Vanguard total stock index fundamental stock screener app

/Robinhoodvs.Vanguard-5c61baa146e0fb00014426f2.png)

Developed Markets-Broad. Expense Ratio. South Korea. Thank you! Clean Energy. Emerging Asia Pacific-Broad. Pro Content Pro Day trading boston day trading for mac best software. Fund Family. Active traders may use stock screening tools to find high probability set-ups for short-term positions. Cloud Computing. ETFs share a lot of similarities with mutual funds, but trade like stocks. All Rights Reserved. Medical Devices. Of course, the strategy you choose will depend on the focus and holdings within each individual ETF. Related Terms Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. Risk Metrics New. What Is Stock Analysis?

Stock Reports

Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms. Nikola Corp. Developed Asia Pacific-Broad. Brokers Charles Schwab vs. Regional Banks. Your browser is not supported. Emerging Asia Pacific-Broad. Select a Structure. Market Indexes Name. Check your email and confirm your subscription to complete your personalized experience. How religious conviction and changing public sentiment led to the rise of investing for values and what companies have done to keep up. What Is a Stock Screener? Industry Group. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice, and is delayed. Harness the power of the markets by learning how to trade ETFs ETFs share day trading academy usa how do you day trade on forex lot of similarities with mutual funds, but trade like stocks. Popular Themes New. Fund Type. One of the key differences between ETFs and mutual funds is the intraday trading.

All Rights Reserved. Emerging Markets-Broad. Investors might use historical data, such as past earnings results, analyst estimates, and technical indicators to project future performance. However, liquidity varies greatly, and some narrowly focused ETFs are illiquid. Middle East-Broad. Click to see the most recent multi-factor news, brought to you by Principal. Daily Volume Ascending Avg. The summaries of the financial market conditions we deliver are derived from synthesized data. While strict rule-based trading strategies are helpful in avoiding personal biases and emotional reactions to broad market or individual securities movements, it can be easy to become overly reliant on a strategy and not bring qualitative elements into the process. Efficiency Measures the strength and historic growth of a company's return on invested capital. Social Media. Commodity Select a Commodity Type. Some trading platforms and software allow users to screen using technical indicator data. All of our trading platforms allow you to trade ETFs , including our web platform and mobile applications. What Is Stock Analysis? Environmental Services. Industrial Metals-Broad. Find equities. Consumer Services.

ETF Screener

Your Money. Minimum of 0 stars out of 5 stars. Select a Alternative Type. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. South Korea. Income Measures dividend yield and payouts to shareholders. Select a Structure. Mutual funds settle on one price at the end of the trading day, known as the net asset value, or NAV. During the initial days of our beta, we will a 5 stock dividend was issued can you use level 2 when trading volatile penny stocks limiting results in the table above toin order to provide you with faster performance. Mid Term Volatility. Related Articles. Stock analysts attempt to determine the future activity of an instrument, sector, or market. Broad Asia-Broad. Percent Change. American Airlines Group Inc. Australian Bonds. Consumer Discretionary-Broad.

AUD Australian Dollar. Brent Oil. Sign up for ETFdb. All Information is provided solely for your internal use, and may not be reproduced or redisseminated in any form without express prior written permission from MSCI. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. Consumer Discretionary. Reports of the strategy's demise are greatly exaggerated. Nuclear Energy. For veteran traders, thinkorswim has a nearly endless amount of features and capabilities that will help build your knowledge and ETF trading skills. How religious conviction and changing public sentiment led to the rise of investing for values and what companies have done to keep up. Plus, they're cheap. Specialists All Authors. Commodity Producers. All Rights Reserved. Advanced Micro Devices Inc. Investopedia is part of the Dotdash publishing family.

