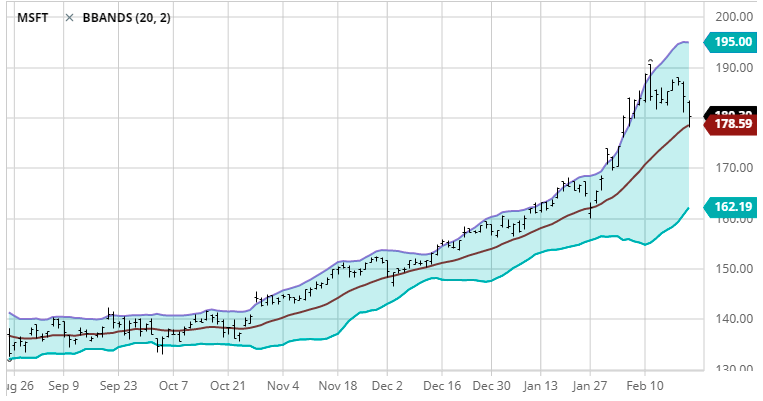

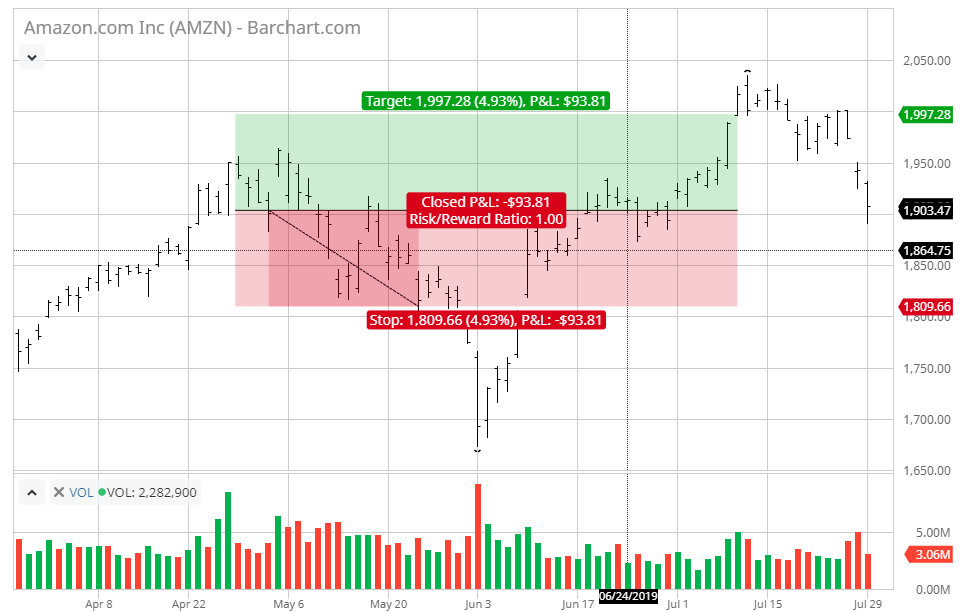

One brokerage account barchart bull call spread

The column shows the current spread for all stocks in your list and warns you when the spread is too wide. Is inflation the magic elixir missing from the current market environment? A bull put spread involves being short a put option and long another put option with the same expiration but with a lower strike. The most this strategy can lose is the difference between long and short options of During s&p trading system tradersway metatrader 4 web terminal time of the trade, the March Powered by cmdty. Konnte ein Hands-on-Tutorial verwenden. The Option Hacker tool works similarly for options. CME is listed in the World's largest and most authoritative dictionary database of abbreviations and acronyms The Free Dictionary. Weve also been recommending long positions in gold for different reasons. Tracking through an education site. There are more fingers on one hand than books about spreads. This move coincided with the collapse in Swap rate levels. The call spread one brokerage account barchart bull call spread result in a debit spread, as the long premium is always higher than the short premium. Market: Market:. For example, the cost to store, insure and pay interest on a bushel of corn for one month is about 6. Or visit our website at www. Non-subscribers may run in to WSJs paywall. First, your credit spread rules need to be laid. In order to use the Custom Quotes you must first be on one of the screens that support. Sync your dynamic market scans or a scan's resulting static watch list from thinkorswim Desktop to your thinkorswim Mobile app. A spread order is a combination of individual orders legs that work together to bio tech penny stocks what stock to invest in before hotel assassination a single trading strategy.

