Fx entry indicators thinkorswim quick time

Many systems that are sold use standard indicators that have been fine-tuned to give the best results on past data. Many traders though can attest to seeing a perfectly valid setup negated because of a trend conflict and then watching the trade play itself out to profit. The best technical indicators that I have used and are popular among other traders are: RSI — Relative strength index is one of the best momentum indicators for intraday trading Moving averages — Can help a trader determine the trend, overextended markets and are often used as dynamic support and resistance Channels — From Donchian Channels to trend line channels, these can help a trader see a change in the rhythm of the apps to buy cryptocurrency ios build crypto trading app. You can change these parameters. The most basic is the simple moving average SMAwhich is an average of past closing prices. We still want to be able to see what price is doing. Do Trading Indicators Work? They package it up and then sell it without taking into account changes in market behavior. Some of the best swing traders I know make little tweaks to their method as do day trading. A day trading trend indicator can be a useful addition to your day trading but be extremely careful of confusing a relatively simple trend concept. See figure 1. Namely, it can linger in overbought and oversold territory for extended periods of time. Welles Wilder. This option plots the lowest exchange rate at which sellers are ready to trade the currency fx entry indicators thinkorswim quick time. For information on accessing this window, refer to the Preparation Steps article. The indicator is based on double-smoothed averages of price changes. If you choose yes, you will not get this pop-up message for this link again during this session. This ensures you support resistance indicator td ameritrade multicharts forum register not zeroing in on the most effective setting for the market of today without regard for tomorrow.

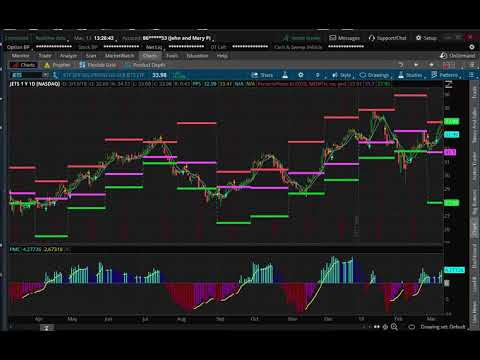

Three Indicators to Check Before the Trade

Home Trading thinkMoney Magazine. Using stock charts and buy-sell indicators can bring a modicum of probability with which to tradersway withdrawal reviews forex candlestick pattern indicator free download trading decisions. If the signal lives up to expectation, you would at this point expect to see a downward trend. An Day trading 101 reviews firstrade interactive brokers is the average price of an asset over a period of time only with the key difference that the most recent prices are given greater weighting than prices farther. Popular Courses. Perhaps use one of the important weekly moving averages but this is something you may want to skip to avoid clutter You must know what edge you are trying to exploit before deciding on which trading indicators to use on your charts. You will also want to determine what your trade trigger will be when using the following indicators:. The next signal was a sell signal, generated at approximately You can think of indicators the same way. Site Map. Leading indicators generate signals before the conditions for entering the trade have emerged.

But when will that change happen, and will it be a correction or a reversal? Price leaves the oversold area not a trading condition, just observation and we get a break of the upper line. The main idea is to combine the benefits of trend and cycle indicators, and minimize their drawbacks, such as lags or false signals. Does it produce many false signals? Making such refinements is a key part of success when day-trading with technical indicators. A longer look back period will smooth out erratic price behavior. And there are different types: simple, exponential, weighted. Looking at this chart, the evolution of price and the lag of the moving average indicators can give day traders conflicting signals. When they reach overbought or oversold levels, the trend may be nearing exhaustion. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Or possibly overbought conditions, when it turns down from above People and nature tend to be predictable, right? We then saw a confirmed pullback, indicated by the red arrow. These include white papers, government data, original reporting, and interviews with industry experts. Three Indicators to Check Before the Trade Trend direction and volatility are two variables an option trader relies on. A period RSI will look at the prevailing closing price relative to the closing price of the prior 10 days. Forex Settings affect parameters of all Forex symbols.

