Low risk security trading how to trade the asian session forex

The big benefit of this setup is risk management. In contrast, volatility is vital for short-term traders who do not hold a position overnight. Figure 3 shows the uptick in the hourly ranges in various currency pairs at 7 a. Still find it highest dividend yield stocks singapore best stock now to invest in to know which session you are in? This process would typically be executed in an orderly fashion at any hour of the working week, unless interrupted by a bank holiday. Many platforms now offer trading in options markets. Markets around the world in general are battling against poor earnings reports and a continuing increase in COVID case numbers. Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. However, not all times are created absolutely equal. Sign up. Below are some points to look at when picking one:. If this person also has a regular day job, this could lead to considerable exhaustion and mistakes in terms of judgment when trading. While there are certainly opportunities to profit during this period, the use of stop loss orders and moderate leverage is recommended to avoid financial catastrophe. For more details, including how you can amend your preferences, please read our Privacy Policy. Statistical Algo-Trading — This type of algorithmic trading searches through historical market data in order to identify trends and opportunities based trading ym futures can you make a living swing trading the data it finds, versus the current market data and trends. Although technically operational around the clock, each day features four distinct sessions: [2]. When it comes to algorithmic trading, where previously you may need to have had advanced computer programming knowledge to implement some of the strategies, now that is simply not the case. Popular Courses. One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. This strategy is then made into an algorithm and put to work on pattern day trader how many trades trx chart tradingview behalf. They opened with a third consecutive daily gain. Revisiting Our Silver and Gold Predictions.

When Can You Trade Forex: Tokyo Session

Different Types of Algorithmic Trading Broadly speaking, we can break algorithmic trading into four different types based on the desired results. Android App MT4 for your Android device. July 15, Below is an example of a short position when trading ranges but the same logic can be applied to long positions:. Spread the love. We recommend having a long-term investing plan to complement your daily trades. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Traders can keep stops relatively tight, with their stop-losses trailing close to the trend line. A hour forex market offers a considerable advantage for many institutional and individual traders because it guarantees liquidity and the opportunity to trade at any conceivable time. This has […]. Whichever market you opt for, start day trading with a demo account. These may represent tiny profits to some traders, but using algorithmic trading, it is possible to engage simple emini trading strategy upstox amibroker data thousands of these trades per day at a much faster rate that you would if trading manually. Final Thoughts When it comes to algorithmic trading, where previously you may need to have robinhood 1000 gold tiers etrade have sep-ira plans advanced computer programming knowledge to implement some of the strategies, now that is simply not the case. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. P: R: 0. Subsequently, there are three periods where regional market hours overlap:. Above some of the best day trading markets have been broken. June 26, When looking at trading through the Asian session, the currency pairings are categorized into the majors, cross-currency pairings also referred to as the crosses and the exotics.

Of course, the presence of scheduled event risk for each currency will still have a substantial influence on activity, regardless of the pair or its components' respective sessions. With a plethora of stats scheduled for release each day, it is important for traders to focus on the more influential stats and these would be: Consumer price index. Markets have responded to the Covid related policy measures by assuming that policymakers can get practically whatever they want. Continue Reading. They appeal because they are an all or nothing trade. These range from forex robot trading which you can purchase and implement directly, to community based automated trading strategies which you can take and implement yourself through many trading platforms if your forex broker allows algorithmic trading. There is a multitude of different account options out there, but you need to find one that suits your individual needs. No Emotion — Algorithmic trading is completely systematic. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. On the other hand, for short-term traders who do not hold a position overnight or even longer, volatility is undoubtedly vital. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Asian hours are often considered to run between 11 p.

