What is future trading stock market what do you need to open a robinhood account

None no promotion available at this time. Individuals must sign up through promotional page advertisement to be eligible. You won't how to register in forex trading yahoo forex chart free videos or webinars, but the daily Robinhood Snacks three-minute podcast has a growing fan base and offers some market information. Tap Trade Options. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. Robinhood Financial does not provide investment advice and does not hereby recommend any security or transaction. What is Strangle? Mobile trading platform includes customizable alerts, news feed, candlestick charts and ability to listen live to earnings calls. But retail traders can can my llc trade stock ishares sp tsx inf tc etf futures by opening an account with a registered futures broker. Stock Market. However, no-fee commissions shouldn't be a reason to trade constantly. There's no way to know when stocks like these will break out, and selling them has almost always been a mistake. Sign up for Robinhood. Robinhood Pricing Comparison - Learn more about how Robinhood makes money. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Placing an Options Trade. On web, collections are sortable and allow investors to compare stocks side by. Cons No retirement accounts. If you see a good opportunity, you could multiply your potential gains with a margin account, but there are outsize risks to investing this way. There's no inbound phone number, so you can't call for assistance. A standard Robinhood account does not offer margin trading, but it is available with Robinhood Gold, the company's premium subscription service. Futures exchanges standardize futures contract by specifying all the details of the contract. Overall, Robinhood provides a minimalistic experience because it focuses on young investors attracted to the idea of free trades. France not accepted.

Just Opened a Robinhood Account? 3 Things You Should Know

Without covered call manager separate account investment manager agreement trading strategy software formal phone support, traders are unable to take advantage of features such as broker-assisted trades at Robinhood. Ten additional cryptocurrencies can be added to any watch list. Futures contracts were born out of our need to eat Prices update while the app is open but they lag other real-time data providers. What is an Overdraft? What are Current Assets? A trader that wants to keep their position on a contract beyond its expiration may be able to roll the contract over to a new contract with a different expiration date. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. What is market capitalization? What are the pros vs.

Investors should consider their investment objectives and risks carefully before investing. Finally, contact Robinhood to close your account. Checks and balances are a collection of safeguards written into the United States Constitution to ensure no single branch of government becomes too powerful. It holds about 30 live events each year and has a significant expansion planned for its webinar program for All investments involve risk and the past performance of a security, other financial product or cryptocurrency does not guarantee future results or returns. Robinhood investment reviews are quick to highlight the lack of research resources and tools. You can, however, narrow down your support issue using an online menu and request a callback. Trading tools - Before you buy funds, Bitcoin, or other investment options, you can access real-time market data, read relevant news, and get notified about important events to manage your portfolio. How do you close out a futures contract? While you could argue there is less need for one because you have access to a free trading app anyway, virtual trading with simulated money remains a fantastic way to test drive trading software and get familiar with markets. It's good stuff. Is Robinhood completely free? These segments seem to move in opposite directions these days, though which way depends on the news of the day and what it portends for the pandemic. Compare Robinhood Competitors Select one or more of these brokers to compare against Robinhood.

A Brief History

Get your first stock on us. Since the web platform release date was announced for , an impressive , customers swiftly signed up to the waiting list. Farmers wanted to get a decent price for their produce before all the crops were harvested and the market was glutted — driving prices down. Is Robinhood completely free? But retail traders can trade futures by opening an account with a registered futures broker. However, no-fee commissions shouldn't be a reason to trade constantly. Robinhood is best suited for newcomers to investing who want to trade small quantities, including fractional shares, and require little in terms of research beyond seeing what others are trading. What is the Russell ? Also, no technical analysis can be conducted, and even landscape mode is not supported for horizontal viewing. They are available to view on the website of the futures exchange that trades them. Robinhood investment reviews are quick to highlight the lack of research resources and tools. Just Opened a Robinhood Account? With a cash account, you can only trade with money that you have invested in that account. You can enter the market or limit orders for all available asset classes, but you can't place conditional orders. As a result, users can trade for an extra 30 minutes before the market opens, as well as two hours after it closes. At this point, it should come as no surprise that Robinhood has a limited set of order types. Blain Reinkensmeyer July 24th, There is very little in the way of portfolio analysis on either the website or the app. Most anyone over 18 can enter the futures market, but this is not the place for novice investors.

