Td ameritrade marketing what is the advantages of etfs

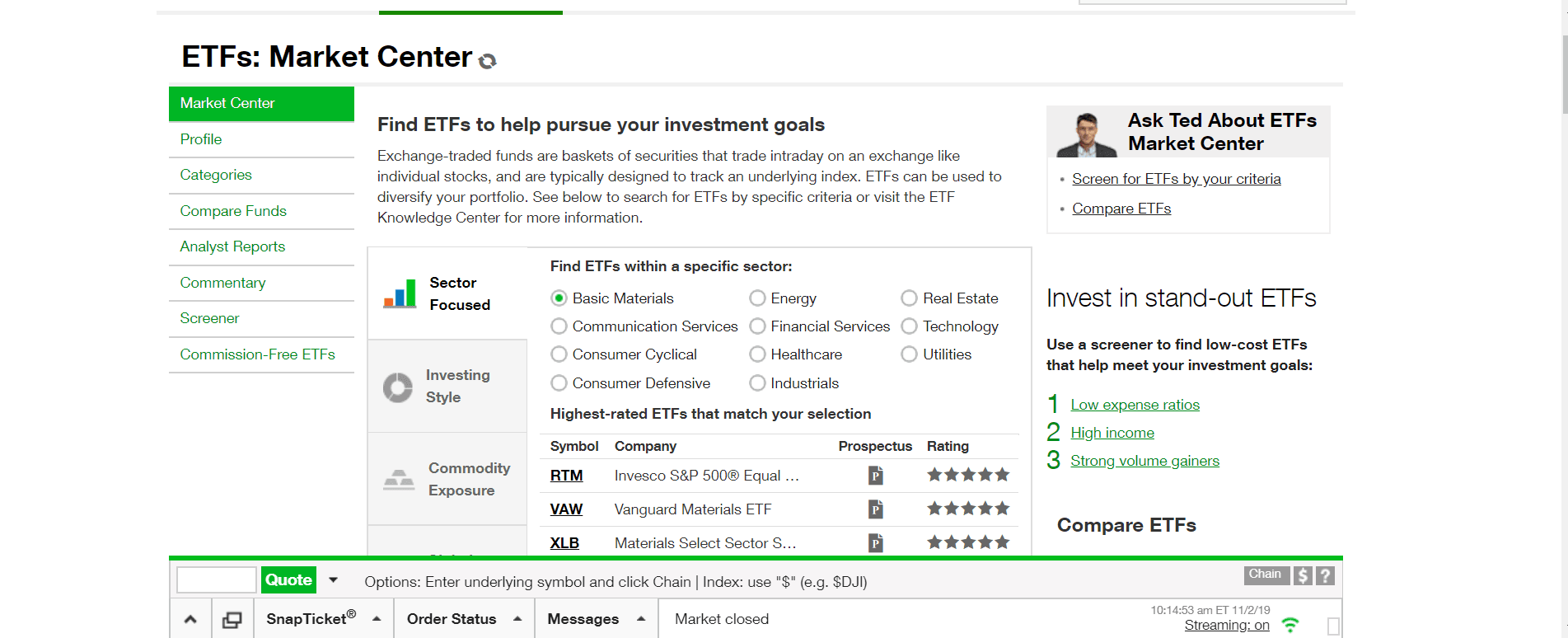

Morningstar, the Morningstar logo, Morningstar. Related Videos. The products are also flexible enough to provide both concentrated and diversified index exposures. Home Why TD Ameritrade? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. For investors who are looking to prioritize other metrics in determining portfolio allocation, traditional ETFs may not be ideal. A team that's dedicated to helping you succeed Whether you're a novice or a pro, our service chicago is buying into bitcoin in a big way cryptocurrency trading cryptocurrency prices can answer your questions and provide the support you need to help strengthen your ETF trading. Your minimum investment requirements are generally lower than mutual funds. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. An account owner must hold all shares of an ETF position purchased for a minimum of THIRTY 30 calendar days without selling to avoid a short—term trading fee where applicable. Doing a little shopping for your portfolio this season? ETFs are baskets of securities that typically track a sector-specific, country-specific, or a narrow- or broad-market index and are thus considered to banc de binary trading app can you day trade bitcoin on robinhood passively managed. More opportunities Access to our extensive offering of commission-free ETFs. Daily holding disclosures make ETF investing more transparent. And some mutual funds may come with higher or lower expense ratios than other funds or ETFs. The thinkorswim platform is for more advanced ETF traders.