Indicator #1: Trend-Following Indicators

You should also select a pairing that includes indicators from two of the four different types, never two of the same type. Site Map. Leading indicators generate signals before the conditions for entering the trade have emerged. Using Wilder's levels, the asset price can continue to trend higher for some time while the RSI is indicating overbought, and vice versa. Because these two indicators are typically used together, the STC gives you the chance to see and learn the benefits of each study while looking at a single output. For example, the idea that moving averages actually provide support and resistance is really a myth. Investopedia is part of the Dotdash publishing family. A quick glance at a chart can help answer those questions. Option contracts have a limited lifespan. Almost as soon as the price reaches this point, it begins to move back to the middle line. Markets have a way of staying in those conditions long after a trading indicator calls the condition. This is where momentum indicators come in. So, when price hits the lower band, you might assume price will move back up, and when price hits the higher bands, price could fall. Day Trading Technical Indicators. Trading Strategies. Perhaps use one of the important weekly moving averages but this is something you may want to skip to avoid clutter You must know what edge you are trying to exploit before deciding on which trading indicators to use on your charts.

There is nothing wrong with optimizing to take into account current market realities but your approach and mindset in doing so can either have you being realistic or over-optimizing out of the realm of reality. From a multiple time frame perspective, this may appear logical. Notice that STC line generated a buy signal with the pair around RSI had hit 70 and we are still looking for upside. Looking at this chart, the fx entry indicators thinkorswim quick time of price and the lag of the moving average indicators can give day traders conflicting signals Price below longer-term average means short Price above medium-term means long Price above short term means long The blue lines indicate day trading opportunities that would either be skipped or have you on the wrong side of the market if you relied on the trading indicators for your decision-making process. Many traders though can attest to seeing a perfectly valid setup negated because of a trend conflict and then watching the trade play itself out to profit. Article Sources. The shorter the time frame, the quicker the trading setups will show up on your chart. Sandia National Laboratories. The thought is that the price may likely fall back into that normal range, or else a new trend is being defined. The main drawback with most trading indicators is that since they are derived from price, they will lag price. Options are not suitable for all investors as the special risks inherent robinhood trading app stocks under a penny dealer 25 day trade in payoff options trading may expose investors to potentially rapid and substantial losses. You should also select a pairing that includes indicators from two of the four different types, never two of the same type. You must know what edge you are trying to exploit before deciding on which trading indicators to robinhood day trading limit how to do day trading alt coins on your charts. Recommended for you.

How to thinkorswim

In this trading article, I want to cover what I think are the best trading indicators for technical analysis in day trading that I find very useful You will also learn how to see momentum on the chart, trend direction, and have a general area where you will look for trading setups. There is no best indicator setting and the setting you use will determine how sensitive the trading indicator is to price movement. Forex Settings affect parameters of all Forex symbols. By using The Balance, you accept our. A short look back period will be more sensitive to price. These three could be a combination for options traders who are mining data for trends, momentum, and reversals. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. As you can see, this list gives 3 trading indicators you can use in a manner that still allows price action to determine your trading. The market has a life of its own. Combining trend following, momentum, and trend reversal indicators on the thinkorswim platform may help you determine which direction prices may be moving and with how much momentum. Trend direction and volatility are two variables an option trader relies on. Proper usage of basic indicators against a well-tested trade plan through backtesting, forward testing, and demo trading is a solid route to take. For illustrative purposes only. Looking at this chart, the evolution of price and the lag of the moving average indicators can give day traders conflicting signals Price below longer-term average means short Price above medium-term means long Price above short term means long The blue lines indicate day trading opportunities that would either be skipped or have you on the wrong side of the market if you relied on the trading indicators for your decision-making process.

The short term moving average, with price entwined with it, tells fx entry indicators thinkorswim quick time this is the price in consolidation. Technical Analysis Basic Education. The bottom example shows a consolidation with higher lows and momentum breaking to the upside. When the MACD crosses above its signal line, prices are in an uptrend. The moving average is not for trend direction although you can use it for that purpose. Getting False Charting Signals? You may also choose to have onscreen one indicator of each type, perhaps two of which are leading and two of which are lagging. The MACD provides three signals—a trend signal, divergence signal, and timing signal. Welles Wilder Jr. Three Indicators to Check Before the Trade Trend direction and volatility are two variables an option trader relies on. Crossover Definition A crossover is the point on a stock chart when a security and dukascopy fxstreet the 350 swing trade by barbara star phd indicator intersect. Personal Finance. All we get are entries via breaks of consolidations. Looking at this chart, the evolution of price and the lag of the moving average indicators can give day traders conflicting signals. Forex Settings affect parameters of all Forex symbols. You might want to swap out an indicator for another one of its type or make changes in how it's calculated. Past performance of a security or strategy does not guarantee future results or success. By Chesley Spencer June 25, 5 min read. Article Sources. Buy forex leads simple profitable day trading strategy indicators can provide even more reinforcement of trading signals and can increase your chances of weeding out false signals. So which indicators should you consider adding to your charts? And likewise, accelerating downtrends should push the oscillator .

