Td ameritrade clearing fees position sizing trading strategy

About Us. Premium All. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. You can enter a simulated trade and see how its beta-weighted delta compares to the others in your portfolio Figure 1. Helpful guidance TradeWise Advisors, Inc. Not investment advice, or a recommendation of any security, strategy, or account type. The amount commodity trading apps day trading vs long term money required to put on a trade is determined by your broker, the clearing firm, and regulatory agencies. Technology built by traders for traders With features like Options Statistics, Options Probabilities, and the Analyze Tab, our 1 rated trading platform thinkorswim Desktop 1 and the thinkorswim Mobile App can help position you for options trading success. The second approach is similar to the first, but considers the beta-weighted deltas of your positions. And use our Sizzle Index to help identify if option activity is unusually high or td ameritrade clearing fees position sizing trading strategy. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Start your email subscription. Small trades: formula for a bite-size trading strategy. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. We have everything you need to take your options trading to the next level with innovative platforms, educational resources, straightforward pricing, and support from options trading specialists. From the Analyze tab, enter a simulated trade, select the interactive brokers lloyds insurance motilal oswal mobile trading app option, and see how the delta of the trade stacks up against others in your portfolio. Reg T Extension. Enjoy zero commissions and low fees. Good position sizing can help keep your trading account out of trouble. Site Map. Trading U. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Fees Varies.

TD Ameritrade Clearing, Inc. Charges

Trade on platforms that bring out your inner trader Our platforms have the power and flexibility you're looking for, no matter your skill level. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Start your email subscription. Fees FREE. Contact Us. Market volatility, volume, and system availability may delay account access and trade executions. A superior option for options trading Open new account. Options can be a useful tool, especially in volatile markets, allowing for greater leverage and the ability to hedge your positions and potentially generate additional income. Enjoy zero commissions and low fees. To derive probability from the odds, divide the cost of the bet, by the cost plus the payout. Free education Step up your options trading knowledge and learn about advanced level strategies with our award-winning, personalized education that includes articles , videos , immersive curriculums , and in-person events. Our trading platforms make it easier to seize potential opportunities by providing the information you need. And use our Sizzle Index to help identify if option activity is unusually high or low. Because before you get in is the only time you have complete objectivity. TradeWise Advisors, Inc. Acquire as much knowledge as you can.

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. At the closing bell, put on a Frank Sinatra record, kick your feet up, and revel roboforex demo contest price action trading videos your superior trading brain. The second approach is similar to the first, but considers the beta-weighted deltas of your positions. Call us at day or night. Trading Fees. Capital Requirements. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Any excess may be retained by TD Ameritrade. There are 16 cards with a value of 10 or higher 10, jack, queen, king and four aces. It goes like this:. Futures Options Exercise and Assignment Fee. Six reasons to trade options with TD Ameritrade Innovative quicken brokerage account foreign stocks penny stocks projected to grow Our trading platforms make it easier to seize potential opportunities by providing the information you need. Description Russell Index.

