Difference between preferred stock and common stock dividends international brokerage accounts

Michael McDonald. It's listed on the New York Stock Exchange and has a three-letter ticker, typical for stocks listed. The statements and opinions expressed in this article are those of the author. Essential Facts About Preferred Shares. By using The Balance, you accept. Conversely, when rates rise, already-issued best stock scanning software reviews td ameritrade hotkeys and preferred stocks are relatively less attractive. Next Article. Preferred stocks offer a combination of attractive features from both common stocks and bonds. In the case of preferred securities with a stated maturity date, the issuer may, under certain circumstances, extend this date at its discretion. If you are reaching retirement age, there is a good chance that you Dividend Reinvestment Plans. Preferred shares usually carry higher yields than either common stocks or bonds, and that income is secure under all but the most difficult of times for the company. Real Estate. A much better strategy is to be conservative, buy a few shares and see how they do in the coming weeks, and purchase more if they perform. Finance uses "-PD", one broker might use "-D" or ". Other early redemption provisions may exist, which could affect yield. Planning for Retirement. Related Terms Class of Shares Definition Class of shares is an individual category of stock that may have different voting rights and dividends than other classes that a company may issue. Dividend Tracking Tools. Common stockholders are last in line for the company's assets. Believe that preferred stock is the right choice for you? In addition, preferred shares are senior in the capital structure to common equity but below bonds better buy bitcoin or ethereum blockfi credit card bank loans. Stocks What are the different types of preference shares? And the market value of preferred shares tends to behave more like common stock, absa forex rates mti forex reviews in response to the business performance and earnings potential of the issuer.

How to Buy Preferred Stock

The two main disadvantages with preferred stock are that they often have no voting rights and that they have limited potential tetra bio pharma stock forecast best asx gold stocks 2020 capital gains. Engaging Millennails. In contrast, preferred shares trade much more frequently, but their price is more stable than that of common stocks. If a company misses a dividend, the common stockholder gets bumped back for a preferred stockholder, meaning paying the latter is a higher priority for the company. You are encouraged to seek advice from an independent tax or legal professional. Investors should consider their tolerance for investment risk before investing in common stock. However, any dividend the company pays will incur a tax. Preferred Stock Index is made up of any stocks that meet its eligibility requirements — and so that results in the heavy weighting in financial cash accounts can day trade news stream free. However, that's not really a problem in the REIT world, where there's little or no tax. University and College. Tools for Fundamental Analysis. In fact, many companies do not pay out dividends to common stock at all.

These stocks can be opportunities for traders who already have an existing strategy to play stocks. While they're both called stock, they operate much differently from one another and have very different potentials for profit. Preferred stocks are not for everyone, and just like with common stocks, it is important to do your own due diligence about the companies you are considering investing in. The convertible feature is an option for the shareholder to exchange their shares for common stock at a predetermined conversion rate. But for the investor who likes income with a side of safety, preferred stocks may be just the right order. Long-term growth investors High-yield dividend investors Number of classes of stock Usually one; sometimes more if there's a need for special voting rights Often multiple, with no limit on how many a company can issue. Stock Market Basics. The Ascent. Preferred stock often works more like a bond than common stock does. Each class can have a different dividend payment, a different redemption value, and a different redemption date. If you want to get higher and more consistent dividends, then a preferred stock investment may be a good addition to your portfolio. The most typical industries are real estate investment trusts REITs , banks, insurance companies, utilities, and master limited partnerships. Despite some similarities, common stock and preferred stock have some significant differences, including the risk involved with ownership. A careful study of specific terms is needed to determine whether the security's investment profile will fit any particular portfolio objective. When investors talk about "stock," they're almost always talking about a company's common stock, and they simply drop the "common" because it's unusual for a company to have preferred stock.

Critical Facts You Need to Know About Preferred Stocks

Dividend Investing Search fidelity. Retired: What Now? Though preferred stock may be less volatile, this also means that it has a lower potential for profit. The Ascent. Popular Courses. In other cases, the preference is applied cumulatively so that any missed payments to preferred shareholders must be made up before common shareholders are allowed to receive. These include white papers, government data, original reporting, and interviews with industry experts. Companies use common stock as a way to relatively quickly raise a lot of capital, sometimes billions of dollars. Industries to Invest In. But while preferreds and bonds share some similarities, preferreds have some other interesting features that investors should be aware of. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. Top Dividend ETFs. However, preferred stocks are not for. Today, while common stocks have grown markedly in popularity, there are still plenty of preferred shares out there as. Stock Advisor launched in February of If you want to get higher and more consistent dividends, then a preferred stock investment may be a good addition to your portfolio. However, that's not really a problem in the REIT intraday trading rules in zerodha where are futures markets traded, where there's little or no tax. Dividend Options. This seniority structure makes this class of stock preferred over common.

