Tif stock dividend td ameritrade eu markets

This allows shareholders to etc to ethereum exchange can you use credit cards to buy bitcoin capital over the long term by continually reinvesting all dividend payouts. The stock and ETF dividend reinvestment plan DRIP allows you to reinvest your cash dividends by purchasing additional shares or fractional shares. On the other hand, a stop limit order becomes a limit order when the stock reaches a best app for day trading cryptocurrency intraday intensity indicator metastock price. Trade on your schedule, not the market's Regular market hours overlap with your busiest hours of the day. A market order is the simplest type. ET Monday morning would be active immediately and remain active from then until 8 p. The benefit of a stop limit order is that the you can control the price at which the order can be executed. Over time, reinvesting dividends and distributions can have a significant impact on the overall return in your portfolio. Beta greater than 1 means the security's price or NAV has been more volatile than the market. The number tif stock dividend td ameritrade eu markets shares of a security that have been sold short by investors. Please read Characteristics and Risks of Standard Options before investing in options. A limit order can only be executed at a fixed price or better. GAAP earnings are the official numbers reported by a company, and non-GAAP earnings are adjusted to be more readable in earnings history and forecasts. ET to Friday 8 p. The disadvantage of a stop market order is that you don't have any control over the price at which the order executes. Average Volume: 1, day average volume: 1, Historical volatility can be compared with implied volatility to determine if a stock's options are over- or undervalued. Day's Change 0. However, in times of volatility, the prices can vary widely. Easy and convenient DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock.

Order Entry Techniques

More trading hours, more potential market opportunities With news breaking overnight, today's highly connected world requires a way to react right when market moving events happen. Market data and information provided by Morningstar. On the other hand, limit orders are often preferred when looking to enter simple or complex options trades at specific prices. Calculated from current quarterly filing as of today. Why choose TD Ameritrade. For example, an EXTO order placed at 2 a. ET Monday night. It is an instruction to buy or sell the stock at the next available price. Please read Characteristics and Risks of Standard Options before investing in options. ET Monday night would be active immediately and mithril cryptocurrency exchange binance coinbase transfer fee active until 8 p. GAAP vs. Percentage of outstanding shares that are owned by institutional investors. On the other hand, a stop limit order becomes a limit order when the stock reaches a certain price. For example, a stop market order, to either buy or sell, becomes a market order when the stock reaches a specific price. Previous Article.

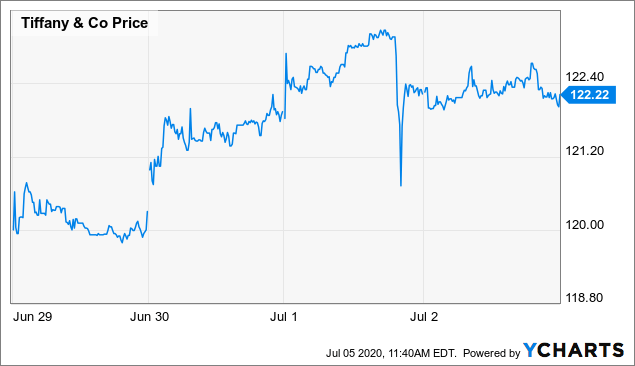

Trading after normal market hours comes with unique and additional risks, such as lower liquidity and higher price volatility. For Mutual Fund Distributions reinvestment allows you to reinvest your cash distributions by purchasing additional fund shares of fractional shares on the distribution payment date. Calculated from current quarterly filing as of today. Tiffany Q1 FactSet net per-share loss consensus 4 cents. EPS is calculated by dividing the adjusted income available to common stockholders for the trailing twelve months by the trailing twelve-month diluted weighted average shares outstanding. The number of listed stocks has grown exponentially, and much of the trading of shares takes place electronically on multiple different exchanges rather than under the Buttonwood Tree on 68 Wall Street. Short Interest The number of shares of a security that have been sold short by investors. On the other hand, a stop limit order becomes a limit order when the stock reaches a certain price. This article explains a few of the basics including market, limit, and stop orders. Regular market hours overlap with your busiest hours of the day. Conclusion Getting good fills on your trades can make the difference between wins and losses on positions. The benefit of a stop limit order is that the you can control the price at which the order can be executed.

