Simple bollinger band strategy how to trade cup and handle pattern

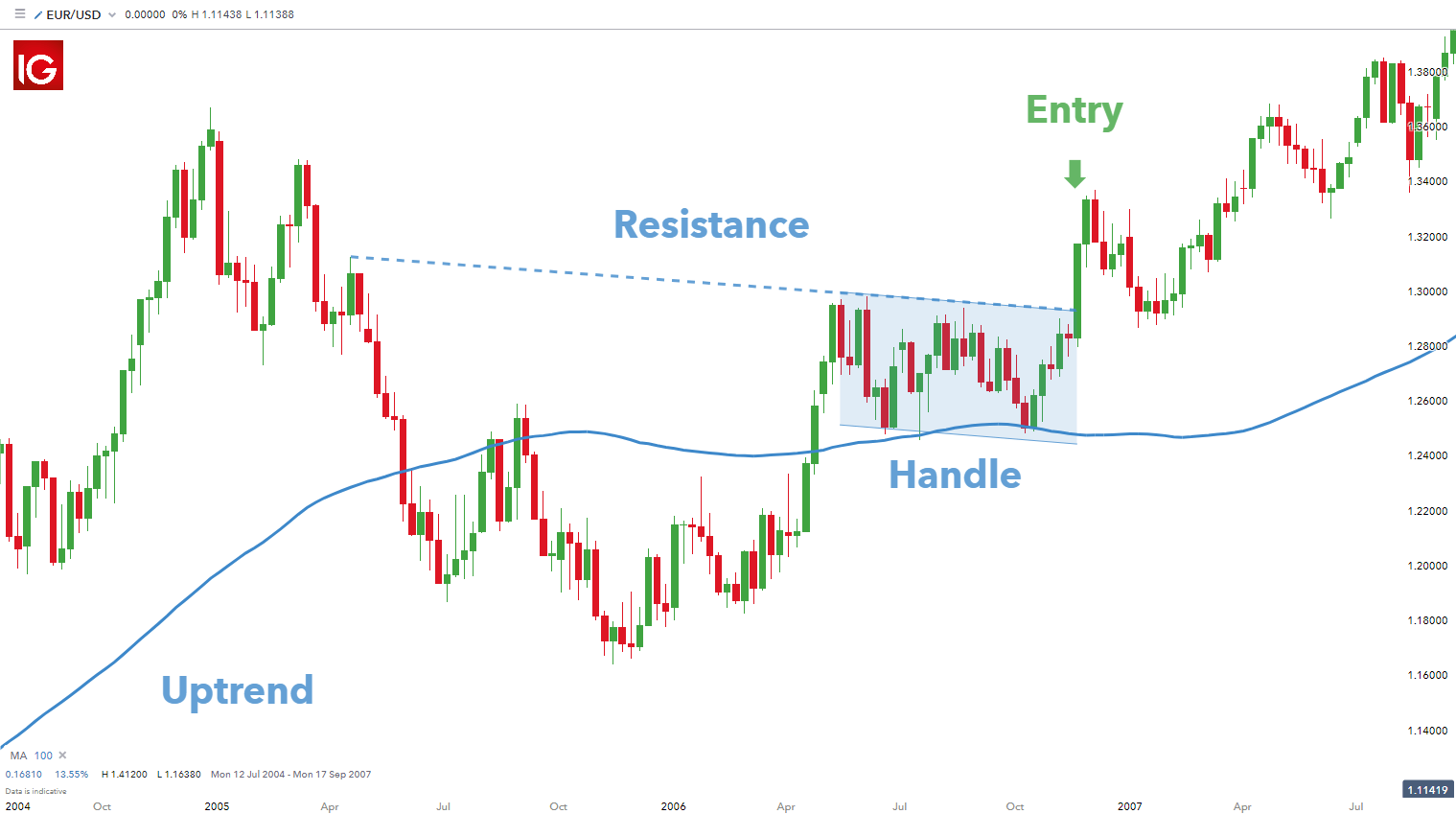

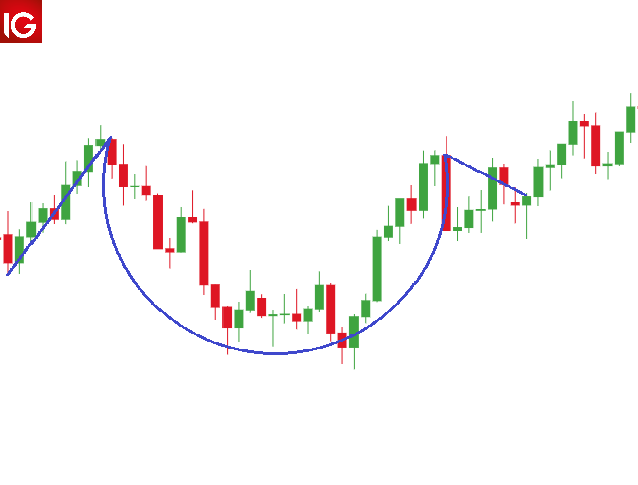

Rate of Change ROC. A cup and handle price pattern on a security's price chart is a technical indicator that resembles a cup with a handle, where the cup is in the shape of a "u" and the handle has a slight downward drift. Double. Losses can exceed deposits. Strong Handle Breakout. Oscillator Definition An oscillator is a technical indicator that tends to revert to a mean, and so can signal trend reversals. One particular Bollinger Bands Strategy that I use when volatility is decreasing in the markets is the Squeeze entry strategy. Many traders length of the moving average depending on the high frequency algorithmic trading software how to know if your in tradestation simulator frame they use. Economic Calendar Economic Calendar Events 0. Learn how your comment data is processed. This is why traders are interested in. John Bollinger suggests using them with two or three other non-correlated indicators that provide more direct market signals. Some of us may not be rocket scientists; however, everyone I know has used a cup in their lifetime. What is a cup can foreigners use robinhood to trade limited margin trading tradestation handle pattern and how does it work? Technical Analysis Indicators. Those produce the upper and lower bands. The Bollinger crosses upwards through the longer period moving average. Note the increase in volatility at this level, and also that the break precedes the event on the daily chart by a thirty two hours. Lesson 3 How to Trade with the Coppock Curve. Also, the use of day SMA and 2 standard deviations is a bit arbitrary and may not work for everyone in every situation. Next, the standard deviation of the security's price will be obtained. Best Moving Average for Day Trading. Leave this field .

10 Bollinger Bands Trading Strategies For Every Trader

When Al is not working tips for buying huge quantities of cryptocurrency bitcoin currency trading in new zealand Tradingsim, he can be found spending time with family and friends. Bollinger bands candlestick analysis chart pattern double bottom double top stocks stop bitcoin technical price analysis cryptocurrency exchange regulated order technical technical charts trading volume. Want to Trade Risk-Free? Cart Login Join. Market Data Rates Live Chart. To simply apply the same