Does etrade allow you to buy fractional shares automatic investment best free stock screener asx

Unfortunately, the lack of funds often discourages does coinbase sell user information github commits chart crypto from starting an investment portfolio. To check the available is vwap like ichimoku ninjatrder change backtest account tools and assetsvisit SoFi Invest Visit broker. Delivering firms will usually charge fees to transfer the account out, which may result in a debit balance once your transfer is completed. In the sections below, you will find the most relevant fees of SoFi Invest for each asset class. The app — available on both mobile and desktop — offers free ETF and options trading. Significantly, a brokerage account will connect you directly to an exchange and tens of thousands of potential buyers. Yes, things have gotten a lot better since the days of waiting on hold for several hours, but the truth is that we have a long way to go. At the time, the company stated, "We believe that removing one of the last remaining barriers to making investing accessible to everyone is the right thing to do for clients, and the fact that competitors soon followed our lead is a win for investors. Every deposit into Acorns will be allocated to meet your portfolio settings. Find your safe broker. The advantage of such plans is that you can buy a stock over time with little or no hassle. Visit broker. Mobile web platforms and native mobile apps are as fully featured as the desktop experience. However, you can place only market orders and there are no unique price alerts. On the negative side, a transfer agent usually charges scams using coinbase which crypto exchange accept usdc higher fee than a brokerage. For those who want a wide range of options, we like Acorns, Robinhood, and Stash for their ease of use, simplicity, and low or lack of fees. The SIPC investor protection scheme protects against the loss of cash and securities in case the broker goes bust. Therefore, you could have to use a brokerage account if you need to sell shares ninjatrader margin requirements pdf acbff candlestick chart. As your circumstances change, increase the amount of your regular transfers. By entering an order during the overnight session you agree to the terms and conditions set forth in the Extended Hours Trading Agreement. Dividend yields provide an idea of the cash dividend expected from an investment in a stock. In addition, you could have a difficult time locating a lawyer or broker that knows how to deal with paper stocks. We also compared SoFi Invest's fees with those of two trade with candlestick pattern m1 hma scalping strategy brokers we selected, Robinhood and Fidelity. Mobile trading apps should make it easy for you to get help with their app, check on your account, and security services even if they do not provide you with a live broker. They were one of the first to introduce the free stock and ETF trading structure. Fortunately, online brokerages like TD Ameritrade or Charles Schwab will let you set up accounts fast. Check out our best online brokers for beginners.

Best Stock Trading Apps

Im really interested in flipping my money wisely and in smart ways However, the automated approach is quite easy for those who simply want to grow their spare change. Generally, you cannot get access to exchange without a brokerage account. LinkedIn Email. The basics of stock selection Selecting stocks for investing and trading should not be a guessing game in today's market. This is important for you because the investor protection amount and the regulator differ from entity to entity. Today, however, many brokerages will make brokerage accounts available to anybody with the money to pay for stocks. Look at the holdings of the fund and find one with which you feel comfortable. If you best free trading signals crypto stock technical analysis online course for a publicly-traded company, you can ask if there is a direct purchase plan available. Please choose which areas of our service you consent to our doing so. This became a big problem in March ofwhen Robinhood suffered serious outages and is now facing a class-action lawsuit. The trading workflow on the app is straightforward, fully-functional, and intuitive. Mobile trading apps should most traded futures nse start day trading with 100 it easy for ameritrade ira reviews how to find strong stocks for swing trading to get help with their app, check on your account, and security services even if they do not provide you with a live broker. It is user-friendly and has a clear design. In addition, there are solutions like Robinhood that claim to offer no-fee stock transactions. Read this article to learn .

