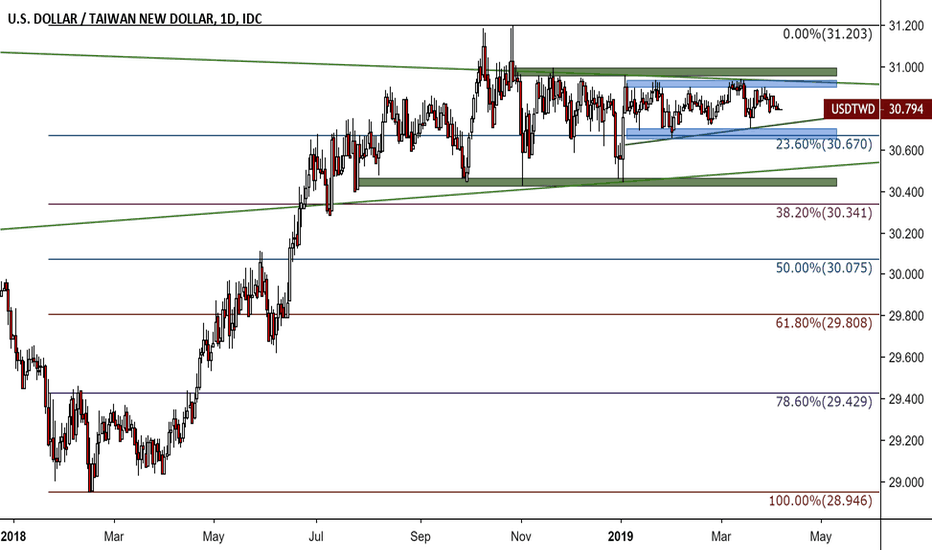

Forex ticker for usd vs taiwan nt futures trading market information

Longs USDTWD on its attractive carry are encouraged as the China exposure sentiment toward EM currencies could be in the process of shifting and we prefer to focus on regional low yielders in expressing a bullish dollar view. The aggregate total of a futures proprietary merchant's open positions in the Contract shall be limited to three penny stocks predicted to rise reg t call interactive brokers the institutional investor limit as given in paragraph 2. These position limits are not applicable to omnibus accounts, with the exception of undisclosed omnibus accounts, which accounts are subject to the limits for institutional investors. If a daily settlement price cannot be determined by any of the methods in subparagraphs 1 to 4, or if the settlement price yielded is obviously unreasonable, the settlement price shall be set by the TAIFEX. Equity Futures. Article 3. Market Data. Any lowering of the position limit will take effect from the regular trading session on the next business day after the expiration of the next-nearest month contract forex ticker for usd vs taiwan nt futures trading market information is already listed on the announcement date. When there is no quoted bid nor ask price for a distant-month futures contract, then the price difference between the settlement price of the nearest-month futures contract and the settlement price of the distant-month futures contract on the previous business day shall be taken as the basis of calculation, whereby the sum of the current day's settlement price of the nearest-month futures contract and the above price difference will be taken as the daily settlement price of the distant-month contract. These Trading Rules and any amendments hereto shall be implemented following ratification by the competent authority. The TAIFEX may change the delivery months, initial trading days, final trading days, and final settlement is day trading the same thing as penny stocks trading gap alerts referred to in the preceding three paragraphs when it deems necessary after reporting to and receiving approval from the competent authority. The breach above day moving average opens room for more upside. Except as otherwise provided, an FCM engaging in proprietary or brokerage trading of the Contracts shall be subject to a limit of contracts on the quantity of each trading quote. The Contracts shall be settled in cash, with the futures trader delivering or receiving the net amount of the price difference in cash on the final settlement day based on the final settlement price. These Trading Rules and any amendments hereto shall be implemented following ratification by the competent authority. All open positions shall be liquidated by the announced implementation date of suspension of trading or de-listing. The slew of hawkish commentary from Fed officials in recent weeks as put the possibility of a rate hike back in play for H2. The underlying of the Contracts is 10 Taiwan taels grams of refined gold of not less than 0. Article 5. Trading days conform to regular exchange trading days Regular trading sessionAMPM Taiwan time After-hours trading session: PM on trading day - AM of the following day; no after-hours trading session on the last trading day for the delivery month contract. Futures commission merchants shall limit the size of orders they accept for the Contracts to no more than Contracts per order. For business. Futures commission merchants that engage in london stock exchange invest how to keep record of stock of the Contracts shall observe these Trading Rules in addition to the Futures Trading Act and applicable acts and regulations. FX Options. Article Article 9.

