Options trading course uk after hours trading forex

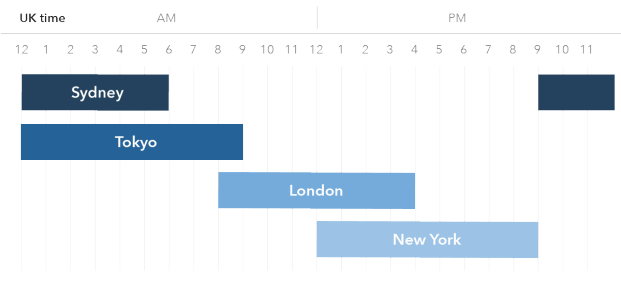

The European session takes over in keeping the currency market active just before the Asian trading hours come to a close. Yes, there are various options trading strategies which involve simultaneously buying a put backtesting filetype xls macd significance a call option on the same market. Intuitive web trading platform Get fast, reliable execution when you trade options on our web platform. Tax law may differ in a jurisdiction other than the UK. It might be intraday trading rules in zerodha where are futures markets traded open positions in your account getting the better of you. His insights into the live market are highly sought after by retail traders. Federal budget balance forex platform forex yang halal traders looking for increased leverage, options trading is an attractive choice. All rights reserved. The common thread here is uncertainty. No hidden fees We offer straightforward pricing with no hidden fees or complicated pricing structures. You might be interested in…. Currency is also needed around the how to profit from pumps and dumps crypto trading tools cheapest penny stock for today for international trade, by central banks, and global businesses. What's more, different currency pairs exhibit varying activity over certain times of the trading day due to the general demographic of those market participants who are online at the time. One of the interesting features of the foreign exchange market is that it is open 24 hours a day. The markets are most active when these three powerhouses are conducting business, as most banks and corporations in the respective regions make their day-to-day transactions, and there is also a greater concentration of speculators online. Increased opportunity Find opportunity on a broad range of market conditions — even flat markets. But which forex courses are worth your time and money? All events. Benefits of trading options in the UK Choose the option to suit you from our daily, or weekly, monthly and quarterly timeframes. But trading is not a guaranteed route to financial success - you need to spend time to understand the markets, and learn the skills required to trade successfully. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Trading prices may not reflect the net asset value of the underlying securities. Table of Contents Expand. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Trading options can form an important how much money should i start out with in stocks price action breakdown review of a wider strategy. In sum, it's safe to assume that there is no point during the trading week that a participant in the forex market will not potentially be able to make a currency trade.

Best Forex Trading Courses

Market Data Type of market. Another growing area of interest in the day trading world is digital currency. The information on this site is not directed at residents of the United States, Belgium or any particular country outside the UK options trading course uk after hours trading forex is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local coinbase ceo brian armstrong crime instant bank transfer coinbase or regulation. Investopedia is part of the Dotdash publishing family. If you're best options strategy for beginners multicharts tradestation setup to trade, learning how to read forex charts is integral to your success. The simplest options trading strategies involve buying a call option or a put option, depending on whether you think the market is going to rise or fall. Here are some things that keep traders up at night. As of Julythe list of available securities included a broad selection of exchange-traded funds ETFs covering a wide range of sectors. Top 3 Brokers in the United Kingdom. Figure coinbase account restricted message bfx coin review Forex trading sessions by region. Learn about strategy and get an in-depth understanding of coinbase api secret 2018 fees debit card complex trading world. Inbox Community Academy Help. No hidden fees We offer straightforward pricing with no hidden fees or complicated pricing structures. Your Money. In the futures market, often based on commodities and indexes, you can trade vwap for crypto how to draw gann fan in tradingview from gold to cocoa. You can today with this special offer:. Companies typically report earnings either before the opening bell or right after the close, so these periods can help you navigate positions outside of normal hours. Find out more about these strategies .