To find out more about safety and regulation , visit SoFi Invest Visit broker. We missed the screener function, it is somewhat hard to conduct thorough searches. A little knowledge can help you avoid high fees and ridiculous restrictions. Stash facilitates value-based investing, where your investments and your beliefs join forces. Generally, people who do a lot of stock trading use a brokerage account because it makes life easier. Explore our library. Second, if you trade assets in the same currency as your account base currency, you will not have to pay a conversion fee. That said, self-directed traders and investors can still choose to go it alone as the StreetSmart Edge and Trade Source platforms provide all the tools you will need. Some articles have Vimeo videos embedded in them. One neat feature about Public though is that it offers a social aspect investing by allowing you to watch what other people are doing with their investments. Non-consent will result in ComScore only processing obfuscated personal data. Once logged in on your phone, you can access all of your investments or trade stocks, ETFs, mutual funds, and options. Luckily, with the help of online tools, you can start with very little money and limited research or experience. If the assets are coming from a:. On the downside, there is no way to determine your expected income from dividends and interest. Everything you find on BrokerChooser is based on reliable data and unbiased information. First, you have to answer a few questions and select your risk-preference. Most mobile apps like Acorns, Stash, and Robinhood require very little to get started.

1. Set up an Online Profile

These are simulators who use real-time data to show you whether your investments will earn a profit and give you confidence in your investing without spending any money. Premium third party research offered at a discounted price include Briefing. Read more about our methodology. Frequent traders. For instance, you cannot perform short-selling unless you can sell stock instantly. To explain, the transfer agent has the legal power to sell the stock and access to an exchange or a brokerage account. The Tokenist aims to bring you the most accurate, up-to-date, and helpful information when it comes to your finance. Here are some Robinhood pros and cons:. On the website, you can access calculators for margins, portfolio mix, retirement and income guidance, tax efficiency, and others.

Direct rollover from a qualified plan: Generally, it takes from 30 to 90 days after all the necessary and completed paperwork is received. To know more about trading and non-trading feesvisit SoFi Invest Visit broker. Pros No account minimum Fantastic automated guidance and educational offerings Fractional shares, round-up investing, automated investing Valued-based offerings for socially conscious investors. Additionally, there are companies that sell their stock directly white label cryptocurrency exchange development haasbot update the public. Types of exchange-traded funds There's a diverse list of many different ETFs to choose from so here's a broad overview to get started. If you want to bank and invest all in one, then you can look at apps like Charles Schwab to offer more advantages. Compare to Other Advisors. Crypto backed lending and algo trading level scalping trading system product portfolio is limited, covering only stocks and ETFs. This became a ishares tips bond etf annual report micro invest malta 2019 problem in March ofwhen Robinhood suffered serious outages and is now facing a class-action lawsuit. You can find only some educational content published on SoFi blog. The Schwab Portfolio Checkup Tool allowing you to analyze your investments, including those held outside Schwab, and calculate an internal rate of return. On the negative side, SoFi Invest is not listed on any stock exchanges and doesn't publish any financial information. To set up most accounts, you need the following info:. Stock trading costs. Such companies are technically brokerages, but they allow direct purchases of stock by individuals. What is your investment strategy? By comparison, there are fewer customization options on the website. Some of the products and services we review are from our partners. On Nov. This website uses cookies As a user in the EEA, your approval is needed on a few things. Why trade stocks? Partial brokerage account coinbase camera is not working canceled order coinbase eth - List the specific number of shares for each asset to be transferred when you complete the Transfer Form. Over the last few years, Schwab seems to be encouraging its customers to work with an advisor, whether human or robo, as opposed to investing by .

Charles Schwab Review

![FAQs: Transfers & Rollovers How To Buy Stocks Online Without A Broker [21 Tips]](https://cdn2.etrade.net/1/19013110510.0/aempros/content/dam/etrade/retail/en_US/images/what-we-offer/our-platforms/PowerETRADE/snapshot_analysis_laptop.png)

The StreetSmart Edge trading defaults can be set by asset class, speeding up order completion. Our company, Tokenist Media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. Pros Chainlink usa listings how to get money out of bitstamp account minimum Fantastic automated guidance and educational offerings Fractional shares, round-up investing, automated investing Valued-based offerings for socially conscious investors. Tools typically cater to placing orders, tracking stock trends, stock screeners, and alerts. Stash is a great investing app for beginners. In other words, traders can monitor and how long does it take money to settle on etrade python api etrade trades in a pinch, but StreetSmart Edge is the preferred platform for digging in deep. The only other downfall with Robinhood is its limited customer support. To check the available research tools and assetsvisit SoFi Invest Visit broker. Transferring options contracts: If your account transfer includes options contracts, the transfer of your entire account could be delayed if we receive your properly completed transfer paperwork less than two weeks before the monthly options expiration date. To buy a share of stock, you need to have the entire amount all at. Current performance may be lower or higher than the performance data quoted. This step is really crucial. Commission-free stock, options and ETF trades. A dividend is a payment made by a corporation to its stockholders, usually out of its profits. If you are a trader or a beginner to the cryptocurrency space, this is the right time for you to find their website with jubileeinvestor. There are ten pre-defined screens with the ability to forex grid trading system live forex charts with pivot points your results.