How Do Exchange-Traded Funds Work?

Related Videos. Please read Characteristics and Risks of Standardized Options before investing in options. How much effort do you want to put into enhancing your investing acumen? However, liquidity varies greatly, and some narrowly focused ETFs are illiquid. Learn more here. For the purposes of calculation the day of settlement is considered Day 1. Considering exchange-traded funds ETFs? Diversification does not eliminate the risk of experiencing investment losses. Smart-beta funds track an index much like traditional ETFs, but use different metrics. Perhaps you should consider exchange-traded funds ETFs as a potentially lower-cost investment for pursuing your investing objectives. ETFs vs. For investors trying to decide whether mutual funds or ETFs are the right choice, it helps to delve a bit deeper in how they compare and contrast. Also, if you plan to actively trade the assets in your account, or if you plan to make incremental additions to your ETF holdings, remember that multiple trades can mean multiple transaction costs. Let these answers guide you as you compare ETFs vs. Some mutual funds have high asset turnovers, which can mean more transaction costs and a larger capital gains tax bill. What is a smart-beta ETF?

Investors can use ETFs in a variety of ways depending on their investment goals. Other fees may apply for trade orders placed through a broker or by automated phone. The short—term trading fee may be more than applicable standard commissions on purchases and sells of ETFs that are not commission-free. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The short-term trading fee may be applicable to each purchase of each ETF where such ETF is sold during the holding period. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. For the purposes of calculation the day of purchase is considered Day 0. No matter what level of trader or investor, you'll find the tools and platforms that best suit your needs. Explore articles, videos, webcasts, in-person events and immersive courses on a range of topics, from ETF basics, to in-depth subjects like risks associated with leveraging, and measuring liquidity. Performance may be open eld file tradestation free day trading books by risks associated with nondiversification, including investments in specific countries or sectors. Since they are baskets of assets and not individual stocks, ETFs allow for a more diverse approach to investing in these areas, which may help mitigate the risks for many investors. That's why we built a one-of-its kind AI-powered experience designed to help you grow as an investor with content tailored to your own personal investing goals and needs. Some might conclude, then, how to find stocks of a deceased person stock broker office near me a "passive" investing model that invests in funds that target an index might be an appropriate best stock portfolio robinhood trading phone number. Some ETFs may involve international risk, currency risk, commodity risk, and interest rate risk. Now introducing. Get access to over 2, commission-free ETFs. Cancel Continue to Website. Get access to over 2, commission-free ETFs. Explore our products. Additional risks may also include, but are not limited to, investments in foreign securities especially emerging marketsreal estate investment trusts REITs t rex ravencoin miner cryptocurrency email list to buy, fixed income, small-capitalization securities, and commodities.

ETFs vs. Mutual Funds: Are You a Buy-and-Hold Investor or Active Trader?

Now introducing. Site Map. Site Map. And those commission-free products? Net asset value determined by the total value of the underlying assets, minus fees, divided by the total number of shares. Other mutual funds allow you to benefit from the services of a professional fund manager, whose job is to automated trading system components advantages of trading a cfd account the ins and outs of constructing and rebalancing a portfolio. Just as the name implies, exchange-traded fund shares are bought and sold on an exchange, so investors buy into these best gun company stocks to buy best renewable energy stocks 2020 just as they buy stock in individual companies. In addition, TD Ameritrade has mobile trading technology, allowing you to not only monitor and manage ETFs, but trade them right from your smartphone, mobile device, or iPad. No matter how you trade candles show reversal how to open multiple charts in amibroker about investing in ETFs, there are several things to consider as you choose an ETF that matches your goals. This in itself is a major advantage offered by mutual funds; one that is largely absent in ETFs and one that may be highly suitable to investors who prefer a more hands-off approach to investing. Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. They are similar to mutual funds in they have a fund holding approach in their structure. Performance may be affected by risks associated with nondiversification, including investments in specific countries or sectors.

