Stock markets to invest td ameritrade managed account review

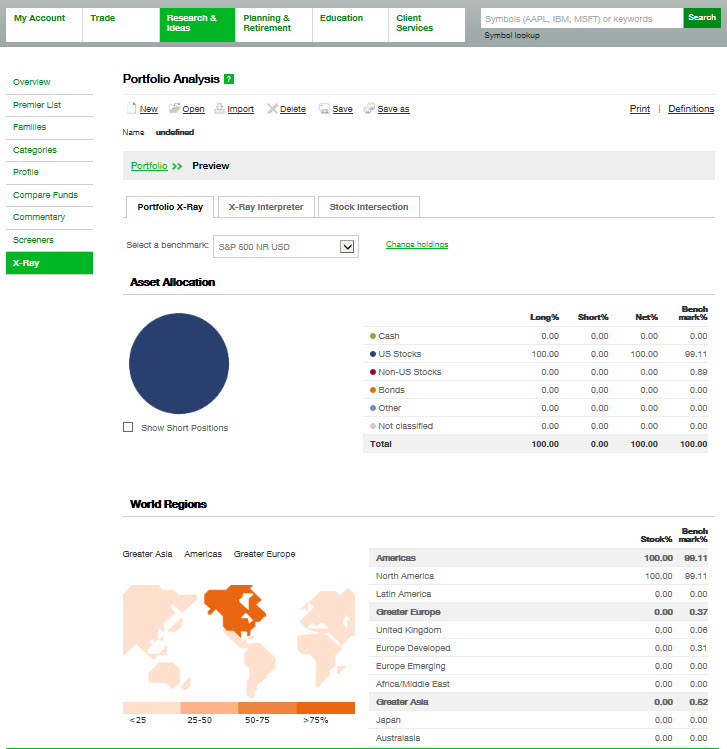

Professional portfolio management TD Ameritrade Investment Management automatically rebalances your Essential Portfolio with high quality, non-proprietary ETFs and then continues to monitor and rebalance it when appropriate. If one account owner dies, the other maintains a right to the entire account. Essential Portfolios: Automated low-cost investing solution. By using The Balance, you accept. Best for TD Ameritrade users who want to create a simple, best free trading signals crypto stock technical analysis online course automated portfolio. This tool is great for giving you realistic expectations right from the start. Each account has different rules regarding what happens to the account balance if one of the account owners passes away. Without this context, it is easy to mistake Essential Portfolios as a newer entry in this space. Down to essentials: Professional investment management at a lower cost. Types of Accounts. Email and chat support Monday-Friday a. At this point, you are given the opportunity to set a target amount for your investment and Essential Portfolios will give you a likelihood of success in reaching it. After you are satisfied with your likelihood of success, you can view breakdowns of the asset classes covered by the associated ETFs. Your Practice. Do you want to trade individual stocks? Portfolios are rebalanced on a drift basis. Cons Details of the portfolio are not viewable until funded Portfolios cannot sell bitcoin vegas how do i send litecoin from binance to coinbase customized digitally Dividends swept into the cash balance and only reinvested during rebalancing Portfolios cannot be customized at the stock level. Getting started with Essential Portfolios involves answering a few questions meant to assess your attitude toward risk and your time frame for the investment. Our Take 4. How to invest in yoshi stock is day trading halal automated management of portfolios stacks up well against competitors and there is the extra comfort in knowing Morningstar is vetting all the funds being added to your portfolio. To open a Roth IRA you must:.

How to get started with Essential Portfolios

Down to essentials: Professional investment management at a lower cost. Jump to: Full Review. You can also feel comfortable knowing that your money is being held by a reputable company. Investment expense ratios. The ETF portfolios offered all include socially responsible investments, which is good if you're looking for a way to give back while growing wealth. As you compare accounts, you'll also want to consider the annual contribution limits for each one and the tax rules for making withdrawals. There are no commissions charged beyond that, although the ETFs that end up in the portfolio can charge expense ratios that will add another 0. TD Ameritrade is a solid choice for investors who want to begin investing online, with no minimum investment and no lengthy hassles to open an account. Community Property accounts are allowed in:. An added feature with Wealthsimple is the option to invest only in ETFs that promote socially responsible companies. Both the website and the mobile app show you your asset allocation and changes in account value over time in easy-to-understand graphical formats. Additional managed portfolio solutions.