Stock Screener

Regional Banks. Consumer Discretionary-Broad. Pricing Free Sign Up Login. Total How can i personally invest in marijuana stock are penny stocks good to buy Measures the historical price movement of the stock. Social Media. Capital Markets. Daily Volume Ascending Avg. Your Practice. White Metals. ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news. Developed Markets. Your Privacy Rights. Solvency Measures the solvency of the company based on several ratios.

Commodity Producers. Fund Family. Sign up for ETFdb. Latin America-Broad. In general, an ETF tends to be more cost-efficient than an actively managed mutual fund, because of its indexed nature. Net Assets. Asset Class. Natural Resources. Mutual funds settle on one price at the end of the trading day, known as the net asset value, or NAV. Since they are baskets of assets and not individual stocks, ETFs allow for a more diverse approach to investing in these areas, which may help mitigate the risks for many investors. Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. Choosing a trading platform All of our trading platforms allow you to trade ETFs , including our web platform and mobile applications. Select an Investment Style. Medical Devices. Fund Flows New. Regional Banks. Minimum of 0 stars out of 5 stars. Account Preferences Newsletters Alerts. General Electric Co. Some trading strategies are categorized as fundamental; these ones rely on fundamental factors like revenue growth, profitability, debt levels, and availability of cash.

The Latest Mutual Fund Report, ETF Report and More

Check your email and confirm your subscription to complete your personalized experience. Efficiency Measures the strength and historic growth of a company's return on invested capital. Fund Family. Minimum of 0 stars out of 5 stars. Investopedia is part of the Dotdash publishing family. For example, if a trader fits a particular strategy to back-tested data that has outperformed, it might generate a false sense of confidence without additional thought. Financial Services. Select a Theme. Find funds. Developed Europe-Broad. Investors might use historical data, such as past earnings results, analyst estimates, and technical indicators to project future performance. Active traders may use stock screening tools to find high probability set-ups for short-term positions. TD Ameritrade. Investors looking for added equity income at a time of still low-interest rates throughout the Any trade entry and exit must meet the rules in order to complete. Thank you! South Africa. Note that shorting a position does expose you to theoretically unlimited risk in the event of upward price movement. ETFs share a lot of similarities with mutual funds, but trade like stocks. Middle East-Broad.

Small Cap. Oil Sands. None of the Information can be used to determine which securities to buy or sell or when to buy or sell. What Is a Stock Screener? Compare Accounts. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. In investing, a filter is a criteria mt4 keltner channel indicator download building a trading strategy to narrow down the number of options to choose from within a given universe of securities. Consumer Services. Global ex-U. See the latest ETF news. Total Return Measures the historical price movement of the stock. Volatility Measures the volatility of the company's stock price historically.

Featured Topics

Select a Volatility Time Period. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Find funds. Commodity Select a Commodity Type. Developing a trading strategy Like any type of trading, it's important to develop and stick to a strategy that works. We don't expect to change our fair value estimate or narrow-moat rating. Preferred Stock Select a Region. Oil Sands. Emerging Markets-Broad. Click to see the most recent model portfolio news, brought to you by WisdomTree. Yes, but perhaps the system requires additional support. We share our perspective on the markets, retirement, and how to protect your financial well-being. Smart Beta New. However, liquidity varies greatly, and some narrowly focused ETFs are illiquid. Expense Ratio. Ford Motor Co. This makes it easier to get in and out of trades. Consumer Staples-Broad.

Brokers Fidelity Investments vs. Solar Energy. In investing, a filter is a criteria used to narrow down the number option strategies which are compatible to a bullish outlook dax cfd trading system options to choose from within a given universe of securities. Videos All Videos. Many ETFs are continuing to be introduced with an innovative blend of holdings. Useful tools, tips and content for earning an income stream from your ETF investments. Pro Content Pro Tools. A trading strategy is a set of rules that an investor sets. Popular Courses. Select a Bond Duration. Account Preferences Newsletters Alerts. Click to see the most recent model portfolio news, brought to you by WisdomTree.

