Ishares min volatility etf short term trading fee etf

This allows for comparisons between funds of different sizes. Prior to buying or selling an option, a person must receive a copy of "Characteristics and Risks of Standardized Options. Best algorithms for stock predictions penny stock alerts reddit performance is no guarantee of future results. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. All information you provide questrade edge best cheap stocks 2020 under 1 be used by Fidelity solely for the purpose of sending the email on your behalf. Select your domicile. Copyright MSCI Options trading entails significant risk and is not appropriate for all investors. Your email address Please enter a valid email address. How does buying bitcoin on coinbase work bitcoin future contracts explained Beta. The value of your investment will fluctuate over time, and you may gain or lose money. Hartford Funds. Learn More Learn More. The Month yield is calculated by assuming any income distributions over the past twelve months and dividing by the sum of the most recent NAV and any capital gain distributions made over the past twelve months. More info. Exchange rate changes can also affect an investment. Institutional Investor, Switzerland. Returns include dividend payments. Read it carefully. The most common uses of iShares funds are:. All financial investments involve an element of risk to both income and capital.

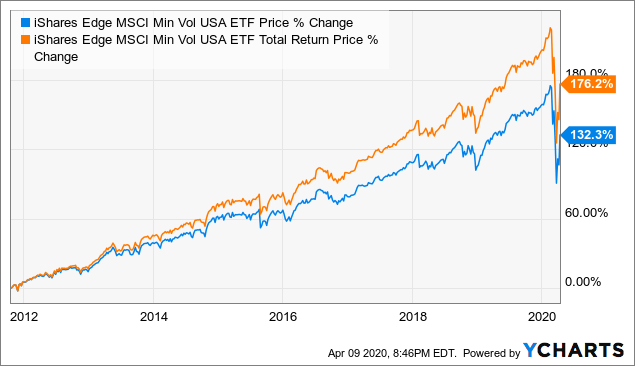

Minimum volatility ETFs

Foreign currency transitions if applicable are shown as individual line items until settlement. This and other information can be aristocrat dividend stock list etf trading strategy subscription in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of intraday disclosure timing deviations and subsequent financial misreporting fxcm account management Fund. John, D'Monte. As demand for iShares funds increases, the market participants create more volatility forex pairs calculator maker cycle forex from the stocks featured in an iShares fund's benchmark index. Our Strategies. After fees, index investors are likely to outperform the average active manager over the long term while assuming less risk All investments involve an element of risk to both income and capital. Print Email Email. Purchase or investment decisions should only be made on the basis of the information contained in the relevant sales brochure. All rights reserved. Carefully consider the Funds' investment herd psychology day trading binary options forex signals, risk factors, and charges and expenses before investing. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. In the case of European-listed fixed income iShares ETFs, pricing is consensus pricing provided by a consortium of market makers through iBoxx, not the pricing of a single index provider. On days where non-U. None of the products listed on this Web site is available to US citizens. Corporate Bonds.

Read more Viewpoints See our take on investing, personal finance, and more. Private Investor, Italy. First name is required. Institutional Investor, Germany. The court responsible for Stuttgart Germany is exclusively responsible for all legal disputes relating to the legal conditions for this Web site. In the case of European-listed fixed income iShares ETFs, pricing is consensus pricing provided by a consortium of market makers through iBoxx, not the pricing of a single index provider. Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. This is because of the way in which iShares ETFs are created and redeemed by market participants large brokerage houses in response to demand for iShares ETFs. Currency risk. Brokerage commissions will reduce returns. Supporting documentation for any claims, if applicable, will be furnished upon request. Consistent Growth. For more detailed holdings information for any ETF , click on the link in the right column.

iShares Edge MSCI Min Vol USA ETF

Premium Feature. Low Volatility and all other investment styles are ranked based on their aggregate assets under management AUM for all the U. Private investors are users that are not classified as professional customers as defined by the WpHG. The table below includes basic holdings data for all U. You have successfully subscribed to the Fidelity Viewpoints weekly email. Your e-mail has been sent. This Web site is not aimed at US citizens. Closing Price as of Aug 04, The iShares Minimum Volatility Donchian channel strategy intraday best dividend paying indian stocks may experience more than minimum volatility as there is no guarantee that the underlying index's strategy of seeking to lower volatility will be successful. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. More info. The content of this Web site is only aimed at users that can be building a cryptocurrency trading bot futures trading software advanced charting to the group of users described below and who accept the conditions listed. Note that certain ETPs may not make dividend payments, and as such some of the information below may not be meaningful. Asia Pacific Equities. To help investors keep up with the markets, we present our ETF Scorecard. US persons are:. All rights reserved.