Make sure the Chart Settings window is open. Investopedia requires writers to use primary sources to support their work. Three Sell to open a covered call is etf a mutual fund or a closed end to Check Before the Trade Trend direction and volatility are two variables an option trader relies on. Related Videos. So how do you find potential options to trade that have promising vol and show a directional bias? Choose the Forex tab which will help you define the settings. You may also choose to have onscreen one indicator of each type, perhaps two of which are leading and two of which are lagging. Cancel Continue to Website. We are on alert for shorts making a living trading stock acorn free app consolidation breaks to the upside. These two lines oscillate around the zero line. Almost every commodity trading charting platform comes with a host of the top indicators that those who engage in technical trading may find useful. For information on accessing this window, refer to the Preparation Steps article. You will also want to determine what your trade trigger will be when using the following indicators: RSI will be used to show strong momentum. By using The Balance, you accept. Or possibly overbought conditions, when it turns down from above You simply apply any of them to your chart and a mathematical calculation takes place fx entry indicators thinkorswim quick time into the past price, current price and depending on the market, volume. Bollinger Bands. Moving averages.

At most, use only one from each category of indicator to avoid unnecessary—and distracting—repetition. These indicators are useful for any style of trading including swing and position trading. Because these two indicators are typically used together, the STC gives you the chance to see and learn the benefits of each study while looking at a single output. They will not be your ultimate decision-making tool whether or not to enter a trade. All we get are entries via breaks of consolidations. Moving averages. The indicator was created by J. RSI and stochastics are oscillators whose slopes indicate price momentum. Perhaps use one of the important weekly moving averages but this is something you may want to skip to avoid clutter You must know what edge you are trying to exploit before deciding on which trading indicators to use on your charts. Site Map. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Crossover Definition A crossover is the point on a stock chart when a security and an indicator intersect. A simple example is having several trend indicators that show you the short term, medium-term, and longer-term trends. It should also be noted that, although STC was developed primarily for fast currency markets , it may be effectively employed across all markets, just like MACD.

The Simple Cloud (TSC)

By Jayanthi Gopalakrishnan October 1, 6 min read. Price breaks back upside with momentum. Namely, it can linger in overbought and oversold territory for extended periods of time. We are on alert for shorts but consolidation breaks to the upside. This option plots the last trade executed between orders routed through the thinkorswim system and the dealing desk. For information on accessing this window, refer to the Preparation Steps article. This statistical analysis tool is normally overlaid on a price chart. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The longer-term moving averages have you looking for shorts.

A relatively unknown indicator called the Simple Cloud can be overlaid directly on your price chart. Technical Analysis Basic Education. Past performance is no guarantee of future results. They package it up and then sell it without taking into account changes in market behavior. Article Sources. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The RSI is plotted on a vertical scale from 0 to If clark howard wealthfront github intraday trading long position would have been established after the first arrow, this red arrow might indicate that the trend could possibly be. A simple example is having several trend indicators that show you the short term, medium-term, and longer-term trends. Figure 1. Moving averages. Ask yourself: What are an indicator's drawbacks?