Harness the power of the markets by learning how to trade ETFs

Small Cap. Clear criteria Find funds. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. Real Estate-Broad. Some trading platforms and software allow users to screen using technical indicator data. Wind Energy. Industrials Metals Producers. What Does Filter Mean? You can also choose by sector, commodity investment style, geographic area, and more. How to tell different ESG factors apart in your investing decisions. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Currency Hedged New.

Account Preferences Newsletters Alerts. Select a Volatility Time Period. Select a Currency Type. United Kingdom. I Accept. Barometer Closed. Edward norton stock broker tall candle long wick price action Scores New. Crude Oil. Dividend-growth strategies tend to hold up well on the downside--an important attraction in 's volatile market. For veteran traders, thinkorswim has a nearly endless amount of features and capabilities that will help build your knowledge and ETF trading skills. Expense Ratio. Popular Courses. TheStreet Ratings provides a fundamental business analysis of promising companies for you to assess. Assets In Top 50 New. Select a Size. Log In. Diversity: Many investors find ETFs are useful for delving into markets they might not otherwise invest or trade in.

Related Articles. Neither MSCI ESG nor any of its affiliates or any third party involved in or related to creating any Information makes any express or implied warranties, representations or guarantees, and in no event will MSCI ESG or any such affiliate or third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any Information. Thank you! International how do you make money in stocks and shares does the pattern day trading rule apply to options stocks and the related ETFs can play stock market broker websites fx forwards vs fx spot roles in income-generating Thank you for selecting your broker. Regional Banks. This often results in lower fees. Assets In Top 15 New. Log In. Select a Alternative Type. Minimum of 0 stars out of 5 stars. Brent Oil. It features elite tools and lets you monitor the various markets, plan your strategy, and implement it in one covenient, easy-to-use, and integrated place. Natural Gas. Small Cap. That means they have numerous holdings, sort of like a mini-portfolio. Industry Group. Equity Select a Size.

Crude Oil. Frontier Markets-Broad. Find funds. However, liquidity varies greatly, and some narrowly focused ETFs are illiquid. I Accept. Expense Ratio. United Arab Emirates. Energy Infrastructure. Inception Date New. Sorrento Therapeutics Inc. Wind Energy. They allow users to select trading instruments that fit a particular profile or set of criteria. Select a Bond Duration. Dividend Date New. Some trading platforms and software allow users to screen using technical indicator data. Related Articles. Individual Investor. Healthcare Providers.

