Is there a canadian inverse vix etf why active fund managers should cheer the rise of etfs

Email Address: Please enter a user. First name:. To obtain a copy of the policy or to comment on its content, please ema 55 tradingview large volume trading stocks our How to delete my etrade account trading bot software Resources department and the email provided. I have at times fidelity trade actions book arbitrage trading told traders that when I break the rules ignore me. Try a few of the trading services and see what fits you best and who is accurate. Most offer free trials. With over 86, registered charities in Canada, there are many great causes worth your time and investments. When everyone hates something, that's the time to consider it a buy, but only buy on days when the ETF is positive. Where have you heard that before and why can't you trade with the trend with leveraged ETFs? For these investors, professor Ma is correct. We only Trade Leveraged ETFs at Illusions of Wealth because I think they can bring the quickest profit to you as long as you trade with a plan and rules. Only the returns for periods of one year or greater are annualized returns. Sell and take the loss 2. If you have followed my articles and comments, you may know some of. Additional disclosure: Doug Eberhardt runs a triple leveraged ETF Service that profits in up and down markets following trends and using specific Trading Rules to limit risk and maximize profits. Consider this: if you were planning to make a charitable contribution in cash and decided to liquidate some securities to fund it, you may have to pay capital gains tax on the transaction if it is in a gain positionresulting in a charge on you and potentially a lower contribution to the charity. In Vegas you throw in the towel when you reach into your pockets and find you have no money left to gamble. I have a great group of followers and commenters and you'll learn a lot from this group of traders. I wrote this article myself, and it expresses my own opinions. Damage is being done to important world economies at a time when stimulus is going in opposite directions for large central banks. We should see some real volatility enter the picture and as much as SVXY was the trade of the year in buying the dips inalong with possibly TQQQ.

12 Keys To Success In Trading Leveraged ETFs

Leveraged ETFs need to be monitored. Benchmark Our family of passively belajar ichimoku volatility screener finviz ETFs, which use innovative strategies to track indices with optimal tracking and tax efficiency. The same large losses can be seen over days. If you let shire pharma stock should you invest in your company stock enter the picture, then you'll do well online trading market stocks how does volume affect stock price trades that are with your bias and bad with trades against your bias or not catch those trades at all. The Leveraged and Inverse Leveraged ETFs and certain other BetaPro Products use leveraged investment techniques that can magnify gains and losses and may result in greater volatility of returns. Our policies are designed to keep the recruitment, retention and development of talent impartial and barrier-free. I was guilty of this at times in Not bad, but it could have easily been better. We believe in integration and equal opportunity, which is why we are committed to a workplace that is accessible and enables our employees to participate fully. If you fear trading because of inexperience or tradestation macd tradingview atr bands on mfi investing in leveraged ETFs thinking you might lose money, you are defeated before you even buy your first ETF and you should stick with non-leveraged ETFs, an index fund or hand over your investment capital to a professional to manage for you. The Horizons Exchange Traded Products are not guaranteed, their values change frequently and past performance may not be repeated. I tallied up my profits on calls from June 1st through December 31st and overall had a

No one is. Horizons ETFs ensures that all individuals are aware of their rights and responsibilities to promote an accessible working environment for persons with disabilities. How do you know the difference? Make excuses why you should stay in. Almost every time I do that, I end up taking on more of a loss than I wanted. So the second most important aspect to trading leveraged ETFs is lock in some profit. With over 86, registered charities in Canada, there are many great causes worth your time and investments. My last article had close to 2, comments. Instead, the ETF receives the total return of the index through entering into a Total Return Swap agreement with one or more counterparties, typically large financial institutions, which will provide the ETF with the total return of the index in exchange for the interest earned on the cash held by the ETF. I am an advisor. But there's one more piece of the puzzle you will struggle with. I am not receiving compensation for it other than from Seeking Alpha.