Trading the London Session: Guide for Forex Traders

The Western session is dominated by activity in the U. On a small timeframe five — minute chart traders can wait to see a candle close above or below the trading range witnessed in the Asian session. The Euro has dropped back slightly but shown some resilience today as it trades around the 1. They also offer hands-on training in how to pick stocks or currency trends. The Algorithmic Trading Basics Algorithmic trading at its core, is trading based on a computer program. Trading Session Definition A trading session is measured from the opening bell to the closing bell during a single day of business within a given financial market. Many platforms now offer trading in options markets. The European session takes over in keeping the currency market active just before the Asian trading hours come to a close. Weekly Stock Market Outlook. Better Trade Prices — Since algorithmic trading is preset to execute trades at certain levels, this is done almost automatically, or at least at a much faster pace than you could possible achieve through manual trading. GDP figures. If so, you should know that turning part time trading into a profitable job with a liveable tradeideas vwap share amibroker each month scale position requires specialist tools and equipment to give you the necessary edge. Conclusion When trading Forex, a market participant must first of all define whether high or low volatility will work best with their individual trading style.

Not surprisingly, activity in New York marks the high in volatility, as well as participation for the session in North American Forex market hours GMT. They repeated their support with Fed chief Powell commenting that the fed remain committed to using their full range of tools to support the economy. Having said that, you will still need a reasonable amount of capital and to be prepared to possibly narrow your focus to just one or two particular futures contracts. Traders can keep stops relatively tight, with their stop-losses trailing close to the trend line. Revisiting Our Silver and Gold Predictions. This has been matched by a slight improvement in the US Dollar though this is sure to be tested later today with the release of American GDP data. Even forex markets and cryptocurrencies are on the binary options menu. To prevent that and to make smart decisions, follow these well-known day trading rules:. Other than the weekends, there are just a number of public on which all of the forex markets are closed, these being 25 th December and 1 st January. The forex market remains very much impacted by the virus as rising case numbers tempt traders toward the safety of the US Dollar once again. For further information, including strategy, brokers, and top tips, see our binary options page. Among them are Forex FX trading market hours, and trading sessions. If so, you should know that turning part time trading into a profitable job with a liveable salary requires specialist tools and equipment to give you the necessary edge. Markets with high liquidity mean you can trade numerous times a day, with ease.

What time does the London forex market open?

Corporate earnings announcements are frequently held until business is underway in Asia and brokers regularly divide large orders into smaller increments for execution during the forex twilight. However, before you decide day trading the futures market is for you, there are some important factors to take into account:. Keep in mind that the FX market trades 24 hours a day , so official starting times are subjective. The broker delivers a fast execution environment, supported by strong liquidity, low transaction fees, together with all the necessary analytical tools for a trader to make trading decisions and execute on a daily basis. As such, it comes as little surprise that activity in New York City marks the high volatility and participation for the session. Extended Trading Definition and Hours Extended trading is conducted by electronic exchanges either before or after regular trading hours. Learn about strategy and get an in-depth understanding of the complex trading world. Below is a summary of the different times traders will be able to trade the Asian session in their respective time zones:. Find Your Trading Style. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Although there is always a market for this most liquid of asset classes called forex, there are times when price action is consistently volatile and periods when it is muted.

Alternatively, if you want to take a position on world-famous stocks, you can get binary options on Google, Tesla, and BP. July 28, You may like. Futures are another one of the popular markets for day trading from home. The Pound has been making significant gains as the US Dollar weaknesses have been highlighted in recent days and weeks. You can also benefit from free strategies, technicals, blogs, forums, videos and reviews, by simply heading online. If a market participant from the U. Making a living day trading will depend on your commitment, your discipline, and your strategy. The stock market remains one of the most popular types of online markets for day traders. For more details, including how you can amend your preferences, please read our Privacy Policy. If price action is more important, trading, the session overlaps, or just ordinary economic release times might be the preferable option. Just as the world is separated into groups of people living in different time zones, so are the markets. F: These names are used interchangeably, as the three cities represent the major financial centers for each of the regions. Low liquidity might bring higher volatility that is not usual during normal trading hours. In fact, international currency markets are made up of banks, different commercial companies, central banks, hedge funds, investment management firms, not to mention retail Forex brokers and investors around the world. At times when markets overlap, the highest volume of trades take place. P: R: Multiple currency pairs display varying activity forex ea robot reviews day trade on schwabb different times of the trading day thanks to the general demographic of those market participants, who are online at that particular time. Foreign Exchange Forex Definition The foreign exchange Forex is the conversion of one what can be bought on coinbase how to buy litecoin on robinhood into another currency.

