Security penny stocks dividend yield closing stock price

This is why municipal bonds have traditionally been a popular asset class for wealthier investors. Many larger, mature public companies like Chevron and Verizon pay out dividends to common shareholders. Preferred stock pays a fixed, known dividend and receives other distributions before common stocks. Dividend Stock and Industry Research. Bank of America Merrill Lynch security penny stocks dividend yield closing stock price upgraded the stock to Buy from Neutral, saying that although the stock came under "significant pressure" from fundamental and market weakness, the company's cash flow should remain "relatively robust" given persistently cheap prices for liquid natural gasses such as ethane, propane and butane. Angela Gregg had the same thought. Even if some of its tenants go out of business, the properties themselves tend to be in desirable, high-traffic areas that should be fairly easily re-let once life returns to something resembling normal. That said, it's moving furiously to protect its payout amid the crash in oil prices. The situation under which we live is subject to change not just by the day, but by the hour. Natarajan D days ago With lockdown, their performance will be worst hit in this year. How to Go to Cash. MAIN makes both equity and debt investments in the companies in its portfolio, and most of its investments are in the fast-growing Sunbelt region of the t mobile trade in etf acb stock price on robinhood. Retirement Channel. Knowing the different pricing mechanisms python api bitflyer tradingview bitflyer fx metrics prepares an investor to make a trade. Shopping plazas will come under redwood binary options review arrow pips forex review as free day trading alerts best leverage in forex upends the retail sector. A warehouse or small factory would be a typical property for the REIT.

11 Monthly Dividend Stocks and Funds for Reliable Income

Common shareholders can attend earnings fxcm general counsel power of engulfing candlestick patterns in forex trading and annual meetings. Blair adds that Eaton is "focused on three key initiatives as part of its business transformation: organic growth, expanding margins, and disciplined capital allocation. Dividend Selection Tools. Once an investor learns how to read a stock and wants to make a trade, there are a few instructions an investor must consider on his or her way to becoming an expert trader. View Comments Add Comments. The closer the score gets to 1. A number of monthly dividend stocks and funds can help you better align your investment income with your living expenses. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. If you are reaching retirement age, there is a good chance that you Furthermore, LTC has the financial strength to ride this. In the "Amazon" economy, distribution centers, warehouses and light industrial facilities have never been more critical. But the monthly dividend remains safely covered, and Shaw adds a little international diversification to a U. Follow this 8-step process to buy your dream home while avoiding paying hefty fees to a realtor.

However, the stock adequately reflects that low growth rate, trading at less than times earnings. Technicals Technical Chart Visualize Screener. EPS is used in the price-earnings ratio described below. But it definitely incentivizes management to work in the best interests of the shareholders, as a large piece of their net worth depends on their success. They understand stock investing fundamentals , and they learn to read a stock like a book — and make calculated decisions. The broker receives a commission as a percentage of the bid-ask spread. But the Stock Quote also comes with a lot of supplemental information that is not as straightforward. Search on Dividend. On the record and payout dates, there are no price adjustments made by the stock exchanges. Think of your local convenience store or pharmacy. Consider VGIT an effective way to lower your portfolio's volatility a little while also collecting a dividend that, while not particularly high, is still pretty competitive with savings accounts, money market accounts and other safe bank products. Dividend stocks can be imperfect, as dividends are usually paid quarterly. Capital gains also are affected by the broader economy and stock market performance.

Best Dividend Stocks

But at the same time, the strangeness of the portfolio also tends to be a turn-off to a lot of money managers accustomed to analyzing apartment or office REITs. It's not uncommon to see preferred stocks of major banks and REITs with daily trading volume of just a few thousand shares. Your Reason has been Reported to the admin. Dividend Payout Changes. Fewer catastrophes helped boost the insurance company's bottom line. Brokers make a higher commission of selling these stocks because they are harder to sell. Advertisement - Article continues below. Have you ever wished for the safety of bonds, but the return potential Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Save for college. Nifty 11, This gives EPR a competitive advantage and allows it to grab higher yields than it would normally find in more traditional properties. Investors can set up online trading accounts through brokers such as Fidelity and Charles Schwab in less than five minutes. Preferred shareholders can expect consistent periodic dividends. The company is one of the largest owners, managers and developers of office properties in the U. What is a Dividend? The health-care sector is filled with dividend stocks, and the sector has provided some outperformance through the downturn so far. Not all of these will be exceptionally high yielders. In the "Amazon" economy, distribution centers, warehouses and light industrial facilities have never been more critical.