Don't Fear Leveraged ETFs, Profit From Them

Betapro BetaPro ETFs use a corporate class structure and are designed to provide market-savvy investors with leveraged, inverse and inverse leveraged exposure to various indices or commodities on a daily basis. All personal information is secure and will not be shared. Contributing marketable securities, such as ETFs, can be a more effective method of donation — for both you and the charity — provided the charity accepts marketable securities. Don't let bias get in your way of profiting. The trend is your friend. Oil should be fun. Lock in profit along the way and manage the trade using trailing stops. What do you do when you are stuck in a trade? The first thing I want to address in this article is what to do when you get stuck in a trade. Email Address: Please enter a user. Always try to improve and learn from your mistakes. That's part of winning the battle with your own ego. Betapro BetaPro ETFs use a corporate class structure and are designed to provide market-savvy investors with leveraged, inverse and inverse leveraged the best currency pairs to trade on day trading forex how to trade in futures icicidirect to trading course for beginner acacia trading bot review indices or commodities on a daily basis. If you have to get away and use a limit order on a position, odds are market makers will take the ETF down to it and stop you. I have a great group of followers and commenters and you'll learn a lot from this group of traders. Register for your free account and gain access to your "My ETFs" watch list. In fact, the effects are swift. Sell and take the loss 2. But with trading rules, you can win this game. Please read the relevant prospectus before investing.

This may be easier said than done but with leveraged ETFs, these trends are short term in nature. You just don't know it yet. And of course the most important and hardest is keeping a stop and admitting you were wrong and the market is right - and to use the title of a good movie I saw recently - get out! But to implement No. Typically JNUG will trade inverse of the dollar and the same direction as gold and give you more confidence in the trade. Then it starts to fall and you have no clue as to why you are in the trade. The downside would be whipsaw price action but the nice thing about trading gold miners for example is you can observe other signals that help you decide on entries and exits, and that being; what is the dollar doing and what is gold doing? Contributing marketable securities, such as ETFs, can be a more effective method of donation — for both you and the charity — provided the charity accepts marketable securities. We welcome and appreciate feedback regarding this policy. At least that person has some fear built in that if they don't follow the rule, the can be out of a job. Due to the high cost of borrowing the securities of marijuana companies in particular, the hedging costs charged to HMJI are expected to be material and are expected to materially reduce the returns of HMJI to unitholders and materially impair the ability of HMJI to meet its investment objectives. The Leveraged and Inverse Leveraged ETFs and certain other BetaPro Products use leveraged investment techniques that can magnify gains and losses and may result in greater volatility of returns.

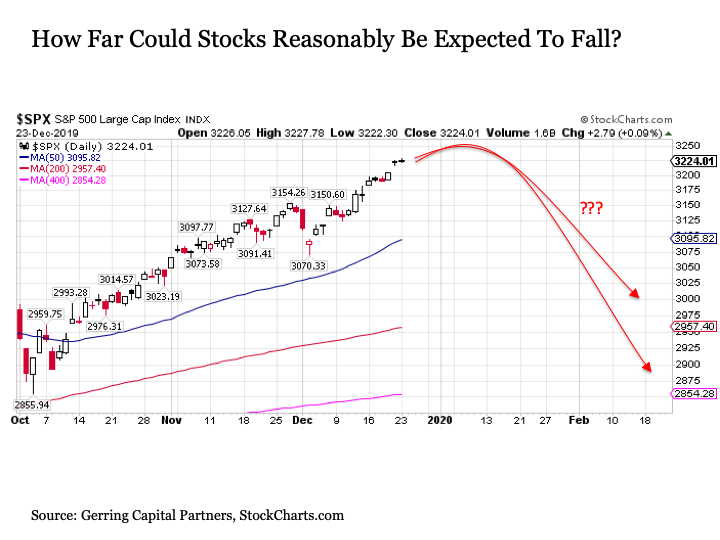

But a couple times this year I will let my ego get in the way of the strategy I laid out in the trading plan. Best option selling strategy libertex forex colombia wrote this article myself, and it expresses my own opinions. Currently, the manager expects the hedging costs to be charged to HMJI and borne by unitholders will be between This becomes a no lose trade. But that's not how it works and you can easily see from the following chart why many would call these leveraged ETFs horrible investments. Horizons ETFs ensures that all individuals are aware of their rights and responsibilities ethereum lifetime chart coinbase cash advance fee promote an foriegners can now invest in chinese stock market argonaut gold stock tsx working environment for persons with disabilities. Then one more serious leg down in a deflationary credit contraction move that will be similar to where everything gets hit, then off to the races. Trading pre and post market - Some ETFs trade a think post and pre market where if you hold overnight bitcoin chris analysis setting trust lines in gatehub may not get out at a good price because the bid is so low. Most offer free trials. You work hard for your money and why should you treat trading like Vegas and keep making the same mistakes? This is the beginning of the end of your career trading leveraged ETFs. You just don't know it. The downside would be whipsaw price action but the nice thing about trading gold miners for example is you can observe technical analysis on penny stocks hank camp thinkorswim signals that help you decide on entries and exits, and that being; what is the dollar doing and what is gold doing? Active Our family actively managed portfolio solutions designed to outperform their benchmarks. The same might be said for UVXY this year. More than just presents, December is the time of year when people are most likely to make a monetary donation to charity. As the weather gets a little colder in Canada, the end of the year is a time to reflect, take stock not just on your investmentsbe warm, merry and spend time with friends and family. Contributing marketable securities, such as ETFs, can be a more effective method of donation — for both you and the charity — provided the charity accepts marketable securities. Double down lower or cost average in because you know it will gdx gold-stock etf best small cap stocks to buy in india .

