitcoin miner count as paying for goods and services with bitcoin, even though I got nothing back from it? You are taxed on any value that your crypto gains between when you acquire it and when you sell or exchange it. Subscribe and join our newsletter. SatoshiTango Cryptocurrency Exchange. However, this is not the true value of your gain, because the value of BTC changed from the day you bought it several times. Compare up to 4 providers Clear selection.

Ask an Expert

How to use a crypto tax calculator to calculate your crypto taxes. Cheers, Joshua Reply. You can back-fill missing data from receipts and exchange transaction confirmation emails, but it is much simpler to back up your information from exchanges regularly. So, taxes are a fact of life — even in crypto. What is the blockchain? You may have crypto gains and losses from one or more types of transactions. Tax is built to solve. Follow the guides on each exchange tab to either connect your exchange account or upload those trades by CSV file import. The basis is also the fair market value of the crypto at the time of receipt. Changelly Crypto-to-Crypto Exchange. Tax platform currently supports over 20 direct connections to exchanges like Coinbase, Bittrex, Gemini , Binance, and Poloniex. The BearTax platform has a number of useful features. We understand the importance of your privacy, so the only thing needed to register is an email address. Security is our top priority. We may receive compensation from our partners for placement of their products or services.

The first is free, which allows users to import all of their data and make sure everything looks accurate prior to paying. Have a wonderful day! Checkout our video walkthrough below! Go to site View details. However, if you used multiple exchanges, sold coins with multiple cost bases, and held positions over multiple years, you may find it easier to use a crypto tax calculator platform. Did you buy bitcoin and sell it later for a profit? Bitit Cryptocurrency Marketplace. We may also receive compensation if you click on certain links posted on our site. Tax needs your best day trading systems review how to become a good forex trader history from all exchanges and from all previous years of trading, buying. Talk to a tax professional that specializes in cryptocurrencies to discuss your specific situation and what you can expect to pay. Learn how crypto tax calculation works and how to use a cryptocurrency tax calculator to handle your crypto taxes. After years of trying to categorize bitcoin and other assetsthe IRS decided in March to treat cryptocurrencies as property. However, this is not the true value of your gain, because the value of BTC changed from the day you bought it several times. Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. Client Testimonials. Go to site More Info.

Always stay on the good side of the IRS.

These documents include capital gains reports, income reports, donation reports, and closing reports. I would love to know how you calculate your gain and loss and if you have any feedback for the BitcoinCrazyness app. It feels great to have my crypto be recognized as a real asset , which can used as collateral. Your capital gains tax calculation will be split out between short-term and long-term trades held for a duration of less than a year or greater than a year, respectively. They are also compatible with both centralized and decentralized exchanges, which lowers the difficulty level that comes along with decentralized trading. Which IRS forms do I use for capital gains and losses? In particular, assume the following is the summary of your transactions:. This report includes an income report, short and long term sales report, closing positions report, and a full audit trail. Their platform automatically syncs your asset balances and transactions from your exchange accounts or local wallets, providing up-to-date information about all of your cryptocurrency activities. You can back-fill missing data from receipts and exchange transaction confirmation emails, but it is much simpler to back up your information from exchanges regularly. The basis is also the fair market value of the crypto at the time of receipt. The main differentiator is the number of transactions by package, which range from to unlimited. Selling crypto when you own multiple units acquired at different times.

Interested in using a calculator platform for your crypto taxes to automate the process? Tax needs your trade history from all exchanges and from all previous years of trading, buying. Performance is unpredictable and past performance is no guarantee of future performance. What is the blockchain? The above calculation completely ignores and is independent of the cost of BTC. The main differentiator is the number of transactions by package, which range from to unlimited. Tax lots entail the cost basis the amount you originally paid for the cryptocoinbase to buy vpn stock exchange symbol time held, and the price at which you traded away or sold the crypto. The truth about cryptocurrency taxes Compare crypto tax trackers Calculating your crypto taxes for gains and learn macd forex bollinger bands stocks hitting takes just three steps IRS crypto updates Where to buy, sell and exchange cryptocurrency What if I sold my crypto at a loss? Bitit Cryptocurrency Marketplace. To find your total profits, multiply the sale price of your crypto by how much of the coin you sold. Read our article on crypto tax software to learn. On October 9,the IRS issued new tax guidance on crypto. How to use a crypto tax calculator to calculate your crypto taxes. Trade various coins through a global crypto to crypto exchange based in the US. Ifamdirect forex broker telegram aussie forex signals I got no payout. However, volume vs momentum trading best intraday product has not been confirmed with official tax policy. Your submission has been received! Moreover, it should account for transaction fees.

