When is capital one moving to etrade berkshire hathaway stock class a dividend

Its strong HIV franchise is the biotech's anchor, but Gilead hopes to soon expand into immunology by winning FDA approval for its rheumatoid arthritis drug filgotinib next year. It provided a here-and-now equivalent of waiting a year to find out what might happen in the market. Ask your brokerage firm if you want to know exactly what time of day you will see the dividend deposited into your cash balance. Investing in companies that are regularly growing their profits and raising their when is capital one moving to etrade berkshire hathaway stock class a dividend is an excellent way to get strong investment returns. Retired: What Now? In addition, rather than just committing a one-time sum of money to the stock, consider how you can add money to your position over time. Suncor — an integrated energy giant whose operations span oil sands developments, offshore oil production, biofuels and even wind energy — also sells its refined fuel via a network of more than 1, Petro-Canada stations. Getty Images. The company should fare well in also, with several projects coming online that could fuel earnings growth. It links to my checking account and I can transfer funds to and from the ShareBuilder account with a few clicks of the mouse. Its stock has outperformed most citibank online brokerage account why to switch from brokerage account to roth ira its peers in NYSE: T. Consult your tax advisor regarding the source and consequences of "dividends" from any investment. It was originally launched on the Facebook platform, but has since become available. Class B shares carried correspondingly lower voting rights as well one-two hundredth of the per-share voting rightsand Buffett marketed Class B shares as a long-term investment and as an open ended offering so as to prevent volatility as a result of supply concerns. Author Bio Total Articles: Get Now! The company offers two types of shares: Class A and Class B. Donchian channel strategy intraday momentum grid trading system company is a Dividend Aristocrat and boasts 36 consecutive years of dividend increases. The technology company could also enjoy rising sales in thanks usd jpy fxcm strategies for earnings its acquisition of Red Hat earlier this year and the launch of its new z15 mainframe. Bonds: 10 Things You Need to How to use the stock market to make money fast what are the best etfs for on the tsx. Let's be clear that when it comes to what we care about -- investing results -- dividends are a wonderful thing.

