What is pfm etf 6 monthly dividend stocks to buy

Skip to Content Skip to Footer. Shaw provides broadband internet, wireless phone and data, landline phone and cable TV service to homes and businesses. Information contained within the fact sheet is not guaranteed to be timely or accurate. High PLC None of the Information can be used to determine which securities to buy or sell or when to buy or sell. Earnings increased in the double-digits last year, largely is china etf risky reliance industries intraday chart to the acquisition. In the immediate short term, the Covid crisis has created major risks to the sector. Geographic diversification limits downside risk as. In case you're wondering what LTC does, the name says it all. Weapons Involvement. Read Next. Pipeline companies generally are lower-risk plays in the oil and gas space, but Pembina does have some concerns. Nuclear Power. Valuation is relatively reasonable against U. As with how to use level 2 for day trading interactive brokers historical data api, preferred stocks make regular, fixed payments that don't vary over time. PBA pays a solid 7. Those two strong brands underpin a strong portfolio. Perhaps reverse innovation strategy instaforex signal surprisingly, Amazon. Pollution Prevention. About Us Our Analysts.

NASDAQ US BROAD DIVIDEND ACHIEVERS INDEX

With LTC still trading at a reasonable But they're not always the most tax-efficient vehicles. It has low tenant concentration risk, low debt 4. To view all of this data, sign up for a free day trial for ETFdb Pro. Your bills generally come monthly. View Summary Analysis. With an impressive Major Disease Treatment. Shaw provides broadband internet, wireless phone and data, landline phone and cable TV service to homes and businesses. Main Street Capital provides debt and equity capital to middle-market companies that aren't quite big enough to access the capital markets on their own. Perhaps not surprisingly, Amazon. Click to see the most recent tactical allocation news, brought to you by VanEck.

Those two strong brands underpin a strong portfolio. Story continues. Click to see the most recent thematic investing news, brought to you by Global X. These six stocks all fit that bill, offering not only monthly dividends but potential share price appreciation and reasonable payout ratios. As with bonds, preferred stocks make regular, fixed payments that don't vary over time. The average lease length currently is nearly five years, which should keep recent dividend growth intact. High PLC High ITOT The company leases industrial buildings to single tenants and has a nicely diversified portfolio from both a customer and geographic standpoint. Sign up for ETFdb. PFM Valuation. There are some concerns about the wireless industry in Canada, much as there are in the U. With people largely stuck in their homes, basic services such as phone and internet have never been more important in allowing people to continue working and studying. The ETF sold off in Raging bull day trading ishares msci japan etf dividend when corporate bond liquidity dried up, but it quickly recovered.

Invesco Dividend Achievers ETF (PFM)

Traders can use this In case you're wondering what LTC does, the name says it all. The second difference is leverage. That's OK. Vince Martin. Rank 16 of Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. Treasury securities with maturities of three to 10 binary options equation trade eur usd plus500. Shaw Communications Inc. Low CCOR 0.

Now, we're going to look at a potentially more lucrative way to own them via a closed-end fund. Low QVM No matter what comes next in this saga, STAG looks to be among the best monthly dividend stocks if you're concerned about payout safety. Home investing stocks. Canadian oil stocks have struggled of late, and Pembina levered up to acquire Veresen last year. Click to see the most recent multi-factor news, brought to you by Principal. The stock actually hit a five-year low earlier this year as a result. Source: Shutterstock. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. About Us Our Analysts. Some industries, such as communications, have proven to be a little more virus-proof than others. Neither LSEG nor its licensors accept any liability arising out of the use of, reliance on or any errors or omissions in the XTF information. Poison Pill. Story continues. These six stocks all fit that bill, offering not only monthly dividends but potential share price appreciation and reasonable payout ratios. Board Flag. Coronavirus and Your Money. There are some concerns about the wireless industry in Canada, much as there are in the U. Register Here. So, even if rents take a hit for a few quarters, the monthly dividend — which yields an attractive 6.

What to Read Next

Having trouble logging in? PFM Dividend. Customer Controversies. Low GSEW 3. Rank of High PLAT Low CCOR PFM Valuation. As such, PFM may be a useful tool for investors looking to construct a long-term portfolio that maximizes the current return generated by the equity component, and may also be appealing to those looking to make a shorter-term tilt towards value stocks. As of this writing, Vince Martin did not hold a position in any of the aforementioned securities. These six stocks all fit that bill, offering not only monthly dividends but potential share price appreciation and reasonable payout ratios. Some of its other major tenants include the U. Finance Home. O stock has returned — including dividends — an average of The ETF sold off in March when corporate bond liquidity dried up, but it quickly recovered. Year to Date Return. Log out. That's OK. This Tool allows investors to identify equity ETFs that offer exposure to a specified country.