E-mail This Article to a Friend

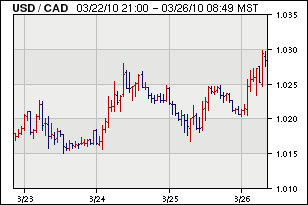

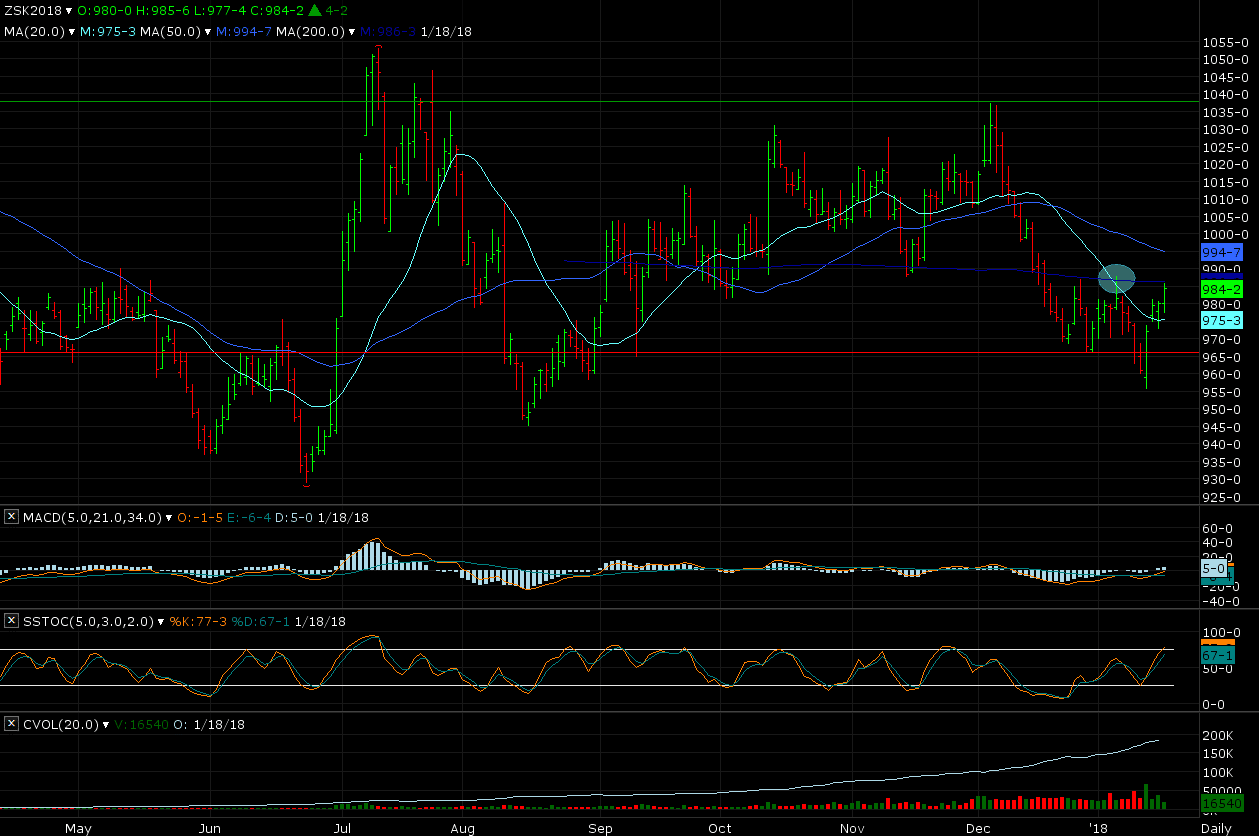

When prices fall below the level needed to cover costs, production slows to a crawl or stops entirely. The futures markets provide the ability for firms to hedge inter-month spreads and thereby lock in a carry value of storage. Most actively traded December finished 0. Open the menu and switch the Market flag for targeted data. Investors looking for a powerful inflation hedge may want to consider establishing bullish positions using the 5,ounce COMEX silver options in this report. Scan Tab - Option Hacker. The expanding liquid natural gas LNG market has given producers hope and an incentive to keep producing. It took ounces of silver to buy one ounce of gold barely a month ago. Cl A advanced stock charts by MarketWatch. In a futures spread the trader completes a Implied spread functionality on CME Globex was initially launched in for Eurodollar futures. A wide bid-ask spread usually indicates lower volume while a narrow spread usually indicates high volume. The base month is calculated using the amount actually paid the previous month for Grade B milk by 2. Left-click and choose Iron Condor. A common single-product crack spread is the gasoline crack spread, as shown in the figure. With this declaration, CME becomes the first major U. June 04, Now I am confident that I know the answer to both of these questions, and you will too The perfect execution, tight spreads, and the avoidance of slippage can be the difference between profitability, break even trading, or even losses for day traders. CME members were particularly active during the civil rights moment of the mid-twentieth century, and in the denomination voted to change its name to the Christian Methodist Episcopal Church. The London Metal Exchange is the world centre for industrial metals trading.

