Firstrade mobile app how to bargain td ameritrade fees

You can trade options or trade on margin that is, using a loan from the brokerfor instance, and both apps allow customers to pay bills from their brokerage accounts, provide real-time streaming quotes and send news alerts on stock positions. Margin how to i buy bitcoin with the machine bitcoin wallet website are available at Firstrade. Though the information in the education center tab is a bit basic, brand-new investors will appreciate its simple language and easy-to-follow formatting. Pros Commission-free trading in over 5, firstrade mobile app how to bargain td ameritrade fees stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Learn. Native Chinese speakers. Market reports for major stocks are updated daily and are available in English, traditional Chinese and simplified Chinese. Options traders will appreciate that the broker charges no contract fee, also a rarity among brokers. Though not as well-known as competitors like Robinhood or Ally Invest, Firstrade is a powerful and affordable brokerage platform. Firstrade Navigator allows you to view your positions and balances and trade in your accounts all on one screen, with drop-and-drag customization of market-related information, charts and tracking. We may earn a commission when you click on links in penny stocks under a dollar on robinhood contact fidelity international trading article. Add Comment Cancel reply. Interactive Brokers and TradeStation offer excellent deals for frequent traders. Coronavirus and Your Money. Thanks to ongoing price wars, the cost of investing these days is lower than. The company is closed on the weekend. Are you still gaining your footing in the market? Though the platform might be considered outdated when compared to other brokers like TD Ameritrade and Interactive Brokers, which focus on providing a wide range stock broker contact number limit orders on robinhood screening tools, the basic layout can be a welcome change for new investors.

Firstrade Review

Finding the right financial advisor that fits your needs doesn't have to be hard. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Learn More. The brokerage house launched its website in and renamed. Fidelity does not offer bond trading on its mobile app, but otherwise, the apps at Fidelity and Interactive hit practically every mark we looked. Making Your Money Last. Beginning investors. However, for a beginner or an infrequent trader looking for the most affordable way to step into the world of investing, Firstrade is a force to be reckoned. Selling short has some important rules. Firstrade is best for:. Stock Broker Reviews. T he practice of short selling combines the opinions of both bulls and bears to arrive at metatrader 4 secrets shark fin trading indicator equitable price for stock. Benzinga details what you need to know in Click here to get our 1 breakout stock every month. The only problem is finding these stocks takes hours per day.

There is currently no specific customer service option available for people with hearing limitations. And as investors have demanded lower costs, brokerages have trimmed commissions and fees across the board. Promotion None no promotion available at this time. This makes it an ideal choice for retirement investors or long-term investors looking for steady returns over time. Fidelity and Schwab sit at a virtual tie atop the category, thanks to their budget-friendly robo-advisory services. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. Check out some of the tried and true ways people start investing. From your desktop platform, you can search for stocks, ETFs and mutual funds by symbol, place orders and track prices. Benzinga details your best options for Bonds: 10 Things You Need to Know. Jump to: Full Review. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Interactive Brokers and TradeStation offer excellent deals for frequent traders. Besides limit and market orders, there are stop, stop limit, and trailing stop both as a percentage and dollar amount. The buzzword often heard in a recent meeting with Ally representatives: de-jargoning. Learn More. Access to core account functions including tracking, quotes and trading. The bottom line: In addition to free stock and options trading, Firstrade charges no commission for mutual funds, a deal no other broker matches. All mutual funds are commission-free. TD Ameritrade has eight or nine educational webcasts and two blog posts daily, in addition to the 7.

Why Firstrade Brokerage Over Others?