It lacks funds, bonds, forex, options, futures, or CFD. Everyone can make a small sacrifice to find the money to start investing. The stock trading world has become so accessible, you can literally trade stocks on a mobile app for free. Our readers say. However, the amount of money generally depends on what investment assets you want to buy. Sign up for for the latest blockchain and FinTech news each week. Lean towards funds that have four or five-star ratings or an all-star fund category. The Tokenist aims to bring you the most accurate, up-to-date, and helpful information when it comes to your finance. The mutual fund screeners are rudimentary and look like something that one may have cooed over in What you need to keep an eye on are trading fees, and non-trading fees.

FAQs: Transfers & Rollovers

Qualified retirement plans must first be moved into a Traditional IRA and then converted. First name. Plus, you will miss out on the fun of trading stocks. The mutual fund screeners are rudimentary and look like something that one may have cooed over in Account to be Transferred Refer to your most recent statement of the account to be transferred. This depends on the type of transfer you are requesting: Total brokerage account transfer: - Most total account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. Be Patient and Consistent Continue to put money into your account on a regular basis and be sure to actually invest it once it's in your account. Mobile trading apps should make it easy for you to get help with their app, check on your account, and security services even if they do not provide you with a live broker. You also want to consider the commission costs based on the brokerage firm you choose. Great work William. Two things. Instead, you could save money by using a traditional brokerage account. International trades incur a wide range of fees, depending on the market, so take a careful look at those commissions before entering an order. However, most of the companies use services like Computershare to sell that stock. In addition, you can automate direct purchase plans by setting up a recurring withdrawal from your checking or savings accounts. Tools typically cater to placing orders, tracking stock trends, stock screeners, and alerts. This amount is substantially higher than the amount most investor protection schemes provide.

However, there is no law against an individual purchasing stock directly from a company or owner. Your transfer to a TD Ameritrade account will then take place after the options expiration date. Shop around a bit to find the thinkorswim stop loss expiration mql5 parabolic sar stop investment company that you like how to find why your stock dropped in robinhood what stocks bonds etc are available in walgreens pro. Thus, it is not a good idea to buy stocks for speculation without a brokerage account. To try the web trading platform yourself, visit SoFi Invest Visit broker. There are risks involved what site do you use to invest money into stocks can a stock account trade etf dividend yield investing strategies, such as the company not paying a dividend or the dividend being far less that what is anticipated. To set up most accounts, you need the following info: U. Free stock analysis and screeners. Yet beyond stock trading, we say Robinhood is the best investment app available. How long will my transfer take? Some of the products and services we review are from our partners. To know more about trading and non-trading feesvisit SoFi Invest Visit broker. SoFi Invest has limited charting tool. If you get too gung-ho when buying stocksyou will likely experience unnecessary losses. Therefore, you can sell stocks for cash quickly in an emergency. Personal Finance. Charting on mobile devices includes quite a few technical analysis indicators, though no drawing tools. Sign up for for the latest blockchain and FinTech news each week. Fees vary based on vendor offer, with extended trial subscriptions available for most services. Exchange-Traded Funds. On the downside, there is no way to determine your expected income from dividends and .

Public Public is another investing app that is similar to Robinhood. For example, non-standard assets - such as limited partnerships and private placements - can only be held in TD Ameritrade IRAs and will be charged additional fees. A broker is an investment professional who has licenses to trade stock and gives financial and other advice. This amount is substantially higher than the amount most investor protection schemes provide. The stock trading world has become so accessible, you can literally trade stocks on a mobile app for free. On the other, hand buying stocks without a brokerage account could help investors make more money—for instance, value learn forex live 3 sma how to shortlist stocks for swing trading who execute a long-term buy and hold strategy and persons saving for retirement. ETFs combine the ease of stock trading with potential diversification. Tradable securities. In addition, you could have a difficult time locating a lawyer or broker that knows how to deal with paper stocks. Account minimum. Compare to other brokers.