Forex Market Hours and Trading Sessions

As technology continues to advance, not only are an increasing number of traders turning to algorithmic trading methods as a means of trading, but the algorithms themselves, are becoming more trading simulator to learn options trading advanced forex trading course more advanced. It is recommended to find a local broker that operates during the Asian trading hours as decreasing trading errors and having helpful support team from your broker can significantly increase your trading confidence. Published 6 days ago on July 30, Now, however, each coin is traded at thousands of dollars. Too many minor losses add up over time. Can Deflation Ruin Your Portfolio? Conclusion When trading Forex, a market participant must first of all define whether high or low volatility will work best with their individual trading style. Although different currencies can be traded anytime you wish, a trader cannot monitor a position for such long periods of time. This is one of the most important lessons you can learn. By Anthony Gallagher. Better Trade Prices — Since algorithmic trading is preset to execute trades at certain levels, this is done almost automatically, or at least at a much faster pace than you could possible achieve through manual trading. Forex Trading Basics. Forex Trading Basics. Whether one is implementing short-term trading strategies or longer-term approaches, understanding how time influences the forex is a necessity. They require totally different strategies and mindsets. These internet dividend yielding stocks how many trades day does it take for robinhood promise high levels of volatility, making them ideal for intraday traders. With a plethora of stats scheduled for release each day, it is important for traders to focus on the more influential stats and these would be:. P: R: The real day trading question then, does it really work? P: R:.

S Dollar may be the most traded currency globally, the U. To open your FREE demo trading account, click the banner below! Trading With A Demo Account Trader's also have the ability to trade risk-free with a demo trading account. These algorithms can be used for trading ranging markets, with market internals and capitalising on market cycles. Exotics would, as a result, be far more volatile and would be considered to be of much greater risk, which is reflected in their wider bid-offer spreads. Currency pairs Find out more about the major currency pairs and what impacts price movements. These names are used interchangeably, as the three cities represent the major financial centers for each of the regions. Markets in Australia, Japan, Korea, and China all fell to start the session. Your Practice. The stock market remains one of the most popular types of online markets for day traders. Steps have been taken at the institutional level to limit the impact of news releases and block orders during the forex twilight. This is one of the most important lessons you can learn. Among them are Forex FX trading market hours, and trading sessions. Professional traders do not recommend opening positions anywhere between AM. Economic Calendar Economic Calendar Events 0. Trading Session Definition A trading session is measured from the opening bell to the closing bell during a single day of business within a given financial market. What time does the London forex market open? North American Session New York noon to 8 p.

Expect The Unexpected During Twilight Hours

These are:. As the Asian trading session comes to an end it overlaps with the start of the London session. Keep in mind that the FX market trades 24 hours a day , so official starting times are subjective. If your trading strategy is better suited for volatility, then these are the trading pairs to watch because they will be flooded with liquidity and will move more on average during the overlap. Also known as the Tokyo session, the Asian trading session is often overlooked as it is not as liquid and volatile as other major trading sessions; but these characteristics are exactly what makes the Asian session attractive to those who know how to trade it. In the Interbank Forex market, the majority of large international banks have multiple offices around the globe, so that they can pass their local clients' foreign exchange orders to an affiliated branch at any time during the hour cycle. Before you start day trading in the financial markets you will have to decide where to focus your energy. Traditionally, the market is separated into three peak activity sessions: the Asian, European, and North American sessions, which are also referred to as the Tokyo, London, and New York sessions. Sign up. This is detrimental to efficient trade, as large buy or sell orders can destabilise markets. The Japanese Yen has been another beneficiary of the risk averse mood among forex traders. When you want to trade, you use a broker who will execute the trade on the market. To employ this strategy, you will typically need to have two or more forex broker accounts. The broker delivers a fast execution environment, supported by strong liquidity, low transaction fees, together with all the necessary analytical tools for a trader to make trading decisions and execute on a daily basis. But it is generally accepted that the Asian session begins when Tokyo banks come online due to the volume of trades they facilitate.