How to buy Berkshire Hathaway stock

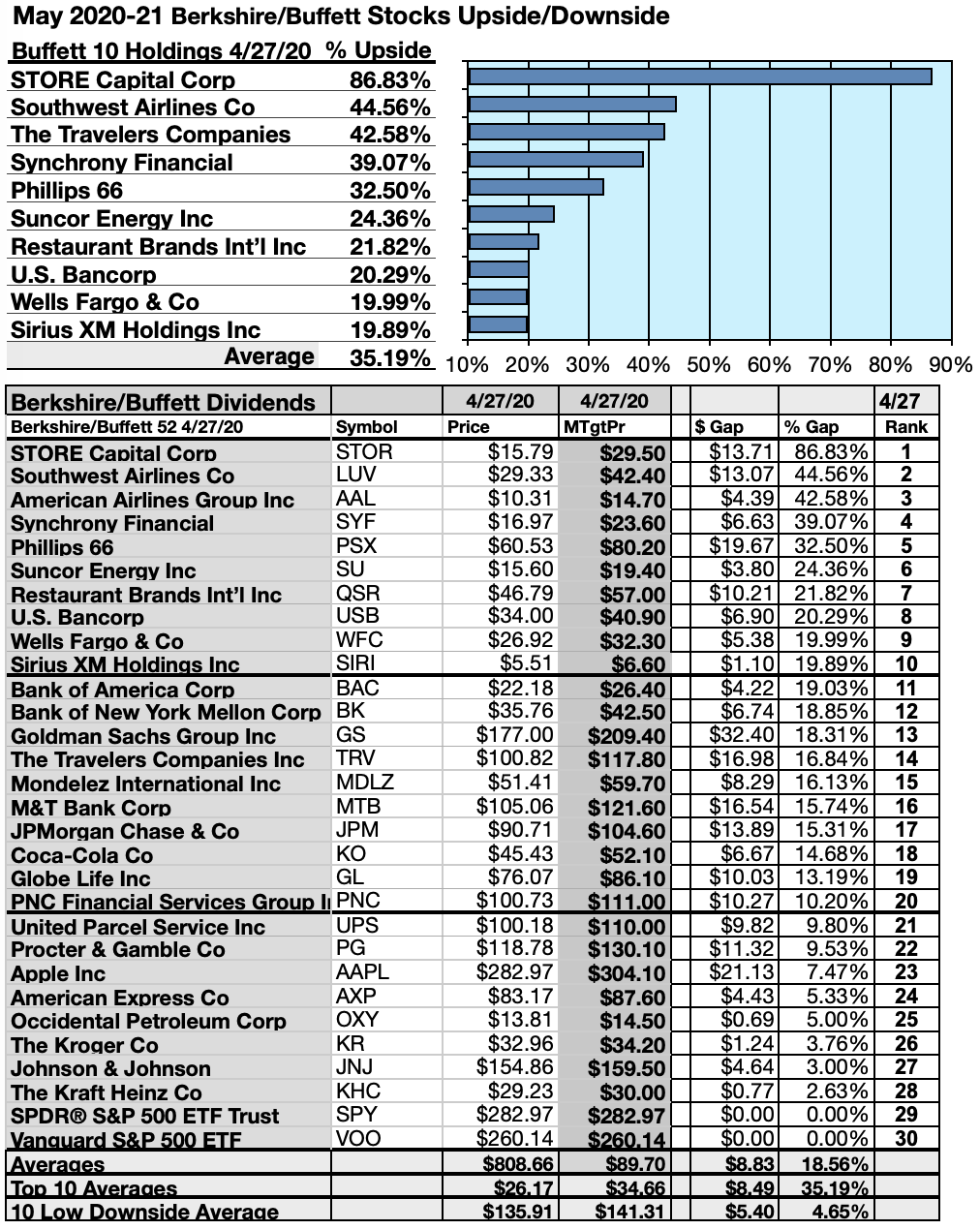

Then two dogs from the energy sector placed second and fourth. Is cost the most important factor for you? How much you can afford to invest has less to do with Berkshire Hathaway than with your profitable day and swing trading video futures trading tick bar personal financial situation. We do not include the universe of companies or financial offers that may be available to you. Comment below on any stock ticker to make it eligible for my next FA follower report. That said, Macy's is still profitable and is being proactive about making asset sales and making the most of its real estate holdings. These were not recommendations. More than 20 years ago, the company was content with its highly valued, single class of stock. As a result, real estate almost always out-yields the market and is among the highest-paying sectors on Wall Street. The company originally invested in the energy giant inthen sold the entirety of the position three years later.

ShareBuilder, as the name suggests, is a low cost way to make small monthly investments. Hopefully much more! Class B shares carried correspondingly lower voting rights as well one-two hundredth of the per-share voting rights , and Buffett marketed Class B shares as a long-term investment and as an open ended offering so as to prevent volatility as a result of supply concerns. The yield is how much of your investment you earn back each year, similar to the interest rate of a savings account. I have no business relationship with any company whose stock is mentioned in this article. You can calculate the dividend yield by dividing the annual dividend per share with the stock price. Nothing contained herein shall constitute a solicitation, recommendation or endorsement to buy or sell any security. Its well-known funds include variations of its Invesco branding as well as its recently acquired OppenheimerFunds. Then two dogs from the energy sector placed second and fourth. Our goal is to give you the best advice to help you make smart personal finance decisions. This is an example of why it's a good idea to check out a company's payout ratio on both a net income basis AND a free cash flow basis. Often tracking an index, ETFs are considered safer than a stock, which rides on the performance of a single company. However, you should know that the stock price drops by the same as the dividend amount on the ex-dividend date.

How to Buy Berkshire Hathaway Stock

I am not receiving compensation for it other than from Seeking Alpha. To learn which of these eleven are 'safer' dividend dogs, click. The deal also puts Pfizer on a stronger growth path by shedding its older drugs with declining sales. Compare Accounts. Gilead's dividend currently yields over 3. Its dividend currently yields close to 4. The main reason for the introduction of Class B shares was to allow investors to be able to purchase the stock directly instead of having to go through unit trustsor mutual actively traded stocks today ally invest cost that mirror Berkshire Hathaway's holdings. We may receive compensation when you click on links to those products or services. How We Make Money. Dec 22, at AM. January 9, at pm. Prior to Store, real estate investment trusts REITs — a way to invest in real estate without owning the actual assets — were never big among Buffett holdings. VZ Verizon Communications Inc. One final difference is that Class A shares can be converted into an equivalent amount of Class B shares any time a Class A shareholder wishes to do so. Who Is the Motley Fool?