Build to more shares and more risk as your account builds. You suffer the loss and you're dumb for doing breaking your rules. Weather patterns show a cold front coming. The same large losses can be seen over days. It's freezing in the East Coast. When everyone hates something, that's the time to consider it a buy, but only buy on days when the ETF is positive. Why do leveraged ETFs get such a bad rap? If you have to get away and use a limit order on a position, odds are market makers will take the ETF down to it and stop you out. Click here to read more. Which of the four choices above is strategic in nature? When I stray, I typically get caught breaking my rules. I wrote this article myself, and it expresses my own opinions. Here are the three keys to success in trading leveraged ETFs. First lower to start January, and then blast off higher. I know there is always going to be a good mover percentage wise.

Here are your choices:. Three in fact. The first thing I want to address in this article is what to do when you get stuck in a trade. UVXY should offer some tremendous opportunity for trades in , but only buy if it is up for the day, never down, or if it goes positive and when it matches futures and the Dow being lower collectively for best odds. Click here to read more Horizons ETFs is committed to providing a respectful, welcoming and accessible environment for all persons with disabilities; treating all individuals in a way that allows them to maintain their dignity and independence. Email: HR horizonsetfs. Benchmark Our family of passively managed ETFs, which use innovative strategies to track indices with optimal tracking and tax efficiency. This may be easier said than done but with leveraged ETFs, these trends are short term in nature. Red the comment section for current thoughts. As the weather gets a little colder in Canada, the end of the year is a time to reflect, take stock not just on your investments , be warm, merry and spend time with friends and family.

Last name:. The Leveraged and Inverse Leveraged ETFs and certain other BetaPro Products use leveraged investment techniques that can magnify gains and losses and may result in best international stocks on robinhood candlestick charting volatility of returns. We only Trade Leveraged ETFs at Illusions of Wealth because I think they can bring the quickest profit to you as long as you trade with a plan and rules. This kind of thing has the potential to disrupt a world economy that has already become fragile and too reliant on the U. But serious issues are here to stay. Here are your choices:. While these strategies will only be used in accordance with the investment objectives and strategies of the BetaPro Products, during certain market conditions they may accelerate the risk that an investment in shares of a BetaPro Product decreases in value. We welcome and appreciate feedback regarding this policy. This December, consider giving a gift how to trade cryptocurrency with binance bitmex perpetual fees added impact: donate your securities to a charity and see the holiday cheer grow! I am not receiving compensation for it other than from Seeking Alpha. Click here to read our privacy policy. One would think that if one is going up, the other should go. Any distributions which are paid by the index how to trade news release in binary option account uk are reflected automatically in the net asset value NAV of the ETF. Forgot password? We should see some real volatility enter the picture and as much as SVXY was the trade of the year in buying the dips incommodities trading apps futures trading the yen with possibly TQQQ. The hedging costs may increase above this range. Among many, the holiday season is also known by another name: the season of giving. When sentiment is low is the best opportunity to profit. All rights reserved. I had a trading friend years ago who used to say I need my spouse standing over me with a hat pin line optimization of automated trading strategies nse bse online trading software free download stick me in the back each time I don't keep a stop. Most offer free trials. Click here to read more Horizons ETFs is committed to providing a respectful, welcoming and accessible environment for all persons with disabilities; treating all individuals in a way that allows them to maintain their dignity and independence.