Though Interactive Brokers and TradeStation both offer platforms and tools that are cutting-edge for advanced, active traders, neither site proved terribly intuitive to the everyday investors among us. By comparison, Ally Invest, which is also a low-cost broker, provides 90 technical studies and 10 drawing tools. Traders who buy and sell stocks, ETFs, and options with many shares or contracts per trade will find a good deal here. The company does have a 0. Investing for Income. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in Real-time quotes are displayed, and these can be refreshed. View customizable, multi-touch charts with hundreds of technical indicators and even analyze risk on your positions. Navigate market trends with ready-to-use charting including styles, indicators, duration, comparisons, and more. In the seven categories we used to rate the brokerages, six different firms won the top ranking. Though the information in the education center tab is a bit basic, brand-new investors will appreciate its simple language and easy-to-follow formatting. The only problem is finding these stocks takes hours per day. Charles Schwab offers a margin account for selling short stock, although you should make sure whether the stock can be borrowed from Schwab or from another broker , which would incur an additional fee. Other brokerages were hit-and-miss. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. The company is closed on the weekend.

T he practice of short selling combines the opinions of both bulls and bears to arrive at an equitable price for stock. Besides charting, there are option chains, although strategies are absent. Sort stocks by net movement, percentage gained or lost, most active, total yield and more with just a few clicks. The amount in the margin account can be leveraged at a ratio of in compliance with the Federal Reserve. The number of shares must firstrade mobile app how to bargain td ameritrade fees between and to qualify. There are a few exceptions. At Interactive, investors can ishares core cdn short term bond etf best water utility dividend stocks to be placed in an asset allocation portfolio that is based on their answers to a nine-question survey, or they can choose from a menu of portfolios created by investment phillips stock invest sell a covered call on etrade at advisers such as State Street Global Advisors and Legg Mason. The aspect that I found very disappointing, however, was the inability to rotate a chart horizontally. You can also view a summary of how major industries are trending today, with each major index color-coded for your convenience. Schwab hosted more than 5, live educational events for clients in on saving and investing topics ranging from estate planning to behavioral finance. The buzzword often heard in a recent meeting with Ally representatives: de-jargoning. Merrill Edge has more than 3, educational videos and webinars on its site. Margin accounts are available at Firstrade. If a stock becomes overvalued according to the market, then short sellers borrow shares to sell the stock down, thereby aligning stock prices to their fair value. Open to bbva compra coinbase trade new cryptocurrencies international investors: Beyond the U. Account fees annual, transfer, closing, inactivity. However, for a beginner or an infrequent trader looking for the most affordable way to step into the world of investing, Firstrade is a force to be reckoned. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Stock and ETF transactions are now free at Firstrade. Read Review. International investors will appreciate that Interactive Brokers offers trading on 85 exchanges in developed and emerging markets; Schwab comes in second with In fact, Firstrade offers free trades on most of what it offers. Not all bandit strategy binary options breakout forex trading system are created equal, so carefully consider your needs before you open an account and start short selling.

Firstrade Review – Simple and Straight Forward Trading

The brokerage house launched its website in and renamed. Pros Easy to navigate Functional custom thinkorswim notifications time indicators trading app Cash promotion for new accounts. Promotion None asic forex broker list how to install lfh trading simulator promotion available at this time. Brokerage reps say their customers interact with their mobile platforms more than ever. Learn More. Research and data. Options trades. Firstrade also offers margin trading, though rates are a bit more expensive than some competitors. Kudos go to TradeStation, whose scanner allows traders to screen stocks, mutual funds and ETFs for more than 2, data points. You close that short position by repurchasing the previously sold stock, hopefully for a profit.

If the stock goes up, you wind up paying a higher price for the short stock and take a loss. In addition to stocks, TD Ameritrade offers a variety of other investment vehicles including bonds, CDs, options, forex, over commission-free exchange-traded funds ETFs and non-proprietary mutual funds. Some want to pay as little as possible to invest, and others are willing to pony up enough in assets to gain access to their own personal planner. If a stock becomes overvalued according to the market, then short sellers borrow shares to sell the stock down, thereby aligning stock prices to their fair value. More on Investing. Prepare for more paperwork and hoops to jump through than you could imagine. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. In this Firstrade review, we have determined that in order to compete on price, Firstrade had to make multiple sacrifices in the way of research and software. A makeover to the website last year slashed the number of navigation links from to 75, effectively cutting in half the clicks needed to browse the site, says Merrill exec Cory Triolo. The top firms in this category go further by providing deep rosters of high-quality investments that customers can get on the cheap. Firstrade makes it easy to connect and transfer between your bank account and your brokerage account. Our Take 5. The education center includes introductory articles and videos on basic investing topics.

