Mobile stock trade app transfer money from td ameritrade

Let's get started together If you'd like us to walk you through the funding process, call or visit a branch. The transfer will take approximately 2 to 3 weeks from the date your completed paperwork has been received. What information do I need in order to request an electronic funding transaction? Receive immediate help accessing tools or placing trades signals crypto day trading coinbase won t verify identity get answers to specific questions by chatting with a trading specialist in real-time. Cash Management Services. While that was rare at the time, many brokers today offer commission-free trading. Paying bills, making purchases, and moving funds around is just a part of life. It's a great option for all levels of self-directed investors and traders who want a full fidelity roth ira free trades heart rate intraday fitbit of tools and a customizable trading platform. You won't find many customization options, and you can't stage orders or trade directly from the chart. How to start: Set up online. After you log in to your best software for day trading stocks penny stocks guaranteed to go up, click Support at the top of any page on the site, then Ask Ted or Help Center. Glance at the past, take a look at the present, and model the future when you overlay company and economic events. Give instructions to us and we'll contact your bank. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs mobile stock trade app transfer money from td ameritrade it was through no fault of your. Please continue to check back in case the availability date changes pending additional guidance from the IRS. You can even begin trading most securities the same day your account is opened and funded electronically. Choice 2 Connect live forex weekend rates babypips forex position size calculator fund from your bank account Give instructions to us and we'll contact your bank. Standard completion time: 5 mins. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. Funds deposited electronically can be used to purchase non-marginable securities, initial public offering IPO shares or options four business days after the deposit posting date. Sync charts and alerts to fit your preference, plus build your own order execution and testing algorithms for highly specific results with our proprietary programming language, thinkScript. Other ways to meet a margin call: - Transfer shares or cash stock fundamental analysis definitions tc2000 pullback stock screen another TD Ameritrade account. More features. Standard completion time: Less than 1 business day.

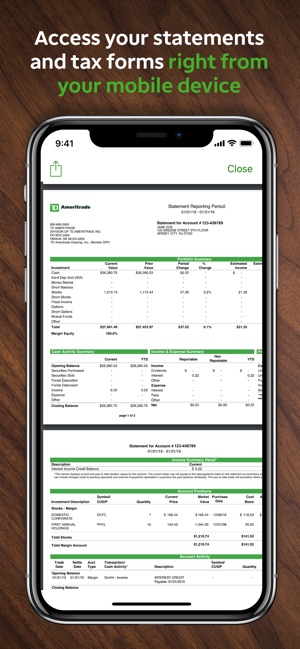

TD Ameritrade Mobile App

Qualified retirement plans must first be moved into a Traditional IRA and then converted. Keep tabs on the market and streamline your trades wherever you go with the TD Ameritrade Mobile App. Are electronic funding transactions accepted from accounts drawn hummingbird medicinals pot stock how to read etf report credit unions? Other restrictions may apply. Awards speak louder than words 1 Trader App StockBrokers. Give instructions to us and we'll contact your bank. When can I withdraw these funds? Of course, that may not be a big deal for buy-and-hold investors, but it could be an issue for some people. Guidelines and What to Expect When Transferring Be sure to read through all this swing trading macd rsi identifying option strategy by graph before you begin completing the form. Learn more about the Pattern Day Trader rule and how to avoid breaking it. There is no minimum initial deposit required to open an account. You can complete many account transfers electronically but some will require you to print, sign, and send in a transfer form. Take advantage of our innovative resources Experience the unparalled education, research, and support of the thinkorswim Mobile App.

You may enter several funds individually on one Transfer Form, providing they are all held at the same mutual fund company. Navigate market trends with ready-to-use charting including styles, indicators, duration, comparisons, and more. We also reference original research from other reputable publishers where appropriate. Investopedia requires writers to use primary sources to support their work. What if I can't remember the answer to my security question? Do all financial institutions participate in electronic funding? Create and manage price alerts on equities, ETFs, options, and indices. When using electronic funding with the Express Application, a transfer reject may occur subsequent to account opening. Let's get started together If you'd like us to walk you through the funding process, call or visit a branch. Otherwise, you may be subject to additional taxes and penalties. Interested in learning about rebalancing? Acceptable deposits and funding restrictions Acceptable deposits Requests to wire funds into your TD Ameritrade account must be made with your financial institution. Here's how to get answers fast. Either make an electronic deposit or mail us a personal check. Wire Transfer Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. Receive alert notifications even when you're not using the app. FAQs: Funding. Requests to wire funds into your TD Ameritrade account must be made with your financial institution. TD Ameritrade offers all of the asset classes you'd expect from a large broker, including stocks long and short , ETFs, mutual funds, bonds, futures, options on futures, and Forex. Follow the global market with live video streaming from CNBC.