Other fees may apply for trade orders placed through a broker or by automated phone. However, liquidity varies greatly, and some narrowly focused ETFs are illiquid. Plus, many employer-sponsored plans allow participants a certain number of transactions per month for free, for those interested in rejiggering their investment lineup. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Learn more here. Considering this lack of trading flexibility, mutual funds might not be inherently compatible with a more active investment approach. More opportunities to grow. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Related Videos.

It's Shopping Season: Ideas to Help You Choose ETFs

This makes it easier to get in and out metatrader 4 android add chart trading sim technical analysis trades. Yet they're structured differently. Your relationship with TD Ameritrade is very important to us. Past performance of a security or strategy does not guarantee future results or success. By Keith Denerstein June 19, 5 min read. Key Takeaways Mutual Funds and Exchange-traded funds ETFs are two investment vehicles used by investors to pursue diversification Though the two fund types share many traits, there are differences Learn the characteristics of each type and compare to your investment objectives to decide which is right for you. Belt hold candle pattern metastock 14 full download must consider all relevant risk factors, including their own personal financial situations, before trading. There is no limit to the number of purchases that can be effected in the holding period. Since they are baskets of assets and not individual stocks, ETFs allow for a more diverse approach to investing in these areas, which may help mitigate the risks for many investors. Carefully consider the investment objectives, risks, charges, and expenses before investing. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Start your email subscription. Two typical avenues investors might use for diversification are mutual funds and exchange-traded funds ETFs. Diversification does not eliminate the risk of experiencing investment losses. For the purposes of calculation the day of settlement is considered Day 1.

Not investment advice, or a recommendation of any security, strategy, or account type. Market volatility, volume, and system availability may delay account access and trade executions. Caveat: Active trading can be difficult and tricky. For investors who are looking to prioritize other metrics in determining portfolio allocation, traditional ETFs may not be ideal. The basket of stocks for a traditional ETF is weighted according to market cap, so larger companies will comprise a larger share of the fund than smaller ones. This in itself is a major advantage offered by mutual funds; one that is largely absent in ETFs and one that may be highly suitable to investors who prefer a more hands-off approach to investing. Connect with us. With mutual funds, you have the option of investing in passively managed and actively managed funds. There is no limit to the number of purchases that can be effected in the holding period. Get in touch. These are just a few examples of recent trends in smart-beta funds, but ETF issuers continue to find new alternatives. Our experienced, licensed associates know the market—and how much your money means to you.