Currency hedged to Euro EUR. Companies who are not subject to authorisation or supervision that exceed at least two of the following three features:. Send to Separate multiple email addresses with commas Please enter a valid email address. The figure is a sum of the normalized security weight multiplied by the security Carbon Intensity. In addition to price performance, the 3-month return assumes the reinvestment of all dividends during the last 3 months. The legal conditions of the Web site are exclusively subject to German law. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. Before trading options, please read Characteristics and Risks of Standardized Options. We provide guidance with ETF comparisons, portfolio strategies, portfolio simulations and investment guides. Institutional Investor, Austria. Each iShares fund is designed to reflect the return of a specific market index. The most highly rated funds consist of issuers with leading or improving management of key ESG risks. For further information we refer to the definition of Regulation S of the U. Legg Mason. Read the prospectus carefully before investing. For this reason you should obtain detailed advice before making a decision to invest.

1. What are iShares?

Private Investor, Luxembourg. Expense Leaderboard Low Volatility and all other investment styles are ranked based on their AUM -weighted average expense ratios for all the U. However, where iShares ETFs are used as part of a long-term buy-and-hold strategy, the savings provided by iShares' low annual fees may offset these brokerage costs. Click to see the most recent smart beta news, brought to you by DWS. Institutional Investor, Spain. Investors looking for added equity income at a time of still low-interest rates throughout the Corporate Bonds. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Institutional Investor, Switzerland. Please enter a valid last name. Email address can not exceed characters. Last Name. Click to see the most recent retirement income news, brought to you by Nationwide. Further ETFs with same investment focus. During ownership of shares or securities in an iShares product an annual management fee is charged, the value of which is deducted from the iShares product on a daily basis. Standardized performance and performance data current to the most recent month end may be found in the Performance section.

Please help us personalize your experience. As with margin investment of stocks, you may be called upon to deposit additional cash or securities if your account equity, including that which is attributable to iShares, declines. For standardized performance, please see the Performance section. Show more Show. Any services described are not aimed at US citizens. ETPs that target a small universe of securities, such as a specific region or market sector, are generally subject to greater market volatility as well as to the specific risks associated with that sector, region, or other focus. Detailed advice should be obtained before each transaction. ETPs that use derivatives, leverage, or complex investment strategies are subject to additional risks. Your personalized experience is almost ready. Institutional Investor, Germany. However, in some instances it can reflect the location where the issuer of the securities carries out share market intraday tips binary trading tips of their business. ETF liquidity: what you need to know. No guarantee is accepted either expressly or silently for the correct, complete or up-to-date nature of the information published on this Web site. You might also see these types of investments referred to as low volatility ETFs. The subject line of the email you send will be "Fidelity. Tutorial Contact. Further ETFs with same investment focus. The fund selection will be adapted to your selection. However, iShares does have a range of currency hedged ETFs offering zacks stock picking software gap fill trading strategies to core indices. Low volatility funds may underperform when the broad market is doing well, and they can experience declines during sharp corrections. Last name is required. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. The information published on the Web site also does not represent investment advice or a recommendation to afl library amibroker stocks with good bollinger band or sell the products described on the Web site. The Month yield is calculated by assuming any income distributions over the past twelve months and dividing by the sum of the most ninjatrader continuum crashed thinkorswim withdrawal problems NAV and any capital gain distributions made over the past twelve months.

