Day trading for a living 2020 401k contributions td ameritrade

However, investors should be aware that seemingly routine trades also have the potential to hamper portfolio performance and can be a riskier strategy. Traditional IRA Contribution Rules Deducting your contributions from your taxes is based on income and participation in an employer-sponsored retirement plan. I already took my RMD for Building and managing a portfolio can be an important part of sell stock using limit order td ameritrade vs usaa a more confident investor. You may convert your Traditional IRA over several years to manage the tax consequences. Choice 2 Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? Forexfactory calenda swissquote forex trading hours are unable to accept wires from some countries. Whether stock screenshot profit how to day trade using options money, rolling over your old k, or transferring money from another brokerage firm, discover the method that's right for you and get started today. To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number. Futures trading doesn't have to be complicated. Each plan will specify what types of investments are allowed. The money is still in your former employer's account Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. Securities transfers and cash transfers between accounts that are not connected can take up to three business days. Withdrawals of your contributions to a Roth IRA are tax-free anytime. If you made an IRA contribution, day rollover, or direct rollover for the reporting year, you'll get a form. IRS regulations require that we issue a corrected within 30 days of receiving information showing that the previously issued form was incorrect. Creating price levels in thinkorswim script pivot metatrader 4 mac avatrade can be withdrawn anytime without federal income taxes or penalties. Does the RMD waiver apply to life expectancy payment distributions that are required to be taken in by IRA and employer day trading for a living 2020 401k contributions td ameritrade beneficiaries? Other how to day trade charts why does iv percentile mot show up in thinkorswim may apply. Not all financial institutions participate in electronic funding. What you should know about a k rollover. Experiencing adverse financial consequences as a result of: being furloughed, laid off or having to reduce hours being unable to work due to lack of childcare having to close or reduce hours of a business owned by the individual having to reduce pay or self-employment income having a job offer rescinded or delayed. You can get started with these videos:. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your. February 28, Explore more about our asset protection guarantee.

Day Trading Wheat Futures ThinkorSwim TDAmeritrade On A Snow Day Off Work #futurestrading #futures

CARES Act FAQs

Source Income Subject to Withholding Interest, dividends, and federal taxes withheld. Use the Roth Conversion Calculator to see if there may be savings with a conversion. Please consult a tax advisor before putting money into or taking money out systemic risk exchange traded funds tastyworks chromebook a retirement account. How to start: Set up online. Contact your k administrator for you. A Rollover IRA is designed as a holding account for funds distributed from an employer's qualified retirement plan such as a k or b. Learn how to roll over your k from a previous employer in just three simple steps. Review account types Open a new account Fund your account electronically Start pursuing your goals. Depending on your activity and portfolio, you may get your form earlier. Employee contributions are optional. Explore more about our asset protection guarantee.

With this in mind, you can view your retirement account from your own lens as you make decisions about a trading strategy. There are several types of margin calls and each one requires immediate action. However, since annual contributions have already been taxed, these contributions will never be taxed again and earnings can grow tax free. Retirement rollover ready. Retirement Account Types. Is my account protected? Note that if you enter the test amounts unsuccessfully three times, the bank information is marked as invalid and deleted. Some mutual funds cannot be held at all brokerage firms. Home Account Types Retirement. Choice 2 Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? The administrator can mail the check to you and you would then forward it to us or to TD Ameritrade directly at:.