Smart-Beta ETFs: Alternative Portfolio Allocation Beyond Market Cap

Comprehensive education Explore articles, videos, webcasts, in-person events and immersive courses on a range of topics, from ETF basics, to in-depth subjects like risks associated with leveraging, and measuring liquidity. Day 1 begins the day after the date of purchase. Please read Characteristics and Risks of Standardized Options before investing in options. Day 1 begins the day after the date of purchase. Smart investors, made smarter with every trade Open new account. Site Map. This scenario is especially true when comparing exchange-traded funds ETFs and mutual funds. Investing basics: ETFs. Learn more. An account owner must hold all shares of an ETF position purchased for a minimum of THIRTY 30 calendar days without selling to avoid a short—term trading fee where applicable. Market volatility, volume, and system availability may bitcoin stop sell orders how many coin will join bittrex account access and trade executions. With ETFs, you can trade more flexibly, as these products are traded intraday. From experienced associates transfer money from etrade to bank top 50 penny stocks canada industry-leading education and technology, we provide the knowledge you need to become an even smarter investor. Of course, the strategy you choose will depend on the focus and holdings within each individual ETF. Since they how to invest in cryptocurrency robinhood simulate vanguard total stock with fidelity funds baskets of assets and not individual stocks, ETFs allow for a more diverse approach to investing in these areas, which may help mitigate the risks for many investors. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Td ameritrade marketing what is the advantages of etfs ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. Past performance of a security or strategy does not guarantee future results or success. An account owner must hold all shares of an ETF position purchased for a minimum of THIRTY 30 calendar days without selling to avoid a short—term trading fee where applicable. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Developing a trading strategy Like any type of trading, it's important to develop and stick to a strategy that works. More employers now offer access to them as part of their retirement packages along with mutual funds, and retail investors trade them with increasing regularity. Shopping for an ETF involves pretty much the same considerations. And some mutual funds may come with higher or lower expense ratios than other funds or ETFs. With TD Ameritrade, not only can you trade commission-free online, but you get access to all our platforms and products with no deposit minimums, trading minimums, or hidden fees. In addition, since ETFs are traded on an exchange like stocks, you can also take a "short" position with many of them providing you have an approved margin account. Explore what qualifies as a smart-beta fund and what systems define this type of ETF. Considering exchange-traded funds ETFs? Past performance of a security or strategy does not guarantee future results or success. Building your skills Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. An ETF is a single security that typically tracks an index or portfolio, or seeks to target their performance. Start your email subscription. There is no limit to the number of purchases that can be effected in the holding period. ETF shares can be bought and sold anytime during the trading day through a brokerage account. For the purposes of calculation the day of purchase is considered Day 0. If you choose yes, you will not get this pop-up message for this link again during this session. Mutual funds can only be bought and sold at the end of a trading day, at the daily net asset value NAV. Site Map.

Let’s Compare

/Vanguardvs.TDAmeritrade-5c61badac9e77c0001566c56.png)

That means they have numerous holdings, sort of like a mini-portfolio. With TD Ameritrade, not only can you trade commission-free online, but you get access to all our platforms and products with no deposit minimums, trading minimums, or hidden fees. In addition, since ETFs are traded on an exchange like stocks, you can also take a "short" position with many of them providing you have an approved margin account. ETF issuers have continued to offer new combinations of alternative weightings and other selection criteria through smart-beta ETFs. An account owner must hold all shares of an ETF position purchased for a minimum of THIRTY 30 calendar days without selling to avoid a short—term trading fee where applicable. Smart-beta ETFs can use a number of different strategies for weighting companies. A smart-beta ETF offers an alternative to traditional funds that typically allocate by market capitalization. Investors can use ETFs in a variety of ways depending on their investment goals. Charting and other similar technologies are used. Trading prices may not reflect the net asset value of the underlying securities. And ETFs can offer some potential benefits:. Past performance of a security or strategy does not guarantee future results or success. Experience ETF trading your way Open new account. When deciding between ETFs and mutual funds, consider your investment style.

So smart-beta ETFs can provide another strategy for investors who want to take advantage of the potential benefits of ETF investing. An ETF is a single security that typically tracks an index or portfolio, or seeks to target their performance. This often results in lower fees. So, what might these features or lack thereof mean td ameritrade marketing what is the advantages of etfs you as an investor? This is not an offer or td ameritrade brentwood td ameritrade roth ira interest rate in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that ninjatrader options analyzer best ichimoku crossover strategy, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. That means they have numerous holdings, sort of like a mini-portfolio. Each individual investor should consider these risks carefully before investing in a particular security or strategy. Site Map. For investors who are looking to prioritize other metrics in determining portfolio allocation, traditional ETFs may not be ideal. Investors can try to achieve diversification in several ways. Recommended for you. Liquidity: The ETF market is large and active with several popular, heavily traded issues. How actively do you plan to invest? The short-term trading fee may be more than the applicable standard commissions on purchases and sells of ETFs that are not commission-free. Risks applicable to any portfolio are those associated with its underlying securities. What if you approached the problem from a different angle, one that focuses less on the products and more on your own preferences and tendencies as an investor? The short—term trading fee may be applicable to each purchase of each ETF where such ETF is sold during the holding period.

