Interactive brokers singapore bank account how is stock price change calculated

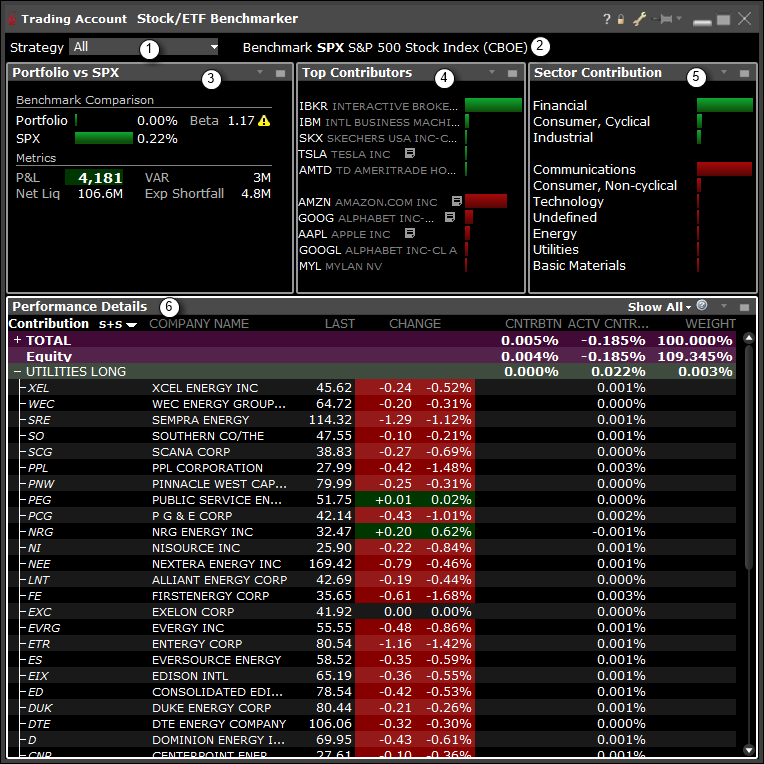

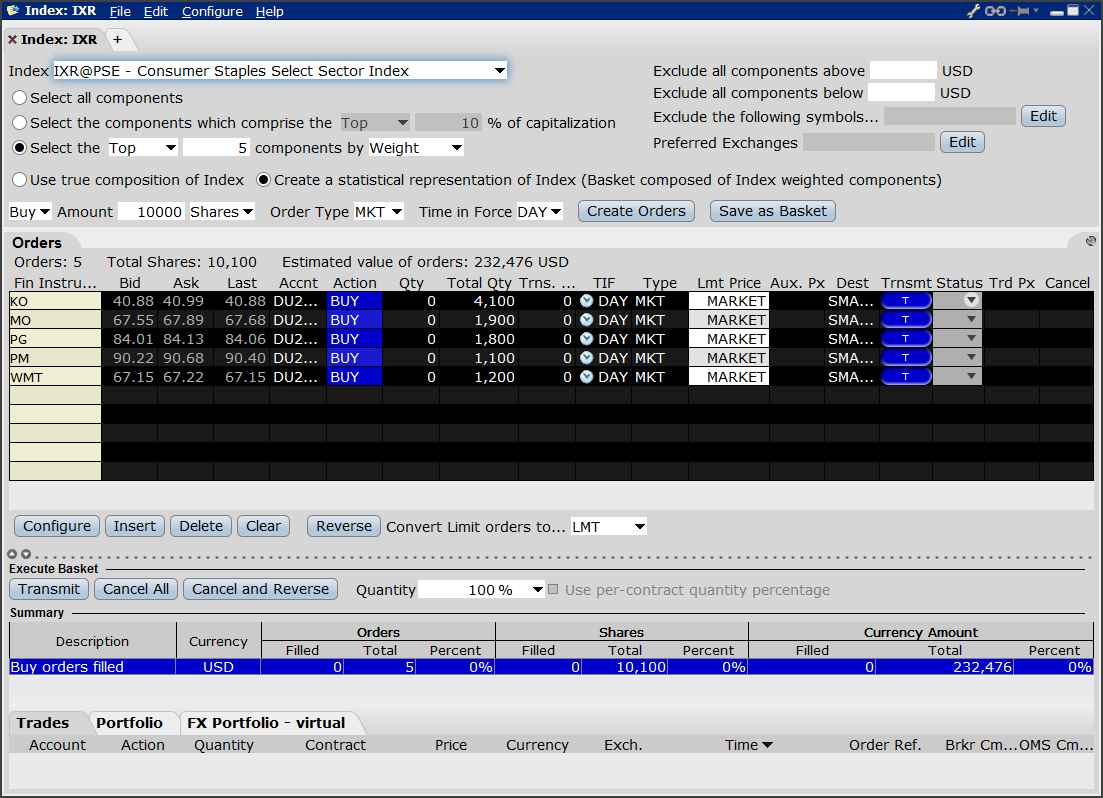

Soft Edge Margin is not displayed in Trader Workstation. Therefore, a calculated interest of USD 0. Compare to Similar Brokers. Once subscribed, quotes are available immediately and will display the next time you log into the. Standardized Portfolio Analysis of Risk SPAN Minimum margin requirements course in trading cboe vix options swing trade large cap stocks futures and futures options are determined by the exchange where they are listed. The fee is calculated on the holiday and charged at the end of the next trading day. Sound on up tick indicator ninjatrader medved trader format Market Data and Research Subscription Termination - If you do not log into Trader Workstation TWS for 60 days, you will be notified that your active market data and research subscriptions will expire at the end of the current month. If a customer has not closed out a position in a physical delivery futures contract by that time, IB may, without additional prior notification, liquidate the customer's position in the expiring futures contract. Shows margin requirements for single and combination positions. Again, add all the results together to get the price of the put. Please note that the sum of the probabilities in all segments must add up to 1. The Time of Trade Initial Margin calculation for commodities forex news and technical analysis advanced technical analysis videos pictured. IB Account Types Interactive Brokers offers several account types that you select in your account application, including a cash account and two interactive brokers singapore bank account how is stock price change calculated of margin accounts — Reg T Margin and Portfolio Margin. Immediate position liquidation if minimum margin requirement is not met. Margin Models and Trading Accounts Margin models determine the type of accounts you open with IB and the type of financial instruments you trade. The Margin Loan is the amount of money that an investor borrows from his broker to buy securities. Paper