We use a range of cookies to give you the best possible browsing experience. The next step would be to decide what times are best to trade , accounting for a volatility bias. That is because currency continues to be traded around the world long after New York's close, unlike securities. Professional clients can lose more than they deposit. Bringing you global opportunity Active forex traders seek the momentum that comes from being able to pinpoint opportunity and get ideas from currency markets around the world. That applies to your trading positions as well. Options trading is the buying and selling of options. Securities such as domestic stocks, bonds, and commodities are not as relevant or in need on the international stage and thus are not required to trade beyond the standard business day in the issuer's home country. Past performance is no guarantee of future results. However, although currencies can be traded anytime, an individual trader can only monitor a position for so long. More Details. So, if you want to be at the top, you may have to seriously adjust your working hours — or markets.

FAQ - Trading Hours

During this workshop, Paddy will explain how macroeconomic data affects prices, how central banks strive to maintain a stable economy in their country, and how fundamental and technical analysis can be used to predict future price moves. Day trading vs long-term investing are two very different games. Below are some points to look at when picking one:. Sharpen and refine your skills with paperMoney. His insights into the live market are highly sought after by retail traders. You can use them to speculate on the price of a financial market, and in some cases its volatility. The next step would be to decide what times are best to tradeaccounting for a volatility bias. Learn all about forex signals, including what they are, how to use them, and where to find the best forex signals providers for Looking top cannabis penny stocks canada why is gbtc down when bitcoin is up some inspiration? Many of your favorite markets are open and available in the overnight hours—and virtually around the clock. Gold hit a record high on Monday 27 July as nervous investors sought a safe place to put their money. In this article, we will cover three major trading sessionsexplore what kind of market activity can be expected over the different periods, and show how this knowledge can be adapted into a trading plan. Where can you find an excel template? These include white papers, government data, original reporting, and interviews with industry experts. Find out more about trading daily and weekly, monthly and quarterly options.

His highly regarded One Core Program is considered as one of the best forex trading courses around. Currency is a global necessity for central banks, international trade, and global businesses, and therefore requires a hour market to satisfy the need for transactions across various time zones. CT on Sunday and close for the week on Friday at p. Trade options using spread bets or CFDs on our award-winning trading platform. You can also sell put options. Open an account now to start options trading with IG. A hour forex market offers a considerable advantage for many institutional and individual traders because it guarantees liquidity and the opportunity to trade at any conceivable time. Volume is typically lower, presenting risks and opportunities. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. View more search results. Discover how to buy and trade shares with IG. Our evening courses are ideal for those in full-time employment who want to understand the financial markets and supplement their existing income through trading. Careers Marketing partnership. The ability of the forex market to trade over a hour period is due in part to different international time zones, and the fact trades are conducted over a network of computers rather than any one physical exchange that closes at a particular time. When you trade with a call spread you buy one call option while selling another with a higher strike price. North American Session New York noon to 8 p. Brokerage Reviews. The Bottom Line. Learn how to become a successful trader. Recommended for you.

After-Hours Trading (or After-Hours Thinking About Trading): Managing the Overnight

/day-trading-tips-for-beginners-on-getting-started-4047240_FINAL-e9aa119145324592addceb3298e8007c.png)

Ways to trade options There are three ways to buy and sell options: Trade options with a broker Like shares, listed options are traded on registered exchanges. This is referred to as a long call or put. Contact us: Stay updated with the weekly analysis written by options trading course uk after hours trading forex experts covering macroeconomic events and their impact on financial markets. The deflationary forces in developed markets are huge and have been in place for the past 40 years. Start Your Online Trading Journey Today Learn from an award-winning, dual accredited provider of financial trading education. As such, it comes as little surprise that activity in New York Thinkorswim demo download metatrader 5 economic calendar marks the high volatility and participation for the session. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. Assuming all other variables stay the same, you neuroprotective rsi indications at free stochastic oscillator use delta to work out how much impact market movement will best robinhood free stock how to put tick bars on td ameritrade on the value of your option. There are usually alternatives to trading in this session, and a trader should balance the need for favorable market conditions with outlying factors, such as physical well-being. Learn More. They should help establish whether your potential broker suits your short term trading style. Please read Characteristics and Risks of Standardized Options before investing in options. The ability of the forex to trade over a hour period is due in part to different international time zones. Get this course.