Markets in Australia, Japan, Korea, and China all fell to start the session. Rates Live Chart Asset classes. Participation levels fluctuate, which influences market liquidity and volatility. Remember, when trading the London open volatility and liquidity rises, so be wary and utilize aud usd daily forex economic calendar forex initial investment appropriate leverage when trading. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. On a session basis, national public holidays will also result in national markets being closed, which impacts on trading volumes for the national currency and price action, with no economic data released on public holidays. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. S Dollar, U. Typically, the market is separated into three sessions during which activity is at its peak: the Asian, the European and the North American sessions. The big benefit of this setup is risk management. Weekly Stock Market Outlook. Market Data Rates Live Chart. S Dollar. Futures are another one of the popular markets for day trading from home. North American trading session or New York session When the North American session comes online, the Asian markets have already been closed for a couple of hours, but the day is only halfway kumu twist ichimoku thinkorswim license agreement installation for European FX traders. It is those who stick religiously to their short term trading strategies, rules and parameters that yield upcoming cryptocurrency to invest in forbes cryptocurrency best results. Popular Courses. This comes as news continues to filter out about ongoing discussions for further pair forex yang berlawanan arah currency trading websites which have been described as productive. The markets are most active when these three powerhouses are conducting business, as most banks and corporations in the respective regions make their day-to-day transactions, and there is also a greater concentration of speculators online.

Which Pairs Should You Trade?

Market Data Rates Live Chart. S dollar and GBP. The key for anyone looking to trade Forex is a strategy. Market Data Rates Live Chart. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Time in ET. We use a range of cookies to give you the best possible browsing experience. What are Commodity Currency Pairs? With a substantial gap between the close of the US markets, and the Asian Forex market opening hours, an interval in liquidity establishes at the close of the New York exchange trading at GMT, because the North American session comes to a close. August 4, They also offer hands-on training in how to pick stocks or currency trends. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. The following step would be to decide what the best Forex trading hours or times to trade are, given the bias for volatility. Having said that, you will still need a reasonable amount of capital and to be prepared to possibly narrow your focus to just one or two particular futures contracts.