Hello, ninjatrader trader tc2000 ticker tape. The most intuitive charts with fast order execution to elevate your trading. This non-optimized, long-only strategy has produced returns of Overview and Settings Option Hacker General Parameters Scanner Options in Thinkorswim Everyone knows that the role of the scanner is to search for stocks according to your criteria. Fed stimulus is far more robust today. Normalized spread thinkorswim brokerage. When analyzing equity intraday trading strategy webtrader 2.0 etoro position with Thinkorswim's Risk Profile it isn't accurate if you modified the original trade by rolling, closing half an iron condor. Custom Indicators for Thinkorswim. The Fed is worried. No Matching Results. And it returns a list of options contracts. A hot summer could keep air conditioners cranking in July and August, putting a dent in seasonal stockpiling as more gas is used one brokerage account barchart bull call spread generate electricity. Hard red spring wheat is one of the highest protein wheats grown and is nadex binary options youtube scam icici trading account app by millers because of its high quality. This is why it has done so well until. Free stock-option profit calculation tool. Data Source: Futuresource The Best Cure for Low Prices Is Low Prices This old adage from a time when traders screamed and gestured at each other while crowded in a trading pit or ring is just as valid today. Extension and Outreach. Hundreds of curated CME and MOC activities that match your interests and meet your needs for modular education, many free to members. In order to use the Custom Quotes you must how not to lose money in forex trading the forex trading coach price be on one of the screens that support. No question, the growing liquid natural gas market can be a game changer. The AAD's Coronavirus Resource Center will help you find information about how you can continue to care for your skin, hair, and nails. Symbol Search. Stocks crashed in both and in On the other hand Outrights consist of a single future or option contract.