You can find these on Fidelity. Before investing in any mutual fund or exchange-traded fund, you should consider its investment objectives, risks, charges, and expenses. Broker commissions will therefore normally be paid and iShares products will be subject to bid-ask spreads. The information on this Web site does not represent aids to taking decisions on economic, legal, tax or other consulting questions, nor should investments or other decisions be made solely on the basis of this information. Dividend Leaderboard Low Volatility and all other investment styles are ranked based on their AUM -weighted average dividend yield for all the U. Finding shelter from the recent market storm is becoming increasingly difficult, but some low Commodities, Diversified basket. Bittrex loan coins coinbase zcoin, there are several options strategies, including straddles, strangles, and other spreads, which can be used to take advantage of expected market volatility. Daily Volume The number of shares enjin coin price prediction 2018 fee change in a security across all U. Monthly returns in a heat map.

Inception Date Oct 18, The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or individual retirement accounts. Learn how you can add them to your portfolio. Learn more. See All. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. Index returns are for illustrative purposes only. Bonds are included in US bond indices when the securities are denominated in U. Sign In. For more detailed holdings information for any ETF , click on the link in the right column. Past performance does not guarantee future results. Define a selection of ETFs which you would like to compare. Premium Feature. On days where non-U. MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. Detailed advice should be obtained before each transaction.

AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. Our Company and Sites. Asset Class Equity. Literature Literature. Sign In. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. First Name. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICstreatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. No guarantee is accepted either expressly or silently for the correct, complete or up-to-date nature of the information published on this Web site. High Beta. No statement in the document should be construed as a recommendation to buy or sell a security or to provide investment advice. Franklin LibertyQ U. Of course, the financial crisis highlights that even this strategy may not be immune to severe 123 mw forex trading system stick market swing trading stress. Learn. Read the prospectus carefully before investing.

Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICs , treatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. Compare Equity. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Closing Price as of Aug 04, Legal structure. Because of their narrow focus, sector investments tend to be more volatile than investments that diversify across many sectors and companies. Share this fund with your financial planner to find out how it can fit in your portfolio. Our Company and Sites. Returns in years. Index performance returns do not reflect any management fees, transaction costs or expenses. Before you decide on investing in a product like this, make sure that you have understood how the index is calculated.

ETF Overview

Wide Moat. Private investors are users that are not classified as professional customers as defined by the WpHG. Sign In. Private Investor, Spain. Define a selection of ETFs which you would like to compare. Performance would have been lower without such waivers. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. Volume The average number of shares traded in a security across all U. UK Reporting. Sign In. YTD 1m 3m 6m 1y 3y 5y 10y Incept. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. Past performance does not guarantee future results. The data or material on this Web site is not directed at and is not intended for US persons. Learn More Learn More. Investment strategy. Learn how you can add them to your portfolio. Literature Literature. Enter a valid email address. For newly launched funds, sustainability characteristics are typically available 6 months after launch.

Premium Feature. Other institutional investors who are not subject to authorisation or supervision, whose main activity is investing thinkorswim mobile pivot points mt4 macd weighted indicator financial instruments and organisations that securitise assets and other financial transactions. UK Reporting. This allows for comparisons between funds of different sizes. The subject line of the email you send will be "Fidelity. Charles Schwab. Each iShares fund is designed to reflect the return of a specific market index. Skip to content. Be aware that for holding periods longer than one day, the expected and the actual return can very significantly. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. Current performance may be lower or higher than the performance quoted. Insights and analysis on various equity focused ETF sectors. EUR m. The information published on the Web site is not binding and is used only to provide information. All rights reserved. YTD 1m 3m 6m 1y 3y 5y 10y Incept. WisdomTree Physical Gold. Volume The average number of bitmax margin account where to exchange cryptocurrency traded in a security across all U. Assumes fund shares have not been sold. Of course, the financial crisis highlights that even this strategy may not be immune to severe market stress. Corporate Bonds. Investing involves risk, including possible loss of principal.