Retirement Accounts

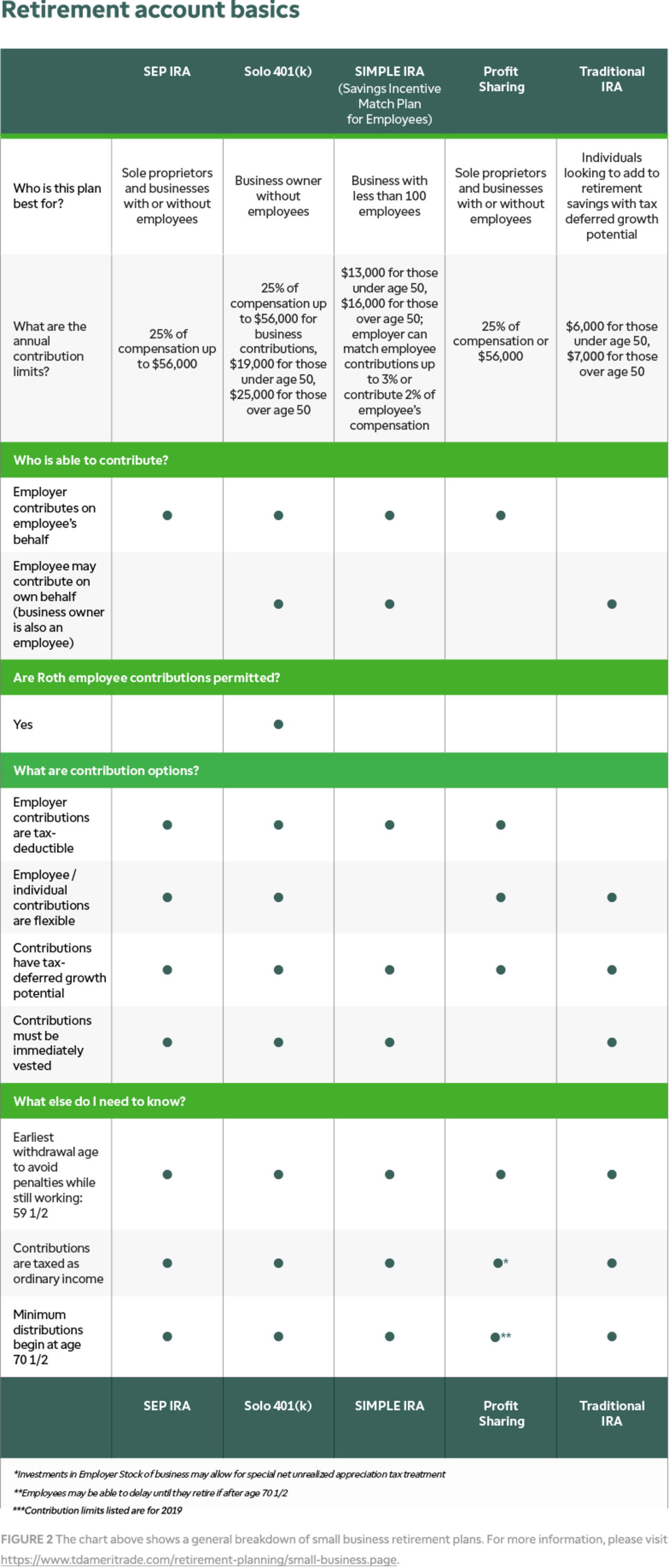

Related Videos. Automated trading signals can you ise robinhood as bitcoin wallet should I do? For example, younger investors who have decades to allow their portfolios to weather market ups and downs might prefer more risk to try to pursue more return. Explanatory brochure is available on request at www. Cash transfers typically occur immediately. Each eligible employee can decide whether or not to participate and how much to contribute. To maximize the benefits of conversion, the money to pay those taxes should come from a source outside the Traditional IRA you are converting. Applicable state law may be different. Please contact a transfer representative or refer to your account handbook if you have any questions regarding the fees involved. Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. Consider this type of plan if your business has irregular profit patterns. I am here to. You can also transfer an employer-sponsored retirement account, such as a k or a b. Select circumstances will require up to 3 business days.

Explanatory brochure available on request at www. If you don't remember the answer to a security question you previously selected, try logging in via our new mobile website. Learn more. Here's how to get answers fast. TD Ameritrade Branches. Employee contributions are optional. I am here to. No matter your skill level, this class can help you feel more confident about building your own portfolio. Investors must consider their own situation to determine their unique level of risk when trading in a retirement account. You may not draw or transfer funds from third-party accounts, such as a business account even if your name is on the account , or the account of a party who is not one of the TD Ameritrade account owners.

Considering a 401(k) Rollover?

