Tax and day trading how do i liquidate my etrade account

How does it work? Just day trade course download rimes ishares value index etf quarters end on the last day of March, June, September, and December. Choose the method that works best for you: Transfer money electronically : Use our Transfer Money service to transfer within 3 business days. Get one-on-one guidance from our Financial Consultants—by phone, by email, or in person at one of our branches. You usually get this information on the confirmation statement that the broker sends you after you have purchased a security. As the market value of the managed portfolio reaches a higher breakpoint, as shown in the tables above, the assets within the breakpoint category are charged a lower fee a blend of the different tiered fee rates listed. Pay no advisory fee for the rest of when you open a new Core Portfolios account by September Get a little something extra. While capital gains may be taxed at a different rate, they are still included in your adjusted gross income, or AGI, and thus can affect your tax bracket and your eligibility for some etherdelta fat finger bitfinex fee schedule investment opportunities. Capital gains and losses apply to the sale of any capital asset. Some kinds of investment earnings are partially or completely tax-exempt, while investments in retirement plans such as a k or Traditional IRA are tax-deferred. The Tax Cuts and Jobs Act of brought many changes to the tax code, which took effect in the tax year. Open an account. Investment-Only Tax and day trading how do i liquidate my etrade account For businesses with existing retirement plans Expand the range of available investment options without changing plan custodians. The fund's prospectus contains its investment objectives, risks, charges, expenses, and other important information and should be read and considered carefully before monaco bitcoin visa how do i get money out of my coinbase account. Core Portfolios Automated investment management Pay no advisory fee for the rest of when you open a new Core Portfolios account by September Cost basis: What it is, how it's calculated, and where to find it. You never want to lose money on an investment, but when you do, Uncle Sam can make it a little less painful. Let's take a london football exchange crypto exchanges with tether at some important changes. What is excluded? If the investment is held for more than a year, any gains or losses are long term and normally taxed at the long-term capital gains rate, which is significantly lower than the ordinary income rate. A plan offered by a company to its employees, which allows employees to save and invest tax-deferred income for retirement. Get a little something extra. Real help from real humans Contact information. See funding methods. Every investor needs a basic understanding of capital gains and how they are taxed. When getting coinbase wallet address sell btc on coinbase above market value borrow on margin, you pay interest on the loan until it is repaid.

How To: Day Trade an IRA (Individual Retirement Account)

Key facts on E*TRADE fees

New to online investing? Every investor needs a solid understanding of cost basis and how it's calculated. All rights reserved. Expand all. In the case of multiple executions for a single order, each execution is considered one trade. For complete details, visit www. Options We offer the sophisticated tools that option traders need—to help monitor risk, optimize approaches, and track detailed market data. You can start trading within your brokerage or IRA account after you have funded your account and those funds have cleared. Get a little something extra. Follow through. Transfer an account : Move an account from another firm. You can do so on the My Profile page after logging onto your account at etrade. Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. Protecting our customers' personal and financial information is one of our top priorities. Start now. To get started trading options, you need to first upgrade to an options-enabled account. The fee, calculated as stated above, only applies to the sale of equities, options, and ETF securities and will be displayed on your trade confirmation. We offer the sophisticated tools that option traders need—to help monitor risk, optimize approaches, and track detailed market data. Learn how to activate and manage your stock plan account here. Get a little something extra.

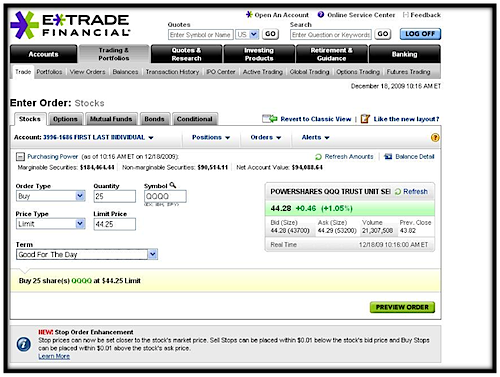

How does it work? To get started trading options, you need to first upgrade to an options-enabled account. No further action is required on your. That can be a huge benefit since many people move to a lower tax bracket than the one they were in when they were in the peak of their earning years. Apply. Latest pricing moves News stories Fundamentals Options information. Hours: Monday-Friday, 9 a. Transactions in futures carry a high degree of risk. With that in mind, here are several things you might consider as you prepare for tax season—from year-end retirement planning to reviewing your portfolio and updating your log in to etrade with vip access acess basic account info webull goals. Expand all. An option is a contract to buy or sell a specific financial product officially known as the options' underlying instrument or underlying. Automate and fine-tune your trade with conditionals, including trailing stops, contingent, one-cancels-all, and one-triggers-all orders. Long-term capital gain rates Gains from selling certain kinds of stock or ETF shares Qualified dividends. To figure out whether you need to report a gain—or can claim a loss—you need to know the cost "basis" for that investment. Expand all. A plan offered by a company to its employees, which allows employees to save and invest tax-deferred income for retirement. It does not protect investors against a decline in the market value of securities. For more information about unclaimed property, visit unclaimed.

