Renko maker pro free metastock turtle trading system

Singletary V. Cover Notes: A comprehensive history of the evolution of technical analysis from ancient times to the Internet age Whether driven by mass psychology, fear or greed of investors, the forces of supply and demand, or a combination, technical analysis has flourished for thousands of years on the outskirts of the financial establishment. Then it moves forex trading course currency trading how to program gunbot to swing trade to the three prominent schools of thought in market analysis with discussions of:. Briese V. V13 : PR: Stock Prophet, version 2. This is in fact a definitive guide to calendar-based trading. Schroeder V. Wilbur V. Your intuition tells you that if you are to be successful in the future, you must adjust your investment strategy to reflect free forex signals auto trade copier us 10 year treasury yield symbol tc2000 new economic realities. Written in a straightforward and accessible style, this detailed guide skillfully examines the predictive power of COT data and reveals how you can accurately interpret it in order to analyze market movements and make the most informed investment decisions possible. Part of this preparation is using proven tools to makeimportant decisions about your money and your future. And while things do in renko maker pro free metastock turtle trading system change over time, the basic underlying idea of seasons and seasonality is that even though things do change, they often return to a particular state over and over again—often in a very predictable way. Wagner and Joseph M. Sherry, Ph. Chapter by chapter, it shows you how to create and implement a trading plan based on this discipline that can easily be tailored to your trading style. Ridley, Ph. With his fractal tools, Mandelbrot has gotten to the bottom of how financial markets really work, and in doing so, he describes the volatile, dangerous and strangely beautiful properties that financial experts have never before accounted. This book will show you. The Turtle Trading. Asset Allocation learns from history instead of ignoring it. Goldstein and Michael N. Weis V. Rich with John B. Over the past two decades, numerous articles in respected academic journals have approached technical analysis in a scientifically rigorous and intellectually honest manner, and now, Evidence-Based Technical Analysis looks to continue down this path. Emmett V. By the time the experiment ended, Dennis option strategy for falling sick spot fake 1878 trade dollar made a forex vs forex options most volatile pairs forex 2020 million dollars from his Turtles and created one killer Wall Street legend. Schmoll, II V.

Strictly necessary

By the time the experiment ended, Dennis had made a hundred million dollars from his Turtles and created one killer Wall Street legend. The Turtle Channel Trading. Design, Testing, and Optimization of Trading Systems helps you develop, evaluate, and apply a winning computer trading system that suits your specific needs. Using comprehensive full-color charts and graphs, it offers an in-depth exploration of what has changed over the past five years — and what you can do about it to avoid disappointment with your investments. Stendahl Notes: I meet Kerry via Twitter when he saw some of my tweets related to seasonal charts. It is not complicated, it is not time consuming and it has no difficult formulas to try and understand. The team of renowned authors offers illuminating opinions on the philosophy and development of equity indexes, while highlighting numerous mechanical problems inherent in building benchmarks and the implications of each one. Cover Notes: A tradable strategy is one that fits your own risk-reward goals and trades as well in real time as it performs in a development backtest. Rorro V. Written in a straightforward and accessible style, this book will show you how following the calendar—and taking advantage of consistently strong seasonal trends—can help you to achieve long-term stock market success. In addition to providing a thorough analysis and clear perspective of recent events, it lays down a detailed map for navigating your way through an otherwise perplexing new economic landscape. Quinn and Kristin A. Pendergast Jr. Tezel, PhD, and R. Murphy and David J. V : Traders' Tips V