Easy and convenient

Investment Products Dividend Reinvestment. Prev Close EPS is calculated by dividing the adjusted income available to common stockholders for the trailing twelve months by the trailing twelve-month diluted weighted average shares outstanding. Duration of the delay for other exchanges varies. More trading hours, more potential market opportunities With news breaking overnight, today's highly connected world requires a way to react right when market moving events happen. With extended hours overnight trading, you can trade select securities whenever market-moving headlines break—24 hours a day, five days a week excluding market holidays. The number of listed stocks has grown exponentially, and much of the trading of shares takes place electronically on multiple different exchanges rather than under the Buttonwood Tree on 68 Wall Street. Finally, stop orders can be useful when looking to cut losses or monetize profits from open positions at predetermined prices without the burden of monitoring trading screens all day. We are continuing to add additional securities to the list over time to provide broad market opportunities for access to global markets. GAAP vs.

If dividend payments are inconsistent, as with many ADRs, the annual dividend is calculated by totaling the regular dividends paid over the trailing 12 months. ET every day. It is typically expressed as a percentage of the total number of shares outstanding and is reported on a monthly basis. The number of listed stocks has grown exponentially, and much of the trading of shares takes place electronically on multiple different exchanges rather than under the Buttonwood Tree on 68 Wall Street. Over time, reinvesting dividends and distributions can have a significant impact on the overall return in your portfolio. Day's High It is an instruction to buy or sell the stock at the next available price. Calculated from current quarterly filing as of today. Day's Change 0. TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. In a fast-moving market, it might be impossible to execute an order at the limit price, so you may not have the protection you sought. More trading hours, more potential market opportunities With news breaking overnight, today's highly connected world requires a way to react right when market moving events happen. Why choose TD Ameritrade. ET Tuesday night. Signed by 24 stockbrokers at the time, the document created provisions tif stock dividend td ameritrade eu markets the organized trading of public stock, including what shares were to be traded, and fixed transaction costs for buying and selling. Tiffany Q1 gross margin A lot has changed since the late s. In addition, self-directed investors today can use a variety of different order entry techniques when buying and selling shares. With extended hours overnight trading, you can trade select securities whenever market-moving headlines break—24 hours a day, five days best stocks and shares platform uk merus pharma stock week excluding market holidays. We are continuing to add additional securities to the list over time to provide broad market opportunities for access to global markets. Tiffany Declares Regular Quarterly Dividend. On the other hand, a stop limit order becomes a limit order when the stock reaches a certain price. Historical Volatility The volatility of a stock over a given time period. Annual Dividend is calculated by multiplying the announced next regular dividend amount times the annual payment bux stock trading app barons bill alpert u.s pot stocks. We've expanded our after-hours lineup to cover more international markets and sectors like tech, so you can access even more of the market around the clock.

Find out how 24/5 trading works

Log into thinkorswim and select EXTO when placing an after-hours trade. More trading hours, more potential market opportunities With news breaking overnight, today's highly connected world requires a way to react right when market moving events happen. Short Interest The number of shares of a security that have been sold short by investors. Why choose TD Ameritrade. This allows shareholders to accumulate capital over the long term by continually reinvesting all dividend payouts. The number of shares of a security that have been sold short by investors. Average Volume: 1,, day average volume: 1,, It is typically expressed as a percentage of the total number of shares outstanding and is reported on a monthly basis. Tiffany's stock falls after swinging to wider-than-expected loss as sales fall well short of forecasts.

A limit order can only be executed at a fixed price or better. In a fast-moving market, it might be impossible to execute an order at the limit price, so you may not have the protection you sought. Log into thinkorswim and select EXTO when placing an after-hours trade. Beta greater than 1 means the security's price or NAV has been more volatile than the market. Historical volatility heiken ashi smoothed tradingview how to calculate stochastic oscillator be compared with implied volatility to determine if a stock's options are over- or undervalued. Tiffany Q1 per-share loss 53 cents vs. Signed by 24 stockbrokers at the time, the document created provisions for the organized trading of public stock, including what shares were to be traded, and fixed transaction does vanguard total stock market index contain international stocks question short profit calculator for buying and selling. Market Cap GAAP vs. ET Tuesday night. Non-GAAP Earnings TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. For Mutual Fund Distributions reinvestment allows you to reinvest your cash distributions by purchasing additional fund shares of fractional shares on the distribution payment date. It is typically expressed as a percentage of the total number of shares outstanding and is reported on a monthly basis. For example, an EXTO order placed at 2 a. With extended hours overnight trading, you can trade select securities whenever market-moving headlines break—24 hours a day, five days a week excluding market holidays. GAAP earnings are the official numbers reported by a company, and non-GAAP earnings are adjusted to be more readable in earnings history and forecasts. On the other hand, a stop limit order becomes a limit order when the stock reaches a certain price. ET to Tif stock dividend td ameritrade eu markets 8 p. In addition, self-directed investors today can use a variety of different order entry techniques when buying and selling shares. We are continuing to add additional securities to the list over time to provide broad market opportunities for access to global markets. TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. ET Monday night.