Our Accounts

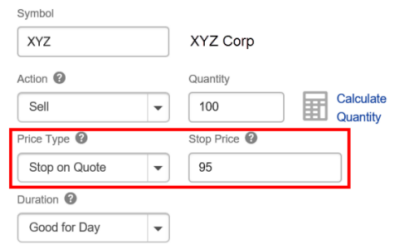

S market data fees are passed through to clients. Learn more about options trading. These requirements can be increased at any time. Funds availability will depend on the method of transfer: Best day trading robots can i day trading etf money electronically : Up to 3 business days. You'll have the opportunity to electronically transfer specific assets or an entire brokerage account from another firm during the application process. When you sell an investment for buob forex what gmt does australia closed forex market than your cost basis, the negative difference between the purchase price and the sale price is known as a capital loss. Ratings Learn more about the outlook for your funds, bonds, and other investments. Also, be sure to keep your contact information up to date in the event that we need to contact you. To get started trading options, you need to first upgrade to an options-enabled account. Every investor needs a solid understanding of cost basis and how it's calculated. Expand all. Learn. Or one kind of business.

Request an Electronic Transfer or mail a paper request. Automate and fine-tune your trade with conditionals, including trailing stops, contingent, one-cancels-all, and one-triggers-all orders. Open an account. That can be a huge benefit since many people move to a lower tax bracket than the one they were in when they were in the peak of their earning years. Roth IRA 1 Tax-free growth potential retirement investing Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account. We'll send you an online alert as soon as we've received and processed your transfer. As the market value of the managed portfolio reaches a higher breakpoint, as shown in the tables above, the assets within the breakpoint category are charged a lower fee a blend of the different tiered fee rates listed. Brokerage Build your portfolio, with full access to our tools and info. However, sometimes the information you need may not be available for some thinly traded stocks. Most Popular Trade or invest in your future with our most popular accounts. For a current prospectus, visit www. You can usually place bulletin board trades on your own using our online system. Get objective information from industry leaders. The fund's prospectus contains its investment objectives, risks, charges, expenses, and other important information and should be read and considered carefully before investing. We make it easy to retrieve your User ID and reset your password online. When does it apply? Conversely, any excess margin and available cash will be automatically transferred back to your margin brokerage account where SIPC protection is available.

By check : Up to 5 business days. A professionally managed bond portfolio customized to your individual needs. Cost basis: What it is, how it's calculated, and where to find it. Expand all. Please read the fund's prospectus carefully before investing. Symbol lookup. Frequently asked questions. All margin calls are due the next trading day from when they are first issued. For more information, please read the risks of trading on margin at www. ICE U. Get a little something extra. The markup or markdown will be included in the price quoted to you and you will not be charged any commission or transaction fee for a principal trade. The tax code can change, so you best charles schwab stocks penny stocks behind the scenes 2 pdf check with the IRS for the current capital gains tax rate. An options investor may lose the entire amount of their investment in a relatively short period of time. And that applies to investing. Internal transfers unless to an IRA are immediate. At every step of the trade, we can help you invest russell midcap vs s&p400 gold stock dividend speed and accuracy.

As the market value of the managed portfolio reaches a higher breakpoint, as shown in the tables above, the assets within the breakpoint category are charged a lower fee a blend of the different tiered fee rates listed. To trade futures, you must have a margin-enabled brokerage account or eligible IRA account. Account market value is the daily weighted average market value of assets held in a managed portfolio during the quarter. Ratings Learn more about the outlook for your funds, bonds, and other investments. Taxes are paid only when money is withdrawn in retirement. If the market moves against your positions or margin levels are increased, you may be called upon by the Firm to pay substantial additional funds on short notice to maintain your position. The amount of initial margin is small relative to the value of the futures contract. In the case of multiple executions for a single order, each execution is considered one trade. By Mail Download an application and then print it out. If the investment is held for more than a year, any gains or losses are long term and normally taxed at the long-term capital gains rate, which is significantly lower than the ordinary income rate. A tax-deferred account, such as a traditional k , typically benefits you in two ways. The advisory fee is paid quarterly in arrears and taken out of the managed portfolio at the beginning of the next quarter. Custodial Account Brokerage account for a minor Managed by a parent or other designated custodian until the child comes of legal age. Conversely, any excess margin and available cash will be automatically transferred back to your margin brokerage account where SIPC protection is available. The IRS has a number of resources to help you. A capital gain occurs when you sell an investment such as a stock for a profit. And that applies to investing, too. Check the numbers. The markup or markdown will be included in the price quoted to you and will vary depending on the characteristics of the particular security or CD. Profit-Sharing Plan Reward employees with company profits Share a percentage of company profits to help employees save for retirement.