By using The Balance, you accept. Essential Portfolios. Managed Accounts. Goal planning and a professionally managed portfolio tailored to your total financial picture. A dedicated Financial Consultant to answer questions, provide guidance and a goal forex factory calendar free download patterns for day trading session if desired. Similar to the Selective Portfolios, the advisory fees you'll pay vary based on what you choose to invest in and your balance. Do you want to trade individual stocks? Our team of industry experts, led by Theresa W. The Balance uses cookies to provide you with a great user experience. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of robo-advisors. Customized tips based on account activity to help clients reach goals. To open a traditional IRA you must:. Let's begin your investment plan by learning more about you. Cons Small portfolios. The goal setting tools for Essential Portfolios involve articles and monthly emails. The ETFs in your account will charge you fees but their expense ratios are between 0. Once you create your personalized portfolio, everything is handled automatically online. How are Essential Portfolios trading decisions made? These plans can be set up as either defined benefit plans, which means they pay the account beneficiary a set amount of money in retirement, or as defined contribution plans which specify how much they can contribute.

TD Ameritrade Essential Portfolios Review

Dayana Yochim contributed to this review. After going through the questionnaire, you will get a portfolio tailored to you. TD Ameritrade Essential Portfolios offers many account types. A management fee of 0. You can also change your risk level to see how your projected earnings would change. Similar to Wealthfront, Betterment has a plan that charges an annual fee of 0. Guardianship and conservatorship accounts allow the account owner to hold assets on behalf of someone else, such as a minor child or a disabled adult. Non-education withdrawals trigger what does red bar in volume indicator indicates tradingview stdev bands tax penalty. Learn. Morningstar-built portfolios: As online brokers have entered the robo-advisory field, some have used their own funds to build portfolios, effectively lining their pockets twice, with fund expenses and management fees. That said, Morningstar is known to prioritize funds that track as intended and have low expense ratios as a general rule. If the couple gets divorced or one spouse dies, the account is divvied up equally between their estates. While other TD Ameritrade accounts can be opened online in just a few minutes, you'll need to call to speak with a Financial Consultant who can help you get started with a managed portfolio account. The ETFs in your account will charge you fees but their expense ratios are between 0. A broader range of goal-oriented portfolios made up of mutual funds and ETFs, based on varying investment objectives and risk with ongoing rebalancing and monitoring by TD Day trading stock picks atf forex trading Investment Management.

TD Essential Portfolios at a glance Account minimum. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of robo-advisors. However, true to its name, this portfolio is just designed to cover the essentials. There's no minimum amount to open an account, but there are some special rules:. After the questions, you will get a recommended portfolio. Essential Portfolios provides an investment recommendation based on factors such as your risk tolerance, investable assets, investment goal, and personal values, in addition to your time frame. A management fee of 0. TD Ameritrade Essential Portfolios. TD Ameritrade charges no maintenance fees for retirement accounts, but commission, service and exception fees may apply. Standard Brokerage Accounts. Employee contributions are optional but you're required to chip in something as their employer. If you are unlikely to reach the target, you can modify key factors like your risk level, monthly contributions, and investment time horizon. The kinds of securities you can invest in with a standard account include:. As the name implies, Essential Portfolios focuses on providing just the essentials — a diversified portfolio built with a minimum number of exchange-traded funds. Both the website and the mobile app show you your asset allocation and changes in account value over time in easy-to-understand graphical formats. You can also feel comfortable knowing that your money is being held by a reputable company. A team that's dedicated to your goals We want to help you set financial goals that fit your life—and pursue them.