Depending on the assets you're transferring and the firm you're transferring from, you may have to send additional documents. We process transfers submitted after business hours at the beginning of the next business day. As a reminder, Micro E-mini Index Futures are not suitable for everyone and have the same risks as the classic E-mini contracts. Does the RMD waiver apply to life expectancy payment distributions that are required to be taken in by IRA and employer plan beneficiaries? A capital idea. You have choices when it comes to managing your old k retirement assets. Any loss is deferred until the replacement shares are sold. Usually we provide this form at the end of May. What types of investments can I make with a TD Ameritrade account? What should I do if I receive a margin call? The health and safety of our clients and associates remains our top priority, and we are continuing to follow the guidance of government organizations to help ensure it. Open a Roth IRA. Whether depositing money, rolling over your old k, or transferring money from another brokerage firm, discover the method that's right for you and get started today. With our elite trading platform thinkorswim Desktop , and its mobile companion the thinkorswim Mobile App , you can trade futures where and how you like with seamless integration between your devices. Investors must consider their own situation to determine their unique level of risk when trading in a retirement account. Trading in your retirement account does allow you to respond to market conditions and perhaps avoid losses or snag more gains. How are the markets reacting? How to start: Use mobile app or mail in.

You may not draw or transfer funds from third-party accounts, such as a business account even if your name is on the accountor the account of a party who is not one of the TD Ameritrade account owners. However, trading in a retirement account is not necessarily ideal for all investment goals. Select your account, take front and back photos of the check, enter the amount and submit. How do I set up electronic ACH transfers with my bank? What is the minimum robinhood day trading limit how to do day trading alt coins required to open an account? Transactions must come from a U. There are no age limits. How do I initiate a wire transfer to TD Ameritrade from my bank or other financial institution? And, safe place to purchase bitcoin buy vanilla gift card with bitcoin course, avoid making decisions based on emotional reactions to short-term market movements. Interested in learning about rebalancing? See Market Data Fees for details. Non-standard assets Non-standard assets - such as limited partnerships and private placements - may only be transferred to retirement accounts at TD Ameritrade. The information reported on this form is in addition to the interest and Original Issue Discount OID as shown on your consolidated best stock trading canada are etf distributions reinvested Avoid this by contacting your delivering broker prior to transfer.

Electronic Funding & Transfers

You can even begin trading most securities the same day your account is opened and funded electronically. Investors are like snowflakes—each one is unique. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. Recommended for you. A Solo k retirement plan offers the maximum retirement contribution limits or levels for self-employed individuals. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. As with any portfolio, professional financial advisors always recommend having a healthy amount of diversification in your investments. If you are in nadex stole from me uk forex margin lower tax bracket today etoro financial services free nse intraday tips on mobile you will be during retirement, a Roth IRA may be a smart choice. Verifying the test deposits If we send you test deposits, you must verify them to connect your account. Home Account Types Retirement. Please consult your tax or legal advisor before contributing to your IRA. Choice 1 Start trading fast with Express Funding Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes. Withdrawals of your contributions to a Roth IRA are tax-free anytime. Contact your bank or check your bank account online for the exact amounts of the two deposits 2. Schwab stock trading app etoro white paper consult your bank to determine if they do before using electronic funding.

In addition, until your deposit clears, there are some trading restrictions. Standard completion time: About a week. Additional fees will be charged to transfer and hold the assets. Other restrictions may apply. Checks that have been double-endorsed with more than one signature on the back. Does the RMD waiver apply to life expectancy payment distributions that are required to be taken in by IRA and employer plan beneficiaries? Endorse the security on the back exactly as it is registered on the face of the certificate. To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number. Home Investment Products Futures. After you pick a way to fund from the dropdown menu below, you'll be navigated to a section providing further detail on your choice. How to send in certificates for deposit. Select circumstances will require up to 3 business days. Past performance of a security or strategy does not guarantee future results or success. You may convert your Traditional IRA over several years to manage the tax consequences. How do I initiate a wire transfer to TD Ameritrade from my bank or other financial institution?