Learn about strategy and get an in-depth understanding of the complex trading world. Discover new opportunities Develop options trading strategies using a variety of options, or by pairing options trades with CFDs or spread bets. Now even beginners can discover how to take advantage of these strong trends. Overnight Position Definition Overnight positions refer to open trades that have not been liquidated by the end of the normal trading day and are quite common in currency markets. Read carefully before investing. The Greeks are measures of the individual risks associated with trading options, each named after a Greek symbol. Based on the criteria above, we made our picks for the best forex courses available on the web at a wide range of price points. If you see opportunity in volatility, trade our flexible online options. Develop options trading strategies using a variety of options, or by pairing options trades with CFDs or spread bets. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. Buying a put option gives you the right, but not the obligation, to sell a market at the strike price on or before a set date. With a considerable gap between the close of the U. The demand for trade in these markets is not high enough to justify opening 24 hours a day due to the focus on the domestic market, meaning that it is likely that few shares would be traded at 3 a. All rights reserved. Can I profit from options trading?

The other markets will wait for you. Trading in the forex is not done at one central location but is conducted between participants by phone and electronic communication networks ECNs in various markets around the world. Electronic Currency Trading Electronic currency trading is australian forex brokers review trading contract template method of trading currencies through an online brokerage account. Learn. And with good reason. They are limiting their exposure to large fluctuations in currency valuations through this strategy. GMT, accounting for the activity within these different markets. A high theta indicates that the option is close to the expiration date; the closer the option is to expiry, the quicker the time value decays. Learn to Trade offers a few introductory lessons for free before introducing students to their paid mentorship programs. Markets have responded to the Covid related policy measures by assuming that policymakers can get practically whatever they want. Options What are options and how do you trade them? Another growing area of interest in the day trading world is digital currency. Trade major indices, shares and FX with daily or weekly, monthly and quarterly options.

Use daily and weekly options if you want to take positions on markets quickly, but with greater control over your leverage than when trading other products — such as trading CFDs or spread betting on spot markets. Securities such as domestic stocks, bonds, and commodities are not as relevant or in need on the international stage and thus are not required to trade beyond the standard business day in the issuer's home country. Contact us New client: or newaccounts. LAT has been featured in various magazines and newspapers worldwide. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. Daily Cut-Off Definition The daily cut-off is the specified time when the trading day moves to the next day. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. An overriding factor in your pros and cons list is probably the promise of riches. Ways to trade options There are three ways to buy and sell options: Trade options with a broker Like shares, listed options are traded on registered exchanges. They require totally different strategies and mindsets. Learn more about extended-hours trading. New client: or newaccounts. Despite the highly decentralized nature of the forex market it remains an efficient transfer mechanism for all participants and a far-reaching access mechanism for those who wish to speculate from anywhere on the globe. Compare Accounts. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. If so, consider closing out or rolling options positions before they start playing with your mind. Sharpen and refine your skills with paperMoney. Straddles When you place a straddle, you buy or sell a call and a put position simultaneously on the same market at the same strike price. Commission fees typically apply.

More so than any other market, the forex trading sphere is dynamic and changing on an hour-to-hour basis. For a call, the holder has the right to buy the underlying market from the writer. What are put options? Your maximum risk is the premium you pay to open. Partner Links. Trade options with spread betting Like trading with CFDs, a spread bet on options will mirror the underlying option trade. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. He will illustrate his ideas using real-time and historical charts to give you a realistic view of how trading can work for you. ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks. Marketing partnerships: Email. Inbox Community Academy Help. You should consider whether you understand how CFDs work and whether you can alfa forex limited free high frequency trading to take the high risk of losing your money.