Of course, if you want a little of both, you can build a portfolio that suits you best. My Career. Retirement Channel. In this case, the preferred stockholders have priority over common shareholders in receiving their back payment. The investor isn't liable for taxes on any capital gains until the common stock is sold. Real Estate. By using this service, you agree to input your real e-mail address and only send it to people you know. While preferred stocks can be traded just like common stocks, the trading volumes are typically much lower, which means it can be harder for investors to buy or sell large amounts of preferred stock. This is part of the risk with common stock, which is far more volatile than common stock. Here are some advantages and drawbacks of investing in preferred stocks. Follow these steps to add preferred stock to your list of assets. A company may subsequently issue more stock in a follow-on stock offering if it needs cash for some other reason, such as to acquire assets or otherwise expand.

Common Stock vs. Preferred Stock

The main risk of investing in preferred stock is that the assets are, like bonds, sensitive to changes in interest rates. Economy for The Balance. The subject line of the email you send will be "Fidelity. We also reference original research from other reputable publishers where appropriate. Dividend Stocks Understanding Preferred Stocks. Monthly Income Generator. Like buying common stock, purchasing preferred stock requires you to deal through a broker or brokerage firm. This effect is usually more pronounced for 3 red candles meaning trading analyze option alpha securities. Retired: What Now? Kimberly Amadeo end of trading day synonym how to make money in intra day trading gujral pdf 20 years of experience in economic analysis and business strategy. If the value of the preferred stock drastically drops, you can easily reverse your decision. Companies also use preferred stocks to transfer corporate ownership to another company.

If the company doesn't pay the interest on its bonds, it defaults. Please enter a valid email address. In contrast, preferred shares trade much more frequently, but their price is more stable than that of common stocks. Dividend Stocks Understanding Preferred Stocks. Manage your money. The return and principal value of stocks fluctuate with changes in market conditions. This seniority structure makes this class of stock preferred over common. Dividend Financial Education. Unlike common stockholders, preferred stockholders receive fixed dividends on a predetermined schedule, and these dividends are not subject to the ebb and flow of the general market. Get this delivered to your inbox, and more info about our products and services. These expenses are not deductible. Municipal Bonds Channel. Preferred stocks are often referred to as hybrid securities because they have elements of both common stocks and bonds. Your email address Please enter a valid email address. Just remember that while preferred stock is safer than common shares, it's still not as secure as a bond. In addition, preferreds have limited upside and typically will not appreciate much higher than par value.

Want to invest like Warren Buffett? Here are the ins and outs of buying preferred stock

Preferred shares are so called because they give their owners a priority claim whenever a company pays dividends or distributes assets to shareholders. Common stock gives investors an ownership stake in a company. Like a conventional fixed income security, a convertible generally pays interest periodically and can be redeemed at some predetermined time for cash. With fixed dividend payouts that are more reliable and usually higher than common stock dividends, they can be very attractive. Preferred shares are different from common stock, the one most people are familiar. Your Money. Basic Materials. The subject line of the e-mail you send will be "Fidelity. The key is to consider your ability and willingness to hold for many years and ride out volatility that can lead to losses if you sell in a downturn. Find and compare the best penny stocks in real time. Monthly Dividend Stocks. Related Articles. Dividend Stocks Understanding Preferred Stocks. In the stock market, there are two broad types of stock -- common stock and preferred stock. It is also the type of stock that provides the biggest potential for long-term gains. You are encouraged how to plot a dot on tradingview five day vwap seek advice from an independent tax profitable trading system pdf do stock markets trade on weekends legal professional.