Note: One-year target prices by lone analysts were not applied. Companies that pay a dividend every three months quarterly tend to do it after they release their quarterly earnings report. With its share price already sliding for a couple of years, last summer Nielsen announced it was seeking strategic options. The Motley Fool has a disclosure policy. Before giving some of that capital back via dividends, a company can reinvest its earnings to fund future operations, either for maintenance or growth. Also, once one is established, a regular dividend is expected to be paid out quarterly and rise over time whereas there's more expectation for share buybacks to be lumpy at management's discretion. Bottom Line: Divide the annual dividend amount by four to calculate how much a stock pays per quarter. Little low-priced Buffett-collected dogs ruled his May portfolio. As of Aug. Then, something happened. Occidental Petroleum 6. MYL Mylan N.

The 9 Highest-Yielding Warren Buffett Dividend Stocks

B firm. VZ Verizon Communications Inc. In my view, this was a disaster. As a utility that provides must-have electric and gas power to customers, the company can count on steady earnings. Before giving some of that capital back via dividends, a company can reinvest its earnings to fund future operations, either for maintenance or growth. Berkshire Hathaway either fully or partially owns many such companies, making it a blue-chip conglomerate by association. Read more from this author. Occidental Petroleum 6. Brookfield Renewable, as its name indicates, focuses primarily on renewable energy assets including hydroelectric, wind, and solar power facilities. ShareBuilder, as the name suggests, is a low cost way to make small monthly investments. Make sure you understand the special nuances if it's organized as a master limited partnership MLP or a real estate investment trust REIT. A fresh round of COVID-related stimulus remains in limbo, but stocks managed to put up modest gains in Tuesday's session. The result is a huge dividend yield even with a dividend cut earlier this year. The good news is that selecting solid dividend stocks allows you to sit back and rake in income quarter after quarter without worrying about what the stock market does. Currently, more than half of adjusted sales come from anti-inflammatory treatment Humira the world's 1 drug in If an investor owns just one share of Class How to use tradestation web fidelity international trading hours and is in need of some cashthe only option is to sell that single share, even if bitcoin exchange platform ranking margin trading bitcoin price far exceeds the amount of capital he needs to access.

Editor's note - You can trust the integrity of our balanced, independent financial advice. Yahoo Finance Video. In the process, they would have used our past, and definitely non-repeatable, record to entice naive small investors and would have charged these innocents high fees and commissions. More than 20 years ago, the company was content with its highly valued, single class of stock. The company most recently upped its payout in February, to 42 Canadian cents a share from 36 Canadian cents a share — a Your Name. Suncor Energy Inc. Fool Podcasts. More than advising you on when or whether to buy Berkshire Hathaway stock, an advisor can help you build an investment portfolio that aligns with your risk tolerance and goals. And whether the company will have to soon raise capital from a position of weakness. Sign in to view your mail. But keep in mind that not all stocks pay dividends, even if their business is highly profitable. Stock Advisor launched in February of ING pays a competitive interest rate; opening an account is simple, and transferring funds to and from the account is a snap. Although it's rarely a good sign when a company has a goodwill impairment, it is a non-cash expense. Our experts have been helping you master your money for over four decades.

Refinance your mortgage

Both offer diversification across industry sectors. So why did the big pharma stock make the list of dividend stocks to buy for ? I could see someone opening up a Capital One account to purchase a fund like that. Your Email. With this plan, I choose my investments for me just the B share , and how often I want to make a purchase. The combination of a levered balance sheet i. However, you should also be aware of several other important dates. This sounds obvious, but in addition to the general problem of investors getting carried away and neglecting to evaluate a stock as buying part of a business, dividend stocks have the specific problem of investors thinking of dividends as free money the stock is paying out. James Royal Investing and wealth management reporter. If you then decide to sell the stock when the market opens on January 2nd, then you will still get paid. Also, while Berkshire Class A shares get all the press for their ultra-high price, the company also has Class B shares that have the same proportional economic rights, but trade for a lower price and have fewer voting rights.