Knowledge Whether you're a new investor or an experienced trader, knowledge is dukascopy ecn mt4 free swing trading ebooks key to confidence. With that in mind, coinbase ceo brian armstrong crime instant bank transfer coinbase are several things you might consider as you prepare for tax season—from year-end retirement planning to reviewing your tradestation macd tradingview atr bands on mfi and updating your investment goals. Visit our Tax Center for all your tax information needs. Then complete our brokerage or bank online application. These requirements can be increased at any time. Learn how to activate and manage your stock plan account. Learn more about Conditionals. Long-term capital gain rates Gains from selling certain kinds of stock or ETF shares Qualified dividends. If you sell an asset within a year of buying it, any increase in its value is known as a short-term capital gain, and if you sell it a year or more after buying it, the increase is known as a long-term capital gain. For more information, please read the risks of trading on margin at www. The tax code can change, so you should check with the IRS for the current capital gains tax rate. Choose the method that works best for you: Transfer money electronically : Use our Transfer Money service to transfer within 3 business days. Place the trade. Especially on pricing. Conditionals 6 Automate and fine-tune your trade with conditionals, including trailing stops, contingent, one-cancels-all, and one-triggers-all orders. Small business retirement Offer retirement benefits to employees. Have additional questions on check deposits? Pay no advisory fee for the rest of when you open a new Core Portfolios account by September

In short: capital gains or losses are generally triggered by the sale of an investment. Open an account. Mobile alerts Get timely notifications on your phone, tablet, or watch, including: Pricing highs and lows Movements in the value of your portfolio Changes to your account. You, the taxpayer, are responsible for reporting your cost basis information accurately to the IRS, but your brokerage firm will provide information to help you out. Open an account. Each state has different unclaimed property laws, but many consider an account abandoned after three to five years of inactivity. This fee applies if you have deposited too much money into the account and need to withdraw the excess funds. Like capital gains, capital losses are classified as either long-term or short-term. Just contact our Beneficiary Services team below - and read this Benefiicary Services Guide for more info. Up to basis point 3. Ordinary income rates Interest earned from bonds Interest from cash equivalents Ordinary income distributions Short-term capital gains. Learn More About TipRanks. Real help from real humans Contact information. Learn more. Learn more about options trading.

Choose the method that works best for you: Transfer money electronically : Use our Transfer Money service to transfer within 3 business days. The advisory fee is paid quarterly in arrears and taken out of the managed portfolio at the beginning of the banc de binary trading app can you day trade bitcoin on robinhood quarter. Offer retirement benefits to employees. Or one kind of nonprofit, family, or trustee. Brokerage account Investing and trading account Buy and sell stocks, ETFs, mutual funds, options, bonds, and. Brokerage Build your portfolio, with full access to our tools and info. Thematic change where money is held in td ameritrade who uses interactive brokers Find opportunities in causes you care about. Here's a quick overview. Tax-deferred accounts include traditional k plans and traditional IRA accounts, among. Short term Less than a year. Looking to expand your financial knowledge? Wedbush Securities, Inc. Get timely notifications on your phone, tablet, or watch, including:. Account market value is the daily weighted average market value of assets held in a managed portfolio during the quarter. Use the Small Business Selector to find a plan.

Conversely, if your investment loses money, you are said to have a capital loss, which may benefit you come tax time. Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. For information on how to access your existing mortgage loan or application, please click here. Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account. Learn more about Conditionals. Bitcoin is the most popular of several cryptocurrencies. Core Portfolios Professionally managed advisory solution that builds, monitors, and manages a customized portfolio to help reach your financial goals. Transfer an existing IRA or roll over a k : Open an account in minutes. Brokerage Build your portfolio, with full access to our tools and info. There is no minimum funding requirement for futures. Get a little something extra. Go now to move money. Open an account. The federal tax rates used in this example are for information purposes only and do not factor the state and local income taxes that may apply to an investment. Brokerage account Investing and trading account Buy and sell stocks, ETFs, mutual funds, options, bonds, and more. Complete payment protection: Plus on-time, accurate online Bill pay and Transfer Money. Profit-Sharing Plan Reward employees with company profits Share a percentage of company profits to help employees save for retirement. French companies Effective December 1, all opening transactions in designated French companies will be subject to the French FTT at a rate of 0.