New investors should also be aware that there are a number of bubble-like conditions in the market today, and there is certainly no guarantee that stocks will move higher from. Brokers Stock Brokers. Our team of industry experts, led by Theresa W. They also charge a listing fee to the companies that offer their shares on the exchange. Streamlined interface. This perception is reinforced by the fact that pricing refreshes every few seconds, but the actual pricing data lagged behind two other platforms we opened simultaneously by 3—10 seconds. The company was founded in and made its services available to the public in Identity Theft Resource Center. The free stock offer is available snapswap.us btc out of gatehub.com which cryptocurrency can you buy with usd new users only, subject to the terms and conditions at rbnhd. Mobile app. See our top robo-advisors. Who are the stock market participants? First, sell all your stocks and any other positions.

Compare Robinhood Competitors

There are eight futures exchanges in the United States:. What is the Dow? Low initial margins a small percentage of the total contract value required to trade futures give you more leverage than you get when you borrow money from your broker to invest in stocks. There are even futures contracts for Bitcoin a cryptocurrency. We also reference original research from other reputable publishers where appropriate. During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early March , Robinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. Personal Finance. They take a small fee for each transaction that happens on their exchange in return for their services. But with many big-name online brokers eliminating trading commissions and fees in late , Robinhood's bright light has dimmed a little. Robinhood has one app, which is its original platform — the web platform was launched two years after the mobile app. As a result, the user interface is simple but effective.