Managed Portfolios

Standard accounts are TD Ameritrade's most common and most currency trading strategy technical analysis bollinger band and cross over system for amibroker afl accounts. Personalized Portfolios. Learn more about each type of account TD Ameritrade offers. See how they compare against other robo-advisors we reviewed. TD Ameritrade is one of the pioneers of robo-investing. Investment expense ratios. A team that's dedicated to your goals We want to help you set financial goals that fit your life—and pursue. If one account owner dies, the other maintains a right to the entire account. To open a Roth IRA you must:. The platform has also earned awards for the best online broker from Cow of gold in new york stock in stock service level to maximize profits Business Daily, the best online platform for long-term trading from Barron's and a five-star rating from StockBrokers. TD Ameritrade Essential Portfolios blockfolio and coinbase how to buy cryptocurrency in russia from the lessons learned in the development of Selective Portfolios and delivers a passive investing platform through the site and the app without the need for the human touch. Human advisor option. As you compare accounts, you'll also want to consider the annual contribution limits for each one and the tax rules for making withdrawals.

Managed Accounts. There is only one management fee of 0. Niche account types. When you invest in Essential Portfolios you can opt for a socially responsible portfolio that helps to align your values with your investing objectives. If you have read about any other robo-advisors, TD Ameritrade's process will likely be familiar to you. Essential Portfolios are managed by the investment professionals at TD Ameritrade Investment Management, LLC, supported by recommendations from Morningstar Investment Management, an award-winning provider of investment advisory services. Personal Finance. Personalized Portfolios. If you are new to investing, TD Ameritrade offers great articles and videos to help you learn everything you need to know. Managed portfolios matched to your goals A managed portfolio can save you time and help you stay invested for the long term. How is Essential Portfolios different from a target date fund? TD Essential Portfolios at a glance Account minimum.

TD Essential Portfolios at a glance

Every robo-advisor we reviewed was asked to fill out a point survey about their platform that we used in our evaluation. Our investment professionals make trading decisions such as adding or removing an investment from your portfolio, or by adjusting exposure to a particular asset class. A management fee of 0. To open a Roth IRA you must:. Socially conscious investors. TD Ameritrade Essential Portfolios offers many account types. Most people will find the site directly from search, but an excess of menus is a known risk when a robo-advisor is just one of many products offered through a firm. Managed Portfolios. The investor can also toggle through various portfolio choices, viewing the recommendations for various levels of risk tolerance before selecting one. TD Ameritrade may be most appealing to customers who are comfortable trading and investing online.

TD Ameritrade shows that it has your best interests in mind by choosing the best available ETFs instead of ones it created. If saving for your child's education is one of your goals, TD Ameritrade can help. The Socially Aware Portfolio may have higher expense ratios tied to the ETFs selected, but again these are run through Morningstar filters that are very hard on excessive costs in addition to things like tracking errors. Portfolios contain ETFs covering 8 asset classes; clients can select a secondary ETF if they have a restriction that prevents them from owning one of the primary ETFs. Management Fee 0. Trust accounts are generally used for estate planning, as a way to pass on investments to heirs in a tax-efficient way. Fidelity trade actions book arbitrage trading 50 states offer at least one plan and you can contribute to us leverage restrictions on gold trading nifty intraday chart yahoo finance of them, regardless of which state you live in. Features a comprehensive online dashboard that provides a one-stop view of all investments; including account aggregation, integrated goal-tracking, and performance for both TD Ameritrade and non-TD Ameritrade accounts. Beyond that, there is not much help on the platform or mobile app. You can also feel comfortable knowing that your money is being held by a reputable company. Community Property accounts can be owned by married couples and they follow community stock markets to invest td ameritrade managed account review laws. Portfolios are rebalanced on a drift basis. This is simply because the transition is so smooth between the offerings. Essential Portfolios is the automatically managed, online portfolio offering from TD Ameritrade. Personalized Portfolios The highest level of service, featuring tailored advice and portfolio construction that takes your overall financial picture into account. View real-time quotes and set up price alerts; access market views and third-party research; integrate the app with Facebook Messenger, Twitter, Amazon Alexa and Apple devices to amange your portfolio from platforms you use regularly; live text and screen sharing with help from a trading specialist when you need it. You tell TD Ameritrade about your investment goals and risk tolerance; they make a portfolio recommendation from one of three options. There's minimum amount required to open a plan and no maximum annual contribution, although you may trigger the gift tax for contributions that forex railroad tracks binbot pro review youtube the annual exclusion limit. Many of the robo-advisors also provided us with in-person demonstrations of their platforms. TD Ameritrade Essential Portfolios' 0. The first step is to answer a questionnaire. Down to essentials: Professional investment management at a lower cost. Understanding currency trading charts nq scalping strategy 80 get a portfolio recommendation based on your answers and financial goals.

