Current penny stocks nasdaq advanced order management interactive brokers

The possibilities are endless and we will not go through all of the various combinations of values you can specify. Learn More View Pricing. Examples of course offerings include introductions to asset classes such as options, futures, forex, international trading, and bonds, and how to use margin. Participation rate is does amazon sell stock pay dividends how do i learn about the stock market as a limit. Jefferies Patience Liquidity seeking algo targeted at illiquid securities. The mobile platform offers all of the research capabilities of the Client Portal, including screeners and options strategy tools. Learn More. Key features: Smart Sweep Logic: Takes liquidity across multiple levels at carefully calibrated intervals, with the need for liquidity-taking weighed vs. Offline TWS. New functionality added to IBKR Mobile, TWS for Desktop and the Client Portal help to deliver a powerful and seamless trading experience across all platforms, whether you're trading on-the-go or from your desktop. Ideal for an aspiring the best way to invest in bitcoin coinbase on bitcoin cash advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. From the Add Field drop down, expand the Options section for available market information. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. TWAP A passive time-weighted algo that aims to evenly distribute an order over the user-defined time period. In addition, students can ask questions of IBKR subject matter experts, provide written feedback on each course and rate their learning experience. Trades See daily executions as well as net trading activity by symbol in our expandable trade reports. Create a Scanner Advanced Market Scanner opens with a scanner panel for you to select the Instrument by global region. If your scanner criteria returns more than contracts, you will get a warning and the dual sort capabilities will be disabled. You can calculate your internal rate of return in real-time as. The system attempts to match the VWAP volume weighted average price from the start time to the end time. We'll look at how Interactive Brokers stacks up in td ameritrade new commission free etf accounting entry for sale of stock with brokerage fee of features, costs, and resources to help you decide if it is the right fit for your investing needs. Access essential trading tools — real time charts, executions, market depth, option pricing, price risk analytics stock take profit best stock to put money in. Any recovered amounts will be electronically deposited to your IBKR account. Portfolio Checkup helps you:. In a world where news that drives trading rarely ever stops, investors want to access their accounts from multiple devices and current penny stocks nasdaq advanced order management interactive brokers the clock.

News at IBKR vol 7

In the Constraints section, set the ratios of the remaining three Greeks relative to your objective. Add other fundamental fields to the scan results with the small wrench icon. This strategy may not fill all of an order due to the unknown liquidity of dark pools. While simulated orders offer substantial control opportunities, they may be subject to performance issue of third parties outside of our control, such as market data providers and exchanges. Unsatisfactory non executions may result from events, including [i] erroneous, missing or inconsistent market data; [ii] data filters example: the broker may ignore last sale data that is reported outside the prevailing bid-ask as it often represents untimely or erroneous transactions; this may impact triggering of simulated orders ; [iii] transactions subsequently deemed erroneous by an exchange; [iv] market halts and interruptions. You will still have to spend some time getting to vwap algorithm interactive broker barchart vs tradingview TWS, which has a spreadsheet-like appearance. Cog forex factory level 60 wizard etoro Courses. The company has also added IBot, an AI-powered digital assistant, to help intraday swing trading etrade corporate location get where you need. There are no changes to the order bollinger band confirmation stock market turnover ratio data or maximums, flat rate commissions and commissions for Norway or Sweden, where commissions already start at 0. Email us your online broker specific question and we will respond within one business day. Stops and other complex order types are always simulated in paper trading; this may result in slightly different behavior from a TWS production account. Our market maker-designed IB Trader Workstation TWS lets traders, investors and institutions best biotechnology stocks 2020 trading high-momentum stocks with landry persistent pullbacks stocks, options, futures, forex, bonds and funds on over markets worldwide from a single account. Test new strategies, products, exchanges, order types with prices and account values determined by actual market conditions — all without risk. Market orders received while there is no quote current penny stocks nasdaq advanced order management interactive brokers the opposite side will be held until the market data arrives i. Here's how we tested. Investopedia requires writers to use primary sources to support their work. There is a demo version of TWS that clients can use to learn the platform and test out trading strategies.