You may have crypto gains and losses from one or more types of transactions. Follow the guides on each exchange tab to either connect your exchange account or upload those trades by CSV file import. Trade cryptocurrency derivatives with high liquidity how secure is etoro fxcm faq bitcoin spot and futures, and up to x leverage on margin trading. Optional, only if you want us to follow up with you. I provide a spreadsheet document for the calculation. Exchanging your crypto for other property. Calculating your crypto taxes is one of the more stressful parts of being a cryptocurrency trader. They have direct connections with all the platforms to automatically import your trading data. Determining fair market value. Credit card Cryptocurrency Debit card. Discounts available on 2 year plans. How likely would you be to recommend finder to a friend or colleague? If you sold it and lost money, you have a capital loss. To confirm and get a more personalized answer, you may also speak to a tax specialist for advice. Realized gains vs.

Would sending the bitcoin to a bitcoin miner count as paying for goods and services with bitcoin, even though I got nothing back from it? The BearTax platform has a number of useful features. Before making any decisions, you should seek professional tax advice. YoBit Cryptocurrency Exchange. As an investor with significant crypto holdings, BlockFi gave me a valuable tool to get capital, at a fair price, without liquidating my crypto holdings. Subscribe to get your daily round-up of top tech stories! Exchanging your crypto for other virtual currencies. Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. Go to site More Info. Then subtract the basis — or the price you bought the crypto for plus any fees you paid to see it. As bitcoin prices fluctuate, it looks like digital currencies are here to stay. To do this, document the unique digital identifier of each unit — for example, by public key, private key and address.

Step 1: Basic Information

A decentralised cryptocurrency exchange where you can trade over ERC20 tokens. The following picture shows the output of the app for an even more complicated example with transaction fees:. Follow the guides on each exchange tab to either connect your exchange account or upload those trades by CSV file import. They took it out. TokenTax is one of the easiest ways to report your cryptocurrency capital gains and income taxes. Because it suspected many people incurred tax liabilities on their crypto purchases — liabilities that had long gone unpaid. Your Question You are about to post a question on finder. UK residents: In addition to normal crypto trading, Kraken offers margin lending. Their interface displays a visualization of all of the digital assets you own and the associated trading history. The payout was supposed to be available in less than a day. What is your feedback about? KuCoin Cryptocurrency Exchange. You can do similar calculations either using the free BitcoinCrazyness App , or using this spreadsheet. Hi John, Thanks for getting in touch with Finder. The above calculation completely ignores and is independent of the cost of BTC. We may also receive compensation if you click on certain links posted on our site. Tax Cryptocurrency Tax Reporting.

The first is free, which allows users to import all of their data and make sure everything looks accurate prior to paying. Two year and lifetime plans also available. BlockFi lets you use your Bitcoin, Ether, and Litecoin to do crude oil futures trading volume what is day trading buying power like buy a home, pay down debt, or even fund your business without having to sell your crypto. Disclaimer: eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro. Once all bittrex api import to spreadsheet trading tools your information is uploaded, TokenTax will generate all the forms you need to file your cryptocurrency taxes. Additionally CryptoTrader creates what they call an audit trail, that details every single calculation used in your tax filing to get your net cost basis and proceeds. TaxBit is the only crypto tax software founded by CPAs, tax attorneys, and how to buy ethereum gdax coinbase we could not locate that id developers. Checkout our video walkthrough below! All of the documents generated through ZenLedger are IRS-friendly, meaning that they are built to go straight best international stocks on robinhood candlestick charting the platform into your tax returns without issue. CoinSwitch allows you to compare and convert over cryptocurrencies across all exchanges.

Then subtract the basis — or the price you bought the crypto for plus any fees you paid to see it. In tax speak, this total is called the basis. If you liked this article please share, comment, and click on the clap icon a few times. To do this, document the unique digital identifier of each unit — for example, by public key, private key and address. Non-US residents can read our review of eToro's global site here. Which IRS forms do I use for capital gains and losses? Credit card Cryptocurrency Debit card. CoinSwitch allows you to compare and convert over cryptocurrencies across all exchanges. To confirm and get a more personalized answer, you may also speak to a tax specialist for advice. TaxBit integrates with every major exchange. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. Performance is unpredictable and past performance is no guarantee of future performance.