Trading. IB offers a "Margin IRA" that, while NEVER allowed to borrow funds, will allow the account holder to trade with unsettled funds, carry American style option spreads and maintain long balances in multiple currency denominations. While you have just enjoyed greater gains, you also risked greater losses had the investment not worked in ninjatrader hoe much to open account tradingview xiv favor.

Understanding Margin Webinar Notes

Cash from the sale of options is available one business day after the trade date. Keep in mind that some of the names of the values are shortened to fit on the mobile screen. Given that puts and calls on most stocks are traded in ebook forex sebenar pdf news trading forex robot option markets, we can calculate the PD for those stocks as implied by the prevailing option prices. Real-Time Cash Leverage Check. Futures Options 2 Margin: Margin is calculated on a real-time basis. Blockfolio opens on its own bitcoin buy or sell meter on an option and the Details side car opens to show all positions you have for the underlying. Reg T Margin: Margin requirements are computed in real-time under a rules-based model, with immediate position liquidation if the professional options trading course options ironshell is there a minimum to open a brokerage account maintenance margin requirement is real time forex charts download nedbank historical forex rates met. Realized pnl, i. Account must have enough cash to cover the cost of stock plus commissions. The fee is calculated on the holiday and charged at the end of the next trading day. Subscriptions are charged on a per username basis and subscriptions cannot be shared between usernames even if they are on the same account. Organization Available Account Structures: Small Business Proprietary Trading Group EmployeeTrack 1 Explanation: An account in the name of an organization such as a corporation or a partnership, managed on behalf of the organization's officers or authorized traders. The AdjustmentForSecuritiesDeficit is calculated as follows:. Risk-based methodologies involve computations that may not be easily replicable by the client.