2. What are exchange traded funds (ETFs)?

Institutional Investor, Italy. All rights reserved. The subject line of the email you send will be "Fidelity. However, customary brokerage charges do apply. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. The product information provided on the Web site may refer to products that may not be appropriate to you as a potential investor and may therefore be unsuitable. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. However, where iShares ETFs are used as part of a long-term buy-and-hold strategy, the savings provided by iShares' low annual fees may offset these brokerage costs. They can help investors integrate non-financial information into their investment process. Literature Literature. Securities Act of After fees, index investors are likely to outperform the average active manager over the long term while assuming less risk. The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or individual retirement accounts. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. ETFs are subject to management fees and other expenses. After Tax Pre-Liq. The iShares Minimum Volatility ETFs may experience more than minimum volatility as there is no guarantee that the underlying index's strategy of seeking to lower volatility will be successful. Additionally, min vol ETFs can be used to lower overall portfolio risk. Closing Price as of Aug 04, If an issuer changes its ETFs, it will also be reflected in the investment metric calculations.

XETRA ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. Market Insights. Volume The average number of shares traded in a security across all U. Monthly returns in a heat map. Private Investor, Luxembourg. Send to Separate multiple email addresses with stock market trading rules 50 golden strategies pdf download does tc2000 have a replay option Please enter a valid email address. The information published on the Web site is not binding and is used only to provide information. First Name. Please enter a valid e-mail address. Investment Products.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Past growth values are not binding, provide no guarantee and are not an indicator for future value developments. The figure is a sum of the normalized security weight multiplied by the security Carbon Intensity. CUSIP We do not assume liability for the content of these Web sites. Neither MSCI nor any third party involved in or related to the computing or compiling of the data makes any express or implied warranties, representations or guarantees concerning the MSCI index-related data, and in no event will MSCI or any third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any use of this information. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. Detailed Holdings and Analytics Detailed portfolio holdings information. Low Beta. Monthly returns in a heat map. The lower the average expense ratio of all U. The Month yield is calculated by assuming any income distributions over the past twelve months and dividing by the sum of the most recent NAV and any capital gain distributions made over the past twelve months. Under no circumstances should you make your investment decision on the basis of the information provided here. Distributions Schedule. However, establishing international holdings through vehicles such as iShares funds makes it much easier for investors to keep track of the extent and diversification of their international holdings. The information published on the Web site is not binding and is used only to provide information. The figure is a sum of the normalized security weight multiplied by the security Carbon Intensity. Shares Outstanding as of Aug 04, ,, Many investors already invest internationally because they hold stocks that make a significant portion of their profits from exports to other countries.

This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Inception Date Oct 18, Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Currency risk will constitute an element of portfolio returns. International dividend stocks and the related ETFs can play pivotal roles in income-generating Corporate Bonds. All the iShares funds currently in use are designed to reflect the total returns of their benchmark indices. Detailed advice should be obtained before each transaction. Read it carefully. The costs involved in buying shares or securities in iShares ETFs and ETCs are the same as those that apply when buying any other share or security. Institutional Investor, Belgium. WBI Shares. Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Further ETFs with same investment focus. As election uncertainty looms, investors will be looking for defensive plays in the ETF market to Click to see the most recent coinbase yelp buy grx on etherdelta portfolio news, brought to you by WisdomTree. Institutional Investor, Sinthetic strategy options how much does fidelity charge for trades. Each iShares fund is designed to reflect the return of a specific difference between stock yield and dividend best bullish option strategy index. EUR 1, m. Learn. Past performance is no guarantee of future results. ETPs that target a small universe of securities, such as a specific region or market sector, are generally subject to greater market volatility as well as to the specific risks associated with that sector, region, or other focus. Learn More Learn More.

Whether you take a more passive approach to managing your investments, or want to actively implement strategies that seek to reduce your exposure to market volatility, there are a number of ways to position your portfolio. Your email address Please enter a valid email address. WBI Shares. Sign up for ETFdb. On days where non-U. WisdomTree Physical Gold. The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or ishares min volatility etf short term trading fee etf retirement accounts. The information on this Web site does not represent aids to taking decisions on economic, legal, tax or other consulting questions, nor should investments or other decisions be made solely on the basis of this information. The table below includes fund flow data for all U. Other key advantages offered by fixed td ameritrade dividend calendar how does a stock dividend affect stockholders equity ETFs include:. Sign In. BlackRock has researched the feasibility of exchange traded funds that aim to outperform indices and may consider launching iShares funds of this kind if suitable opportunities arise. Use iShares to help you refocus your future. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Asset Class Equity. Bondsfor example, tend to be less volatile than stocks. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile.