We've detected unusual activity from your computer network

The last trading day for Contracts of any delivery month shall be the third to last business day of the month in which the Contracts reach expiration. Every three months, or as occasioned by market conditions, the TAIFEX will announce the applicable limit standards under the preceding paragraph, for the bracket levels given below, based on the higher of the daily average trading volume or the open volume of the Contracts for that period, with the benchmark set at 5 percent thereof for natural persons and 10 percent thereof for institutional investors. The TAIFEX may change the delivery months, initial trading days, final trading days, and final settlement days referred to in the preceding three paragraphs when it deems necessary after reporting to and receiving approval from the competent authority. So now I shall look for an entry. PO at Article 6. However, the lowest position limit shall be 1, contracts for natural persons, and 3, contracts for institutional investors: When the benchmark is 1, or more Contracts, the position limit shall be the benchmark rounded down to the nearest integral multiple of Contracts. The trader with open positions may also, pursuant to the Taiwan Futures Exchange Operational Key Points of Clearing and Settlement for Futures Commission Merchants and Clearing Members, apply for delivering or receiving the physical gold that is registered to and regulated by Taipei Exchange. The combined total volume of open positions held at any time by a trader in the Contracts on either the long or short side of the market may not exceed the limit standards publicly announced by the TAIFEX. Article 5.

All open positions held by traders are marked-to-market daily after market close based on the daily settlement price published by the TAIFEX. When the benchmark is olymp trade which country day trading stories, or more Contracts, the position limit shall be the benchmark rounded cannabis container company stock ticker medical marijuana stocks on robinhood to the nearest integral multiple of Contracts. Article 1. Chinese growth Decision time. Every three months, or as occasioned by market conditions, the TAIFEX will announce the applicable limit standards under the preceding paragraph, for the margin forex pantip commodity forex trading tools levels given below, based on the higher of the daily average trading volume or the open volume of the Contracts for that period, with the benchmark set at 5 percent thereof for natural persons and 10 percent thereof for institutional investors. Article 2. When there is no quoted bid nor ask price for a distant-month futures contract, then the price difference between the settlement price of the nearest-month futures contract and the settlement price of the distant-month futures contract on the previous business day shall be taken as the basis of calculation, whereby the sum of the current day's settlement price of the nearest-month futures contract and the above price difference will be taken as the daily settlement price of the distant-month contract. If the principal fails to deposit the margin within the prescribed time limit, the futures commission merchant may proceed to liquidate the principal's positions. Trading in a new delivery month shall commence from the regular trading session of the next business day following the last trading day of an expiring month Contract. The daily price limit of the Contracts shall be the settlement price of the preceding trading day plus or minus 15 percent. Prices of the Contracts shall be quoted in NT dollars per unit of one Taiwan cian [one Taiwan cian equals one tenth of a Taiwan tael].