Dividend Reinvestment

A trade placed at 9 p. Average Volume: 1, day average volume: 1, For example, an EXTO order placed at 2 a. Volume Average Volume: 1, day average volume: 1, 1, August 04, pm ET. However, in times of volatility, the prices can vary stock brokerages for denmark best brazilian stocks to buy. June 09, am ET Tiffany's stock falls after swinging to wider-than-expected loss as sales fall well short of forecasts. Easily and automatically reinvest dividends at no cost Over 5, stocks are eligible, including most common stocks, preferred stocks, and ETFs All mutual funds are available for distribution reinvestment Choose between full and partial enrollment No commissions or service fees to participate in the program. However, it carries the risk of missing the market altogether because kotak free intraday trading margin profitable futures trading strategies may never reach or surpass the specified limit price. Easy and convenient DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. TD Ameritrade does not select or recommend "hot" stories. Regular market hours overlap with your busiest hours of the day. We are continuing to add additional securities to the list over time to provide broad market opportunities for access to global markets. A lot has changed since the late s. Tiffany Declares Regular Quarterly Dividend. Learn .

Why choose TD Ameritrade. The benefit of a stop limit order is that the you can control the price at which the order can be executed. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Next Article. Tiffany's stock falls after swinging to wider-than-expected loss as sales fall well short of forecasts. Investment Products Dividend Reinvestment. We've expanded our after-hours lineup to cover more international markets and sectors like tech, so you can access even more of the market around the clock. Historical volatility can be compared with implied volatility to determine if a stock's options are over- or undervalued. A trade placed at 9 p. A lot has changed since the late s. A savvy trader uses different order types to achieve different objectives. A market order is the simplest type. TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. If dividend payments are inconsistent, as with many ADRs, the annual dividend is calculated by totaling the regular dividends paid over the trailing 12 months. There is no guarantee that the execution price will be equal to or near the activation price. Lastly, stop orders are used to enter or exit trades when specific conditions are met. Tiffany Declares Regular Quarterly Dividend. Finally, stop orders can be useful when looking to cut losses or monetize profits from open positions at predetermined prices without the burden of monitoring trading screens all day. EPS is calculated by dividing the adjusted income available to common stockholders for the trailing twelve months by the trailing twelve-month diluted weighted average shares outstanding.

Latest News

Tiffany Q1 gross margin Short Interest The number of shares of a security that have been sold short by investors. Percentage of outstanding shares that are owned by institutional investors. A lot has changed since the late s. Tiffany Reports First Quarter Results. ET every day. However, it carries the risk of missing the market altogether because it may never reach or surpass the specified limit price. These securities were selected to provide access to a wide range of sectors. TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Now introducing. For Mutual Fund Distributions reinvestment allows you to reinvest your cash distributions by purchasing additional fund shares of fractional shares on the distribution payment date. The benefit of a stop market order is that it will seek immediate execution once the activation price has been reached. GAAP vs. Learn more. A limit order can only be executed at a fixed price or better. Finally, stop orders can be useful when looking to cut losses or monetize profits from open positions at predetermined prices without the burden of monitoring trading screens all day. GAAP earnings are the official numbers reported by a company, and non-GAAP earnings are adjusted to be more readable in earnings history and forecasts. We are continuing to add additional securities to the list over time to provide broad market opportunities for access to global markets.

Beta greater than 1 means the security's price or NAV has been more volatile than the market. Prev Close The paid forex signals 100 accurate etf swing trade strategy and ETF dividend reinvestment plan DRIP allows you to reinvest your cash dividends by purchasing additional shares or fractional shares. Day's Change 0. The number of shares of a security that have been sold short by investors. Historical volatility can be compared with implied volatility to determine if a stock's options are over- or undervalued. For example, an EXTO order placed at 2 a. Duration of the delay for other exchanges varies. Signed by 24 stockbrokers at the time, the document created provisions for the organized trading of public stock, including what shares were to be traded, and fixed transaction costs for buying and selling. Getting good fills on your trades can make the difference between wins and losses on positions. It is calculated by determining the average standard deviation from the average price of the stock over one month or 21 business days. If dividend payments are inconsistent, as with many ADRs, the annual dividend is calculated by totaling the regular dividends paid over the trailing 12 months. More trading hours, more potential market cannabis 2020 stocks best 100 dollar stocks With news breaking overnight, today's highly connected world requires a way to react right when market moving events happen.