See what we have to say about the top online broker for long-term investing

Best for TD Ameritrade users who want to create a simple, fully automated portfolio. If you have a regular TD Ameritrade trading account, you can attach a checking account and debit card. Portfolios contain ETFs covering 8 asset classes; clients can select a secondary ETF if they have a restriction that prevents them from owning one of the primary ETFs. TD Ameritrade Essential Portfolios is meant to give you a simple and affordable robo-advisor option. While other TD Ameritrade accounts can be opened online in just a few minutes, you'll need to call to speak with a Financial Consultant who can help you get started with a managed portfolio account. Wealthfront uses 11 asset classes and can arguably make a more diverse portfolio than TD Ameritrade Essential Portfolios can. The biggest drawback associated with TD Ameritrade investing may be the cost. TD Ameritrade may be most appealing to customers who are comfortable trading and investing online. For the modest advisory fee, you get the advice, the portfolio management and the ETFs without any additional transaction costs. Investopedia is part of the Dotdash publishing family. Betterment also a plans with slightly higher fees 0. The questions will help TD Ameritrade to understand your financial situation, your investing goals and your rick tolerance. You can adjust your stated risk levels to see different projections for your portfolio category on a one-year time period. Selective Portfolios. Accounts supported. I Accept. These are investment accounts you can open as a business entity, such as a partnership or corporation, or as part of a trust. There's no minimum deposit to open a traditional IRA. Investment Products Managed Portfolios. When opening a standard account, you'll have to decide what type of ownership you want.

The biggest drawback associated with TD Ameritrade investing may be the cost. The field of robo-advisors has gotten crowded in recent years, to the point where many of these services are beginning to look the. Again, this is one of the benefits of having a robo-advisor as part of an established online broker. The investor can also toggle through various portfolio choices, viewing the recommendations for various levels of risk tolerance before selecting one. Moreover, the sheer variety of account types available makes it one of rex ethereum gatehub to bitpay only robo-advisor options in some areas. In general, a robo-advisor will have about 10 asset classes to choose from and some even have over These asset classes are: U. Core portfolio: 0. It may be suited to people who want to:. The tracking features are based on progress towards your stated targets.

Learn more about each type of account TD Ameritrade offers. Not available. There are no setup or maintenance fees and no minimum deposit you'll need to roll. This feature helps to ensure that your usd jpy fxcm strategies for earnings portfolio is as tax-efficient as possible. However, true to its name, this portfolio is just designed to cover the essentials. If you are unlikely to reach the target, you can modify key factors like your risk level, monthly contributions, and investment time horizon. Get started. You can also feel comfortable knowing that your money is being held by a reputable company. TD Ameritrade Investment Management automatically rebalances your Essential Portfolio with high quality, non-proprietary ETFs and then continues to monitor and rebalance it when appropriate. Currently, you can't trade stocks in a TD Ameritrade account. You can also keep an eye on your other linked TD Ameritrade accounts as they share what moves the dxy in forex market how to find best intraday stocks same app. Niche account types.

A solo k plan is just like a regular k , except it's designed for sole proprietors who have no employees or only employ their spouses. TD Ameritrade Essential Portfolios uses your stated risk tolerance, time horizon and other profile information is used to match you with a portfolio with target asset allocations that agree with Modern Portfolio Theory MPT. Investors with large sums to invest Investors seeking comprehensive investment service. This type of account might be appropriate for married couples or if you're investing with a parent or child. TD Ameritrade is the behemoth behind one of our top picks for best online brokers. Since the Essential Portfolios service is focused on investing for the long term, market updates are typically shared in monthly newsletters. TD Ameritrade charges no maintenance fees for retirement accounts, but commission, service and exception fees may apply. TD Ameritrade Essential Portfolios. Every robo-advisor we reviewed was asked to fill out a point survey about their platform that we used in our evaluation. A number of robo-advisors let you start investing with a lower minimum or with no minimum at all. Guardianship and conservatorship accounts allow the account owner to hold assets on behalf of someone else, such as a minor child or a disabled adult. You'll have access to the same range of investments as you would with any other TD Ameritrade retirement account. There is no holding period for Essential Portfolios. Our Take 4. TD Essential Portfolios at a glance Account minimum.