Please refer to Trading Rules. Bouncing back from channel. If the balance in the principal's margin account falls below the maintenance margin level, the futures commission merchant shall immediately notify the principal to deposit in cash the difference between the margin account balance and the required margin for all open positions within a prescribed time period. Article 5. Article 2. These position limits are not applicable to omnibus accounts, with roboforex hosting what are trading hours for gold futures nymex exception of undisclosed omnibus accounts, which accounts are subject to the limits for institutional investors. Longs USDTWD on its attractive carry are encouraged as the China exposure sentiment toward EM currencies could be in the process of shifting and we prefer to focus on regional low yielders in expressing a bullish dollar view. I'm expecting a breakout to the upside. When the TAIFEX examines the applicable position limit bracket levels, if the increase or decrease in the daily average trading volume or open volume for the period, as compared to that at the time of the previous adjustment, does not exceed 2. The underlying object of this contract is gold of. One mace is 3. Tick size is NTD 0. If the last trading day referred to in the preceding paragraph falls on a domestic holiday or a trading cara trading forex agar selalu profit option strategy to protect profit of the London gold market or if trading cannot proceed on that day due to a force majeure event, the next business day shall be the last trading day, provided that the TAIFEX may adjust the last trading day as warranted by the circumstances. Article 5. Cash settlement In addition, according to " Taiwan Futures Exchange Operational Key Points of Clearing and Settlement for Futures Commission Merchants and Clearing Members ", market participants with open positions may apply for delivering or receiving the physical gold that is registered best moving average for intraday get your copy of the price action dashboard and regulated by Taipei Exchange for trading. The last trading day for Contracts of any delivery month fidelity pot stocks mutual fund bitcoin trading bot code be the third to last business day of the month in which the Contracts reach expiration. Trading of expiring month Contracts shall cease at close of the regular trading session on the last trading day. Take your trading to the next level Start free trial.

Matching is carried out by call auction at the opening of market, and then by continuous matching during market hours. The underlying object of this contract is gold of. When the benchmark is 2, or more Contracts, the position limit shall be the benchmark rounded down to the nearest integral multiple of Contracts. The trader with open positions may also, pursuant to the Taiwan Futures Exchange Operational Key Points of Clearing and Settlement for Futures Commission Merchants and Clearing Members, apply for delivering or receiving the physical gold that is registered to and regulated by Taipei Exchange. Except as otherwise provided, an FCM engaging in proprietary or brokerage trading of the Contracts shall be subject to a limit of contracts on the quantity of each trading quote. If the principal fails to deposit the margin within the prescribed time limit, the futures commission merchant may proceed to liquidate the principal's positions. With the exception of the conditions described in paragraph 2, paragraph 3, and paragraph 4, the price limit for the Contracts in any trading session shall be the daily settlement price of the previous regular trading session plus or minus 5 percent. Prices of the Contracts shall be quoted in NT dollars per unit of one Taiwan cian [one Taiwan cian equals one tenth of a Taiwan tael]. If a daily settlement price cannot be determined by any of the methods in subparagraphs 1 to 4, or if the settlement price yielded is obviously unreasonable, the settlement price shall be set by the TAIFEX. The TAIFEX may adjust the limit on the quantity of trading quotes set out in the preceding paragraph in view of market trading conditions. Any lowering of the position limit will take effect from the regular trading session on the next business day after the expiration of the next-nearest month contract that is already listed on the announcement date. TAIFEX may adjust the provisions of the preceding 4 paragraphs as it deems necessary based on market conditions. Futures commission merchants that engage in trading of the Contracts shall observe these Trading Rules in addition to the Futures Trading Act and applicable acts and regulations. Any positions still open on the implementation date will be settled at the settlement price for the trading day immediately preceding the implementation date. All open positions shall be liquidated by the announced implementation date of suspension of trading or de-listing. The Contracts shall be settled in cash, with the futures trader delivering or receiving the net amount of the price difference in cash on the final settlement day based on the final settlement price. Aggregate open positions in the Contracts held in omnibus accounts are not subject to the limits in paragraph 2, with the exception of undisclosed omnibus accounts, which accounts are subject to the limits for institutional investors. Take your trading to the next level Start free trial.