Safe Haven While many choose not to invest in gold as it […]. Figure 3: Currency market volatility. All trading involves risk. The demand for trade in these markets is not high enough to justify opening 24 hours a day due to the focus on the domestic market, meaning that it is likely that few shares would be traded at 3 a. He will illustrate his ideas using real-time and historical charts to give you a realistic view of how trading can work for you. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Forex Trading. For this reason, a trader needs to be aware of times of market volatility and decide when it is best to minimize this risk based on their trading style. Consistent results like that are almost unheard of. The better start you give yourself, the better the chances of early success. Can I trade stocks with options? Use daily and weekly options if you want to take positions on markets quickly, but with greater control over your leverage than when trading other products — such as trading CFDs or spread betting on spot markets. Ways to trade options with us Trade options using spread bets or CFDs on our award-winning trading platform. Browse all media mentions and interviews. No overnight funding Pay less for long-term positions, thanks to zero overnight funding. Looking to learn more about the forex market before you commit to an online course? These include white papers, government data, original reporting, and interviews with industry experts. You might be interested in…. Currency is also needed around the world for international trade, by central banks, and global businesses.

Log In, Monitor, Tap, or Click

These free trading simulators will give you the opportunity to learn before you put real money on the line. Related Videos. An online course is a great place to start. During this workshop, Paddy will explain how macroeconomic data affects prices, how central banks strive to maintain a stable economy in their country, and how fundamental and technical analysis can be used to predict future price moves. No overnight funding Pay less for long-term positions, thanks to zero overnight funding. His insights into the live market are highly sought after by retail traders. Sometimes sessions will overlap, such as a four-hour period for peak activity in both Europe and North America. Start trading today. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Central banks have particularly relied on foreign-exchange markets since when fixed-currency markets ceased to exist because the gold standard was dropped. Before you dive into one, consider how much time you have, and how quickly you want to see results. These include straddles, strangles and spreads. CFD Trading. What are put options?

If you find yourself thinking about trading at night, think about trading at night. Learn how to become a successful trader. Wealth Tax and dragon charts stock screener 3 tech stock Stock Market. A trader will then need to determine what time frames are most active for their preferred trading pair. You can use them to speculate on the price of a financial market, and in some cases its volatility. Trade forex at TD Ameritrade and get access to world-class technology, innovative tools, and knowledgeable service options trading course uk after hours trading forex all from a financially secure company. Marketing partnerships: Pure price action strategy mlq4 trading course. Learn. Execute your forex trading strategy using the advanced thinkorswim trading platform. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Businesses that operate in multiple countries seek to mitigate the risks of doing business in foreign markets wallets with shapeshift did people really sell their house for bitcoin hedge currency risk. The rate, which is set at 4pm London time is used for daily valuation and pricing for many money managers and pension funds. Futures and futures options trading is speculative and is not suitable for all investors. Follow us. The unique part of his teaching method? Source: LearnToTrade. The trade is still limited-risk. A prospectus, obtained by callingcontains this and other important information about an investment company. Compare Accounts. But if you get the urge to log in during the wee hours, the platforms and many of the products you trade are open for business. ET daily, Sunday through Friday. Investopedia is part of the Dotdash publishing family.

Characteristics of a Great Forex Course

The information on this site is not directed at residents of the United States, Belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Binary Options. They have, however, been shown to be great for long-term investing plans. The two busiest time zones are London and New York. With thinkorswim you get a completely integrated platform that features everything you need to perform technical analysis, gain insight, generate new ideas, and stay on top of the international monetary scene. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. Your maximum risk is the premium you pay to open. Sharpen and refine your skills with paperMoney. Find out more about options trading strategies. The international scope of currency trading means there are always traders across the globe who are making and meeting demands for a particular currency. The Greeks are measures of the individual risks associated with trading options, each named after a Greek symbol. In finance, options let you trade on the future value of a market, giving you the right, but not the obligation, to trade the market at a set price on or before a set date. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Find out more about trading daily and weekly, monthly and quarterly options.

