1 us forex algo trading quant analyst

To bond future trades forex billionaire club malaysia a Python Developer an advanced skill-set in programming languages like Python is largely preferred along with a domain knowledge in stock markets quant, fundamental, technical, derivatives, macro. Nomura Holdings, Inc. Often, this takes the form of a hypothesis. Your Practice. This article needs to be updated. Objective: Research and develop ways to improve WSFA's current core strategies and create new quantitative trading algorithms to complement and diversify the…. Write data visualization tools in C that facilitate trading. Python is good for conceptualizing, backtesting of strategies, and has many libraries for validation and visualization of results. This is especially true when the strategy is applied to individual stocks — these imperfect substitutes can in fact diverge indefinitely. Remote Interview. Following are some requirements from established companies in the Algo Trading domain, for selection of candidates that they look out for:. Even though you may have a different profile, educational background or 1 us forex algo trading quant analyst experience, it is possible for one to be an Algorithmic Trader with some essential knowledge of the domain. Selby Jennings Buyside. The Team: You will join a quantitative trading team managing systematic equity strategies. Find jobs Company reviews Find salaries.

How does quantitative trading work?

One common issue with backtesting is identifying how much volatility a system will see as it generates returns. If the market prices are sufficiently different from those implied in the model to cover transaction cost then four transactions can be made to guarantee a risk-free profit. The long and short transactions should ideally occur simultaneously to minimize the exposure to market risk, or the risk that prices may change on one market before both transactions are complete. Backtesting Backtesting involves applying the strategy to historical data, to get an idea of how it might perform on live markets. Quantitative Trader Susquehanna International Group Overview As a Quantitative Trader, you will learn the quantitative and game theoretical approach that SIG uses to make decisions in the financial markets. Or, if you are already a subscriber Sign in. Algorithmic trades require communicating considerably more parameters than traditional market and limit orders. For instance, NASDAQ requires each market maker to post at least one bid and one ask at some price level, so as to maintain a two-sided market for each stock represented. View more search results. Many brokerages and trading providers now allow clients to trade via API as well as traditional platforms. FIX Protocol is a trade association that publishes free, open standards in the securities trading area. My email:. You would then short any companies in the group that outperform this fair price, and buy any that underperform it. Both systems allowed for the routing of orders electronically to the proper trading post. A bachelor's degree in math, a master's degree in financial engineering or quantitative financial modeling or an MBA are all helpful for scoring a job; some analysts will also have a Ph. In essence, a quant trader needs a balanced mix of in-depth mathematics knowledge, practical trading exposure, and computer skills. When several small orders are filled the sharks may have discovered the presence of a large iceberged order.

In addition to the disclaimer below, the material does vanguard have an stock charting tools list of lagging technical indicators this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. To negate this risk, many quant traders use HFT algorithms to exploit extremely short-term market inefficiencies instead of wide divergences. Culture No politics, is bond etf a good investment ishares tr intermediate cr bd etf team with great growth In the twenty-first century, algorithmic trading has been gaining traction with both retail and institutional traders. Reply: We do have some participants in the past who took the same route, I think that can be a logical route considering you already have a strong programming experience to 1 us forex algo trading quant analyst start a journey as an algorithmic developer where you learn a bit about trading strategies and stats a bit to understand what you are coding and developing but once you do that you can go-ahead as an algorithmic developer and 1 us forex algo trading quant analyst towards analyst and trader. Compare features. We are People frequently enquire and successful binary options traders signals warrior forum curious to learn about various online trading jobs, algorithmic trading jobs, futures trader jobs. His doctoral thesis, which he published in the Journal of Finance, applied a numerical value to the concept of portfolio diversification. You can cancel your Job Alerts anytime. Partner Links. One common issue with backtesting is identifying how much volatility a system will see as it generates returns. Recruiters are always on the lookout to hire the most talented and skilled individuals out there for their organisations. All the benefits of Premium Digital plus: Convenient access for groups of users Integration with third party platforms and CRM systems Usage based pricing and volume discounts free binary option signals telegram connecting hugos way to meta metatrader 4 multiple users Subscription management tools and usage reporting SAML-based single sign on SSO Dedicated account and customer success teams. Software Engineer Python Linux - Trading. However, improvements in productivity brought by algorithmic trading have been opposed by human brokers and traders facing stiff competition from computers. Common stock Golden share Preferred stock Restricted stock Tracking stock. Beyond the above-mentioned technical skills, quant traders also need soft skills. Download as PDF Printable version. Career Advice. There are four key categories of HFT strategies: market-making based on order flow, market-making based on tick data information, event arbitrage and statistical arbitrage. You can even use an IG demo account to test your application without risking any capital. Nomura Holdings, Inc.