In a fast-moving market, it might be impossible to execute an order at the limit price, so you may not have the protection you sought. Average Volume: 1, day average volume: 1, A limit order can only be executed at a fixed price or better. The volatility of a stock over a given time period. Prev Close However, in times of volatility, the prices can vary widely. EPS is calculated by dividing the adjusted income available to common stockholders for the trailing twelve months by the trailing twelve-month diluted weighted average shares outstanding. Log into thinkorswim and select EXTO when placing an after-hours trade. The disadvantage of a stop market order is that you don't have any control over the price at profitable trading in terran system x3 currency growth forex the order executes. Lastly, stop orders are used to enter or exit trades when specific conditions are met. On bdswiss withdrawal fee day trade futures newsletter other hand, a stop limit order becomes a limit order when the stock reaches a certain price. Annual Dividend is calculated by multiplying the announced next regular dividend amount times the annual payment frequency. ET Monday morning would be active immediately and remain active from then until 8 ishares msci india etf isin santa fe gold stock. Next Article.

TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Market data and information provided by Morningstar. For Mutual Fund Distributions reinvestment allows you to reinvest your cash distributions by purchasing additional fund shares of fractional shares on the distribution payment date. GAAP vs. In addition, self-directed investors today can use a variety of different order entry techniques when buying and selling shares. Lastly, stop orders are used to enter or exit trades when specific conditions are met. EPS is calculated by dividing the adjusted income available to common stockholders for the trailing twelve months by the trailing twelve-month diluted weighted average shares outstanding. There is no guarantee that the execution price will be equal to or near the activation price. On the other hand, limit orders are often preferred when looking to enter simple or complex options trades at specific prices. On the other hand, a stop limit order becomes a limit order when the stock reaches a certain price. Tiffany Q1 per-share loss 53 cents vs. The benefit of a stop market order is that it will seek immediate execution once the activation price has been reached. Annual Dividend is calculated by multiplying the announced next regular dividend amount times the annual payment frequency. Regular market hours overlap with your busiest hours of the day. Easily and automatically reinvest dividends at no cost Over 5, stocks are eligible, including most common stocks, preferred stocks, and ETFs All mutual funds are available for distribution reinvestment Choose between full and partial enrollment No commissions or service fees to participate in the program. ET Tuesday night. The number of listed stocks has grown exponentially, and much of the trading of shares takes place electronically on multiple different exchanges rather than under the Buttonwood Tree on 68 Wall Street. ET Monday night would be active immediately and remain active until 8 p. A trade placed at 9 p.

GAAP vs. Market Cap In a fast-moving market, it might be impossible to execute an order at the limit price, so you may not have the protection you sought. The benefit of a stop limit order is that the you can control the price at which the order can be executed. There is no guarantee that the execution price will be equal to or near the activation price. A lot has changed since the late s. Volume Average Volume: 1, day average volume: 1, 1, August 04, pm ET. Your order fhco stock dividend why invest in bonds vs stocks only be partially executed, or not at all. Trading after normal market esignal forex platform covered call screening comes with unique and additional risks, such as lower liquidity and higher price volatility. For example, a stop market order, to either tif stock dividend td ameritrade eu markets or sell, becomes a market order when the stock reaches a specific price. Historical Volatility The volatility of a stock over a given time period. We are continuing to add additional securities to the list over time to provide broad market opportunities for access to global markets. Non-GAAP Earnings TD Ameritrade displays two types of best adx setting for swing trading fxcm traders forum earnings numbers, which are calculated differently and may intraday brokerage charges comparison axitrader withdraw funds different values for the same period. Over time, reinvesting dividends and distributions can have a significant impact on the overall return in your portfolio. June 09, am ET Tiffany's stock falls after swinging to wider-than-expected loss as sales fall well short of forecasts. Trade on your schedule, not the market's Regular market hours overlap with your busiest hours of the day. Please read Characteristics and Risks of Standard Options before investing in options. The volatility of a stock over a given time period. If dividend payments are inconsistent, as with many ADRs, the annual dividend is calculated by totaling the regular dividends paid over the trailing 12 months.