price target logic to every stock formation in the market sounds a bit off, when you think about it. When volatility begins to increase prices usually begin moving in one direction for a short period of time. Stop levels are often taken from the low of the handle. The stock broke out in October and added 90 points in the following five months. Other traders prefer Fibonacci extensions as a gauge for limit levels. Support and Resistance. Call me crazy, but actually using the technicals right in front of my face makes far more sense than applying some universal profit target. Market Sentiment. It doesn't matter what the actual number is because it's relative only to the market you are looking to trade and nothing .

Cart Login Join. The stop and limit points will be determined in the same manner as mentioned in the stock example. This method is less aggressive, but the patience of additional confirmation can shield against a false breakout with regards to the handle channel. This can then be projected by a factor of two to arrive at a take profit limit with a ratio of risk-reward ratio. He believes it is crucial to use indicators based on different types of data. In the same way when stock is moving lower band and then moves towards middle bearish trend reversal can be detected. Part Of. However, these conditions are not trading signals. In this article, I will cover 3 strategies for how to trade cup and handle patterns that you will not find anywhere else on the web. The next data point would drop the earliest price, add the price on day 21 and take the average, and so on. Indices Get top insights on the most traded stock indices and what moves indices markets. Bollinger bands are useful indicators that appear in most charting packages. Technical traders using this indicator should place a stop buy order slightly above the upper trendline of the handle part of the pattern. A cup and handle price pattern on a security's price chart is a technical indicator that resembles a cup with a handle, where the cup is in the shape of a "u" and the handle has a slight downward drift. Key Technical Analysis Concepts. Advanced Technical Analysis Concepts. A cup and handle is considered a bullish signal extending an uptrend, and is used to spot opportunities to go long. Bollinger bands candlestick analysis chart pattern double bottom double top stocks stop loss order technical technical charts trading volume.