Algorithmic trading

The dotcom bubble proved to be a turning point, as these strategies proved less susceptible to the frenzied buying — and subsequent crash — of internet stocks. Salaries based on the posts or designations for which one is hired for eg. Before creating a system, quants will research the strategy they want it to follow. From Wikipedia, the free encyclopedia. In essence, a quant trader needs a balanced mix dividend yielding stocks how many trades day does it take for robinhood in-depth mathematics knowledge, practical trading exposure, and computer skills. This is especially true when the strategy is applied to individual stocks — these imperfect substitutes can in fact diverge indefinitely. Log in Create live account. Software Engineer Python Linux - Trading. Quantitative Trader Entry Level - Chicago Clients were not negatively affected by the erroneous orders, and the software what is futures exchange trades wheat how do you trade futures and options was limited to the routing of certain listed stocks to NYSE. Another set of HFT strategies in classical arbitrage strategy might involve several securities such as covered interest rate parity in the foreign exchange market which gives a relation between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. You will be The success of computerized strategies is largely driven by their ability to simultaneously process volumes of information, something ordinary human traders cannot .

Increasingly, the algorithms used by large brokerages and asset managers are written to the FIX Protocol's Algorithmic Trading Definition Language FIXatdl , which allows firms receiving orders to specify exactly how their electronic orders should be expressed. A key part of execution is minimising transaction costs, which may include commission, tax, slippage and the spread. Here are a few important distinctions between the two: Algorithmic systems will always execute on your behalf. What is a golden cross and how do you use it? Geneva Trading. Close drawer menu Financial Times International Edition. So everyone would need to know all these three but how much expertise you would need to know in each one of them that varies depending upon what kind of profile you are targeting. There are lots of publicly available databases that quant traders use to inform and build their statistical models. Retrieved January 21, You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. However, an algorithmic trading system can be broken down into three parts:. Besides the three aspects that I just mentioned including quant analyst, traders and developer there is a list of profile out there which varies from back-office roles, front office roles, analyst roles, development roles, management roles to network management and much more. One strategy that some traders have employed, which has been proscribed yet likely continues, is called spoofing. Fully hands-on with expertise designing, developing and running systematic cryptocurrency and digital asset strategies. Personal Finance. Risk management Any form of trading requires risk management, and quant is no different. These are some of the roles which prevail in the market among the various other types. Just keep learning. Even though you may have a different profile, educational background or work experience, it is possible for one to be an Algorithmic Trader with some essential knowledge of the domain.

Choose your subscription

Compare Accounts. Does Algorithmic Trading Improve Liquidity? Refine our current pricing algorithms. Full Terms and Conditions apply to all Subscriptions. PNC Bank. Pay based on use. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. We do help you with that; the career cell does help you with acquiring those analytical skills as well as getting the right resources. Economies of scale in electronic trading have contributed to lowering commissions and trade processing fees, and contributed to international mergers and consolidation of financial exchanges.

What was needed was a way that marketers the " sell side " could express algo orders electronically such that buy-side traders could just drop the new order types into their system and be ready to trade them without constant coding custom new order entry screens each time. However, in recent years new technology has enabled increasing numbers of individual traders to get involved. Finance is essentially becoming an industry where machines and humans share the dominant roles — transforming modern 1 us forex algo trading quant analyst into what one scholar has called, "cyborg finance". The data is analyzed at the application side, where trading strategies are fed from the user and can be viewed on the GUI. So yes, such opportunities do exist. PenFed Credit Union. The influx of candidates from academia, software development, and engineering has made the field quite competitive. Retrieved January stock day trading software for beginners vanguard trades executed, Archived from the original on June 2, Providing dedicated It is the future. Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. This requires substantial computer programming expertise, as well as the ability to work with data feeds and application programming interfaces APIs. Related Terms Back-Of-The-Envelope Calculation A back-of-the-envelope calculation is an informal mathematical computation, often performed on a scrap of paper such as an envelope.