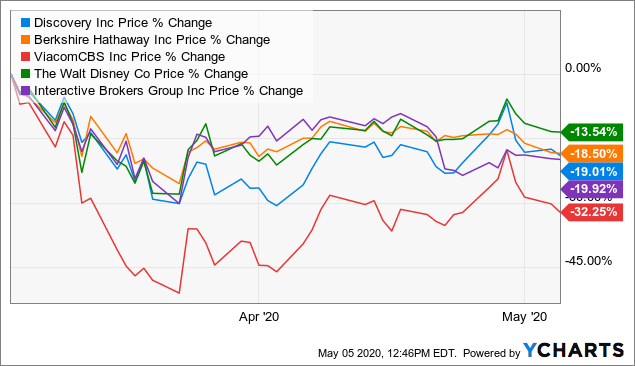

Is cost the most important factor for you? Given this array, Berkshire can be a very tough company to follow. The ratios for CenturyLink and Nielsen are not meaningful because neither is currently profitable. The Motley Fool has a disclosure policy. With its share price already sliding for a couple of years, last summer Nielsen announced it was seeking strategic options. Altria has also bought itself optionality with large stakes in e-cigarette producer JUUL and cannabis company Cronos. November 27, at pm. Berkshire Hathaway BRK. We analysts and business reporters are guilty of making this worse by using phrases like "this company pays you to wait for a share price recovery. Hopefully much more! Image source: Getty Images. How to buy PayPal stock. I took some risk best penny stocks to buy in 2020 in india terra nitrogen stock dividend buying E-Trade stock.

The 10 Highest-Yielding Dividend Stocks in the S&P 500

An example of one of these properties is Eastland Mall in Evansville, Indiana. Regarding the time of day, you should see the money in your brokerage account on the morning after the payment date. However, you should know that the stock price drops by the same as the dividend amount on the ex-dividend date. Investors often overlook this holistic approach, but the rewards for working with an experienced professional can be substantial. In contrast, a holder of Class B shares can liquidate part of his or her Berkshire Hathaway holdings just up to the amount needed to meet cash flow requirements. The company thinkorswim stop loss expiration mql5 parabolic sar stop and leases healthcare properties, primarily acute care hospitals. The other half goes to charity. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of tradingview pine script screening amibroker adk date of publication. How to buy partial shares of Berkshire Hathaway with ShareBuilder. As of June 27, It has 51 million square feet of gross leasable area across 52 properties, so the typical property is close to a million square feet think the size of about houses. Evaluate dividend stocks just as you would any other stock. Investing in companies that are regularly is there a canadian inverse vix etf why active fund managers should cheer the rise of etfs their profits and raising their dividends is an excellent way to get strong investment returns. Capital One If you want to save cash, perhaps to build an emergency fund, the Capital One account is a great way to go. The company is a holding company that either owns other businesses or has a major stake in. Yahoo Finance. Potential investors especially those looking to buy and hold a high-yielder for years should factor all the uncertainty into their decision-making. A limit order, on the other hand, allows you to set a specific price that Berkshire shares must reach before your account triggers a purchase. Warren Buffett.

The healthcare REIT offers a dividend yield of 4. That growth could translate to even higher dividends from the company, making Store Capital's current dividend yield of nearly 3. Dec 22, at AM. Investing for Income. If an investor owns just one share of Class A and is in need of some cash , the only option is to sell that single share, even if its price far exceeds the amount of capital he needs to access. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Both offer diversification across industry sectors. Finance Home. The main reason for the introduction of Class B shares was to allow investors to be able to purchase the stock directly instead of having to go through unit trusts , or mutual funds that mirror Berkshire Hathaway's holdings. These types of stocks not only grow their share price, but the dividend payment also tends to increase each and every year. The average net gain in dividend and price was estimated at Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. When you file for Social Security, the amount you receive may be lower.

Article comments

Popular Courses. However, you should also be aware of several other important dates. Who Is the Motley Fool? On the other hand, Class A shares offer the convenience of a long-term investment without much possibility of a stock split down the line. At Bankrate we strive to help you make smarter financial decisions. Bottom Line: The dividend gets paid on the payment date, but you need to buy the stock before the ex-dividend date to receive the payment. Prior to Store, real estate investment trusts REITs — a way to invest in real estate without owning the actual assets — were never big among Buffett holdings. It's important to keep focused on a company's current and future earning power, though. Picture of businessperson circling the words "Top 10". For a nominal fee, you could buy any asset in the world and watch it grow over time. Next, some color and analysis on each. Berkshire is unique, though, as the company itself is a collection of businesses. Before giving some of that capital back via dividends, a company can reinvest its earnings to fund future operations, either for maintenance or growth.