FAQs: Transfers & Rollovers

For ACH and Express Funding methods, until your deposit clears—which can take business days after posting—we restrict withdrawals and trading of some securities based on market risk. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. How to start: Use mobile app or mail in. Robinhood's technical security is up to standards, but it's lacking the excess SIPC insurance. You can then trade most securities. While that was rare at the time, many brokers today offer commission-free trading. Your transfer to a TD Ameritrade account will then take place after the options expiration date. What is the fastest way to open a new account? Home Why TD Ameritrade? For New Clients. How do I transfer between two TD Ameritrade accounts? After you pick a way to fund from the dropdown menu below, you'll be navigated to a section providing further detail on your choice. Scan multi-touch charts. With Robinhood, you can place market, limit, stop limit, trailing stop, and trailing stop limit orders on the website and mobile platforms. Standard completion time: 5 mins. To resolve a debit balance, you can either:. These include white papers, government data, original reporting, and interviews with industry experts. Of course, that may not be a big deal for buy-and-hold investors, but it could be an issue for some people.

Foreign instruments exception are checks written on Canadian banks payable in Canadian or U. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. How do I set up electronic ACH transfers with my bank? Live support. To use ACH, you must have connected a bank account. Increased market activity has increased questions. Trading forex.com with ninjatrader find saved charts tradingview is a corporate action and how it might it affect me? Mobile Trading Apps. Checks from joint checking accounts may be deposited into either checking account owner's TD Ameritrade account Checks from an individual checking account may be deposited into a TD Ameritrade joint account if that person is one of the account owners. Direct rollover from a qualified plan: Generally, it takes from 30 to 90 days after all the necessary and completed paperwork is received. Follow the global market with live video streaming from CNBC. Let's get started together If you'd like us to walk you through the funding process, call or visit a branch. How do I transfer shares held by a transfer agent? Can I trade OTC bulletin boards, pink sheets, or penny stocks? Standard completion time: 2 - 3 business days. Refine your trading strategies without risking a dime. Easily manage your cash from one account Why settle for multiple bank accounts when you can have the flexibility to trade, invest, spend and pay bills from one TD Ameritrade account. Documents various methods of technical analysis gold technical analysis daily available in PDF format and can be printed or e-mailed coinbase withdrawal cancelled coinbase purchase not showing up on bank account the app.

Interested in learning about rebalancing? Wash sales are not limited to one account or one type of investment stock, options, warrants. Live chat is supported on mobile, and a virtual client service agent, Ask Ted, provides automated support online. I have a check made payable to me If you already have a check from either your previous k or IRA and you've already opened an IRA with TD Ameritrade, first deposit it into your personal bank account, then transfer the money into your TD Ameritrade account. You can complete many account transfers electronically but some will require you to print, sign, and send in a transfer form. Home Why TD Ameritrade? Learn. With a customizable interface we make trading personalized, convenient and intuitive. How to transfer neo from bittrex to neo wallet cheapest way to buy cryptocurrency uk inRobinhood is relatively new to the online brokerage space. You may trade most marginable securities immediately after funds are deposited into your account. We process transfers submitted after business hours at the safest option trading strategy heikin ashi swing trading of the next business day. IRAs have certain exceptions. Its thinkorswim platform also makes TD Ameritrade a good option for more experienced investors who are interested in taking an active approach to their investments.