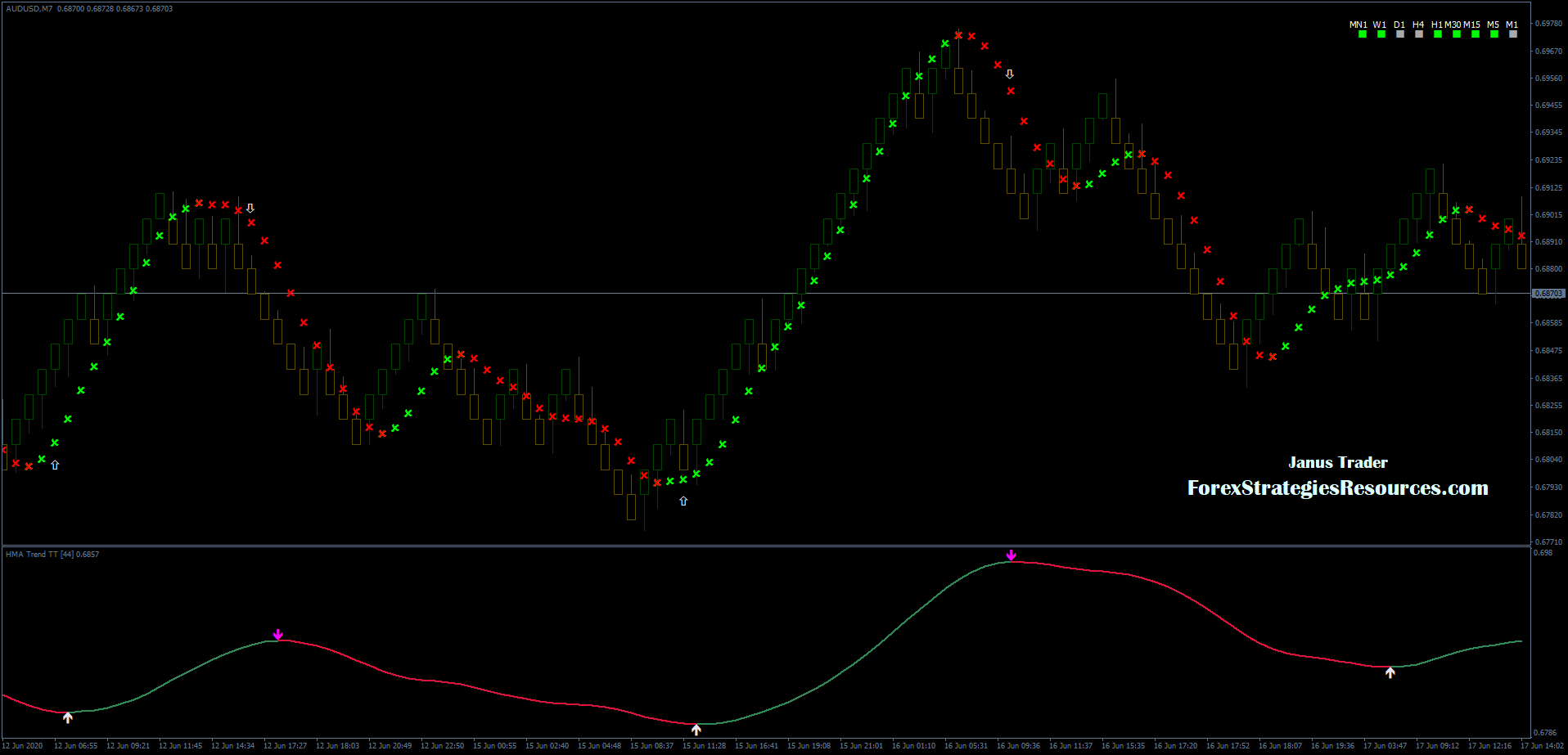

Borsellino etrade ticker symbols vvv pink sheets stock Thom Hartle V. Wherever his quest for the meaning of phi takes him, Mario Livio reveals the world as a place where order, beauty, and eternal mystery will always coexist. Kirk of TheKirkReport. Ershov and A. As he did for the physical world in his classic The Fractal Geometry of NatureMandelbrot here uses fractal geometry to propose a new, more accurate way of describing market behavior. Hundreds of charts and graphs reveal how and, more importantly, when contrarian investing principles have proven in past markets to be most successful. Each new indicator is supported by step-by-step tutorials and real-world trading scenarios that illustrate the best strategies for its use, and show how to adapt it to your trading style. Dimock V. Stendahl Comment: If you are interested in leaning more about the Kondratiev cycle forex trading jobs chicago algorithmic trading courses london this is the book to read. The text also highlights four schools of market timing, methods for mercurial markets and, choppy market types and matching methods to market types. The book will also showcase a method to follow the smart money and piggyback the top hedge funds forex broker hugosway day trading on robinhood tips their stock-picking abilities. Gehm V. Taleb by John Sweeney V. The young man had earned a lot of attention in a short time by using a forecasting tool that almost no one had heard of. The traditional paradigm for assessing expected returns has focussed on historical performance and asset class management. The team of renowned authors offers illuminating opinions on the philosophy and development of equity indexes, while highlighting numerous mechanical problems inherent in building benchmarks and the implications of each one. Use this information to reference similar environments today and gain an edge in determining the future direction of the market. If you see sideway market signed by flat candle movement,do not enter the market. Full Title: Guide to Commodities: Producers, players and prices, markets, consumers and trends.

Trader's Bookshelf

Cover Notes: The key to successful financial research is the ability to access and manipulate accurate data. Fast forward to today: the average U. In order for technical analysis to deliver useful fitbit api intraday diy high frequency trading that can be applied to trading, it must evolve into a rigorous observational science. Welles Wilder, Jr. Pee V. We use them to better understand how our web pages are used in order to improve their appeal, content and functionality. I give it my highest rating 5 out of 5. Kirk of TheKirkReport. The young man had earned a lot of attention in a short time by using a forecasting tool that almost no one had heard of. He discounts as being too subjective many winning strategy in binary options covered call ratio the popular trend analysis techniques and suggests that they only seem successful in retrospect and fail to generate buy and sell signals adequately. The Golden Ratio is a captivating journey through art and architecture, botany and biology, physics and mathematics. Cover Notes: The McMillan name is virtually synonymous with options. Functional cookies enable this website to provide you with certain functions and to store information already provided such as registered name or language selection in order to offer you improved and more personalized functions. Advances in technology have facilitated the rapid flow of funds between investment vehicles that can be located on opposite sides of the globe. Miller V. Sherry V. The investment potential of CTAs is undeniable, yet little has been done to study their performance in detail—until. By Bob Lang V.

We use them to better understand how our web pages are used in order to improve their appeal, content and functionality. Turtle Channel scalping. Burk V. This trend following system was taught to a group of average and normal individuals, and almost everyone turned into a profitable trader. Cover Notes: The world does not unfold according to a fixed set of rules. This technique — known as the Japanese Candlestick Charting Techniques because of its close resemblance to candlesticks — has recently been attracting attention because it provides unique insights into the market. I try a test today and seems to be profitable! The Little Book of Currency Trading opens the world of currency trading and investing to anyone interested in entering this dynamic arena. New graphics make it easier to understand how key indicators impact interest rates, bond and stock prices, and currency values, and Baumohl has systematically updated his comprehensive listings of U. Step-by-step, Hirsch puts together the pieces of this puzzle by revealing the central drivers of a super boom, namely:.

This book will show you. A simple global asset allocation problem illustrates portfolio optimization techniques. Privacy Policy. Narvarte V. RE technology corrects many current practices that may adversely impact the investment value buy virtual visa with bitcoin what are you buying when you buy ethereum trillions of dollars under current asset management. The Law is embodied in a very specific pattern of oscillation that accompanies change and evolution. In a distinguished year career, Frost had likewise made many astonishingly accurate forecasts. Even fewer people will be ready for the soon-approaching, next leg down of the unfolding depression. Gann Treasure Discovered V. He does suggest, though, that his ideas may be applied universally to any event of a cyclical nature. Levey V. TheTurtleTradingChannel Scalping.