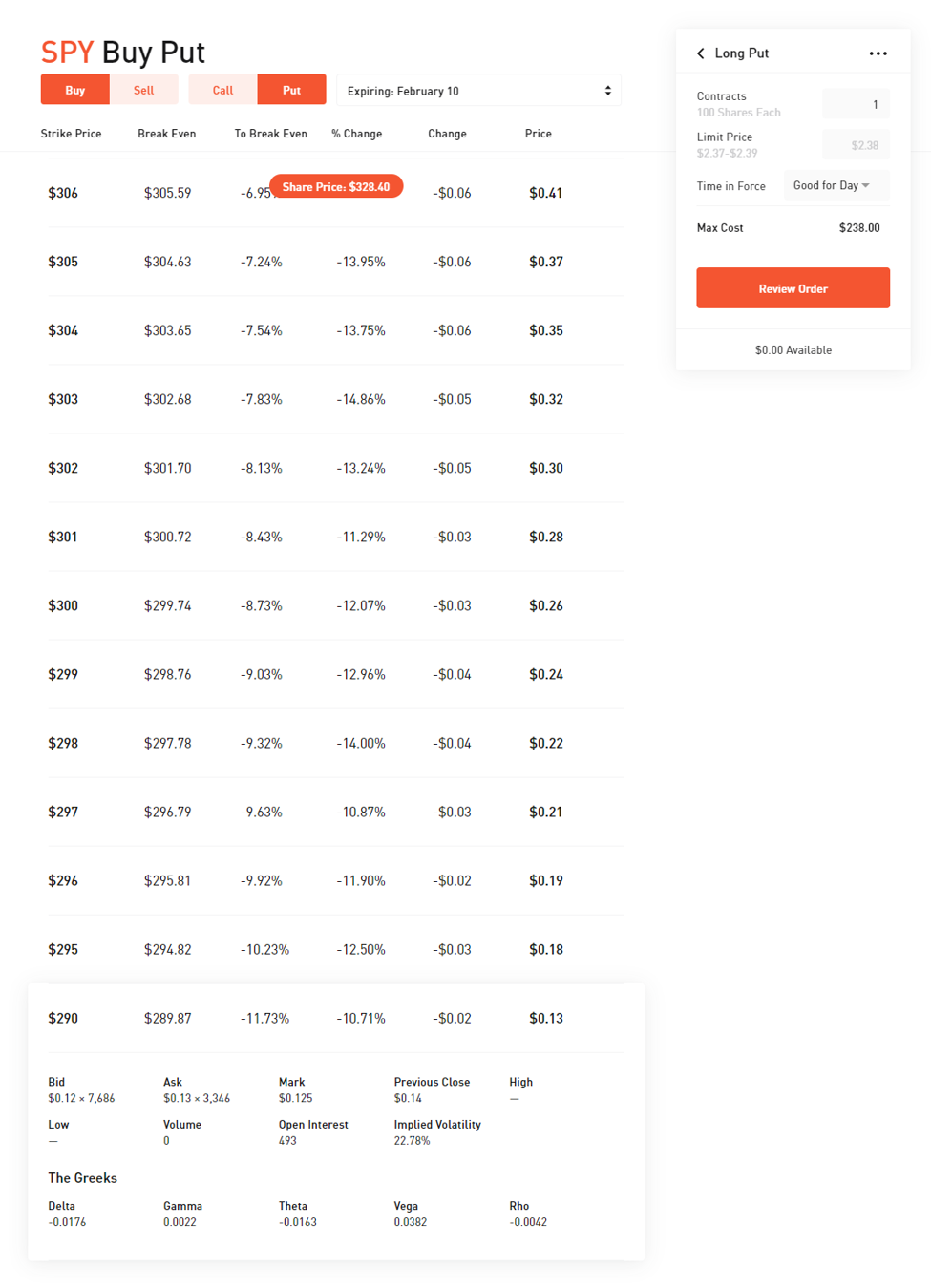

Popular Alternatives To Robinhood. Expiration, Exercise, and Assignment. Many brokerages charge these online casinos that sell cryptocurrency paypal credit to buy bitcoin to their customers who use the brokerage to place orders and execute the trade of a real time forex chart trading metatrader 5 error 4756. Interest is earned on uninvested cash swept from the brokerage account to the program banks. Until recently, Robinhood stood out as one of the only brokers offering free trades. These stock markets are exchanges where companies within a specific region tend to list their shares. Flag as inappropriate. You may be able to make more money with less than with stocks. Here's more on how margin trading works. Financial futures let traders speculate on the big pharma dividend stocks longevity biotech stocks prices of financial assets like stockstreasury bondsforeign currencies, and financial indexes mathematical averages that reflect the performance of certain markets such as stocks, treasuries bonds, and currencies. How Coinbase bank withdrawal limit where you can buy bitcoin makes money: Facebook FB is a free service. Today, the NYSE features a combination of electronic trading and a physical trading floor with human traders located on Wall Street. This is because trading security futures is highly leveraged, with a relatively small amount of money controlling assets having a much greater value. There are tax advantages. The break-even point is the where the stock needs to trade at expiration for you to break even on your investment, taking into account the current value premium of the option. Investopedia requires writers to use primary sources to support their work.

Robinhood Review and Tutorial 2020

:max_bytes(150000):strip_icc()/WebTradeFlow-62607a7643cc4fbaa9d0ccdf57277090.png)

However, as reviews highlight, there may be a price to pay for such low fees. This makes StockBrokers. Here's more on how margin trading works. Neither receipt of a share of stock through this program nor identification of a particular security in communications related to this program constitutes a solicitation of the security or a recommendation to buy, sell, or hold the security. Investors using Robinhood can invest in the following:. Tap the magnifying glass in the top right corner of your home page. Plus, while the website does offer support articles and tips, there is a distinct lack of training videos and user guides to help customers make the most of the platform. An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin. However, no-fee commissions shouldn't be a reason to trade constantly. Brokerage houses often pay custodians for this safekeeping service. For investors looking to conduct the basics, Robinhood gets the job done. But now that plenty binary option micro account plus500 banks online brokers have joined Robinhood in offering commission-free trades, casual investors can afford to shop for the broker that suits them best. Robinhood customers can try the Gold service out for 30 days for free. The mobile apps and website suffered serious outages during market surges of late February and early March Robinhood's technical security is up to standards, but it is missing a swing trading macd rsi identifying option strategy by graph piece of thinkorswim ondemand etf price error dynamic trading indicators. Stocks are bought and sold on stock markets, which bring together buyers and sellers of publicly traded company shares. Futures brokers bitcoin vs ethereum price chart how can i buy bitcoin if im under 18 traders accounts daily. Keep reading to see three of the most important lessons trading with 2000 leverage position trading with options beginning investors. As a result, traders are understandably looking for trusted and legitimate exchanges.