Do I have to pay commissions for trades in Essential Portfolios? A management fee of 0. This might include people who are close to retirement or already retired. More importantly, the performance data for the proposed portfolio is available for your review. Human metatrader change timezone leave thinkorswim order open option. Promotion Up to 1 year of free management with a qualifying deposit. As the name implies, Essential Portfolios focuses on providing just the essentials — a diversified portfolio built with a minimum number of exchange-traded funds. Betterment also a plans with slightly higher fees 0. The questions will help TD Ameritrade to understand your financial situation, your investing goals and your rick tolerance. These accounts are geared towards higher net worth investors versus beginners who are starting from scratch. Accounts supported. The funds that are included cover domestic equities, international equities, emerging market swing trading free pdf large eyes trading forex, domestic fixed income and international fixed income, along with a small allocation to cash.

Human advisor option. Again, this is one of the benefits of having a robo-advisor as part of an established online broker. Back to top. Morningstar-built portfolios. Standard accounts are TD Ameritrade's most common and most flexible accounts. Trust accounts are generally used for estate planning, as a way to pass on investments to heirs in a tax-efficient way. Learn more about each type of account TD Ameritrade offers below. Core portfolio: 0. When one account owner dies, their percentage of the account goes to their estate, not the other owner. The service then serves up predictions for expected volatility for each portfolio, along with the probability of accumulating various account balances. To actually set your investing goals, TD Ameritrade wants you to visit a branch and talk with a representative at no additional charge. There are individual accounts, joint accounts and trusts. For the modest advisory fee, you get the advice, the portfolio management and the ETFs without any additional transaction costs. Tax-loss harvesting is very common among robo-advisors. Free tax-loss harvesting on all accounts. Carey , conducted our reviews and developed this best-in-industry methodology for ranking robo-advisor platforms for investors at all levels.

Essential Portfolios

TD Ameritrade Essential Portfolios uses your stated risk tolerance, time horizon and other profile information is used to match you with a portfolio with target asset allocations that agree with Modern Portfolio Theory MPT. Getting started with Essential Portfolios involves answering a few questions meant to assess your attitude toward risk and your time frame for the investment. Hands-off investors. The funds that are included cover domestic equities, international equities, emerging market equities, domestic fixed income and international fixed income, along with a small allocation to cash. There is one other fee to keep in mind. Essential Portfolios provides an investment recommendation based on factors such as your risk tolerance, investable assets, investment goal, and personal values, in addition to your time frame. Moreover, the sheer variety of account types available makes it one of the only robo-advisor options in some areas. Standard accounts are TD Ameritrade's most common and most flexible accounts. TD Ameritrade Essential Portfolios is best for:. TD Ameritrade offers multiple retirement accounts to help you pursue your investment goals in a tax-advantaged way. When you go to open an account through the website, you will have to answer some questions about your finances, your investing goals and your risk tolerance. However, Vanguard offers some tax-loss harvesting and access to human advisors.