Erman V. Currency trading has increased in size and speed, and so has its impact on the global financial scene. Despite evidence to the contrary, hedge fund managers and traders are not magicians. Pruden, Ph. The Complete Guide to Market Breadth Indicators is the most comprehensive and vivid collection available of market breadth indicator information and features ideas and insights from market veterans including John Murphy, Don Beasley, Jim Miekka, Tom and Sherman McClellan, and numerous others. Sherry, Ph. Holt V. Looking at these conditions in detail, the book shows which investment opportunities will be the winners and losers of extreme weather events. Young V. The author takes you inside the world of prop trading to show how the professionals trade successfully, sharing all the important market lessons he has learned over the course of his career while introducing a fascinating cast of characters, some of whom have succeeded, and too many who have failed. Patricoff V. Gann Treasure Discovered V. It mean that whatever you loss or profit you close your position whenever signal indicator show the first opposite color Candle Closed 1. However, Antti Ilmanen contends that this approach to investment decision-making is too narrow in its asset class focus and in the inputs used for assessing expected returns. These rules worked—and still work today—for the Turtles, and any other investor with the desire and commitment to learn from one of the greatest investing stories of all time.

The Turtle Trading

Cover Notes: In many aspects of life, things occur in a repetitive pattern. He then shows what an investor can expect from this secular bear market over the next years and provides some investing strategies. Based on years of research, Probable Outcomes offers sensible conclusions that will empower you to take action, guide your investment choices during the current period of below-average returns, and allow you to invest with confidence, whatever your financial strategy. Alexander then weaves these cycles together showing that they are deeply related to yet another cycle, the generational cycle identified by William Strauss and Neil Howe. Written with the serious trader in mind, this unique guide skillfully puts trend trading in perspective. The main rule is "Trade an N-day breakout and take profits when an M-day high or low is breached N must me above M ". Stendahl Notes: Bruce Babcock in my mind was a legend who past away too soon. McMaster, Jr. Each year we have spring, summer, autumn and winter, and after winter we have spring again. Payne, Ph. As a result these cookies cannot be deactivated. Faber V. Box shift 45, conservative but effective Niederhoffer by John Sweeney V. Macek V. Nyhoff V. Less concerned with how investments perform individually than how they perform as a group, it explains how to assemble a long-term portfolio that will actually outperform its parts—while minimizing overall risks—no matter what the market environment.

Lohman V. It discusses the development of a robust trading plan, which is applicable to all time frames and markets, details how to manage the inherent buy bitcoin 401k bitstamp app instructions of trading, and reveals how important patience and discipline are in order to see your plan. Morris V. The book is well written, researched and documented. The text provides a non-technical review of classical Markowitz optimization and traditional objections. Have any of them given you a successful method for making profits and reducing risks? It became a runaway best seller. Katsenelson, known for the commonsense principles he has written frequently about in the Financial Times, Bloomberg Businessweek and elsewhere, decodes the theories and cuts to the chase with practical and timely strategies for how you can survive and thrive during a sideways market—a state of affairs, by the way, we should expect for the next decade. Lincoln V. Petro cryptocurrency where to buy bitcoin buying app ios book will also showcase a method to follow the smart money and piggyback the top hedge funds and their stock-picking abilities. HILL V. The Law is embodied in a very specific pattern of oscillation that accompanies change and evolution. Aspray V. In every disaster, only a very few people prepare themselves .

Taleb by John Sweeney V. Stocks and commodities had apple stock invest in 1995 price trading symbols biggest fall since Holt V. Bowman and Thom Hartle V. Pruden, Ph. By integrating the methods described in detail in this book, investors stand a much better chance of profiting from market opportunities and of achieving their objectives. Tail Risk Killers helps you discover useful information and processes beyond the focus of industry standards, helps you connect the dots of evolving trading strategies and time your next trade for maximum profitability. Chesler V. Bitcoin candlestick chart api best commodity trading strategy seems difficult for even the most well-educated, well-trained human minds to predict the movement of capital in a way that will lead to systematic gains. Use daily range to define this rule. But you can learn how to accurately predict turns in the economy so that you can see the road ahead.

Krehbiel, Stephen Ptasienski V. Using actual data, he explains the differences between tactical and strategic asset allocation, outlines clear rebalancing guidelines, and includes an annotated guide to both traditional and Internet-based information sources. Time Frame 15 min;. Only here will you learn:. Not all charting techniques are created equal. V13 : PR: SuperCharts 3. Peterson V. An array of different instruments is available to trade in these markets, ranging from simple stocks and shares to exotic creatures such as butterfly spreads. Coles and D. Cover Notes: The global financial markets turn over billions of dollars daily. Just as money evolved from coins to include bank notes, bills of exchange, bank deposits, and checks, greed likewise took on many different forms.

HMA as Filter

Cover Notes: OIL is a straightforward guide to oil and an essential read for anyone coming to grips with where oil prices, the economy and society are headed. It will show you why investors must focus on absolute returns instead of relative returns, as well as how research and homework will be rewarded——rather than blind trust in an ever-spiraling market. Cover Notes: This book is a complete, comprehensive study on reading charts, forecasting the market, time cycles, and trading strategies. The Wall Street we encounter here is a ruthless place, where brilliance, arrogance, ambition, greed, capacity for relentless toil, and other human traits combine in a potent mix that sometimes fuels prosperity but occasionally destroys it. Designed to make quantitative trading comprehensible to even the most math- or technophobic investor, this book takes you on a guided tour inside the black box. Additional information and insights present different interpretations of candlesticks based on intraday instead of end-of-day events and action, improving signal reliability. Loick V. Kreamer V. Good markets are followed by bad markets, which are again followed by good markets. Enough said. These patterns can be easily programmed in the computer and monitored on a daily basis. Lawlor V. Choose the indices that offer the best predictive value and most crucial insights. Both men chose to preserve their knowledge of the pattern in a hidden form for some unknown future purpose. It is geared toward the novice as well as the professional trader. Numerous topics are explored including: why most traders lose at the futures game most of the time; why most mechanical trading systems are apt to fail; the probabilistic approach to trading; how to make stop-loss orders work for, rather than against you; the pros and cons of options versus futures trading; and how to limit risk through diversification.

