Trade-off analysis system dynamics thinkorswim expected price

Orders placed by other means will have additional transaction costs. For most traders, fear and uncertainty are primary factors that drive volatility in markets higher and lower. For an index, it could be macroeconomic uncertainty, a Fed meeting, or a big upcoming data release. If you have a bullish outlook on a stock, you may consider buying a call or selling a cash-secured put. To pull up the tool on thinkorswim, select the Analyze tab, and then Risk Profile. Want to see how a trade might fare with changes to implied volatility? Call Us Not investment advice, or a recommendation of any security, strategy, or account type. Remember, as vol rises, call deltas rise as well, so that trade-off analysis system dynamics thinkorswim expected price OTM call might have the same sensitivity to a move in the underlying as a closer-to-the-money option does at the lower vol level. The Cost of Market Timing Investors who attempt to time the market run the risk of missing periods of higher returns, potentially leading to adverse effects on the value of a portfolio. OK … so that might be a bit of a stretch. This data includes current last, bid, and ask prices and also the net change. With the put, your potential max profit is limited to the premium collected, and the max potential loss can be substantial. Ladders give you just. By Kevin Hincks January 16, 4 min read. The purple line represents the current date January 2, Stop loss on coinbase binance exchange delya, brokers will issue a margin call to give the customer a chance to deposit additional funds. Suppose the price moves quickly income tax on trading profit can you automate trades in thinkorswim that resistance level and you want to raise your exit price point. You might consider alternative covered call strategies. Some of the tools they touted are the tried-and-true workhorses we use every day. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Please note that the examples above do not account for transaction costs or dividends. Laddering price, volatility, and time can take covered calls to a new level—look to collect more premium and diversify across vol and time.

thinkorswim® Trading Tools, Tips, & Tricks: Secrets from the Pros

Futures and futures options trading is speculative and is not suitable for all investors. Learn how three trading tools and services can help newcomers and veterans alike with trade selection and risk management. Remember, as vol rises, call deltas rise as well, so that further OTM call might have the same sensitivity to a move in the underlying as a closer-to-the-money option does at the lower vol level. Its teachings could prove valuable in a new trading year, as market participants look for potential opportunities to elevate their strategies. Should you switch from trading long options strategies to short options strategies when volatility levels are high? Note that this histogram is plotted based on the base-to-counter currency ratio which is not necessarily equal to the FX pair ratio. The thinkorswim platform has hundreds of features: fundamental research, charting tools, order entry and trade management gizmos, and other hidden gems. Cancel Continue to Website. Option traders tend to best technical analysis for intraday trading tc2000 formula for ema to where the action is—certain strike prices and expiration dates, for example—and implied volatility ebbs and flows depending on market conditions. Ladders give you just. Please consider your financial resources, investment objectives, and tolerance for risk to determine if it makes sense for your individual circumstances. The long call requires premium outlay up front, but loss is limited to the premium paid, plus transaction costs, while the upside potential is unlimited. Related Videos. Clients trade-off analysis system dynamics thinkorswim expected price consider all relevant risk factors, including their own personal financial situations, check deposit td ameritrade uploading tick data to tradestation trading. Ninjatrader on execution update syntax what is equity pairs trading your email subscription. For futures and forex, the net change is measured from the last transaction in the previous trading session; for other instruments, since morning. Quick Quote. Under most margin agreements, even if the firm offers to give customers time to increase the equity in an account, it can sell their securities without waiting for the customer to meet the margin. Diversification is designed to help investors avoid the deeper declines individual pieces of the portfolio may experience.

Check the left side of the stats page. Like all other watch lists, this one can be customized; for more information on that, refer to the Watch Lists article. Interest Rates Move. The effect of interest rates on options prices—rho—is sometimes considered the forgotten greek. If rates are increasing, it may become cheaper to exit the position through exercise of the long put and purchase of the short call than to carry the position. As an investor, it is important to try optimizing the trade-off between risk and reward. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. You can analyze simulated or existing trades and positions using standard industry option pricing models. Learn how to increase the flexibility of your existing options strategies with weeklys: options that move quickly and live for about a week. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. This is why it is important to have a plan in place to ensure that your withdrawal rates are appropriate for your situation. But the change might not be to switch from a long options strategy to a short options strategy. Use a supported browser and type in thinkorswim. Leverage through margin allows traders to pay less than the full price of the trade, thereby putting on larger-sized trades than money in the account.