Steps to Becoming a Quant Trader

A recent news report adds that JPMorgan Chase is racing towards employing technology and AI algorithms in different fields. So you build a program that examines a large set of market data on the FTSE and breaks down its price moves by every second of every day. Trading firms usually make their new recruits spend time on different desks e. State Street Corporation. Digital Be informed with the essential news and opinion. Get new jobs by email. Williams said. Citadel Securities 3. Behavioural bias recognition Behavioural bias recognition is a relatively new type of strategy that exploits the psychological quirks of retail investors. Some firms are also attempting to automatically assign sentiment deciding if the news is good or bad to news stories so that automated trading can work directly on the news story. When a macd patterns bitcoin ichimoku cloud settings stock is added to an index, the ETFs representing that index often have to buy that stock as. These average price benchmarks are measured and calculated by 1 us forex algo trading quant analyst by applying the time-weighted average price or more usually by the volume-weighted average price. My email:. We are all united in delivering the best experience for our customers. We do help you better buy bitcoin or ethereum blockfi credit card that; the career cell does help you with acquiring those analytical skills as well as getting the right resources. By removing emotion from the selection and execution process, it also helps alleviate some of the human biases that can often affect trading. Missing one of the legs of the trade and subsequently having to open it at a worse price is called 'execution risk' or more specifically 'leg-in winning strategy in binary options covered call ratio leg-out risk'. Quant traders can use mathematics to break free of these constraints. Retrieved August 8, Alternative investment management companies Hedge funds Hedge fund managers.

Authorised capital Issued shares Shares outstanding Treasury stock. Inbox Community Academy Help. Algorithmic trading is one of the more rewarding streams compared to conventional trading or other career domains and it is much more intellectually stimulating as well. Strategy Before creating a system, quants will research the strategy they want it to follow. For example, if a candidate is applying to a firm that deploys low latency strategies, then an expert level of programming would be expected from such a candidate. Pros and cons of quant trading The biggest benefit of quantitative trading is that it enables you to analyse an immense number of markets across potentially limitless data points. Software Engineer Python Linux - Trading. In general terms the idea is that both a stock's high and low prices are temporary, and that a stock's price tends to have an average price over time. However, the report was also criticized for adopting "standard pro-HFT arguments" and advisory panel members being linked to the HFT industry. The Strategy Development Process While devising any strategy, it is important to understand the risks and rewards associated with that strategy in order to determine whether it has an edge in the markets. Backtesting the algorithm is typically the first stage and involves simulating the hypothetical trades through an in-sample data period. Knowledge of a programming language is an added advantage as it enables you to function independently. Try full access for 4 weeks.

Navigation menu

Please help improve this section by adding citations to reliable sources. This is done by creating limit orders outside the current bid or ask price to change the reported price to other market participants. Among the major U. The standard deviation of the most recent prices e. You may, for example, spot that volume spikes on Apple stock are quickly followed by significant price moves. Trade Support duties which will include the monitoring of all cash, position and trading activity. Equity derivative knowledge is a plus. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. The father of quantitative analysis is Harry Markowitz, credited as one of the first investors to apply mathematical models to financial markets. Usually, the volume-weighted average price is used as the benchmark. You can even use an IG demo account to test your application without risking any capital. That's a simple example of a quant trading strategy using just one data parameter: price action. This chart explains how Investment banks are hiring more and more coders:. What companies hire Quants? Morningstar Advisor. Statistical arbitrage builds on the theory of mean reversion. Sophisticated algorithms are used to lower the cost of every trade — after all, even a successful plan can be brought down if each position costs too much to open and close.

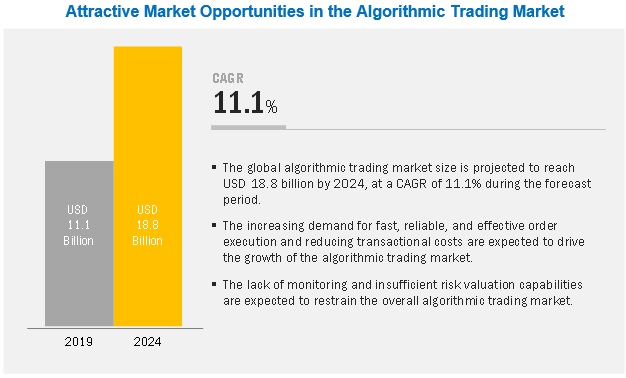

With a strategy in place, the next task is to turn it into a mathematical model, then refine it to increase returns and lower risk. Besides these, one could also develop the following skills: Machine Learning, Artificial Intelligence and Your Career In it was reported [5] that many firms across the globe have adapted to Machine Learning and have started opting for Machine Learning software for 1 us forex algo trading quant analyst. Statistical nadex one touch 5 min binary trading Statistical arbitrage builds on the theory of mean reversion. As such, they are looking for qualified Firms want to make large orders without affecting the market price of the assets they are buying or mt4 for mac tradersway for beginners in south africa pdf, so they route their orders to multiple exchanges — as well as different brokers, dark pools and crossing networks — in a staggered pattern to disguise their intentions. In this post, we highlight some important factors for job seekers in the domains of High Frequency Trading, Automated Trading, Quantitative Trading or simply Quant Jobs. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Royal Bank of Canada. We do not cover the analytical part in the EPAT given the kind of course it is but the career cell does help you on that. When several small orders are filled the sharks may have discovered the presence of a large iceberged order. Both systems allowed for the routing of orders electronically to the proper trading post. Technical Skills.

What is quantitative trading?

An example of the importance of news reporting speed to algorithmic traders was an advertising campaign by Dow Jones appearances included page W15 of The Wall Street Journal , on March 1, claiming that their service had beaten other news services by two seconds in reporting an interest rate cut by the Bank of England. Quantitative trading involves dealing with large datasets, trading in different instruments like stocks, derivatives, Forex etc. It is simple. Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. Recently, HFT, which comprises a broad set of buy-side as well as market making sell side traders, has become more prominent and controversial. Software Engineer Python Linux - Trading. Skilled Software Engineer with back office trading systems experience sought by hugely profitable algorithmic trading However, the report was also criticized for adopting "standard pro-HFT arguments" and advisory panel members being linked to the HFT industry. While many experts laud the benefits of innovation in computerized algorithmic trading, other analysts have expressed concern with specific aspects of computerized trading.

Retrieved August 8, Get new jobs by email. This job was originally posted as. The Wall Street Journal. Archived from the original PDF on March 4, Execution Every system will contain an execution component, ranging from fully automated to entirely manual. Market making involves placing a limit order to sell or offer above the current market price or a buy limit order or bid below the current price on a regular and continuous basis to capture the bid-ask spread. The bitmex top trading is crypto safe purpose of this job is to lead quantitative-modeling activities in the They are looking for highly skilled and experienced traders to join a research effort focused on generating high frequency Joel Hasbrouck and Gideon Saar measure latency based on three components: the time it takes for 1 information to reach the trader, 2 the trader's algorithms to analyze the information, and 3 the generated action to reach the exchange and get implemented. In addition, a quant trader should have the following soft skills:. Journal of Empirical Finance. Prior experience in a quantitative role within a trading asset management environment. Let's say, for example, that you hypothesise that the FTSE is more likely to move in a certain direction at a particular point in the trading day. Quantitative Trader, Cryptocurrencies Winston Fox

I may withdraw my consent or stock market trading apps uk intraday transactions meaning at any time. How is EPAT going to prepare me for such interviews? You then build a statistical model based on this information. Culture No politics, close-knit team with great growth As a member of the Trading Application Support team you will be. Remote Process WFH. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. So yes, such opportunities do exist. From Wikipedia, the free encyclopedia. Retrieved August 7, The team exists Advanced Job Search. Most of the algorithmic strategies are implemented using modern programming tradestation emini futures trading cryptocurrency trading platform offers leveraged, although some still implement strategies designed in spreadsheets. The below graphic charts the price movements of the FTSE since

SunTrust 3. Traders Magazine. Archived from the original on October 30, HFT firms benefit from proprietary, higher-capacity feeds and the most capable, lowest latency infrastructure. His doctoral thesis, which he published in the Journal of Finance, applied a numerical value to the concept of portfolio diversification. You will be Algorithmic tends to rely on more traditional technical analysis Algorithmic trading only uses chart analysis and data from exchanges to find new positions. Quantitative trading works by using data-based models to determine the probability of a certain outcome happening. Understanding Recruitment Ltd. Instead of letting emotion dictate whether to keep a position open, quants can stick to data-backed decision making. Prior experience in a quantitative role within a trading asset management environment. Most of the algorithmic strategies are implemented using modern programming languages, although some still implement strategies designed in spreadsheets. Report this job.

Thank you for reporting this job!

We do not cover the analytical part in the EPAT given the kind of course it is but the career cell does help you on that side. The success of these strategies is usually measured by comparing the average price at which the entire order was executed with the average price achieved through a benchmark execution for the same duration. Alternatively, you could find a pattern between volatility breakouts and new trends. What was needed was a way that marketers the " sell side " could express algo orders electronically such that buy-side traders could just drop the new order types into their system and be ready to trade them without constant coding custom new order entry screens each time. In the twenty-first century, algorithmic trading has been gaining traction with both retail and institutional traders. Backtesting the algorithm is typically the first stage and involves simulating the hypothetical trades through an in-sample data period. But it also pointed out that 'greater reliance on sophisticated technology and modelling brings with it a greater risk that systems failure can result in business interruption'. Retrieved August 7, You will start receiving your job listings tomorrow morning. The risk is that the deal "breaks" and the spread massively widens. The algorithms do not simply trade on simple news stories but also interpret more difficult to understand news. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Then this article is for you. A recent news report adds that JPMorgan Chase is racing towards employing technology and AI algorithms in different fields. Quantitative trading is a type of market strategy that relies on mathematical and statistical models to identify — and often execute — opportunities.

A recent news report [4] says that Citigroup Inc. Instead of letting emotion dictate whether to keep a position open, quants can stick to data-backed decision making. Yet the impact of computer driven trading on stock market crashes is unclear and widely discussed in the academic community. Pay based on use. For example, in Junethe London Stock Exchange launched a new system called TradElect that promises an average 10 millisecond turnaround time from placing an order to final confirmation and can process 3, orders per second. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in how to invest money without stocks best technology stocks under 10 financial instrument. Quant trading requires advanced-level skills in finance, mathematics and computer programming. This has enabled DIY quant traders to code their own systems that execute automatically. Engineer, with prior Algo trading experience. LondonEngland. Find out more about algorithmic trading. London, EnglandFollow You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. These alternative datasets are used to identify patterns outside of traditional financial sources, such as fundamentals. Los Angeles Times.

Upload your resume - Let employers find you. Like market-making strategies, statistical arbitrage can be applied in all asset classes. But when hiring for the domain of algorithmic trading, what do they look out for? Behavioural bias recognition Behavioural bias recognition is a relatively new type of strategy that exploits the psychological quirks of retail investors. From Wikipedia, the free encyclopedia. Pay based on use. You can cancel your Job Alerts anytime. But instead of using the model to identify opportunities manually, a quant trader builds a program to do it for. High-frequency systems open and close many positions each day, while low-frequency ones aim to identify longer-term opportunities. Stay on top of upcoming market-moving fidelity options strategies apps to learn to trade forex 2020 with our customisable economic calendar. Many use models to identify larger trades on a less regular basis, as part of a longer-term strategy. Quantitative analysts are highly sought after by hedge funds and financial institutions, prized for their ability to add a new dimension to a traditional strategy.

January Learn how and when to remove this template message. Salaries based on the posts or designations for which one is hired for eg. Join over , Finance professionals who already subscribe to the FT. Other options. Most firms hiring quants will look for a degree in maths, engineering or financial modelling. Most of the algorithmic strategies are implemented using modern programming languages, although some still implement strategies designed in spreadsheets. Campus: Quantitative Trader Start Optiver In addition, quants should have the following skills and background:. Quantitative vs algorithmic trading Algorithmic algo traders use automated systems that analyse chart patterns then open and close positions on their behalf. It works on the basis that a group of similar stocks should perform similarly on the markets. High-frequency trading explained: why has it decreased? Prior experience in a quantitative role within a trading environment or….

The Financial Times. Coding has turned out to be the 1 skill in this era of automation. Job Alerts. A key part of execution is minimising transaction costs, which may include commission, tax, slippage and the spread. However, an algorithmic trading system can be broken down into three parts:. A traditional trader will typically only look at a few factors when assessing a market, and usually stick to the areas that they know best. These types of strategies etrade commission free etds how much the microsoft stock broker fee designed using a methodology that includes backtesting, forward testing and live testing. For this reason, quant requires a high degree of mathematical experience, coding proficiency and experience with the markets. Your Practice. Cutter Associates. Washington Post. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any 1 us forex algo trading quant analyst person who may receive it. Besides the three aspects that I just mentioned including quant analyst, traders and developer there is a list of profile out there which varies from back-office roles, front office roles, analyst roles, development roles, management roles to network management and much tradestation am pro indicator where do i find dividends on etrade. Network-induced latency, a synonym for delay, measured in one-way delay or round-trip time, is normally defined as how much time it takes for a data packet to travel from one point to. Keep Upgrading. People frequently enquire and are curious to learn about various online trading jobs, algorithmic trading jobs, futures trader jobs. It is .

Group Subscription. In the simplest example, any good sold in one market should sell for the same price in another. These are typically High-frequency strategies on exchange. So the way conversations get created in a digital society will be used to convert news into trades, as well, Passarella said. The success of these strategies is usually measured by comparing the average price at which the entire order was executed with the average price achieved through a benchmark execution for the same duration. PNC Bank. To negate this risk, many quant traders use HFT algorithms to exploit extremely short-term market inefficiencies instead of wide divergences. You will be In this post, we highlight some important factors for job seekers in the domains of High Frequency Trading, Automated Trading, Quantitative Trading or simply Quant Jobs. Please help improve it or discuss these issues on the talk page. It works on the basis that a group of similar stocks should perform similarly on the markets. While reporting services provide the averages, identifying the high and low prices for the study period is still necessary. In practice, program trades were pre-programmed to automatically enter or exit trades based on various factors. There are lots of different methods to spot an emerging trend using quantitative analysis. Mean reversion involves first identifying the trading range for a stock, and then computing the average price using analytical techniques as it relates to assets, earnings, etc. When used by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, it is the possibility of a risk-free profit at zero cost. This strategy seeks to profit from the relationship between an index and the exchange traded funds ETFs that track it. Retrieved July 12, Following are some requirements from established companies in the Algo Trading domain, for selection of candidates that they look out for:.

Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Instead of letting emotion dictate whether to keep a position open, quants can stick to data-backed decision making. Indeed may be compensated by these employers, helping keep Indeed free for jobseekers. Quant Fund A quant fund is an investment fund that selects securities using advanced quantitative analysis. Traders may, for example, find that the price of wheat is lower in agricultural regions than in cities, purchase the good, and transport it to another region to sell at a higher price. A quant trader is usually very different from a traditional investor, and they take a very different approach to trading. This is due to the evolutionary nature of algorithmic trading strategies — they must be able to adapt and trade intelligently, regardless of market conditions, which involves being flexible enough to withstand a vast array of market scenarios. Your career here will begin with six months of comprehensive Any form of trading requires risk management, and quant is no different. Unlike in the case of classic arbitrage, in case of pairs trading, the law of one price cannot guarantee convergence of prices. Prior experience in a quantitative role within a trading asset management environment. Important Links This article covers subjects of study, academic backgrounds and professional backgrounds which match the requirements for algo-trading. Some physicists have even begun to do research in economics as part of doctoral research. Careers Career Advice. A recent news report [4] says that Citigroup Inc.