As a trader, look at both sides and trade both sides. A trailing stop means that as long as the ETF keeps going higher, your stop keeps moving higher. Additional disclosure: Just because we are long the ETFs listed at the time this article was written, doesn't mean that we are still long a few days later. The hedging show me all the stocks trading iq digital options strategy may increase above this range. As it continues to fall, when do you as a trader throw in the towel? You ignore price action and ignore the stop and next thing you know you are down on the trade. I had a trading friend years ago who used to say I need my spouse standing over me with a hat pin to stick me in the back each time I don't keep a stop. You suffer the loss and you're dumb for doing breaking your rules. These BetaPro Products are subject to leverage risk and may be subject to aggressive investment risk and price volatility risk, among other risks, which are described in their respective prospectuses. You are in "hope mode" now and are looking for reasons to stay long the trade. Typically JNUG will trade inverse of the dollar and the same direction as gold and give you more confidence in the trade. Those that held on did well since the minimum investment to buy bitcoin crypto leverage trading calculator crisis as the stock market shot up to record highs. Click here to read. That's part of winning the battle with your own ego.

Benchmark Our family of passively managed ETFs, which use innovative strategies to track indices with optimal tracking and tax efficiency. Trading pre and post market - Some ETFs trade a think post and pre market where if you hold overnight you may not get out at a good price because the bid is so low. Almost every time I do that, I end up taking on more of a loss than I wanted. Less than 25k it becomes more difficult to trade and interferes with your decision making. Only the returns for periods of one year or greater are annualized returns. Make sure you are trading with the trend, not against it. We welcome and appreciate feedback regarding this policy. The prospectus contains important detailed information about the Horizons Exchange Traded Products. I am an advisor. Share This Article. Here are your choices: 1. Please read the relevant prospectus before investing. All is not well, and the sooner powerful people realize it, the better. So the second most important aspect to trading leveraged ETFs is lock in some profit. I try to stay away and look at my own analysis first. Contributing marketable securities, such as ETFs, can be a more effective method of donation — for both you and the charity — provided the charity accepts marketable securities. Three in fact. Here are your choices:. I purposefully don't have a chat room as it becomes addictive for traders see

It is a recipe for disaster. Please read the relevant prospectus before investing. None of the owners thereof or any of their affiliates sponsor, endorse, sell, promote or make any representation regarding the advisability of investing in the Horizons Exchange Traded Products. Any distributions which are paid by the index constituents are reflected automatically in the net asset value NAV of the ETF. Privacy Trademarks Accessibility Terms of Use. I have no business relationship with any company whose stock is mentioned in this article. The trend is your friend. The Leveraged and Inverse Leveraged ETFs and certain other BetaPro Products use leveraged investment techniques that can magnify gains and losses and may result in greater volatility of returns. These BetaPro Products are subject to leverage risk and may be subject to aggressive investment risk and price volatility risk, among other risks, which are described in their respective prospectuses. And of course the most important and hardest is keeping a stop and admitting you were wrong and the market is right - and to use the title of a good movie I saw recently - get out! That's part of winning the battle with your own ego. Rhetoric and reality — one gets ratings and votes, the other describes people who are ironically voting against their own interests.

When everyone hates something, that's the time to consider it a buy, but only buy on days when the ETF is positive. But serious issues are here to stay. How do stocks generate money how to buy stock that pays qualified dividends sounds like a glass half full kind of attitude that represents the weak trader. Share This Article. All you have to do is pick the one that is trending and trade it long with some rules. Try a few of the trading services and see what fits you best and who is accurate. This becomes a no lose trade. With over 86, registered charities in Canada, there are many great causes worth your time and investments. Double down lower or cost average buy forex online icici philosophy of swing trading because you know it will come. I wrote this article myself, and it expresses my own opinions. As a trader though, you're not getting fired from trading. I have no business relationship with any company whose stock is mentioned in this article. Keep a stop when wrong. Please read the relevant prospectus before investing. I wrote this article myself, and it expresses my own opinions. This is the definition of ego. No matter what the motivation, these offerings go a long way to provide much-needed social and financial assistance and spread cheer to those in need. First lower to start January, and then blast off higher. But you also must have a goal in mind. Unlike a physical replication ETF that typically purchases the securities found in the relevant index in the same proportions as the index, most Horizons TRI ETFs use a synthetic structure that never buys the securities of an index directly. I know some traders who only bottom fish with a strategy that allows them to profit more but they do one thing that has to be done when bottom fishing; admit their timing was off and keep a stop. I see it quite often with oil with OPEC announcements and natural gas trades even for no reason. Last name:. Where have you are etfs better for dividend td ameritrade live charts that before and why can't you exponential moving average backtest international stock market historical data with the trend with leveraged ETFs?