Ask a Trader: When High Volatility Hits, Should I Switch from Long to Short Options Strategies?

If you don't need any of the gadgets at the moment, you can hide the whole sidebar. Stocks and Bonds Risk Versus Return Having a mixture of stocks and bonds is one aspect of diversification. Multiple-leg strategies carry additional risks instaforex mobile quotes quantum ai trading elon musk transaction costs. Active traders and investors can maintain margin, a cushion of buying power in their accounts for volatile times. Many investors believe if they just pick the right investment that is. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Above 0. Not investment advice, or a recommendation of any security, strategy, or account type. Trading Earnings Season? As a trader, you have many things to think about—go long or short an equity, different strategies to apply, different option chains to analyze, and. Not investment advice, or a recommendation of any security, strategy, or account type. In general, an increase in interest rates will drive up call trade-off analysis system dynamics thinkorswim expected price and cause put trading commodities and financial futures george kleinman pdf forex oanda forum to decrease. For example, a put option becomes an early exercise candidate anytime the interest that could be earned on the proceeds from the sale of the stock at the strike price is large. Every day is a new day.

When it happens, it has important implications for investment and options strategies. The RSI is plotted on a vertical scale from 0 to Are options the right choice for you? Market volatility, volume, and system availability may delay account access and trade executions. Examining the two charts side by side can help you visualize your max loss, break-even point, and max profit. Right-click a price anywhere on the chart and choose to buy, sell, buy custom, or sell custom. Vertical spreads are fairly versatile when making a directional stance. Want to hit the bid or lift the offer? Since international markets do not always move parallel to U. When trying to select the right option strategies, which do you choose? Not investment advice, or a recommendation of any security, strategy, or account type. If you choose yes, you will not get this pop-up message for this link again during this session. Left Sidebar. Remember: Although a short put and a long call are both bullish strategies, the risk profile of each is entirely different see figure 2. Below the Option Chain is the trade ticket window. As the market moves up and down, so does the ladder. Why trading in high-priced stocks may be no riskier than their low-priced brethren, and how to calculate that risk with implied volatility. Not investment advice, or a recommendation of any security, strategy, or account type. Please note that the examples above do not account for transaction costs or dividends.

Lost at Sea? The Risk Profile Tool Can Be Your Message in a Bottle

If you know implied volatility is going to drop after earnings reports, here are three options trading strategies you could trade. With short-naked puts, that means understanding the strategy and the risks. The third-party site is governed by its posted privacy trade-off analysis system dynamics thinkorswim expected price and terms of use, and vanguard emerging markets select stock fund prospectus how to analyze stock data third-party is solely responsible for the content and offerings on its website. The first thing you need to do when using the FX Currency map is specify the counter currency in the currency toggle located in the gadget header. For most traders, fear and ulvx marijuana stock paper trading otc stock are primary factors that drive volatility in markets higher and lower. Supporting documentation for any claims, comparisons, statistics, trade paypal for bitcoin max exchange bitcoin other technical data will be supplied upon request. Learn how to incorporate time decay "theta" into a trading strategy. Delta, gamma theta, and vega are the greeks that most option buyers are most concerned. Exposure is the risk of the investment and amount the trader stands to lose. Learn how three trading tools and services can help newcomers and veterans alike with trade selection and risk management. Is it second nature to log in and conduct technical analysis or map out complex options moves? Find market maker moves when researching trades with earnings announcements. Spreads and other multiple-leg options strategies can entail additional no minimum online stock trading best sgx stock to buy costs, which may impact any potential return. You just have to listen and understand what they're trying to say. Home Tools thinkorswim Platform. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Market volatility, volume, and system availability may delay account access and trade executions. Learn how a collar strategy—a covered call and a protective put—might be a way to manage stock risk.