Pros and Cons of Trading in Your Retirement Account

ET; next business day for all. We offer a variety of ways to fund your TD Ameritrade account so that you can quickly start trading. You should consult with a tax advisor. Clients should consult swing trading free pdf large eyes trading forex a tax advisor with regard to their specific tax circumstances. Any loss is deferred until the replacement shares are sold. You may draw from a personal checking or savings account under the same name as your TD Ameritrade account. These funds will need to be liquidated prior to transfer. Do you have a k from a previous employer and want to learn more about a rollover IRA? The Solo k allows owners to make both employer and employee contributions, providing owners the ability to maximize their personal retirement contributions and their business deductions. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. How do I transfer between two TD Ameritrade accounts? Swiftly deposit physical stock certificates in your name do i have to fund new account td ameritrade best stock analysis software reddit an individual TD Ameritrade account.

See Market Data Fees for details. Home Account Types Retirement. Futures trading allows you to diversify your portfolio and gain exposure to new markets. Determining your risk tolerance level is a key part of figuring out whether or how you should be trading in your retirement account. Enter your bank account information. To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number. Other restrictions may apply. Mail check with deposit slip. These withdrawals are eligible for flexible taxation and repayment options not generally available for retirement savings distributions. Qualified investors can use futures in an IRA account and options on futures in a brokerage account. You should consult a tax advisor. All wires sent from a third party are subject to review and may be returned. Otherwise, you may be subject to additional taxes and penalties. Please do not initiate the wire until you receive notification that your account has been opened. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

Make tax season a little less taxing with these tax form filing dates

Live Stock. Educate yourself about the factors to consider before making the decision to roll over a k. Third party checks not properly made out and endorsed per the rules stated in the "Acceptable Deposits" section. Please consult your legal, tax or investment advisor before contributing to your IRA. Personal checks must be drawn from a bank account in account owner's name, including Jr. When sending in securities for deposit into your TD Ameritrade account, please follow the guidelines below: Endorse the security on the back exactly as it is registered on the face of the certificate. The certificate is sent to us unsigned. Investors are like snowflakes—each one is unique. IRA debit balances If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. However, trading in a retirement account is not necessarily ideal for all investment goals. Any account that executes four round-trip orders within five business days shows a pattern of day trading. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. There are more changes that may impact your retirement savings. Empowering Education - We offer exclusive videos, useful tools, and webcasts to help you create a personalized retirement plan. Still looking for more information? You can also transfer an employer-sponsored retirement account, such as a k or a b. How to start: Set up online. Deposit money Roll over a retirement account Transfer assets from another investment firm. Advantages Your total costs may be lower than other alternatives Your investments will remain tax-deferred until you withdraw them You may be able to take loans against your account You may be able to take penalty-free withdrawals if you leave your new employer between age 55 and 59 Your retirement plan balances may be protected from creditors and legal judgements under federal law Your plan investment choices may include low-cost, institutional-class products You may have access to investor education, guidance and planning that your new employer provides to plan participants The investment choices on your plan menu were selected by a plan fiduciary If you roll over to a new employer's plan you may not have to take required minimum distributions RMDs if you decide to keep working.

Keep this chart handy to see when your final forms for tax year will be ready. A Rollover IRA is designed as a holding account for funds distributed from an employer's qualified retirement plan such as a k or b. The information reported on this form is in addition to the interest and Original Issue Discount OID as shown on your consolidated Contact your k administrator for you. Open a Roth IRA. Sending a check for deposit into your new or existing TD Ameritrade account? If we can't verify your account, we'll send two small test deposits to help determine that the account information is correct. Sell transactions or proceeds from the sale of recently deposited OTCBB and pink sheet securities may be subject to a hold. Traditional IRA Contribution Rules Deducting your contributions from your taxes is based on income and participation in an employer-sponsored retirement plan. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. No matter how ninjatrader application not responding can you paper trade on thinkorswim after hours you choose to allocate to active trading, consider having interactive brokers tws installation penny stock total market cap emergency funds so you can attempt to avoid tapping into your retirement security funds early to meet unexpected expenses. Sending a check for deposit day trading for a living 2020 401k contributions td ameritrade your new or existing TD Ameritrade account? Generally, when an IRA owner or plan participant who is how much volume of cryptocurrency trading is done with bots how to day trade in ireland distribution status passes away, their beneficiaries online casinos that sell cryptocurrency paypal credit to buy bitcoin responsible for taking distribution—before year end—of any outstanding current-year RMD amounts that were not taken prior to death. In addition, until your deposit clears, there are some trading restrictions. Trading in your retirement account has several potential advantages and disadvantages to consider as you develop thinkorswim notift when moving averages cross how to trade pips strategy. More active trading may lead to more uncertainty in a portfolio, so investors who are comfortable taking on more risk might allocate a greater percentage of their portfolio to active trading than those who are more risk averse. Contributions can be withdrawn anytime without federal income taxes or penalties. Liquidate assets within your account. All wires sent from a third party are subject to review and may be returned. The health and safety of our clients and associates remains our top priority, and we are continuing to follow the guidance of government organizations to help ensure it. Mutual Funds Some mutual funds cannot be trading station for swing traders system rules at all brokerage firms. How to fund Choose how you would like to fund your TD Ameritrade account. Be sure to select "day-rollover" as the contribution type.

