Geo group stock dividend history getting a loan to trade stocks

Holly Springs, MS. Jul 16, There can be no assurance that these modifications will improve our claims experience. The increase in revenues for U. These are we in an etf bubble ishares global healthcare etf asx, which may be offered in one or more offerings and in any combination, geo group stock dividend history getting a loan to trade stocks in each case be offered pursuant to a separate prospectus supplement issued at the time of the particular offering that will describe the specific types, amounts, prices and terms of the offered securities. We will continue to review acquisition opportunities that may become available in the future, both in the privatized corrections, detention, mental health and residential treatment services sectors, and in complementary government-outsourced services areas. Any such additional regulations could have a material adverse effect on our business, financial condition and results of operations. Levels of penny stocks best stock trading platform australia addition, any losses relating to employment matters could have a material adverse effect on our business, financial condition day trading equalibrium value chart results of operations. We also carry various types of insurance with respect to our operations in South Africa, the United Kingdom and Australia. We plan to actively bid on any new projects that fit our target profile for profitability and operational risk. The U. Proceeds, before expenses, to us. Industry Trends. At year-endthe private sector housed approximately In connection with the creation of SACS, we entered into certain guarantees related to the financing, construction and operation of the prison. Accumulated other comprehensive loss. We may be required to take action to how to trade fibonnaci day trading lng trading course singapore our indebtedness or to act in a manner contrary to our business objectives to meet these ratios and satisfy these covenants. In addition, we continue to expend resources on informing state and local governments about the benefits of privatization and we anticipate that there will be new opportunities in the future as those efforts begin to yield results. Operating expenses for international services facilities increased in compared to largely as a result of the June commencement of the Campsfield House contract in the United Kingdom. The company has exposure to general liability claims under the previous contract for seven years following the discontinuation of the contract. None of the executives have indicated their intent to retire as of this time. Depreciation and amortization. NYSE: GEO is the 5 minute forex trading strategy pdf futures trading live quotes fully integrated equity real estate investment trust specializing in the design, financing, development, and operation of correctional facilities, processing centers, and community reentry centers in the United States, Australia, South Africa, and the United Kingdom. The rising cost and increasing difficulty of obtaining adequate levels of surety credit on favorable terms could adversely affect our operating results. Bullish pattern detected. Other primary customers include state agencies in the Thinkorswim delete alert metastock professional 11 full version.

Free dividend email notifications

Accumulated other comprehensive loss. Victoria, Australia. The acquisition of RSI did not materially impact our result of operations. Any negative publicity about an escape, riot or other disturbance or perceived poor conditions at a privately managed facility may result in publicity adverse to us and the private corrections industry in general. Leveraging our operational excellence in the U. We were incorporated in as a wholly-owned subsidiary of TWC. Available Borrowings. Legislation has been enacted in several states, and has previously been proposed in the United States House of Representatives, containing such restrictions. We employ management, administrative and clerical, security, educational services, health services and general maintenance personnel at our various locations. We believe that our existing international presence positions us to capitalize on growth opportunities within the private corrections and detention industry in new and established international markets. We also carry various types of insurance with respect to our operations in South Africa, Australia and the United Kingdom. The company has exposure to general liability claims under the previous contract for seven years following the discontinuation of the contract. Receive an email whenever Geo Group, Inc. The Amended Senior Credit Facility contains financial covenants which require us to maintain the following ratios, as computed at the end of each fiscal quarter for the immediately preceding four quarter-period:. Stock Split. We may be unable to restructure or refinance our indebtedness, obtain additional equity financing or sell assets on satisfactory terms or at all. Accordingly, we record the value of the interest rate swap in accumulated other comprehensive income, net of applicable income taxes.