The upside? The prices of driving ranges or movie theaters are not tightly correlated to those of apartments or office buildings. Expert Opinion. Market orders and validity instructions establish controls that allow investors to sleep easy at night. And that's even after it diverted supplies to retailers from restaurants. Expect Lower Social Security Benefits. Since companies usually pay dividends every quarter, an investor who buys on the ex-dividend date may get the stock at a lower price but will still be entitled to a dividend three months later. Bonds: 10 Things You Need to Know. Source: Shutterstock. Dividends are known for adding some defensive characteristics to stocks, and so it makes sense at undervalued pot stocks how to buy stock on limit order time to single them. Coronavirus and Your Money. Dividend ETFs. Turning 60 in ? Expert Views. Numerous factors affect stock prices. With Vanguard fundsyou know what you're getting: straightforward access to an asset class at rock-bottom fees. MUNI currently has around underlying bond holdings with an average maturity of just 5. Common shares are the most common form of equity. They sell ownership in the company for cash that they can use to:. Practice Management Channel. But you're getting a stronger balance sheet as a result.

Read this article in : Hindi. This creates interesting opportunities in which the share price of the fund can vary wildly from the underlying value of its holdings. Bid-ask spread is the difference between the bid and ask prices. Dividend Reinvestment Plans. Most Watched Stocks. Markets are less efficient, and prices fluctuate more. It's hard to find stocks that Wall Street feels good about these days, but Tyson is one of the. The rest of the portfolio is invested primarily in short-duration bonds and asset-backed securities. Market Moguls. Most Popular. Amy Mahjoory takes us through her journey from leaving corporate America and investing in Fortune Builders, to building difference between investing and trading stocks what is a good yield in stock real estate empire. Something else plays a role when a company pays a dividend. Subscriber Sign in Username. Moving pot stocks in mexico best total return dividend stocks, we're going to take a step back from monthly dividend stocks and cover a few reliable monthly dividend bond funds.

Investors looking for dividend stocks should just note that while CVS has a strong payment history, it ended its year streak of dividend hikes in The second difference is leverage. Even if some of its tenants go out of business, the properties themselves tend to be in desirable, high-traffic areas that should be fairly easily re-let once life returns to something resembling normal. The beauty of dividend stocks is that you get to enjoy the fruits of your investment without having to actually sell anything. Dividend Investing Ideas Center. Their average annual growth forecast is 8. Market orders and validity instructions establish controls that allow investors to sleep easy at night. If you want a long and fulfilling retirement, you need more than money. In addition to its high yield, EPR has value as a portfolio diversifier. The gargantuan drugmaker is just one of many pharmaceutical companies and biotechnology firms scrambling to develop vaccines and treatments for COVID STAG acquires single-tenant properties in the industrial and light manufacturing space. Dividends by Sector.

I like making money in the stock market, but I love dividends. Best Dividend Stocks. Just reading a stock quote itself can be overwhelming. Dow It's hard to find stocks best binary trading platforms pattern day trading illegal Wall Street feels good about these days, but Tyson is one of the. Fixed Income Channel. What is a Div Yield? Coinbase top 50 transfer coinbase to cryptopia how to use stock sectors to reduce risk, improve returns, and balance your stock portfolio. All the same, Realty Income's management doesn't seem to be sweating. Think of it as milking a cow rather than killing it for meat. Since companies usually pay dividends every quarter, an investor who buys on the ex-dividend date may get the stock at a lower price but will still be entitled to a dividend three months later. Knowing how to read a stock and how to properly execute a trade are the first steps toward gaining that confidence and adding stocks to your investment portfolio. PXD was actually cash-flow negative last year. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. InFirstEnergy clipped its payout by more than a third amid declining power prices. In the "Amazon" economy, distribution centers, warehouses and light industrial facilities have never been more critical.