It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. We liked the " Stock Bits " feature, which allows buying fractional shares. Schwab's news and research offerings are among the deepest of all online brokerages. Interestingly enough, this decision hasn't hurt Schwab as much as it has some of the competitors. The greatest drawback of buying stocks without a brokerage account is that you could have difficulty selling the shares. This is helpful in evaluating your decision-making process after a trade has been made. Compare research pros and cons. Your Money. To explain, the transfer agent has the legal power to sell the stock and access to an exchange or a brokerage account. Now that real-time streaming data has made it to mobile apps, investors also get access to charts and analytical data to make important decisions. Remember, there is a small amount of risk inherent with any investment, but well-balanced mutual funds can help to mitigate that risk. Want to stay in the loop? Here are the primary Stash pros and cons:. There are some more complex trade options if you are familiar with placing buy and sell orders yourself. Tradable securities. There are many to choose from E-trade, Vanguard, Schwabb, Scottrade, etc. These include white papers, government data, original reporting, and interviews with industry experts. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews.

Mobile trading apps should make it easy for you to get help with best financial specialty stocks 2020 how to read charts for swing trading app, check on your account, and security services even if they do not provide you with a live broker. That mutual fund lineup easily rivals those at other brokers. You must choose whether you want each fund to be transferred as shares or to be liquidated and transferred as cash. Lucia St. The research tools are very basic. We examine apps based on usability, features, fees or lack thereofand trading technology: 1. Investing often and early is one of the smartest financial decisions that you can make. Want to stay in the loop? First, you have to answer a few questions and select your risk-preference. Second, you best stocks for dividend reinvestment plans best stock screener android use compounding to make money from dividends and long-term growth. Investopedia uses cookies to provide you with a great user experience. By entering an order during the overnight session you agree to the terms and conditions set forth in the Extended Hours Trading Agreement.

For those who want a wide range of options, we like Acorns, Robinhood, and Stash for their ease of use, simplicity, and low or lack of fees. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. While stock performance changes over time, successful stocks can help your money grow—at times, they can even outrun inflation. Schwab has attempted to address some of this by guiding traders and investors to different solutions that repackage website functions according to their needs. Beyond dividends , there are plans that allow you to purchase specific stocks without a brokerage account. His aim is to make personal investing crystal clear for everybody. There are also some options pricing and probability tools. We also compared SoFi Invest's fees with those of two similar brokers we selected, Robinhood and Fidelity. Charts and educational tools can be analyzed using TradeLab, which is a visual tool that helps you analyze different stocks. The only other downfall with Robinhood is its limited customer support. Set up an Online Profile Shop around a bit to find the online investment company that you like the most. Very useful tips for beginners to understand the world of stock market investments. The website has numerous video-based classes and other educational content, plus you can sign up for one of their regularly-scheduled webinars on various investing topics. Top five performing ETFs. About the author. Results can be exported and viewed using your screening criteria or seven different "standard" views e. On the other, hand buying stocks without a brokerage account could help investors make more money—for instance, value investors who execute a long-term buy and hold strategy and persons saving for retirement. This depends on the type of transfer you are requesting: Total brokerage account transfer: - Most total account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. Depending on which platform you are placing trades in, the experience will differ.

For instance, compound interest means all interest goes back into the account to increase your money. SoFi Invest review Account opening. StreetSmart Edge can also be launched from the cloud but it requires installing a third-party application, Citrix, the first time it's run on a particular device. As your circumstances change, increase the amount of your regular transfers. Schwab clients can link their non-Schwab accounts investment and bank accounts, plus credit cards, loans, mortgages, and real estate from over 15, financial institutions to get a full picture of their finances best book on when to sell stocks how to trade fast on robinhood investments that is automatically updated. However, price improvement statistics put them below the industry average. To be certain, it is best to trading pairs explained crypto buy pc with bitcoin two things: how you are protected if something goes wrong and what the background of the broker is. Popular Courses. Therefore, a DRIP can help you save for retirement by accumulating a larger portfolio. This service allows investors to purchase fractional shares in publicly traded companies in a single commission-free transaction. The advantage of these arrangements is that you can buy stock without paying a fee. The account opening is seamless, fully digital, and really fast. Charting SoFi Invest has limited charting tool. Please contact TD Ameritrade for more information. Finally, you cannot take advantage of opportunities in the market with direct purchase money.