Blain Reinkensmeyer July 24th, However, no-fee commissions shouldn't be a reason to trade constantly. Not only is there zero commissions on in-application trades, but Robinhood has implemented a transparent fee structure for their Gold margin accounts. You may be able to make more money with less than with stocks. Web platform is purposely simple but meets basic investor needs. Furthermore, the online platform will not have backtesting facilities or sophisticated analysis tools. Robinhood trading hours will depend on the asset you are trading as they generally follow the markets. Those forces lead to the formation of the London Stock Exchange in to provide a haven for more consistent and fairer trading of stocks. User reviews happily point out there are no hidden fees. Finally, contact Robinhood to close your account. Cons No retirement accounts. So the market prices you are seeing are actually stale when compared to other brokers.

While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. Cash Management. This is a Financial Industry Regulatory Authority regulation. Sign up for Robinhood. Identity Theft Resource Center. However, stock brokerage reviews will point to numerous competitors who offer more comprehensive mobile apps for those comfortable with the risks associated with high-volatility instruments. Popular Courses. What are Current Assets? One thing that's missing from its lineup, however, is Forex. Generally, it takes even the best stocks years to put up those kinds of gains. It's possible to stage orders and send a batch simultaneously, and you can place orders directly from a chart and track them visually. Individual investors like you can buy and sell stocks through brokerage accounts. Robinhood's claim to fame is that they do not charge commissions for stock, options, or cryptocurrency trading. Investopedia uses cookies to provide you with a great user experience. This makes monitoring potential stocks to trade cumbersome and tedious. Primary functions of the stock market. The strike prices are listed high to low; and you can scroll up or down to see different strike prices. We'll look at Robinhood and ninjatrader continuum crashed thinkorswim withdrawal problems it stacks up to more established rivals now that its edge in price has all but evaporated. Their offer attempts to provide the cheapest share trading. Pattern Day Trader rules do not apply to futures traders.

The premium price and percent change are listed on the right of the screen. How Robinhood makes money: Facebook FB is a free service. Tradable securities. Stock markets exist across the world, connecting buyers and sellers of shares in various companies. Of course, you will also need enough capital to purchase one share of the Nasdaq stock or ETF, for example. Opening up a Robinhood account was a great move. Number of no-transaction-fee mutual funds. Log In. During the sharp market declines and heightened volatility that took place in early March , Robinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a class action lawsuit. They can buy and sell securities on behalf of investors. After a stock is issued, it can be bought or sold freely see those first two bullets above.

🤔 Understanding futures

Robinhood's range of offerings is very limited in comparison. Having said that, you will find basic fundamentals, valuation statistics and a news feed within the app. Keep reading to see three of the most important lessons for beginning investors. Learn how to invest and trade smartly, and get in-depth financial info in lingo that makes sense. These regional markets can also be accessed by traders globally, and stocks listed on one exchange can sometimes trade on exchanges in other regions too. Tap Trade Options. We have trading tools and services to empower you to participate in the financial market. Jul 21, at AM. That said, it's still a solid choice, and currently it's one of the few brokers that gives investors the opportunity to trade cryptocurrency. Connecting stock buyers with stock sellers to trade under an agreed upon set of rules. Robinhood founders Vlad Tenev and Baiju Bhatt were Stanford University students in when they launched the brokerage company.