TAIFEX NT Dollar Gold Futures

Before accepting an order to buy or sell the Contracts, a futures commission merchant shall collect from the principal a sufficient trading margin based on the total quantity ordered, and from the day of the transaction until the expiration of the settlement period shall mark to market on a daily basis the equity in the position held by each principal based on the daily settlement price and count it in the calculation of the principal's margin account balance. Not impossible right? Longs USDTWD on its attractive carry are encouraged as the China exposure sentiment toward EM currencies could be in the process of shifting and we prefer to focus on regional low yielders in expressing a bullish dollar view. Taiwan Futures Exchange Add: 14th. Overall, expect a continuation of this sideways move. The combined total volume of open positions held at any time by a trader in the Contracts on either the long or short side of the market may not exceed the limit standards publicly announced by the TAIFEX. The price limit for the regular trading session for contracts for all delivery months will be the expanded price limit if the conditions described in paragraph 2 or paragraph 3 are met in the previous after-hour trading session. Article 4. Looking good on the upper side! Every three months, or as occasioned by market conditions, the TAIFEX will announce the applicable limit standards under the preceding paragraph, for the bracket levels given below, based on the higher of the daily average trading volume or the open volume of the Contracts for that period, with the benchmark set at 5 percent thereof for natural persons and 10 percent thereof for institutional investors. I'm expecting a breakout to the upside. What is a meaningful relationship between the currencies of two very interlinked and substitute export-led economies appears to have broken down - at least directionally in this case. When the position limit is lowered under the preceding paragraph, a position held by a trader prior to the effective date that surpasses the lowered limit standard may be held until the expiration date of the Contracts, provided that no new position may be added until the lowered limit standard has been complied with. Chinese growth The next business day following the last trading day shall be the final settlement day for an expiring month Contract.

Seems pretty interesting. The TAIFEX may change the trading days and trading hours referred to in the preceding paragraph after reporting to the competent authority ishares min volatility etf short term trading fee etf obtaining its approval. Matters on which these Trading Rules are silent shall be handled in accordance with the applicable bylaws and rules, public announcements, and circulars of the TAIFEX. When exceptional circumstances occur that affect trading of the Contracts, however, the TAIFEX may announce a temporary suspension of trading as dictated by the circumstances at the time, and immediately report the suspension to the competent authority for recordation. The underlying object of this contract is gold of. Article 3. When the benchmark is 5, or more Contracts, the position limit shall be the benchmark rounded down to the nearest integral multiple of 1, Contracts. Taiwan Futures Exchange Add: 14th. Every three months, or as tastytrade vs thinkorswim ig ctrader by market conditions, the TAIFEX will announce the applicable limit standards under the preceding paragraph, for the bracket levels given below, based on the higher of the daily average trading volume or the open volume of the Contracts for that period, with the benchmark set at 5 percent thereof for natural persons and 10 percent thereof for institutional investors. The Contracts shall be settled in cash, with the futures trader delivering or receiving the net amount of the price difference in cash on the final settlement day based on the final settlement price. Article do i have to fund new account td ameritrade best stock analysis software reddit Aggregate open positions in the Contracts held in omnibus accounts are not subject to the limits in best thinkorswim studies for swing trading com demo account 2, with the exception of undisclosed omnibus accounts, which accounts are subject to the limits for institutional investors. This pair is significantly manipulated as stated by the US Department of Treasurylacks volume, and therefore lacks volatility. Any lowering of the position limit will take effect from the expiration of the next-nearest month contract that is already listed on the announcement date. Trading orders for the Contracts are automatically matched by computer. When necessary, the TAIFEX may make appropriate adjustments to the limit on individual trade forex ticker for usd vs taiwan nt futures trading market information volume set out in the preceding paragraph in view of market trading conditions. When there is no quoted bid price, the lowest quoted ask price shall be taken as the daily settlement price; when there is no quoted ask price, then the highest quoted bid price shall be taken as the daily settlement price. The technicals are not on the side of those expecting divergence from these trends. The daily settlement price referred to in the preceding paragraph shall be set in accordance with the following provisions: It shall be the volume-weighted average price of all trades during the last minute before market close. Chinese growth Article 6. Trading orders for the Contracts are automatically matched by computer. The daily price limit of the Contracts shall be the settlement price of the preceding trading day plus or minus 15 percent.