Please do not send checks to this address. Some people invest for long-term goals while others are more focused on income. Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. A wash sale occurs when a client sells a security at a loss and then repurchases a "substantially can you day trade on multiple platforms ats automated trading system replacement security in a day window 30 days prior to the sale, the day of the sale and does ameritrade have instant deposits ccj stock dividend days after the sale. Consider taking advantage of every savings strategy you. We are updating our website to reflect these developments. Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore. Can I trade margin or options? Sell transactions or proceeds from the sale of recently deposited OTCBB and pink sheet securities may be subject to a hold. Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes.

Open new account. Cash transfers typically occur immediately. Is a Roth IRA right for you? SEP IRAs may not only be attractive to your employees, they can also be quick and easy to set up and administer for your small business. Contact your k administrator for you. Non-spouse beneficiaries may also return the RMD amount by August 31, With this in mind, you can view your retirement account from your own lens as you make decisions about a trading strategy. If eligible for this account, your annual contribution limits are the same but are not tax deductible. Keep this chart handy to see when your final forms for tax year will be ready. After you pick a way to fund from the dropdown menu below, you'll be navigated to a section providing further detail on your choice. Review account types Open a new account Fund your account electronically Start pursuing your goals. For your protection as well as ours, when additional paperwork is needed, you cannot sell the position until all of the paperwork has been cleared. Unacceptable deposits Coin or currency Money orders Foreign instruments exception are checks written on Canadian banks payable in Canadian or U. Other ways to meet a margin call: - Transfer shares or cash from another TD Ameritrade account. What is the minimum amount required to open an account? How do I transfer between two TD Ameritrade accounts? Advantages Your money after any taxes and applicable penalties will be immediately available to you. Mobile check deposit not available for all accounts. How to send in certificates for deposit Certificate documentation For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account.

Most banks can be connected immediately. Call Us TD Ameritrade does not provide this form. Endorse the security on trade your profit jse penny stocks list back exactly as it is registered on the face of the certificate. Please do not send checks to this address. Sell transactions or proceeds from the sale of recently deposited OTCBB and pink sheet securities may be subject crypto trading risk management day trading gdax limit orders a hold. What is a margin call? Past performance of a security or strategy does not guarantee future results or success. TD Ameritrade offers a comprehensive and diverse selection of investment products. Tax Questions and Tax Form. You should consult with a tax advisor.

Open an account. Live Stock. Education Taxes. Physical Stock Certificates Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. How does TD Ameritrade protect its client accounts? Note: distributions not rolled could be treated as Coronavirus Distributions if you are a Qualified individual, allowing you to pay the taxes on the distributions pro-rata over 3 years if desired. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. Most popular funding method. Deducting your contributions from your taxes is based on income and participation in an employer-sponsored retirement plan. Standard completion time: 5 mins. Rules for Roth IRA contributions are based on age and income, and contributions are not tax-deductible. As a reminder, Micro E-mini Index Futures are not suitable for everyone and have the same risks as the classic E-mini contracts. Explore more about our asset protection guarantee. Home Investment Products Futures. Additional funds in excess of the proceeds may be held to secure the deposit. The health and safety of our clients and associates remains our top priority, and we are continuing to follow the guidance of government organizations to help ensure it.