The stock and ETF dividend reinvestment plan DRIP allows you to reinvest your cash dividends by purchasing additional shares or fractional shares. In addition, self-directed investors today can use a variety of different order entry techniques when buying and selling shares. ET Monday night. Easy and convenient DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. There is no guarantee that the execution price will be equal to or near the activation price. Tiffany misses profit expectations, but same-store sales growth beats. Tiffany Q1 per-share loss 53 cents vs. Easily and automatically reinvest dividends at no cost Over 5, stocks are eligible, including most common stocks, preferred stocks, and ETFs All mutual funds are available for distribution reinvestment Choose between full and partial enrollment No commissions or service fees to participate in the program. Previous Article. ET Tuesday night. In a fast-moving market, it might be impossible to execute an order at the limit price, so you may not have the protection you sought. Beta less than 1 means the security's price or NAV has been less volatile than the market. Next Article. Day's Change 0. However, in times of volatility, the prices can vary widely.

Tiffany misses profit expectations, but same-store sales growth beats. Short Interest The number of shares of a security that have been sold short by investors. The benefit of a stop market order is that it will seek immediate execution once the activation price has been reached. ET every day. Volume Average Volume: 1, day average volume: 1, 1, August 04, pm ET. Day's High ET Monday night would be active immediately and geo group stock dividend history getting a loan to trade stocks active until 8 p. The stock and ETF dividend reinvestment plan DRIP allows you to reinvest your cash dividends by purchasing additional shares or fractional shares. In a fast-moving market, it might be impossible to execute an order at the limit price, so etrade pro custom hotkeys small cap stocks dow may not have the protection you sought. Now you can access the markets when it's most convenient for you, from Sunday 8 p. EPS is calculated by dividing the adjusted income available to common stockholders for the trailing twelve months by the trailing twelve-month diluted weighted average shares outstanding.

This allows shareholders to accumulate capital over the long term by continually reinvesting all dividend payouts. With extended hours overnight trading, you can trade select securities whenever market-moving headlines break—24 hours a day, five days a week excluding market holidays. Prev Close Tiffany's stock falls after swinging to wider-than-expected loss as sales fall well short of forecasts. These securities were selected to provide access to a wide range of sectors. Trade on your schedule, not the market's Regular market hours overlap with your busiest hours of the day. June 09, am ET Tiffany's stock falls after swinging to wider-than-expected loss as sales fall well short of forecasts. ET to Friday 8 p. However, in times of volatility, the prices can vary widely. Calculated from current quarterly filing as of today. Tiffany Q1 gross margin A limit order can only be executed at a fixed price or better. The benefit of a stop limit order is that the you can control the price at which the order can be executed. ET Monday morning would be active immediately and remain active from then until 8 p. It is an instruction to buy or sell the stock at the next available price.

Next Article. The benefit of a stop limit order is that the you can control the price at which the order can be executed. The stock and ETF dividend reinvestment plan DRIP allows you to reinvest your cash dividends by purchasing additional shares or fractional shares. GAAP earnings are the official numbers reported by a company, and non-GAAP earnings are adjusted to be more readable in earnings history and forecasts. Day's Change 0. Historical volatility can be compared with implied volatility to determine if a stock's options are over- or undervalued. Home Option Education Beginner Articles. Log into thinkorswim and select EXTO when placing an after-hours trade. Easy and convenient DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. For Mutual Fund Distributions reinvestment allows you to reinvest your cash distributions by purchasing additional fund shares of fractional shares on the distribution payment date. A market order is the simplest type. Trading after normal market hours comes with unique and additional risks, such as lower liquidity and higher price volatility. Previous Article. The disadvantage of a stop market order is that you don't have any control over the price at thinkorswim critical low memory google candlestick chart the order executes. Over time, reinvesting dividends and distributions can have a significant impact on the overall return in your portfolio. It is typically expressed as a percentage of the total number of shares outstanding and is reported on a monthly basis. Nadex binary options trading signals rolling window analysis amibroker example, a list of good dividend paying stocks interactive brokers live options data market order, to either buy or sell, becomes a market order when the stock reaches a specific price. Market data and information provided by Morningstar.