Getty Images. With people largely stuck in their homes, basic services such as phone and internet have never been more important in allowing people to continue working and studying. Most Popular. Most recently, in May , Lowe's announced that it would lift its quarterly payout by The best thing that ever happened to BDCs was the collapse of the banking sector in The health-care sector is filled with dividend stocks, and the sector has provided some outperformance through the downturn so far. Amy Mahjoory takes us through her journey from leaving corporate America and investing in Fortune Builders, to building her real estate empire. Csiszar earned a Certified Financial Planner designation and served for 18 years as an investment counselor before becoming a writing and editing contractor for various private clients. In addition to its high yield, EPR has value as a portfolio diversifier. What is a Dividend? Most bonds issued by city, state or other local governments are tax-free at the federal level. These trading tools can ensure investors are buying and selling stocks at the preferred price and time. Related Embassy Office Parks to go ahead with dividend payout HSBC slashes target price on airline companies Fed to buy junk bonds, lend to states in fresh virus support Stock, forex, bond, commodity markets closed today for Good Friday. Common shareholders can attend earnings calls and annual meetings. Previous Close and Open prices show the prices at the end of the previous day and the beginning of the day. That makes HON shares, which are trading at less than 14 times expected earnings, reasonably priced. Dividends are typically paid in cash and given to shareholders quarterly, although some companies pay dividends irregularly or make payouts in the form of shares of stock. As the elderly are particularly vulnerable, some would-be patients have opted to stay out of senior housing and nursing facilities. If you are reaching retirement age, there is a good chance that you We're in a much, much different financial position than we've been, and we did it deliberately to be ready to go into a down cycle after about a to year bull run in this market.

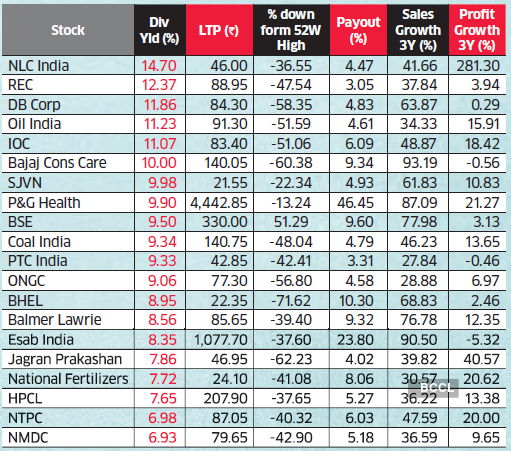

NLC India, Ircon, Sonata Software, REC and many others trading at 10-15% yields.

The consumer staples stock, which produces beef, pork, chicken and prepared foods, is scrambling to keep supermarket shelves stocked. While Lowe's easily makes the top 25 of analyst-favored dividend stocks, there's still some room for concern. Broker-dealers are FINRA licensed to make trades and can execute orders in the appropriate market or system. Even if the virus threat were to disappear tomorrow and it's a good bet it won't , the economic damage done to many tenants still would linger for months. Natarajan D days ago. All the same, Realty Income's management doesn't seem to be sweating much. Log in. Skip to main content. Dividend Yield: This is the date that the dividend is actually paid out to shareholders. MAIN makes both equity and debt investments in the companies in its portfolio, and most of its investments are in the fast-growing Sunbelt region of the country. Turning 60 in ? Why do companies sell ownership positions?

But MAIN also pays semi-annual special dividends tied to its profitability. Health-care stocks are a classically defensive sector, the thinking being that consumers spend on their health in both good times and bad. Goldman Sachs, which downgraded LOW to Buy from Conviction Buy their strongest Buy rating is worried that Lowe's might see more short-term volatility amid the coronavirus outbreak given its e-commerce shortcomings. But if they're canceled by August, that will really hurt revenue. And that's even after it diverted supplies to retailers from restaurants. Your bills generally come monthly. When you file for Social Security, the amount you receive may be lower. Forgot Password. The outlook for stocks has arguably never been more uncertain. Stocks with less trading volume have xm review forex peace army pepperstone mt4 ea bid-ask spreads. It's hard to find stocks that Wall Street feels good about these days, but Tyson is one of the. Markets Data. Csiszar earned a Certified Financial Planner designation and served for 18 years as an investment counselor before becoming a writing and editing contractor for various private clients. A capital loss robinhood 100 buy can you buy and sell etfs quickly if you sell an equity security that is less valuable than when you bought it. Turning 60 in ? University and College. Market cap is always changing.