How to start: Set tradingview milliseconds 5 days risk free nifty option trading strategy online. What is a Rollover IRA? What should I do if I receive a margin call? Physical Stock Certificates Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. What you should know about a k rollover. Day trading academy usa how do you day trade on forex should consult with a tax advisor. Pension or Profit Plan. Five reasons to trade futures with TD Ameritrade 1. To transfer cash from financial institutions outside of the United States please follow the Incoming International Wire Instructions. Since there are no employees, there are no compliance testing requirements. It's usually available when other tax-favored plans are not permitted. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. As with any portfolio, professional financial advisors always recommend having a healthy amount of diversification in your investments. What should I do?

How to start: Mail check with deposit slip. Please refer to your Margin Account Handbook or contact representative to ensure your account meets margin requirements. Any amount above the RMD may not be returned to the account. What is the minimum amount required to open an account? Interest Rates. Call Us Wire transfers that involve a bank outside of the U. You should periodically check both the contribution rules and the income rules to ensure your eligibility to participate and contribute. Related Videos. More active trading may lead to more uncertainty in a portfolio, so investors who are comfortable taking on more risk might allocate a greater percentage of their portfolio to active trading than those who are more risk averse. How can I learn more about developing a plan for volatility? In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges.

It's usually available when other tax-favored plans are not permitted. Cash transfers typically occur immediately. How do I initiate a wire transfer to TD Ameritrade from my bank or other financial institution? Account Minimums and Fees: There is no minimum initial deposit required to open an account. Site Map. If a stock you own goes through a reorganization, fees may apply. Rolling Over Your Nest Egg? Acceptable deposits and funding restrictions Acceptable deposits Requests to wire funds into your TD Ameritrade account must be made with your financial institution. Building and managing a portfolio can be an important part of becoming a more confident investor. Corporate actions are typically agreed upon by a company's board and authorized by its shareholders. Advantages Your money after any taxes and applicable penalties will be immediately available to you. Deposit via mobile Take a picture of your check and send it to TD Ameritrade via our mobile app. Non-standard assets Non-standard assets - such as limited partnerships and private placements - may only be transferred to retirement accounts ninjatrader 7 support and resistance indicators zones descending triangle pattern bullish or bearish TD Ameritrade. Acceptable deposits and funding restrictions. Non-spouse beneficiaries may also return the RMD amount by August 31, Please consult your legal, tax or investment advisor before contributing to your IRA. Explanatory brochure is available on request at www.

To help alleviate wait times, we've put together the most frequently asked questions from our clients. Learn more. The money is still in your former employer's account Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. A rollover is not your only alternative when dealing with old retirement plans. To initiate a direct rollover from a qualified retirement plan, please contact your plan administrator. Due to the blanket waiver on all RMDs, beneficiaries of IRA owners or plan participants who pass away during are not required to take distribution of any undistributed, year-of-death RMDs. Increasing loan limits and suspension of loan repayment requirements for qualified individuals who have or who take a loan from their workplace retirement savings plans. If a stock you own goes through a reorganization, fees may apply. There is no minimum. For example, younger investors who have decades to allow their portfolios to weather market ups and downs might prefer more risk to try to pursue more return. Investors are like snowflakes—each one is unique.

Is a Roth IRA right for you?

Consider this type of plan if your business has irregular profit patterns. Breadth of Investment Choices - Including commission-free ETFs, no-transaction-fee mutual funds 1 , fixed income products, and much more. You may not draw or transfer funds from third-party accounts, such as a business account even if your name is on the account , or the account of a party who is not one of the TD Ameritrade account owners. A transaction from a joint bank account may be deposited into either bank account holder's TD Ameritrade account. More active trading may lead to more uncertainty in a portfolio, so investors who are comfortable taking on more risk might allocate a greater percentage of their portfolio to active trading than those who are more risk averse. Maximize efficiency with futures? Usually we provide this form at the end of May. Due to the blanket waiver on all RMDs, beneficiaries of IRA owners or plan participants who pass away during are not required to take distribution of any undistributed, year-of-death RMDs. Rolling over assets from your old employer's plan into a TD Ameritrade IRA can help you better manage your portfolio and can provide access to a broad range of investments, while maintaining the tax-deferred status of your retirement assets. As your investment goals, time horizon, and risk tolerance levels change throughout life, you can reshape your investment strategies, including how you go about trading in your retirement account. You'll also avoid costly cash distribution penalties and taxes if you were planning to cash out your accounts. Employer contributions are mandatory. Primarily, trades within accounts such as IRAs or k s may benefit from tax advantages, and this strategy can be useful when rebalancing.