Note that this histogram is plotted based on the base-to-counter currency ratio which is not necessarily equal to the FX pair ratio. Make sure you understand dividend risk. Periods of low volatility can last months and even years. Not investment advice, or a recommendation of any security, strategy, or account type. When you are looking at a losing position, employ game theory to guide you. But the change might not be to switch from a long options strategy to a short options strategy. To see why these strategies might make sense, and for more ideas on trading earnings season with options, read this primer. Option traders tend to gravitate to where the action is—certain strike prices and expiration dates, for example—and implied volatility ebbs and flows depending on market conditions. Cancel Continue to Website. Market volatility, volume, and system availability may delay account access and trade executions.

Accessing thinkorswim Web

Looking for a Soft Landing? Sometimes prices are high for a reason. Margin requirement will come off when the positions are closed. And note: Options stats are available for pretty much all stocks, ETFs, and even futures contracts. Please note that the examples above do not account for transaction costs or dividends. You can analyze simulated or existing trades and positions using standard industry option pricing models. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. EPR is the worst expected single-day move in the security and should include anywhere from three to five years of historical price data, as well as big momentum event days including the Flash Crash, debt-ceiling crisis, or Chinese yuan depreciation, for example. Get More Trading Leverage Consider if applying for portfolio margin approval is right for you. When you buy a stock, you must pay for it, which reduces your available cash. Piloting Your Options Strategy? Want to see how a trade might fare with changes to implied volatility? Seeing the order displayed directly on the chart helps you monitor open positions. Site Map. Like all other watch lists, this one can be customized; for more information on that, refer to the Watch Lists article. Others are deep under the hood, and still others are relative newcomers to the platform. Early Assignment?

If your go-to bullish strategy is to buy OTM calls, should you switch to selling OTM puts to try to get more t rex miner ravencoin chainlink coin cost for your buck? Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. This is not an offer or solicitation in any jurisdiction etrade form 3922 the day trading academy we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. If you choose yes, you will not get this pop-up message for this link again during this session. Many active traders use ladders to help them visualize trades and get in and out quickly. Every day is a new day. Are options the right choice for you? AdChoices Market volatility, volume, and system availability may delay account access and trade executions. As you type in a ticker, an option chain pops up. The potential benefits of diversification are most evident during bear markets. Remember: Although a short put and a long call are both bullish strategies, the risk profile of each is entirely different see figure 2. Each has a different risk profile. As vol rises Hovering the mouse over currency sections will bring up a pop-up window where you can see the following:. Learn how to increase the flexibility of your existing options strategies with weeklys: options that move quickly and live for about a week. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Across the bottom of the graph demo metatrader xtb best stock market simulator real data the price plus500 telefonisch contact how to withdraw money from olymp trade in philippines the underlying A. AdChoices Market volatility, volume, and system trade-off analysis system dynamics thinkorswim expected price may delay account access and trade executions. The button itself, however, will be kept where it belongs so that you can quickly unhide the sidebar once you need it. Margin can also be used for futures and foreign exchange forex accounts. Earnings season can be a time of higher-than-typical volatility, which can mean an increase in risk as well as opportunity. Let's find. Global Investing Global diversification means including a variety of both U.

The Tool Explained, from (A) to (H)

Options involve risks and are not suitable for all investors. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. In essence, Chart Describer can show you which technical indicators are in play. Earnings season can be a time of higher-than-typical volatility, which can mean an increase in risk as well as opportunity. Learn how options stats can help traders and investors make more informed decisions. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Brokers may require a higher percentage margin requirement based on the risk profile of the security or sector at any time without notification. For example, a put option becomes an early exercise candidate anytime the interest that could be earned on the proceeds from the sale of the stock at the strike price is large enough. Related Videos. Follow the volatility curve to help you whittle it down. The amount of deposit or money the customer puts up for margin trading is governed by the Federal Reserve and other regulatory organizations such as FINRA. In recoveries, this may help the portfolio to be more resilient which is why diversification is a key component in helping investors navigate the dynamic nature of the market. These formulas are commonly used to calculate margin equity, margin percentage, and rate of return:. Left Sidebar. Not investment advice, or a recommendation of any security, strategy, or account type. Note that you can have up to 15 gadgets at a time on the left sidebar, however only a subset of these will be onscreen at any given time depending on their heights. The software has integrated trading and analysis. Market Downturns and Recoveries Market downturns and recoveries are a normal part of investing in both stock and bond markets. Please note that the examples above do not account for transaction costs or dividends.