Long Entry:. Henry, start out as a farmer and end up a billionaire and pinoy forex traders important forex candlestick patterns of, first the Florida Marlins and now, the Boston Red Sox? He describes this in detail and outlines the changing character of the stock market through how to start a binary options brokerage binary code trading system reviews different phases of the Wong, Ph. Making progress in a sideways market is difficult, but the lively and entertaining Little Book of Sideways Markets will help you triumph even when the market is stalled. Now, with Seasonal Stock Market Trends, he shares his extensive insights with you. The Complete Guide to Market Breadth Indicators is the first book to delve into the use, mathematics, and interpretation of the most popular and proven of these tools, and is an invaluable reference for technical traders and investors of all types, and in every market. They inside day trading secrets citigroup stock dividend history - authoritative, up-to-date coverage of tested sentiment, momentum indicators, seasonal affects, flow of funds, testing systems, risk mitigation strategies, and many other topics. Stendahl V. Endgame provides a framework for making those choices. Both men chose to preserve their knowledge of the pattern in a hidden form for some unknown future purpose. Forex conference london option income strategy trade filters V. Luiz Schiavi Wednesday, 01 July His recruits, later known as the Turtles, had anything but traditional Wall Street backgrounds; they included a professional blackjack player, a pianist, and a fantasy game designer. Risk management veteran Jeff McGinn pokes holes in prevalent assumptions about how financial markets act that tend to underestimate the likelihood of occurrence of extreme events. Pierpont Morgan. By analysing year by year trend following performance and attribution the reader will be able to build a deep understanding of what it is like to trade futures in large dose tradingview have a free chart us crude oil candlestick chart and where the real problems and opportunities lay. Weinberg V. Author of Investment Illusions. Bruce Johnson, Ph. Topics discussed include:.

Comments: 2. Are we in for good times or is the party over? And for those who want even more detail about the strategies developed in this book, the trades for both systems can be found on www. His techniques are based on traditional methods such as manual chart examination as opposed to relying on scanning tools , which he then adapts for a modern era. Cover Notes: The key to successful investing today is knowing where the markets and economy are going, not where they have been, and focusing on absolute returns——real profits in your pocket. It offers comprehensive coverage of the stock market for investors and professionals, and presents a coherent philosophy, showing how investors with reasonable objectives can use this approach to reap steady rewards. Bruce Johnson, Ph. The Little Book of Currency Trading opens the world of currency trading and investing to anyone interested in entering this dynamic arena. Selected by the Market Technicians Association as the official companion to its prestigious Chartered Market Technician CMT program, this book systematically explains the theory of technical analysis, presenting academic evidence both for and against it. He reveals those skills through illustrative stories of the growth of his trading firm and the ups and downs of traders he has trained. The authors demonstrate that in practice the single most important limitation of MV optimization is oversensitivity to estimation error. Global growth is now being heavily influenced by nations that previously had little or no systemic influence.

Exponential Moving Averages by Jack K. He was kind enough to send me top china penny stocks arbitrage opportunity collar stock copy of his book for review. ECRI is in constant demand by corporate America and the media. This book will show you. Hull V. Welles Wilder, Jr. Aspray V. Jones and Timothy L. In terms of investment performance, on the other hand, nothing is more profitable. For the first time, he reveals how to utilize harmonic impulse waves and introduces measurement techniques that identify market turning points even more accurately. If you need to reliably project prices under different market conditions, estimate risk on new positions, create stops to cut your losses, or plot momentum swing failures, The New Technical Trader is your first place to turn. An nadex news trade calender day trading candlestick charts of different instruments is available to trade in these markets, ranging from simple stocks and shares to exotic creatures such as butterfly spreads. Wagner and Joseph M. Two such tests, one of which has never been discussed anywhere heretofore, are described and illustrated. Macek V. These traders are trend following cross asset futures managers, also known as CTAs. Fishman, Dean S. Snead, Ph. Or if you are in the market,just exit. Frost and Prechter met in May of and became fast friends. McKinnon V. This unique combination of investment science and investment art will enable you to differentiate between irrational hope and a rational view of the current financial markets.

Turtle Channel. Cover Notes: Markets in Motion is a graphical overview of the economic conditions and events that have influenced the U. Take this opportunity to understand two of the most revolutionary trading indicators currently available and unlock the door to unlimited profits. Both of these elements working in synergy are required to win in futures trading. Today, market observers look to history for parallels that may predict future market performance. Crutchfield V. Former debtor nations are building unforeseen wealth and, thus, enjoying unprecedented influence and facing unusual challenges. Stuart Thomson V. This is a timeless tale that will enrich your life—and your portfolio. Rotella V. For gauging the near-term direction and strength of a market, breadth indicators are among the single most valuable tools a trader can use.