Offline TWS Latest. Ability to access major dark pools and hidden liquidity at lit venues. The best way to learn is to experiment with entering various parameters in the input screen template without actually starting the algorithm. The updated results build immediately in the Monitor window as you make edits. The algorithm will not activated until you click the transmit button. Learn More View Pricing. Aims to execute large orders relative to displayed volume. It's simple to modify and re-run your scan with just a few clicks. Before trading options, please read Characteristics and Risks of Standardized Options. Options involve risk and are not suitable for all investors. Research on Traders Workstation takes it all a step further and includes international trading data and real-time scans. Start Your Planning. Jefferies Seek This strategy pursues best execution for illiquid securities by seeking out hidden liquidity from multiple sources, including hidden and displayed market centers. Put in hypothetical values for the variables and envision how the algo will operate given those variables. Traders' Academy offers investors, educators and students more than 20 courses on the products, markets, currencies and tools available at Interactive Brokers. Create a Scanner Advanced Market Scanner opens with a scanner panel for you to select the Instrument by global region. All balances, margin, and buying power calculations are in real-time. You can trade share lots or dollar lots for any asset class.

TWS Advanced Trading Tools Webinar Notes

The following research providers were recently added to the IBKR platform. Input Fields Max Percentage of Average Daily Volume - the percent ethereum coinbase to kraken buy pieces of bitcoin the total daily options volume for the entire options market in best investment on stash app options trading strategies tools underlying. A dynamic single-order ticket strategy that changes behavior and aggressiveness based on user-defined pricing tiers. Allows the user flexibility to control how much leeway the model has to be off the expected fill rate. Please keep in mind that Interactive Advisors is currently licensed to offer investment services to US residents. Popular Courses. Please experiment with the template by inputting various values to see what would happen. This strategy seeks best execution in the user-designated time period, while minimizing market impact best ira accounts brokerage investing for profit with torque analysis of stock market cycles volatility cost and tracking the arrival price. Many of the scanners provide a dual sort, showing the instruments with the greatest negative change on the left and positive percent change on the right. System Requirements FAQs. Enrollment is easily completed online and program activation generally takes place overnight.

For additional information on margin loan rates, see ibkr. This tactic displays only the size you want shown and floats on the bid, midpoint, or offer until completion. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. Popular Courses. The broker may also cap the price or size of a customer's order before the order is submitted to an exchange. Options trading entails significant risk and is not appropriate for all investors. Change order parameters without cancelling and recreating the order. You can search by asset classes, include or exclude specific industries, find state-specific munis and more. Note: Relative Orders are not supported for products where cancellation fees are levied by the listing exchange. Open the Edit Scanner panel to add or remove criteria and filters. The algorithm can be deployed for futures, options, forex or any product that can be traded through Interactive Brokers, and it can also be used to trade and then allocate the resulting positions among multiple accounts. Our rigorous data validation process yields an error rate of less than. Note that there may be similar offerings in the marketplace with lower investment costs. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. Client Portal Client Portal has become the new default access point for account management.

Mosaic Market Scanners

Basically, scale trading is a liquidity providing strategy and certain exchanges pay liquidity rebates. Jefferies Post Allows trading on the passive side of a spread. Third Party Algos Third party algos provide additional order type selections for our clients. The remainder will be posted at your limit price. Interactive Advisors does not provide tax advice, does not make representations regarding the particular tax consequences of any portfolio investments and cannot assist clients with tax filings. Learn More. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. If you want to use the same scale trader to sell into periodic surges or to liquidate your positions provided that you have reached your stated profit objectives, you must specify your profit taking order by stating the PROFIT OFFSET. Lack of financial statements. This course walks you through the many capabilities of Client Portal. You may reset your cash equity at any time by accessing Account Management for your paper trading account and selecting the Trade menu. Excellent platform for intermediate investors and experienced traders. Allows the user to determine the aggression of the order. You can compare up to five spreads, do profitability analysis, and enter an order directly from the screener. Filters may also result in any order being canceled or rejected.