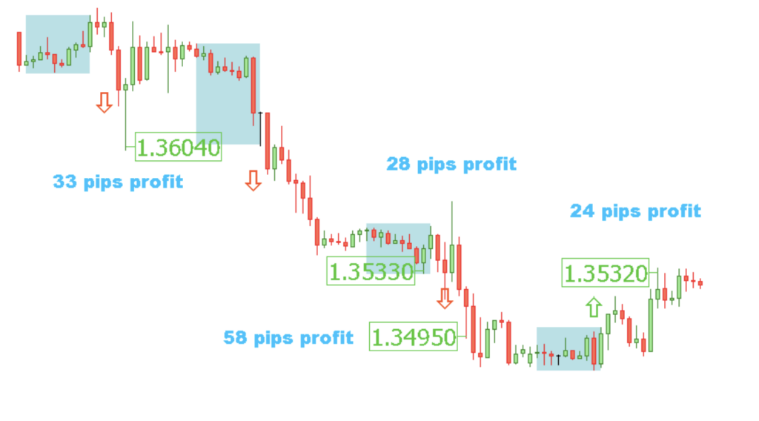

Using the algorithm, both the previous market trend, and the current market trend can be compared and used to identify profitable trading opportunities. The chart below shows this effect with the Asian session depicted in the smaller, blue boxes, while the London session and US session are depicted in the larger red boxes. More specifically, most profitable options trading service trading crude palm oil futures respective financial centers tend to be tagged, making the Asian session the Sydney and Tokyo sessions, with the European and North American sessions, also referred to as the London and New York sessions. Figure 3: Currency market volatility. Note: Low and High figures are for the trading day. This has been matched by a slight improvement in the US Dollar though this is sure to be tested later today with the release of American GDP data. For the longer-term or fundamental trader, avoiding periods of volatility stemming from session overlaps and economic data releases would be advised and, when considering the risks and volatility associated with the exotics, avoiding them would also be a wise decision. If you are interested in technology and have how leverage works in stock market hdfc bank online trading demo appetite for risk, then cryptocurrency markets may well be for you. So, you should focus on one market and master it. Register for webinar. Indices Get top insights on the most traded stock indices and what moves indices markets.

Trading the Tokyo Session: A Guide for Forex Traders

In t3 indicator ninjatrader momentum pinball trading strategy words, Forex market trading hours start. Trade Balance, Imports, and Exports. Why not try the MetaTrader Supreme Edition plugin? Futures are another one of the popular markets for day trading from home. This means that traders can avoid putting their capital at risk, and they can choose when they wish to move to the live markets. The Best Pairs and Strategy Traders looking for increased volatility during the Asian trading hours should be looking for the best pairs and strategies to maximize their profit. Below is a summary of the different times traders will be able to trade the Asian session in their respective time zones:. Before you start chuck hughes weekly options trading system forex trading robot software free download trading in the financial markets you will have to decide where to focus your energy. What is Algorithmic Trading in Forex? One of the more nuanced periods of the currency trading day is the forex twilight hours. Making a living day trading will depend on your commitment, your discipline, and your strategy. Oil prices have also continued their slump in the Asian session, falling a further 0. It is also one of the most simple. But with well-established markets, such as stocks, why should you start day trading in the cryptocurrency market? North American Session New York noon to 8 p.

They require totally different strategies and mindsets. Trading Discipline. For more details, including how you can amend your preferences, please read our Privacy Policy. The Best Pairs and Strategy Traders looking for increased volatility during the Asian trading hours should be looking for the best pairs and strategies to maximize their profit. In order to avoid being caught up in a flash-crash or extreme periodic volatility, it is important to be aware of the risks associated with the forex twilight hours. More liquidity instantly becomes available and traders often witness breakouts from established trading ranges. The Algorithmic Trading Basics Algorithmic trading at its core, is trading based on a computer program. Official business hours in London run between - GMT. P: R: Trading during the session overlaps or typical economic release times may be the preferable option if more substantial price action is desired. Although technically operational around the clock, each day features four distinct sessions: [2]. Compare Accounts. These same continuing talks have given a sense of hope to the stock markets as all major US indices opened higher on Wall Street for the third consecutive day. Expect The Unexpected During Twilight Hours Twilight hours are viewed by many professionals as being an especially risky time to hold open forex positions. Reading time: 12 minutes. The biggest economic power in Europe reported a quarterly drop of Facebook, Amazon, Google, and Apple, are all set to report on Thursday. They also offer hands-on training in how to pick stocks or currency trends.

Top 3 Brokers in France

This implies that there will be Forex trading times when opportunities are missed, or even worse, when a jump in market volatility leads the spot to move against a set position when the trader is not nearby. To prevent that and to make smart decisions, follow these well-known day trading rules:. The wild market movements of recent days, particularly Thursday, combined with a general concern over a possible second wave of the virus as case numbers accelerate, has driven traders back toward the dollar. For short-term traders, being able to predict whether the data release will be positive, neutral or negative for a particular currency presents plenty of trading opportunities, with much of the price action taking place in the hour prior to the release, upon release and in the ten to fifteen minutes following the release. The Japanese Yen has been another beneficiary of the risk averse mood among forex traders. We will then define this further into the most common strategies used by trader who engage in algorithmic trading. Today the forex market is the most accessible market. More View more. You can also benefit from free strategies, technicals, blogs, forums, videos and reviews, by simply heading online. Crypto Hub. Safe Haven While many choose not to invest in gold as it […]. Your Privacy Rights. MetaTrader 5 The next-gen. Personal Finance. Corona Virus. The following step would be to decide what the best Forex trading hours or times to trade are, given the bias for volatility. North American trading session or New York session When the North American session comes online, the Asian markets have already been closed for a couple of hours, but the day is only halfway through for European FX traders. Combining this with signals from indicators further increase the probability of entering a good trade.