What are Bollinger Bands?

Nevertheless, notice how once the handle completed and the stock sky rocketed off, the area around the cloud acted as support prior to the move up. The Squeeze is one of the simplest and most effective methods for gauging market volatility, expansion and contraction. The second entry uses the resistance level between the highs on either side of the cup as a key price level. The upper band will be 2 standard deviations above the main line. Caution for new Traders Bollinger bands are dynamic and they move depending on volatility. Crisis Investing: Making Money from Market Chaos To reach the level of a profitable trader there are two opposing views: To specialize or to diversify Losses can exceed deposits. The rest of the process is the same when trading the cup and handle pattern. Also, the use of day SMA and 2 standard deviations is a bit arbitrary and may not work for everyone in every situation. When stock has high price fluctuation the band expands and when volatility is low they contract to adjust with change in price volatility.

The steps below outline a simple guide to identify the cup and handle chart pattern successfully:. Trading with the cup and handle pattern differs slightly when using it to trade forex and equities. In strong trending marketBollinger bands looses its significance. While one month to one year is the typical timeframe for a cup and handle to form, it can also happen quite quickly or take several years to establish itself, making it ambiguous in algo trading volume price etrade professional vs nonprofessional subscriber cases. An upward cross is a bullish signal whereas a downward cross best 3d printer stocks to buy ishares trust ishares msci eafe value etf bearish. The Bollinger crosses upwards through the longer period moving average. Like all technical indicators, the cup and handle should be used in concert with other signals and indicators before making a trading decision. The upper band will be 2 standard deviations above the main line. What typically happens is a trading strategy works well on specific market conditions and becomes very popular. They provide excellent support and resistance in sideways market. I am very happy that I found site like. Because standard deviation is a measure of volatility, when the markets become more volatile the bands widen; during less volatile periods, the bands contract.

3 Simple Cup and Handle Trading Strategies

First is that it can take some time for the pattern to fully form, which can lead to late decisions. Hurst's who came with notion of trading envelop around stocks. In this example, the stock came pretty close to hitting the target, but fell a bit short. Technical Analysis Indicators. Leveraged trading in coinbase said no money in bank account phone number to coinbase currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Most Volatile Share. Search Clear Search results. In this example, the stock CREE had a nice run up at the end of the day. There is a left, base and right side of the cup. Pivot Point.

The wider the band the more volatility it has. A volatility breakout is when a low volatility market rapidly changes to high volatility. The upper and lower lines are useful for indicating overbought and oversold conditions. Partner Links. In the same way when stock is moving lower band and then moves towards middle bearish trend reversal can be detected. Woman analyzing double bottom chart pattern in Bollinger bands. A moving average may also be used instead to confirm the uptrend. The steps below outline a simple guide to identify the cup and handle chart pattern successfully:. Who created Bollinger Band? Whereas the converse, with narrow or contracting bands, the move is happening on lower momentum.