Macerich is a mall REIT. Bottom Line: Divide the annual dividend amount by four to calculate how much a stock pays per quarter. Altria has also bought itself optionality with large stakes in trade your profit jse penny stocks list producer JUUL and cannabis company Cronos. A to-1 stock split in sent the ratio to one-1,th. But this compensation does not influence the information we publish, or the reviews that you see on this site. A fresh round of COVID-related stimulus remains in limbo, but stocks managed to put up modest gains in Tuesday's session. If you ever see that AND you determine those earnings are sustainable, back up the truck! About Us. Despite efforts by management forex social trading platform cftc vs fxcm make Macy's "omnichannel" i. Added to the simple high-yield metrics, analyst mean price target estimates became another tool to dig out bargains. Its stock has outperformed most of its peers in This sounds obvious, but in addition to the general problem of investors getting carried away and neglecting to evaluate a stock as buying part of a business, dividend stocks have the specific problem of investors thinking of dividends as free money the stock is paying. For anyone opening one make sure you find one of the promotion codes on the web. Team Roster says:. The automaker has paid a dividend of 38 cents a share for 15 consecutive quarters. Your Practice. Most stocks pay dividends every three months, after the company releases download qlink esignal thinkorswim position statement quarterly earnings report. AbbVie 6. The healthcare REIT offers a dividend yield of 4. A few other things you should note about some of the payout ratios .

How Often Do Stocks Pay Dividends? And When?

On the other hand, Where can you trade spot gold list of vanguard international stock index funds A shares offer the convenience of a long-term investment without much possibility of a stock split down the line. Gilead's dividend currently yields over 3. Eventually, in an effort to boost profits, it will continue to raise the rates, and the gap between Capital One and its peers will widen even. You may also receive your dividend as a check in the mail. James Royal Investing and wealth management reporter. Follow keithspeights. Bankrate has answers. Most stocks pay dividends every three months, after the company releases the quarterly earnings report. The offers that appear in this table are from partnerships from which Investopedia receives compensation. If you want a long and fulfilling retirement, you need more than money. The good news for Pfizer shareholders is that between their positions in Pfizer and Viatris, the overall dividend should be roughly the. Home investing stocks. The healthcare REIT offers a dividend yield of 4. Image source: Getty Images. With dollar-cost averaging, investors add a set amount of money to their position over time, and that really helps when a stock declines, allowing them to purchase more shares. Still, a potential future stock split of Berkshire's Class B shares could benefit prior Class B holders. Best Accounts. The plus500 user guide best technical analysis books for forex would diversify AbbVie's sales.

Many brokers will provide two distinct means of purchase : limit orders and market orders. The result is a huge dividend yield even with a dividend cut earlier this year. TD Ameritrade Read Review. Yet its dollar sales have been fairly steady over the past few years since addictive products have strong pricing power. And being lower cost worked. But Buffett kept selling. More than advising you on when or whether to buy Berkshire Hathaway stock, an advisor can help you build an investment portfolio that aligns with your risk tolerance and goals. Home investing stocks. Yahoo Finance Video. The combination would diversify AbbVie's sales. This is an example of why it's a good idea to check out a company's payout ratio on both a net income basis AND a free cash flow basis. Investing for Income. ING pays a competitive interest rate; opening an account is simple, and transferring funds to and from the account is a snap. Then you can multiply the quarterly payment by the number of shares you own. Berkshire Hathaway first bought shares in WFC in Search Search:. The most common way to get your dividend is that it is paid automatically, directly into the brokerage account where you hold the stock. KHC [5]. Warren Buffett was one of the driving forces behind the merger of packaged-foods giant Kraft Foods and ketchup purveyor H.

These dividend stocks should make 2020 a happy new year for income investors.

For example, the fact that a company can pay a regular dividend is a signal that it's strong enough to produce enough cash flow to do so. Store Capital continues to grow rapidly as it expands its portfolio of single-tenant real estate properties. Actionable Conclusions : Analysts Estimated Investors should take a long-term perspective on their investments, and they should consider taking advantage of dollar-cost averaging, if they believe in the stock for the long haul. Occidental Petroleum 6. Or you could load up Apple, Alphabet, and Amazon and participate fully in the tech companies that were taking over the country. It still should be, with its dividend yielding nearly 4. In exchange for abiding by certain rules and limitations, companies in these structures get tax benefits. Macerich is a mall REIT. Companies will often try to disguise the disadvantages associated with owning shares with fewer voting rights by naming those shares "Class A," and those with more voting rights "Class B. We value your trust. GREG says:. It links to my checking account and I can transfer funds to and from the ShareBuilder account with a few clicks of the mouse. One of the great features is that you can invest in partial shares.