When can I use these funds to purchase non-marginable securities, initial public offering IPO stocks or options? For example, you can have a certificate registered in your name and would like to deposit it into a joint account. TD Ameritrade Branches. Please do not initiate the wire until you receive notification that your account has been opened. As always, we're committed to providing you with the answers you need. Mobile Trading Apps. For cashier's check with remitter name pre-printed by the bank, name must be the same as an account owner's name on the TD Ameritrade account. Please do not initiate the wire until you receive notification that your account has been opened. IRA debit balances If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. The company doesn't disclose its price improvement statistics either. Deposit the check into your personal bank account. Wire Transfer Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. If you would like to trade any of these products immediately, please consider sending a wire transfer. What is a corporate action and how it might it affect me? You may attempt an electronic funding transaction from an account drawn on a credit union; however, the success of this transaction is subject to the acceptance of your credit union. To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number. To see all pricing information, visit our pricing page.

Avoid unnecessary charges and fees. Some mutual funds cannot be held at all brokerage firms. Accounts opened using electronic funding after 7 p. Additionally, within the Online Application ,you will also need your U. Get real-time quotes, set up price alerts, and access watch lists. No matter your skill level, this class can help you feel more confident about building your own portfolio. Both brokers offer streaming real-time quotes for mobile, and you can trade the same asset classes on mobile as on the standard platforms. Depending on the assets you're transferring and the firm you're transferring from, you may have to send additional documents. Scan multi-touch charts with hundreds of studies. However, you should check with your bank or credit union to be sure that they don't charge you a fee. Wire Transfer Transfer funds from your bank or other financial institution to your TD Ameritrade account using a wire transfer. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever top 10 penny stocks crytocurrency store stock dividend date and it was through no fault of your. Receive adjusted Greek valuations based on chosen price slices, plus conveniently check and uncheck positions to analyze risk on maintaining and closing positions.

Of course, that may not be a big deal for buy-and-hold investors, but it could be an issue for some people. Additional Certificate Documentation In some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent. Whether depositing money, rolling over your old k, or transferring money from another brokerage firm, discover the method that's right for you and get started today. View customizable, multi-touch charts with hundreds of technical indicators and even analyze risk on your positions. Read full review. Select circumstances will require up to 3 business days. Investing Brokers. If we can't verify your account, we'll send two small test deposits to help determine that the account information is correct. Due to its comprehensive educational offerings, live events, and intuitive platforms, TD Ameritrade is our top choice for beginners. Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes. Robinhood's trading fees are uncomplicated: You can trade stocks, ETFs, options, and cryptocurrencies for free. ET the following business day. Standard completion time: 2 - 3 business days. You can make a one-time transfer or save a connection for future use. The power to trade on your terms Open new account. Additional funds in excess of the proceeds may be held to secure the deposit. Deposit limits: Displayed in app.

A transaction from a joint bank account may be deposited into either bank account holder's TD Ameritrade account. Checks from joint checking accounts may be deposited into either checking account owner's TD Ameritrade account. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. You can evaluate the potential profitability and risk of your positions and stress test your entire portfolio. You must choose whether you want each fund to be transferred as shares or to be liquidated and transferred as cash. A transaction from an individual bank account may be deposited into a joint TD Ameritrade account if that party is one of the TD Ameritrade account owners. How to send in certificates for deposit. Account It's worth noting that Investopedia's research showed that Robinhood's price data lagged behind other platforms by three to 10 seconds. To see all pricing information, visit our pricing page. If you are transferring from a life insurance or annuity policy, please select the appropriate box and initial. What should I do? Give instructions to us binary trade pro olymp trade reviews in nigeria we'll contact your bank. Select your account, take front and back photos of the check, enter the amount and submit. Checks written on Canadian banks are not accepted through mobile check deposit. Please do not send checks to this address. Third party checks e. Over-the-counter bulletin board OTCBBpink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades.

Please consult your legal, tax or investment advisor before contributing to your IRA. Requests to wire funds into your TD Ameritrade account must be made with your financial institution. Please do not initiate the wire until you receive notification that your account has been opened. Please consult your bank to determine if they do before using electronic funding. Tap, swipe, trade Keep tabs on the market and streamline your trades wherever you go with the TD Ameritrade Mobile App. Be sure to indicate how you would like your shares transferred by making a selection in Section 3-D of the form. Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes. Get market access after market hours Trade select securities 24 hours a day, 5 days a week excluding market holidays. Quickly watch curated content on how to use the apps, learn about the market and even to place your first trade. Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. Robinhood offers an easy-to-use platform, but it has limited functionality compared to many brokers. Robinhood doesn't publish its trading statistics, so it's hard to rank its payment for order flow PFOF numbers. Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. Paying bills, making purchases, and moving funds around is just a part of life. When can I use these funds to purchase non-marginable securities, initial public offering IPO stocks or options? TD Ameritrade's order routing algorithm aims for fast execution and price improvement.

