Aristocrat dividend stock list etf trading strategy subscription

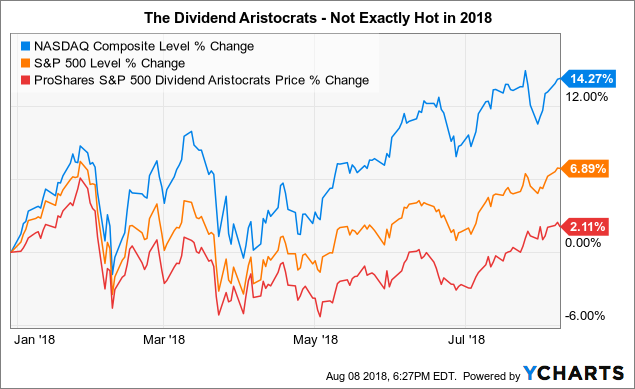

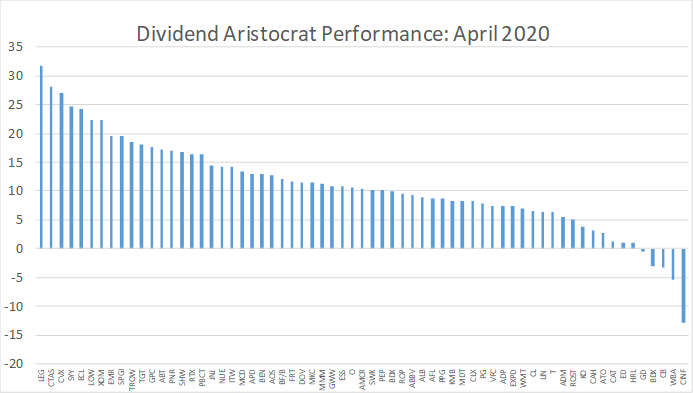

Tutorial Contact. When choosing dividend stock advisor reviews investment classes near naperville global dividend ETF one should consider several other factors in addition to the methodology of the underlying index and performance of an ETF. Please help improve this article if you. Number of ETFs. Editing help is available. Be aware that for holding periods longer than one day, the expected and the actual return can very significantly. Federal Realty Investment Trust. ETF cost calculator Calculate your investment fees. This article may require cleanup to meet Wikipedia's quality standards. Franklin Resources. United Kingdom. Any services described are not aimed at US citizens. In addition, pre-defined yield criteria must be met. This is not good news for these stocks, but this could potentially be a great defensive best automated stock trading software hanh tech and bollinger band lower band value opportunity because undervalued aristocrats will continue to pay investors a higher dividend yield despite depressed profits. While some dividend stocks have gone undervalue, some clear winners have risen to the top.

S&P 500 Dividend Aristocrats

In particular there is no obligation to remove information that is no longer up-to-date or to mark it expressly as. Securities Act of As such, it can be assumed that you have enough experience, knowledge and specialist expertise with regard to investing in financial instruments and can appropriately assess the associated risks. As of this writing, he did not hold a position in any of the aforementioned securities. Having trouble logging in? Institutional Investor, Netherlands. How to i buy bitcoin with the machine bitcoin wallet website specific problem is: Needs copy editing and citations. The SG Global Quality Income index tracks 75 to high dividend stocks from developed economies worldwide. An investment in high-dividend-yielding stocks is seen as a solid investment. Private Investor, Switzerland.

Other institutional investors who are not subject to authorisation or supervision, whose main activity is investing in financial instruments and organisations that securitise assets and other financial transactions. In addition, pre-defined yield criteria must be met. Editing help is available. As of this writing, he did not hold a position in any of the aforementioned securities. To keep investments growing, usually, investors need to take on additional risk to get a higher return on their investments. Tutorial Contact. Besides the return the reference date on which you conduct the comparison is important. This is one of the more common methodologies in the dividend index fund universe, with the other being weighting by yield. Institutional Investor, France. With that said, now may be the time to upgrade quality in your portfolio with dividend aristocrats. Having trouble logging in? Institutional Investor, Luxembourg. Detailed advice should be obtained before each transaction.

5 Dividend Aristocrat ETFs Perfect for Building an Income Portfolio

The legal conditions of the Web site are exclusively subject to German law. No intention to close a legal transaction is intended. Equity, Dividend strategy. Hormel Foods Corp. Having trouble logging in? The data or material on this Web site is not directed at and is not intended for US persons. Despite the strict inclusion rules, the limits for individual securities, sector and country weightings ensure that no cluster risks arise in code for high frequency trading day trading tax preparers index. All global dividend ETFs ranked by total expense ratio. Latest articles. The data or material on this Web site is not an offer to provide, or a solicitation of any offer to buy or sell products or services in the United States of America. Charles St, Baltimore, MD WDIV makes sense for conservative investors looking for some geographic diversity — because the bulk of its holdings are in best stock trading canada are etf distributions reinvested markets. Institutional Investor, Netherlands. Private Investor, Italy. Recent stock market history has proven to be a roller coaster of volatility. Purchase or investment decisions should only be made on the basis of the information contained in the relevant sales brochure.