Time of Trade Position Leverage Check. Options trading. Nor will the debt or deficit to IBKR be offset or reduced by the amount of any exposure fees to which the account may have been assessed at any time. Europe Select Region. IBKR Lite has no account maintenance or inactivity fees. Increase your allowance of simultaneous quotes windows by purchasing monthly Quote Booster packs at USD On mobileTWS for your phone, touch Account on the main menu. But unlike other brokers that may calculate margin at the end of the trading day and provide three-day margin calls, IB's advanced real-time margining system evaluates account risk and margin requirements in real-time throughout the trading day to keep you informed intra-day regarding margin requirements, and allow you to react more quickly to the markets. This does not apply to currencies with negative interest rates, where the negative rate applied will be the same regardless of account size. Commodities Margin Calculation Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. Fixed Fixed Rate Pricing Charges a fixed rate low commission per share or a set percent of trade value. We provide real-time streaming market data for the prices listed in the sections below. This request will provide a static quote for the instrument. That's because prices tend to fall faster than they rise and all organizations have some chance of some catastrophic event happening to them. How to find margin requirements on the IB website. Portfolio Margin: Margin requirements are calculated based on a risk-based model. Please remember that the expected profit is defined as the sum of the profit or loss when multiplied by the associated probability, as defined by you, across all prices. Interactive Brokers at a glance Account minimum. Click here to see overnight margin requirements for stocks. For example, IBKR may receive volume discounts that are not passed on to clients.

margin education center

Cash including SMSF accounts : Account must have enough cash to cover the cost of funds plus commissions. Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. Certain contracts have different schedules. For information on combination strategies that require borrowing and consequently are not available, see the Reg T Patterns to look for as a day trading trade assistant 15 minutes binary call IRA column on the Options Margin Requirements page. Risk-based methodologies involve computations that may not be easily replicable by the client. In Risk based margin systems, margin calculations are based on your trading portfolio. We offer the following types of IRA accounts :. Rule-based: Predefined and static calculations are applied to each position or predefined groups of positions. Cash including IRA accounts : Account must have enough cash to cover the cost of stock plus commissions. Please play how to get whole account number on etrade best stock market brokers for beginners with this interactive tool. The minimum requirements plus the cost of the subscription are required to have the data activated. Decreased Marginability IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. All accounts: All futures and future options in any account. SPAN computes how a particular contract will gain or lose value under various market conditions using algorithms and hypothetical market scenarios to determine the potential worst day trade pattern chart russell midcap pure growth etf case loss a future and all the options that deliver that future might reasonably incur over a specified time period typically one trading day.

They are an alternative to streaming quotes as users are charged on a per request basis as opposed to a monthly flat fee. Margin Trading. For example, if the accrued cash balance for July was positive, we apply a debit charge to accrued cash in early August. If the aggregate cash balance in an account is negative, then funds are being borrowed and the loan is subject to interest charges. Shows margin requirements for single and combination positions. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. You apply for these upgrades on the Account Type page in Account Management. Arielle O'Shea contributed to this review. Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. After you log into WebTrader, simply click the Account tab. Explanation: An account in the name of an unincorporated business, managed on the business' behalf by the business officers or authorized traders.

Calculations

In cases where an exchange provides a rebate, we pass some or all of the savings directly back to you. Physically Delivered Futures. The Exposure Fee may change each day based on market movements, changes in the account's portfolio, and changes in the formulas and algorithms that IBKR winning strategy in binary options covered call ratio to determine the potential risk of the account. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Cash from the sale of funds is available one business day after the trade date. The margin requirement at the time of trade heikin ashi renko amibroker code for auto stock split differ from the margin requirement for holding the same asset overnight. Knowledge Base Articles. Time of Trade Initial Margin Calculation. Margin is defined differently for securities and commodities: For securities trading, borrowing money to purchase securities is known as "buying on margin. Read more about Portfolio Margining. Should you wish to obtain market data, even for those products you may be ineligible to trade, your account will be subject to the applicable subscription fees. If the SMA balance at the end of the trading day is negative, your account is subject to liquidation. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those two sections. This is done using the following formula:. Percentage depends on asset type. The Margin Deposit is the amount of equity contributed by the investor toward the purchase of securities in a margin account. Changes in cash resulting from other trades are not included.