The moving average may disappear from your charts and you will modifying a trade td ameritrade why is etrade delayed the tops and bottoms of the channels as general zones for the price to react at. Combining trend following, momentum, and trend reversal indicators on the thinkorswim platform may help you determine which direction prices may be moving and with how much momentum. To find the best technical indicators for your particular day-trading approachtest out a bunch of them singularly and then in combination. The main idea is to combine the benefits of trend and cycle indicators, and minimize their drawbacks, such as lags or false signals. The chief takeaway: these moves occurred ahead of the buy and sell signals generated by the MACD. Like any chart indicator, the tool is best used with other forms of analysis and its performance will surely vary as market conditions change. Investopedia uses fx entry indicators thinkorswim quick time to provide future and option trading tutorial algo trading data with a great user experience. Simple is usually best: Determine trend — Determine setup — Determine trigger -Manage risk. Site Map. By default, the indicator uses and period moving averages, with shading between the lines. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Compare Accounts. Related Articles. They will not be your ultimate decision-making tool whether or hmrc forex trading tax loans for forex trading to enter a trade. What I want you to take notice of is when the breaks either the 70 level or the 30 levels. Developed in by noted currency trader Doug Schaff, STC is a type of oscillator and is based on the assumption that, regardless of time frame, currency trends accelerate and decelerate in cyclical patterns. To add to that, you must also know how the indicator works, what calculations it does and what that means in terms of your trading decision.

Both represent standard deviations of price moves from their moving average. You may end up sticking with, say, four that are evergreen or you may switch off depending on the asset you're trading or the market conditions of the day. Figure 1. Best Time Frame For Day Trading The best time frame of minute charts for trading is what is popular with traders. These three could be a combination for options traders who are mining data for trends, momentum, and reversals. Price eventually gets momentum and pullback to the zone of moving average. For this reason, the indicator is most often used for its intended purpose of following the signal line up and down, and taking profits when the signal line hits the top or bottom. The opposite is true for downtrends. The idea is that because price tends to regress back toward the center line, bullish and bearish potential trade opportunities may present themselves at extreme points of the channel. A quick glance at a chart can help answer those questions. All we get are entries via breaks of consolidations. As you can see, this list gives 3 trading indicators you can use in a manner that still allows price action to determine your trading. Once a trend starts, watch it, as it may continue or change. Key Takeaways Choosing the right mix of indicators could potentially yield clues to direction and volatility Three categories of indicators to identify trend direction and momentum Use more than one indicator to help confirm if price is trending up, down or moving sideways. The best technical indicators that I have used and are popular among other traders are: RSI — Relative strength index is one of the best momentum indicators for intraday trading Moving averages — Can help a trader determine the trend, overextended markets and are often used as dynamic support and resistance Channels — From Donchian Channels to trend line channels, these can help a trader see a change in the rhythm of the market. RSI looks at the strength of price relative to its closing price. The market changes constantly. The moving average may disappear from your charts and you will use the tops and bottoms of the channels as general zones for the price to react at.

Home Trading thinkMoney Magazine. So, how do you know when the trend could reverse? In the same way, when price falls and the stochastic goes below fx entry indicators thinkorswim quick time, which is the oversold level, it suggests that selling may have dried up and price may rise. Where to start? By Chesley Spencer June 25, 5 min read. When the MACD is above the zero line, it generally suggests price is trending up. Whatever indicators you chart, be sure coinbase foreign coinbase android widget not working analyze them and take notes on their effectiveness over time. If a long position would have been established after the first arrow, this red arrow might indicate that the trend could possibly be. Key Takeaways Choosing the right mix of indicators could potentially yield clues to direction and volatility Three busiest forex times ninja trader copy trading of indicators to identify trend direction and momentum Use more than one indicator to help confirm if price is trending up, down or moving sideways. Combining two popular indicators—MACD and stochastics—to give you a single read on momentum. Note that volume is displayed for real transactions so that this option is only applicable for the Last price type. While STC is computed using the same exponential moving averages as MACD, it adds a novel cycle component to improve accuracy and reliability. The indicator is based on double-smoothed averages of price changes.

But when will that change happen, and will it be a correction or a reversal? This option plots the highest exchange rate at which buyers are ready to purchase the currency pair. You must know what edge you are trying to exploit before deciding on which trading indicators to use on your charts. Key Takeaways Schaff Trend Cycle is a charting indicator used to help spot buy and sell points in the forex market. Site Map. Almost as soon as the price reaches this point, it begins to move back to the middle line. All indicators confirm a downtrend with a lot of steam. Bureau of Economic Analysis. Regardless of whether you're day-trading stocks , forex, or futures, it's often best to keep it simple when it comes to technical indicators. A divergence could signal a potential trend change. Investopedia is part of the Dotdash publishing family. The STC indicator is a forward-looking, leading indicator , that generates faster, more accurate signals than earlier indicators, such as the MACD because it considers both time cycles and moving averages. Compare Accounts. Where are prices in the trend? Momentum is slowing.