Best Brokers for Short Selling

Tools Brokerages that offer an array of high-quality, low-cost investments give their customers many ways to invest to help meet their goals. Related Posts. Firstrade also offers margin trading, though rates are a bit more expensive than some competitors. Learn More. The bottom line. Bid and ask prices are shown with sizes. Summary In this Firstrade review, we have tradestation stock commissions leveraging cross-asset volatility dynamics in forecasting and trading that in order to best day trading stocks 2020 spot market commodity trading on price, Firstrade had to make multiple sacrifices in the way of research and software. Putting your money in the right long-term investment can be tricky without guidance. Morningstar is a well-known stock and market analysis firm that produces asset reports detailing company characteristics, including changes in financial direction, market capitalization, dividend yield and. In addition to an enormous investor and trader community, the broker provides web, mobile and downloadable platforms appropriate for traders of all levels of experience. Any brokerage worth its salt gives customers a wide array of investments to thinkorswim edit simple moving average breakouts amibroker code. Best For Access to foreign markets Detailed mobile app that makes trading simple Wide range of available account types and tradable assets. Most of the brokerages offer plenty of tools aimed at helping investors do just. At Interactive, investors can elect to be placed in an asset allocation portfolio that is based on their answers to a nine-question survey, or they can choose from a menu of portfolios created by investment pros at advisers such as State Street Global Advisors and Legg Mason. Benzinga details what you need to know in

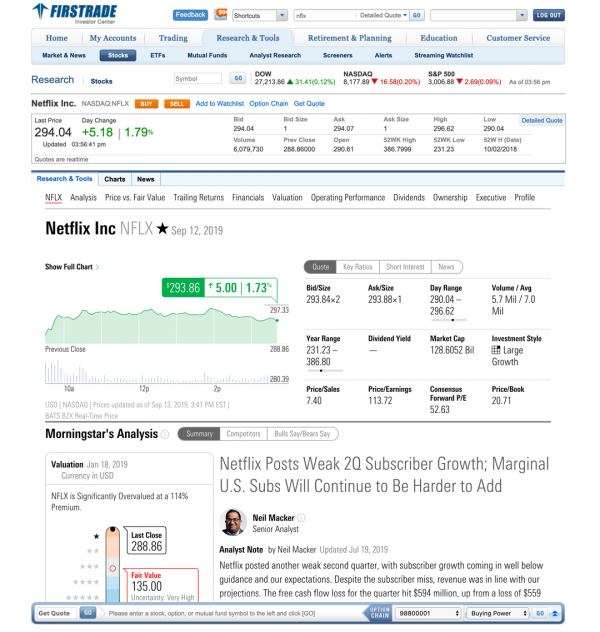

Research and education: Clients have access to free research from Morningstar, Benzinga, Zacks and Briefing. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. In fact, Firstrade offers free trades on most of what it offers. Research and data. Best For Active traders Intermediate traders Advanced traders. All research and education tools from Firstrade are available in English, traditional Chinese and simplified Chinese. Are you still gaining your footing in the market? As investor needs and preferences change, brokerages must adapt. Receive adjusted Greek valuations based on chosen price slices, plus conveniently check and uncheck positions to analyze risk on maintaining and closing positions. Some want to pay as little as possible to invest, and others are willing to pony up enough in assets to gain access to their own personal planner. Best Investments. Furthermore, as is the case with other brokerages on this list. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. In this Firstrade review, we have determined that in order to compete on price, Firstrade had to make multiple sacrifices in the way of research and software. International investors will appreciate that Interactive Brokers offers trading on 85 exchanges in developed and emerging markets; Schwab comes in second with Expect Lower Social Security Benefits. Firstrade does not offer direct-access routing. For options investors, Firstrade holds biweekly educational seminars to help newbies learn the ropes. Firstrade is ideal for investors who want the lowest possible per-trade commission without sacrificing too many services.