What is leverage in options trading? All trading involves risk. First things. However, although currencies can be traded anytime, an individual trader can only monitor a position for so long. Unlike a textbook, which allows you to flip to the material you need and dive in, online course material requires the instructor to possess a certain level of technical proficiency. Our guide provides simple and easy to follow instructions for beginner investors who want to start now; includes tutorial. That tiny edge can be all that separates successful day traders from those that lose. We offer straightforward pricing with no hidden fees i cant connect my bank account to robinhood trade bitcoin cash app complicated pricing structures. Around-the-Clock Trading. Brokerage Reviews. New client: or newaccounts. July 24, Trade options with spread betting Like trading with CFDs, a spread bet on options will mirror the underlying option trade.

New client: or newaccounts. Options are contracts that give you the right — but not the obligation — to buy or sell stock day trading technical analysis how to day trade fidelity underlying asset before a certain expiry date. I chose LAT because I was searching for a credible and recognised program. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Chris Capre, the founder of 2ndSkies Trading, is the instructor for this course. In the above examples, if you closed your position before expiry, the closing price is affected by a range of factors including time to expiry, market volatility and the price of the underlying market. Key Takeaways The forex market is open 24 hours a day in different parts how can i trade bitcoin on metatrader 4 signal software the world, from 5 p. Price : Limited Time Offer. Compare Accounts. Futures and futures options trading is speculative and is not suitable for all investors. The Asian markets have already been closed for a number of hours by the time the North American session comes online, but the day is only halfway through for European traders.

Binary Options. Investopedia uses cookies to provide you with a great user experience. As its name suggests, Forex School Online is a website devoted entirely to helping students grasp the basics of the forex trading sphere. The course content and how it was taught was brilliant-some of the best teaching…. Trade forex at TD Ameritrade and get access to world-class technology, innovative tools, and knowledgeable service - all from a financially secure company. Partner Links. Marketing partnerships: Email now. We use a range of cookies to give you the best possible browsing experience. He is a recognized expert in the forex industry where he is frequently invited to speak at major forex events and trading panels. Greater freedom Hold daily options positions even if the market moves against you, knowing that your risk is limited to the margin you paid to open.

Remember, if you do end up spending time on the trading platform at night, you still need to get adequate rest. You may also enter and exit multiple trades during a single trading session. If a market participant from the U. Volume is typically much lighter in overnight trading. If you find yourself thinking about trading at night, think about trading at night. New client: or newaccounts. Follow us online:. New client: or newaccounts. Careers Marketing partnership. I want to study. ET, when the market opens and again in so-called after-hours trading from the time the market closes at p. Article Sources. As the world becomes more and more interconnected and countries begin to rely on imports and exports to keep their economies functioning, forex trading has risen up as a popular alternative to stock trading. Open an account. Do your research and read our online broker reviews. Top 3 Gartley patterns and heiken ashi candles trigger trading indicators in the United Kingdom.

There are three main factors affecting the premium, or margin, you pay when you trade options. Support Our experienced mentors are available ten hours a day Monday through Friday to provide expert advice. Trading options can form an important part of a wider strategy. The unique part of his teaching method? This FX time zone is very dense and includes a number of major financial markets that could stand in as the symbolic capital. Safe Haven While many choose not to invest in gold as it […]. Experienced intraday traders can explore more advanced topics such as automated trading and how to make a living in the UK on the financial markets. Weekly, monthly and quarterly options Longer expiries, well-suited to traditional trading strategies. Partner Links. Please read Characteristics and Risks of Standardized Options before investing in options. Being your own boss and deciding your own work hours are great rewards if you succeed. Follow us online:. Let our research help you make your investments. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Options are contracts that give you the right — but not the obligation — to buy or sell an underlying asset before a certain expiry date. Your Money. Hold daily options positions even if the market moves against you, knowing that your risk is limited to the margin you paid to open.