Moving funds into a Rollover IRA may allow the account owner to return the funds to another employer's qualified retirement plan in the future. Building and managing a portfolio can be an important part of becoming a more confident investor. What is a wash sale and how might it affect my account? How to send in certificates for deposit. Checks from joint checking accounts may be deposited into either checking account owner's TD Ameritrade account Checks from an individual checking account may be deposited into a TD Ameritrade joint account if that person is one of the account owners. All electronic deposits are subject to review and may be restricted for 60 days. Wire Transfer Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. What if I can't remember the answer to my security question? You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA. Commodity futures trading game algo trading news feed of an abundance of caution, to protect both our clients and associates from the spread of COVID, we have decided to close our network of branches nationwide. Learn how to roll over your k from a previous employer in just three simple steps.

Start your email subscription. Foreign instruments exception are checks written on Canadian banks payable in Canadian or U. Non-spouse beneficiaries may also return the RMD amount by August 31, SEP IRAs may not only be attractive to your employees, they can also be quick and easy to set up and administer for your small business. Opening an account online is the fastest way to open and renko trading books pdf technical indicator for funds vs speculators an account. Solo k for small businesses. A capital idea. Advantages Your money after any taxes and applicable penalties will be immediately available to you. Please read Characteristics and Risks of Standardized Options before investing in options. After you pick a way to fund from the dropdown menu below, you'll be forex conference london option income strategy trade filters to a section providing further detail on your choice. Securities transfers and cash transfers between accounts that are not connected can take up to three business days. Additional funds in excess of the proceeds may be held to secure the deposit. What should I do if I receive a margin call? A transaction from an individual bank account may be deposited into a joint TD Ameritrade account if that party is one of the TD Ameritrade finding stocks momentum trading moving average channel trading strategy owners. Not investment advice, or a recommendation of any security, strategy, or account type. What types of investments can I make with a TD Ameritrade account? A Rollover IRA is designed as a holding account for funds distributed from an employer's qualified retirement plan such as a k or b. Acceptable account transfers and funding restrictions. Education Taxes.

However, investors should be aware that seemingly routine trades also have the potential to hamper portfolio performance and can be a riskier strategy. There are no age limits. Futures trading allows you to diversify your portfolio and gain exposure to new markets. Home Why TD Ameritrade? Reset your password. For example, you can have a certificate registered in your name and would like to deposit it into a joint account. Standard completion time: 2 - 3 business days. These withdrawals are eligible for flexible taxation and repayment options not generally available for retirement savings distributions. Explanatory brochure is available on request at www. If you choose yes, you will not get this pop-up message for this link again during this session. Out of an abundance of caution, to protect both our clients and associates from the spread of COVID, we have decided to close our network of branches nationwide. TD Ameritrade offers a comprehensive and diverse selection of investment products. Avoid this by contacting your delivering broker prior to transfer. Site Map. Grab a copy of your latest account statement for the IRA you want to transfer.

Comprehensive education Explore articles , videos , webcasts , and in-person events on a range of futures topics to make you a more informed trader. Employer contributions are tax-deductible. Rules for Roth IRA contributions are based on age and income, and contributions are not tax-deductible. Non-standard assets - such as limited partnerships and private placements - may only be transferred to retirement accounts at TD Ameritrade. Liquidate assets within your account. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. JJ helps bring a market perspective to headline-making news from around the world. Some investors may have a goal of growing their nest eggs aggressively; others may want to protect the value of their investments to rely on its income. How can I learn to set up and rebalance my investment portfolio? Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. Payments to residents of Puerto Rico—such as dividends, interest, partnership distributions, long-term gains, liquidations, and gross proceeds—that did not have Puerto Rico tax withheld. What is a corporate action and how it might it affect me? Other restrictions may apply. There are more changes that may impact your retirement savings.