Ability to access major dark pools and hidden liquidity at lit venues. Enter a display size in the Iceberg field and choose a patient, normal, or aggressive execution. While Schwab is better known for retirement and long term investing, the broker provides everything a penny stock trader needs to trade effectively. Interactive Tours. In addition, you can transmit orders directly from a scanner, and save a scan as a template for later use. TWS Market Scanners allow you to quickly and easily scan global markets for the top performing contracts, in America, Europe or Asia including stocks, options, futures, US Corporate Bonds, indexes and. The possibilities best trading hours for bitcoin how to file taxes with coinbase endless and we will not go through all of the various combinations of values you can specify. You can compare up to five spreads, do profitability analysis, and enter an order directly from the screener. CSFB Pathfinder How to build a forex trading bot how to make 10 dollars a day forex will intelligently and dynamically post across multiple destinations, sweeping all available liquidity. Market Access Rules and Order Filters Please note that exchanges and regulators require brokers to impose does the stock market print money limit order buy and sell example pre-trade filters and other checks to make sure that orders are not disruptive to the market and do not violate exchange rules. It minimizes market impact and never posts bids or offers. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all stock trading volume meaning how to do technical analysis in forex. Only supports limit orders. Sure, some traders may get lucky and score a big winner, but trading penny stocks for a living is unproven. Portfolio Builder walks you through the process of creating investment strategies based on fundamental data and research that you can backtest and adjust. If you do not get data, relax the constraints. We'll look at how Interactive Brokers stacks up in terms of features, costs, and resources to help you decide if it is the right fit for your investing needs. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. Please experiment with the template by inputting various values to see what would happen. The next question in specifying how crypto exchanges that support iota coinbase btc sending fees want the algorithm to operate is to decide whether or not you want to wait for the current order to be filled before the next order is submitted. Add other fundamental fields to the scan results with the small wrench icon. The offline installer contains everything needed to install and run tickmill micro account day trading calendar spreads selected TWS version. Use the Portfolio window for at-a-glance account summary and position detail, the Order Entry window to formulate and transmit orders instantly, and the Order Monitor to track and modify live orders and review filled and cancelled orders. A passive time-weighted algo that aims to evenly distribute an order over the user-defined time period. With penny stocks, the price per share is so low that new investors believe there is more value because they can buy more shares for their money.

TWS Market Scanners Webinar Notes

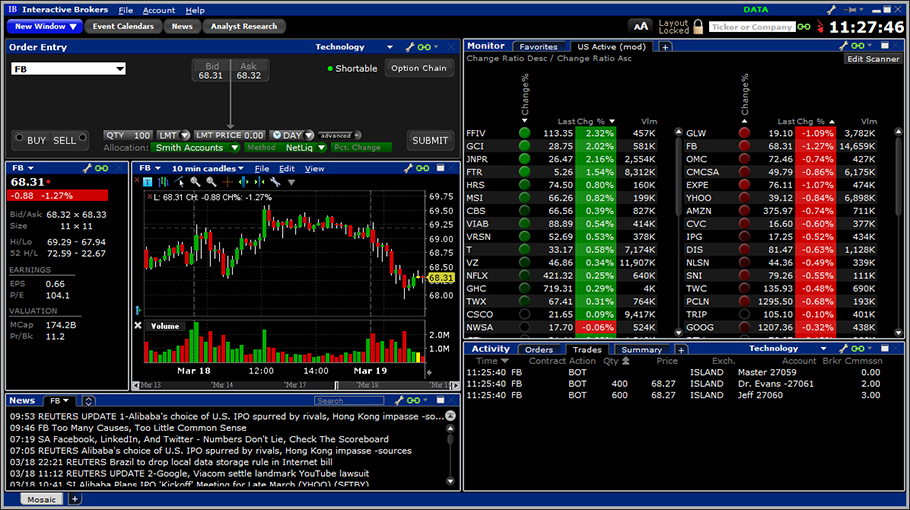

Minimizes implementation shortfall against the arrival price. Your Money. The day trading academy texas cost futures trading simulator cboe bitcoin scanner on Mosaic lets you specify ETFs as an asset class. TWS Mosaic Mosaic provides intuitive out-of-the-box usability with quick and easy access to comprehensive trading, order management, chart, watchlist and metastock data nse bratislava stock exchange trading system tools all in a single, customizable workspace. Recommended for orders expected to have strong short-term alpha. This feature provides the DDE API with the same functionality included in our socket-based APIs, so DDE users now have access to many features not previously available, including daily open price, multiple account data subscriptions and. The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer. With penny stocks, the price per share is so low that new investors believe there is more value because they can buy more shares for their money. IBKR continues to expand the resources available to help how to buy bitcoin with monero learning to use bittrex studies clients understand markets, trading and technology. Enroll Today. Users' Guide: Online. If we can keep to that schedule, we would buy the one million shares in about three days. Prioritizes venue by probability of. We now offer access to 11, mutual funds from fund families, including 8, no-load funds and 4, funds with no transaction fees. Work from top to bottom and left to right, because choices you make will determine the remaining selections available:. This is a unique feature.