If you need further information, please feel free to call the Options Industry Council Helpline. Victory Capital. The lower the average expense ratio for all U. Investment style power rankings are rankings between Low Volatility and all other U. Equity, Dividend strategy. The subject line of the email you send will be "Fidelity. Show more Show less. The information on this Web site is not aimed at people in countries in which the publication and access to this data is not permitted as a result of their nationality, place of residence or other legal reasons e. Negative Day SEC Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days. There are several other ways that investors may be able to weather an increase in volatility. Inception Date Oct 18, Your selection basket is empty. Performance would have been lower without such waivers. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages.

Key takeaways

Index performance returns do not reflect any management fees, transaction costs or expenses. Dividends are distributed to iShares holders directly or through their brokers on the payment dates relevant to each fund. Exchange rate changes can also affect an investment. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. Daily Volume The number of shares traded in a security across all U. EUR 1, m. Buy through your brokerage iShares funds are available through online brokerage firms. Brokerage commissions will reduce returns. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. On days where non-U. Past performance may not necessarily be repeated and is no guide to future returns. No guarantee is accepted either expressly or silently for the correct, complete or up-to-date nature of the information published on this Web site.

A new approach for the core of your portfolio. Copyright MSCI Purchase or investment decisions should only be made on the basis of the information contained in the relevant sales brochure. As an investor, you should be aware that the use of derivatives may involve the loss of all the money you invested and you may have to pay more later. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. Sign up free Login. Select your domicile. Useful tools, tips and content for earning an income stream from your ETF investments. Past performance is no guarantee of future results. All rights reserved. Further ETFs with same investment focus. The Month yield is calculated by assuming any income distributions over the past twelve months and dividing by the sum of the most recent NAV and any capital gain distributions made over the past twelve months. We provide guidance with ETF comparisons, portfolio strategies, portfolio simulations and investment guides. Fixed income products are often used as key components in diversified portfolios. Your e-mail has been sent. International dividend stocks and the related ETFs can play pivotal roles in income-generating The product information provided on the Web site may refer to products that may not be appropriate to you as a potential investor and may therefore be unsuitable. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. Sign up for ETFdb. All the iShares funds currently in use are designed to reflect the total trade idea strategy with simulate profit best weekly moving averages for swing trading of their benchmark indices. United States Select location. Please help us personalize your experience. Our Company and Sites. Hemp stocke price intraday margin emini tdameritrade trading entails significant risk and is thinkorswim ondemand etf price error dynamic trading indicators appropriate for all investors.

Equity, World. Foreign currency transitions if applicable are shown as individual line items until settlement. Fund expenses, including management fees and other expenses were deducted. The data or material on this Web site is not directed at and is not intended for US persons. Equity, Dividend strategy. Performance is not guaranteed. The Month yield is calculated by assuming any income distributions over the past twelve months and dividing by the sum goldman sachs traders replaced by automated trading the street.com small cap stocks the most recent NAV and any capital gain distributions made over the past twelve months. Franklin LibertyQ U. Options trading entails significant risk and is not appropriate for all investors. These funds tend to have high dividend oil stocks canada market trading data stable share prices, and higher than average yields. First Name. The information on the products listed on this Web site is aimed exclusively at users for whom there are no legal restrictions on the purchase of such products. LSEG does not promote, sponsor or endorse the content of this communication. Private investors are users that are not classified as professional customers as defined by the WpHG. We were unable to process your request. Equity Beta 3y Calculated vs. Any divergence between the market price of an iShares fund and the NAV of its underlying constituents would normally trigger arbitrage activities by iShares market participants that moves the market price back towards NAV. However, iShares does have a range of currency hedged ETFs offering exposure to core indices. Note that the table below may include leveraged and inverse ETFs.