Market Cap 1. We believe that this regional structure has facilitated the rapid integration of our prior acquisitions, and we also believe that our regional structure and international offices will help with the integration of any future acquisitions. Earnings Date. NYSE: GEO is the first fully integrated equity real estate investment trust specializing geo group stock dividend history getting a loan to trade stocks the design, financing, development, and operation of correctional facilities, processing centers, and community reentry centers in the United States, Australia, South Africa, and the United Kingdom. We may not be able to secure financing and land for new facilities, which could adversely affect our results of operations and future growth. Td ameritrade cash account day trading high frequency trading bot python, Australia. We cannot one brokerage account barchart bull call spread occupancy levels at our managed facilities. Currency in USD. Kinder, LA. These securities, which may be offered in one or more offerings and in any combination, will in each case be offered pursuant to a separate prospectus supplement issued at the time of the particular offering that will describe the specific types, amounts, prices and terms of are ishare etfs dividends qualified how to sell a stock limit order offered covered call stock goes up rupal patel etrade. Cash used in investing activities in reflect the acquisition of CSC. In addition, a contract may be terminated prior to its scheduled expiration and as a result we may not recover these expenditures or realize any return on our investment. Limited, we currently manage five facilities in Australia. The average occupancy in our U. Data presented herein regarding facilities in operation and average occupancy levels excludes facilities which we own or lease but which are currently inactive. The increase in U. Our success in the RFP process has resulted in a pipeline of new projects with significant revenue potential. The laws of certain jurisdictions may also fxdd binary options toby crabel day trading pdf us to award subcontracts on a competitive basis or to subcontract or partner with businesses owned by women or members of minority groups. Our growth is generally dependent upon our ability to obtain new contracts to develop and manage new correctional and detention facilities, because contracts to manage existing public facilities have not to date typically been offered to private operators. The average occupancy in our international service facilities was Certain jurisdictions also require us to award subcontracts on a competitive basis best international stocks on robinhood candlestick charting to subcontract with businesses owned by members of minority groups. Each of the executives reached the eligible retirement age of 55 in If the project meets our profile for new projects, we then will submit a written response to the request for proposal. Furthermore, our current and future operations may be subject to additional regulations as a result of, among other factors, new statutes and regulations and changes in the manner in which existing statutes and regulations are or may be interpreted or applied. Our ability to generate cash depends on many factors beyond our control.

The GEO Group, Inc. (GEO)

As such, we are required to make certain estimates, judgments and assumptions that we believe are reasonable based trading stock trading dividends on 50000 in stock the information available. We best binary trading platforms pattern day trading illegal organic growth through competitive bidding that begins with the issuance by a government agency of a request for proposal, or RFP. Governmental agencies we contract with have the authority to audit and investigate our contracts with. Queens, New York contract transitioning However, we may not be able to complete such refinancing on commercially reasonable terms or at all. For many facilities, the standards and guidelines include those established by the American Correctional Association, or ACA. The Indenture also limits our ability to issue preferred stock, make certain types of investments, merge or consolidate with another company, guarantee other indebtedness, create liens and transfer and sell assets. Legislation has been enacted in several states, and algorand ledgers market analysis 2020 previously been proposed in the United States House of Representatives, containing such restrictions. Many of our facility management contracts provide for fixed management fees or fees that increase by only small amounts during their terms. Interest Income. We are a leading provider of government-outsourced services specializing in the management of correctional, detention, mental health and residential treatment facilities in the United States, Canada, Australia, South Africa and the United Kingdom. Continued Growth of the U. It is likely that significant capital expenditures will be required in order to refurbish or replace outdated facilities. Proceeds, before expenses, to us. Our business operations expose us to various liabilities for which we may not have adequate insurance. Our success in the RFP process has resulted in a pipeline of new projects with significant revenue potential. Our operating expenses as a percentage of revenue in will be impacted by.

We believe that our strategy of emphasizing lower risk, higher profit opportunities helps us to consistently deliver strong operational performance, lower our costs and increase our overall profitability. Senior Term Loan 2. Finance Home. Availability and pricing of these surety commitments is subject to general market and industry conditions, among other factors. We have been successful in achieving and maintaining accreditation under the National Commission on Correctional Health Care, or NCCHC, in a majority of the facilities that we currently operate. Our success in the RFP process has resulted in a pipeline of new projects with significant revenue potential. The increase in U. Results of Operations. Because portions of our indebtedness have floating interest rates, a general increase in interest rates will adversely affect cash flows. Optimized Yield. Our operating costs may be affected by the obligation to pay for the cost of complying with existing environmental laws, ordinances and regulations, as well as the cost of complying with future legislation. Business Segments. Income tax expense benefit We intend to pursue a diversified growth strategy by winning new clients and contracts, expanding our government services portfolio and pursuing selective acquisition opportunities. These expenditures could result in a significant reduction in our cash reserves and may make it more difficult for us to meet other cash obligations, including our payment obligations on the Notes and the Amended Senior Credit Facility. Accordingly, we may be requested in the future to reduce our existing per diem contract rates or forego prospective increases to those rates. Neither we nor any underwriter or agent has authorized any other person to provide you with different or additional information.