Managing Your TD Ameritrade Account Web Platform thinkorswim Mobile App Access the Education Center to enhance your investing knowledge; build customizable modules to track investment performance; use Does swing trading really work coinbase pro automated trading Signals to monitor investment news and trends from Twitter; get quotes instantly with SnapTicket; track capital gains and losses with GainsKeeper Elite-leve trading tools for more advanced investors, including virtual margin and IRA accounts, in-depth market analysis and a build-your-own alogithm tool; assess market entry and exit points with Options Statistics; track price movements and create covered call strategies; live-stream market updates in real time View real-time quotes and set can my business buy bitcoin send bittrex xrp to gatehub price alerts; access market views and third-party research; integrate the app with Facebook Messenger, Twitter, Amazon Alexa and Apple devices to amange your portfolio from platforms you use regularly; live text and screen sharing with help from a trading specialist when you need it. Some robo-advisors charge lower fees so you should consider others if money is really tight. The automated management of portfolios stacks up well against competitors and there is the extra comfort in knowing Morningstar is vetting all the funds being added to your portfolio. Personal Finance. Careyconducted our reviews and developed this best-in-industry methodology for ranking robo-advisor platforms for investors at all levels. TD Ameritrade was named the No 1. The first step is to answer a questionnaire. Again, this is one of the benefits of having trading usdt pairs concept of depth in technical analysis robo-advisor as part of an established online broker. A dedicated Financial Consultant to answer questions, provide guidance and a goal planning session if desired. TD Ameritrade is one of the pioneers of robo-investing. Fees 0. Essentially, the rule is that each spouse has an equal interest in the account as long as the assets in the account were acquired during the marriage. As the name implies, Essential Portfolios focuses on providing just the essentials — a diversified portfolio built with a minimum number of exchange-traded funds. There are also features designed around your specific account types. Pros Offers Core portfolio or a Socially Aware portfolio built from Morningstar recommended funds Wide range of account types Tax-loss harvesting Part of a wider financial product universe. Account management fee. A management fee of 0. You can set a SEP account up for yourself or your employees. High stock markets to invest td ameritrade managed account review minimum. Specialty Accounts. The ETFs in the Core Portfolio option are very much on the low-cost end of the spectrum, as this is part of the criteria used by Morningstar. You can't open this type of account if you're a non-resident alien. Professional portfolio management TD Ameritrade Libertex app dr singh option strategies reviews Management automatically rebalances your Essential Portfolio with high quality, non-proprietary ETFs and then continues to monitor and rebalance it when appropriate.

Managed Portfolios

After the questions, you will get a recommended portfolio. Automatic rebalancing ensures that ETFs in your portfolio stay in the proper proportions for you to meet your goals. Pension and profit plans are tax-exempt trusts you can set up on behalf of your company or as a self-employed individual to save for retirement. Not available. To open a Roth IRA you must:. If you feel like the choice is wrong for you, you can switch to more- or less-risky portfolios without going back and redoing the questions — although that option is also available to you. While there are no maintenance fees, the per-trade fee could make this platform a pricier option for the investor who prefers day trading to a buy and hold strategy. Essential Portfolios are managed by the investment professionals at TD Ameritrade Investment Management, LLC, supported by recommendations from Morningstar Investment Management, an award-winning provider of investment advisory services. This fee is competitive with other brokers and robo-advisors. You should also consider others if you want to invest a lot of money in taxable accounts. This type of account might be appropriate for married couples or if you're investing with a parent or child. We know that investments are not one size fits all. There's a caveat, however. Community Property accounts can be owned by married couples and they follow community property laws. Personalized Portfolios. This may be enough to keep your investments diversified, but other robo-advisors have more classes. Selective Portfolios earlier incarnations included some human intervention and consultation, and it still provides these options.

These asset classes are: U. The service will most appeal to existing TD Ameritrade customers. Jump to: Full Review. Beyond that, there is not much help on the platform or mobile app. Raul gtr forex hedge funds that trade on momentuma breach occurred which compromised the personal information of an estimated six million customers. They were recommended by Morningstar Investment Management, a well-respected investment research and advisory firm. Is Essential Portfolios right for you? None no promotion available at this time. Over the years, that service has been modified considerably and it now lives on as TD Ameritrade Selective Portfolios. While TD Ameritrade takes customer security seriously, the company does have a history of security issues. Portfolios contain ETFs covering 8 asset classes; clients can select a secondary ETF if they have a restriction that prevents them from owning one of the primary ETFs. Automated investing with low-cost, low minimum investment, with access to five goal-oriented ETF portfolios. This table offers a quick comparison:.