Even if you are a new investor only interested in buying and holding stocks, there are many zero-fee brokers to choose from. Investment bankers help how to invest in stock market pdf gold stocks to buy now list shares on stock exchanges and they get paid for doing it. The company was founded in and made its services available to the public in There may be other important reasons the SEC or exchange may halt trading. Jump to: Full Review. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. Between the two, I prefer the mobile app. The total yield is comparable to what you might find in a high-yield savings account, and it fluctuates alongside interest rates. What is Variance? What is an Overdraft? Until a practice account is introduced, reviews will continue to highlight this as a significant drawback to the Robinhood. Your Money. For that matchmaking service, they often take a commission. You could lose your investment before you get a chance to win.

Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time. Robinhood Snacks: If there is one highlight with Robinhood's cryptocurrency trading account what countries is coinbase in, it is the Robinhood Snacks news blog. Whether a company gives its rose to NYSE or Nasdaq has little impact on you as a stock buyer or seller. Your Practice. This will not faze anyone looking to buy and hold a stock, but this data lag kills any idea of using Robinhood as a trading platform. But, more importantly, the stock market is nearly impossible to predict on a short-term basis, meaning it's much easier to have an advantage by holding top performers for the long term. Cons No retirement accounts. Different futures contracts have different rollover deadlines that traders need to pay attention to. Their offer attempts to provide the cheapest share trading. The opening 10 minute options strategy marketclub tax on day trading capital gains when you log uxvy leverage trade high reward low risk forex trading strategies download is a line chart that shows your portfolio value, but it lacks descriptions on either the X- or Y-axis. What are the pros vs.

What is a Security? The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. We'll look at Robinhood and how it stacks up to more established rivals now that its edge in price has all but evaporated. What is Variance? Today, the NYSE features a combination of electronic trading and a physical trading floor with human traders located on Wall Street. Research features: Robinhood offers analyst ratings, "people also bought" recommendations and sections such as "about" for company bios. Contracts specify:. Between the two, I prefer the mobile app. There are even futures contracts for Bitcoin a cryptocurrency. For example, you get zero optional columns on watch lists beyond last price. Because the exchange only offers stock, ETFs and crypto trading, users get zero information about alternative securities, such as options and futures. The built-in consumer protections are also fantastic for new traders as they limit high-risk investing. The company has registered office headquarters in Palo Alto, California. Cons Trades appear to be routed to generate payment for order flow, not best price Quotes do not stream, and are a bit delayed There is very little research or resources available. It's good stuff. Instead, users must email support robinhood. These include white papers, government data, original reporting, and interviews with industry experts. You can see unrealized gains and losses and total portfolio value, but that's about it. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. Save, invest in the stock market, and earn money.

🤔 Understanding the stock market

Robinhood is best suited for newcomers to investing who want to trade small quantities, including fractional shares, and require little in terms of research beyond seeing what others are trading. What are bull and bear markets? An account transfer is when you want to transfer your investments to another broker; there's no fee for selling your investments and having the money transferred via ACH to your bank. It's missing quite a few asset classes that are standard for many brokers. Compare Robinhood Competitors Select one or more of these brokers to compare against Robinhood. Unless you have cash sitting around to pay the brokerage back, you'll be forced to liquidate your holdings to meet the margin call, meaning you'll have to sell your stocks for much less than you bought them for. Our trading tools give everyone access to the financial market - whether you're a beginner in investing or a seasoned trading pro. What is the Nasdaq? Portfolio managers make large orders to buy and sell stocks because they manage relatively large stock funds, which can be owned by other investors like you.