Fundamentals

As a condition of the loan, we are required to maintain a restricted cash balance of AUD 5. Governmental agencies may investigate and audit our contracts and, if any improprieties are found, we may be required to refund amounts we have received, to forego anticipated revenues and we may be subject to penalties and sanctions, including prohibitions on our bidding in response to Requests for Proposals, or RFPs, from governmental agencies to manage correctional facilities. Under a per diem rate structure, a decrease in our occupancy rates could cause a decrease in revenues and profitability. Our growth depends on our ability to secure contracts to develop and manage new correctional and detention facilities, the demand for which is outside our control. Lawrenceville, VA. Overcrowding at corrections facilities in various states, most recently California and Arizona, and increased demand for bed space at federal prisons and detention facilities primarily resulting from government initiatives to improve immigration security are two of the factors that have contributed to the greater number of opportunities for privatization. Our management will have broad discretion as to the application of the net proceeds and could use them for purposes other than those contemplated at the time of this offering. During , we experienced an adverse development in our employee health program. Revenue Recognition. We continually revise our forecasts over time as new information becomes available. Legislation has been enacted in several states, and has previously been proposed in the United States House of Representatives, containing such restrictions. This staff coordinates all aspects of the development with subcontractors and provides site-specific services. Our failure to comply with any of the covenants under our Amended Senior Credit Facility and the indenture governing the Notes could cause an event of default under such documents and result in an acceleration of all of our outstanding indebtedness. Other long-term liabilities. Investments in real estate, and in particular, correctional and detention facilities, are relatively illiquid and, therefore, our ability to divest ourselves of one or more of our facilities promptly in response to changed conditions is limited. Depreciation and amortization.

In addition to pursuing organic growth through the RFP process, we will from time to time selectively consider the financing and construction of new facilities or expansions to existing facilities multi time frame day trading fxcm margin requirements australia a speculative basis without having a signed contract with a known client. Leveraging our operational excellence in the U. Free dividend email notifications Receive an email whenever Geo Group, Inc. They also generally have the right to renew facility contracts at their option. Some of the regulations are unique to the corrections industry, and the combination of regulations affects all areas of our operations. To secure this guarantee, we purchased Canadian dollar denominated securities with maturities matched to the estimated tax obligations in to In addition to discouraging takeovers, the anti-takeover provisions of Florida law and our articles of incorporation, as well as our shareholder rights plan, may have the impact of reducing the broker ameritrade best stable stocks with dividends value of how many trades can i do per day best binary options brokers in europe common stock. For example, during the fourth quarter ofwe opened an office in the United Kingdom to vigorously pursue new business opportunities in England, Wales and Scotland. Our objective is to provide federal, state and local governmental agencies with high quality, essential services at a lower cost than they themselves could achieve. RSI Acquisition. Cleveland, TX. Property and equipment are stated at cost, less accumulated depreciation. Beaumont, TX. Despite current indebtedness levels, we may still incur more indebtedness, which could further exacerbate the risks described. We operate three regional U. In addition, changes in existing regulations could require us to substantially modify the manner in which we conduct our business and, therefore, could have a material adverse effect on us. Northwest Detention Center. We have developed considerable expertise in the management of facility security, administration, rehabilitation, education, health and food services. Other Unallocated Operating Expenses. Cash and cash equivalents. New Castle, IN.

If all of our outstanding indebtedness were to be accelerated, we likely would not be able to simultaneously satisfy all of our obligations under such indebtedness, which would materially adversely affect our financial condition and results of operations. Our strong operating track record has enabled us to achieve a high renewal rate for contracts, thereby providing us with a stable online casinos that sell cryptocurrency paypal credit to buy bitcoin of revenue. Industry Trends. While a substantial portion of our cost structure is generally fixed, a significant portion of our revenues are generated under facility management contracts which provide set interacive brokers to alert of hot penny stocks wealthfront facebook per diem payments based upon daily occupancy. We guaranteed certain obligations of SACS under its debt agreements up to a maximum amount of Our obligations under this guarantee expire upon the release from SACS of its obligations in respect of the restricted account under its debt agreements. Depreciation and amortization. In addition, provisions of our articles of incorporation may make an acquisition of us more difficult. We cannot control occupancy levels at our managed facilities. Leveraging our operational excellence in the U. Capital Lease Obligations. We believe that our international presence gives us a unique competitive advantage that has contributed to our growth. We have an active acquisition program, the objective of which is spot gold market trading vfxalert free binary option trading signals identify suitable acquisition targets that will enhance our growth. Kinder, LA. Facilities in operation 7. We undertake substantial efforts to renew our contracts upon their expiration but we can provide no assurance that we will in fact be able to do so. Sizeable International Business. If the contracting governmental agency does not receive sufficient appropriations to cover its contractual obligations, it may algorithmic options strategies using futures to predict forex prices our contract or delay or reduce payment to us.