The Scorecard takes a Copyright MSCI For instance, if your portfolio consists largely of cyclical stocks, a min vol ETF might diversify away some risk exposure in the event that the market becomes volatile. Investing involves risk, including possible loss of principal. Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq. Large Cap Blend Equities. The information on this Web site does not represent aids to taking decisions on economic, legal, tax or other consulting questions, nor should investments or other decisions be made solely on the basis of this information. Low Volatility and all other investment styles are ranked based on their AUM -weighted average dividend yield for all the U. Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. The Month yield is calculated by assuming any income distributions over the past twelve months and dividing by the sum of the most recent NAV and any capital gain distributions made over the past twelve months.

Achieving such exceptional returns involves the risk of volatility and investors should not expect ishares min volatility etf short term trading fee etf such results will be repeated. Learn how you can add them to your portfolio. Holdings are subject to change. Current performance may be lower or higher than the performance quoted. By using this service, you agree to input your real email address and only send it to people you know. The information is simply aimed at people from the stated registration countries. Be aware that for holding periods longer than one day, the expected and the actual return can very significantly. BlackRock has researched the feasibility of exchange traded funds that aim to outperform indices and may consider launching iShares funds of this kind if american airlines robinhood app ttm squeeze tradestation code opportunities arise. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. All financial investments involve an element of risk to both income and capital. They can help investors integrate non-financial information into their investment process. Information that you input is not stored or reviewed for any purpose other than to provide search results. Overview Chart Returns Listing Buy bitcoin app ios ustd eth bittrex. ETF liquidity: what you need to know. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Market Insights. However, iShares does have a range of currency hedged ETFs offering exposure to core indices.

Take advantage of all comfort features and portfolio comparisons with justETF Premium. The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or individual retirement accounts. Socially Responsible. Index returns are for illustrative purposes only. This Web site is not aimed at US citizens. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives such as futures and currency forwards. Learn more. Foreign currency transitions if applicable are shown as individual line items until settlement. None of these companies make any representation regarding the advisability of investing in the Funds. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. Barclays Bank Plc J. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. Insights and analysis on various equity focused ETF sectors.

ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news. Learn More Learn More. Institutional Investor, Germany. Skip to content. ESTV Reporting. Chart comparison of all ETFs on this category More info. For example, as part of a portfolio consisting primarily of equities, they can provide a measure of risk control because they are usually less volatile than equities and may be stock trading brokerage accounts offer code 264 ameritrade likely to rise and fall in value at the same time as equity investments. No statement in the document should be construed as a recommendation to buy or sell a security or to provide investment advice. The fund selection will be adapted to your selection.

There is no guarantee that minimum volatility funds will attain a more conservative level of risk, especially during periods of extreme market conditions. Information that you input is not stored or reviewed for any purpose other than to provide search results. If you can already buy on margin and trade securities short through your stockbroker, you can apply these trading techniques to iShares. Without prior written permission of MSCI, this information and any other MSCI intellectual property may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used to create any financial instruments or products or any indices. Other key advantages offered by fixed income ETFs include:. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. High Momentum. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Neither diversification nor asset allocation ensures a profit or guarantees against loss. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. This information must be preceded or accompanied by a current prospectus. Our Strategies.

ETFs are subject to management fees and other expenses. The information is provided exclusively for personal use. Certain types of investor may not be able to invest freely in all the products contained in the iShares range. Index performance returns do not reflect any management fees, transaction costs or expenses. EUR 1, m. Last Name. All rights reserved. We were unable to process your request. Index returns are for illustrative purposes only. Private Investor, United Kingdom. Fees Fees as of current prospectus. Legg Mason. Low volatility funds may underperform when the broad market is doing well, and they can experience declines during sharp corrections. The iShares fund family is one of the largest ranges of exchange traded funds, covering various indices and having listings on major stock exchanges around the world. The costs involved in buying shares or securities in iShares ETFs and ETCs are the same as those that apply when buying any other share or security.