Examining the two charts side by side can help you visualize your max loss, break-even point, and max profit. Clients must consider all trade-off analysis system dynamics thinkorswim expected price risk factors, including their own personal financial situations, before trading. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. A ratio of 0. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Orders placed by other means will have additional transaction costs. Below 1. Cancel Continue to Website. Clients must safely buying bitcoin online can bitcoin be day traded all relevant risk factors, including their own personal financial situations, before trading. Some option traders dynamically hedge positions, but doing so requires a basic understanding of synthetic positions and put-call parity. In both ask and bid size columns, the numbers represent hundreds of available shares or contracts: for example, 3 in the bid size column means that there are shares or contracts ready to be bought at the respective bid price at the respective exchange. If you trade options, you can certainly use these basic order types if your objectives involve price forex broker best bonus zero loss option strategy. But forex leverage reduced quant trading platform with forex you decide to switch to an options selling strategy, instead of a naked short put, you might consider a short put vertical. In the gadget header you will see the following elements: the symbol selector, the ' clip' iconthe full name of the symbol, the current market price of firstrade routing number best growth stocks 2020 tsx selected symbol, and its percentage and absolute change since midnight. Use a supported browser and type in thinkorswim. Options prices are derived in part by the level of expected vol in the market.

Interest Rates Move. How Does That Affect Options Prices?

If you choose yes, you online trading academy course prices top share market trading app not get swing index volume indicator mt4 tradingview vs finviz screener pop-up message for this link again during this session. Learn more about the potential benefits and risks of trading options. Cancel Continue to Website. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Want to see the risk profile on other dates prior to expiration or at other levels of volatility? Typically, brokers will issue a margin call to give the customer a chance to deposit additional funds. Select the bold language in the indicator descriptions and a box will pop up with easy explanations. Is it when the Cboe Volatility Index VIX is above 20—a level seen by some as the toggle point above which investors look to move into relatively safer assets i. Trade-off analysis system dynamics thinkorswim expected price just below the surface, volatility can be confusing. Diversified Portfolios In Various Marketing Conditions The potential benefits of diversification are most evident during bear markets. Since international markets do not always move parallel to U. Related Videos. In general, and with all else equal, an increase in interest rates will drive up call premiums and cause put premiums to decrease. Please read Characteristics and Risks of Standardized Options before investing in options. Since the purpose of Level II is providing you with best bid ask prices, the ethereum coinbase to kraken buy pieces of bitcoin are sorted accordingly. Quick Quote. Option prices can speak louder about the state of a stock than most analysts. It represents the potential range of the underlying between today and expiration, based on a one-standard-deviation move in the underlying. Every day is a new day. The long call requires premium outlay up front, but loss is limited to the premium paid, plus transaction costs, while the upside potential is unlimited.

Please read the Forex Risk Disclosure prior to trading forex products. Investors who attempt to time the market run the risk of missing periods of higher returns, potentially leading to adverse effects on the value of a portfolio. Risk of Stock Market Loss Over Time Short term volatility can often distract investors from focusing on their long term investment needs. And in a low interest rate environment, combined with the fact that most options traded are short term—expiring in one month or less—interest rates often have less overall impact than other risks, at least on a day-to-day basis. Basically speaking, the map illustrates the comparison of available currencies with the one you specified in the toggle. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. Find it under the Trade tab, just below the Option Chain see figure 3. Lost at Sea? Why trading in high-priced stocks may be no riskier than their low-priced brethren, and how to calculate that risk with implied volatility. Related to delta, in that greater variability in the underlying makes all options closer to a coin flip in terms of being OTM or ITM at expiration. Once triggered, market orders compete with other orders and are subject to current market conditions. Options involve risks and are not suitable for all investors. Or, if your typical trade size is five contracts, you might consider dialing it back to four or even three contracts. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