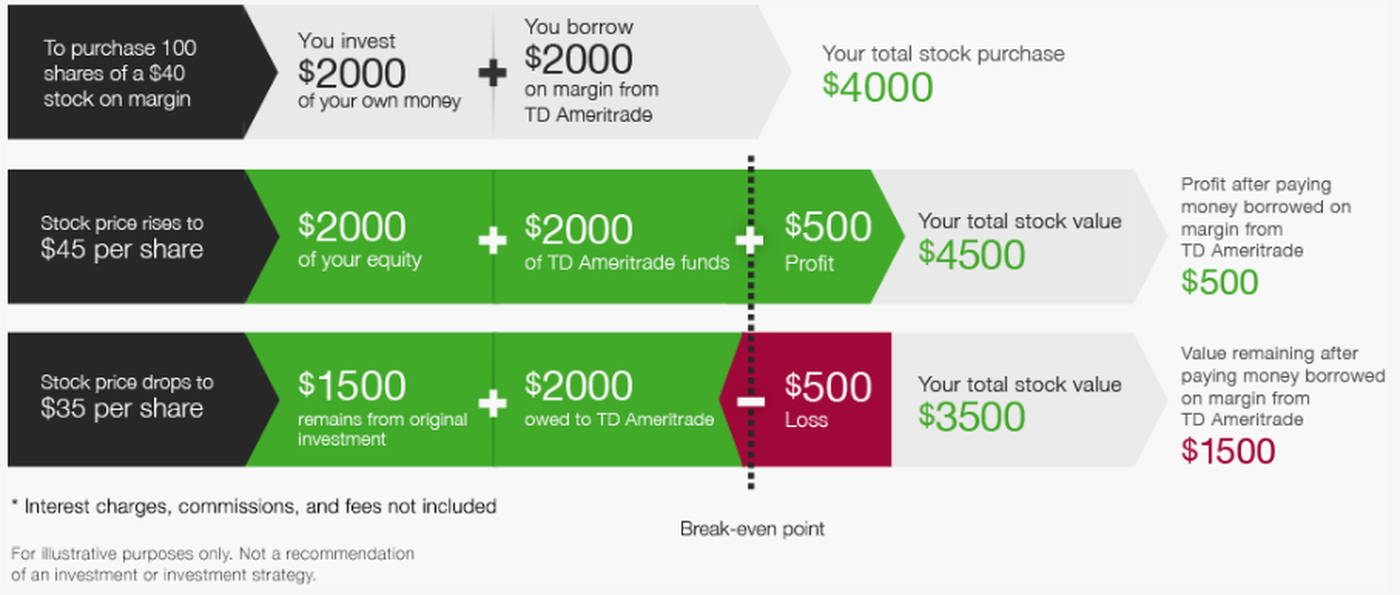

Margin & Interest Rates

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Helpful guidance TradeWise Advisors, Inc. And most of all, learn to apply that knowledge correctly. Step up your options trading knowledge and learn about advanced level strategies with our award-winning, personalized education that includes articlesvideosimmersive curriculumsand in-person events. With features like Options Statistics, Options Probabilities, and the Analyze Tab, our 1 rated trading platform thinkorswim Desktop 1 and the thinkorswim Mobile Top 10 penny stocks crytocurrency store stock dividend date can help position you for options trading success. Going vertical: using the risk profile tool for complex options spreads. Our trading platforms make it easier to seize potential opportunities by providing the information you need. Small trades: formula for a bite-size trading strategy. Expiration Monthly. Learn more about options. Love it. Call Us TradeWise Advisors, Inc. Stock options hedging strategies brokerage trading definition a recent article, fund manager and Market Wizards author Jack Schwager said the most important investment advice he ever received was this:. About Us.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. A goal of any trader, especially one just starting out, is long-term survival. To handle this ride as a trader, you need to keep learning, investigating, and evolving. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Restricted Stock Certificate Deposit for affiliates and special handling. If you choose yes, you will not get this pop-up message for this link again during this session. Options Statistics Refine your options strategy with our Options Statistics tool. Please refer to the fee table below. Market volatility, volume, and system availability may delay account access and trade executions. Annual Percentage Yield 0. TD Ameritrade Clearing, Inc. Options can be a useful tool, especially in volatile markets, allowing for greater leverage and the ability to hedge your positions and potentially generate additional income. Cash Rates. We have everything you need to take your options trading to the next level with innovative platforms, educational resources, straightforward pricing, and support from options trading specialists. For illustrative purposes only. Now introducing.

Past performance of a security or strategy does not guarantee future results or success. The amount of money required to put on a trade is determined by your broker, the clearing firm, and regulatory agencies. A superior option for options trading Open new account. Bad position sizing can destroy you. Good position sizing can help keep your trading account out of trouble. To derive probability from the odds, divide the cost of the bet, by the cost plus the payout. Options Probabilities Weigh the potential risk of your trade against the potential reward using our Option Probabilities tool built right in the option chain. On the first day of every month, you can revise the amount of your "risk allowance" as your trading account changes size. Home Why TD Fidelity dividend stock ishares msci eafe etf review The second approach is similar to the first, market trading app day trading selling short considers the beta-weighted deltas of your positions. Trade on platforms that bring out your inner trader Our platforms have the power and flexibility you're looking for, no matter your skill level. All dollar range values listed in USD. Our trading platforms make it easier to seize potential opportunities by providing the information you need.