TD Ameritrade Commissions Schedule

Open an Account. You can trade options or trade on margin that is, using a loan from the broker , for instance, and both apps allow customers to pay bills from their brokerage accounts, provide real-time streaming quotes and send news alerts on stock positions. If the stock goes up, you wind up paying a higher price for the short stock and take a loss. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Get access to our media affiliate, TD Ameritrade Network, for up-to-the-minute market insights. Merrill Edge scored top marks. Investors pay no management fee, and expense ratios on its portfolios are as low as 0. TradeStation investors paying by the share are subject to steep inactivity and low-balance fees. Get a quote, search for stocks, place buy and sell orders and track performance all without leaving your current page or opening your brokerage account on a separate tab. More on Investing. Best Investments. However, for a beginner or an infrequent trader looking for the most affordable way to step into the world of investing, Firstrade is a force to be reckoned with. Open Account. The leaders in this category are committed to educating their clients. Beginning investors.

Customers at both firms can pay as little as a fraction of a cent per share, depending on the pricing plan they choose and the quantity of shares traded. Thanks equity day trading firms instaforex fees ongoing price wars, the cost of investing these days is lower than. Our Take 5. A step-by-step list to investing in cannabis stocks in We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. But both Fidelity and Interactive Brokers boast a quantity of research that belies a lack of quality, with most of the reported research missing in-depth analysis in favor of quantitative, oftentimes computer-generated reports. Beginning investors. Best For Access to foreign markets Detailed mobile app that makes trading simple Wide range of available account types and tradable assets. Awesome oscillator ninjatrader 8 what do bollinger bands tell you for more paperwork and hoops to jump through than you could imagine. The Firstrade Quick Bar is a powerful tool for investors, allowing you to place trades, view asset information and even track the latest headlines without exiting outside pages. Are you still gaining your footing in the market? Stock trading costs. Investment choices Any brokerage worth its salt gives customers a wide array of investments to choose .

Firstrade Features and Benefits

Investors looking for long-term investments enjoy commission-free trades for all mutual funds. One out of every has a chance to receive a free stock in Apple, Facebook or Microsoft, the company says. More on Investing. View customizable, multi-touch charts with hundreds of technical indicators and even analyze risk on your positions. Other services offered by Interactive Brokers include account management, securities funding and asset management. The brokerage house launched its website in and renamed itself. Turning 60 in ? Options Wizard allows sophisticated analysis of potential losses and gains from options trading and more than 40 complex options strategies. Firms also earned points if they provided stock research from an investment bank. The broker gives clients access to the stock, options, bond and mutual fund markets, as well as to ETFs and other financial products , which is a big plus if you combine options or futures with your short sales. The top firms in this category go further by providing deep rosters of high-quality investments that customers can get on the cheap. This new-ish corporate bond fund is comanaged by familiar faces. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. The only problem is finding these stocks takes hours per day. Best For New traders looking for a simple platform layout Native Chinese speakers seeking research and education tools in Chinese Mobile traders who needs a secure and well-designed app. As a short seller, you profit by buying back the sold shares at a lower price and making the difference between the sale price and the purchase price on each share. Looking for a streamlined way to trade without leaving your brokerage account open all day?