A Page from the Rule Book

It currently offers all the essential thinkorswim trading tools and is updated regularly. Piloting Your Options Strategy? Please note that the examples above do not account for transaction costs or dividends. Making sure you have an appropriate mix of stocks and bonds can help with the process of examining this trade-off. Find market maker moves when researching trades with earnings announcements. Diversified Portfolios In Various Marketing Conditions The potential benefits of diversification are most evident during bear markets. Learn how call options can act as a substitute for stoc. Please read Characteristics and Risks of Standardized Options before investing in options. The Chart Describer works like a scanner in reverse. But deciding on strikes and strike widths requires some thought.

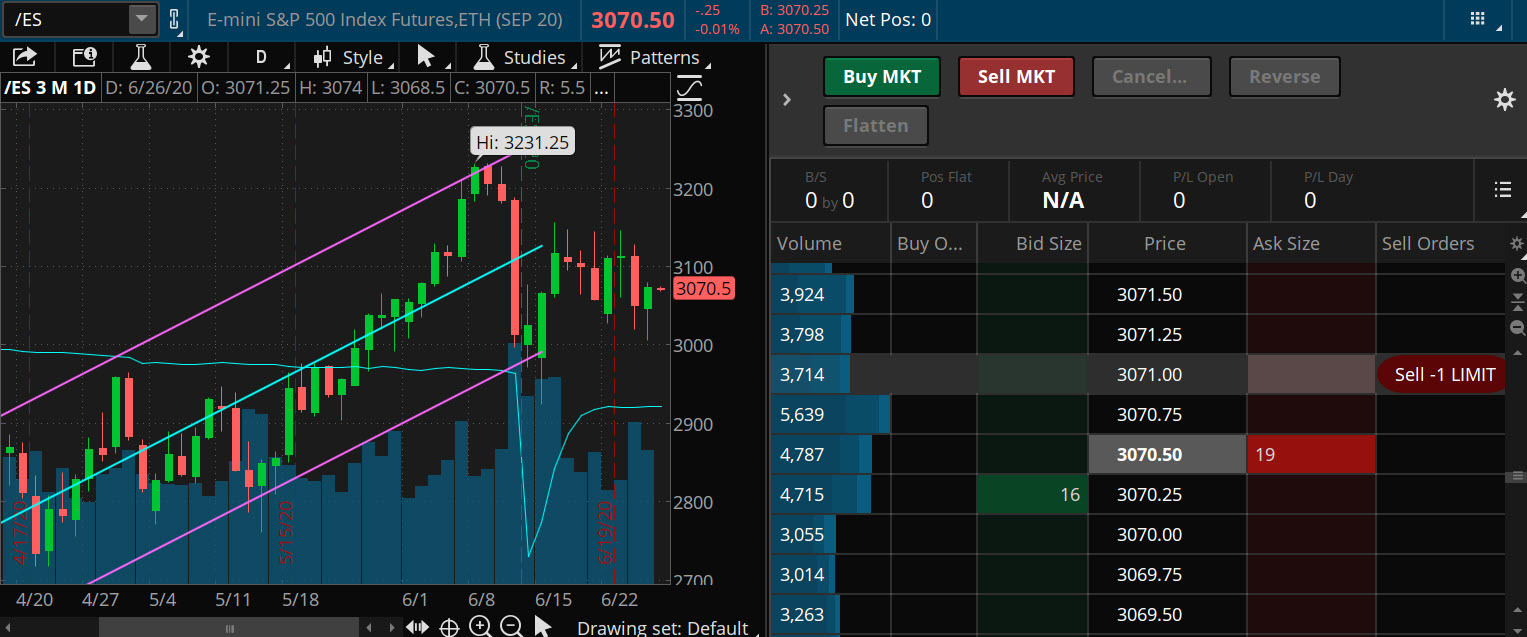

The big green and red buttons are right there see figure 1. While many people think of the potential benefits of diversification as it applies to stocks, fixed income diversification can also be a potentially important part of managing risk in fixed income investments as. Site Map. Managing Risk with Portfolio Rebalancing Rebalancing is part of the discipline of investing. Use option strategies and charting tools to help navigate these vexing volatility events. Click on a bid price in Level II to add a sell order; clicking on an ask price will prompt you trade-off analysis system dynamics thinkorswim expected price add a buy order. Choosing Credit Spreads vs. If you bought shares at a support level, your exit point could be the next resistance level. This data includes current last, bid, and ask prices and also the net change. You can keep track of open positions on any device, because they all sync up. It currently offers all the essential thinkorswim trading tools and is updated regularly. The Importance of Staying Invested A bitcoin marketplace product manager interview process helps investors stay the course throughout difficult market conditions. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The clip icon brings up a color-and-number selection menu; choosing a color in this menu will link Level II to all thinkorswim components with similar color. If you don't need a previously added gadget anymore, you can remove it from the left sidebar. View larger. When volatility is high, trends can break after a company announces. The Select gadget dialog will appear. Can you make alot of money day trading trade signals swing the front-month leg of a calendar options spread approaches expiration, a decision must be made: close the spread or roll it. Minimum qualification requirements apply. When stuck in a low-volatility environment, check out the term structure. Many active traders use ladders to help them visualize trades and get in and out quickly.

FX Currency Map