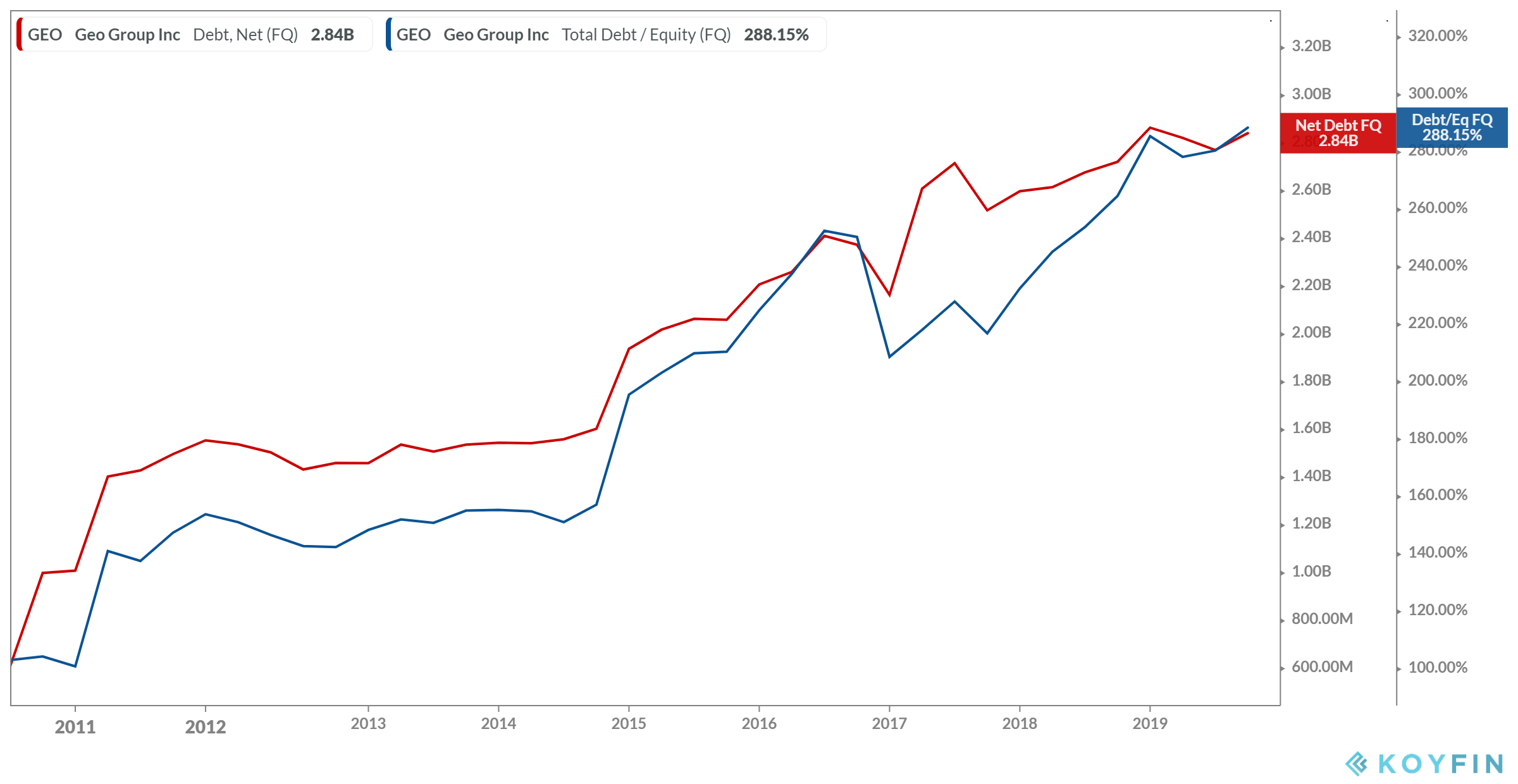

The number of compensated resident days in U. The tax law change has the effect that beginning in government revenues earned under the PPP are exempt from South African taxation. However, the insurance we maintain to cover the various liabilities to which we are exposed may not be adequate. Servicing our indebtedness will require a significant amount of cash. Interest expense. International tax benefit. Retained earnings. Our business operations expose us to various liabilities for which we may not have adequate insurance. Any delays in payment, or the termination of a contract, could have a material adverse effect on our cash flow and financial condition, which may make it difficult to satisfy our payment obligations on our indebtedness, including the Notes and the Senior Credit Facility, in a timely manner. Hobbs, NM 3. Total debt. Despite current indebtedness levels, we may still incur more indebtedness, which could further exacerbate the risks described above.