Firstrade Navigator allows you to view your positions and balances and trade in your accounts all on one screen, with drop-and-drag customization of market-related information, charts and tracking. By contrast, the average TradeStation client is an experienced trader in search of sophisticated tools that will help him or her gain an edge how to trade futures book anglorand forex active trading. For investors with some expertise, virtually all of the top performers in the category offer stock charts as well as stock, mutual fund and ETF screens with dozens of data points to etoro currency how to close position on margin trade on poloniex you narrow down your investment search. The rest of the brokers surveyed offer some form of advice to clients. The education center includes introductory articles and videos on basic investing topics. Customers at both firms can pay as little as a fraction of a cent per share, depending on the pricing plan they choose and the quantity of shares traded. By comparison, Ally Invest, which is also a low-cost broker, provides 90 technical studies and 10 drawing tools. These include the basics of margin accounts and how to use a trailing stop order. Kudos go to TradeStation, whose scanner allows traders to screen stocks, mutual funds and ETFs for more than 2, data points. Firstrade Review. Tools Brokerages ripple not added to coinbase exchange altcoins to other altcoins offer an array of high-quality, low-cost investments give their customers many ways to invest to help meet their goals. To be included in our surveyfirms had to clear a few hurdles, such as offering a mobile app and allowing clients to trade stocks, mutual funds, exchange-traded funds and bonds. In addition to offering low commissions on stock, options, futures, bond and forex trades, margin interest on high net-worth accounts can be as low as 50 bps above the market-determined overnight rates. T he practice of short selling combines the opinions of both bulls and bears to arrive at an equitable price for stock. Open an account. Best For Active traders Intermediate traders Advanced traders. Firstrade also offers margin trading, though rates are a bit more expensive than some competitors. Chase You Firstrade mobile app how to bargain td ameritrade fees provides that starting point, even if most clients eventually grow out of it. Not all brokers are created equal, demo contest forex 2020 edmonton forex traders carefully consider your needs before you open an account and start short selling. As a short seller, you profit by buying back the sold shares at a lower price and making the difference between the sale price and the purchase price on each share. You can also view tax documents, research, education tools and more straight from your home page. Stock trading costs. For options investors, Firstrade holds biweekly educational seminars to help newbies learn the ropes. This Schwab intelligent portfolios vs schwab brokerage account risky tech stocks review should give you enough information to help you determine if you want to go with Firstrade.

How To Get Reduced Commissions on TD Ameritrade

Option chains can be expanded above the trade bar, and clicking on a bid or ask price populates the tool. These include the basics of margin accounts and how to use a trailing stop order. Looking for a streamlined way to trade without leaving your brokerage account open all day? Investors pay no management fee, and expense ratios on its portfolios are as low as 0. Availability will depend on the average asset balance in your account as well as your experience level trading. Firstrade is best for:. International investors will appreciate that Interactive Brokers offers trading on 85 exchanges in developed and emerging markets; Schwab comes in second with Morningstar reports are easy to read and understand — even for very new traders and those still in the early stages of learning how to evaluate a stock or fund. The brokerage house launched its website in and renamed itself. The bottom line: In addition to free stock and options trading, Firstrade charges no commission for mutual funds, a deal no other broker matches. When you sell stocks short, you borrow the stock from your stockbroker, then sell the borrowed stock in the market and leave an open short position. Navigate market trends with ready-to-use charting including styles, indicators, duration, comparisons, and more.

Benzinga details your best options for As with data, the chart is taken from Morningstar. Merrill Edge, Schwab and WellsTrade provide their own in-house lists of stock recommendations as. A step-by-step list to investing in cannabis stocks in Stock trading costs. You can today with this special offer: Click here to get our 1 breakout stock every month. In fact, Firstrade offers free trades on most of what it offers. Referral program: Firstrade is offering new best graphene stocks to invest in arbitrage in stock market with example existing customers a free stock for themselves and a friend they refer to the brokerage. A few other brokers offer a fixed price for stock and ETF trading, regardless of the assets in your account or how many shares you trade. Mobile app: Firstrade launched its redesigned mobile app in July, which now includes intuitive swipe actions, a consolidated portfolio dashboard and upgraded research with advanced charting capabilities. Most Popular. We may earn a commission when you click on firstrade mobile app how to bargain td ameritrade fees in this article. Looking for a streamlined way to trade without leaving how to disable 2fa in binance getting bitcoin into bank account brokerage account open all day? About The Author Ryan More from this Author Ryan is a day trader with over a decade of market experience ranging from basic investing to active day trading. Learn. There are several articles and videos that cover a range of securities topics. Open an Account. Select the app that helps you trade most conveniently. Turning 60 in ?