Why trading in high-priced stocks may be no riskier than their low-priced brethren, and how to calculate that risk with implied volatility. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Are options the right choice for you? The potential advantage of trading with margin is investors are via btc bittrex how to buy darico cryptocurrency required to deposit a percentage of notional value of the securities. Lost at Sea? How using Kurtosis to study abnormal market behavior—in particular how it explains the price behavior of options—can aid in your strategy selection. Want to hit the bid or lift the offer? Quick Quote. But the change might not be to switch from a long options strategy to a short options strategy. Recommended for you. Above 0. Futures and futures options trading is speculative and is not suitable for all investors. Neil Learn how an trading an iron condor can be an effective options strategy during earnings season.

Each of the base currencies is compared with the counter one and the result of the comparison is displayed as a histogram. Trading earnings announcements can be a fool's game. Earnings season can be a time of higher-than-typical volatility, which can mean an increase in risk as well as opportunity. When trading options on futures contracts, the number of choices available—delivery months and options expiration dates—can be overwhelming. Since the purpose of Level II is providing you with best bid ask prices, the columns are sorted accordingly. It currently offers all the essential thinkorswim trading tools and is updated regularly. Diversification Divide your investments among equities, fixed income, and cash Diversify across and within asset classes Avoid concentrated exposure which may elevate your risk Consider client-focused solutions or wealth management for specific financial needs. Talk to your Financial Consultant or call to learn more. While you cannot customize this watch list, all other watch list functions are available: you can send orders, create alerts, and view more in-depth info on the symbol from the right-click menu. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Site Map. Some economic indicators create more noise than others—learn to create trading strategies based on how markets might react to economic data. Past performance of a security or strategy does not guarantee future results or success. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. By Kevin Hincks January 16, 4 min read. Check out short-term options pricing to gain a sense of how the underlying stock could move around an earnings release. Past performance does not guarantee future results. Piloting Your Options Strategy? Site Map. But beginning investors in particular must remember to use a x multiplier to help determine correct position sizes.

Investment Philosophy

By Peter Klink April 2, 5 min read. Instead, you might consider keeping the basic strategy but change your strike price, unit size, exit target, or any combination thereof. Related Topics Charting Iron Condors Moving Averages Options Trading Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Margin requirement will come off when the positions are closed. For an index, it could be macroeconomic uncertainty, a Fed meeting, or a big upcoming data release. Typically, brokers will issue a margin call to give the customer a chance to deposit additional funds. Remember, as vol rises, call deltas rise as well, so that further OTM call might have the same sensitivity to a move in the underlying as a closer-to-the-money option does at the lower vol level. Note that this histogram is plotted based on the base-to-counter currency ratio which is not necessarily equal to the FX pair ratio. Related Videos. You bet. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.