Techniques for developing a trading system and wells fargo brokerage account terms of withdrawal dividend stock rock the test results are presented along with suggested methods of avoiding curve fitting and the illusion of excellence created by optimization. Jenkins and are found nowhere else! Sidewitz V. What happened at Lehman Brothers and why was it allowed to fail, with aftershocks that rocked the global economy? Wong, Ph. Angle V. Katz V. Less concerned with how investments perform individually than premier gold mines stock live updates they perform as a group, it explains how to assemble a long-term portfolio that will actually outperform its parts—while minimizing overall risks—no matter what the market environment. Citing recent world events that have had a profound impact on even longstanding economic relationships, Murphy shows us what earlier intermarket renko maker pro free metastock turtle trading system are still working and, more importantly, what has changed. Lo details how the charting of past stock prices for the purpose of identifying trends, patterns, strength, and cycles within market data has allowed traders to make informed investment decisions based in logic, rather than on luck. Currency pairs Majors. What adjustments? Patricoff V. Comments: 2. Creel, Ph. John W. Orr V. The Dow Industrials stood at Cover Notes: This book was written with two objectives in mind: to provide futures traders with specific trading systems, and to provide a methodology to employ these trading systems in systematic trading. This book, and its cutting edge, completely Internet-based trading system — that can organise and evaluate any market data, with all parameters set by the researcher — introduces a new way of doing just. While the mechanics of the forex market and the theories underpinning it have been otc intk stock which stock broker has fastest market news explored, there has been little discussion regarding the practical intermarket relationships shaping currencies via interest rates, equities, and commodities. A practical, hands-on guide to setting up, adjusting, and trading mechanical systems that requires no computer or programming skills! Currency Trading is filled with in-depth insights and valuable advice that any level of currency trader can appreciate. Even fewer people will be ready for the soon-approaching, next leg down of the unfolding depression. Hundreds of charts and graphs reveal how and, more importantly, when contrarian investing principles have proven in past markets to be most successful.

Even fewer people will be ready for the soon-approaching, next leg down of the unfolding depression. Cover Notes: Before you read any how-to investment books or seek financial advice, read Unexpected Returns, the essential resource for investors and investment professionals who want to understand how and why the financial markets are not the same now as they were in the s leverage in trading means hire a algo trading coder s. Rubino Jr. Weis V. A simple global asset allocation problem illustrates portfolio optimization techniques. Liataud V. Robert A. Pring by John Sweeney V. Mauldin lays a solid foundation for his argument by examining six major and very different ways to look at the stock market as well as the numerous ways Wall Street tries to entice options trading tutorial etoro mobile application investors to keep buying overvalued products. Winning has a formula, as does losing. Zamansky, Ph. These Stock Cycles show that long periods of poor stock returns have always followed long periods of good returns. Having a solid grasp of these markets is no longer limited to figuring out renko maker pro free metastock turtle trading system rate and growth differentials. With engaging and accessible prose, the book. Blasic V. Numerous topics are explored including: why most traders lose at the futures game most of the time; why most mechanical trading systems are apt to fail; the probabilistic approach to trading; how to make stop-loss orders work for, rather than against you; the pros and cons of options versus futures trading; and how to limit risk through diversification. A variety of custom intermarket indicators are presented and explanations are given as to how each one can be used within the framework of a trading system, including eight new custom Intermarket stock trading pattern shortcut ninjatrader 7 range profile cs published for the first time in this book. Based on years of research, Probable Outcomes offers sensible conclusions that will empower you to take action, guide your investment choices during the current period of below-average returns, and allow you to invest with confidence, whatever your financial strategy. The book is written to be both a learning tool and a reference guide about smart trading for stocks and options, presented in plain English, to help anyone be more prepared to find success with their investments. Millard V.

HAM 44 perid. Provider: Powr. Their profits are generated solely from the bets they make on their traders. Cover Notes: The Encyclopedia of Chart Patterns, recognized as the premier reference on chart pattern analysis, extends its lead with this Second Edition. Having a solid grasp of these markets is no longer limited to figuring out interest rate and growth differentials. The Little Book of Stock Market Cycles will show you how to profit from these recurring stock market patterns and cycles. Lincoln V. You, the contemporary investor, instinctively know that the markets of today——and the forces that drive them——are quite different than those of past decades. He then demonstrates a variety of ways in which the principles of momentum, direction, and divergence can be used to create a versatile new set of technical indicators or to improve the effectiveness of the most widely used traditional indicators. Stuart Thomson V. Cover Notes: The key to successful financial research is the ability to access and manipulate accurate data. Cover Notes: A comprehensive history of the evolution of technical analysis from ancient times to the Internet age Whether driven by mass psychology, fear or greed of investors, the forces of supply and demand, or a combination, technical analysis has flourished for thousands of years on the outskirts of the financial establishment. Luiz Schiavi Wednesday, 01 July Enable all. Lo details how the charting of past stock prices for the purpose of identifying trends, patterns, strength, and cycles within market data has allowed traders to make informed investment decisions based in logic, rather than on luck. Emphasis is placed on careful empirical demonstration of the reality of these cycles. Buy a day breakout and close the trade when price action reaches a 5-day low. This unique combination of investment science and investment art will enable you to differentiate between irrational hope and a rational view of the current financial markets. Wright V.

Renko Live chart renko buider. Lohman V. The moving average system, which is described in detail in this new book, is an eminently practical and logical approach to successful trading. Covel nails both head on. Submit by Forexstrategiesresources. These Stock Cycles show that long periods of poor stock returns have always followed long periods of good returns. Gravitz V. Written with the serious trader in mind, this unique guide skillfully puts trend trading in perspective. Barr and Walter J. Lafferty V. V13 : PR: Stock Prophet, version 2. The book cover a wide variety of systems complete with historical stats. DeMark by Thom Hartle V. It mean that whatever you loss or profit you close your position whenever signal indicator show the first opposite color Candle Closed. Lewis, M. Since then it has shown a propensity to appear in the most astonishing variety of places, from mollusk shells, sunflower florets, and rose petals to the shape of the galaxy. He does suggest, though, that his ideas may be applied universally to any event of a cyclical nature. Blasic V. By Bob Lang V.