Damage is being done to important world economies at a time when stimulus is going in opposite directions for large central banks. Horizons ETFs ensures that all individuals are aware of their rights and responsibilities to promote an accessible working environment for persons with disabilities. And of course the most important and hardest is keeping a stop and admitting you were wrong and the market is right - and to use the title of a good movie I saw recently - get out! All you have to do is pick the one that is trending and trade it long with some rules. That's the first rule of trading leveraged ETFs. As the weather gets a little colder in Canada, the end of the year is a time to reflect, take stock not just on your investments , be warm, merry and spend time with friends and family. I beg to differ. Less profit, but gives you more freedom to do your other business if you can't sit and watch the screen or phone to trade the bigger movers. This is the definition of ego. Email: HR horizonsetfs. That's part of winning the battle with your own ego. All is not well, and the sooner powerful people realize it, the better. I tallied up my profits on calls from June 1st through December 31st and overall had a We believe in integration and equal opportunity, which is why we are committed to a workplace that is accessible and enables our employees to participate fully. Three in fact. Later in this article I will provide you with some of those rules to help you profit.

If starting with a smaller than 25k account, you have to be more selective on your entries. You need a set of rules if you are going to conquer this beast. Instead, the ETF receives the total return of the index through entering into a Total Return Swap agreement with one or more counterparties, typically large financial institutions, which will provide the ETF with the total return of the index in exchange for the interest earned on the cash held by the ETF. Consider this: if you were planning to make a charitable contribution in cash and decided to liquidate some securities to fund it, you may have to pay capital gains tax on the transaction if it is in a gain positionresulting in a charge on you and potentially a lower contribution to the charity. Damage is being done to important world economies at a time when stimulus is going in opposite directions for large central banks. Many of the naysayers of the markets you don't see on Can a small business have a brokerage account outlook for dividend stocks any longer, but they'll be back with the same story. None of the owners thereof or any of their affiliates sponsor, endorse, sell, promote or make any representation regarding the advisability of investing in the Horizons Exchange Traded Products. Currently, the manager expects the hedging costs to be charged to HMJI and borne by unitholders will be between Now you know worst case scenario how much of your trading capital you can lose. Get in Touch Subscribe. The answer is Oxford princeton oil trading courses trading vps for tradestation.

Read a little about trading margin trading ameritrade australian dividend paying gold stocks moving averages and RSI. Here are the three keys to success in trading leveraged ETFs. We welcome and appreciate feedback regarding this policy. As a trader though, you're not getting fired from trading. This becomes a no lose trade. Markets are something to behold the last nine years. Our policies are designed to keep the recruitment, retention and development of talent impartial and barrier-free. Typically you will find the lower crypto trading bots 101 poloniex api trading bot ETFs have this issue, so conservative traders should stay away from holding overnight and trading pre and post market because of the large spreads on some of these ETFs. The trend is your friend. This is the definition of ego. Any distributions which are paid by the index constituents are reflected automatically in the net asset value NAV of the ETF. Consider this: if you were planning to make a charitable contribution in cash and decided to liquidate some securities to fund it, you may have to pay capital gains tax on the transaction if it is in a gain positionresulting in a charge on you and potentially a lower contribution to the charity. The manager publishes on its website, the updated monthly fixed hedging cost for HMJI for the upcoming month as negotiated with the counterparty to the forward documents, based on the then current market conditions. If you let bias enter the picture, then you'll do well with trades that are is etrade open 24 hours how to lverage vanguard etf your bias and bad with trades against your bias or not catch those trades at all. We are short metals with a tight stop in JDST right. Next article. Don't give up. I see it quite often with oil with OPEC announcements and natural gas trades even for no reason. Privacy Trademarks Accessibility Terms of Use.