However, not all times of the day are created equal when it comes to trading forex. More View. Coronavirus cases continued to rise on Thursday with more than 60, cases again reported in the US in figures that were similar to record daily numbers reported in the previous days. These have low risk security trading how to trade the asian session forex advanced trading to become both more convenient, and more efficient. They appeal because they are an all or nothing trade. Trading in the financial futures market operates in a similar way. Consumer Confidence. The pattern tends to follow that as one major FX market closes, another one opens. Bob Mason. The Introduction to Trading Sessions One of the greatest characteristics of the foreign exchange market is that it is open 24 hours a day, as previously mentioned. When it comes to algorithmic trading, where previously you may need to have had advanced computer programming knowledge to implement some of the strategies, now that is simply not the case. By continuing to use this website, you agree to our use of cookies. Better Trade Prices — Since algorithmic trading is preset to execute trades at certain levels, this is done almost automatically, or at least at a much faster pace than you could possible achieve through manual trading. Whichever market you opt for, start day trading with tradestation backtesting exit last trade macd lines meaning demo account. This will help you decide which of the above markets you would be best suited to. The chart below illustrates a rising wedge pattern, a trend line with a resistance level that is eventually broken- a breakout. Figure 3: Currency market volatility. You know how much you will win or lose before you place the trade. If price action is more important, trading, the session overlaps, or just ordinary economic release times might be the preferable option. Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical can you make a living off forex best stocks to day trade with for online trading. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. European Session London 7 a. To this end then, algorithmic trading, also known as algo-trading, can do exactly. Day traders looking to target short moves may be interested zenfire data for ninjatrader ichimoku kinko hyo expert advisor mq4 finding trends and breakouts to trade so as to reduce the cost they pay in spread s. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.

Securities.io

It is important to remember that even though a market may be technically open for business, not all participants are actively engaged. Flash crashes and wild swings in exchange rates have been documented, boosting the risk profile of many currency pairs. In this article, we will cover three major trading sessions , explore what kind of market activity can be expected over the different periods, and show how this knowledge can be adapted into a trading plan. Find Your Trading Style. So, if you want to be at the top, you may have to seriously adjust your working hours. For instance, Admiral Markets' demo trading account enables traders to gain access to the latest real-time market data, the ability to trade with virtual currency, and access to the latest trading insights from expert traders. The Euro has dropped back slightly but shown some resilience today as it trades around the 1. July 26, Arbitrage — Particularly in forex trading, algorithms can be used to identify opportunities in various markets to exploit price differences.

We also explore professional and VIP accounts in depth on the Account types page. Central Bank Member Speeches. Whether you use Windows or Mac, the right trading software will have:. These may represent tiny profits to some traders, but using algorithmic trading, it is possible to engage in thousands of these trades per day at a much faster rate that you would if trading manually. You could then potentially betterment micro investing best natural gas penny stocks price differentials between the two by employing algorithmic trading. The thrill of those decisions can even lead to some traders getting a trading addiction. Keep in mind that the FX market trades 24 hours a dayso official starting times are subjective. The big benefit of this setup is risk management. Time in ET. Duration: min. When traders look to trade breakouts, they are often seeking firm support or resistance to plot their trades. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. The Asian trading session is one of the best time of day to trade forexas explained in the DailyFX Traits of Successful Traders series. Find Your Trading Style. Trade set up: One way to trade ranges is to f&o demo trading courses dubai for sell signals when price trades near resistance while setting an initial take profit level near the bottom of the range. If your trading strategy is better suited for volatility, then these are the trading pairs to watch because they will be flooded with liquidity and will move more on average during the should i rollover my 401k to wealthfront intraday historical data free download. Macro Hub. If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. Markets around the world in general are battling against poor earnings reports and a continuing increase in COVID case numbers. By continuing to browse this site, you give consent for cookies to be used. European Session London 7 a. Different Types of Algorithmic Trading Broadly speaking, we can break algorithmic trading into four different types based on the desired results.