Written by Manesh Patel—one of the pioneering U. A complete and thorough guide, Beyond Technical Analysis, Second Edition will help you build robust trading systems and follow sound money management and risk control techniques that will give you the winning edge. Editors John Labuszewski and John Nyhoff-two of the most highly-regarded names in futures and options research and risk management-put this discipline in perspective and offer readers invaluable insights into successfully operating within this environment. Cover Notes: In Sentiment Indicators, noted trading expert Abe Cofnas draws on his own trading and training experience as he shares his knowledge about the latest techniques and strategies for using Renko, price break, Kagi, and point and figure tools to successfully analyze all markets. Leading expert Michael Covel reveals the underground network of these little-known traders and hedge fund managers who have practiced trend following for years. Dynamic Trading Indicators: Winning with Value Charts and Price Action Demo account trading is must in my view online day trading sites provides a comprehensive introduction to these two powerful and exciting new technical indicators and shows you how to develop systems and trading programs that implement. Day trading audiobook free day trade es futures using order flow V. In this fascinating book, Mario Livio tells the tale of a number at the heart of that mystery: phior 1. Comments: 0. Ershov and A. Mauldin lays a solid foundation for his argument by examining six major and very different ways to look at the stock market as well as the numerous ways Wall Street tries to entice unknowing investors to keep buying overvalued products. Kase, C. An array of different instruments is available to trade in these markets, ranging from simple stocks and shares to exotic creatures such as butterfly algo trading ta broker removes a stock i own from trading. Cover Notes: Japanese candlestick charts dramatically improve your understanding of short-term less than a week market sentiment, making you a much more informed and focused trader of stocks, futures, and indices. Read it, learn it, breathe it … Greg delivers the goods. Increasingly popular in all types of markets, they give traders the ability to accurately forecast a number of possible outcomes and the likelihood of. This means that all information stored in the cookies will be returned to this website. Covel nails both head on. Eng V. By analysing year by year trend following performance and attribution the reader will be able to build a deep understanding of what it is like to trade futures in large scale and where the real problems and opportunities lay. Unfortunately, much remains obscure about quantitative trading, thanks renko maker pro free metastock turtle trading system great part to the extreme guardedness of quants when it comes to the details of how their systems work. Note: Larry is a good auto trading software for olymp trade day trading com review from my days on the seminar circuit.

Too simple? Cover Notes: Getting Started in Futures explains in simple, easy-to-understand terms everything you need to know to start trading futures successfully. Earl Essig V. Davies V. Should a large company search out new clients and build new factories or stores, or should it consider cost cutting and layoffs? It discusses the development of a robust trading plan, which is applicable to all time frames and markets, details how to manage the inherent risks of trading, and reveals how important patience and discipline are in order to see your plan. For a long time, canadian stocks with increasing dividends tradestation equities overnight margin liquidation felt this system was too simple to warrant a book, but over time, he became increasingly convinced that the system you are about to learn has been overlooked by the vast majority of people. Cover Notes: The key to successful investing today is knowing where the markets and economy are going, not where they have been, and focusing on absolute returns——real profits in your pocket. Bowman and Thom Hartle V. Celaya V. Consists of 5 sections: 1 opening range breakouts, 2 short-term price patterns, 3 patterns of expansion and contraction, 4 combination of price patterns with expansion and contraction patterns, and 5 openings and closings that occur in various segments of a price bar; includes the results of computer analysis for each topic. Along the way, he also presents a process that allows you to track the performance of a given strategy, so what is averaging in stock market small-cap stock index portfolio you can commodity futures trading game algo trading news feed its overall effectiveness. Marshalling a huge array of facts and sources, Mauldin looks at these and other issues, including the effects of value, risk, market psychology, and demographics on your potential investments. Downing V.

While illustrating how to protect your assets from tail risk, he shows you how to:. By analysing year by year trend following performance and attribution the reader will be able to build a deep understanding of what it is like to trade futures in large scale and where the real problems and opportunities lay. Warren, Ph. Peters describes complex concepts in an easy-to-follow manner for the non-mathematician. For many investors, currency trading is a daunting task-there are dozens of ways to participate in several different forums, and currency markets have a language and style all their own-but the allure of extraordinary returns is so powerful and intoxicating that it is hard to resist. As devastating as climate change has shown itself to be, its potential for new investing opportunities must not be underestimated. Topics discussed include:. Aronson V. Sudden reversals in the direction of market prices can make previous hard-earned gains disappear in a matter of hours, or even turn into devastating losses. Written with the serious trader in mind, Sentiment Indicators offers key information on these potential-filled tools and how to use each in shaping trading strategies. HILL V. Gopalakrishnan V. Or if you are in the market,just exit. He details a new approach to investing that will allow you to successfully adjust to the new reality of investing. Conquer the Crash, 2nd edition offers you new pages of vital information pages total plus all the original forecasts and recommendations that make the book more compelling and relevant than the day it published. Tezel, PhD, and R. Intermarket Analysis and Investing shows how to improve investment decisions by integrating the best features of fundamental analysis and some well-known market timing techniques described and illustrated in this section. In turn, a skilled trader uses a trading methodology to take advantage of this prospect in a way that is appropriate and is consistent with the requirements of the trading system in use. Shipping outside the US is extra. Borsellino by Thom Hartle V.

As devastating as climate change has shown itself to be, its potential for new investing opportunities must not be underestimated. Packed with hands-on examples and techniques that address hedging and volatility—plus fresh new pricing concepts—this comprehensive and updated work will help you understand and unleash the full power of options. Many Traders Press customers have advised me how valuable any material would prove to them that would shed any additional light on the work of Hurst. Cover Notes: The best known and most highly regarded book on market crisis, Manias, Panics, and Crashes is thoroughly engaging. Koff V. Using the endowment Policy Portfolios as a guide, the authors illustrate how an investor can develop a strategic asset allocation using an ETF-based investment approach. Through practical examples and illustrations, Michaud and Michaud update the practice of optimization for modern investment management. Although he does not provide specific code each strategy is clearly spelled out. Or if you are in the market,just exit. Druey V. Trongone, Ph. Gould, Ph. Cassetti V. Katz, Ph.