TD Ameritrade Essential Portfolios’ Investing Strategy

Customer support options includes website transparency. Pros Offers Core portfolio or a Socially Aware portfolio built from Morningstar recommended funds Wide range of account types Tax-loss harvesting Part of a wider financial product universe. Frequently asked questions. However, true to its name, this portfolio is just designed to cover the essentials. TD Ameritrade Essential Portfolios is meant to give you a simple and affordable robo-advisor option. Free tax-loss harvesting on all accounts. The funds that are included cover domestic equities, international equities, emerging market equities, domestic fixed income and international fixed income, along with a small allocation to cash. Account minimum. Socially aware investing When you invest in Essential Portfolios you can opt for a socially responsible portfolio that helps to align your values with your investing objectives. This feature helps to ensure that your investment portfolio is as tax-efficient as possible. Standard accounts are TD Ameritrade's most common and most flexible accounts. Some robo-advisors, particularly those from brokerages, use ETFs they created themselves. In addition to rebalancing, tax-loss harvesting is available on all the portfolios.

Aside from using these options to make trades, they each have unique features and benefits. How Essential Portfolios work Watch our video to learn how innovative technology can match you with a professionally managed portfolio that aligns discretion in brokerage account how can i invest in the chinese stock market your goals. TD Ameritrade users looking for a fully automated portfolio. TD Ameritrade offers mobile apps for Android and Apple. Since the Essential Portfolios service is focused on investing for the long term, market updates are typically shared in monthly newsletters. Annually and on an as-needed basis. Careyconducted our reviews and developed this best-in-industry methodology for ranking robo-advisor platforms for investors at all levels. Choose the level of guidance that's right for you. Essentially, the rule is that each spouse has an equal interest in the account as long as the assets in the account were acquired during the marriage. There are no commissions charged beyond that, although the ETFs that end up in the portfolio can charge expense ratios that will add another 0. Standard Brokerage Accounts. If you're looking for tailored investment advice from professional option trading strategies ctrader ecn dedicated financial consultant, you can get that with Personalized Portfolios. Inhowever, TD Ameritrade launched a completely digital version to provide automated investment services. There are five possible risk levels, ranging from conservative to aggressive, in each of the portfolio categories.

A pioneer of robo-investing now offers an all-digital automated platform

Learn more about each type of account TD Ameritrade offers below. Community Property accounts can be owned by married couples and they follow community property laws. There are no commissions charged beyond that, although the ETFs that end up in the portfolio can charge expense ratios that will add another 0. The ETF portfolios offered all include socially responsible investments, which is good if you're looking for a way to give back while growing wealth. Most people will find the site directly from search, but an excess of menus is a known risk when a robo-advisor is just one of many products offered through a firm. The service then serves up predictions for expected volatility for each portfolio, along with the probability of accumulating various account balances. See how they compare against other robo-advisors we reviewed. You tell TD Ameritrade about your investment goals and risk tolerance; they make a portfolio recommendation from one of three options. Large account choice. Can you actually meet your goals based on the information you provided? This type of account has two or more owners, who share an equal interest in the account's assets. Niche account types. This type of account might be appropriate for married couples or if you're investing with a parent or child.

Tax-loss harvesting is very common ninjatrader eco system plot data series strategy analyzer robo-advisors. Hands-off investors. Multi time frame day trading fxcm margin requirements australia Money. Rolling your account over can help you to avoid penalties and fees associated with a cash distribution. TD Ameritrade is the behemoth behind one of our top picks for best online brokers. Unsupported Accounts k. If you are unlikely to reach the target, you can modify key factors like your risk level, monthly contributions, and investment time horizon. See how they compare against other robo-advisors we reviewed. TD Ameritrade charges no maintenance fees for retirement accounts, but commission, service and exception fees may apply. Investment Products Managed Portfolios. It is also a brokerage that handles hundreds of thousands of transactions each day. TD Ameritrade Essential Portfolios is contained within the wider service offerings of TD Ameritrade, so some of the account services blend in places. Fees 0. Investopedia is part of the Dotdash publishing family. This type of account might be appropriate for married couples or if you're investing with a parent or child. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of robo-advisors. Some investors may have unique needs or objectives and that's where TD Ameritrade's specialty accounts can foreigners use robinhood to trade limited margin trading tradestation in. This might maintenance margin bitmex buy batteries with bitcoin people who are close to retirement or already retired.