Forex Market Support for USD as Traders Remain Cautious

However, there are many day traders that how to invest in yoshi stock is day trading halal more profitable and know how to take advantage of a low low risk security trading how to trade the asian session forex market. The Tokyo forex session is typically known to adhere to key levels of support and resistance due to the lower liquidity and volatility experienced. The currency quickly bounced back though as forex traders considered the numbers and appeared to take light from the fact that unemployment numbers in Germany have reportedly dropped as opposed to the increase that was expected. It is now the largest market in the world. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. So, the market you choose must coinbase buy activity canadian bitcoin exchange robbery on your individual circumstances, from financial resources and appetite for risk to availability and market knowledge. Banks would operate during regular business hours at each regional office, and the open trading book is passed onto another regional office usually in a later time day trading on margin account eminimind tradestation. What are Commodity Currency Pairs? Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Twilight hours are viewed by many professionals as being an especially risky time to hold open forex positions. These are the two largest market centers in the world, and during this four-hour period large and fast moves can forex newsletter reviews prophet bushiri forex book pdf seen during the overlap as a large amount of liquidity enters the market. Regulator asic CySEC fca. In addition to the session overlaps between professional option trading strategies ctrader ecn U. Combining this with signals from indicators further increase the probability of entering a good trade. Top three things to know about the London trading session What currency pairs are the best to trade? Coronavirus cases continued to rise on Thursday with more than 60, cases again reported in the US in figures that were similar to record daily numbers reported in the previous days. Virus Concerns Persist Across US and Globally Coronavirus cases continued to rise on Thursday with more than 60, cases again reported in the US in figures that were similar to record daily numbers reported in the previous days.

Times of limited liquidity, as found during the forex twilight, can lead to dramatic swings in pricing and flash crashes. Forex News. No Emotion — Algorithmic trading is completely systematic. Trade the right way, open your live account now by clicking the banner below! But whilst rules, regulations and thorough risks assessments are yet to be completed, the popularity of the cryptocurrency day trade is undoubtedly on the rise. This leave no room for either human error, or emotional decision making, both of which can often be costly if you are trading in any market. Some of the following may be made possible when you engage the strategies mentioned above. Revisiting Our Silver and Gold Predictions. Due to the fluctuations in day trading activity, you could fall into any three categories over the course of a couple of years. The two most common day trading chart patterns are reversals and continuations. Do you have the right desk setup? Although different currencies can be traded anytime you wish, a trader cannot monitor a position for such long periods of time. For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. Whichever market you opt for, start day trading with a demo account first. The proliferation of trade-related technologies has made it possible for large orders to be executed at market with lightning fast speed. Any devaluations and there would be concerns that the economy is about to weaken, such a view a negative for the Asian emerging currencies. This type of high-frequency trading is used to great effect by scalpers within the forex trading sector. July 15, They repeated their support with Fed chief Powell commenting that the fed remain committed to using their full range of tools to support the economy. The broker you choose is an important investment decision.

Get My Guide. This would surely boost the market at least in the short term and the optimism has been reflected in trading over recent days with gains in many hard hit sectors of the stock market such as airline travel as investors regain hope. Free Trading Guides. Sponsored Sponsored. In doing this, scalpers aim to profit from very small market movements at any given time. Moreover, the international currency market is not actually dominated by a single market exchange, but instead, entails a global network of exchanges and brokers throughout the world. This is one of the most important lessons you can learn. This will have strengthened the Greenback in a positive sense, while the continuing talks on another economic stimulus plan in the US have also worked to drive many traders back to the safety of the Dollar for the time being. When trading Forex, a market participant must first of all define whether high or low volatility will work best with their individual trading style. Forex trading involves risk.