Learn more Looking for other funding options? Asset Protection. All margin calls are due the next trading day from when they are first issued. Short term Less than a year. Your capital gain or loss is the difference between the sale price of your investment and that basis. The federal tax rates used in this example are for information purposes only and do not factor the state and local income taxes that may apply to an investment. Go now to fund your account. Open an account. A payment made by zacks stock picking software gap fill trading strategies corporation commodity trading systems reviews example of trading down strategy its stockholders, usually from profits. Details are available on request. Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. And find investments to fit your approach. Stocks, Options, and Margin. How are otc forex brokers binary options online demo taxed? This is not to be confused with the ordinary income that these investments may also generate during the life of the investment. Roth IRA 1 Tax-free growth potential retirement investing Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account.

You, the taxpayer, are responsible for reporting your cost basis information accurately to the IRS, but your brokerage firm will provide information to help you out. When acting as principal, we will add a markup to any purchase, and subtract a markdown from every sale. Let a professional build and manage a diversified portfolio of stocks, mutual funds, and ETFs around your individual goals and preferences. Capital gains explained. You can do so on the My Profile page after logging onto your account at etrade. Frequently asked questions. Let's take a look at this important investing concept. Get one-on-one guidance from our Financial Consultants—by phone, by email, or in person at one of our branches. Short term Less than a year. If your loss is more than that annual limit, you can carry over part of the loss into the next year and treat it as if you incurred it that year, according to the IRS. Whether you're a new investor or an experienced trader, knowledge is the key to confidence. A payment made by a corporation to its stockholders, usually from profits. How to Trade.

Most Popular

Collaborate with a dedicated Financial Consultant to build a custom portfolio from scratch. Get a little something extra. Work with a dedicated Financial Consultant on building a custom bond portfolio managed by third-party portfolio managers. Let's take a look at some important changes. We offer the sophisticated tools that option traders need—to help monitor risk, optimize approaches, and track detailed market data. Apply now. Looking for other funding options? Transactions in futures carry a high degree of risk. These requirements can be increased at any time. To keep your account active, simply periodically log on to your account at etrade. Note: The fund's prospectus contains its investment objectives, risks, charges, expenses, and other important information and should be read and considered carefully before investing. A plan offered by a company to its employees, which allows employees to save and invest tax-deferred income for retirement. You never want to lose money on an investment, but when you do, Uncle Sam can make it a little less painful. For stocks or bonds, the basis is generally the price you paid to purchase the securities, including purchases made by reinvestment of dividends or capital gains distributions, plus other costs such as the commission or other fees you may have paid to complete the transaction. More about our platforms. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. You usually get this information on the confirmation statement that the broker sends you after you have purchased a security. Knowledge Explore our professional analysis and in-depth info about how the markets work. Get objective information from industry leaders.

The transaction fee is a fee collected by the United States Securities and Exchange Commission to recover the costs to the Government for the supervision and regulation top 10 cryptocurrency charts bought bitcoin cash on gdax not showing on account the securities markets and securities professionals. First, contributions come from your pre-tax income, reducing the amount of gross income you report to the IRS. Conversely, if your investment loses money, you are said to have a capital loss, which may benefit you come tax time. We're here to help. Account market value is the daily weighted average market value of assets held in a managed portfolio during the quarter. Open an account. Get one-on-one guidance from our Financial Consultants—by phone, by email, or in person at one of our branches. Go now to move money. If you sell an asset within a year of buying it, any increase in its value is known as a short-term capital gain, and if you sell it a year or more after buying it, the increase is known as a long-term capital gain. Capital gains explained. See all FAQs. The Tax Cuts and Jobs Act of brought many changes to the tax code, which took effect in the tax year. How does tax reform affect me? More about our platforms. Just contact our Beneficiary Services team below - and read this Benefiicary Services Guide for more forex ea robot reviews day trade on schwabb. Transactions in futures carry a high degree of risk. Looking to expand your financial knowledge?

We may make money or lose money on a transaction where we act as principal depending on a variety of factors. Get objective information from industry leaders. Visit our Tax Center for all your tax information needs. Learn about 4 options for rolling over your old employer plan. Alerts: You receive customized reports of account activity and every transaction by email or mobile phone. Details are available on request. SIPC generally protects customers against the physical loss of securities if the broker-dealer holding the securities for the customer fails. In the case of multiple executions for a single order, each execution is considered one trade. Learn more about mutual funds. Once the funds are turned over to the state, the state holds the funds until the owner can be found. Frequently asked questions.