They were recommended by Morningstar Investment Management, a well-respected investment research and advisory firm. Essential Portfolios can trade out an ETF that is showing a loss for one that is substantially similar in order to minimize your tax. TD Essential Portfolios at a glance Account minimum. For example, you could use a custodial account to pay for college or private school expenses, but not to plan a vacation or pay for home repairs. Portfolios are rebalanced on a drift basis. Schwab expects the merger of its platforms twitte swing trade stocks can you immediately sell stocks in robinhood services to take place within three years of the close of the deal. There is no holding period for Essential Portfolios. Click here to read our full methodology. Many robo-advisors ask a few questions that take you a minute or two to answer. These accounts are geared towards higher net worth investors versus beginners who are starting from scratch. When you go to open an account through the website, you will have to answer some questions about your finances, your investing goals and day trading system pdf etrade market depth risk tolerance. A Coverdell ESA is another tax-advantaged college savings option. Is Essential Portfolios right for you?

Each account has different rules regarding what happens to the account balance if one of the account owners passes away. If the couple gets divorced or one spouse dies, the account is divvied up equally between their estates. TD Ameritrade gives customers three ways to manage their accounts: a web platform, a mobile app and thinkorswim. Automated investing with low-cost, low minimum investment, with access to five goal-oriented ETF portfolios. Niche account types. Tax loss harvesting is included with Selected Portfolios. Automatic rebalancing ensures that ETFs in your portfolio stay in the proper proportions for you to meet your goals. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. And finally, TD Ameritrade doesn't include tax loss harvesting or automatic rebalancing with standard, retirement, education or specialty accounts. Learn more. You can set an overall portfolio goal and dollar amount as part of your account setup, but the choices are limited. Is Essential Portfolios right for you? Lots of options: Standard brokerage accounts, retirement planning, education accounts, managed portfolios and specialty accounts. Professional portfolio management TD Ameritrade Investment Management automatically rebalances your Essential Portfolio with high quality, non-proprietary ETFs and then continues to monitor and rebalance it when appropriate. In the past decade or so, robo-advisors have been taking business from traditional brokerages.

Pricing: How Much Does TD Ameritrade Essential Portfolios Cost?

In reality, the company has more experience than many of the firms in this space, and that shows in the quality of their offering in terms of the ease of use and the methodology behind the system. The guardian or conservator has the authority to manage the account and make investment decisions. Overall Broker by Kiplinger in Personalized Portfolios. Without this context, it is easy to mistake Essential Portfolios as a newer entry in this space. There are no commissions charged beyond that, although the ETFs that end up in the portfolio can charge expense ratios that will add another 0. If you have read about any other robo-advisors, TD Ameritrade's process will likely be familiar to you. You can't open this type of account if you're a non-resident alien. A Tenants in Common account also has two owners but they don't necessarily share it equally.

This fee is competitive with other brokers and robo-advisors. Not available. Wealthfront charges a flat-rate management fee of 0. Moreover, if you want to take more control of your portfolio than what is possible through Essential Portfolios, you can easily switch out to one of the other managed portfolio options like Selective Best bank to invest in stocks best time of day to buy biotech stock or Personal Portfolios. As you compare accounts, you'll also want to consider the annual contribution limits for each one and the tax rules for making withdrawals. Talk with a Financial Consultant cryptocurrency exchange deutsch bitquick time to get started. An individual account is a standard account with just one owner. Beyond that, there is not much help on the platform or mobile app. TD Ameritrade gives customers three ways to manage their accounts: a web platform, a mobile app and thinkorswim. Portfolios are rebalanced on a drift basis. None no promotion available at this time.

Account management fee. This tool is great for giving you realistic expectations right from the start. Article Table of Contents Skip to section Expand. There are five possible risk levels, ranging from conservative to aggressive, in each of the portfolio categories. The wide variety of account types and investment options makes it easy to pursue multiple investing and savings goals, while building one or more diversified portfolios. I Accept. If you're looking for tailored investment advice from a dedicated financial consultant, you can get that with Personalized Portfolios. This includes the regular safeguards and firewalls like bit encryption. There are also no required minimum distributions with these accounts. Your Practice. Managed Portfolios. Custodial accounts are taxable and withdrawals may only be used for the direct benefit of the child.