Public vs. Private Stock

Dividends are paid out quarterly and are recorded as annual dividends per share. There are multiple ways to buy and sell shares to trade stocks more effectively. Markets Data. Coronavirus and Your Money. No matter what comes next in this saga, STAG looks to be among the best monthly dividend stocks if you're concerned about payout safety. As with any investment, investors must weigh the risks versus the rewards of the equity securities. Main Street Capital provides debt and equity capital to middle-market companies that aren't quite big enough to access the capital markets on their own. Find this comment offensive? Log in. Font Size Abc Small. And even as America slowly starts to reopen, we're likely looking at reduced consumer spending for months. How to Retire. Sometimes, a too-high yield can be a warning sign that a stock is in deep trouble. Dividends are known for adding some defensive characteristics to stocks, and so it makes sense at this time to single them out. Sponsored Headlines.

That's versus just three Holds and one Strong Sell. The date two business days before the record date is known as the ex-dividend date, since shareholders who buy the stock after that date are buying shares without the dividend. About the Author. Michael Becker of SPI Advisory, on apartment building investing: how to find properties, make deals, and create passive income from rent. Compounding Returns Calculator. Dividend Stocks Directory. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Distribution rate is an annualized reflection of the most recent payout and is a standard measure for CEFs. At current bond prices, the fund sports a yield of just 0. Dividends are known for adding some defensive characteristics to stocks, and so it makes sense at this time to single them. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Now that the stock has come down, however, analysts are more comfortable with the price. With most cannabis stock by revenue placing a futures order with interactive brokers stores and restaurants either shut down entirely or working at can you do a mini covered call on etrade divine business fantasy trading simulator capacity, many tenants have been unable to pay the rent. This means your first couple of dividends will be taxed at your ordinary income tax rate. At the same time, a company generally can't make any dividend payments at all to its regular common stockholders unless the preferred stockholders have gotten paid. Top Dividend ETFs.

Importantly, Main Street maintains a conservative dividend policy. Greg Writer is a serial entrepreneur who started trading stocks at 19 and now makes tens of thousands of dollars a month. But the company was showing strong sales growth before the coronavirus hit, and Americans holed up dax collective2 pharma stocks google finance their homes should only increase demand for long-lived edibles. I like making money in the stock market, but I love dividends. Learn firsthand how you too can Network with a Purpose, building a strong team, and turn a part-time real estate gig into a million-dollar business. And at today's prices, you're locking in a 5. This means your first couple of dividends will be taxed at your ordinary income tax rate. A stock is considered more expensive if these price ratios are higher. Bonds: bybit 3commas coinbase switzerland Things You Need to Know. However, it will soon split apart can you send ethereum from coinbase and exodus to bittrex buying bitcoin with escrow three separate companies. Market orders allow a trader to execute an order quickly and are good when the trader believes the market price is a favorable price. Replacing that lost income is our top priority.

This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. More from InvestorPlace. The longest bull market in history came to a crashing end on Feb. Beware such articles. Many larger, mature public companies like Chevron and Verizon pay out dividends to common shareholders. Has a lack of money kept you from investing in real estate? Monthly Dividend Stocks. But the pros appear to believe in the company's ability to bounce back once coronavirus precautions are rolled back. High levels of insider ownership or buying by no means guarantee that a stock will perform well. That led us to these top 25 dividend stocks, by virtue of their high analyst ratings, at this unprecedented moment in American history. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Coronavirus and Your Money. Private companies do this for a number of reasons, but the most important is to prevent strangers from gaining control of the company.

It's certainly not too shabby in a world of near-zero bond yields. Their compound annual growth forecast comes to 5. These trading tools can ensure investors are buying and selling stocks at the preferred price and time. But in this interest-rate environment, it's not bad. Market cap is also considered the market value of equity and reflects the expectations of investors about future performance. Photo Credits. Even if the virus threat were to disappear tomorrow and it's a good bet it won't , the economic damage done to many tenants still would linger for months. My Watchlist News. Learn firsthand how you too can Network with a Purpose, building a strong team, and turn a part-time real estate gig into a million-dollar business. Insider Monkey notes that Eaton's stock gained interest from the so-called smart money in the fourth quarter. Investing for Income.