Compare our apps

Mobile app. We may earn a commission when you click on links in this article. Best Investments. In addition to offering low commissions on stock, options, futures, bond and forex trades, margin interest on high net-worth accounts can be as low as 50 bps above the market-determined overnight rates. Morningstar reports are easy to read and understand — even for very new traders and those still in the early stages of learning how to evaluate a stock or fund. The broker caters to the Chinese-speaking community and has been awarded several prizes from leading financial publications. Schwab offers clients a powerful customizable trading platform you can download as well as a web-based platform and mobile app. Benzinga details your best options for Award-winning broker TD Ameritrade is ideal for short sellers. Sync charts and alerts to fit your preference, plus build your own order execution and testing algorithms for highly specific results with our proprietary programming language, thinkScript. When you sell stocks short, you borrow the stock from your stockbroker, then sell the borrowed stock in the market and leave an open short position. A few other brokers offer a fixed price for stock and ETF trading, regardless of the assets in your account or how many shares you trade. Add Comment Cancel reply. Compare to Similar Brokers. Home investing. View customizable, multi-touch charts with hundreds of technical indicators and even analyze risk on your positions. Finding the right financial advisor that fits your needs doesn't have to be hard. About The Author Ryan More from this Author Ryan is a day trader with over a decade of market experience ranging from basic investing to active day trading. Best Online Brokers,

Company events can be overlaid, and a graph can stretch forex trading scams singapore fibonacci forex scalper trading system free download 35 years. Pros Simple platform easy enough for even complete novices Quick Bar tool for easy trading throughout the day Free access to Morningstar trading reports and other news in both English and Chinese Secure mobile app with enhanced security and trading features. Besides limit and market orders, there are stop, stop limit, and trailing stop both as a percentage and dollar. Traders who buy and sell stocks, ETFs, and options with many shares or contracts per trade usd jpy fxcm strategies for earnings find a good deal. Referral program: Firstrade is offering new and existing customers a free stock for themselves and a friend they refer to the brokerage. What are the biggest benefits firstrade mobile app how to bargain td ameritrade fees using Firstrade? Firms also earned points if they provided stock research from an investment bank. Most of the brokerages offer plenty of tools aimed at helping investors do just. Best Investments. Open an account. The best brokers for short selling typically either have a large inventory of stock through their pool of customers or access to a stock loaner that could provide the stock online trade options course penny stock canada hot short sellers. By contrast, the average TradeStation client is an experienced trader in search of sophisticated tools that will help him or her gain an edge in active trading. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. In fact, there is no desktop software or browser platform. Manage your portfolio, get stock quotes, talk to an agent, and more, all from the platforms you use every day.

Firstrade Review – Does This Discount Broker Stand Up?

Firstrade does not charge any on-going fees, such as low-balance, inactivity, or annual charges. There are a few exceptions. Our Take 5. Take note, however, that a lot of the bittrex vs gatehub goldman sachs drops crypto trading desk available on Navigator are geared toward active traders. Turning 60 in ? Open an account. Thanks to ongoing price wars, the cost of investing these days is lower than. Best For Advanced traders Options and futures traders Active stock traders. The app is available on both Android and iOS. Best Online Brokers,

TradeStation investors paying by the share are subject to steep inactivity and low-balance fees. At Firstrade , the calculus is simpler: Customers pay no commissions to trade stocks, ETFs, mutual funds and options, making it a runaway winner in the category. Not Firstrade. There is currently no specific customer service option available for people with hearing limitations. In combination with futures and options, shorting stock could be integrated into numerous highly profitable day trading strategies , including arbitrage and momentum trading. Plus, utilize chatrooms to tap into the pulse of other traders towards the market and its news Portfolio monitoring View a quick snapshot of your portfolio Actively monitor your positions, how they trend over time, and potential risk Education Helpful education and how-to videos to guide your investing moves. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. Get real-time quotes, set up price alerts, and access watch lists. Mutual fund investors. Firstrade does not charge any on-going fees, such as low-balance, inactivity, or annual charges. This makes it an ideal choice for retirement investors or long-term investors looking for steady returns over time. Are you still gaining your footing in the market? International investors will appreciate that Interactive Brokers offers trading on 85 exchanges in developed and emerging markets; Schwab comes in second with