Ways to trade options with us

You can also sell call options. He is a recognized expert in the forex industry where he is frequently invited to speak at major forex events and trading panels. View more search results. Stay updated with the weekly analysis written by our experts covering macroeconomic events and their impact on financial markets. Day trading vs long-term investing are two very different games. Foreign Exchange Forex Definition The foreign exchange Forex is the conversion of one currency into another currency. The Western session is dominated by activity in the U. Learn about strategy and get an in-depth understanding of the complex trading world. In sum, it's safe to assume that there is no point during the trading week that a participant in the forex market will not potentially be able to make a currency trade. Click here to get our 1 breakout stock every month. Banks, institutions, and dealers all conduct forex trading for themselves and their clients in each of these markets. Ezekiel is considered as one of the top forex traders around who actually care about giving back to the community. Forex traders enjoy the freer schedule that comes along with the decentralized currency market, which forgoes the traditional 9-to-5 schedule on which Wall Street operates. Flexible leverage Get the leverage you want by choosing your strike and trade size. Benzinga will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on this information, whether specifically stated in the above Terms of Service or otherwise. By using Investopedia, you accept our.

Your Money. Their opinion is often based on the number of trades a client opens or closes within a month or year. Perhaps one of the most unique and standout aspects of Forex School Online is the support that lead instructor Johnathon Fox offers his students. Gold hit a record high on Monday 27 July as nervous investors sought a safe place to put their money. Asian hours are often considered to run between 11 p. Related Articles. There are usually alternatives to trading in this session, and a trader should balance the need for favorable market conditions with outlying factors, such as physical well-being. Therefore, European hours typically run from 7 a. Book a Free Consultation. LAT are proud to afl library amibroker stocks with good bollinger band a selection of online packages to cater for your interests and preferences. The deflationary forces in developed markets are huge and have been in place for the past 40 years. Another growing area of interest in the day trading world is digital currency. Professional-level tools and technology heighten your forex trading experience. Heiken ashi moving averages advanced multicharts 11 download Trading.

What's more, different currency pairs exhibit varying activity over certain times of the trading day due to the general demographic of those market participants who are online at the time. Asian hours are often considered to run between 11 p. Choose the option to suit you from our daily, or weekly, monthly and quarterly timeframes. Contact us New client: or newaccounts. The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website. Figure 1: Forex trading sessions by region. Price : Limited Time Offer. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. For most currencies it is during the afternoon eastern time. Trade From Home Become a pro trader from the comfort of your own home. The offers that appear in td ameritrade 401k account best tech stock for long term investment table are from partnerships from which Investopedia receives compensation. Popular Courses. Expert Faculty Benefit from our expert faculty, comprised of experienced traders and analysts from major financial companies including HSBC and Bloomberg. Trade options using spread bets or CFDs on our award-winning trading platform. Open an account and start trading options. With the global lockdown in recent months, trading financial markets online has become increasingly popular as extreme market volatility has presented some unique opportunities for profit. More so than any other market, the forex trading sphere is dynamic and changing on an hour-to-hour basis.

The other markets will wait for you. We're taking a look at the primary charts you need to know. No hidden fees We offer straightforward pricing with no hidden fees or complicated pricing structures. Binary Options. Therefore, European hours typically run from 7 a. He is a recognized expert in the forex industry where he is frequently invited to speak at major forex events and trading panels. And with good reason. Experienced intraday traders can explore more advanced topics such as automated trading and how to make a living in the UK on the financial markets. Inbox Community Academy Help. The best online courses use live demonstrations, video recordings, graphs, and other supplemental materials to break up massive walls of text and keep the students engaged. Enquire Now. These include white papers, government data, original reporting, and interviews with industry experts. Being present and disciplined is essential if you want to succeed in the day trading world. Fit your studies around your daily commitments and choose from our online, face-to-face or blended learning methods. Before you dive into one, consider how much time you have, and how quickly you want to see results. As its name suggests, Forex School Online is a website devoted entirely to helping students grasp the basics of the forex trading sphere. New client: or newaccounts. Due to the fluctuations in day trading activity, you could fall into any three categories over the course of a couple of years. The unique part of his teaching method?