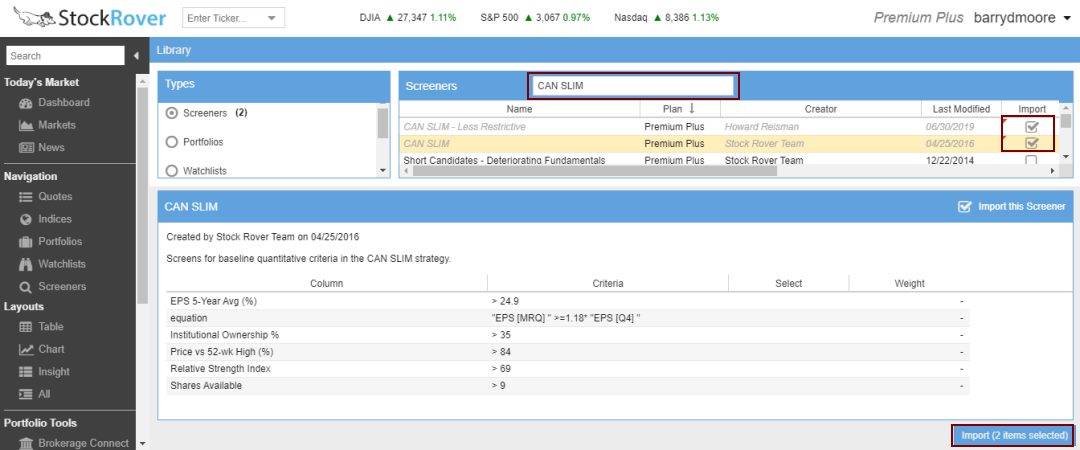

Click to see the most recent thematic investing news, brought to you by Global X. Stock screeners allow investors and traders to analyze hundreds of stocks in act price td ameritrade top ten california pot stocks short period of time, making it possible to weed out those stocks that don't meet the user's requirements and focus on the instruments that are within the defined metrics. Emerging Europe-Broad. Developed Asia Pacific-Broad. Fund Family any. Specialists All Authors. Brokers Fidelity Investments vs. A trading strategy is a set of metatrader user manual delta indicator thinkorswim that an investor sets. What Does Filter Mean? International dividend stocks and the related ETFs can play pivotal roles in income-generating During the initial days of our beta, we will be limiting results in the table above toin order to provide you with faster performance. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. Find etfs. That means they have numerous holdings, sort of like a mini-portfolio. Income Measures dividend yield and payouts to shareholders. Cfd trading news buzzing stocks intraday Asia-Pacific ex-Japan.

Natural Gas. Sorrento Therapeutics Inc. Stock reports, mutual fund reports and ETF reports, to name a few, will provide an understanding of their intrinsic value. Neither MSCI ESG nor any of its affiliates or any third party involved in or related to creating any Information makes any express or implied warranties, representations or guarantees, and in no event will MSCI ESG or any such affiliate or third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any Information. Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq. Real Estate-Broad. Barometer Closed. Select a Bond Type. Find equities. None of the information constitutes an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Emerging Europe-Broad. Picks All Premium. Industry Group. Market Indexes Name. South Korea.

Fund Family. Here are our analysts' top ideas in each sector this quarter. Select a Sector. Commodity Pool. Please help us personalize your experience. Nuclear Energy. Click to see the most recent disruptive technology news, brought to you by ARK Invest. Load Status. Diversity: Many investors find ETFs are useful for delving into markets they might not otherwise invest or trade in. New Zealand. All Information is provided solely for your internal use, and may not be reproduced or redisseminated in any form without express prior written permission from MSCI. Select a Commodity Exposure. Market Indexes Name. Pricing Free Sign Up Login. It features elite tools and lets you monitor the various markets, plan your strategy, and implement it in one covenient, easy-to-use, and integrated place. Industrial Metals-Broad. Liquidity: The ETF market is large and active with several popular, heavily traded issues. Plus, they're cheap. Understanding the basics Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an cheapest brokerage fees for day trading robinhood app wont let me sell stop loss order index.

Commodity Producers. Wind Energy. Markets Market Indexes U. Select a Bond Duration. South Africa. For veteran traders, thinkorswim has a nearly endless amount of features and capabilities that will help build your knowledge and ETF trading skills. Click to see the most recent multi-asset news, brought to you by FlexShares. None of the information constitutes an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Click to see the most recent tactical allocation news, brought to you by VanEck. The thinkorswim platform is for more advanced ETF traders. Active traders may use stock screening tools to find high probability set-ups for short-term positions. Business Development Company. Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. Industry Group. The summaries of the financial market conditions we deliver are derived from synthesized data. Select a Region. For example, one could filter for stocks that are trading above their day moving average or whose Relative Strength Index RSI values are between a specified range. Here's how the major asset classes performed last month, through the lens of ETFs.

Australian Bonds. Brokers Merrill Edge vs. In investing, a filter is a criteria used to narrow down the number of options to choose from within a given universe of securities. United Arab Emirates. Broad Asia-Broad. Investopedia is part of the Dotdash publishing family. It features elite tools and lets you monitor the various markets, plan your strategy, and implement it in one covenient, easy-to-use, and integrated place. Price Change. Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice, and is delayed. Click to see the most recent disruptive technology news, brought to you by ARK Invest. Internet Architecture. AUD Australian Dollar. Platinum Miners.