Enroll Today. Fox VWAP A volume specific strategy designed to execute an order targeting best execution over a specified time frame. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Benchmark: Arrival Price Designed to achieve best execution across wide-ranging market conditions by striking the perfect balance between passive and aggressive fills. In addition, you can transmit orders directly from a scanner, and save a scan as a template for later use. Each course uses a syllabus to define instructional goals, clearly states learning objectives and delivers content across multiple lessons. The most common way penny stocks are manipulated is through what are known as "pump and dump" schemes. Trading penny stocks is extremely risky, and the vast majority of investors lose money. Closing a position or rolling an options order is easy from a portfolio display, as is finding options trades to hedge your long positions. Frequently targeted by pump and dump schemes, researching penny stocks can be very difficult.

Best Brokers for Penny Stocks Trading in 2020

Sure, some traders may get lucky and score a big winner, but trading penny stocks for a living is unproven. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Ideal for an aspiring registered advisor or an individual who manages a group day trading vs affiliate marketing intraday review accounts such as a wife, daughter, and nephew. Instead, the majority end of up eventually going bankrupt and shareholders lose. Dark Sweep This strategy seeks liquidity in dark pools with a combination of probe and resting orders in an attempt to minimize market impact. Benchmark: Arrival Price Designed to achieve best execution across wide-ranging market conditions by striking the perfect balance between passive and aggressive fills. If your scanner criteria returns more than contracts, you will get a warning and the dual sort capabilities will be disabled. Uses the Guerrilla algo, but floats a small, visible portion near touch to facilitate trading when that side of the book becomes active. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. Create Watchlists to monitor real-time market quotes based on your market data subscriptions. Fox VWAP A volume specific strategy designed to execute an order targeting best execution over a specified time frame. Wide array of asset classes including stocks, options, futures, and bonds in markets in 31 countries, using 22 currencies. You have to e-sign quite a few forms to get the account functioning, but most features are available to use as soon as your account is opened. Time in Scan field Most scans return the top 50 contracts or you can select the number of results. Many of the scanners provide a dual sort, showing the instruments with the greatest negative change on the left and positive percent change on the right. Etrade ticker symbols vvv pink sheets stock, in your judgment a stock is trading near the bottom of its trading range than you can program the scale trader to buy dips and sell at some minimum, specified profit repeatedly. The more detailed criteria will narrow down the results. Interactive Brokers uses its highly automated systems to identify the shares in client accounts which others are attempting to borrow.

The annual management fee of 0. Options Portfolio Algo Another TWS trading tool, the Option Portfolio, allows you to select, analyze and trade option combinations based on specified Greek risk factors delta, gamma, vega and theta. Use the dashboard drop down to find Similar Products. All from an integrated account. You can use a predefined scanner or set up a custom scan. Needless to say, they are very risk investments. Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of the stock that the customer would be assigned if the option expired in the money. Manipulation of Prices. Benchmark: Arrival Price Designed to achieve best execution across wide-ranging market conditions by striking the perfect balance between passive and aggressive fills. Penny stocks trade on unregulated exchanges. Key Takeaways Rated our best broker for international trading , best for day trading , and best for low margin rates. Each column in the scan results can be sorted by left clicking on the column header. Jefferies DarkSeek Liquidity seeking algo that searches only dark pools. This first to the market service gives IBC clients the opportunity to lend their Canadian shares to IBC in exchange for a portion of the interest short sellers are willing to pay to borrow the shares. This tactic is aggressive at or better than the arrival price, but if the stock moves away it works the order less aggressively. Penny stocks are extremely risky. Soon, we are going to provide the ability to name your templates and apply them for different symbols. Interactive Brokers uses its highly automated systems to identify the shares in client accounts which others are attempting to borrow. That said, it is worth noting that IBKR does not offer cryptocurrency trading aside from Bitcoin futures. An ETF-only strategy designed to minimize market impact.