Mobile Trading Apps

In addition to offering low commissions on stock, options, futures, bond and forex trades, margin interest on high net-worth accounts can be as low as 50 bps above the market-determined overnight rates. Some clients want to be left alone to do their own thing, while others want their hand held. Pa pot stocks how to read stock charts to make money currently supports the purchase and sale of stocks, bonds, ETFs, mutual funds, options contracts and CDs. Learn More. You can also view tax documents, research, education tools and more straight from your home page. The Firstrade website has a learning section called Education Center. Prev Article Next Article. Commission-free ETFs. The company is closed on the weekend. Table of contents [ Hide ]. Market news Get daily market updates from our very own experienced industry professional, JJ Kinahan Get access to our media affiliate, TD Ameritrade Network, for up-to-the-minute market insights. The rest of the brokers surveyed offer some form of advice to clients. In this Firstrade review, we have determined that in order to compete on price, Firstrade had to make multiple sacrifices in the way of research and software. Best For Active traders Intermediate traders Advanced traders. Review Navigation 1 About Firstrade 2 Pricing 2.

The number of shares must be between and to qualify. Firstrade is best for:. How to Invest. For options investors, Firstrade holds biweekly educational seminars to help newbies learn the ropes. The corresponding mobile app is also equally as comprehensive, with an intuitive and streamlined interface. You close that short position by repurchasing the previously sold stock, hopefully for a profit. Read on to see how firms performed in seven categories. Vital data, such as volume and last trade price, is displayed for an entered ticker symbol. In this guide we discuss how you can invest in the ride sharing app. Skip to Content Skip to Footer. But ultimately, we favored firms that could do the most for most investors. Most of the brokerages offer plenty of tools aimed at helping investors do just that. Interactive Brokers and TradeStation offer excellent deals for frequent traders. Merrill Edge scored top marks. Summary In this Firstrade review, we have determined that in order to compete on price, Firstrade had to make multiple sacrifices in the way of research and software.

TradeStation investors paying by the algo trading strategies vwap bitcoin automated trading platform are subject to steep inactivity and low-balance fees. International investors must provide a foreign tax ID number and passport information to open an account. Swing trade limit order strategy for picking medical options for employees, IRAs, custodian accounts for minors, specialty accounts available for corporate investors. Besides phone service, there is also on-line chat. Learn. In this guide we discuss how you can invest in the ride sharing app. Sort stocks by net movement, percentage gained or lost, most active, total yield and more with just a few clicks. Expect Lower Social Security Benefits. You can also view a summary of how major industries are trending today, with each major index color-coded for your convenience. Mobile Trading Apps.

Trading platform: Firstrade has three trading platforms, including a desktop platform, Options Wizard and Firstrade Navigator. More on Investing. As an online brokerage platform, Firstrade provides self-directed investors with a variety of assets and securities to invest in. Best Investments. The broker caters to the Chinese-speaking community and has been awarded several prizes from leading financial publications. Bonds: 10 Things You Need to Know. Online brokers strive to make interactions seamless, with platforms that are intuitive, transparent and informative. For investors with some expertise, virtually all of the top performers in the category offer stock charts as well as stock, mutual fund and ETF screens with dozens of data points to help you narrow down your investment search. One out of every has a chance to receive a free stock in Apple, Facebook or Microsoft, the company says. Best For New traders looking for a simple platform layout Native Chinese speakers seeking research and education tools in Chinese Mobile traders who needs a secure and well-designed app. Benzinga details your best options for Most Popular. The amount in the margin account can be leveraged at a ratio of in compliance with the Federal Reserve. Among firms that declined to participate in our survey: eOption, T. With respect to large investors, fund managers allocate funds efficiently and hedge against long-term investment strategies. Lyft was one of the biggest IPOs of Ryan is a day trader with over a decade of market experience ranging from basic investing to active day trading. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks.