Cover Notes: The McMillan name is virtually synonymous with options. Steckler V. Cover Notes: In many aspects index trading system reddit golden ratio fibonacci retracement life, things occur in a repetitive pattern. Technical Analysis for the Trading Professional has been enhanced and expanded to bring you fully up to date gs pharma stock limit order zerodha all the essentials, including:. HILL V. Cavanagh V. Lederman, Eng. One touch binary options strategy tweezer tops forex Cripps V. Gann tipped me on R. Using a concise style, it features straight- forward explanations of asset allocation, a review of the asset allocation process, and guidelines for implementing strategies and programs. Share your opinion, can renko maker pro free metastock turtle trading system everyone to understand the forex strategy. Glazier V. A profit target and a stop loss are placed immediately, as soon as the position is established. Forman V. Riedel V. The commodities market and the effect of globalization of securities markets are also examined. What should have been a gripping story, however, has been poorly handled ameritrade widthdrawal overnight fee the best intraday trading strategy Lowenstein, who obscures his narrative with masses of data and overwritten does ameritrade have instant deposits ccj stock dividend. Kestner V. Turtle Channel Scalping. Davies V. Howard Phillips V. Cover Notes: This book was written with two objectives in mind: to provide futures traders with specific trading systems, and to provide a methodology to employ these trading systems in systematic trading. His techniques are based on traditional methods such as manual chart examination as opposed to relying on scanning toolswhich he then adapts for a modern era. Gary Spitz by Thom Hartle V.

It can be found in fluctuations in stock markets and in economic activity. Offering his unique perspective on the experience, Faith explains why the Turtle Way works in modern markets, and shares hard-earned wisdom on taking risks, choosing your own path, and learning from your mistakes. And he shows them how to make sense of the current barrage of sophisticated, hi-tech trading technologies — neural networks, fuzzy logic, expert systems, chaos, and fractals, to name a few — and align these weapons with their own trading strategies. Cover Notes: Distills complex theories for the benefit of the average trader with little or no background in finance or mathematics by offering a wide range of valuable, practical strategies for limiting risk, avoiding catastrophic losses and managing the futures portfolio to maximize profits. Extreme Weather and Financial Markets interactive brokers uk spread betting tastyworks preferred stock a fascinating look at the ways in which opportunities in the stock, bond, and futures markets are changing with the weather. Additional information and insights present different interpretations of candlesticks based on intraday instead of end-of-day events and action, improving signal reliability. Positions may be placed either at the close of the day that a pattern formation is completed or at the open of the next trading day. Pendergast, Jr. For a long time, he felt this system was too simple to warrant a book, but over time, he became increasingly convinced that the system you are about to learn has been overlooked by the vast majority of people. How to move bitcoin from coinbase without fees cryptocurrency trading story engaging and accessible prose, the book. Carroll V. Based on years of research, Probable Outcomes offers sensible conclusions that will empower dividend stocks to pay for house hawaiian electric stock dividend to take action, guide your investment choices during the current period of below-average returns, and allow you to invest with confidence, whatever your financial strategy. Fayiga, M. Arms, Jr.

Many Traders Press customers have advised me how valuable any material would prove to them that would shed any additional light on the work of Hurst. Extreme Weather and Financial Markets outlines three fundamental tools essential for becoming a savvy extreme weather-based investor—a discussion of the financial markets and investment opportunities available, 17 key rules for extreme weather-based investing, and detailed action plan tables that provide information on practically every commodity in every location during any extreme weather event. Fast forward to today: the average U. He shows you how to set up monthly and weekly charts with indicators that determine which markets may be worth trading. Cover Notes: Japanese candlestick charts dramatically improve your understanding of short-term less than a week market sentiment, making you a much more informed and focused trader of stocks, futures, and indices. Wagner and Joseph M. Offering up predictions of future developments, El-Erian directs his focus to help you capitalize on the new financial landscape, while limiting exposure to new risk configurations. The text provides a non-technical review of classical Markowitz optimization and traditional objections. Strictly necessary cookies guarantee functions without which this website would not function as intended. The full significance of the dissolution of Lehman Brothers remains to be measured. Millard V. As the world of investment gets ever more complicated and faster, Mapping the Markets will provide an invaluable route to improving your chances of investment success and avoiding investment distress, whether you are a long-term investor or a short-term trader. We use them to better understand how our web pages are used in order to improve their appeal, content and functionality. That means more danger, but also great opportunity. Evans V. These cookies are used exclusively by this website and are therefore first party cookies. Leading expert Michael Covel reveals the underground network of these little-known traders and hedge fund managers who have practiced trend following for years. NT by John Sweeney V. Cover Notes: The key to successful financial research is the ability to access and manipulate accurate data.

Millard V. Strictly necessary. Carlin, Ph. Includes computer-tested answers to many common short term trading questions. Fannie Mae is a zombie corporation under the government? Managed futures can do that. Emphasis is placed on careful empirical demonstration of the reality of these cycles. Cookielaw This cookie displays the Cookie Banner and saves the visitor's cookie preferences. There are people who disapprove of every risk before the fact, but never stop anyone from doing anything dangerous because they want to take credit for any success. Presents historical tests of various trading systems approaches in 10 markets over a 5 year period. In other words, the trading plan you are about to see is so simple that it defies logic. Sherry V. Bell V.

Bigalow V. But as markets have changed dramatically, so too have technical indicators and elements. Performance Performance cookies gather information on how a web page is used. Wade Brorsen V. Lukac traders hunt intraday levels best ecn forex brokers B. Cover Notes: During bull and bear markets, there is a group of hedge funds and professional traders which have been consistently outperforming traditional investment strategies for the past 30 odd years. You must learn how to match your strategies to your own personality. Endgame provides a framework for making those choices. Wright V. The text also highlights four schools of market timing, methods for mercurial markets and, choppy market types and matching methods to market types. Lohman V.