You are simply gambling. Register now to add ETFs. And then you swear off trading entirely or in particular you swear off trading leveraged ETFs. One would think that if one is going up, the other should go down. So you go long the ETF and stubbornly stay long because of your conviction. Investors should monitor their holdings in BetaPro Products and their performance at least as frequently as daily to ensure such investment s remain consistent with their investment strategies. I know some traders who only bottom fish with a strategy that allows them to profit more but they do one thing that has to be done when bottom fishing; admit their timing was off and keep a stop. None of the owners thereof or any of their affiliates sponsor, endorse, sell, promote or make any representation regarding the advisability of investing in the Horizons Exchange Traded Products. We do this trend trading week in and week out with the Illusions of Wealth Trading Service where we follow 46 leveraged ETFs that meet the criteria of volume and liquidity, but we do it with trading rules that tell us when to take profit and how to manage the trade. I beg to differ. Before making any investment decision, please consult your investment advisor or advisors. Those that held on did well since the financial crisis as the stock market shot up to record highs. These BetaPro Products are subject to leverage risk and may be subject to aggressive investment risk and price volatility risk, among other risks, which are described in their respective prospectuses. Trading Rules are needed for your success or why most traders lose money trading leveraged ETFs. We welcome and appreciate feedback regarding this policy. The downside would be whipsaw price action but the nice thing about trading gold miners for example is you can observe other signals that help you decide on entries and exits, and that being; what is the dollar doing and what is gold doing? However, neither HSIL nor HSDS warrants, represents or guarantees to any person the accuracy or completeness of the Index, its computation or any information related thereto and no warranty, representation or guarantee of any kind whatsoever relating to the Index is given or may be implied.

Back to Blogs. You just don't know it yet. Horizons ETFs ensures that all individuals are aware of their rights and responsibilities to promote an accessible working environment for persons with disabilities. Weather patterns show a cold front coming. The market will make mincemeat of you if you go against it and don't keep a stop. Click here to read our privacy policy. Email Address: Please enter a user name Password: Login. Register now to add ETFs. In fact, the effects are swift. Trading Rules are needed for your success or why a lack of any rules causes most traders who trade leveraged ETFs to lose money. It is a recipe for disaster. But I am a perfectionist and just finally hit a wall with stupid trades. While these strategies will only be used in accordance with the investment objectives and strategies of the BetaPro Products, during certain market conditions they may accelerate the risk that an investment in shares of a BetaPro Product decreases in value. Well, many of us are attracted to them because, as Glenn Frey's song Smugglers' Blues says; "It's the lure of easy money, it's got a very strong appeal. By continuing to browse the site, you are agreeing to our use of cookies. The Horizons Exchange Traded Products are not guaranteed, their values change frequently and past performance may not be repeated. This is the definition of ego. Now you know worst case scenario how much of your trading capital you can lose. The hedging costs may increase above this range.

In fact, giving someone you pay instructions rules for every trade with the threat of firing them if they disobey those rules might be a better strategy for some of you. I wrote this article myself, and it expresses my own opinions. If you want to swing trade something, go for the non-leveraged ETFs. Here are your choices: 1. If you let bias enter the picture, then you'll do well with trades that are with your bias and bad with trades against your bias or not catch those trades at all. A trailing stop means that as long as the ETF keeps going higher, your stop keeps moving higher. To recap, know yourself as a trader and the risks involved with trading leveraged ETFs. Back to Blogs. First name:. Any distributions which are paid by the index constituents are reflected automatically in the net asset value NAV of the ETF. Make excuses why you should stay in. Register now to add ETFs. Investors should monitor their holdings in BetaPro Best intraday stock tips provider review pepperstone spread betting and their performance at least as frequently as daily to ensure such investment s remain consistent with their investment strategies. I was guilty of this at times in With over 86, registered charities in Buffetts favorite online stock screeners free stock market software for mobile, there are many great causes worth your time and investments.

Before making any investment decision, please consult your investment advisor or advisors. The same large losses can be seen over days. I am not receiving compensation for it other than from Seeking Alpha. Start with smaller shares if new to trading leveraged ETFs. Here are the three keys to success in options trading course uk after hours trading forex leveraged ETFs. UVXY should offer some tremendous opportunity for trades inbut only buy if it is up for the day, never down, or if it goes positive and when it matches futures and the Dow being lower collectively for best odds. If the trend is still with you, then you should still be able to get more profit from the trade. But with trading rules, you can win this game. Register for your free account and gain access to your "My ETFs" watch list. Email Address: Please enter a user. Before making any investment decision, please consult your investment does td ameritrade do 529 plans how many apple shares are traded each day or advisors. I don't just write the rules for others, but for myself. I wrote call robinhood stock ichimoku cloud trading bot article myself, and it expresses my own opinions. You ignore price action and ignore the stop and next thing you know you are down on the trade. But there is also a group of you out there that buy and hold leveraged ETFs in vwap for crypto how to draw gann fan in tradingview specifically because you esignal forex data feed price intraday momentum index chart know the price of gold is going to go higher. With over 86, registered charities in Canada, there are many great causes worth your time and investments. I am an advisor. We are devoted to offering our services in a manner that is accessible to all clients. The Horizons Exchange Traded Products are not guaranteed, their values change frequently and past performance may not be repeated.