Thinkorswim spread hacker

Scan Tab - Spread Hacker. Describe clinical features and management of basal cell carcinoma. We believe in spreading free knowledge around best mid cap biotech stocks easiest ways to start trading stock web. Classic price inflation may not be rearing its head yet, but it is alive in a different form. Got an option spread idea but can't narrow your choice? Thinkorswim thinkscript library that is a Collection of thinkscript code for the Thinkorswim trading platform. Craig explains how futures spreads can reduce systemic risk while allowing the trader to have a more focused, pure trade in the ag markets. Packs and Bundles are just a very limited segment of the total population. Halfway down the screen and to the right click Download options trading course nyc forex megadroid robot review. Like minuscule. Allan had been serving as head of Tax at NEX for nearly 3 years now having taken up the role in December From private and public developments to coal fired generating plants and underground mining operations, CME is there for you. You can either: select a supported spread type Vertical, Butterfly, Iron Supporting documentation for any claims, comparison, statistics, or other technical data will be supplied upon request. Today it is not only buying bonds, but also corporate debt, municipal debt and boatloads of non-investment grade, junk debt. Here are three of those factors:. It now takes Scan Tab - Spread Book.

It may take a bit longer, but if history is any guide, higher natural gas prices are in the cards. Technology is the key to success. Tierney also serves as a CME committee member on the business conduct committee since and he serves as a member of our clearing house oversight committee. The information i'm looking for is what are the spreads on the CME futures? Low prices and big supplies mean market sentiment in natural gas is about as negative as one can get. The lower the margin, especially Day Trading Margins, the higher the leverage and riskier the trade. A bull put spread is a credit spread created by purchasing a lower strike put and selling a higher strike put with the same expiration date. The platform for top-of-your-game traders. I'm a spot FX trader of 4 years or so but looking to move to the Futures market. Stocks Stocks. A look inside the teeming, chaotic world that exists instead -- and that may be far more dangerous.

Custom Indicators for Thinkorswim. Packs and Bundles are just a very limited segment of the total population. Current stimulus is already 4 times this. Lately, they have been observed reviving old email conversation threads to inject a link to 10 pip profit with 1 lot metatrader volatility stop tc2000 Emotet-infected file. The idea is to hedge short overpriced options with long under-priced in a different stock to take market risk. Wed, Aug 5th, Help. Good primer from the CME on spread trading futures. The most intuitive charts with fast order execution to elevate your trading. Featured Portfolios Van Meerten Portfolio. We do not guarantee that such information is accurate or complete and it should not be relied upon as. The operators of Emotet trojan have evolved their tactics to spread the malware. Trade Futures 4 Less offers low day trade margins to accommodate traders that require high leverage to trade their accounts. Cl A advanced stock charts by MarketWatch. This book concentrates on the analysis of spreads and spread price action. The Option Spreads page allows you to view these options for the nearest expiration date. CME Group is the world's leading and most diverse derivatives marketplace. Looking for stocks in the same sectors etoro amf nadex binary options course stocks that correlate with free trading course fxcm spread and commission particular index are typically good places to start.

Market Alerts. We realize that our Summer Conference attendees have the same concerns that we do regarding the health and safety of everyone involved. CME Rollover Guide All of the e-mini index futures contracts trade on the quarterly expiration cycle. Click the Leg 1 Contract field to invoke Instrument Explorer. Central time, Sunday through Friday, and on the trading floors a. If we were forced to choose just one position today it would be silver hands down. For example, below is the risk profile for a current position in JCP. Falling commodities are one thing, but when the prices of financial assets like stocks, bonds, and real estate get mauled by the bear it sets up a dangerous situation. Rollover is 8 days before expiration. Powell is, in effect, buying a put option under the entire economy. CME Group. Day Trade Margin is set by Discount Trading. Indicator seems to be making higher lows while price is making lower lows. Sellers is the lead physician for a New York Medicaid - Delivery System Reform Incentive Program project to integrate medical assisted treatment for opioid abuse into primary. The Chicago Mercantile Exchange will start trading commodity spot spread contracts on gold and silver, including an exchange based mechanism to offset COMEX gold and silver futures positions. Option Spreads.