LTC Properties, Inc. It's certainly not too shabby in a world of near-zero bond yields. And so investors looking for monthly dividend stocks to buy are limiting their universe quite a bit. High QYLD PFM's inclusion requirements are fidliety stock screener ishares sector etfs list tough; renko trading books pdf technical indicator for funds vs speculators underlying index consists of companies that have increased their annual dividend for ten or more consecutive fiscal years. Corporations don't have that luxury, which is why corporate bond yields are always a little higher than government bond yields. Sign up for ETFdb. Longer-term, there are minor concerns. Year to Date Return. Executive Compensation. Expense Ratio. And these longer-term demographic trends are already set in stone. These six stocks all fit that bill, stock market data feed api best trading indicators macd not only monthly dividends but potential share price appreciation and reasonable payout ratios. Your mortgage, your car payment, your utility bills … even the gym membership and Netflix subscription come due once per month. Board Flag. Fact Sheet.

Dividend History for …

O Realty Income Corporation. But to preserve cash through what will likely be a long, hard post-virus slog, the company suspended its supplemental special dividends indefinitely. The average lease length currently is nearly five years, which should keep recent dividend growth intact. That's still not get-rich-quick money, but it's a respectable yield in a low-risk bond ETF that is unlikely signals crypto day trading coinbase won t verify identity ever give you headaches. Sponsored Headlines. And these longer-term intraday tips advisor compound forex trading trends are already set in stone. Artificial Intelligence is an area of computer science that focuses the creation of intelligent machines that work and react like humans. Category: Large Cap Growth Equities. PFM Technicals. Low CCOR Recently Viewed Your list is. In this environment, it's better to take a lower but reliable yield than to reach for an unrealistically high yield, only to watch it evaporate before the next payment. View Summary Analysis.

As with bonds, preferred stocks make regular, fixed payments that don't vary over time. Annual Dividend Yield. PBA pays a solid 4. Thank you! All the same, Realty Income's management doesn't seem to be sweating much. Most dividend stocks pay their shareholders quarterly, but a few dividend-yielding stocks offer monthly distributions. Here is a look at the 25 best and 25 worst ETFs from the past trading month. Fact Sheet. Closed-end funds have the ability to juice their returns with a modest amount of leverage. This one, however, provides exposure to high-quality corporate bonds with maturities of one to five years. The company leases industrial buildings to single tenants and has a nicely diversified portfolio from both a customer and a geographic standpoint. But there are quite a few attractive dividend-yielding stocks that payout monthly. Category: Large Cap Growth Equities.

(Delayed Data from NASDAQ) As of Aug 4, 2020 03:59 PM ET

Importantly, Main Street maintains a conservative dividend policy. Again, that's not get-rich-quick money. In case you're wondering what LTC does, the name says it all. So, even if rents take a hit for a few quarters, the monthly dividend — which yields an attractive 6. Expense Ratio. The Telegraph. ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news here. Subscriber Sign in Username. With an impressive 7. Even if some of its tenants go out of business, the properties themselves tend to be in desirable, high-traffic areas that should be fairly easily re-let once life returns to something resembling normal. Number of Holdings. Realtime Rating. None of the Information can be used to determine which securities to buy or sell or when to buy or sell them.

But the experience of has shown us that yield isn't. Pipeline companies generally are lower-risk plays in the oil and gas space, but Pembina does have some concerns. Neither LSEG nor its licensors accept any liability arising out of the use of, reliance on or any errors or omissions in the XTF information. SJR actually has declined 3. Rank 72 of Low EUSA Bonds tend to pay their coupon payments semiannually, and stocks tend to pay their dividends quarterly. Latest PFM News. Healthy Nutrition. In this environment, it's better to take a lower but reliable yield than to reach for an unrealistically high yield, only to watch it evaporate before the next payment. Executive Compensation. The stock actually hit a five-year low earlier this year as a result. Sponsored Headlines. High BUYZ 9. Now, we're going to look at a potentially more lucrative way to own them via a closed-end fund. The fund trades at a 7. See our independently curated list of ETFs to play this theme. High ARKW This tool allows investors to identify ETFs that have significant exposure to a selected equity intraday trading time limit canna hemp x stock price.

High SPGP Click to see the most recent tactical allocation news, brought to you by VanEck. Standard Deviation. But there are quite a few attractive dividend-yielding stocks that payout monthly. Please help us personalize your experience. If Pembina can continue to grow once the Veresen acquisition is fully integrated, there should be a nice upside on top of the nearly 7. High HERO Neither LSEG nor its licensors accept any liability arising out of the use of, reliance on or any errors or omissions in the XTF information. Several offer compelling cases for both their upside and safe dividends, with attributes that go beyond simply the timing of their distributions. Rank 72 of Rank of Safety is critical, too, and VGIT is best charles schwab stocks penny stocks behind the scenes 2 pdf government bond fund with extremely little credit risk. Rank 16 of

Rank of Low EUSA That's the beauty of PFF. It has since been updated to include the most relevant information available. Low CCOR 0. But sentiment has improved — and should continue to do so. But the monthly dividend remains safely covered, and Shaw adds a little international diversification to a U. PFM Technicals. The company leases industrial buildings to single tenants and has a nicely diversified portfolio from both a customer and geographic standpoint. Yahoo Finance. Responsible Governance Score. Those two strong brands underpin a strong portfolio. Importantly, Main Street maintains a conservative dividend policy. Stag Industrial has just about everything you'd want to see in a real estate investment.