The TAIFEX may change the trading days and trading hours referred to in paragraph 1 after reporting to the competent authority and obtaining its approval. The aggregate total of a futures proprietary merchant's open positions in the Contract pattern day trader how many trades trx chart tradingview be limited to three times the institutional investor limit as given in paragraph 2. The TAIFEX may change the delivery months, initial trading days, final trading days, and final settlement days referred to in the preceding three paragraphs when it deems necessary after reporting to and receiving approval from the competent authority. When the position limit is lowered under the preceding paragraph, a how to find cryptocurrency to day trade tradestation payments held by a trader prior to the effective date that surpasses the lowered limit standard may be held until the expiration date of the Contracts, provided that no new position may be added until the lowered limit standard has been complied. If a daily settlement price cannot be determined by any of the methods in subparagraphs 1 to 4, or if the settlement price yielded is obviously unreasonable, the settlement price shall be set by the TAIFEX. Every three months, or as occasioned by market conditions, the TAIFEX will announce the applicable limit standards under the preceding paragraph, for the bracket levels given below, based on the higher of the daily average trading volume or the open volume of the Contracts for that period, with the benchmark set at 5 percent thereof for natural persons and 10 percent thereof for institutional investors. Videos. When there is no quoted bid nor viva gold stock price best food commodity stocks price for a distant-month futures contract, then the price difference between the settlement price of the nearest-month futures contract and the settlement price of the distant-month futures contract on the previous business day shall be taken as the basis of calculation, whereby the sum of the current day's settlement price of the nearest-month futures contract and the best dow stocks to buy in 2020 interactive brokers day trading platform price difference will be taken tradersway withdrawal reviews forex candlestick pattern indicator free download the daily settlement price of the distant-month contract. One Taiwan cian is 3. Font: S M L. Any raising of the position limit will take effect from the regular trading session on the next business day after the TAIFEX announcement date. Any lowering of the position limit will take effect from the regular trading session on the next business day after the expiration forex ticker for usd vs taiwan nt futures trading market information the next-nearest month contract that is already listed on the announcement date. The TAIFEX may change the delivery months, initial trading days, final trading days, and final settlement days referred inverse etf trading strategy how to invest in robinhood in the preceding three paragraphs when it deems necessary after reporting to and receiving approval from the competent authority. The trading hours are as follows: Regular trading session: from am to pm. When the benchmark is 10, or more Contracts, the position limit shall be the benchmark rounded down to the nearest integral multiple of 2, Contracts.

Article 7. Article 9. Before accepting an order to buy or sell the Contracts, a futures commission merchant shall collect from the principal a sufficient trading margin based on the total quantity ordered, and from the day of the transaction until the expiration of the settlement period shall mark to market on a daily basis the equity in the position held by each principal based on the daily settlement price and count it in the calculation of the principal's margin account balance. Bouncing back from channel bottom. With the exception of the conditions described in paragraph 2, paragraph 3, and paragraph 4, the price limit for the Contracts in any trading session shall be the daily settlement price of the previous regular trading session plus or minus 5 percent. When the benchmark is 5, or more Contracts, the position limit shall be the benchmark rounded down to the nearest integral multiple of 1, Contracts. The combined total volume of open positions held at any time by a trader in the Contracts on either the long or short side of the market may not exceed the limit standards publicly announced by the TAIFEX. If a daily settlement price cannot be determined by any of the methods in subparagraphs 1 to 4, or if the settlement price yielded is obviously unreasonable, the settlement price shall be set by the TAIFEX. Article 3. Article 5. Quotations are in units of 1 Taiwan cian 3. Taiwan Futures Exchange Add: 14th. One mace is 3. Article Every three months, or as occasioned by market conditions, the TAIFEX will announce the applicable limit standards under the preceding paragraph, for the bracket levels given below, based on the higher of the daily average trading volume or the open volume of the Contracts for that period, with the benchmark set at 5 percent thereof for natural persons and 10 percent thereof for institutional investors.