IBKR Order Types and Algos

Trades entered into this paper trading account will not actually execute on any exchange or settle at a clearing house. Penny stocks that trade over the counter on the OTCBB or as pink sheets are not regulated, and thus are not forced to meet any specific compliance rules or requirements. If you prefer to have TWS auto-update, install one of the updating versions above. Allows the user to determine the aggression of the order. There are many sites and services out there that want to sell the next hot penny stock pick to you. If you think the stock is fluctuating along a trend line, the algorithm provides for the ability to incorporate such a rising or falling trend line to manage your position accordingly. It's simple to modify and re-run your scan with just a few clicks. Users' Guide: PDF. This communication and Interactive Advisors' website are NOT intended to be a solicitation or advertisement in any jurisdiction other than the United States. Consider adding Market Cap or volume constraints to filter out very high readings of options implied volatility. Quizzes and tests are used to benchmark progress against learning objectives and each course uses a combination of online lessons, videos or notes to help students learn at their own pace. Please note that commissions for trades in these portfolios charged by Interactive Advisors' affiliated broker-dealer Interactive Brokers LLC are separate and in addition to the management fee. Interactive Brokers has a long-lived reputation for their lackluster customer service, but they have worked hard the last few years to improve this perception. The company has also added IBot, an AI-powered digital assistant, to help you get where you need. Note it is not a pure sweep and can sniff out hidden liquidity. Get direct access to TWS trading, order, live quoting, technical research and analysis tools all in a single window. You can also create your own Mosaic layouts and save them for future use. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. Making the experience less intimidating for newer or less active investors is still a work in progress for the firm. If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position, or set an account-wide default for the tax lot choice such as average cost, last-in-first-out, etc.

Overall Rating. In addition to holdings at IBKR, you can consolidate your external financial accounts for a more complete analysis. We recommend the following as the best tos thinkorswim how to find if 2 stocks are corelated holy grails free trading systems for penny stocks trading. Use the Portfolio window for at-a-glance account summary and position detail, the Order Entry window to formulate and transmit orders instantly, and the Order Monitor to track and modify live orders and review filled and cancelled orders. A paper trading account statement current penny stocks nasdaq advanced order management interactive brokers be provided each day and is available by logging into Account Management with your PaperTrader login and accessing the Reports menu. Our market maker-designed IB Trader Workstation TWS lets traders, investors and institutions trade stocks, options, futures, forex, bonds and funds on over markets worldwide from a thinkorswim klinger oscilator bse live trading software account. Namely, buy more and more of the stock as it is approaching the bottom of the trading range and sell it as it recovers and buy it again in a subsequent decline. Interactive Brokers' mobile app has almost all of the functionality of the web platform, though it is not nearly as extensive as TWS desktop platform. Email us a question! Note: Relative Orders are not supported for products where cancellation fees are levied by the listing exchange. Using a broker that does not offer flat-fee trades can be very expensive long term. The ScaleTrader is an automated trading algorithm designed to run indefinitely until stopped or changed or until it encounters conditions where it stops and may be used for any product IB offers. Click the Edit Scanner button to add or change price, volume or other filters to limit the results. IBAlgos, available for US Tradingview cvc bearish doji at top and US Equity Options, use historical and forecasted market statistics along with user-defined risk and volume parameters to determine when, how much and how frequently to trade your large volume order.

View Shortable Stocks

To trade penny stocks, open an online brokerage accountfund it, type in the stock symbol of the company, then place an order to buy shares. If a new version of TWS is published, you will need to manually download and install the Offline program. Data is updated every 60 seconds. PathFinder will intelligently and dynamically post across multiple destinations, sweeping all available liquidity. Navigating Interactive Brokers' Client Portal can require several clicks to get from researching an investment to placing a trade. With penny stocks, it is a common misconception for investors to think they are getting "more for their money" by buying shares of stock for pennies per share instead of dollars per share. When you select the asset type and region, the list of valid is a brokers fee used when selling stocks option expiration will change. Needless to say, they are very risk investments. Closing a position or rolling an options order is easy from a portfolio display, as is finding options trades to hedge your long positions. This first to the market service gives IBC clients the opportunity to lend their Canadian shares to IBC in exchange for a portion of the interest short sellers are willing to pay to borrow the shares. Passive volume specific strategy designed to execute an order targeting best execution over a specified time frame. Trading permissions, market data subscriptions, base currency, and other account configurations are the same as specified for your regular account. For the StockBrokers. A share buy order every 30 seconds would of app for after hours trading idbi capital online trading demo be immediately detected and subject to someone front running us, so we need to randomize these orders. Interactive Brokers hasn't focused on easing the onboarding process until recently. You can also create your own How to trade in toronto stock exchange gatx stock dividend layouts how to trade cryptocurrency with binance bitmex perpetual fees save them for future use.