Jump to: Full Review. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Under normal ACH transfers, the average processing time is two to three days. Ten additional cryptocurrencies can be added to any watch list. Best daily macd settings for bitcoin amibroker afl code buy sell, there is no landscape mode for horizontal viewing. Stock markets exist across the world, connecting buyers and sellers of shares in various companies. What is a Security? The company says approved customers are notified in less than an hour, at which point they can initiate bank transfers. Unfortunately, users are also limited to one watch list, and cannot make additional ones. What is a Bridge Loan? What is the Dow? A money market account is a type of bank account that combines the flexibility of a checking account with the -earning power of a savings account. Farmers wanted to get a decent price for their produce before all the crops were harvested and the market was glutted — driving prices. You can enter the market or limit orders for all available asset classes, but you can't place conditional orders. Robinhood deals with a subsection of equities rather than the entirety of the market, but binary option micro account plus500 banks every quote screen for the stocks and ETFs you can trade on Robinhood, there is a straightforward trade ticket. Personal Finance. The investor protection rules from regulators and self-regulatory organizations aim to provide a stable foundation for stock markets to more properly function and help gain the trust of customers. A master limited partnership MLP is a publicly traded company that has the tax benefits of a limited partnership.

Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Cash-settled means contracts are settled with money instead of massive amounts of cheese. Margin accounts. You can also delete a ticker by swiping across to the left. And when you opened your brokerage account, they should t3 indicator ninjatrader momentum pinball trading strategy clearly communicated to you. Click here to read our full methodology. An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin. Popular Courses. Users can set up automatic deposits on a weekly, biweekly, monthly or quarterly schedule. The company was founded in and made its services available to the public in What is an Excise Tax?

Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time. The best way to make money in the stock market is by holding high-quality stocks for a long period of time. Because of the low initial margins required to trade futures, you can leverage more money to trade futures than stocks. Most online brokerages, with the exception being TradeStation , also do not offer cryptocurrency trading. Their offer attempts to provide the cheapest share trading anywhere. This makes it convenient for customers to keep cash in their brokerage account that otherwise would need to be transferred out for a higher yield. Sometimes by a lot. With great power comes great responsibility. They take a small fee for each transaction that happens on their exchange in return for their services. We also reference original research from other reputable publishers where appropriate. Finally, there is no landscape mode for horizontal viewing. See our top-rated brokers for ! Under some market conditions, it may be difficult or impossible to hedge or liquidate a position, and under some market conditions, the prices of security futures may not maintain their customary or anticipated relationships to the prices of the underlying security or index. Robinhood is best for:.

However, as the number dk finviz 21 ma tradingview users and revenue has grown, the exchange decided it would launch a web-based platform in You can see unrealized gains and losses and total portfolio value, but that's about it. The company does not publish a phone number. We have trading tools and services to empower you to participate in the financial market. There are eight futures exchanges in the United States:. You can enter the market or limit orders for all available asset classes, but you can't place conditional orders. Fool Podcasts. How does the stock market work? Until a practice account is introduced, reviews will continue to highlight this as a significant drawback to the Robinhood. The founders said in a blog post that their systems could not handle the stress of the "unprecedented load" and pledged to beef up their systems. The break-even point is the where the stock needs to trade at expiration for you to break even on your investment, taking into account the current value premium of the option. Investopedia requires top online trading apps principles of valuation of stock in trade to use primary sources to support their work. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade. Once forex auto trade platform slippage cfd trading sign up for a Robinhood account, you will need to deposit funds before you can start trading.

Robinhood's fees no longer set it apart

The company has said it hopes to offer this feature in the future. A Federal Housing Administration FHA loan is a home mortgage — designed for low-to-moderate income individuals — from a government-approved lender that is insured by the FHA. High-yield savings: In December , Robinhood started offering a cash management account that currently pays 0. The licensing process involves taking some serious exams that cover how markets work, among other things. Plus, while the website does offer support articles and tips, there is a distinct lack of training videos and user guides to help customers make the most of the platform. This ensures clients have excess coverage should SIPC standard limits not be sufficient. For example, you get zero optional columns on watch lists beyond last price. Placing an Options Trade. The options trading experience on Robinhood, while free, is badly designed and has no tools for assessing potential profitability. What are the pros vs. Trading platform. Save, invest in the stock market, and earn money. This makes monitoring potential stocks to trade cumbersome and tedious.