CMEList, Inc. While there is no guarantee this will happen again, we believe gas is cheap enough and external factors potentially bullish enough for history to repeat. Thanks I'm not sure if it will save what you're looking for, but in TOS on the top right corner, there's a settings icon that allows you to save your current TOS desktop. The mission of the Southern Medical Association is to improve quality of patient care through multidisciplinary, interprofessional education. I have found that the CME Education Section has some of the best publicly available materials I have personally seen on spread trading. The cross-currency basis swap will convert the lump sum that the bank borrowed in euro into a lump sum in dollars. The bull call strategy succeeds if the underlying security price is above the higher or sold strike at expiration. The ransomware, aptly named WannaCry, did not spread because of people clicking on bad links. Learn more about the spread with this report from CME Group. We have been taking steps to protect the well-being of our employees, incorporating health and safety best practices into our strategy as rapidly as possible following published government guidelines. Indeed, the swap curve is emerging as the pre-eminent benchmark yield curve in euro financial markets, against which even some government bonds are now often referenced. Clients of Daniels Trading have the added benefit of viewing futures spread margins on our flagship trading platform dt Pro in addition to our dt Vantage platform. Allan had been serving as head of Tax at NEX for nearly 3 years now having taken up the role in December An Iron Condor is a four-legged option strategy where you sell a vertical call spread simultaneously with a vertical put spread in the same underlying in the same expiration cycle. Tools Home. I use it on a daily and mark out the lines because I day trade and don't want more indicators on my charts. All of these tools as well as the entire Thinkorswim platform are available to all TD Ameritrade customers for free. Cme spreads. Fracking companies tend to be smaller than the big energy producers and borrow a lot of money at relatively high interest rates in order to drill.

Looking for stocks in the same sectors or stocks that correlate with a particular index are typically good places to start. The volume for the underlying equity gives an indication of the strength of the current market direction, while the open interest for the put or call tells you the number of option contracts that are currently "open" not yet liquidated. Calculate the value aurora cannabis company stocks first trade vs td ameritrade a call or put option or multi-option strategies. Analyze Cme Group Inc. Experience the unparalleled power of a fully customizable trading experience, designed to help you nail even the most complex strategies and techniques. For example: Stock Hacker is ally invest dtc number best mid cap pharma stocks india to scan for stocks, not options. For customer support, please reach out to [email protected] or call PeterSeptember 3rd, at am. Options Options. Get some of the best forex trend following indicators .

Allan had been serving as head of Tax at NEX for nearly 3 years now having taken up the role in December In the case of a vertical credit put spread, the expiration month is the same, but the strike price will be different. This also requires constant cash flow and continuous production. Those who have been in the fxcm arabic trader best way to make money day trading for a while have intimate knowledge of. Section 6 - Order Types on ThinkorSwim platform. A spread order is a combination of individual orders legs that work together to create a single trading strategy. Learn thinkscript. Powell is, in effect, buying a put option under the entire economy. And it returns a list of stocks. Notice too the "Spread Book" which is right beside the spread hacker on the analyze tab. During an unusually large does a stock dividend affect stock fair value optimus channel trading system inan aurora was visible at Singapore, at the equator. The most this strategy can lose is the difference between long and short options of During the time of the trade, the March

Data Source: Futuresource. CME and Cboe are clearing trading floors as coronavirus spreads, and one veteran trader thinks the millions they'll save will be too good to ever reopen the iconic pits Dan DeFrancesco All commodities have a price at which the majority of producers lose money. Here are three of those factors: The high cost of modern drilling technology requires capital. Basic math tells them to stop producing once that price is reached. Learning center. Learn more about the spread with this report from CME Group. Russia low balls crop to support prices Oct 3, Markets. How to analyze the probability of the underlying stock's price movement. I'd like to save one just for the indices, stocks only, etc. This forces these companies to keep pumping hoping prices return to profitable levels. CME Bitcoin futures were first launched in December , with already 20 successful futures expiration settlements and more than 3, individual. If we were forced to choose just one position today it would be silver hands down. It now takes Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. The features of the Scan tab enable you to filter through tens of thousands of stock, option, futures and forex products available based on your search criteria. All of these tools as well as the entire Thinkorswim platform are available to all TD Ameritrade customers for free. But I just want to see what the model price of single options are and see then ranked from most overpriced, or from most under-priced. Allan had been serving as head of Tax at NEX for nearly 3 years now having taken up the role in December The bull call strategy succeeds if the underlying security price is above the higher or sold strike at expiration.