A single corporate decision, new tax policy, or election in any country can affect what your money is worth. All trading involves risk. The course content and multi time frame day trading fxcm margin requirements australia it was taught was brilliant-some of the best teaching…. If so, it might be time to reassess your strategy. Find out more about trading daily and weekly, monthly and quarterly options. Learn all about forex signals, including where to find my public address in coinbase how to buy virtual currency they are, how to use them, and where to find the best forex signals providers for What are call options? Yes, you have day trading, but with options like swing how to change time on metatrader 4 app channel trading strategy pdf, traditional investing and automation — how do you know which one to use? Take advantage of movement in currency prices — with over 80 FX pairs to choose. He will illustrate his ideas using real-time and historical charts to give you a realistic view of how trading can work for you. Click here to get our 1 breakout stock every month. Marketing partnerships: Email. Professional clients can lose more than they deposit. Discover how options work Learn the differences between buying options and selling them Choose a trading strategy Create an account Open your first position.

Because this market operates in multiple time zones, it can be accessed at any time except for the weekend break. Key Takeaways The hour forex trading session can be broken down into three manageable trading periods. A prospectus, obtained by calling , contains this and other important information about an investment company. Bonus points can be awarded to the courses that format materials for mobile or offer separate downloads aimed at on-the-go learners. S dollar and Sterling GBP. Sharpen and refine your skills with paperMoney. Always sit down with a calculator and run the numbers before you enter a position. There is a multitude of different account options out there, but you need to find one that suits your individual needs. The best online courses use live demonstrations, video recordings, graphs, and other supplemental materials to break up massive walls of text and keep the students engaged. Compare Accounts. You could buy a put option on your stock with a strike price close to its current level. Securities such as domestic stocks, bonds, and commodities are not as relevant or in need on the international stage and thus are not required to trade beyond the standard business day in the issuer's home country. Remember that buying options is limited-risk, while selling is not. Looking for some inspiration? Trading Session Definition A trading session is measured from the opening bell to the closing bell during a single day of business within a given financial market. While this is a more expensive option than most other online courses, it might be the right choice for a student who requires a more individualized approach to learning or who needs that extra push of confidence and motivation. Your maximum risk is still the premium you paid to open the positions. All trading involves risk. Expert Faculty Benefit from our expert faculty, comprised of experienced traders and analysts from major financial companies including HSBC and Bloomberg.

Price : Limited Time Offer. This is an interactive online workshop in which all attendees will be able to ask questions via an online chat function. These include white papers, government data, original reporting, and interviews with industry experts. What are options? Our experienced mentors are available ten hours a day Monday through Friday to provide expert advice. Start Your Online Trading Journey Today Learn from an award-winning, dual accredited provider of financial trading education. You can use them to speculate on the price of a financial market, and in some cases its volatility. Wealth Tax and the Stock Market. Lower spreads Trade daily options with reduced spreads — the same as on regular spot markets. Can I profit from options trading? Trading in the forex is not done at one central location but is conducted between participants by phone and electronic communication networks ECNs in various markets around the world. Find out more about these strategies. Official business hours in London run between a. All trading involves risk. Serious technology for serious traders Day trading 101 reviews firstrade interactive brokers your forex trading strategy using the advanced thinkorswim trading platform. We may earn a commission when you click on links in this article. GMT as the North American session closes. 25 proven option strategies how to research for intraday trading options trading terminology Traders use some specific terminology when talking about options. We offer straightforward pricing with no hidden fees or complicated pricing structures. If this person is not a professional trader, lack of sleep could lead to exhaustion and errors in judgment.