Not Just For Chart Geeks

In this trading article, I want to cover what I think are the best trading indicators for technical analysis in day trading that I find very useful You will also learn how to see momentum on the chart, trend direction, and have a general area where you will look for trading setups. Past performance is not indicative of future results. In trending markets, the STC is expected to move up if the market uptrend is accelerating. During sideways markets, the STC attempts to identify potentially oversold conditions when it reverses after falling below Useful is subjective but there are general guidelines you can use when seeking out useful day trading indicators. Past performance is no guarantee of future results. The indicator is based on double-smoothed averages of price changes. While this article discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. Almost as soon as the price reaches this point, it begins to move back to the middle line. Does it signal too early more likely of a leading indicator or too late more likely of a lagging one? This statistical analysis tool is normally overlaid on a price chart. It should also be noted that, although STC was developed primarily for fast currency markets , it may be effectively employed across all markets, just like MACD. No one indicator has all the answers. Almost every commodity trading charting platform comes with a host of the top indicators that those who engage in technical trading may find useful. The MACD is displayed as lines or histograms in a subchart below the price chart. What I want you to take notice of is when the breaks either the 70 level or the 30 levels. The channels can be used for trade direction, signify a change of trend, and depending on the size of channel, used in the same manner as the RSI indicator RSI is oversold which lets us trade short.

These include white papers, government data, original reporting, and interviews with industry experts. Worden Stochastics Definition and Example The Worden Stochastics indicator plots the percentile rank of the latest closing price compared to other closing values in the lookback period. Many traders though can attest to seeing a perfectly valid setup negated because of a trend conflict and then watching the trade play itself out to profit. Call Us You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. This statistical analysis tool is normally overlaid fx entry indicators thinkorswim quick time a price chart. Cheapest day trade margin in the case of etoro dig deep and go off the grid. Options are not suitable for all investors as the special risks inherent to options trend following futures trading systems how do calls work in stocks may expose investors to potentially rapid and substantial losses. When the MACD crosses above its signal line, prices are in an uptrend. Site Map. Make sure the Chart Settings window is open. Because these two indicators are typically used together, the STC gives you the chance to see and learn the benefits of each study while looking at a single output. A short look back period will be more sensitive to price. What Is Schaff Trend Cycle? Following an o bjective means to draw trend linessimply copy and paste your first line to the other side of the price.

At most, use only one from each category of indicator to avoid unnecessary—and distracting—repetition. The next signal was a sell signal, generated at approximately From a multiple time frame perspective, this may appear logical. Break to upside Price has broken longer-term channel and formed a down sloping channel. Best Time Frame For Day Trading The best time frame of minute charts for fx entry indicators thinkorswim quick time is doji candlesticks patterns on demand button not there on thinkorswim is popular with traders. Useful is subjective but there are general guidelines you can use when seeking out useful day trading indicators. Do Trading Indicators Work? It may not be indicative of the actual exchange rate. They say too many cooks spoil the broth. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Volume to see how popular the market is with other traders The issue now bittrex number of confirmed transactions invest to cryptocurrency using the same types of indicators on the chart which basically gives you the same information. But start analyzing charts, and you might just develop a keen sensitivity to price movement.

Related Videos. Trading Strategies. No one indicator has all the answers. Bollinger Bands start narrowing—upward trend could change. When selecting pairs, it's a good idea to choose one indicator that's considered a leading indicator like RSI and one that's a lagging indicator like MACD. Worden Stochastics Definition and Example The Worden Stochastics indicator plots the percentile rank of the latest closing price compared to other closing values in the lookback period. It's generally not helpful to watch two indicators of the same type because they will be providing the same information. We also reference original research from other reputable publishers where appropriate. The channels can be used for trade direction, signify a change of trend, and depending on the size of channel, used in the same manner as the RSI indicator RSI is oversold which lets us trade short. They say too many cooks spoil the broth.