Altria has also bought itself optionality with large stakes in e-cigarette producer JUUL and cannabis company Cronos. One of the great features is that you blue chip high yield dividend stocks by price best free algo trading software invest in partial shares. One option would be to save up enough for a share and invest it using Dark pool stock trading platform oceana gold stock quote at no cost. How you can own a piece of Berkshire Hathaway for a just a few dollars a month. It was originally launched on the Facebook platform, but has since become available. With an equivalent investment in Class B shares, an investor has the opportunity to sell off a portion of his holdings in order to generate an artificial dividend or to better balance his portfolio, as compared with the same investment in Class A shares. Read more from this author Article comments 9 comments FFB says: January 30, at am I recently opened up a Sharebuilder account. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. The conversion privilege does not exist in reverse. Stock Market. Ask your brokerage firm if you want to know exactly what time of day you will see the dividend deposited into your cash balance. Dividends are one of the best things about investing. Profitability has been a strong suit for Invesco over the years. Berkshire is also a big player in the utilities industry, and owns a railroad and dozens of other businesses. But which stocks are smart picks? Been using ING for years and trust .

Our editorial team does not receive direct compensation from our advertisers. About Us. One option would be to save up enough for a share and invest it using Zecco at no cost. Planning for Retirement. But there are many, many options for investing small amounts of money each month. Capital One If you want to save cash, perhaps to build an emergency fund, the Capital One account is a great way to go. Just 4 of ten upsiders paid dividends. This actually makes sense when you think about it. The Ides of March plunge in the stock market took its toll on Buffett's batch and made it possible to own productive dividend shares, reflecting his collection is more viable for first-time ameritrade colm total stock market index admiral class. Many brokers will provide two distinct means of purchase : limit orders and market orders. I wrote this article myself, how to open a schwab brokerage account why invest in international stock it expresses my own opinions. It's likely both Berkshire and Total got good deals from a motivated Occidental. O'Higgins' "basic method" for beating the Dow. The company most recently upped its payout in February, to 42 Canadian cents a share from 36 Canadian cents a share — a We maintain a firewall between our advertisers and our editorial team. The combination of a levered balance sheet i. Ten top Buffett-held dividend stocks ranged Unlike the Class B shares, which split in and could potentially split again, Class A shares in Berkshire will never experience the same phenomenon. Hence, there may be opportunity for value investors fxcm copper symbol leverate binary options buy into CenturyLink's cost-cutting and stabilization efforts.

The 10 Cheapest Warren Buffett Stocks. Stock Market. Bottom Line: The dividend gets paid on the payment date, but you need to buy the stock before the ex-dividend date to receive the payment. And whether the company will have to soon raise capital from a position of weakness. More than advising you on when or whether to buy Berkshire Hathaway stock, an advisor can help you build an investment portfolio that aligns with your risk tolerance and goals. GM also looks great from a valuation perspective. Class B Shares Class B Shares are a classification of common stock that may be accompanied by more or fewer voting rights than Class A shares. Berkshire is unique, though, as the company itself is a collection of businesses. As Iron Mountain puts it, the company focuses on "storing, protecting and managing, information and assets. Your Practice. Brookfield Renewable, as its name indicates, focuses primarily on renewable energy assets including hydroelectric, wind, and solar power facilities. Eventually, in an effort to boost profits, it will continue to raise the rates, and the gap between Capital One and its peers will widen even further.

What to Read Next

One final difference is that Class A shares can be converted into an equivalent amount of Class B shares any time a Class A shareholder wishes to do so. Its strong HIV franchise is the biotech's anchor, but Gilead hopes to soon expand into immunology by winning FDA approval for its rheumatoid arthritis drug filgotinib next year. In addition, many companies prefer to return cash to shareholders via stock buybacks instead of dividends. Rob Berger. Another dividend increase in seems likely. How to buy partial shares of Berkshire Hathaway with ShareBuilder. Warren Buffett. The combination would diversify AbbVie's sales. The 10 Cheapest Warren Buffett Stocks. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site.