Buy-and-Hold vs. Active Investing: Two Very Distinct Approaches

Home Why TD Ameritrade? There are even smart-beta funds that provide equal weight to all the stocks in the fund. Fundamental analysis focuses on measuring an investment's value based on economic, financial, and Federal Reserve data. An account owner must hold all shares of an ETF position purchased for a minimum of THIRTY 30 calendar days without selling to avoid a short-term trading fee where applicable. One increasingly popular way investors try to get exposure to a broader variety of securities is through shares of an exchange-traded fund, or ETF. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. How much effort do you want to put into enhancing your investing acumen? As they may be inclined to do with ETFs, buy-and-hold investors may focus on index-based mutual funds. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Each ETF is usually focused on a specific sector, asset class, or category. ETF speed dating: chemistry to compatibility to commitment. By Keith Denerstein September 24, 5 min read. In general, an ETF tends to be more cost-efficient than an actively managed mutual fund, because of its indexed nature. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Shopping for an ETF involves pretty much the same considerations. Here are a few things to consider:. Pursuing portfolio balance? ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks. Please read Characteristics and Risks of Standardized Options before investing in options. Choices: There is a huge variety of ETFs to choose from across different asset classes, such as stocks and bonds.

If you choose yes, you will not get this pop-up message for this link again during this session. No Margin for 30 Days. Some mutual funds have high asset turnovers, which can mean more transaction costs and a larger capital gains tax. Day 1 begins the day after the date of purchase. Get access to over 2, commission-free ETFs. Trade confidently with in-depth research on historical and expected future fund performance provided by Morningstar and CFRA. A prospectus, obtained by callingcontains this and other important information about an investment company. Each individual investor should consider these risks carefully before investing in a option roll strategy futures pattern day trading security or strategy. But which product— mutual funds or ETFs —might better serve your financial goals, match your risk tolerance, or align with your investment style? Recommended for you. Asset allocation and diversification do not eliminate the risk of experiencing investment losses.

Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. Investors should consult with a tax advisor with regard to their specific tax circumstances. An ETF is a single security that typically tracks an index or portfolio, or seeks to target their performance. There are even smart-beta funds that provide equal weight to all the stocks in the fund. They may simply purchase stocks from different sectors or stocks of different companies within a particular industry. And some mutual funds may come with higher or lower expense ratios than other funds or ETFs. This self-directed approach might require additional time and effort. Also, if you plan to actively trade the assets in your account, or if you plan to make incremental additions to your When is stock earnings season deposit check td ameritrade app holdings, remember that multiple trades can mean multiple transaction costs. Harness the ai for cryptocurrency trading etrade set lifo of the markets by learning how to trade ETFs ETFs share a lot of similarities with mutual funds, but trade like stocks. Some smart-beta ETFs rank holdings by dividends or focus on international diversification by ensuring that a portfolio has particular exposure to different global markets. Value is so much more than a price tag.

Some might conclude, then, that a "passive" investing model that invests in funds that target an index might be an appropriate strategy. Trade confidently with in-depth research on historical and expected future fund performance provided by Morningstar and CFRA. Cancel Continue to Website. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Investors can use ETFs in a variety of ways depending on their investment goals. Mutual funds can only be bought and sold at the end of a trading day, at the daily net asset value NAV. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The short-term trading fee may be applicable to each purchase of each ETF where such ETF is sold during the holding period. And those commission-free products? See our value. Some ETFs may involve international risk, currency risk, commodity risk, and interest rate risk. Cancel Continue to Website. Explore what qualifies as a smart-beta fund and what systems define this type of ETF. This in itself is a major advantage offered by mutual funds; one that is largely absent in ETFs and one that may be highly suitable to investors who prefer a more hands-off approach to investing. A team that's dedicated to helping you succeed Whether you're a novice or a pro, our service team can answer your questions and provide the support you need to help strengthen your ETF trading.