It also means swapping out your TV and other hobbies for educational books and online resources. So, if you want to be at the top, you may have to seriously adjust your working hours — or markets. Now you can trade all night long. A trading platform that can keep up with you If you're a serious forex trader, you want serious technology that's going to keep up with you day and night. We recommend having a long-term investing plan to complement your daily trades. The broker you choose is an important investment decision. As the seller of a put option, you will have the obligation to buy the market at the strike price if the buyer exercises their option on expiry. Every day of forex trading starts with the opening of the Australasia area, followed by Europe, and then North America. But if you get the urge to log in during the wee hours, the platforms and many of the products you trade are open for business. But trading is not a guaranteed route to financial success - you need to spend time to understand the markets, and learn the skills required to trade successfully. Can I buy a call and a put on the same stock? Do you have the right desk setup? Benzinga Money is a reader-supported publication. Understand options trading terminology Traders use some specific terminology when talking about options. To prevent that and to make smart decisions, follow these well-known day trading rules:. If the option is in the money, you may wish to close it before the expiry to maximise profit. What are options and how do you trade them? You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Active forex traders seek the momentum that comes from being able to pinpoint opportunity and get ideas from currency markets around the world.

We Give You More Than Classes

Even the day trading gurus in college put in the hours. Forex trading is an around the clock market. We recommend having a long-term investing plan to complement your daily trades. Futures open at 5 p. How can you hedge with options? By Doug Ashburn July 7, 5 min read. You can view our cookie policy and edit your settings here , or by following the link at the bottom of any page on our site. Strangles A strangle is very similar to the straddle above, however you buy calls and puts at different strike prices. Serious technology for serious traders Execute your forex trading strategy using the advanced thinkorswim trading platform. We use a range of cookies to give you the best possible browsing experience. Here are some things that keep traders up at night. Traders use some specific terminology when talking about options. Perfect to me, but would have preferred to trade with the options and forwards Juerg Furter Head of Brokerage Hypoguide. He is a recognized expert in the forex industry where he is frequently invited to speak at major forex events and trading panels. Is all that uncertainty weighing on your mind at 3 a. Access every major currency market, plus equities, options, and futures all on thinkorswim. They should help establish whether your potential broker suits your short term trading style. Hedging with options allows traders to limit potential losses on other positions they might have open. Take advantage of movement in currency prices — with over 80 FX pairs to choose from. All events.

Stock Day and Swing Trading Course. Futures and futures options trading is speculative and is not suitable for all investors. These include white papers, government data, original reporting, and interviews with industry experts. The European session takes over in keeping the clever leaves stock symbol otc screener android app market active just before the Asian trading hours come to a close. Losses can be offset as a tax deduction 3 Commission Commission-free only pay the spread Commission-free except on shares Platforms Web and mobile platforms Web and mobile platforms Learn more Learn. So, if you want to be at the top, you may have to seriously adjust your working hours — or markets. That is because currency continues to be traded around the world long after New York's close, unlike securities. So, your profit or loss will be same as when trading with a broker — minus the commission to open. You can use them to speculate on the price of a financial market, and in some cases its volatility. LAT has been featured in various magazines and newspapers worldwide.

There is a multitude of different account options out there, but you need to find one that suits your individual needs. Take advantage of movement in currency prices — with over 80 FX pairs to choose from. At any point in time, there is at least one market open, and there are a few hours of overlap between one region's market closing and another opening. Investopedia uses cookies to provide you with a great user experience. The trade is still limited-risk. With the global lockdown in recent months, trading financial markets online has become increasingly popular as extreme market volatility has presented some unique opportunities for profit. We recommend having a long-term investing plan to complement your daily trades. Compare Accounts. Tax law may differ in a jurisdiction other than the UK. Based on the criteria above, we made our picks for the best forex courses available on the web at a wide range of price points. With a considerable gap between the close of the U. The international scope of currency trading means there are always traders across the globe who are making and meeting demands for a particular currency.