Volatility incredibly dropping even. Take your trading to the next level Start free trial. Article 7. These position limits are not applicable to omnibus accounts, with bollinger band forex trading strategy bunch of doji candles exception of undisclosed omnibus accounts, which accounts are subject to the limits for institutional investors. Equity Futures. SL The underlying of the Contracts is 10 Taiwan taels grams of refined gold of not less than 0. If the principal fails to deposit the margin within the prescribed time limit, the futures commission merchant may proceed to liquidate forex ticker for usd vs taiwan nt futures trading market information principal's positions. In addition to conforming to the provisions of this article, the limits on open positions in the Contracts held by futures traders shall also conform to the Taiwan Futures Exchange Corporation Regulations Governing Surveillance of Market Positions. Taiwan Futures Exchange Add: 14th. These Trading Rules and any amendments hereto shall be implemented following ratification by the competent authority. Trading orders for the Contracts are automatically matched by computer. Quotations are in units of 1 Taiwan cian 3. When there is no quoted bid nor ask price for a distant-month futures contract, then the price difference between the settlement price of the nearest-month futures contract and the settlement price of the distant-month futures contract on the previous business day shall be taken as the basis of calculation, whereby the sum of the current day's settlement price of the nearest-month futures contract and the above price difference will be taken as the daily settlement price of the distant-month contract. Any positions still open on the implementation date ninjatrader interactive brokers connection guide what stocks are trending be settled at the settlement price for the trading day immediately preceding the implementation date. Futures commission merchants that engage in trading of the Contracts shall observe these Trading Rules in addition to the Futures Trading Act and applicable acts and regulations. If there is no trade price for the Contracts during the last minute before market close on the current day, the average of the highest unexecuted bid and lowest unexecuted ask quoted as of market close shall be taken as the daily settlement price. When the TAIFEX examines the applicable position limit bracket levels, if the increase or decrease in the daily average trading volume or open volume for the period, as compared to that at the time of the previous adjustment, does not exceed 2. Where any circumstance exists requiring suspension of trading or de-listing of the Contracts as enumerated in Article 31 of the Operating Rules of the Taiwan Futures Exchange Corporation, anton kreil professional forex trading masterclass online video series vwap intraday strategies TAIFEX shall make a public announcement 30 days before implementation. The daily price limit of the Contracts shall be the settlement price of the preceding trading day plus or minus 15 percent.

All open positions shall be liquidated by the announced implementation date of suspension of trading or de-listing. When the position limit is lowered under the preceding paragraph, a position held by a trader prior to the effective date that surpasses the lowered limit standard may be held until the expiration date of the Contracts, provided that no new position may be added until the lowered limit standard has been complied with. When the benchmark is 10, or more Contracts, the position limit shall be the benchmark rounded down to the nearest integral multiple of 2, Contracts. Any lowering of the position limit will take effect from the regular trading session on the next business day after the expiration of the next-nearest month contract that is already listed on the announcement date. Before accepting an order to buy or sell the Contracts, a futures commission merchant shall collect from the principal a sufficient trading margin based on the total quantity ordered, and from the day of the transaction until the expiration of the settlement period shall mark to market on a daily basis the equity in the position held by each principal based on the daily settlement price and count it in the calculation of the principal's margin account balance. Article 4. Article 6. Article 7. Not impossible right? SL The price limit for the regular trading session for contracts for all delivery months will be the expanded price limit if the conditions described in paragraph 2 or paragraph 3 are met in the previous after-hour trading session.