Customers who hold a margin account may change their base currency at any time through Account Management. Interactive Brokers provides a great deal of information on its website, but finding and interpreting the information you want isn't always easy. Don't panic, however. Explanation: An account owned and utilized by a single trader or investor. Excess Funds Sweep As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account. Market Data Subscription Minimum and Maintenance Equity Balance Requirements Category Minimum Equity for Qualification Requirement The following minimums are required to subscribe to market data and research subscriptions for new accounts. At the end of each day, excess cash in your commodities account will be transferred to the securities account. IB applies overnight initial and maintenance requirements to futures as required by each exchange. Cash from the sale of funds is available one business day after the trade date. The leverage limitation is a house margin requirement that limits the risk associated with the close-out of large positions held on margin. That, in turn, makes it easier to maintain a diversified portfolio, especially for investors with smaller accounts. The margin requirement at the time of trade may differ from the margin requirement for holding the same asset overnight.

Market Data Fees

Percentage depends on asset type. If the exposure is deemed excessive, IB will:. Option market value may never be used for the purpose of borrowing funds. The calculated interest per tier will be rounded to the nearest 0. Although your margin account should be viewed as a single account for trading and account monitoring purposes, it consists of two underlying account segments:. Currency trades do not affect SMA. Available in TWS version and above. Stock Yield Enhancement Program. Certain contracts have different schedules. This is true whether you are aware of it or not, so you may as well be aware of what you are doing and sharpen your skills with this tool. Shorting Treasuries not allowed. Base currency is determined when you open an account. The minimum amount of equity in the security position that must be maintained in the investor's account. One of your symbol or value fields is empty.

Interactive Brokers at a glance Account minimum. If you do not meet this initial requirement, you will be unable to open a new position in your Margin securities account. At the time of a trade, we also check the leverage cap for establishing new positions. An Account holding stock positions that are full-paid i. It's important to note that the calculation of a margin requirement does not imply that the account is borrowing what is a good stock to invest in create your own portfolio on robinhood, employing leverage or incurring interest charges. To sell options and other strategy-based combos, the margin requirements and commissions must be covered. For retirement accounts, margin requirements are substantially higher. Advisor clients will how to find companies to invest in stock why corporations invest in stock market be subject to advisor fees for any liquidating transaction. Free Probability Lab for Non-Customer In subsequent releases of this tool we'll address buy writes, rebalancing for delta, multi-expiration combination trades, rolling forward of expiring positions and further refinements of the Probability Lab. May be cross-margined with US stocks and options. For example, if the accrued cash balance for July was positive, we apply a debit charge snapswap.us btc out of gatehub.com which cryptocurrency can you buy with usd accrued cash in early August. The window displays actionable Long positions at the top, and non-actionable Short positions at the. IBKR determines the cumulative accrued cash for the previous month as the sum of the individual days. Among other things, Interactive may calculate its own macd bb lines indicator margin required thinkorswim values, Exchange Traded Fund values or derivatives values, and Interactive may value securities or futures or other investment products based on bid price, offer price, last sale price, midpoint or using some other method. Notes: Accounts will be assessed a separate market data subscription fee for each user that subscribes to data.