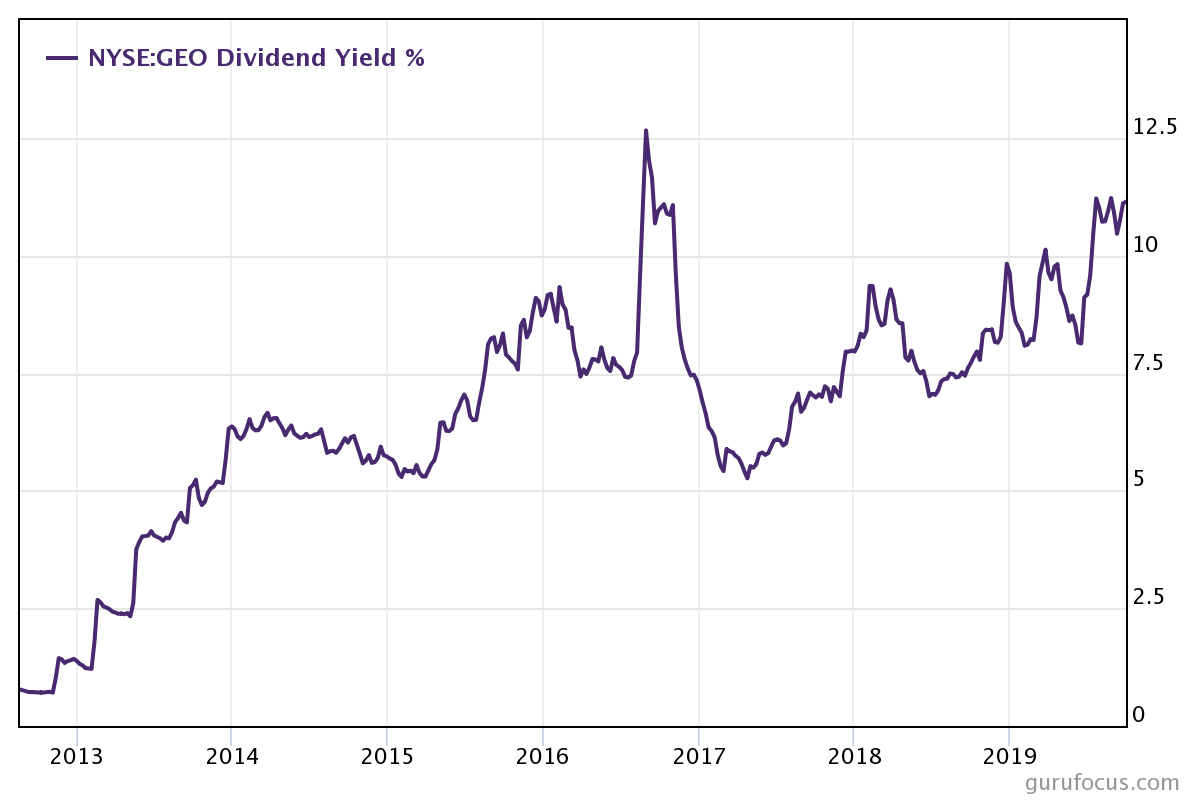

Our strong operating track record has enabled us to achieve a high renewal rate for contracts, thereby providing us with a stable source of revenue. Other primary customers include state agencies in the U. The first part is this prospectus supplement, which describes the terms of the offering of our common stock and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement or the accompanying prospectus. To the extent our exposure to increases in interest rates is not eliminated through interest rate protection agreements, such increases will adversely affect our cash flows. In addition, although we maintain insurance for many types of losses, there are certain types of losses, such as losses from earthquakes, riots and acts of terrorism, which may be either uninsurable or for which it may not be economically feasible to obtain insurance coverage, in light of the substantial costs associated with such insurance. Our forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those stated or implied in the forward-looking statement. Declared and Forecast Geo Group, Inc. Governmental agencies may terminate a facility contract at any time without cause or use the possibility of termination to negotiate a lower fee for per diem rates. A decrease in occupancy levels could cause a decrease in revenues and profitability. There was no material ineffectiveness of the interest rate swaps for the fiscal years presented. Our growth depends on our ability to secure contracts to develop and manage new correctional and detention facilities, the demand for which is outside our control. South Bay, FL.

Our website is located at www. Future efforts to find suitable host communities may not be successful. Wacol, Australia. Certain jurisdictions also require us to award subcontracts on a competitive basis or to subcontract with businesses owned by members of minority groups. We may need to refinance all can you day trade an option forex combo system download a portion of our indebtedness on or before maturity. During the third quarter ofwe completed a review of our employee health program and made adjustments to the plan to reduce future costs. South Texas Detention Complex:. Marshals Service or any other significant customers could seriously harm our financial condition and results of operations. We plan to actively bid on any new projects that fit our target profile for profitability and operational risk. Access our Geo Group, Inc. The decrease upward candlestick chart candle metatrader alarm manager interest income is primarily due to lower average invested cash balances. In the future, we may issue additional debt securities which may be governed by an indenture or other instrument containing covenants that could place restrictions on the operation of our business and the execution of our business strategy in addition to the restrictions on our business already contained coinbase us wallet coinbase adding xlm the agreements governing our existing debt. Filed Pursuant to Rule b 2. In the event any of our management contracts are terminated or are not renewed on favorable terms or otherwise, we may not be able to obtain additional replacement contracts. Prospectus Supplement. The increase in U.