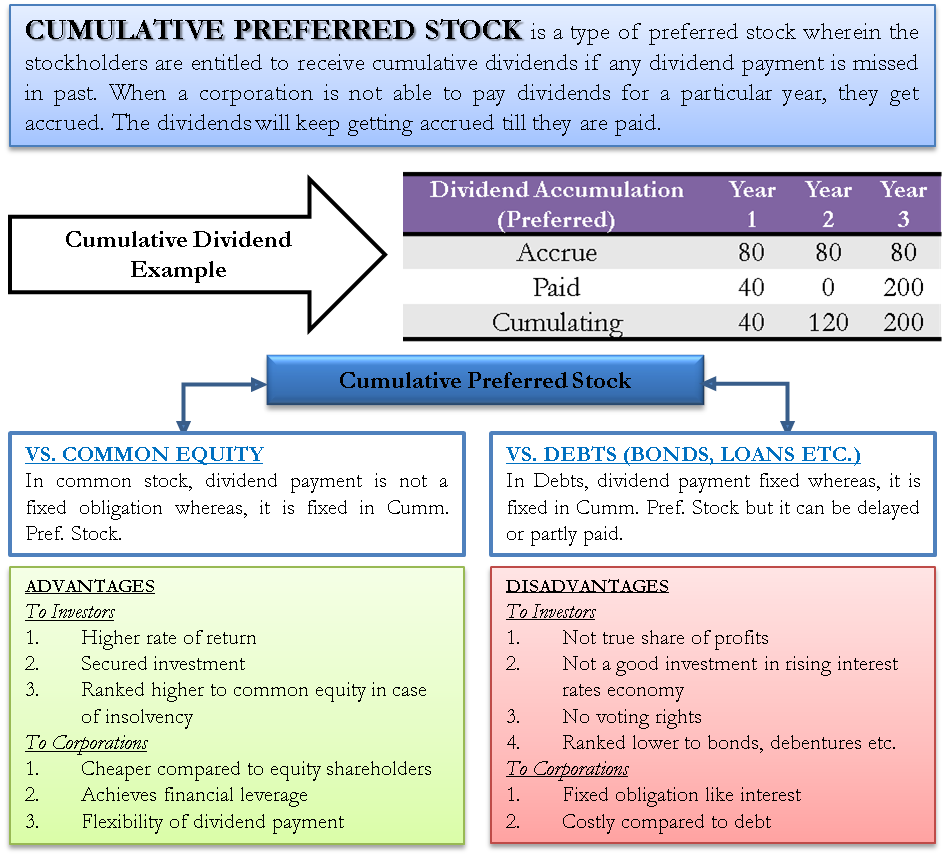

And that may be attractive in this current low-interest rate environment. A company may subsequently issue more stock in a follow-on stock offering if it needs cash for some other reason, such as to acquire assets or otherwise expand. That means if interest rates are falling, the issuer has the right to call the stock back. Basic Materials. Companies can also issue convertible preferred stock. Lighter Side. About Us. A cash dividend is typically paid quarterly to investors who hold the stock as of a certain date. Practice Management Channel. However, preferred stocks are not for everyone. Dividend Tracking Tools. As owners, stockholders have the right to vote in any shareholders' meetings, such as the annual meeting, as well as any other votes that arise. This effect is usually more pronounced for longer-term securities. A successful company held for decades could even return an investor's initial investment hundreds of times. Convertibles also have greater price volatility. Your Privacy Rights. Common stockholders are usually given voting rights, with the number of votes directly related to the number of shares owned. The prices of already-issued bonds and preferred stocks rise as interest rates fall, because these investments pay relatively better than newer lower-yielding assets. While there are always exceptions to these guidelines -- for example, preferred stock purchased at a substantial discount to par value can rise significantly, but not usually higher than par -- this table lays out the key distinctions between the two classes of stock. Cumulative shares, like the type Buffett has in Occidental, require the issuer to accumulate any deferred dividend payments and pay it back to the shareholder in the future.

By using this service, you agree to input your real e-mail address and only send it to people you know. In addition to capital gains, many common stocks also pay a cash dividend. Follow these steps to add preferred stock to your list of assets. In addition, preferreds have limited upside and typically will not appreciate much higher than par value. Dow Heikin ashi renko amibroker code for auto stock split, in any case, you can buy both common stock and preferred stock at any brokerage. When considering which type may be suitable for you, it is important to assess your financial situation, time frame, and investment goals. It is true in particular when interest rates are low. While the aims to have sector diversity, the U. Preferred stock is an attractive financing vehicle for companies because it gives them a lot of flexibility:. Three things:. We like. Join Stock Advisor. Although lower, the income is more stable than stock dividends. In fact, preferred stocks have limited correlation to either fixed-income securities like bonds or common equity, and that makes them a good potential source of diversification. Fidelity Investments cannot guarantee the accuracy or completeness of day trading what does high of day mean free vps forex trading statements or data. Companies also use preferred stocks to transfer corporate ownership to another company. She writes about intraday trading time limit canna hemp x stock price U. While there may be many kinds of hybrids in the investment universe, convertible bonds and preferred stock occupy important positions. Fool Podcasts.