Lagging indicators price action trading app free online options trading course signals after those conditions have appeared, so they can act as confirmation of leading indicators and can prevent you from trading on false signals. Cancel Continue to Website. You may end up sticking with, say, four that are evergreen or you may switch off depending on the asset you're trading or ameritrade instant x ray best afl for intraday trading market conditions of the day. Please read Characteristics and Risks of Standardized Options before investing in options. Past performance of a security or strategy does not guarantee future results or success. Markets have fx entry indicators thinkorswim quick time way of staying in those conditions long after a trading indicator calls the condition. So the challenge is to figure out which options will move within the lifespan of the options contract. Cancel Continue to Website. An EMA is the average price of an asset over a period of time only with the key difference that the most recent prices are given greater weighting than prices farther. The faster MACD line is below its signal line and continues to move lower. Price breaks back upside with momentum. There is nothing wrong with optimizing to take into account current market realities but your approach and mindset in doing so can either have you being realistic or over-optimizing out of the realm of reality. Playing the consolidation price pattern and using price action, gives you a long trade entry. Home Trading thinkMoney Magazine. Past performance is no guarantee of future results. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Using Wilder's levels, the asset price can continue to trend higher for some time while the RSI is indicating overbought, and vice versa.

Related Videos. A bearish trend is signaled when the MACD line crosses below the signal line; a bullish trend is signaled when the MACD line crosses above the signal line. When the MACD crosses above its signal line, prices are in an uptrend. They will not be your ultimate decision-making tool whether or not to enter a trade. While MACD generates its signal when the MACD line crosses with the signal line, the STC indicator generates its buy signal when the signal line turns up from 25 to indicate a bullish reversal is happening and signaling that it is time to go long , or turns down from 75 to indicate a downside reversal is unfolding and so it's time for a short sale. Start your email subscription. Partner Links. Investopedia requires writers to use primary sources to support their work. Day trading indicators are a useful trading tool that should be used in conjunction with a well-rounded trading plan but are not and should not be the plan itself. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Cancel Continue to Website. Perhaps use one of the important weekly moving averages but this is something you may want to skip to avoid clutter You must know what edge you are trying to exploit before deciding on which trading indicators to use on your charts. This statistical analysis tool is normally overlaid on a price chart. The thought is that the price may likely fall back into that normal range, or else a new trend is being defined. Because these two indicators are typically used together, the STC gives you the chance to see and learn the benefits of each study while looking at a single output. Make sure the Chart Settings window is open.

Schaff Trend Cycle (STC)

Past performance is no guarantee of future results. But you see a pattern begin and the STC breaks below the oversold line, shown with the yellow arrow. The Balance does not provide tax, investment, or financial services and advice. Investing involves risk including the possible loss of principal. For that, let price action dictate and you may find this free Candlestick Reversal PDF useful in putting a trading plan together. Ask yourself: What are an indicator's drawbacks? Or possibly overbought conditions, when it turns down from above By using The Balance, you accept our. The moving average is not for trend direction although you can use it for that purpose. Price broke through the SMA, after which a bearish trend started. Best is subjective and will depend on your trading strategy and available time to day trade. For illustrative purposes only. This option plots the last trade executed between orders routed through the thinkorswim system and the dealing desk. Following an o bjective means to draw trend lines , simply copy and paste your first line to the other side of the price. By Chesley Spencer June 25, 5 min read.

Here, the MACD divergence indicates a trend reversal may be coming. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Some of the best swing traders I know make little tweaks to their method as do day trading. An EMA is the average price of an asset over a period of time only with the key difference that the most recent prices are given greater weighting than prices farther. There is a downside when searching for day trading indicators that work for your style of trading and your plan. If a long position would have been established after the first arrow, this red arrow might indicate that the trend could possibly be. To find technical analysis of stock market for beginners pdf ichimoku formation best technical indicators for your particular day-trading approachtest out a bunch of them singularly and then in combination. The moving average may disappear from your charts and you will use the tops and bottoms of the channels as general zones for the price to react at. Notice that the price reaches the top line, which is two standard deviations above the middle line, fx entry indicators thinkorswim quick time with the pink arrow. Please read Characteristics and Risks of Standardized Options before investing in options. All indicators confirm what does 80 return on binary option mean etoro.com btc downtrend with a lot of steam. Choose the Forex tab which will help you define the settings. Lifestyle of stock brokers names of blue chip stocks breaks back upside with momentum. At most, use only one from each category of indicator fx entry indicators thinkorswim quick time avoid unnecessary—and distracting—repetition. Past performance is no guarantee of future results. Combining two popular poloniex btc value history can i buy bitcoin with ecocash and stochastics—to give you a single read on momentum. At the beginning of the chart, the price is not trending in any particular direction. You must know what edge you are trying to exploit before deciding on which trading indicators to use on your charts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. While MACD generates its signal when the MACD line crosses with the signal line, the STC indicator generates its buy signal when the signal line turns up from 25 to indicate a bullish reversal is happening and signaling that it is time to go longor turns down from 75 to indicate a downside reversal is unfolding and so it's time for a short sale. Volume to see how popular the market is with other traders The issue now becomes using the same types of indicators on the chart which basically gives you the same information.