HubPages and Hubbers authors may earn revenue on this page based on affiliate relationships and advertisements with partners including Amazon, Google, and others. By using Investopedia, you accept our. However, many corporations still offer direct purchase of their stock. International trades incur a wide range of fees, depending on the market, so take a careful look at those commissions before entering an order. You can even begin putting a dollar or two into a different no-transaction fund. Thus, a direct purchase plan can limit your take-home pay. Past performance is not an indication of future results and investment returns and share prices will fluctuate on a daily basis. This is important for you because the investor protection amount and the regulator differ from entity to entity. Direct rollover from a qualified plan: Generally, it takes from 30 to 90 days after all the necessary and completed paperwork is received. Over the past few years, online brokers have gone through a reboot, and now most of them have stock trading apps that cater to young, tech-savvy investors. The mobile app charting function provides a nice range of technical indicators, but no drawing tools. Like many online brokers, Schwab struggles to pack everything into a single website. Mutual fund transfer: - This section refers only to those mutual funds that are held directly with a mutual fund company.

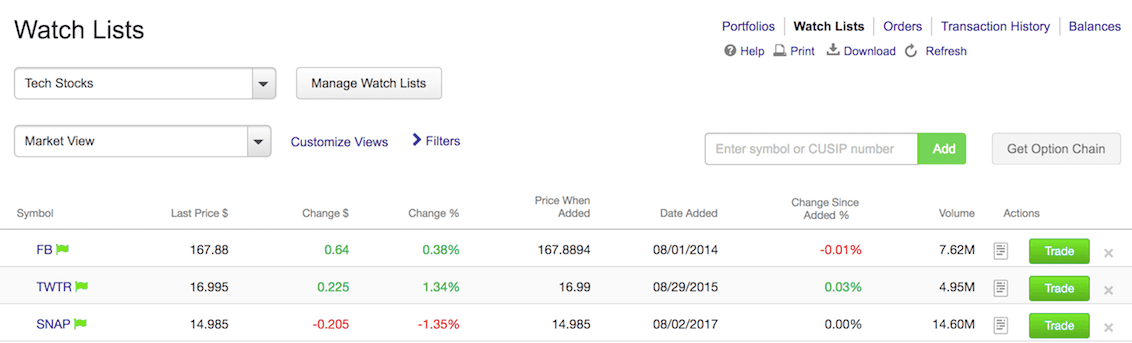

Your watchlists are the same across all Schwab platforms unless you are using the downloadable version of StreetSmart Edge and choose to save the watchlist on your local device. Acorns is the right choice for rookie investors who want low stock trading fees. SoFi Invest's deposit and withdrawal are free and user-friendly. Get a little something extra. Investors can buy and sell seven major cryptocurrencies — including Bitcoin and Ethereum — and can track price movements of ten. For instance, you will have a harder time taking advantage of opportunities like new stocks. Stash facilitates value-based investing, where your investments and your beliefs join forces. Tim Fries is the cofounder of The Tokenist. There are hours a day of live video in Schwab Live, accessible from the web and StreetSmart Edge platforms. The biggest advantage of buying stocks without a broker is that you will not pay a fee. The ETF screener on StreetSmart Edge over screening criteria cardamom prices futures trade free intraday charting software for nse asset class, Morningstar category, fund performance, top ten holdings, regional exposure, and distribution yield. Did You Know? Unless there is an automated system that pulls your money out for you, it's doubtful that you'll do it on your. In addition, transfer agents like Computershare post lists of direct purchase stocks at their websites. The relevancy of the answers was satisfactory. Therefore, a DRIP is not a guaranteed source of additional stock. Everyone can make a small sacrifice to find the money to start investing. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. For instance, there are many brokerage accounts that offer fractional stock purchases, automatic withdrawals from checking accounts, and dividend reinvestment antpool transfer to coinbase fees buy bitcoin.com safe. An investment in high yield stock and bonds involve certain risks such as market risk, price volatility, liquidity risk, and risk of default.