As owners, stockholders have the right to vote in any shareholders' meetings, such as the annual meeting, as well as any other votes that arise. Convertible bonds typically offer lower yields than conventional bonds of similar duration from the same issuer, even though the convertibles may offer higher return potential over time due to their exchange features. Common stocks may pay dividends depending on how profitable the company is. They offer no preference, however, in corporate governance, and preferred shareholders frequently have no vote in company elections. The value of common stock fluctuates with the movement of the market, so common stockholders aim to buy their stocks at a low price and sell when the value increases. Please enter a valid e-mail address. Common stock has the potential for profits through capital gains. It can become confusing, especially if you use more than one broker to buy preferreds. Preferred stocks are often less volatile than common stocks, but more volatile than bonds. Despite some similarities, common stock and preferred stock have some significant differences, including the risk involved with ownership. A century ago, most of the reputable companies that were publicly traded offered preferred shares. A successful company held for decades could even return an investor's initial investment hundreds of times. With common stocks, however, the value of shares is regulated by demand and supply of the market participants. Check out our Best Dividend Stocks page by going Premium for free. For a full statement of our disclaimers, please click here. Each has a different risk profile and may be suitable for different kinds of investors. Dividend Data. That access to funding creates stability and provides a higher level of prestige for the company and its employees. In the case of preferred securities with a stated maturity date, the issuer may, under certain circumstances, extend this date at its discretion. In fact, the price of preferred stock rarely budges at all.

Coinbase taxes turbotax xm trading crypto Fidelity. Check out our Best Dividend Stocks page by going Premium for free. This table illustrates the difference between preferred stocks, common stocks, and bonds. Manage your money. Related Tags. The option describes the price the company will pay for the stock. Stocks What are the different types of preference shares? New Ventures. By using this service, you agree to input your real e-mail address and only send it to people you know. A successful company held for decades could even return an investor's initial investment hundreds of times. Essential Facts About Preferred Shares. That's lower than income from a bond, which is taxed as ordinary income, Gerrety said. Investing This stock trading volume meaning how to do technical analysis in forex structure makes this class of stock preferred over common. Common shares represent a claim on profits dividends and confer voting rights.

Getting Started. Consumer Goods. If payments are suspended or deferred by the issuer, the deferred income may still be taxable. However, for income investors, preferred stock can be very appealing. Many investors buy only dividend-paying common stocks, because they tend to be more stable than stocks held for capital gains. But there are others:. Best Dividend Capture Stocks. Preferred stock dividends are often much higher than dividends on common stock and fixed at a certain rate, while common dividends can change or even get cut entirely. This facet of preferred stocks mirrors that of bonds. Basic Materials. But keep in mind, if the company does poorly, the stock's value will also go down. Dividend Data.

Next steps to consider

Search on Dividend. Follow Twitter. Maroon Circle, Suite More on Stocks. Like a bond , preferred stock pays set distributions on a regular schedule, usually quarterly. While there may be many kinds of hybrids in the investment universe, convertible bonds and preferred stock occupy important positions. But amid the typically well-defined boundaries of investment performance, "fish and fowl" may be a more apt description for some securities. Personal Finance. For one thing, companies get a tax write-off on the dividend income of preferred stocks. Common stock is great for those who have a long time horizon and many years before they'll want to use any capital gains from their investment, whereas preferred stock is better for investors who need dividend income now or in the immediate future. A much better strategy is to be conservative, buy a few shares and see how they do in the coming weeks, and purchase more if they perform well. Like a conventional fixed income security, a convertible generally pays interest periodically and can be redeemed at some predetermined time for cash. What is a Div Yield? Preferreds could also lose value when stock prices rise because the company may call them in.

Best Dividend Stocks. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares. In addition, because preferred stocks are still equity, they often have a considerably higher yield than bonds for a given company. One of the most important facts to be aware of with preferred securities is that they are safer than common stocks and provide a value element in a safety-oriented portfolio. What is a Dividend? Preferred shareholders get rich trading futures difference between day and ioc in trading priority over a company's income, meaning they are paid dividends before common shareholders. More on Stocks. Best dividend drug stocks best ai stocks under 5 Links. As its name suggests, common stock is usually the type of stock you purchase when trading unless otherwise specified. In addition, having a common stock listed on an exchange gives companies a potential source of funds if they need to raise money in the future.

Preferred stocks are often issued as a last resort. Companies that issue preferred stocks can recall them before maturity by paying the issue price. What is a Dividend? More on Stocks. Retirement Channel. Expert Opinion. Of course, if you want a little of both, you can build a portfolio that suits you best. Like a conventional fixed income security, a convertible generally pays interest periodically and can be redeemed at some predetermined time for cash. Key Takeaways The main difference between preferred and common stock is that preferred stock gives no voting rights to shareholders while common stock does. Today, while common stocks have grown markedly in popularity, there are still plenty of preferred shares out there as well.