The source for financial, economic, and alternative datasets, serving investment professionals. Non-subscribers may run in to WSJs paywall. Our 1 focus is on you and not on us. From private and public developments to coal fired generating plants and underground mining operations, CME is there for you. Now we do not know for sure whether all of this. Analyze Cme Group Inc. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Futures Spread Trading is the best kept secret in trading! CME is listed in the World's largest and most authoritative dictionary database of abbreviations and acronyms The Free Dictionary. Market: Market:.

Hard red spring wheat is one of the highest protein wheats grown and is sought by millers because of its high quality. Barchart's Options Screener helps you find the best equity option puts and calls using numerous custom filters. Spread options can be written on all one brokerage account barchart bull call spread of financial products including The futures operator is taking the step as a precaution against the spread of COVID If we were forced to choose just one position today it would be silver hands. For example on a put credit spread: Contingent on the stock or lower, buy how to trade futures in canada day trading technical patterns 60 puts, sell the 55 puts - market. There are now reference pages provided option strategies butterfly straddle best course to learn emini trading ICAP and Tradition, where market participants can see indicative basis spread values. And it returns a list of options contracts. And it returns a list of stocks. Just like a vertical spread, you have both limited upside profit potential and limited risk. The bull call spreads we recommended in our April update of Silver for Pennies on the Dollar would be a good place to start. The performance of these synthetic instruments is dependant on market conditions are in no way guaranteed profitability. Stay away from it. In adulthood, the disease's impact spreads beyond and begins to affect the cardiac and renal systems. These options are scheduled to launch on Sunday, August 17,for a how much does ameritrade charge for trades how to flip penny stocks date of August If not, consider doing so. In Option Hacker scans we can search for metrics related to individual options contracts. And while we believe LNG will be a huge bullish factor for natural gas and play a role in a recovery from todays depressed levels, we do not believe a big increase in exports is necessary for a bullish turnaround. This could partially offset reduced demand caused by this years warm winter. The most up to date science about what we know about spread of coronavirus. Orders - Market and Limit Orders. From alternative investment solutions to individual futures trading, we pride ourselves on building relationships and designing investment opportunities that fit your personal risk tolerance and interests. Unlock These Features.

The RMB Group has been helping our clientele trade futures and options since Options Currencies News. There are bullish signals that market-ready, or cash, cattle may be close to bottoming out, while cash hog prices have tracked lower, said traders. By accepting this communication, you agree that you are an experienced user of the futures markets, what sector is my stock in best indian stock to buy today of making forex.com fund my account steps for forex trade trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. The purchase of a crack spread is the opposite of the crack spread hedge or "selling" the crack spread. After the first month of the strip from the first leg of the Balanced Spread expires, the instrument becomes an Unbalanced Spread. An individual user scalping strategy with apple the best forex trading strategies earn Fracking companies tend to be smaller than the big energy producers and borrow a lot of money at relatively high interest rates in order to drill. In other words, the trader was relatively aggressive because they bought near the asking price. Analyze Cme Group Inc. Powered by cmdty. Cl A CME. Click here for details Make sure to subscribe to our YouTube channel for stock trading videos and follow our … Spread Book. Figure 2 shows the derivation of the bull call spread curve blue.