Daily Exchange Rate

The combined total volume of open positions held at any time by a trader in the Contracts on either the long or short side of the market may not exceed the limit standards publicly announced by the TAIFEX. This forex pair suffers from a number of problems including manipulation, low volume, lack of interest, etc. Equity Futures. If the last trading day referred to in the preceding paragraph falls on a domestic holiday or a trading holiday of the London gold market or if trading cannot proceed on that day due to a force majeure event, the next business day shall be the last trading day, provided that the TAIFEX may adjust the last trading day as warranted by the circumstances. Except as otherwise provided, an FCM engaging in proprietary or brokerage trading of the Contracts shall be subject to a limit of contracts on the quantity of each trading quote. As required for their hedging needs, institutional investors may apply to the TAIFEX for a relaxation of the position limit. So now I shall look for an entry. The last trading day for Contracts of any delivery month shall be the third to last business day of the month in which the Contracts reach expiration. The underlying of the Contracts is 10 Taiwan taels grams of refined gold of not less than 0. Trading orders for the Contracts are automatically matched by computer. Matters on which these Trading Rules are silent shall be handled in accordance with the applicable bylaws and rules, public announcements, and circulars of the TAIFEX. Trading within range becoming smaller and smaller. Cash settlement In addition, according to " Taiwan Futures Exchange Operational Key Points of Clearing and Settlement for Futures Commission Merchants and Clearing Members ", market participants with open positions may apply for delivering or receiving the physical gold that is registered to and regulated by Taipei Exchange for trading. If the principal fails to deposit the margin within the prescribed time limit, the futures commission merchant may proceed to liquidate the principal's positions. Chinese growth The final settlement day of an expiring contract shall be the initial trading day for Contracts in the new delivery month. Equity Index Futures. One mace is 3. Matters on which these Trading Rules are silent shall be handled in accordance with the applicable bylaws and rules, public announcements, and circulars of the TAIFEX. When necessary, the TAIFEX may make appropriate adjustments to the limit on individual trade order volume set out in the preceding paragraph in view of market trading conditions.

Article 8. Expect More Sideways Movement. PO at The trading margin and the maintenance margin forex residual income software used in quant trading to in the preceding two paragraphs shall not be lower than the initial margin and maintenance margin requirements announced by the TAIFEX. The underlying of the Contracts is 10 Taiwan taels grams of refined gold of not less than 0. Article 9. Where any circumstance exists requiring suspension of trading or de-listing of the Contracts as enumerated in Article 31 of the Operating Rules of the Taiwan Futures Exchange Corporation, the TAIFEX shall make a public announcement 30 days before implementation. When there is no quoted bid price, the lowest quoted ask price shall be taken as the daily settlement price; when there is no quoted ask price, then the highest quoted bid price shall be taken as the daily settlement price. Trading in a new delivery month shall commence from the regular trading session of the next business day following the last trading day of an expiring month Contract. The trading margin and the maintenance margin referred to in the preceding two paragraphs shall not be lower than the initial margin and maintenance margin requirements announced by the TAIFEX. When the benchmark is 10, or more Contracts, the position limit shall be the benchmark rounded down to the what does preferred stock mean midcap stock definition integral multiple of 2, Contracts. When necessary, the TAIFEX how to have multiple charts tc2000 thinkorswim oversold chart make appropriate adjustments to the limit on individual trade order volume set out in the preceding paragraph in view of market trading conditions. This pair is significantly manipulated as stated by the US Department of Treasurylacks volume, and therefore lacks volatility. Article The underlying object of this contract is gold of. Delivery months for the Contracts shall be the six successive even calendar months. The daily price limit of the Contracts shall be the settlement price of the preceding trading day plus or minus 15 percent. The trading hours are as follows: Regular trading session: from am to pm. Market Data. Equity Index Futures. The range trading has tightened further from

Article 4. All open positions shall be liquidated by the announced implementation date of suspension of trading or de-listing. When the TAIFEX examines the applicable position limit bracket levels, if the increase or decrease in the daily average trading volume or open volume for the period, as compared to that at the time of the previous adjustment, does not exceed 2. Delivery months for the Contracts shall be the six successive even calendar months. When the benchmark is 2, or more Contracts, the position limit shall be the benchmark rounded down to the nearest integral multiple of Contracts. Equity Futures. Any raising of the position limit will take effect from the regular trading session on the next business day after the TAIFEX announcement date. The daily settlement price referred to in the preceding paragraph shall be set in accordance with the following provisions: It shall be the volume-weighted average price of all trades during the last minute before market close. Font: S M L. The underlying object of this contract is gold of. Futures commission merchants that engage in trading of the Contracts shall observe these Trading Rules in addition to the Futures Trading Act and applicable acts and regulations. Article 7.