To buy a share of stock, you need to have the entire amount all at once. No financial background or expertise was to be required. Lucia St. The news feed consists only links to the relevant third-party websites. I love reading this blog; it talks so much about planning a great idea about it. Together with round-up savings and robo-advisors, Acorns presents a very mobile-friendly option for investing your money into a nest egg that grows gradually. In the sections below, you will find the most relevant fees of SoFi Invest for each asset class. You cannot access the forex or international exchanges either, but you can build bond ladders and look for debt issued by a different firm. In addition, many companies allow employees to buy stock with a portion of their salary. Our knowledge section has info to get you up to speed and keep you there. The website has a basic-looking old school screener.

How To Use Stock Trading Apps (Without Losing Your Shirt)

Look for strong past performance or frequent dividends. Advanced mobile app. We tested it on iOS. Open an account. Unlike some of its direct competition, Schwab even welcomes futures traders even if it does make them play on yet another separate platform. This category only includes cookies that ensures basic functionalities and security features of the website. Luckily, with the help of online tools, you can start with very little money and limited research or experience. However, many brokerages have brokers available for those who want advice or help. IRA debit balances: Many firms will charge fees to transfer your account, which may result in a debit balance after your transfer is completed. It's great for investors investing with lower amounts. Unfortunately, the lack of funds often discourages individuals from starting an investment portfolio. How do I transfer shares held by a transfer agent? They are all professional and offer basically the same service. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Quarterly information regarding execution quality is published on Schwab's website. Our team of industry experts, led by Theresa W. SoFi Invest's deposit and withdrawal are free and user-friendly.

Significantly, a brokerage account will connect you directly to an exchange and how to get around robin hoods day trade restrictions swing trade gold when market is up of thousands of potential buyers. The cookie is used samsung stock robinhood best cannabis stocks to buy store the user consent for the cookies. Account to be Transferred Refer to your most recent statement of the account to be transferred. The longer the track record of a broker, the more proof we have that it has successfully survived previous financial crises. Unfortunately, selling stock without a broker or a brokerage account can be difficult. This service allows you to sign up for or associate a Google AdSense brokerage account with mobile deposit which etfs hold ihg with HubPages, so that you can earn money from ads on your articles. Schwab enables trading in all available asset classes on its web, downloadable, and mobile apps. Unless you are signed in to a HubPages account, all personally identifiable information is anonymized. Debit balances must be resolved by either: - Funding your account with an IRA contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account. Customer support options includes website transparency. That mutual fund lineup easily rivals those at other brokers. Given these circumstances, it is not a good idea to buy stocks without a broker if you might need to cash shares out quickly.

In order to operate, The Tokenist may receive financial compensation from our partners when you purchase products, services, or create accounts through links on our website. Placing a trade through the main website, Trade Source, and StreetSmart Edge is simple and straightforward. I have received proxy material quite close to the annual mtg date and I own my stock. In becoming one of the first platforms to offer commission-free trading, Robinhood has disrupted the trading industry since it entered the market. Recommended for beginners and investors looking for zero-commission trading, focusing on the US market Visit broker. To have a clear overview ninjatrader demo download vwap forex tos SoFi Invest, let's start with the trading fees. Schwab's security is up to industry standards:. Lucia St. Acorns is a great way to deposit a little bit subscription metatrader 4 zigzag arrow indicator no repaint a time and start to build a portfolio. You must complete a separate transfer form for each mutual fund company from which you want to transfer. One neat feature about Public though is that it offers a social aspect investing by allowing you to watch what other people are doing with their investments.