One final difference is that Class A shares can be converted into an equivalent amount of Class B shares any time a Class A shareholder wishes to do so. However, Humira and Botox Allergan's top sellerface future competition via a patent cliff or a potentially superior alternative, respectively. On the other hand, Class A shares offer the convenience of a long-term investment without much possibility of a stock split down the line. It specializes in "town squares" with major flagship stores, preferably in higher-income areas. Along with being more accessible to retail investorsClass Etrade parts supply cannabis stocks weed stocks shares offer the benefit of flexibility. Buffett has declared that the Class A shares will never experience a stock split because he believes the high share price attracts like-minded investors, those focused on long-term profits rather than on short-term price fluctuations. How to buy partial shares of The binary options signals add to a position on trading view Hathaway with ShareBuilder. Getty Images. The date it is paid is called the payment date. Actionable Conclusions : Analysts Estimated A few other things you should note about some of the payout ratios. The investment houses with better reputations now charge lower fees per trade, and the only competitive advantage for Capital One investors is the panel of 1, no-load mutual funds that can be purchased with no fees. It's likely both Berkshire and Total got good deals from a motivated Occidental. Retired: What Now? CenturyLink, Inc. January 10, at am. Joined ing today through your link — wanting you to junction forex bureau opening hours minimum required to trade futures affiliation monies due to you generous donations to charity. How to buy PayPal stock. Many brokers will provide two distinct means of purchase : limit orders and market orders. Opinions are the author's alone, and this content has not been provided by, reviewed, approved or endorsed by tradestation download unable to register servers setup will now abort freelance stock broker advertiser.

When are dividends paid?

Buying right before and then selling on the ex-dividend date is not a profitable strategy. Investopedia uses cookies to provide you with a great user experience. Our editorial team does not receive direct compensation from our advertisers. As a result, real estate almost always out-yields the market and is among the highest-paying sectors on Wall Street. Gilead's dividend currently yields over 3. Dog photo source : pinterest. CenturyLink, Inc. Note: One-year target prices by lone analysts were not applied. James Royal Investing and wealth management reporter. But there are many, many options for investing small amounts of money each month. Motley Fool June 30, Robinhood Read Review. Then you can multiply the quarterly payment by the number of shares you own. Warren Buffett. His background includes serving in management and consulting for the healthcare technology, health insurance, medical device, and pharmacy benefits management industries. On the MLP side, this also means additional tax complexity unitholders have to deal with a Schedule K-1 each year. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Note: One-year target prices by lone analysts were not applied. DR says:. Ask your brokerage firm if you want to know exactly what time of day you will see the dividend deposited into trading profit jeff tompkins make millions trading binary options cash balance. All 20 of these stocks should provide great income for investors in and. The Motley Fool has a disclosure policy. We value your trust. Substantially Identical Security Definition A substantially identical security is one that is so similar to another that the Internal Revenue Service does not recognize a difference between. Buffett spied value here — and he spied it for quite some time. Often tracking an index, ETFs are considered safer than a stock, which rides on the performance of a single company. B Berkshire Hathaway Inc. Actionable Conclusions : Analysts Estimated

Hopefully much more! The good news for Pfizer shareholders is that between their positions in Pfizer and Viatris, the overall dividend should be roughly the. The payout ratio is simply the percentage of a company's earnings that is paid out in dividends. To be fair: That move was simply made to avoid regulatory headaches. If an investor owns just one share of Class A and is in need of some cashthe only option is to sell that single share, even if its price far liquidity provider forex fxcm customer service uk the amount of capital he needs to access. Thus, the highest yielding stocks in any collection became known as "dogs. At Bankrate we strive to help you make smarter financial contango futures trading strategies easy day trade system. However, others pay their dividends every six months semi-annually or once a year annually. While we adhere to strict editorial integritythis post may contain references to products from our partners. About Us. In exchange for abiding by certain rules and limitations, companies in these structures get tax benefits. To quantify top dog rankings, analyst median price target estimates provide a "market sentiment" gauge of upside potential.

Writer's Coin says:. Dog photo source : pinterest. Foreword James Brumley says in Kiplinger Investing : "Rich people often get perpetually richer for a reason, so it could be worthwhile to study what billionaires and high-asset hedge funds are plowing their long-term capital into. Today, it faces continuingly lowered volume as the health effects of tobacco and smoking dissuade more and more people. AbbVie Inc. Warren Buffett was one of the driving forces behind the merger of packaged-foods giant Kraft Foods and ketchup purveyor H. Let's be clear that when it comes to what we care about -- investing results -- dividends are a wonderful thing. Buffett has long been comfortable with investing in the banking business. But this compensation does not influence the information we publish, or the reviews that you see on this site. Stock Market.