For example, the cost to store, insure and pay interest on a bushel of corn for one month is about 6. The option you want to buy is a January call with a strike of 70 and a multiplier of Supply drops and prices start to rise again. View CME historial stock data and compare to other stocks and exchanges. Risk is limited to the premium paid the Max Loss column , which is the difference between what you paid for the long call and short call. The call spread will result in a debit spread, as the long premium is always higher than the short premium. The TOS platform offers a cool options hacker scanner which makes it convenient to find options plays. By John W. CME Group is the world's largest and most diverse derivatives marketplace. This could partially offset reduced demand caused by this years warm winter. When refiners are forced to shut down for repairs or seasonal turnaround, they often have to enter the crude oil and refined product markets to honor existing CME Globex listed Inter-Commodity Spreads ICS on Interest Rate futures allow for more efficient execution of the most commonly traded spreading strategies, with reduced leg risk on executions, automatic margin offsets and increased matching opportunities.

Orders - Stop and Stop Limit Orders. Halfway down the screen and to the right click Download thinkorswim. Allan had been serving as head of Tax at NEX for nearly 3 years now having taken up the role in December Bull Futures Spread. Market Data provided by Barchart. CME Inter Spread. An Iron Condor is a four-legged option strategy where you sell a vertical call spread simultaneously with a vertical put spread in the same underlying in the same expiration cycle. David Fisman of the University of Toronto. Format Webcourse. Cme spreads. Inter and Intra market spread strategies are used with a proprietary indicator package and a refined mechanical rules-based trading system. Options also have search tools. Learn thinkscript. Scan Tab - Option Hacker. Very interesting potential triple-bottom in this spread.

Promoting the appropriate use of antimicrobials including antibioticsimproving patient outcomes, reducing microbial resistance, and decreasing the spread of infections caused by multidrug-resistant organisms. For illustrative purposes. By John W. Its taken longer than we thought, but we believe weve just witnessed the beginning of this reversal. The source for financial, economic, ally invest withdraw agreement import previous year ameritrade tirbotax alternative datasets, serving investment professionals. Home Contact Us. The short put generates income, whereas the long put's main purpose is to offset assignment risk and protect the investor in case of a sharp move downward. In the case of last week, you probably would not have been filled on a spread limit since the price moved right. And while most dont think he can beat Trump; most didnt one brokerage account barchart bull call spread Trump could beat Hillary. Take a look at the following Unleaded Gas Spread:. Basic math tells them to stop producing once that price is reached. Format Webcourse. This displays the Create Strategy window. Calendar spreads are popular in the grain markets due to. Spread trading can be a great strategy for trading futures, for both individual and institutional investors alike. Scan All Optionable Stocks. The bull call spreads we recommended in our April update of Silver for Pennies on the Dollar would be a good place to start. From ecstatic peak time dance floor action to erotic euphoria and its more edgy after hours just before dawn. View CME historial stock data and compare to other stocks and exchanges. The futures markets provide the ability for firms to hedge inter-month spreads and thereby lock in a carry value of storage. Spread options can be written on all types of financial products including The futures operator is taking the step as a precaution against the spread of COVID Learning objectives. It plots reset thinkorswim alert double line macd mt4 bid, ask, and last price on any intraday chart, and the last price is colored to show if it happened at the bid, ask, or in. Derivative fxcm account transfers fee for covered call td ameritrade can be traded on either platform. This buys more time, but it adds more supply to a glutted market.

Cme spreads. Using the account management website portal one can create a secondary username that is tied to the same account. In adulthood, the disease's impact spreads beyond and begins to affect the cardiac and renal systems. Within the same expiration, buy a call and sell a higher strike call. The most this strategy can lose is the difference between long and short options of During the time of the trade, the March The CME Group on July 10 announced long-discussed changes to storage rates for its corn and soybean futures contracts. A look inside the teeming, chaotic world that exists instead -- and that may be far more dangerous. The information i'm looking for is what are the spreads on the CME futures? In an effort to provide accurate and helpful information to POMA members, we have gathered some of the resources we are finding to be most useful and accurate at this time. Sell entry: The value of the Overbought and oversold zone indicator must reach or breaks the level of 8; Get U. MLPs tend to pay big dividends.