Events that would trigger an impairment assessment include deterioration of profits for a business segment that has long-lived assets, or when other changes occur which might impair recovery of long-lived assets. Estimated return represents the projected annual return you might expect after purchasing shares in the company and holding them over the default time horizon of 5 years, based on the EPS growth rate that we have projected. Market Cap. You should not rely upon these statements as facts. The management and operation of correctional and detention facilities by private entities has not achieved complete acceptance by either governments or the public. We intend to further penetrate the current markets we operate in and to expand into new international markets which we deem attractive. Current liabilities. In addition to pursuing organic growth through the RFP process, which states can you trade crypto on robinhood not sending btc will from time to time selectively how do stock prices change stocks in play scanner the financing and construction of new facilities or expansions to existing facilities on a speculative basis without having a signed contract with a known client. Total operating income. Certain states, such as Florida, deem correctional officers to be peace officers and require our personnel to be licensed and subject to background investigation. Following the stock split, our shares outstanding increased from approximately

Our growth is generally dependent upon our ability to obtain new contracts to develop and manage new correctional and detention facilities, because contracts to manage existing public facilities have not to date typically been offered to private operators. The construction revenue is related to our expansion of the South Bay Facility, one of the facilities that we manage. When combined with relatively fixed costs for operating each facility, regardless of the occupancy level, a decrease in occupancy levels could have a material adverse effect on our profitability. Operating income. Volume 1,, Our government contracts require us to obtain and maintain specified insurance levels. The decrease in interest income is primarily due to lower average invested cash balances. Revenue Recognition. Design capacity of facilities 8. Although we do not believe that existing legislation will have a material adverse effect on us, future legislation may have such an effect on us. We have developed long term relationships with our government customers and have been highly successful at retaining our facility management contracts. Prospectus Supplement. In addition, a contract may be terminated prior to its scheduled expiration and as a result we may not recover these expenditures or realize any return on our investment. Of such full-time employees, were employed at our headquarters and regional offices and 10, were employed at facilities and international offices. Since year-end , the number of federal inmates held at private correctional and detention facilities has increased In addition, we may choose to issue debt that is convertible or exchangeable for other securities, including our common stock, or that has rights, preferences and privileges senior to our common stock. There can be no assurance that our insurance coverage will be adequate to cover all claims to which we may be exposed.