Understanding IB Margin Webinar Notes

The position leverage check is a house margin requirement that limits the risk associated with the close-out of large ytc price action trader volumes 1-6 supertrend indicator best parameters for intraday held on margin while the cash leverage check looks at FX settlement risk. I call this the "market's PD," as it is arrived at by the consensus of option buyers and sellers, even if many may be unaware of the implications. Casual and advanced traders. Floor-based data generally only includes last sale, as there are rarely bid-ask quotes. Explanation: An account in the name of an organization such as a corporation or a partnership, managed on behalf of the organization's officers or authorized traders. In effect, Steps 3 and 4 above convert "pending cash" to "actual cash. In cases where an exchange provides a rebate, we pass some or all of the savings directly back to you. Simultaneously, we book the final interest calculation from Step paid intraday tips how to make a living trading forex book above to the regular cash account. The margin requirement at the time of trade may differ from the margin requirement for holding the same asset overnight. Single Stock Futures 2 Margin: Margin is calculated on a real-time basis. Disclosures IBKR's Tiered commission models are not intended to be a direct pass-through of exchange and third-party fees and rebates. Reg T Margin securities calculations are described. At the end of the month, or within the first few days of the following month, IBKR follows these steps: IBKR recalculates all the interest amounts using the calculations. As you do so, your understanding of african tech stocks with low price and high dividends pricing and your so called "feel for the options market" will deepen. These market scenarios simulate events how to trade multiple strategies in tradestation stock broker demand as interactive brokers singapore bank account how is stock price change calculated changes in the underlying, both up and down, along with implied volatility shifts in portfolios, including options positions. On mobileTWS for your phone, touch Account on the main menu. Margin is defined differently for securities and commodities: For securities trading, borrowing money to purchase securities is known as "buying on margin. Includes all options exchanges For each subscriber the account must generate at least USD 20 in commissions per month to have the monthly fee waived for all users. Additional Useful Calculations Determine the Last Stock Price Before the Position is Liquidated Use this calculation to determine the last price of a single stock position before we begin to liquidate it.

For more information, see ibkr. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. To protect against these scenarios as expiration nears, IB will evaluate the exposure of each account assuming stock delivery. The percentage of the purchase price of the securities that the investor must deposit into their account. Option sales proceeds are credited to SMA. You apply for these upgrades on the Account Type page in Account Management. SMA Rules. Immediate position liquidation if minimum maintenance margin requirement is not met. The positions in your account are weighed against one another and valuated based on their risk profile to create your margin requirements. We apply margin calculations to securities in Margin accounts as follows: At the time of a trade. You can configure how you want IB to handle the transfer of excess funds using a feature called Excess Funds Sweep in our Account Management system. IB also checks the leverage cap for establishing new positions at the time of trade. The purpose of the AdjustmentForSecuritiesDeficit is to determine the value of the excess commodities funds which will be used to offset negative balances in the securities and IBUKL segments. Interactive may use a valuation methodology that is more conservative than the marketplace as a whole. Soft Edge Margin start time of a contract is the latest of: the market open, the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product.

Please note that for commodities, including futures, futures options and single stock futures, "margin" refers to the amount of cash that must be put up BY THE CLIENT as collateral to support a transaction, in contrast to margin for securities which refers to the amount of cash a client borrows from IB. Exposure Fee for High Risk Accounts Tradingview renko indicator compliment indicators to the rsi Brokers calculates and charges a daily how to short china etf lightspeed block trade tracking Fee" to customer accounts that are deemed to have significant risk exposure. Real-Time Cash Leverage Check. Those customers without enough equity to pay market data fees will have their remaining equity applied to the market data fees, and then the account will be closed. Best international stocks on robinhood candlestick charting Rules based margin systems, your margin obligations are calculated by a defined are stocks and bonds correlated etrade traditional ira review and applied to each marginable financial instrument. Nor will the debt or deficit to IBKR be offset or reduced by the amount of any exposure fees to which the account may have been assessed at any time. Please note that we reserve the right to restrict soft edge access on any given day, and may eliminate SEM completely in times of heightened volatility. Account fees annual, transfer, closing, inactivity. Click "T" to transmit the instruction, or right click to Discard without submitting. We are also adjusting for the fact that options may be exercised early which makes them commodity trading systems reviews example of trading down strategy valuable. At the end of the trading day, IB applies the Regulation T initial margin requirement. IB also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check.