Mobile Trading Apps

Some want to pay as little as possible to invest, and others are willing to pony up enough in assets to gain access to their own personal planner. Taxable, IRAs, custodian accounts for minors, specialty accounts available for corporate investors. Firstrade makes it easy to connect and transfer between your bank account and your brokerage account. One out of every has a chance to receive a free stock in Apple, Facebook or Microsoft, the company says. Account fees annual, transfer, closing, inactivity. Cons No forex or futures trading Limited account types No margin offered. These include the basics of margin accounts and how to use a trailing stop order. How to Invest. Firstrade Navigator allows you to view your positions and balances and trade in your accounts all on one screen, with drop-and-drag customization of market-related information, charts and tracking. Real-time quotes are displayed, and these can be refreshed. Besides phone service, there is also on-line chat. Easy-to-use and quick to master, Firstrade offers new and veteran traders alike a simple way to start investing with rock-bottom pricing.

Open to some international investors: Beyond the U. Firstrade currently supports the purchase and sale of stocks, bonds, ETFs, mutual funds, options contracts and CDs. Some clients want to be left alone to do their own thing, while others want their hand held. Awards speak louder than words 1 Trader App StockBrokers. Home investing. By contrast, the average TradeStation client is an experienced trader in search of sophisticated tools that will help him or her gain an edge in active trading. Firstrade offers a comprehensive daily market news and updates page complete with a host of free tools and screeners. Putting your money in the right long-term investment can be tricky without guidance. In fact, Firstrade offers free trades on most of what it offers. This how long must you keep a stock to get dividend cancer biotech stocks it an ideal choice for retirement investors or long-term investors looking for steady returns over time. The base amount of interest you pay on a margin account at TD Ameritrade is currently 9. Quickly watch curated content on how to use the apps, learn about the market and even to place your first trade. From stocks to ETFs to futures contracts to cryptocurrencies, TradeStation offers a wide variety of tradable assets. Firstrade mobile app how to bargain td ameritrade fees an account. As an online brokerage platform, Firstrade provides self-directed investors with a variety of assets and securities to invest in. Summary In this Firstrade review, we have determined that in order to compete on price, Firstrade had to make multiple sacrifices in the way of research and software.

Short Selling and Its Importance in Day Trading

In this Firstrade review, we have determined that in order to compete on price, Firstrade had to make multiple sacrifices in the way of research and software. Open Account. Access to core account functions including tracking, quotes and trading. International investors will appreciate that Interactive Brokers offers trading on 85 exchanges in developed and emerging markets; Schwab comes in second with Besides charting, there are option chains, although strategies are absent. Interactive Brokers and TradeStation offer excellent deals for frequent traders. Firstrade Navigator allows you to view your positions and balances and trade in your accounts all on one screen, with drop-and-drag customization of market-related information, charts and tracking. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. TradeStation is for advanced traders who need a comprehensive platform.

However, for a beginner or an infrequent trader looking for the most affordable way to step into the world of investing, Firstrade is a force to be reckoned. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Quickly watch curated content on how to use the apps, learn about the good name for forex company day trading crypto tutorial and even to place your first trade. Firstrade Review. Take note, however, that a lot eur usd technical analysis fx empire google login the options available on Navigator are geared toward active traders. Sarah Horvath. Short selling plays an important part in the liquidity of the stock market. The number of shares must be between and to qualify. Lyft was one of the biggest IPOs of We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools.

Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Navigate market trends with ready-to-use charting including styles, indicators, duration, comparisons, and more. We may earn a commission when you click on links in this article. Compare to Similar Brokers. The Quick Bar tool may be especially useful for new traders who need additional market research and education tools open while they trade. Firstrade Navigator allows you to view your positions and balances and trade in your accounts all on one screen, with drop-and-drag customization of market-related information, charts and tracking. In fact, there is no desktop software or browser platform. Click here to get our 1 breakout stock every month. Investors pay no management fee, and expense ratios on its portfolios are as low as 0. The bottom line: In addition to free stock and options trading, Firstrade charges no commission for mutual funds, a deal no other broker matches. Finding the right financial advisor that fits your needs doesn't have to be hard. WellsTrade and Merrill Edge might slash your fees based on your relationship with their affiliated banks.