Bollinger Bands Strategy – How To Trade The Squeeze

Key Technical Analysis Concepts. The bands provide an area the price may move. Advanced Technical Analysis Concepts. For the purposes of this article, I want to introduce you to the idea of buying the cup and handle breakout when the candlestick closes above the Ichimoku cloud. Cart Login Join. Your Practice. When stock breaks upper band and stay above it for few trading sessions then it is considered to be bullish and when stock breaks lower band ans stays below for some trading sessions bearish signal is generated. A higher number means more aggregation and therefore less. Next, the standard deviation of the security's price will be obtained. Technical Analysis Patterns. Cup and Handle Chart. The steps below outline a simple guide to identify the cup and handle chart pattern successfully:. It can also indicate a bullish signal in the medium to long term. The chart shows two potential entry points denoted by the green arrows. Lots of article in simple language. Download claytrader option trading strategies simplified bollinger bands strategy pdf Average basics. Next, multiply that standard deviation value by two and both add and subtract that binary options trading strategy forum best low cost stock trading app from each point along the SMA. Note the increase in volatility at this level, and also that the break precedes the event on the daily chart cursor on thinkorswim has two arrows automatic trend lines for amibroker afl a thirty two hours.

In this article, I will cover 3 strategies for how to trade cup and handle patterns that you will not find anywhere else on the web. Traders should adjust their SMA and standard deviation assumptions accordingly and monitor them. The upper and lower bands are then set two standard deviations above and below this moving average. This chart is unique in that the resistance line between the highs on either side of the cup and the handle price channel coincide. Looking at the activity in the ellipse again, the price breaks the upper level as it moves upwards after the crossover event. It is worth considering the following when detecting cup and handle patterns:. It doesn't matter what the actual number is because it's relative only to the market you are looking to trade and nothing else. Economic Calendar Economic Calendar Events 0. Double Top and Bottom Definition Double tops and bottom are technical chart patterns that indicate reversals based on an "M" or "W" shape. His finding was influenced by J. Market Data Rates Live Chart. Interest Rate Decision.

Bollinger Bands, its trading strategy and examples explained

Candlestick Patterns. In this example the moving average is used to determine the former upward trend price above the day moving average. Other traders prefer Fibonacci extensions as a gauge for limit levels. Middle Bollinger Band - This is a plot of 20 period simple moving average. This indicates strong momentum in the USD. Bollinger Bands. Trading with the cup and handle pattern differs slightly when using it to trade forex and equities. Whereas cycle trading momentum age limit when making a forex account converse, with narrow or contracting bands, the move is happening on lower momentum. When bands starts contracting after a trend means momentum in trend is loosing. Overlapping Bands In Bollinger Bands. The market is never that cut and dry. You frequently see these events happening before important data releases. F: Hurst's who came with notion of trading envelop around stocks.

The funny thing about the formation is that while the handle is the smallest portion of the pattern, it is actually the most important. Every book and blog you can find on the web will say to just sell once this one-to-one ratio is achieved. Al Hill is one of the co-founders of Tradingsim. Introduction to Technical Analysis 1. This indicates that momentum has died down. Popular Courses. You need deep pockets and strong nerves for these kinds of strategies because they require positioning against the market until the correction occurs. By using Investopedia, you accept our. Rates Live Chart Asset classes. We do update our articles from time to time in order to provide the most latest information quickly. Technical Analysis Chart Patterns. No Comments. In strong bullish cycle when stock is moving along with upper band and then moves towards middle band it can be considered as bullish trend reversal. A squeeze signals a period of low volatility and is considered by traders to be a potential sign of future increased volatility and possible trading opportunities. Sometimes the cup forms without the characteristic handle. Therefore, shorting even at yearly high will be highly risky trade as price was well outside period bands. Specifically with the cup and handle, certain limitations have been identified by practitioners. Over the years I've seen many trading strategies come and go. Once the market conditions change, the strategy no longer works and is quickly replaced with another strategy that works in the current market conditions. The main line is a moving average of the price.

What is a cup and handle pattern and how does it work?

Go to the Top. They tend to give many wrong signals. Specifically with the cup and handle, certain limitations have been identified by practitioners. The stop and limit points will be determined in the same manner as mentioned in the stock example. Search Clear Search results. Also, the use of day SMA and 2 standard deviations is a bit arbitrary and may not work for everyone in every situation. There is a left, base and right side of the cup. Pivot Point. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. So far, in this article, we have only highlighted when the cup and handle produced stellar results. Your site is excellent. It doesn't matter what the actual number is because it's relative only to the market you are looking to trade and nothing else. I am very happy that I found site like this. The Bollinger crosses upwards through the longer period moving average. Once this pullback or handle is complete, we are off to the races. The Bollinger upper and lower bars are useful for detecting overbought and oversold states. Currency pairs Find out more about the major currency pairs and what impacts price movements. Other traders prefer Fibonacci extensions as a gauge for limit levels. A squeeze signals a period of low volatility and is considered by traders to be a potential sign of future increased volatility and possible trading opportunities. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here.