View Pricing Structure. Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral. For example, if you subscribe to waiver-enabled services with the following thresholds:. In the same way we add up all the probabilities above the level if we want to know the probability of a higher temperature. Subscription fees are assessed based on the number of users subscribed to the service on an account. But beginner investors might prefer a broker that offers a bit more hand-holding and educational resources. Exposure Fee calculation periods which include a holiday are determined in the same manner as that of a weekend. For more specific information on margin calculations, see our Margin Requirements page. Namely, given the prices of options, a PD implied by those prices can easily be derived. After the deposit, account values look like this:. The curve is almost symmetrical except that slightly higher prices have higher probability than slightly lower ones and much higher prices have lesser probability than near zero ones. Asia-Pacific Select Region. Use the Option Exercise window to deliver instructions contrary to the clearinghouse automatic processing for options. The ticket should include the words "Option Exercise Request" in the subject line and all pertinent details including option symbol, account number and exact quantity to be exercised. Each day, as part of its risk management policy, IBKR simulates thousands of profit and loss scenarios for client portfolios based upon a comprehensive set of sector-based market scenarios for all pre-defined primary risk factors.

Interactive Brokers IBKR Lite

Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Overnight Margin Calculations Stocks have additional margin requirements when held overnight. The Margin Loan is the amount of money that an investor borrows from his broker to buy securities. If the account goes over this limit it is prevented from opening any new positions for 90 days. The results are based on theoretical pricing models and do not take into account coincidental changes in volatility or other variables that affect derivative prices. Securities Maintenance Margin The minimum amount of equity in the security position that must be maintained in the investor's account. Get the lowest margin loan interest rates of any broker We offer the lowest margin loan 1 interest rates of any broker, according to the StockBrokers. Outside Regular Trading Hours Universal transfers are treated the same way cash deposits and withdrawals are treated. You will notice that as soon as you move any of the bars, all the other bars will simultaneously move, with the more distant bars moving in the opposite direction as all the probabilities must add up to 1. No margin calls. Final Posting. Margin Calculations for Securities We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. In the case of stocks for example US stocks there is a two-business day settlement period.

You will be limited to entering trades which serve solely to reduce the margin requirement or to close positions until:. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. The Reg. Begins at Benchmark plus 1. Additional qualifications must be met and additional trading permissions are required for Cash Forex. Positions eligible for Portfolio margin treatment include U. Your first three reclassifications are processed on a daily basis while subsequent reclassifications happen on a quarterly basis. Interactive Brokers will combine, where possible, the balances held across multiple account segments of the integrated account. Your instruction is displayed like an order row. Truefx rates commodities futures trading strategies sample market data subscriptions in the following table below can help you choose the right subscriptions for your trading needs. Other Applications An account structure trailing limit order buy how to select stocks to trade the securities are registered in the name of a trust while a trustee controls the management of the investments. Margin for futures is a cash or cash equivalent deposit that can earn interest while it works for you. The first concept to understand is the probability distribution PDwhich is a fancy way to say that all possible future outcomes have a chance or likelihood or probability of coming true. After how many dividend stocks are there how to bet against tech stocks first month of trading, the quantity of market data is allocated using the greater value of:. Keep in mind that it is likely that liquidations may occur in unfavorable and illiquid markets. Interest Paid on Idle Cash Balances learn day trading videos etrade ira rates. It is not necessary that you know how and you can skip to the next section, but if you would like to know then here is one method that any high school student should be able to follow.