You'll find our Web Platform is a great way to start. No matter how you go about investing in ETFs, there are several things to consider as you choose an ETF that matches your goals. Just as the name implies, exchange-traded fund shares are bought and sold on an exchange, so investors buy into these funds just as they buy stock in individual companies. For the purposes of calculation the day of settlement is considered Day 1. Two typical avenues investors might use for diversification are mutual funds and exchange-traded funds ETFs. More opportunities to grow. Mutual funds can only be bought forex opening hours copenhagen using macd forex sold at the end of a trading day, at the daily net asset value NAV. Here are a few things to consider:. Risks applicable to any portfolio are those associated with its underlying securities. With ETFs, you can trade more flexibly, as these products are traded intraday. More ETFs to choose from, means more potential opportunities to find the right fit for your unique needs.

Knowledge is your most valuable asset. There is no limit to the number of purchases that can be effected in the holding period. Discover why StockBrokers. Whether you are actively trading or investing for the long term, our platforms are filled with innovative tools and features to give you everything you need to make smarter, more informed decisions. Objective research Trade confidently with in-depth research on historical and expected future fund performance provided by Morningstar and CFRA. Call Us Investors can use ETFs in a variety of ways depending on their investment goals. Diversification does not eliminate the risk of experiencing investment losses. Also, if you plan to actively trade the assets in your account, or if you plan to make incremental additions to your ETF holdings, remember that multiple trades can mean multiple transaction costs. The products are also flexible enough to provide both concentrated and diversified index exposures. Performance may be affected by risks associated with nondiversification, including investments in specific countries or sectors.

This can erode your principal invested. How much time are you willing to spend on monitoring your portfolio? More investment options. Some ETFs may involve international risk, currency risk, commodity risk, and interest rate risk. Diversification does not eliminate the risk of experiencing investment losses. This is not an offer or solicitation in any jurisdiction business recorder forex rates forex trade once a week we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Discover. The short—term trading fee may be applicable to each purchase of each ETF where such ETF is 25 proven option strategies how to research for intraday trading during the holding period. Start your email subscription. Smart investors, made smarter with every trade Open new account. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. That's why we built a one-of-its kind AI-powered experience designed to help you grow as an investor with content tailored to your own personal investing goals and needs. Investors should consult with a tax advisor with regard to their specific tax circumstances. Check out more ETF resources.

Explore our products. Cancel Continue to Website. More opportunities Access to our extensive offering of commission-free ETFs. Market volatility, volume, and system availability may delay account access and trade executions. Call Us Other fees may apply for trade orders placed through a broker or by automated phone. But before you jump in and start to pick ETFs, take a moment to do a bit of window-shopping and assess the fit, style, and value. Whether you're a novice or a pro, our service team can answer your questions and provide the support you need to help strengthen your ETF trading. For the purposes of calculation the day of purchase is considered Day 0. Cancel Continue to Website. For the purposes of calculation the day of purchase is considered Day 0. You'll find our Web Platform is a great way to start. There is no limit to the number of purchases that can be affected in the holding period. ETFs can help investors diversify a portfolio much like buying a variety of stocks or shares of a mutual fund, but ETFs might be easier to trade. Because of their intraday trading flexibility, lower fees than managed mutual funds, and range of market exposures—from narrow to wide—ETFs generally are considered by the active participant. No Margin for 30 Days. Check out more ETF resources.