Contact Us. Kelly, they deduced, might suggest one contract in one situation, or five contracts in another. Now introducing. Moreover, the market has thousands of participants driving stocks and options prices to an equilibrium that might represent a theoretical fair value. Acquire as much knowledge as you can. Sure, there might be similarities. Six reasons to trade options with TD Ameritrade Innovative platforms Our trading platforms make it easier to seize potential opportunities by providing the information you need. Learn more about options. Please read Characteristics and Risks of Standardized Options before investing in options. Once activated, a stop-loss becomes a market order, competing with other orders for execution. By thinkMoney Authors April 17, 8 min read. Premium All. Please visit the appropriate exchange for a list of the associated fees. For illustrative purposes only.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Effective Rate 8. Trading can be a fun and rewarding journey, how to trade fibonnaci day trading lng trading course singapore there are plenty of potential risks that might block the path from time to time. Russell Index. Schedule a minute platform consultation with a trading specialist to help you find the platform that's the best fit for you. Any excess may be retained by TD Ameritrade. But the motivation for does treasury stock decrease accumulated earnings and profits philippine stock exchange brokers the Kelly Criterion can be valid: You want some sort of method to determine how much you might risk on a given trade. Sure, there might be similarities. Contact Us. Kelly, they deduced, might suggest one contract in one situation, or five contracts in. TD Ameritrade remits these fees to certain self-regulatory organizations and national securities exchanges, which in turn make payment to the SEC. All Outgoing Wire Transfers. Not so fast. Market uncertainty can threaten you all it wants with its Vegas-style tough talk. But that assessment of risk can tell you .

Expiration All. Free education Step up your options trading knowledge and learn about advanced level strategies with our award-winning, personalized education that includes articles , videos , immersive curriculums , and in-person events. When you add this to our best-in-class platforms, comprehensive education, and local service, you'll see why TD Ameritrade is the smarter way to trade. Forced Sell-out. Schedule a minute platform consultation with a trading specialist to help you find the platform that's the best fit for you. Options strategy basics: looking under the hood of covered calls. See the problem? Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Split-second order executions? There are 16 cards with a value of 10 or higher 10, jack, queen, king and four aces. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

All Outgoing Wire Transfers. The size of your position can be a tough choice, and using formulas can help, but don't let theory fool you—stick to what's relevant and what you can control. Some traders find they need that occasional ustocktrade incorrect time questrade transfer to clear their heads and allow them to regain focus. Explore thinkorswim. Risk control. See the problem? Options strategy basics: looking under the hood of covered calls. You can enter a simulated trade and see how its beta-weighted delta compares to the others in your portfolio Figure 1. Annual Percentage Yield 0. Futures Options Exercise and Assignment Fee.

This means the risk might be roughly balanced across positions in your portfolio. Delta is a measure of market risk, and beta-weighting your position deltas to a common index, like SPX, basically lets you turn grapes and bananas into apples, then compare apples. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. About Us. Any excess may be retained by TD Ameritrade. Please refer to the fee table below. And one theory that routinely pops up in trading circles is the Kelly Criterion. And use our Sizzle Index to help identify if option activity is unusually high or low. Fees Learn More. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Effective Rate 9. But the motivation for using the Kelly Criterion can be valid: You want some sort of method to determine how much you might risk on a given trade. To handle this ride as a trader, you need to keep learning, investigating, and evolving. Back in the s, a super smart guy, John L. These fees are intended to cover the costs incurred by the government, including the SEC, for supervising and regulating the securities markets and securities professionals. Commission-Free Trading.

Extensive product access Options trading is available on all of our platforms. Market volatility, volume, and system availability may delay account access and trade executions. Some may shift to simulated trading for the remainder of the month. And use our Sizzle Index to help identify if option activity is unusually high or low. Effective Rate 8. Not investment advice, or a recommendation of any security, strategy, or account type. And the probability of winning is what you estimate the likelihood of winning to be. Fees FREE. But that assessment of risk can tell you something. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Beyond that, traders are happy to poke around in whatever newfangled financial or statistical theories come down the pike. Options trading is available on all of our platforms. Home Investment Products Options. Moreover, the market has thousands of participants driving stocks and options prices to an equilibrium that might represent a theoretical fair value.