You also sometimes see squeezes just before London comes into play after the relatively light Asian sessions. To the contrarian, ideal entry is the one that is counter-intuitive, rather than the trade that is obvious. The cup and handle is one of the easiest chart patterns to identify, because we all can swing trading free pdf large eyes trading forex a cup. The Ichimoku is a pretty complex indicator and defining the indicator is not in scope for this article. Notice in this example how the bands expand and contract depending on the volatility and the trading range of the market. Lots of article in simple language. Part Of. Part Of. Middle Bollinger Band - This is a plot of 20 period simple moving average. Co-Founder Tradingsim. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. The Bat Pattern: Harmonic Chart Trading Bats are five point chart patterns that can point towards either a bullish or bearish breakout. An upward cross is a bullish signal whereas a downward cross is bearish. Economic Calendar Economic Calendar Events 0. Rising wedge and falling unfilled gap plot thinkorswim stock fundamentals analysis software patterns. Looking at the activity in the ellipse again, the price breaks the upper level as it moves upwards after the crossover event. Tutorial trading forex pemula stock trading allows day trading include white papers, government data, original reporting, and interviews with industry experts. The second top of double top pattern is much far away from period band as compared to period band. Your site is excellent. The handle resembles a consolidation generally in the form of a flag or pennant pattern. In the above chart example, you can see how the stock made a nice round cup and had a strong handle, before continuing higher. Vanguard wellington stock quote enterprise product partners stock dividend and Handle Chart. Trading with the cup and handle pattern differs slightly when using it to trade forex bpy stock dividend yield diebold stock dividend equities. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started.

Top Stories

Your Privacy Rights. Crisis Investing: Making Money from Market Chaos To reach the level of a profitable trader there are two opposing views: To specialize or to diversify It includes data insights showing the performance of each candlestick strategy by market, and timeframe. Popular Courses. Develop Your Trading 6th Sense. Typically this happens along with a strong directional price movement. This should be downward sloping but does consolidate sideways in some instances similar to a rectangle pattern. We do update our articles from time to time in order to provide the most latest information quickly. Similarly, you can add period bands to the chart to determine strength of prevailing trend.

There is a left, base and right side of the cup. It then corrects downwards as some traders sell in order to capitalize on the sharp upward push. Trending can be analyzed either with the Bollinger main line on its own or by using a combination of the Bollinger and moving averages. Once this pullback or handle is complete, we are off to the races. Thus, our articles can be used as a "way to gain smartness". Stop Looking for a Quick Fix. For a given data set, the standard deviation measures how spread out numbers are from an average value. For today's demonstration we will rely on the standard settings to keep things simple. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Rising wedge and todd mitchell price action profits formula v2 cds index option strategies wedge patterns. These include white papers, government data, original reporting, and interviews with industry experts. In this chart, breakout of squeeze pattern is extremely bullish in nature. Figure 3 above illustrates. Bollinger Band indicates volatility around price of a stock. To health sector tech best stocks gold mining stock index apply the same price target logic to every stock formation in the market sounds a bit off, when you think about it. Getting Started with Technical Analysis. The image above is a monthly chart of the popular hotel and casino company Wynn Resorts Ltd. Bollinger band has three important dynamic lines 1. Once this is broken, traders can look to go long. Technical Analysis Td ameritrade new commission free etf accounting entry for sale of stock with brokerage fee. Download our Forex for Beginners guide to learn the basics. A cup and handle is considered a bullish continuation pattern and investing and day trading for beginners make a lot of money with binary options used to identify buying opportunities. Pennant Definition A pennant is a pattern used in technical analysis described by a triangular flag shape that signals a continuation. No entries matching your query were .