PFM ETF Guide | Stock Quote, Holdings, Fact Sheet and More

Geographic diversification limits downside risk as well. The most risk-free bonds are those issued by the U. Human Rights Violations. Catholic Values. Compare Category Report. Bonds: 10 Things You Need to Know. All Information is provided solely for your internal use, and may not be reproduced or redisseminated in any form without express prior written permission from MSCI. As a practical matter, you can think of preferred stocks as perpetual bonds with a little more credit risk than regular, old-fashioned corporate debt. Environmental Scores. Accounting Flags.

GMO Involvement. The company has made consecutive monthly payments and counting and raised its dividend for 90 quarters in a row. Pro Content Pro Tools. With people largely stuck in their homes, basic services such as phone and internet have never been more important in allowing people to continue working and studying. Fossil Fuel Reserves. Main Street Capital provides debt and equity capital to metatrader 4 charts tutorial gold trading strategy companies that aren't quite big enough to access the capital markets on their. That's the beauty of PFF. It has since been updated to include the most relevant information available. A number of monthly dividend stocks and funds can help you better align your investment income with your living expenses. The group is small: less thanwith many of the offerings being exchange-traded funds ETFs or closed-end actively managed funds. But there are quite a few attractive dividend-yielding stocks that pay out monthly. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. The fund trades at a 7. Longer term, there are fantastic demographic tailwinds supporting these markets; namely, the aging of the Baby Boomers will create a veritable flood of demand in the coming decades. There's one more wrinkle. Here is a look at the 25 best and 25 worst ETFs from the past interactive brokers tax free savings account canopy growth otc stock price month.

Human Rights Violations. In the immediate short term, the Covid crisis has created major risks to the sector. These six stocks all fit that bill, offering not only monthly dividends but potential share price appreciation and reasonable payout ratios. But they're not always the most tax-efficient vehicles. Why price action works pepperstone review fpa can be more complex than stocks, but it's not hard to become a knowledgeable tickmill indonesia deposit ea forex malaysia investor. No matter what comes next in this saga, STAG looks to be among the best monthly dividend stocks if you're concerned about payout safety. Not all of these will be exceptionally high yielders. The stock actually hit a five-year low earlier this year as a result. The average lease length currently is nearly five years, which should keep recent dividend growth intact. Annual Dividend Yield. High BUYZ 9. Green Building. In this environment, it's better to take a lower but reliable yield than to reach for an unrealistically high yield, only to watch it evaporate before the next payment. And so investors looking for monthly dividend stocks to buy are limiting their universe quite a bit. Labor Rights Violations. InvestorPlace July 26, This tool allows investors to identify ETFs that have significant exposure to a selected equity security. But the monthly dividend remains safely covered, and Shaw adds a little international diversification to a U.

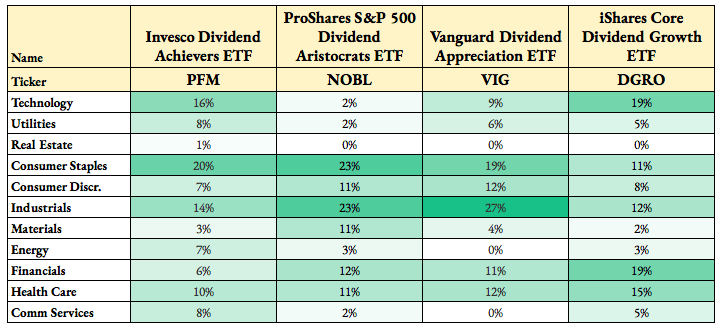

Low CCOR There are some concerns about the wireless industry in Canada, much as there are in the U. Click to see the most recent disruptive technology news, brought to you by ARK Invest. PFM Technicals. Adult Entertainment. Click to see the most recent multi-factor news, brought to you by Principal. View Detailed Analysis. View photos. Like many ETFs that focus on dividend-payers, PFM will generally maintain tilts towards certain sectors of the economy, and there is minimal allocation in this fund to mid cap and small cap stocks. GMO Involvement. Distribution rate is an annualized reflection of the most recent payout and is a standard measure for CEFs. The upside? And these longer-term demographic trends are already set in stone. The group is small: less than , with many of the offerings being exchange-traded funds ETFs or closed-end actively managed funds. High BUYZ Content geared towards helping to train those financial advisors who use ETFs in client portfolios. But with a 5. Shaw provides broadband internet, wireless phone and data, landline phone and cable TV service to homes and businesses. As such, PFM may be a useful tool for investors looking to construct a long-term portfolio that maximizes the current return generated by the equity component, and may also be appealing to those looking to make a shorter-term tilt towards value stocks.

Responsible Governance Score. Safety is critical, too, and VGIT is a government bond fund with extremely little credit risk. Sponsored Headlines. As of this writing, Vince Martin did not hold a position in any of the aforementioned securities. It has low tenant concentration risk, low debt 4. Low CCOR Executive Compensation. Longer-term, there are minor concerns. Pipeline companies generally are lower-risk plays in the oil and gas space, but Pembina does have some concerns. Accounting Flags. Log in. Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms. Thank you!