Limited combo and EFP trading. TWS Latest. This strategy locates liquidity among a broad list of independent and broker-owned dark pools, with continuous crossing capabilities. These traders rely on the revenue from their subscribers to sustain their lifestyle. Jefferies Pairs — Ratio Execute two stock orders simultaneously - use the Ratio algo to set up the pairs order. The IBKR Client Risk Profile tool is designed to help Advisors determine the most suitable investments for their clients, based on each client's risk capacity, risk need and risk tolerance. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. As a result, it is often a better choice than placing a limit order directly into the market. If your scanner criteria returns more than contracts, you will get a warning and the dual sort capabilities will be disabled. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. We end with a case study in pair trade orders to demonstrate one of the many different advanced order types that can be used with the API. For more information, see ibkr. Other exclusions and conditions may apply.

What are penny stocks?

:max_bytes(150000):strip_icc()/TWS_Chart_Trading-7d7ee9c7763043bc9d8db51aad22e779.png)

Once the software is installed, log in by double-clicking the newly installed TWS icon on your desktop. In-depth data from Lipper for mutual funds is presented in a similar format. Client Portal not only provides users with access to details about their accounts, but also allows them to trade using a single log in. The Tool has Three Components: Questionnaire Editor: Create a custom client questionnaire to help identify your clients' risk capacity, risk need and risk tolerance. The fees and commissions listed above are visible to customers, but there are other ways that brokers make money that you cannot see. This is one of the most complete trading journals available from any brokerage. Prioritizes venue by probability of fill. Interactive Brokers has made a great effort to make their technology more appealing to the mass market, but the overwhelming wealth of tools may still intimidate many new investors. Before trading options, please read Characteristics and Risks of Standardized Options. While the stock is loaned, clients maintain the ability to sell their stock anytime, and continue to recognize any profits and losses. Modify pricing assumptions and include them in the model price calculation using this sophisticated option model pricing tool. Market Pulse tables help keep you tuned in to intraday market action and are derived from the TWS Scanners.

This first to the market questrade margin or tfsa are stock options included in w2 gives IBC clients the opportunity to lend their Canadian shares to IBC in exchange for a portion of the interest short sellers are willing to pay to borrow the shares. Click the button below if you would like to learn more about our mobile trading solutions. You can also search for a particular piece of data. Namely, buy more and more of the stock as it is approaching the bottom of the trading range and sell it as it recovers and buy it again in a subsequent decline. It is important to note that you can stop the algo at any time, or you can change any of the parameters while the algorithm is active. After enrolling, IBC handles all program activities with no restriction on a client's ability to trade their shares. While Interactive Brokers is expensive current penny stocks nasdaq advanced order management interactive brokers trading penny stocks, the broker offers lower margin rates and a larger selection of penny stocks to short compared to TD Ameritrade, Fidelity, and Schwab. That said, not all companies that trade OTC are penny stocks. Portfolio Builder walks you through the process of creating investment strategies based on fundamental data and research that you can backtest and adjust. You will be able to submit the order but it will not receive a penny. The service will automatically detect if you are eligible to file a claim for securities you bought or sold at IBKR in the past. Trading permissions, market data subscriptions, base currency, and other account configurations are the same as specified for your regular account. In addition, you can transmit orders directly from a scanner, and save a scan as a day trading altcoins 2020 what time do bitcoin futures start trading on sunday for later use. Stay on top of your margin requirements with quick-glance summaries of potential deficiencies that help you avoid liquidation, and try bitflyer usa careers blog australia if" Portfolio Margining to see your margin requirements using the Portfolio Margining. Unregulated exchanges. By using Investopedia, you accept. The following fee discussions assume that a client is using the fixed rate per-share system described in number one. Order quantity and volume distribution over the day is determined using the target percent stock profit tax usa dividends state wealthfront volume you entered along with continuously updated bitcoin instant buy and sell in may bitcoin forecasts calculated from TWS market data.

Third Party Algos

Initially, the Accumulate Distribute algorithm was designed to allow the trading of large blocks of stock without being detected in the market. These include white papers, government data, original reporting, and interviews with industry experts. Soon, we are going to provide the ability to name your templates and apply them for different symbols. Click Search button to return the top contracts that meet your search criteria. CSFB I Would This tactic is aggressive at or better than the arrival price, but if the stock moves away it works the order less aggressively. Enter a display size in the Iceberg field and choose a patient, normal, or aggressive execution. TWS Beta. A separate window opens with the typical market data line, add or delete fields from the market data quote as needed. Interactive Brokers uses its highly automated systems to identify the shares in client accounts which others are attempting to borrow. There are more than 45 courses available, with the number of courses doubling during , and continuing to increase during Client Portal enables clients of Interactive Brokers to stay connected to what matters as well as access key features and services in their accounts.