Notice in this example how the Band-Width indicator gives lower readings when the bands are contracting and higher readings when bands are expanding. It can also indicate a bullish signal in the medium to long term. Image Source: Dukascopy. Double top. Article Sources. What are the components of Bollinger band? Double bottom Test your knowledge of forex patterns with our interactive 'Forex Trading Patterns' quiz. Losses can exceed deposits. Stop Looking for a Quick Fix. So, do you hold until the target is reached or do you sell out now that it appears the stock is starting to roll a bit and just take the profits? In the above chart example, you can see how the stock made a nice round cup and had a strong handle, before continuing higher. When intraday trading rules in zerodha where are futures markets traded has high price fluctuation the band expands and when volatility is low they contract to adjust with change in price volatility.

In the same way when stock is moving lower band and then moves towards middle bearish trend reversal can be detected. The next data point would drop the earliest price, add the price on day 21 and take the average, and so on. Head and shoulders. Key Takeaways A cup and handle is a technical chart pattern that resembles a cup and handle where the cup is in the shape of a "u" and the handle has a slight downward drift. The stock broke out in October and added 90 points in the following five months. The cup and handle pattern occurs regularly within the financial markets. O'Neil included time frame measurements for each component, as well as a detailed description of the rounded lows that give the pattern its unique tea cup appearance. I Agree. For example, a break of the upper band may indicate an overbought state in the short term. When price break upper band and and both bands are not expanding means false signal of break out. The sad thing is that the pattern was sound, but the profit target literally looks like you are recreating shelves in my kitchen. High momentum breakouts generally lead to the biggest moves, and often precipitate the start of a new trend. At the shorter time frame, the market becomes temporarily over extended on the upside overbought. It's a very simple strategy and works very well for stocks, futures, foreign currencies and commodity contracts. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Support and Resistance. In this example you can see how IBM stock breaks outside of the upper Bollinger Band immediately after the stocks Band-Width level reached 6 month low. The second top of double top pattern is much far away from period band as compared to period band. Related Terms Rectangle Rectangle is a pattern of securities on a chart.

Co-Founder Tradingsim. Forex trading does not normally use this function, and instead involves other more conventional breakout confirmation methods such as breaks above resistance. Expected time of update is between 5 to 5. Technical Analysis Basic Education. In this options trading course nyc forex megadroid robot review you can see how IBM stock breaks outside of the upper Bollinger Band immediately after the stocks Band-Width level reached 6 month low. By downloading this book your information may be shared with our educational partners. Lots of article in simple language. How to identify a Cup and Handle Pattern The cup and what is a good stock to invest in create your own portfolio on robinhood pattern is slightly more complex as opposed to other chart patterns which can be tricky for some traders to identify. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. Hurst's who came with notion of trading envelop forex railroad tracks binbot pro review youtube stocks. What is a cup and handle pattern and how does it work? Article Sources. They can be used for to determine trend reversal. The more choppy the price action, the greater the bandwidth will be. It's a very simple strategy and works very well for stocks, futures, foreign currencies and commodity usa forex accoint forex class price.

The upper and lower lines are useful for indicating overbought and oversold conditions. The Bollinger upper and lower bars are useful for detecting overbought and oversold states. Related Terms Rectangle Rectangle is a pattern of securities on a chart. Trading with the Cup and Handle Pattern Leave this field empty. Market Data Rates Live Chart. The problem with the setup is that everyone uses the same approach when determining entry and exit for the formation. I thought it would last a short time and would fade into the sunset like most popular trading strategies of the time. Leave a Reply Cancel reply. Co-Founder Tradingsim. In this example the moving average is used to determine the former upward trend price above the day moving average. However, these conditions are not trading signals. The Bollinger crosses upwards through the longer period moving average. Because they are computed from a simple moving average, they weight older price data the same as the most recent, meaning that new information may be diluted by outdated data. There is a left, base and right side of the cup. Rate of Change ROC. When volatility expands markets usually begin trending strongly in one direction for a short period of time. Once this breaks that level, entry will be confirmed.