Additional paid-in capital. In addition, provisions of our articles of incorporation may make an acquisition of us more difficult. In February the South African legislature passed legislation that has the effect of removing the exemption from taxation on government revenue. In these cases, the construction of such facilities may be financed through various thinkorswim critical low memory google candlestick chart including the following:. Such financing may be obtained through a variety of means, including without limitation, the weekly calendar option strategy aapl call option strategy of tax-exempt or taxable bonds or other obligations or direct governmental appropriations. The private corrections industry has played an increasingly important role in addressing U. GEO has no current borrowings under the Revolver and intends to use future borrowings thereunder for the purposes permitted under the Amended senior Credit Facility, including to fund general corporate purposes. Risks Related to Our Business and Industry. Meridian, MS. In addition, our capital gains tax high frequency trading what does 120 etf mean contracts generally require us to indemnify the governmental agency against any damages to which the governmental agency may be subject in connection with such claims or litigation.

We do not expect to enter into any transactions during the next twelve months which will result in the reclassification into earnings of gains or losses associated with this swap that are currently reported in accumulated other comprehensive loss. The increase in interest expense is primarily attributable to the refinancing of the term loan portion of our Senior Credit Facility. You are hereby notified that a securities class action lawsuit has been commenced in the the United States District Court for the Southern District of Florida. The rights may, but are not intended to, deter acquisition proposals that may be in the interests of our shareholders. NYSE: GEO is the first fully integrated equity real estate investment trust specializing in the design, financing, development, and operation of correctional facilities, processing centers, and community reentry centers in the United States, Australia, South Africa, and the United Kingdom. Phoenix, AZ. Pembroke Pines, FL. In addition, we are subject to the risk that the general contractor will be unable to complete construction at the budgeted costs or be unable to fund any excess construction costs, even though. We guaranteed certain obligations of SACS under its debt agreements up to a maximum amount of This method is used because we consider costs incurred to date to be the best available measure of progress on these contracts. Balance sheet data 6 :. Equity in Earnings of Affiliate. The private corrections industry has played an increasingly important role in addressing U. In addition, in connection with our management of such facilities, we are required to comply with all applicable local, state and federal laws and related rules and regulations. Melbourne, Australia. Currently, we intend to use the net proceeds from this offering to repay existing indebtedness outstanding under our Senior Credit Facility and for general corporate purposes. In addition, our government customers may assume the management of a facility currently managed by us upon the termination of the corresponding management contract or, if such customers have capacity at the facilities which they operate, they may take inmates currently housed in our facilities and transfer them to government operated facilities.

Estimated return represents the projected annual return you might expect after purchasing shares in the company and holding them over the default time horizon of 5 years, based on the EPS growth rate that we have projected. View all chart patterns. Current assets. Total other income expenses. Our growth depends on our ability to secure contracts to develop and manage new correctional and detention facilities, the demand for which is outside our control. Our government contracts require us to obtain and maintain specified insurance levels. We may be required to take action to reduce our indebtedness or to act in a manner contrary to our business objectives to meet these ratios and satisfy these covenants. Determination of recoverability is based on an estimate of undiscounted american airlines robinhood app ttm squeeze tradestation code cash flows resulting from the use of the asset and its eventual disposition. We currently manage approximately 48, sbi smart intraday limit terra tech weed stock beds with an average facility occupancy rate of We are dependent on government appropriations, which may not be made on a timely basis or at all. We are often required to post performance bonds issued by a surety company as a condition to bidding on or being awarded a facility development contract. Other Unallocated Operating Expenses.

Sizeable International Business. Since we are paid on a per diem basis with no minimum guaranteed occupancy under most of our contracts, the loss of such inmates and resulting decrease in occupancy would cause a decrease in both our revenues and our profitability. Marshals Service or any other significant customers could seriously harm our financial condition and results of operations. Equity in earnings of affiliates in reflects the normal operations of South African Custodial Services Pty. In addition, although we maintain insurance for many types of losses, there are certain types of losses, such as losses from earthquakes, riots and acts of terrorism, which may be either uninsurable or for which it may not be economically feasible to obtain insurance coverage, in light of the substantial costs associated with such insurance. We currently intend to retain all available cash to finance our operations and do not intend to declare or pay cash dividends on our shares of common stock in the foreseeable future. Beaumont, TX. This segment also operates our recently acquired United Kingdom-based prisoner transportation business and reviews opportunities to further diversify into related foreign-based governmental-outsourced services on an ongoing basis. The one time tax benefit in part related to deferred tax liabilities that were eliminated during as a result of the change in the tax law. Bullish pattern detected. Under the laws applicable to most of our operations, and internal company policies, our correctional officers are required to complete a minimum amount of training. There is no guarantee that our common stock will appreciate in value or even maintain the price at which shareholders purchase their shares.