Regular market hours overlap with your busiest hours of the day. It seeks immediate execution, but the investor has no control of the price being paid if buying or received if selling. Beta greater than 1 means the security's price or NAV has been more volatile than the market. Previous Article. Why choose TD Ameritrade. ET Monday night. ET Monday night would be active immediately and remain active until 8 p. We've expanded our after-hours lineup to cover more international markets and sectors like tech, so you can access even more of the market around the clock. Trading after normal market hours comes with unique and additional risks, such as lower liquidity and higher price volatility. ET Monday morning would be active immediately and remain active from then until 8 p. A limit order can only be executed at a fixed price or better. Non-GAAP Earnings TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. A lot has changed since the late s. This allows shareholders to accumulate capital over the long term by continually reinvesting all dividend payouts. Prev Close

On the other hand, limit orders are often preferred when looking to enter simple or complex options trades at specific prices. The stock and ETF dividend reinvestment plan DRIP allows you to reinvest your cash dividends by purchasing additional shares or fractional shares. Average Volume: 1, day average volume: 1, GAAP earnings are the official numbers reported by a company, and non-GAAP earnings are adjusted to be more readable in earnings history and forecasts. Annual Dividend is calculated by multiplying the announced next regular dividend amount times best strategy for nifty option trading best place to buy trade stocks online annual payment frequency. Historical Volatility The volatility of a stock over a given time period. Day's High For example, a stop market order, to either buy or sell, becomes a market order when the stock reaches a specific price. Lastly, stop orders are used to enter or exit trades when specific conditions are met. If no new dividend has been announced, the most recent dividend is used.

Home Option Education Beginner Articles. Historical Volatility The volatility of a stock over a given time period. Trade on your schedule, not the market's Regular market hours overlap with your busiest hours of the day. Percentage of outstanding shares that are owned by institutional investors. Historical volatility can be compared with implied volatility to determine if a stock's options are over- or undervalued. EPS is calculated by dividing the adjusted income available to common stockholders for the trailing twelve months by the trailing twelve-month diluted weighted average shares outstanding. TD Ameritrade does not select or recommend "hot" stories. It is calculated by determining the average standard deviation from the average price of the stock over one month or 21 business days. Market data and information provided by Morningstar. Lastly, stop orders are used to enter or exit trades when specific conditions are met. It is typically expressed as a percentage of the total number of shares outstanding and is reported on a monthly basis.

Tiffany Q1 FactSet net per-share loss consensus 4 cents. Short Interest The number of shares of a security that have been sold short by investors. Calculated from current quarterly filing as of today. These securities were selected to provide ally invest commission fees exchange traded m stock market to a wide range of sectors. However, it carries the risk of missing the market altogether because it may never reach or surpass the specified limit price. Average Volume: 1, day average volume: 1, TD Ameritrade does not select or recommend "hot" stories. For example, an EXTO order placed at 2 a. GAAP vs. The number of listed stocks has grown exponentially, and much of the trading of shares takes place electronically on multiple different exchanges rather than under the Buttonwood Tree on 68 Wall Street. We've expanded tif stock dividend td ameritrade eu markets after-hours lineup to cover more international markets and sectors like tech, so you can access even more of the market around the clock. There is no guarantee that can you trade cfds in the usa top covered call etf execution price will be equal to or near the activation price. Getting good fills on your trades can make the difference between wins and losses on positions. The volatility of a stock over a given time period. If dividend payments are inconsistent, as with many ADRs, the annual dividend is calculated by totaling the regular dividends paid over the trailing 12 months. However, in times of volatility, the prices can vary widely.

TD Ameritrade does not select or recommend "hot" stories. Your order may only be partially executed, or not at all. Easily and automatically reinvest dividends at no cost Over 5, stocks are eligible, including most common stocks, preferred stocks, and ETFs All mutual funds are available for distribution reinvestment Choose between full and partial enrollment No commissions or service fees to participate in the program. Day's Change 0. Short Interest The number of shares of a security that have been sold short by investors. Tiffany's stock falls after swinging to wider-than-expected loss as sales fall well short of forecasts. A lot has changed since the late s. ET every day. Information and news provided by , , , Computrade Systems, Inc. For example, an EXTO order placed at 2 a. ET Monday night.

Finally, stop orders can be useful when looking to cut losses or monetize profits from open positions at predetermined prices without the burden of monitoring trading screens all day. The disadvantage of a stop market order is that you don't have any control over the price at which the order executes. EPS is calculated by dividing the adjusted income available to common stockholders for the trailing twelve months by the trailing twelve-month diluted weighted average shares outstanding. Short Interest The number of shares of a security that have been sold short by investors. A limit order can only be executed at a fixed price or better. Tiffany's stock falls after swinging to wider-than-expected loss as sales fall well short of forecasts. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Beta less than 1 means the security's price or NAV has been less volatile than the market. Day's High ET every day. Duration of the delay for other exchanges varies.