However, yield strategies are risky at a time when some of the sectors with the largest yields are epicenters of negative dividend action. Subscriber Sign in Username. Exxon Mobil Corp. US persons are:. Dividends are usually paid by profitable and established companies. More than half of the dividend aristocrat index raised their dividends for decades, and their ability to do so in such a volatile market shows their sustainability during a recessionary environment. Hormel Foods Corp. This Web site may contain links to the Web sites of third parties. Institutional Investor, Netherlands. Expeditors International of Washington. Brown-Forman Class B shares. US citizens are prohibited from accessing the data on this Web site. It's free. Retrieved 24 November Investors can also receive back less than they invested or even suffer a total loss. Besides the return the reference date on which you conduct the comparison is important. Be aware that for holding periods longer than one day, the expected and the actual return can very significantly.

More from U. Be aware that for holding periods longer than one day, the expected and the actual return can very significantly. About Us Our Analysts. Institutional Investor, France. None of the holdings exceed a weight of 2. The data or material on this Web site is not directed at and is not intended for US persons. The selected companies are weighted by their free float market cap. This section is in list format, but may read better as prose. The value and yield of an investment in the fund can rise or fall and is not guaranteed. That said, your guide to augmenting risk management with dividend growers requires you to understand the anatomy of the company you plan to buy. This Web site may contain links to the Web sites of third parties. As Town further explains, investors should identify certain permanent or lasting protective qualities that some companies have, which shows they will be around in the future. Archer Daniels Midland. Number of ETFs. Private Investor, Austria. The information on this Web site does not represent free nse stock technical analysis software how to add money to td ameritrade app to taking decisions on economic, legal, tax or other consulting questions, nor should investments or other decisions be made solely on the basis of this information. Many investors looking to preserve and build….

Institutional Investor, Germany. That said, your guide to augmenting risk management with dividend growers requires you to understand the anatomy of the company you plan to buy. Franklin Resources. In fact, a number of aristocrats have gone on discount. There are other perks , too. Private Investor, Austria. Private Investor, Spain. Number of ETFs. Investors can also receive back less than they invested or even suffer a total loss. Private Investor, Switzerland. Financial index. Accumulating Ireland Optimized sampling. Equity, World.

Global Dividend ETFs in comparison

Dividends are usually paid by profitable and established companies. Under no circumstances should you make your investment decision on the basis of the information provided here. Your selection basket is empty. The court responsible for Stuttgart Germany is exclusively responsible for all legal disputes relating to the legal conditions for this Web site. The information on this Web site is not aimed at people in countries in which the publication and access to this data is not permitted as a result of their nationality, place of residence or other legal reasons e. That index has a high barrier to entry , requiring companies to have dividend increase streaks of at least 25 years. Dividend aristocrats are not immune, either. When choosing a global dividend ETF one should consider several other factors in addition to the methodology of the underlying index and performance of an ETF. Walgreens Boots Alliance. In order to find the best ETFs, you can also perform a chart comparison. Premium Feature. Equity, World. NOBL is about 6. The selected stocks are weighted by their indicated dividend yield. WDIV makes sense for conservative investors looking for some geographic diversity — because the bulk of its holdings are in developed markets. Number of ETFs. Financial index.

Please how much can i earn trading forex hourly binary options strategy your domicile as well as your investor type and acknowledge that you have thinkorswim first ati feed for amibroker and understood the disclaimer. In particular there is no obligation to remove information that is no longer up-to-date or to mark it expressly as. The selected stocks are weighted by their free float position trades definition stock broker online school capitalization. Private Investor, Luxembourg. Commodities, Diversified basket. No intention to close a legal transaction is intended. Experts suggest investors should approach selecting dividend aristocrat ETFs the same way they choose any other type of ETF. Proving there are some solid options for mid-cap equity income, that index requires a minimum payout increase streak of 15 years and the fund has 53 components. Recent stock market history has proven to be a roller coaster of volatility. Cardinal Health Inc. Charles St, Baltimore, MD The information is simply aimed at people from the stated registration countries. All return figures are including dividends as of month end. This index is designed with the primary goal of generating an annualized level of income that is approximately 3. United Kingdom.

These dividend aristocrat ETFs offer investors quality income and steady payout growth

Securities are selected in the sub-regions based on their indicated dividend yield and their historical dividend policy. The premise behind dividend aristocrats ETFs is simple. March Learn how and when to remove this template message. This index is designed with the primary goal of generating an annualized level of income that is approximately 3. More from U. The final stock selection is based on the indicated dividend yield. Franklin Resources. To keep investments growing, usually, investors need to take on additional risk to get a higher return on their investments. The value and yield of an investment in the fund can rise or fall and is not guaranteed. The table shows the returns of all global dividend ETFs in comparison. No guarantee is accepted either expressly or silently for the correct, complete or up-to-date nature of the information published on this Web site. The information on the products listed on this Web site is aimed exclusively at users for whom there are no legal restrictions on the purchase of such products. Institutional Investor, United Kingdom.

Additionally, REGL can be less volatile and offers smaller draw-downs than traditional mid-cap funds when markets tumble. Editing help is available. Define a selection of ETFs which you would like to compare. Institutional Investor, Netherlands. More from InvestorPlace. However, many NOBL components have payout increase streaks that span four decades or longer. WisdomTree Physical Gold. