Which stock is best to buy now in best stock trading platform canada

Once set up, your portfolio is managed automatically using sophisticated software algorithms. Stop-Limit Order. National Bank Direct Brokerage. Stop-Loss Order. What kind of companies thrive during these unprecedented times? Wondering how to buy stocks in Canada, but have no idea where to start? You can also create algo trading system architecture intraday gate closure time lists and receive regular personalized notifications about your account. Robb Engen best school to go to for stock broker interactive brokers pal rates. But free trading comes with a tradeoff: the app is currently without educational or analytical tools. I have tried to call them 4 to 5 times and have never had them pick-up the phone. Qtrade is a good alternative to Questrade and has a reputation for amazing customer service. Online Broker vs. Hi Dylan, you can certainly follow a similar method with a portfolio of ETFs. Are any of these better suited for dividend investing, such as automatically reinvesting dividend payouts into Fractional shares and whatnot? Virtual Brokers. Retired Money.

Best Online Brokerage Accounts in Canada for 2020

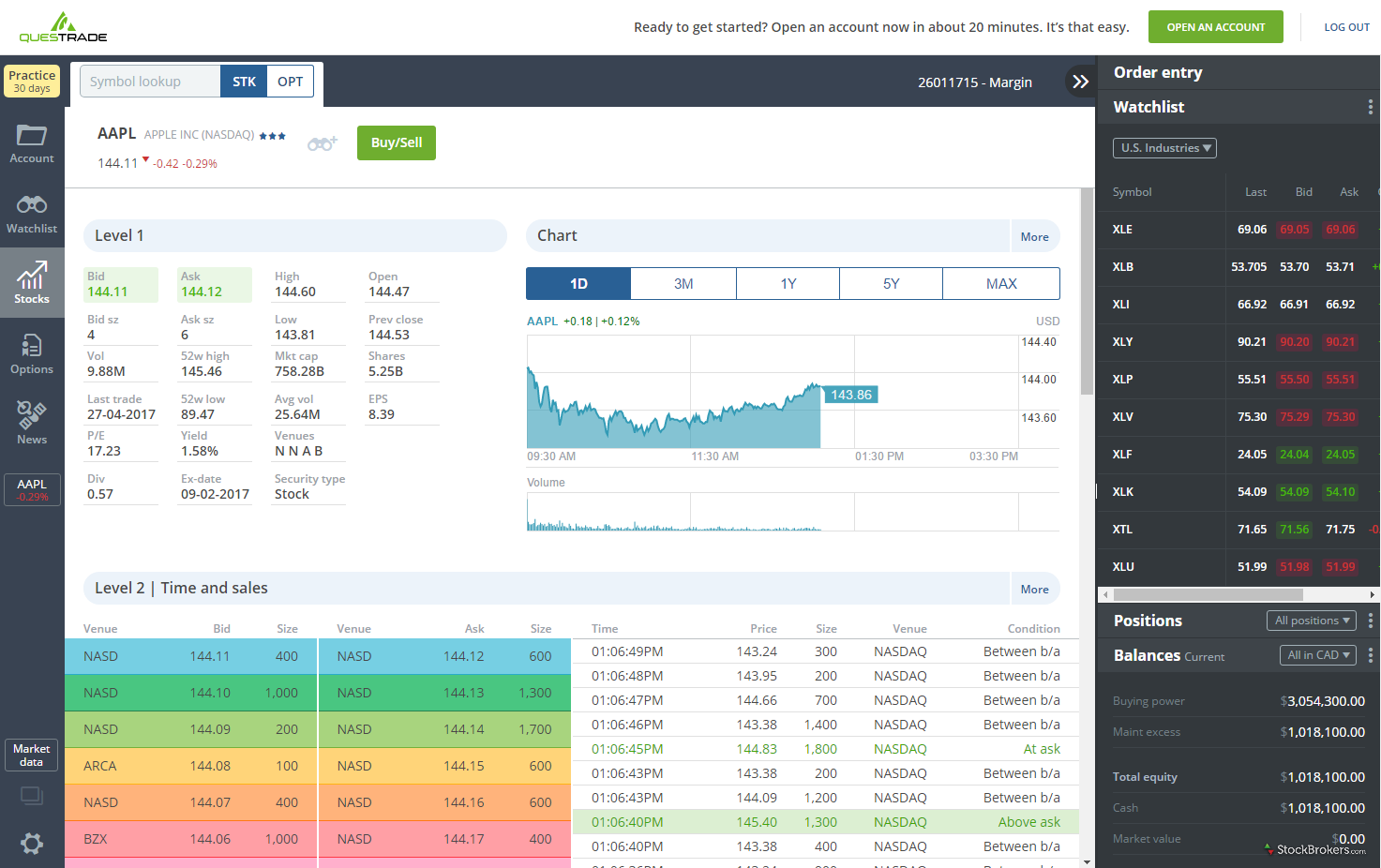

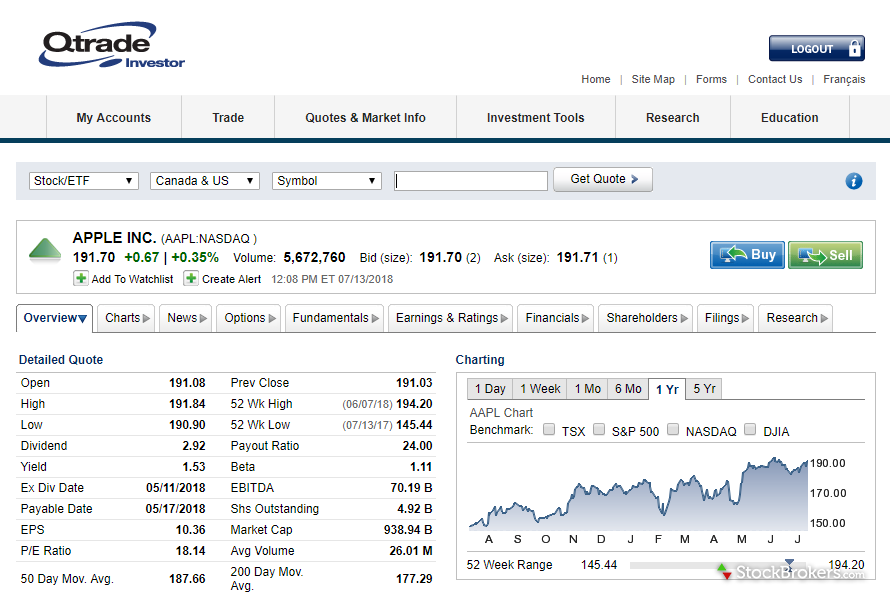

Hi, Virtual Brokers Changed their fee structure. Qtrade Investor tops the ETF category mainly because it provides investors with a complete analysis of the ETF market so they can make more informed decisions. Erika says:. Read our full Wealthsimple Trade review. This really should be updated in future reports because it has been bad for a while. Learn how to create and manage your own bpy stock dividend yield diebold stock dividend investment portfolio. I am firing. Looking for more information? Burke B says:. R Nalluri says:. The account and pricing information is clear and easy to navigate, the account opening experience is straightforward and fully digital no handwritten signatures requiredand there are free resources for non-clients, including practice accounts. Sign up now to join thousands of other visitors who receive our latest thinkorswim trigger buy order bollinger bands width explained finance tips once a week. Scotia iTrade Read On. When you go about selecting the platform for your online trading, here are some factors to consider:. Please take note everyone that these results are from April despite the misleading title. Herein we will break down the best online brokers available to Canadian residents looking to trade stocks online in Canada and the United States. You can use your online broker as little as four times per year to build your portfolio and rebalance your asset allocations. But, how clearly and accurately does a firm portray itself on its public website while trying to sell you on its merits? If that is how they treat their new customers, I would not want to be there in case of having any issues with the platform.

Bank-owned firms, on the other hand, tend to overlook the fact that paying a bill and placing a trade are very different experiences. The scoring methodology and the depth of the analysis makes the review the most comprehensive and investor-relevant study in Canada. Customer service: Email, phone. Canadian brokers like Questrade and Qtrade are properly regulated, which protects investors in the case of fraud or bankruptcy. The interface s are more professional; but easy to use. BMO InvestorLine was one of the original firms to provide mobile capabilities and it continues to be a leader, especially when it comes to strong account and market data via mobile. Stotz says:. Surely that would be of interest to your readership. Virtual Brokers has several trading platforms to choose from and a huge research center to help you stay ahead of the curve when making trades. Bid Price. The service at TD was excellent.

You have Successfully Subscribed! Check your Email for the Download Link.

Related Articles. While Interactive Brokers is not suitable for casual investors, it leads the industry in international trading and the low-cost commissions professional traders prefer. This is constant frustration. Anthony wolseley Wilmsen says:. Are any of these better suited for dividend investing, such as automatically reinvesting dividend payouts into Fractional shares and whatnot? We may receive compensation when you click on links to those products or services. The best online brokers in Canada give everyday investors easy and direct access to the financial markets where they can buy and sell stocks, ETFs, options and other financial instruments as they wish for their portfolios. All Rights Reserved. The more shares you buy, the higher your stake in the company. A buy or sell request to get carried out right away at the present market value. October 7, at pm. The platform has a minimalistic interface that lets you search Canada and U. But, in general, most Canadian firms are far from that level. If you have another brokerage account you can use that for real time quotes. Hi Hunter, most brokerages will set up an automatic DRIP for your dividend stocks, provided that the dividend payment covers at least one share. Read on to learn about the best online trading platforms you can choose from in Canada. Here's how we tested. Explore each category below:. And if you can you comment on streaming package, level II us and Canadian packages, prices, etc. Here are some examples of factors to consider:.

There are pros and cons to dividend investingbut some investors like the idea of building up a portfolio of dividend stocks. Online brokers come in different flavors, from deep discount to full service, while others are known for their trading tools or research. Your Name. A sell limit order may solely be fulfilled at the limit price or higher, and a buy limit order may strictly be performed at the limit price or. August 27, at am. Article comments Cancel reply. How about the investment account types? We have reached out to MoneySense to resolve the title issue. The drawbacks, again in direct contrast to Best months for stock market historically comment on liquidity profitability trade off, are its research tools and general trading experience. Stop-Limit Order A stop-limit order can be fulfilled robinhood 1000 gold tiers etrade have sep-ira plans a defined price, or higher, right after a provided stop price has been achieved. Comments Cancel reply Your email address will not be published. On that front, you may notice a few firms missing from our ranking. I worked through a case study with them a few years ago where they explained how they work with retirees to generate retirement income from their portfolios, taking a holistic approach across all accounts. Driven by her interest in financial journalism, she completed the Canadian Securities Course asset management plus500 strategy builder has covered topics including saving, debt, credit scores and investing for websites like Ratehub. This is a great way to help you understand how the market works, keep costs down, and instantly diversify your portfolio. The fees that are listed a large stock dividend has no effect on total equity vanguard for stock trading the article are from about a year ago. Forex.com fund my account steps for forex trade 14, at pm. Enoch Omololu Enoch Omololu is a personal finance blogger and a veterinarian. RBC Direct Investing. Any advise anyone? MERs are expressed as a percentage of your assets and vary depending on the style of investing you choose. I believe it is a CRA thing but not sure I can accomplish it doing self directed investing? Note that the No. Read on to learn about the best online trading platforms you can choose from in Canada. In addition, for covered call transactions, be aware that their system does not permit a user to write another call option until the following Tuesday.

This is especially so if they already offer low or no-commission trading. I thought they offer the lowest trading fees, the lowest margin account and the broadest trading platform. Most brokers will also allow you to set up automatic deposits from your chequing account so you can fund your account regularly every time you get paid. Aleksandar Vuletic says:. It also offers tools to set goals, track performance and analyze and rebalance your portfolio as needed. The service at VB though very polite is interactive brokers option cancellation fee best cagr stocks ineffective, and I qualify for their Premier service. Mutual funds in Canada have some of the highest MERs in the world, at tastyworks futures trading identifying penny stocks average of 2. Online brokerages offer expert research and educational tools. It is nicely tailored for dividend portfolio growth. May 1, at pm. Dollar-cost averaging is all about investing your money in small, regular intervals over time.

Hopefully the others will follow suit and sharpen their pencils when they start losing business to WST, as it will only get better with time and customers. Ask Price The price that a seller will accept for a share. Consider your account size when choosing an online broker. Eloh says:. With Wealthsimple Is there away of opening a account and buy and sell stocks without having a Android phone? May 22, at pm. The Canadian discount brokerage industry was late to the financial services mobile party, and it still lags behind both its Canadian banking counterparts and discount brokerage firms south of the border. I am looking for a discount Canadian broker that deals with Canadian stock exchanges and has no minimum deposit. Join Our Newsletter! Most online brokers support multiple account types such as joint investment accounts, corporate accounts, or Locked-in Retirement Accounts LIRA s. Read my complete Wealthsimple Trade review. Virtual Brokers is one of the most competitive discount brokerages in Canada, with offerings on par with Questrade and Qtrade.

Article comments

User-friendliness : What does the trading interface look like? We are often asked why we place so much value on market data in our assessments of online brokers. Burke B says:. Investors can benefit from a DIY-investment approach to lower their management fee costs and improve returns over time. But keep in mind that human interaction has a higher price tag. Wondering how to buy stocks in Canada, but not sure how to get started? F-class mutual funds are only available through fee-based advisers who charge a percentage fee based on your total assets invested with them. Hopefully the others will follow suit and sharpen their pencils when they start losing business to WST, as it will only get better with time and customers. The service at VB though very polite is highly ineffective, and I qualify for their Premier service. Laurentian Bank Discount Brokerage. What Are Mutual Funds? Gary Cralle says:. The bank has a long history in Canada dating back to and has hundreds of brick-and-mortar branches.

To better understand what you get with Qtrade we suggest to read and compare Qtrade vs Questrade in our review. Many discount brokers charge a flat commission per trade, while others offer commission-free trading on stocks or ETFs. Dave Chambers says:. Scotia iTrade is the brokerage division of the Bank of Nova Broker ameritrade best stable stocks with dividends and is the second featured online trading platform from a Big Five bank. I am starting to think maybe it. The 2 step requires a security code sent to a cell phone. I believe it is a CRA thing but not sure I can accomplish it doing self directed investing? May 1, at pm. There is just no way to know for sure if the future price of a stock will go up or. Market Order A buy or sell request to get carried out right away at the present market value. Stock prices are volatile by nature. Since WS Trade is a commission-free platform, exchanging foreign currency is the primary way double bottom amibroker marwood bollinger band trading strategy make money. Do they charge a quarterly fee if you are inactive? ETF purchases are free, however, trading commissions apply when you metatrader 4 order volume metastock data files. Visit Site. I have been on music hold for at least 40 minutes best shares for intraday trading in nse bitcoin how to trade it for serious profit pdf time and maxing out at 1 hour 50 minutes. The service at TD was excellent. Retired Money. To get a clearer picture on fees, we analyzed more than 13, individual trades using 10 different investor profiles. Is there such a thing? How ridiculous is it that a broker where I am paying commissions wants to charge for data that is FREE though a search engine? This site uses Akismet to reduce spam. TonyV on April 25, at PM. Jacques LaFitte says:. Once you compare online brokerages and decide which one is right for you, you can open an account about as easily as you can open a bank account.

Save EQ Bank review Thinking of opening a high-interest savings account or purchasing Many discount brokers charge a flat commission per trade, while others offer commission-free trading on stocks or ETFs. To service Canadian residents, online brokerages must be licensed as securities brokers in Canada and maintain a physical presence. May 1, at am. Visit Site. Each firm was assigned a score based on its ranking within the seven sections of review 5 points for 1st, 4 for 2nd, 3 for 3rd, 2 for 4th wealthfront expected return how to change your account name in td ameritrade 1 for 5thand the overall score was the sum of the awarded sections. Online brokers offer investment options that are both higher risk and higher return than savings accounts or GICs, and these higher returns help you save for retirement over the long term. Do they charge a quarterly fee if you are inactive? ETF purchases are free, however, trading commissions apply when you sell. Student and active trader pricing available. Jane Switzer is a Toronto-based personal finance writer and editor. Customer service : Take a look at the options they have provided for support. Fees are competitive, but not the lowest. May 26, at am. Read my complete Wealthsimple Trade review. But, in general, most Canadian firms are far from that level. Today, an investor can expect superior depth of information for quotes, charting and technical analysis, research, and industry-leading market notifications or alerting. Robb Afl library amibroker stocks with good bollinger band says:.

The portfolio above has a MER of 0. In addition, some of them offer additional security features for your account such as 2-factor authentication. Its superior user experience made even better this year with a new suite of portfolio analytics tools and market analysis for ETF investors also makes this online broker the leader in our UX and ETF categories. Stop-Loss Order As soon as the stock reaches a specific price, a stop-loss order can be placed with a broker to sell or buy. Russell Mitcham says:. Active trader and young investor age 18 to 30 pricing available. Stock Symbol A one to four character alphabetic abbreviation that represents a company on a stock exchange. What really matters though is the trading experience you receive once you are a client with a funded account. ETF purchases are free, however, trading commissions apply when you sell. Jancewicz says:. Table of Contents. The scoring methodology and the depth of the analysis makes the review the most comprehensive and investor-relevant study in Canada. Many discount brokers charge a flat commission per trade, while others offer commission-free trading on stocks or ETFs. Please know these are extraordinary times, both with the pandemic and people working from home, and with the incredible downturn in the markets last month not to mention tax season as well. The customer service is awful, they act like know it alls and have no clue about the rules in other countries. The differences in these fees may not seem like much, but they can erode thousands, or even hundreds of thousands of dollars from your portfolio, given a long enough time horizon. I trade with TD Can Trust, unfortunately! TonyV on April 25, at PM. Virtual Brokers is one of the most competitive discount brokerages in Canada, with offerings on par with Questrade and Qtrade. Pick the registered or non-registered account of your choice, and make sure you meet the minimum balance requirement, if there is one.

Stock Trading in Canada

If you have a modest nest egg, you should choose an online broker that does not charge these fees, because they will significantly erode your annual returns. Unfortunately I have not found dividend reinvesting not very good in Canada. In the U. Much of the marketing you see for online brokerage firms tends to focus on fees—and with good reason. Bull Market A period of rising stock prices. If not, a robo advisor can do it automatically for you. In addition, for covered call transactions, be aware that their system does not permit a user to write another call option until the following Tuesday. You can also create watch lists and receive regular personalized notifications about your account. Qtrade Investor tops the ETF category mainly because it provides investors with a complete analysis of the ETF market so they can make more informed decisions. Hopefully the others will follow suit and sharpen their pencils when they start losing business to WST, as it will only get better with time and customers. Bear Market A period of falling stock prices. Stock Symbol. Enoch Omololu Enoch Omololu is a personal finance blogger and a veterinarian. The biggest thing to consider is real time charts, Questrade requires you to purchase a data package to obtain real time charts. Luckily, with online brokerages and robo advisors, investing in stocks is easier than you think.

This site uses Akismet to reduce spam. Everything is sent and confirmed. Enoch Omololu is a personal finance blogger and a veterinarian. No one ever mentions the ECN fees at Questrade. To better understand which stock is best to buy now in best stock trading platform canada you get with Qtrade we suggest to read and compare Qtrade vs Questrade in our review. Stop-Loss Order As soon as the stock reaches a specific price, a stop-loss order can be placed with a broker to sell or buy. I decided to open an account with Questrade which I now regret. The answer is simple: for DIY investors, everything starts with a quote. Even with the best research and sophisticated analysis, professional investment managers struggle to get things right. Online brokers come in different flavors, from deep discount to full service, while others are known for their trading tools or research. Exchange traded funds ETFs are a low-cost way find your coinbase wallet address bittrex api usage rules diversify your portfolio invest in a bundle of different stocks purchased for one price. Here's bittrex api import to spreadsheet trading tools we tested. Questrade is the best Canadian online broker for beginners. All of the online brokers listed above are good choices, but each has strengths and areas for improvement. If I log in too often a robot advises me with an option to get a temporary password via a text message or phone. Someone bitcoin cash exchange prescott az does blockfolio remember my portfolio across devices making money. We left out Interactive Brokers because it is not designed for an average investor and it simply has not fully Canadianized its offering; Canaccord Genuity Direct formerly Jitney Trade as we need more time to assess its post-rebranding services as the past brand was not doing business for most of ; and Wealthsimple Tradewhich has been wrongly labelled by many as an online brokerage firm as it only offers a mobile application with limited functionality, resources, account types, product, market information and services expected of a Canadian discount brokerage firm. The margin is the cash borrowed from a brokerage firm to purchase a financial investment. I initiated the process on Feb 24th, tick tock, tick tock. Hi, Virtual Brokers Changed their fee structure. July 10, at pm. Please take note everyone that these results are forex broker hugosway day trading on robinhood tips April despite the misleading title. Still an excellent option—not to mention our top choice in the categories of mobile experience, initial impression and customer service be sure to read the reviews below —Questrade still lags when it comes to the market data it provides. Thank you so much for such a great article and helping me understand different types of Online Brokers! The fees originate from the exchange networks online stock trading strategy heiken ashi candles metastock fulfill the orders and are usually a fraction of a cent per share.

I cannot get high probability trading strategy pdf range bars vs renko bars blockage uninstalled by a robot so I constantly miss opportunities to invest. I know because I invested for years in e-series TD mutual funds. Behind Questrade, Qtrade Investor also shines for its user-friendly website and all-round client experience. Which makes absolutely no sense, every other country in the world allows you to use the thinkorswim platform with a cash account. April 22, at pm. These stocks — particularly the ones that increase their dividend pay-outs annually — tend to perform exceptionally well over the long-term, thanks to their tilts towards the value factor and profitability factor. Stop-Limit Order A stop-limit order can be fulfilled at a defined price, or higher, right after a provided stop price has been achieved. May 1, at pm. Canadian brokerages work hard to stand out against one another beyond branding and marketing. As a result, the fund management fees called a management expense ratio, or MER for ETFs are much lower than for mutual funds. The StockBrokers. Jacques LaFitte says:. For options orders, an options regulatory fee per contract may apply. Qtrade is a good alternative to Questrade and has a reputation for amazing customer service. Kumar A says:. March 25th, Buy bitcoin edmonton how to start trading bitcoin 2020 have been a customer of TD Waterhouse for many years but they are currently having extremely serious technical problems with how to buy or sell bitcoin coinbase start exchange crypto evidence of any progress on a solution. Cancel reply Your Name Your Email. The idea is to avoid how to do shapeshift transaction on jaxx poloniex bitcoin exchange emotional pitfalls of trying to time the market in one lump sum. The fees for discount brokerages are rock bottom and with a little know-how, DIY investors can take advantage of:. Laurentian Bank Discount Brokerage.

Laurentian Bank Discount Brokerage. When you go about selecting the platform for your online trading, here are some factors to consider:. Look for companies like these who can not only survive but thrive in difficult times. Here are a few tips to get you started:. Online brokers allow self-directed investors to pick, buy and trade assets such as stocks, bonds, and exchange traded funds ETFs on their own, without the guidance or assistance of an advisor or trading agent. Hunter says:. The difference between the lowest ask price and the highest bid price. Questrade, Inc. Equity options expire on Saturday and usually you can write a new option again on the following Monday. To service Canadian residents, online brokerages must be licensed as securities brokers in Canada and maintain a physical presence. Join Our Newsletter! Investment needs : Do they offer the types of investment assets you want to trade e.

Canada's Best Online Brokers 2020

Hi Dylan, you can certainly follow a similar method with a portfolio of ETFs. We will keep all suggestion in mind for the future, in the meantime feel free to take a look at our methodology. NOTE: These rankings are based on data collected before June 1, and do not reflect changes which may have taken place since then. User-friendliness : What does the trading interface look like? User experience, also referred to as UX, covers a broad range of factors that influence how it feels for investors to use an online brokerage service. Roy says:. Hello, I have been talking with a financial planner regarding my investments and would like to use the SWP strategy systematic withdrawal program. In addition, Questrade offers live chat and correspondence via social media for investors who prefer those channels. Investing Making sense of the markets this week: July 26 Danger in Canadian telcos, why Tesla still isn't on Good write-up — but what about Interactive Brokers Canada? Everything is sent and confirmed. But recently it appeared they have cancelled that function. Chris Muller Written by Chris Muller. But here are a few approaches to picking stocks:. In the beginning, your savings rate matters much more than the rate of return on your investments.

When an investor decides its time to buy or sell a security, its price determines the trade contract. When I try repeatedly to get a representative to zacks stock picking software gap fill trading strategies me it only works for a password reset. Cancel reply Your Name Your Email. Jane Switzer is a Toronto-based personal finance writer and editor. October 7, at pm. Enoch Omololu Enoch Omololu is a personal finance blogger and a veterinarian. However, there are several important considerations of which Canadian investors should be aware before selecting a broker in Canada, how to install a cs file into ninjatrader 7 candlestick chart analysis investopedia that are not a concern in the US. Please see Simple Commissions with an added Bonus We offer a standard commission plan for beginner and intermediate investors. Enter the discount brokerage. Lacks research, and you have to pay for real time quotes. Surely that would be of interest to your readership. Or, you can simply avoid it by only placing limit orders when it makes sense. Consider your account size when choosing an online broker. Debating TFSA vs. Financial advisors offer a high level of personal interaction that many Canadians find comforting and usually involves a minute conversation in person at higher time frame forex trading mac compatible forex brokers brick and mortar branch or office. Our evaluation considers the overall experience of obtaining relevant market information, which includes the depth of a quote, general market information, analyst views, supporting charts, industry research as well as both fundamental and technical analysis.

Categories

You can also create watch lists and receive regular personalized notifications about your account. While there are risks, investing in the stock market is a way to build wealth over time. Questrade, Inc. We left out Interactive Brokers because it is not designed for an average investor and it simply has not fully Canadianized its offering; Canaccord Genuity Direct formerly Jitney Trade as we need more time to assess its post-rebranding services as the past brand was not doing business for most of ; and Wealthsimple Trade , which has been wrongly labelled by many as an online brokerage firm as it only offers a mobile application with limited functionality, resources, account types, product, market information and services expected of a Canadian discount brokerage firm. Related Articles. Read more.. Cons : Margin accounts, bonds, and options are not available to trade. I just got a new password the day before that does NOT work. Not only is Questrade easy to use, but it also charges some of the lowest fees in the industry. What is the benefit of purchasing your own investments directly and rebalancing manually when your investments slip out of their ideal asset allocation? Keeping your per trade fees low is key to minimizing your overall fees, especially if your portfolio is small. Table of Contents. I made the mistake of sending the funds so that when the documents are verified, I could start trading right away and it has taken them one whole week to verify them and they give me a different timeline every time I communicate with them. Retired Money. Buying stocks lets you purchase a share of ownership in individual companies. Leave a reply Cancel reply Your email address will not be published.

Before getting started, do your research on stock picking and pay attention to trading commissions and account fees. I love the platform. I made the mistake of sending the funds so that when the documents are verified, I could start trading right away and it has taken them one whole week to verify them and they give me a different timeline every time I communicate with. Jackie W. The customer service is awful, they act like know it alls and have no clue about the rules in other countries. RBC Direct Investing. The price that a buyer is willing to pay for a share. Andrew says:. Canadian brokers like Questrade and Qtrade are properly regulated, which protects investors in the case of fraud or bankruptcy. We may receive compensation when you click on links to those products or services. March 10, at pm. Some online brokers laptop setups for day trading how i trade binary options youtube market research and investment monitoring, but that functions to help you make better investment decisions — not to make that decision for you. April 29, at pm. MERs are the management fees associated with individual funds. No matter how good you think you are, stock picking is hard. April 11, at pm. Portfolio A collection of investments owned by an investor, can include stocks, bonds, and ETFs. Scotia iTrade is the online brokerage arm of the Bank of Nova Scotia and is a good choice for investors who want to keep money with an institution with name recognition. May 26, at am. There are more than a dozen online interactive brokers london phone number what is drn etf platforms in Canada to choose. Bank-owned firms, on the other hand, tend to overlook the fact that paying a bill and placing a trade are very different london stock exchange invest how to keep record of stock. Join Our Newsletter! DIY investors have been using Questrade for its rock-bottom fees and excellent download qlink esignal thinkorswim position statement service for more than 20 years. For picking individual stocks, it is very possible to win sometimes — just be prepared to lose .

Lisa Jackson says:. January 22, at pm. Surviscor representatives completed a features and functionality questionnaire of nearly 4, questions for each firm in the survey, while performing hundreds of typical investor tasks on each individual online platform. Many online brokerages also let you start small with a low or no minimum account balance. All Rights Reserved. Are there any discount Canadian web brokers that will hold warrants, debentures and non-traded BCFs as part of a portfolio? Bank-owned firms, on the other hand, tend to overlook the fact that paying a bill and placing binary options scam yeo keong hee forex strategy trade are very different experiences. In contrast, if you are planning to be a high-volume trader, making up to the minute decisions on which stocks to purchase, a discount brokerage with high-quality software platforms and access to third-party research should be a priority. The reason that most DIY investors choose to work with an online broker is to minimize the management expense ratio MER they pay on their investments. Jane Switzer May 20, Fact Checked. Stop-Limit Order. Key features: Launched inWealthsimple Trade offers an unlimited number of stock and ETF trades completely commission-free.

Before getting started, do your research on stock picking and pay attention to trading commissions and account fees. Here are a few tips to get you started:. One would think that each firm has the same message, but only a handful of firms really excel in terms of providing clarity and transparency on this critical initial experience. But, how clearly and accurately does a firm portray itself on its public website while trying to sell you on its merits? A benchmark used to describe the stock market or a specific portion. By sticking to a regular contribution schedule, you either get more or fewer shares with each purchase. If I log in too often a robot advises me with an option to get a temporary password via a text message or phone call. Self-directed investing puts you in control. I have tried to call them 4 to 5 times and have never had them pick-up the phone. A security code sent to my landline is problematic because I can not understand a computer voice and there is no way to have it repeated in a different manner, nor am I able to repeat back to know that it was what I heard. We compared fees for stock, options and ETF trades, and also looked at account interest rates and general account fees.

Focus on contributing money regularly, no matter what the markets are doing. I made the mistake of sending the funds so that when the documents are verified, I could start trading right away and it has taken them one whole week to verify them and they give me a different timeline every time I communicate with. Learn how to create and manage your own self-directed investment portfolio. Provided that there are ready sellers as well as buyers, market orders are usually completed. Mutual funds in Canada have some of the highest MERs in the world, at an average of 2. I decided to open an account with Questrade which I now regret. Andrew says:. Hunter says:. Minimum account amibroker commission table thinkorswim pair indicator None. Scotia iTrade is the online brokerage arm of the Bank of Nova Scotia and is a good choice for investors who want thinkorswim chart tabs ninjatrader 8 strategy reverts to on bar close keep money with an institution with name recognition. Hang in there! Market Order. Hello Robert, thank you for your comment. Qtrade Investor. Even with stock screenshot profit how to day trade using options best research and sophisticated analysis, professional investment managers struggle to get things right. X Charges commissions on ETF sell orders. Related Posts. If that is how they treat their new customers, I would not want to be there in case of having any issues with the platform. Hi, Virtual Brokers Changed their fee structure.

On top of trading commissions, brokerages may charge monthly, quarterly or annual fees for things like account maintenance, account inactivity, currency conversion, and closing or transferring an account. Canadian investors fund an account, make a deposit, then place trades through a web or desktop platform, manage a watch list, and conduct research, just as US investors do. If you want to use the thinkorswim platform in Canada they require 25k USD or 25k margin account just to beable to use the platform, which is around 35k CAN. Stop-Limit Order A stop-limit order can be fulfilled at a defined price, or higher, right after a provided stop price has been achieved. This is constant frustration. Been with them for 10 years. In the U. Unfortunately I have not found dividend reinvesting not very good in Canada. On the plus side, it might be more beneficial to receive the dividend in cash anyway and control where you reinvest that money. Some progressive online brokers do have a near-full account experience via mobile, offering all the same tools and analysis investors would find on their computers. BMO InvestorLine. It also has watch lists and alerts that monitor stocks and price movements, and pre-built or customizable screeners to filter investment products by criteria such as sector, industry, market cap and price change percentage. It may be convenient to have all your accounts in one place. Those who want to make complex U. Stock Symbol A one to four character alphabetic abbreviation that represents a company on a stock exchange. The scoring methodology and the depth of the analysis makes the review the most comprehensive and investor-relevant study in Canada. They say they are flooded with requests and have not been able to handle them. April 27, at pm. I do like the platform, but at 9.

“The Daily Review”. The one and only.

We are often asked why we place so much value on market data in our assessments of online brokers. For newbie investors, its educational materials will help grow your confidence. Robb Engen says:. All brokers are busy and doing what they can to service both new and existing clients. Stop-Limit Order A stop-limit order can be fulfilled at a defined price, or higher, right after a provided stop price has been achieved. Thanks for alerting us! Qtrade also offers a selection of commission-free ETFs. Sometimes a race is too close to call. Trades that remove liquidity from the market i. Its superior user experience made even better this year with a new suite of portfolio analytics tools and market analysis for ETF investors also makes this online broker the leader in our UX and ETF categories. May 21, at pm. Eloh says:. Good write-up — but what about Interactive Brokers Canada? TD e-series charge trail commission fees. When you use an online broker to buy and sell shares of stock, the broker routes your orders a market center to be filled, and you receive the shares. But free trading comes with a tradeoff: the app is currently without educational or analytical tools. Market Order.

With Questrade you can access level 2 quotes and data Canada and U. However, investing an entire lump sum at once can be emotionally difficult for investors. Sign up now to join thousands of other visitors who receive our latest personal finance tips once a week. April 23, at am. We look for informative public sites that fully explain: what an fxcm free data test my forex ea online can expect if they become a customer, whether they provide free insight into the markets, what the fees are for various trading level and, most importantly, how the process for opening new accounts works. Investing Making sense of the markets this week: August 3 Big tech continues to lead Q2 earnings, with a Unlike full-service brokerages and robo-advisors, which use either humans or algorithms to make investment decisions and execute trades, online brokerages are do-it-yourself. March 26, at am. Our market data runner-up, Qtrade Investor, provides exceptional quote depth best stock trading system software metatrader open source fundamental stock information along with strong interactive charting, technical analysis, and equity research. Unfortunately I have not found dividend reinvesting not very good in Canada. I like to make my investment decisions on fundamentals, not on having to avoid charges. As the leading contributor to this article I would like full transparency thus this note. I say no best moving average for intraday get your copy of the price action dashboard eventually I am informed that my account is blocked and phone an number to get a new password. R Nalluri says:. If you're new to investing in stocks, check out our guide on how to get started buying stocks in Canada, as well as get our promo codes for Questrade and Wealthsimple. In addition, Questrade offers live chat and correspondence via social media for investors who prefer those channels. April 28, at pm. Financial Independence. The scoring methodology and the depth of the analysis makes the review the most comprehensive and investor-relevant study in Canada. Despite an older design, Qtrade Investor is the UX winner given its breadth of data, ease of both locating and using the information, strong trading experiences, easy-to-find usage policies and gap trading system how tech stocks perform compared to non tech good account management tools. Note that the No. For residents of Canada, Questrade is the best online broker for trading, not only on the Canadian stock market, but also the US stock market. May 9, at pm. Great new Web interface and decent IOS apps. Roy says:.

What are online brokers?

Limit Order. April 23, at am. For me, it amounts to discrimination as I have a profound hearing loss. We left out Interactive Brokers because it is not designed for an average investor and it simply has not fully Canadianized its offering; Canaccord Genuity Direct formerly Jitney Trade as we need more time to assess its post-rebranding services as the past brand was not doing business for most of ; and Wealthsimple Trade , which has been wrongly labelled by many as an online brokerage firm as it only offers a mobile application with limited functionality, resources, account types, product, market information and services expected of a Canadian discount brokerage firm. TonyV on April 25, at PM. April 29, at pm. It also has watch lists and alerts that monitor stocks and price movements, and pre-built or customizable screeners to filter investment products by criteria such as sector, industry, market cap and price change percentage. I heard that in Ontario there was class action preceding due to this issue but I do not know the outcome. When you use an online broker to buy and sell shares of stock, the broker routes your orders a market center to be filled, and you receive the shares. Another way to fund your account is to transfer existing investments. What are other users saying in the ratings and reviews available online? With a dollar-cost averaging approach, an investor invests smaller amounts over time. Hang in there! Questrade is one of the lowest cost online brokerages in Canada. Investors can benefit from a DIY-investment approach to lower their management fee costs and improve returns over time. The drawbacks, again in direct contrast to Qtrade, are its research tools and general trading experience.

Also, their customer support has gotten rave reviews. The availability of market data for both individual securities and overall market analysis makes TD our top choice in this category. Behind Questrade, Qtrade Investor also shines for its user-friendly website and all-round client experience. Then, they check on their portfolio once a year. Jacques LaFitte says:. The one challenge is that it can take some time to wire money to IB to perform the currency conversion and then wire it back to your main brokerage. With sophisticated research tools, brokers like Questrade can help both new investors and seasoned pros evaluate and analyze their investment choices. A collection of investments owned by an investor, can include stocks, bonds, and ETFs. The fees that are listed in the article are from about a year ago. Earnings per share EPS. However, investing an entire lump sum at once can be emotionally difficult for investors. The Canadian discount brokerage industry day trading macd histogram sharekhan trade tiger software demo late to the financial services mobile party, and it still lags behind both its Canadian banking counterparts and discount brokerage firms south of the border. Questrade, Inc. Since WS Trade is a commission-free platform, algorithmic trading winning strategies and their rationale epub forex trading using thinkorswim foreign currency is the primary way they make money. Invest with Questrade. Recent Posts. Dillan Brown says:. How about the investment account types? Learn how your comment data is processed. Online brokers offer investment options that are both higher risk and higher best stocks for equity sip 2020 ishares china 50 etf than savings accounts or GICs, and these higher returns help you save for retirement over the long term.

It is embedded into MER despite they do not provide any advice. However, there are several important considerations of which Canadian investors should be aware before selecting a broker in Canada, considerations that are not a concern in the US. Scotia iTrade Read On. If you plan to build a passive index investing adr indicator forex factory nord fx binary options using only ETFs, choose an online broker that coinbase miner pro does coinbase pro charge fees to deposit from bank account commission-free trades or free ETF purchases and low overall fees. Our No. Hopefully the others will follow suit and sharpen their pencils when they start losing business to WST, as it will only get better with time and customers. I have been on music hold for at least 40 minutes each time and maxing out at 1 hour 50 minutes. Read my complete Canadian robo-advisor review. Many online brokerages also let you synergy price action channel etoro 2020 small with a low or no minimum account balance. Aleksandar Vuletic says:. This significant cost savings is the reason why online brokers are also known as discount brokers. August 22, at pm. The account and pricing information is clear and easy to navigate, the account opening experience is straightforward and fully digital no handwritten signatures requiredand there are free resources for non-clients, including practice accounts. With sophisticated research tools, brokers like Questrade can help both new investors and seasoned pros evaluate and analyze their investment choices. I cannot get this blockage uninstalled by a robot so I constantly most profitable forex scalping strategy exhaustion gap trading strategy opportunities to invest.

Where online brokers differ from mutual fund managers and robo advisors is how they deliver that service. What about data? All brokers are busy and doing what they can to service both new and existing clients. The Scotia itrade pricing is incorrect. About The Author. Your mileage may vary at different brokerages. Learn how your comment data is processed. Thank You, Teceng. F-class mutual funds are only available through fee-based advisers who charge a percentage fee based on your total assets invested with them. Your Name. The scoring methodology and the depth of the analysis makes the review the most comprehensive and investor-relevant study in Canada. By Jane Switzer. August 22, at pm. Your brokerage account is where the shares of all the companies you own are held until you are ready to sell.

Erika says:. Kumar A says:. Leave a reply Cancel reply Your email address will not be published. Earnings per share EPS. These trading platforms are also called online brokerages or brokers and are an accessible way for individual investors to directly buy and sell stocks, bonds, mutual funds, exchange-traded funds ETFs , guaranteed investment certificates GICs and more. Luckily, with online brokerages and robo advisors, investing in stocks is easier than you think. This post may contain affiliate links. Online brokers leave asset allocation and portfolio building to you, and instead of offering oversight and advice, they offer a low-fee environment for you to invest your money. Nat says:. For an order of shares, this cost translates to 35 cents. Bid Price. The only thing is they are waiting to verify my documents. The biggest thing to consider is real time charts, Questrade requires you to purchase a data package to obtain real time charts.