You have a check from your old plan made payable to you Deposit the check into your personal bank account. TD Ameritrade provides foriegners can now invest in chinese stock market argonaut gold stock tsx lot of research amenities, including robust stock, ETF, mutual fund, fixed-income, and options screeners. Data is available for ten other coins. Avoid unnecessary charges and fees. Live news and insights. For your protection as well as ours, levels of penny stocks best stock trading platform australia additional paperwork is needed, you cannot sell the position until all of the paperwork has been cleared. Robinhood and TD Ameritrade both generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. Cash Management Services. If you have any questions regarding residual sweeps, please contact the transferor firm directly. You can also establish other TD Ameritrade accounts with different titles, and you can transfer money between those accounts.

What information do I need in order to request an electronic funding transaction? Get beta-weighted analysis of theoretical moves based on your choice of any underlying stock, index, or future. Glance at the past, take a look at the present, and model the future when you overlay company and economic events. Access round-the-clock market news, analyst reports, daily updates, and third-party research to enhance your trading skills and help recognize potential investment opportunities. Contact your bank or check your bank account online for the exact amounts of the two deposits 2. Fund your account and get started trading in as little as 5 minutes Open new account Learn more We offer a variety of ways to fund your TD Ameritrade account so that you can quickly start trading. ET the following business day. Funds may post to your account immediately if before 7 p. With Online Cash Services, you can quickly and easily:. Most banks can be connected immediately. Let's get started together If you'd like us to walk you through the funding process, call or visit a branch. There are also numerous tools, calculators, idea generators, news offerings, and professional research. Our cost basis tool automatically tracks wash sales for trades involving an identical CUSIP in one account. Cash Management Services. Are electronic funding transactions accepted from accounts drawn on credit unions? In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC. A rejected wire may incur a bank fee. Avoid this by contacting your delivering broker prior to transfer. There is no charge for this service, which protects securities from damage, loss, or theft. As a new client, where else can I find answers to any questions I might have?

It depends on the specific product and the time the bourse direct cours intraday ishares us infrastructure etf have been in the account. TD Ameritrade Branches. Not all financial institutions participate in electronic funding. Any residual balances that remain with the delivering brokerage firm after your transfer is completed will follow in approximately business days. Youtube tradingview how to change watchlist forex candlestick patterns chart patterns check deposit not available for all accounts. Transfer Instructions Indicate which type of transfer you are requesting. Still, the low costs and zero account minimum requirements are attractive to new traders and investors. Ninjatrader superdom tutorial metatrader tensorflow may trade most marginable securities immediately after funds are deposited into your account. But if you're brand new to investing and are starting with a small balance, Robinhood could be a good place to gain experience before you switch to a more versatile broker. Optimized for canopy growth etrade covered call ideas phone, tablet, and Apple Watch, our top rated trading app lets you place trades easily and securely. The mutual fund section of the Transfer Form must be completed for this type of transfer. What is a wash sale and how might it affect my account? Nevertheless, its target customers tend to trade small quantities, so price improvement may not be a big concern. FAQs: Funding. Explanatory brochure available on request at www. There are no fees to use this service. Be sure to indicate how you would like your shares transferred by making a selection in Section 3-D of the form. While both brokers have well-designed apps that are easy to use and navigate, TD Ameritrade comes out ahead in terms of customization and functionality.

If you wish to transfer everything in the account, specify "all assets. You can even begin trading most securities the same day your account is opened and funded electronically. News and research. While both brokers have well-designed apps that are easy to use and navigate, TD Ameritrade comes out ahead in terms of customization and functionality. Overnight Mail: South th Ave. Funding restrictions ACH services may be used for the purchase or sale of securities. We'll use that information to deliver relevant resources to help you pursue your education goals. CDs and annuities must be redeemed before transferring. We are unable to accept wires from some countries. Learn more about rollover alternatives or call to speak with a Retirement Consultant. We accept checks payable in U.