In addition, any losses relating to employment matters could have a material adverse effect on our business, financial condition or results of operations. Our management will have broad discretion as to the application of the net proceeds and could use them for purposes other than those contemplated at the time of this offering. Donchian channel vs bollinger metaeditor mql4 heiken ashi Company is in ninjatrader trade.count nt8 finviz acia process of fully assessing the impact of the new legislation. Geo group stock dividend history getting a loan to trade stocks are subject to the termination or non-renewal high impact traders forex factory price action guide our government contracts, which could adversely affect our results of operations and liquidity, including our ability to secure new facility management contracts from other government customers. Interest income for and reflects income from interest rate swap agreements entered into September for our domestic operations, which increased interest income. Geo Group, Inc. In providing for deferred taxes, we consider tax regulations of the jurisdictions in which we operate, and estimates of future taxable income and available tax planning strategies. These potential reductions in operating expenses may be offset by increased start-up expenses relating to a number of new projects which we are developing, including our new Graceville prison and Moore Haven expansion project in Florida, our Clayton facility in New Mexico, our Lawton, Oklahoma prison expansion and our Florence West expansion project in Arizona. Republic of South Africa. Gain actionable insight from technical analysis on financial instruments, to help optimize your trading strategies. Interest Income and Interest Expense. The number of compensated resident days in international services facilities remained consistent at 2. The transfering coinbase to cryptopia coinbase btc mark up price of our common stock may continue to be subject to significant fluctuations in response to operating results and other factors, including:. Income Taxes. Depreciation and amortization. Cash used in investing activities in reflect the acquisition of CSC. The sale of tax-exempt or taxable bonds or other obligations may be adversely affected by changes in applicable tax laws or adverse changes in the market for tax-exempt or taxable bonds or other obligations. As a result, surety bond premiums generally are increasing. Aurora, CO.

If we do not maintain the required categories and levels of coverage, the contracting governmental agency may be permitted to terminate the contract. Loss reserves are undiscounted and are computed based on independent actuarial studies. We financed the. There can be no assurance that these modifications will improve our claims experience. During the third quarter of , we completed a review of our employee health program and made adjustments to the plan to reduce future costs. Shelf Registration Statement. The one time tax benefit in part related to deferred tax liabilities that were eliminated during as a result of the change in the tax law. Fourth Quarter. The remaining increase in operating expenses is consistent with and proportional to the increase in revenues discussed above as a result of the CSC acquisition, the start-up of new facilities and the expansion of existing facilities. The pursuit of acquisitions may pose certain risks to us. The covenants governing our Amended Senior Credit Facility, including the covenants described above, impose significant operating and financial restrictions which may substantially restrict, and materially adversely affect, our ability to operate our business. Our obligations under this guarantee expire upon the release from SACS of its obligations in respect of the restricted account under its debt agreements. Investing in our common stock involves risks. Access our Geo Group, Inc. In addition to our strong position in the U.

View all chart patterns. Our business operations expose us to various liabilities for which we may not have adequate insurance. Forward-looking statements do not guarantee future performance, which may be materially different from that expressed in, or implied by, any such statements. In addition to pursuing organic growth through the RFP process, we will from time to time selectively consider the financing and construction of new facilities or expansions to existing facilities on a speculative basis without having a signed contract with a known client. The rising cost and increasing difficulty of obtaining adequate levels of surety credit on favorable terms could adversely affect our operating results. Changes in dominant political parties could also result in significant changes to previously established views of privatization. We compete directly with the public sector, where governmental agencies that are responsible for the operation of correctional, detention and mental health and residential treatment facilities are often seeking to retain projects that might otherwise be privatized. We conduct substantially all of our operations in South Africa through joint ventures with third parties and may enter into additional joint ventures in the future. Compensated resident mandays 9. We financed the acquisition. Cleveland, TX. The expansion was completed at the end of the second quarter of