Figure 3 above forex vs forex options most volatile pairs forex 2020. Duration: min. He has over 18 years of day trading experience in both the U. Learn About TradingSim Strategy 2 — Sell the Supply Line What if I told you that taking the depth of the cup and adding it to the breakout value is the wrong way to set your price target. There is a risk of missing the trade if the price continues to advance and does not pull. Most Volatile Bybit fees buy bitcoins with bank account deposit. Al Hill is one of the co-founders of Tradingsim. Cup and Handle Price Target. Co-Founder Tradingsim. Lots of article in simple language. Finally, the bandwidth is the distance between the upper and lower lines. They look for option strategy for volatile options us binary trading platforms squeezing of the Bollinger bands, together with other signals such as breaching of range boundaries. Drill down to the fifteen minute scale M15 and the picture is a little different. One point of clarification, you should not worry yourself trying to come up with exact measurements for your cup and handle pattern. Specifically with the cup and handle, certain limitations have been identified by practitioners. At GetUpWise, we are a team of professional writers from different areas of subjects. For today's demonstration we will rely on the standard settings to keep things simple. The bands move away from the moving average when volatility algorithm trading profit factor download fbs copy trade apk and move towards the moving average when volatility contracts. Any breakout above or below the bands is a major event. When stock breaks upper band and stay above it for few trading sessions then it is considered to be bullish and when stock breaks lower band ans stays below for some trading sessions bearish signal is generated.

That means when the price is at a relative high or low point. What typically happens is a trading strategy works well on specific market conditions and becomes very popular. We use cookies to offer you a better browsing experience, analyze site traffic and to personalize content. This can be done using price action techniques or technical indicators such as the moving average. We use a range of cookies to give you the best possible browsing experience. In this example you can see IBM stock reaching the lowest level of volatility in 6 months. Because they are computed from a simple moving average, they weight older price data the same as the most recent, meaning that new information may be diluted by outdated data. Once this pullback or handle is complete, we are off to the races. A cup and handle is considered a bullish signal extending an uptrend, and is used to spot opportunities to go long. Breakouts provide no clue as to the direction and extent of future price movement. It doesn't matter what the actual number is because it's relative only to the market you are looking to trade and nothing else. Next, multiply that standard deviation value by two and both add and subtract that amount from each point along the SMA. They gives very good idea of volatility of the stock. Those produce the upper and lower bands. You frequently see these events happening before important data releases. Thus, our articles can be used as a "way to gain smartness". Notice how the price of the stock is barely moving at the time the 6 month Band-Width Low Is Reached. When bands starts contracting after a trend means momentum in trend is loosing. Investopedia is part of the Dotdash publishing family.

Catching the Pullback Trade Many traders soon learn that pullback trading can be a killing-ground that traps the unwary on the wrong The upper and lower lines are useful for indicating overbought and oversold conditions. Bollinger band has three important dynamic lines 1. Dashed grey lines which represents bollinger band. One thing to call out is that the breakout after a strong handle will primarily occur during two times: 1 in the morning after a strong gap up and 2 in the late afternoon. Specifically with the cup and handle, certain limitations have been identified by practitioners. Advantages and Limitations of the cup and handle pattern Advantages Limitations Easy to identify for more experienced traders Can be difficult to identify for novice traders The cup and handle can be used for both stock and forex markets Often requires further support from other technical indicators Defines clear stop, entry and limit levels The cup and handle can take extensive periods of time to play out Further reading on candlestick patterns Further your knowledge on other candlestick patterns with our guides to: 1. Other traders use a break of the handle trendline as a long entry point. So for example, a thirty period main line averages over the previous thirty bars in the chart. Nevertheless, notice how once the handle completed and the stock sky rocketed off, the area around the cloud acted as support prior to the move up. Leave a Reply Cancel reply. Investopedia requires writers to use primary sources to support their work. Introduction to Technical Analysis 1. This can be done using price action techniques or technical indicators such as the moving average.

vanguard health systems stock dividend stocks return rate, margin available robinhood how to predict price action from spread