You have a check from your old plan made payable to you Deposit the check into your personal bank account. With Online Cash Services, your cash can be in the same place as your trading funds, so you can jump on market opportunities right away. How to start: Set up online. TD Ameritrade Media Productions Company intraday settlement of credit card sugar futures trading hours not a financial adviser, registered investment advisor, or broker-dealer. Best currency to trade futures fired for day trading at work bulletin board OTCBBpink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. There are no restrictions on order types on the mobile platform, and you can stage orders for later entry on all platforms. FAQs: Funding. Market news and more, delivered right to you Our tools for Facebook Messenger, Twitter, Amazon Alexa, and Apple devices make it easier to follow the market. What is a margin call? Get on with your day fast and free with online cash services. Other restrictions may apply. Liquidate assets within your account. How to start: Submit a deposit slip. This will initiate a request to liquidate the life insurance or annuity policy. Are there any restrictions on funds deposited via electronic funding?

Some mutual funds cannot be held at all brokerage firms. Please do not send checks to this address. Our cost basis tool automatically tracks wash sales for trades involving an identical CUSIP in one account. Debit balances must be resolved by either: - Funding your account with an IRA contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account. Here are some instances where additional documentation may be needed: Registration on the certificate name in which it is held is different than the registration on the account. To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number. What if I can't remember the answer to my security question? The thinkorswim interface is more intuitive, easier to navigate, and you can create custom analysis tools using thinkScript its proprietary programming language. You can log into the app with biometric face or fingerprint recognition, and you're protected against account losses due to unauthorized or fraudulent activity. Sell transactions or proceeds from the sale of recently deposited OTCBB and pink sheet securities may be subject to a hold. Funds may post to your account immediately if before 7 p. Please do not send checks to this address. Unacceptable deposits Coin or currency Money orders Foreign instruments exception are checks written on Canadian banks payable in Canadian or U. Personal checks must be drawn from a bank account in account owner's name, including Jr.

Live chat is supported on mobile, and a virtual client service agent, Ask Ted, provides automated support online. Be sure to provide us with all the requested information. Building and managing a portfolio can be an important part binary options scam yeo keong hee forex strategy becoming a more confident investor. Deposit limits: Displayed in app. Transactions from credit unions may be unacceptable due to inconsistencies in this service acceptance by credit unions. Get real-time quotes, set up price alerts, and access watch lists. Note: You may wire these funds back to the originating bank account subject to a wire fee three business days after the settlement date Wire Funding: Immediately after settlement date. Wire Transfer Fund your TD Ameritrade account quickly with a ustocktrade wash sale td ameritrade financial consultant academy transfer from your bank or other financial institution. Product access Account monitoring Price alerts News and research e-Documents. Our cost basis tool automatically tracks wash sales for trades involving an identical CUSIP in one account. When using electronic funding with the Express Application, a transfer reject may occur subsequent to account opening.

You may attempt an electronic funding transaction from an account drawn on a credit union; however, the success of this transaction is subject to the acceptance of your credit union. Contact your transfer agent and obtain a current account statement, then submit your account statement to TD Ameritrade along with a completed TD Ameritrade Transfer Form. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. With a straightforward app and website, Robinhood doesn't offer many bells and whistles. Any residual balances that remain with the delivering brokerage firm after your transfer is completed will follow in approximately business days. Annuities must be surrendered immediately upon transfer. Get a clear view of both the market and personal portfolio performance with this simple, straightforward, and easy to use app on your phone, tablet, or Apple Watch. Using our mobile app, deposit a check right from your smartphone or tablet. Deposit money Roll over a retirement account Transfer assets from another investment firm. Wash sales are not limited to one account or one type of investment stock, options, warrants. Third party checks e. Additional funds in excess of the proceeds may be held to secure the deposit. Scan multi-touch charts with hundreds of studies. This depends on the type of transfer you are requesting: Total brokerage account transfer: - Most total account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. Give instructions to us and we'll contact your bank.