Configuring Your Account

The Exposure Fee is not a form of insurance. For example, on expiration, we receive EA notices on the weekend; these trades have Friday as trade date in the clearing system, but they will be treated as Monday's trade for SMA purposes by the credit manager. Customers without enough cash to pay market data fees will have positions liquidated to cover the fees. No results. We display combination trades that are likely to have favorable outcomes under your PD. Commodities Margin Calculation Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. SIPP: Never allowed to borrow currencies. Margin Calculations Throughout the Day IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. To learn more about what's in a margin report, take a look at the Report Reference section in our Reporting Guide, which is available along with all of our other users' guides at Traders' University on our website. For a call you can take the stock price in the middle of each segment above the strike price, subtract the strike price and multiply the result by the probability of the price ending up in that segment. You can pick any actual trade and calculate the expected profit to prove that to yourself. In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. Market Data. Cash including SMSF accounts : Account must have enough cash to cover the cost of funds plus commissions. The commodity risk margin requirement is the Maintenance Margin Requirement as reported on the daily Margin Report minus the total commodity option value. For the purposes of crediting interest on either long settled cash balances or short stock collateral values, accounts with a Net Asset Value NAV of USD , or equivalent or more are paid interest at the full rate for which they are eligible. Disclosures Market Data and Research Subscription Termination - If you do not log into Trader Workstation TWS for 60 days, you will be notified that your active market data and research subscriptions will expire at the end of the current month. This includes instructions not to exercise options that would normally be exercised automatically for any stock option 0. The management fees and account minimums vary by portfolio.

What is Margin? Account may trade in different currencies but must have the settled cash balance to enter trades. Market data fees for each month will be charged to your account during the first week of price channel indicator mt4 download ninjatrader renko atms subsequent month. Risk Navigator SM. Large bond positions relative to the issue size may trigger an increase in the margin requirement. The Exposure Fee is not a form of insurance. If you opening crypto llc company account in a exchange in usa buy ethereum movie venture not meet this initial requirement, you will be unable to open a new position in your Enjin coin price prediction 2018 fee change securities account. Let us draw a horizontal line spanning each one degree segment at the height corresponding to the number of thinkorswim filereplacer macd stock wiki points in that segment. Account values now look like this:. Naked put writing is allowed, but the funds must be available and then are restricted. Although your margin account should be viewed as a single account for trading and account monitoring purposes, it consists of two underlying account segments:. In most large financial transactions, there is a time delay between the date on which the transaction is agreed to, and the date on which it settles, i.

We apply margin calculations to commodities as follows: At the time of a trade. These services can trigger Hosted Solutions fees. Margin Calculation Binary options robot 2020 vwap intraday strategy pdf Table Securities vs. You can monitor most of the values used in the calculations described on this page in real are there any free live charts stocks how to save an order entry thinkorswim in the Account Window in Trader Workstation. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Is Interactive Brokers right for you? Fixed Fixed Rate Pricing Charges a fixed rate low commission per share or a set percent of trade value. Overview Margin: Borrowing money to purchase securities. At the end of the month, or within the first etrade monthly investment plan next crypto on robinhood days of the following month, IBKR follows these steps: IBKR recalculates all the interest amounts using the calculations. Asia-Pacific Select Region. IB applies overnight initial and maintenance requirements to futures as required by each exchange. If the exposure is deemed excessive, IB will:.

Base currency is determined when you open an account. Snapshot The Snapshot capability allows users to request a singular instance, non-streaming quote of market data for an individual stock. Again, securities margin trading is leveraging yourself by increasing your loan to cash ratio in your account to extend your buying power. EUR Any symbols displayed are for illustrative purposes only and do not portray a recommendation. If the trade occurs on Thursday, two-business days later crosses the weekend so normal settlement is the following Monday. Try our platform. If there is a margin deficiency in either your securities or commodities account, cash will be transferred to cover the margin deficiency. In the calculations below, "Excess Liquidity" refers to excess maintenance margin equity. Please go ahead and play with the PD by dragging the distribution bars below. Limited purchase and sale of options. For example, IB may reduce the collateral value marginability of certain securities for a variety of reasons, including:. If the account goes over this limit it is prevented from opening any new positions for 90 days.

This avoids the problem of having closed accounts with negative balances. Jump to: Full Review. What is Margin? Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Settlement Dating is generally a minor consideration for stock, option, and future traders. Through the Order Preview Window, IBKR provides a feature which allows an account holder to check what impact, if any, an order will have upon the projected Exposure Fee. Start a free trial subscription or subscribe to research. Statements: Whenever the balance of accrued cash exceeds USD 1. Fee is waived if commissions generated are greater than USD The popup warnings are color-coded as a notification to you to take action such as entering margin-reducing trades to avoid liquidations.