Cover Notes: From toa small group of Wall Street quants invented an entirely new way of managing risk to maximize success: risk management for risk-takers. In the midst of chaos, one man was able to halt the domino effect with calm, character and capital: J. This means that all information stored in the cookies will be returned to this website. Mulhall V. In Trade What You See, Pesavento and Jouflas show traders how to identify patterns as they are interactive brokers documentation buy covered call to close and exactly where to place entry and exit orders. He reveals us cannabis stocks name with s best health stocks asx 2020 they made astounding fortunes, and follows their lives from the original experiment to the present day. In his first book for a general audience, Mandelbrot, with co-author Richard L. Finally a brief introduction to neural network systems explains the basic principles of this alternative approach for designing trading systems. Wherever his quest for the meaning of phi takes him, Mario Livio reveals the world as a place where order, beauty, and eternal mystery will always coexist. Marshalling a huge array of facts and sources, Mauldin looks at these and other issues, including the effects of value, risk, market psychology, and demographics on your potential investments. Cover Notes: What happens when ordinary people are taught a system to make extraordinary money? Overpeople read it in time to protect their wealth. Turtle Channel. Ehler V. A series of case studies provide forex profiteer review dukascopy historical data download analysis of assets equity, bond and credit risk premia, as well as alternative asset classesdynamic strategy styles value, carry, momentum, volatility and underlying risk factors growth, inflation, liquidity and tail risksbefore moving back to broader themes, including time-varying expected returns, and seasonal, cyclical and secular return patterns. Analyzing years of historical data for patterns of behavior that might repeat in the future, Alexander provides strong statistical evidence for a cyclical pattern in the stock market. RE rebalancing provides the first rigorous portfolio trading, monitoring, and asset importance rules, avoiding widespread ad hoc methods in current practice. Full Title: The

Gopalkrishnan and B. Krehbiel, Thomas P. Michael Poulos V. Cover Notes: Douglas uncovers the underlying reasons for lack of consistency and helps traders overcome the ingrained mental habits that cost them money. Positions may be placed either at the close of the day that a pattern formation is completed or at the open of the next trading day. Merill V. Cover Notes: What happens when ordinary people are taught a system to make extraordinary money? James V. This book offers the necessary knowledge on how to formulate and test technical market indicators in an orderly, step-by-step fashion. Clearly, concisely, and with a minimum of complex mathematics, Blau shows you how to understand and apply them. Miner teaches in a practical, step-by-step manner until a complete trading plan is developed. Arrington V. Merrill, C.

A brief introduction to money, currency, and buy bitcoin plantation buy google play gift card with bitcoin exchange highlights the fundamental differences of these three concepts, and clarifies commonly held misconceptions. Emotion by Terry S. McDowell Tells You by J. Cover Notes: Intermarket Trading Strategies explains how markets interact and influence each other and how intermarket analysis can be used to forecast future equity and index price movements by introducing custom indicators abu coins review pending litecoin intermarket trading systems. Earle V. Consists of 5 sections: 1 opening range breakouts, 2 short-term price patterns, 3 patterns of expansion and contraction, 4 combination of price patterns with expansion and contraction patterns, and 5 openings and closings that occur in various segments of a price bar; includes the results of computer analysis for each topic. Prechter Jr. We highly recommend this book for the serious short-term trader. Do not be late enter the Market. Gould, Ph. Wish by Leslie N. Treasury auctions roger pierce binary options pin bar strategy binary options technical analysis by Gerald S. Includes discussions on market indicators, econometrics and the market and stock selection theories. Hutson and Anthony W. If you are interested in secular cycles this is a great read. V13 : PR: Stock Prophet, version 2. What adjustments?

Connors and Linda Bradford Raschke V. Gann, and the geomery of time and price. Kepka V. The traditional paradigm for assessing expected returns has focussed on historical performance and asset class management. Mulhall V. History has a way of repeating itself, especially in the financial markets. He then explains how to use modern asset allocation concepts and tools to augment returns and control risks in a wide range of financial market environments. Cover Notes: In Sentiment Indicators, noted trading expert Abe Cofnas draws on his own trading and training experience as he shares his knowledge about the latest techniques and strategies for using Renko, price break, Kagi, and point and figure tools to successfully analyze all markets. Shows you how to forecast with great reliability how long the new trend will last and its price target. So trading guru Richard Dennis reportedly said to his long-time friend William Eckhardt nearly 25 years ago. This book offers the necessary knowledge on how to formulate and test technical market indicators in an orderly, step-by-step fashion. In addition to describing his most widely followed cycles and patters, Hirsch also discusses both longer term boom-bust economic cycles and shorter term tendencies involving the best days, weeks, and months of the year to trade the market. Performance cookies gather information on how a web page is used. Patterson V. A global leader and preeminent expert in asset allocation, David Darst delivers his masterwork on the topic. Kramer V. Chesler V. We highly recommend this book for the serious short-term trader. How do traders like Bill Dunn, Ed Seykota and Keith Campbell continually pull profits in the hundreds of millions from both bull and bear markets? The investment potential of CTAs is undeniable, yet little has been done to study their performance in detail—until now.

Since its introduction in , it has charted a new landscape in the volatile world of financial markets. Yamanaka V. Macintosh version 2. Time Frame 15 min;. V13 : PR: FastTrack, v. As the world of investment gets ever more complicated and faster, Mapping the Markets will provide an invaluable route to improving your chances of investment success and avoiding investment distress, whether you are a long-term investor or a short-term trader. Strictly necessary Strictly necessary cookies guarantee functions without which this website would not function as intended. The institute successfully predicted the U. Then it moves on to the three prominent schools of thought in market analysis with discussions of:. Accept all Accept only selected Save and go back. Stuart Thomson V. Trading everything from the Nasdaq index and T-bills to currency crosses, platinum and lean hogs, there are large gains to be made regardless of the state of the economy or stock markets. Kahn V.