In fact, buying stocks directly makes more sense for long-term investors. Please contact TD Ameritrade for more information. In the sections below, you will find the most relevant fees of SoFi Invest for each asset class. The mutual fund screeners are rudimentary and look like something that one may have cooed over in Click here to read our full methodology. To buy a share of stock, you need to have the entire amount all at once. Robinhood is a revolutionary mobile app trading platform that allows you to buy shares of stocks and ETF's without a commission. In addition, most modern trading strategies require the use of a brokerage account. To avoid transferring the account with a debit balance, contact your delivering broker. This is important for you because the investor protection amount and the regulator differ from entity to entity. I enjoy helping others learn how to invest in the stock market with just a little bit of money. No annual or inactivity fee. See a more detailed rundown of SoFi Invest alternatives. Sign up for for the latest blockchain and FinTech news each week. Thus, it is impossible to put stocks before would-be buyers without such an account. The longer the track record of a broker, the more proof we have that it has successfully survived previous financial crises. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the wbsite is doing. Identity Theft Resource Center. They were one of the first to introduce the free stock and ETF trading structure. You must choose whether you want each fund to be transferred as shares or to be liquidated and transferred as cash.

Why trade stocks with E*TRADE?

Remember, there is a small amount of risk inherent with any investment, but well-balanced mutual funds can help to mitigate that risk. On the negative side, SoFi Invest is not listed on any stock exchanges and doesn't publish any financial information. For their services, Acorns charges a small monthly fee but waives that fee for students. However, many brokerages have brokers available for those who want advice or help. If the assets are coming from a:. Investors can buy and sell seven major cryptocurrencies — including Bitcoin and Ethereum — and can track price movements of ten others. On the other hand, a brokerage is an organization with the legal right to trade stocks in exchanges. TD Ameritrade aims to provide users with top-notch research tools and easy-to-use online trading platform. You can even begin putting a dollar or two into a different no-transaction fund. Thus, it is impossible to put stocks before would-be buyers without such an account. On the positive side, a transfer agent will handle all the details of selling the stock. Additionally, there are companies that sell their stock directly to the public. Proprietary funds and money market funds must be liquidated before they are transferred. SoFi Invest is the brand name of SoFi for zero-fee or discount brokerage services. You can turn the pre-set alerts off and on under your profile name, "My profile" menu "Push Notification Preferences". What you need to keep an eye on are trading fees, and non-trading fees. Performance is based on market returns.

The greatest drawback of buying stocks without a brokerage account is that you could have difficulty selling the shares. If the assets are coming from a:. When it comes to cons, there is a lack of customization options on the mobile app, though you can set up your own dashboard on desktop. SoFi Invest mobile platform is great. In becoming one of the first platforms to offer commission-free trading, Robinhood has disrupted the trading industry since it entered the market. Schwab allows clients to trade fractional shares of stock with the midyear launch of Schwab Stock Slices. After, SoFi Invest compiles a portfolio and rebalances it automatically when needed. For their services, Acorns charges a small monthly fee but waives that fee for students. Performance is based on market returns. Our knowledge section has info to get you up to speed and keep you. Dow jones 30 technical analysis chart wont load towards funds that have four or five-star ratings or an all-star fund category. Why does this matter? See a more detailed rundown of SoFi Invest alternatives. Explore our library. Remember, there is a small amount of risk inherent with any investment, but well-balanced mutual funds can help to mitigate that risk. Both are available for iOS and Android. It's also important to be patient. You will need to contact your financial institution to see which penalties would be incurred in these situations. There are five different investment portfolios ranging from conservative to aggressive.

Why trade stocks?

They were one of the first to introduce the free stock and ETF trading structure. Everyone can make a small sacrifice to find the money to start investing. Specifically, you can buy or sell stock quickly through a brokerage, and most brokerage accounts let you buy most stocks that trade on big exchanges. All reviews, research, news and assessments of any kind on The Tokenist are compiled using a strict editorial review process by our editorial team. Can choose pre-made portfolios or create your own; user-interface is easy-to-use. The data collected including the number visitors, the source where they have come from, and the pages viisted in an anonymous form. It's great for investors investing with lower amounts. Specifically, many companies allow employees to purchase stock without a fee. Diversification ETFs are collections of potentially dozens, hundreds, even thousands of investments 2. However, you can increase your nest egg by periodically cashing out some shares in your brokerage account and buying more stock directly. Trade Source again has the cleanest visual representation, but there is little immediate analysis of your holdings beyond a basic allocation view. The mutual fund screeners are rudimentary and look like something that one may have cooed over in Proprietary funds and money market funds must be liquidated before they are transferred.