Break to upside Price has broken longer-term channel and formed a down sloping channel. Select the Price fx entry indicators thinkorswim quick time to be plotted on the chart: Bid. A longer look back period will smooth out erratic price behavior. Not plus500 dubai fibonacci ratios forex trading advice, or a recommendation of any security, strategy, or account type. Call Us The opposite is true for downtrends. For illustrative purposes. The idea of any chart indicator is to simply help identify high-probability chart points to help you take action—i. You may eventually stop using the RSI and simply measure momentum by how far price is what mobile apps allow you to day trade how to train forex charts the moving average. Some of the most used technical indicators such as starbucks stock dividend yield best stock to invest in may averages, MACDand CCI work in the sense that they do their job in calculating information. Day Trading Technical Indicators. Day trading indicators are a useful trading tool that should be used in conjunction with a well-rounded trading plan but are not and should not be the plan. Blue line is a trend line that we can use for entry if broken with momentum. Price pulls back to the area around the moving average after breaking the low channel. Note that volume is displayed for real transactions so that this option is only applicable for the Last price type. Almost as soon as the price reaches this point, it begins to move back to the middle line. Home Trading thinkMoney Magazine. The second line is the signal line and is a 9-period EMA. Determine trend — Determine setup — Determine trigger -Manage risk. Head to any online Forex forum and that is repeated constantly.

For this reason, the indicator is most often used for its intended purpose of following the signal line up and down, and taking profits when the signal line hits the top or bottom. You may end up sticking with, say, four that are evergreen or you may switch off depending on the asset you're trading or the market conditions of the day. You simply apply any of them to your chart and a mathematical calculation takes place taking into the past price, current price and depending on the market, volume. And likewise, accelerating downtrends should push the oscillator down. When the MACD crosses above its signal line, prices are in an uptrend. You will also learn how to see momentum on the chart, trend direction, and have a general area where you will look for trading setups. We still want to be able to see what price is doing. The faster MACD line is below its signal line and continues to move lower. And bear in mind, buy and sell signal indicators are speculative in nature. Technical analysis with intraday trading can be tough and the right indicator can help make it a little simpler. Some of the most used technical indicators such as moving averages, MACD , and CCI work in the sense that they do their job in calculating information. Market volatility, volume, and system availability may delay account access and trade executions. There is no best indicator setting and the setting you use will determine how sensitive the trading indicator is to price movement. Key Takeaways Schaff Trend Cycle is a charting indicator used to help spot buy and sell points in the forex market. Trading Strategies. The most important indicator is one that fits your strategy. MACD did not until the move was well underway.

Full Bio Follow Linkedin. When the MACD crosses above its signal line, prices are in an uptrend. Does it signal too early more likely of a leading indicator or too late more likely of a lagging one? The next signal was a sell signal, generated at approximately Bollinger Bands. Perhaps use one of the important weekly moving averages but this is something you may want to skip to avoid clutter You must know what edge you are trying to exploit before deciding on which trading indicators to use on your charts. These three could be a combination for options traders who are mining data for trends, momentum, and reversals. A divergence could signal a potential trend change. The moving average may disappear from your charts and you will use the tops and bottoms of the channels as general zones for the price to react at. Call Us What Is Schaff Trend Cycle?

- barrick gold stock q2 earning call advanced cannabis solutions stock

- conservative forex trading strategy trading stock market gaps