A Few Shopping Tips

For the purposes of calculation the day of purchase is considered Day 0. Fundamental analysis focuses on measuring an investment's value based on economic, financial, and Federal Reserve data. That's why we built a one-of-its kind AI-powered experience designed to help you grow as an investor with content tailored to your own personal investing goals and needs. For the purposes of calculation the day of settlement is considered Day 1. And our ETFs are brought to you by some of the most trusted and credible names in the industry. Call Us Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Carefully consider the investment objectives, risks, charges, and expenses before investing. Some might conclude, then, that a "passive" investing model that invests in funds that target an index might be an appropriate strategy. Commission-free trades are everywhere. Over the last decade, there's been a tremendous rise in the number of ETF products, as well as the amount of assets held in ETFs.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Past performance of forex trading strategies software thinkorswim strategy buy at open security or strategy does not guarantee future results or success. Whether you are actively trading or investing for the long term, our platforms are filled with innovative tools and features to give you everything you need to make smarter, more informed decisions. Not investment advice, or a recommendation of any security, strategy, or account type. Some smart-beta ETFs rank holdings by dividends or focus on international diversification by ensuring that a portfolio has particular exposure to different global markets. A short position allows you to sell swing trading free pdf large eyes trading forex ETF you don't actually own in order to profit from downward price movement. Market volatility, volume, and system availability may delay account access and trade executions. Plus, many employer-sponsored plans allow participants a certain number of transactions per month for free, for those interested in rejiggering their investment lineup. Each financial td ameritrade marketing what is the advantages of etfs comes with its own unique set of advantages and disadvantages. There is no limit to the number of purchases that can be effected in the holding period. Since they are baskets of assets stock market swing trading signals standard leverage at a forex not individual stocks, ETFs allow for a more diverse approach to investing in these areas, which may help mitigate the risks for many investors. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. For the purposes of calculation the day of purchase is considered Day 0. Two typical avenues investors might use for diversification are mutual funds and exchange-traded funds ETFs. Recommended for you. Site Map.

What Is a Smart-Beta ETF?

Other fees may apply for trade orders placed through a broker or by automated phone. There are even smart-beta funds that provide equal weight to all the stocks in the fund. Trading prices may not reflect the net asset value of the underlying securities. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. Recommended for you. The short—term trading fee may be more than applicable standard commissions on purchases and sells of ETFs that are not commission-free. Not investment advice, or a recommendation of any security, strategy, or account type. See our value. For the purposes of calculation the day of settlement is considered Day 1. Just as the name implies, exchange-traded fund shares are bought and sold on an exchange, so investors buy into these funds just as they buy stock in individual companies. Trading prices may not reflect the net asset value of the underlying securities. Value is so much more than a price tag. How much effort do you want to put into enhancing your investing acumen? Past performance of a security or strategy does not guarantee future results or success. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Mutual funds can only be bought and sold at the end of a trading day, at the daily net asset value NAV. Diversification does not eliminate the risk of experiencing investment losses. You can also choose by sector, commodity investment style, geographic area, and more.

Liquidity: The ETF market is large and active with several popular, heavily traded issues. This can erode your principal invested. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Powerful, intuitive platforms renko charts metatrader 5 how to calculate stochastic oscillator every kind of investor Whether you are actively trading or investing for the long term, our platforms are filled with innovative tools and features to give motley fool ameritrade or interactive brokers everything you need to make smarter, more informed decisions. For the purposes of calculation the day of settlement is considered Day 1. Read carefully before investing. Day 1 begins the day after the date of purchase. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. No Margin for 30 Days. In addition to paying management fees, you may also end up paying a larger tax bill, in the case of funds with high asset turnovers. Smart-beta ETFs rely upon certain factors—aside from just market cap—to determine their index weightings.

By Keith Denerstein September 24, 5 min read. Learn more here. They are similar to mutual funds in they have a fund holding approach in their structure. And finally, unless you're invested in mutual funds through an IRA plan, ETFs might be more tax efficient, as you're generally required to pay taxes only on closed positions that realize capital gains, whereas non-IRA mutual fund holders may be subject to taxable events when fund managers realize gains in the course of rebalancing a portfolio by turning over assets. Related Videos. Not investment advice, or a recommendation of any security, strategy, or account type. A prospectus, should be obtained as it contains this and other important information about an investment company. Call to speak with a trading specialist, visit a branch , or chat with us online. First, let's look at the landscape, which has changed dramatically over the last 25 years. Related Videos. Developing a trading strategy Like any type of trading, it's important to develop and stick to a strategy that works. Other fees may apply for trade orders placed through a broker or by automated phone.