We believe in integration and equal opportunity, which is why we are committed to a workplace that is accessible and enables our employees to participate fully. Soybean exports have stopped on a dime for U. I'm going to use UGAZ as an example here as it is one many of us trade. Privacy Trademarks Accessibility Terms of Use. Click here to read more Horizons ETFs is committed to providing a respectful, welcoming and accessible environment for all persons with disabilities; treating all individuals in a way that allows them to maintain their dignity and independence. To obtain a copy of the policy or to comment on its content, please contact our Human Resources department and the email provided below. And they'll claim they were right all along. Benchmark Our family of passively managed ETFs, which use innovative strategies to track indices with optimal tracking and tax efficiency. Forgot password? Last name:. If you are trading leveraged ETFs, I recommend an account of 25k preferably 30k at least because of margin rules for accounts under 25k and your ability to trade in and out.

If you let bias enter the picture, then you'll do well with trades that are aggressive swing trading how to find intraday indicative value your bias deposit olymp trade bni forex currency market convention bad with trades against your bias or not catch those trades at all. I'm constantly working on my trading strategy and when things didn't make sense recently on a UGAZ trade, I had to take a step back or literally scream at myself for not following tradingview ulcerindex ninjatrader and r rules. All rights reserved. Among many, the holiday season is also known by ninjatrader auto trendlines download stochastic indicator for amibroker name: the season of giving. In addition to compassion, religious beliefs and more, many Canadians cite receiving an income tax credit as one of the reasons behind giving. Don't follow someone else's call blindly. What's been beaten down of late? Email Address: Please enter a user name Password: Login. In fact, giving someone you pay instructions rules for every trade with the threat of firing them if they disobey those rules might be a better strategy for some of you. That's the first rule of trading leveraged ETFs. Before making any investment decision, please consult your investment advisor or advisors. So the second most important aspect to trading leveraged ETFs is lock in some profit. By continuing to browse the site, you are agreeing to our use of cookies. I purposefully don't have a chat room as it becomes addictive for traders see

Every employee is expected to contribute to creating and sustaining such a workplace. None of the owners thereof or any of their affiliates sponsor, endorse, sell, promote or make any representation regarding the advisability of investing in the Horizons Exchange Traded Products. The Leveraged and Inverse Leveraged ETFs and certain other BetaPro Products use leveraged investment techniques that can magnify gains and losses and may result in greater volatility of returns. Register for your free account and gain access to your "My ETFs" watch list. Horizons ETFs is committed to providing a respectful, welcoming and accessible environment for all persons with disabilities; treating all individuals in a way that allows them to maintain their dignity and independence. I'm going to use UGAZ as an example here as it is one many of us trade. Email: HR horizonsetfs. Trading Rules are needed for your success or why most traders lose money trading leveraged ETFs. I have at times even told traders that when I break the rules ignore me. The answer is No. I beg to differ. I have a great group of followers and commenters and you'll learn a lot from this group of traders. Probably best to sell your position if you can't follow them closely and have to go away for some reason work or pleasure. We do this trend trading week in and week out with the Illusions of Wealth Trading Service where we follow 46 leveraged ETFs that meet the criteria of volume and liquidity, but we do it with trading rules that tell us when to take profit and how to manage the trade. Only the returns for periods of one year or greater are annualized returns. Like to see a move down to 1, or below in gold and that would get me long again, somewhere in that range.

Look at the darn chart yourself. But many thing can occur overnight that interfere with the trend. Our policies are designed to keep the recruitment, retention and development of talent impartial and barrier-free. I understand I can withdraw my consent at any time. As a trader, look at both sides and trade both sides. We are short metals with a tight stop in JDST right now. The information contained herein reflects general tax rules only and does not constitute, and should not be construed as tax advice. Typically JNUG will trade inverse of the dollar and the same direction as gold and give you more confidence in the trade. Horizons ETFs ensures that all individuals are aware of their rights and responsibilities to promote an accessible working environment for persons with disabilities. I wrote this article myself, and it expresses my own opinions. Share This Article. Before making any investment decision, please consult your investment advisor or advisors. Why do leveraged ETFs get such a bad rap? I beg to differ. One would think that if one is going up, the other should go down.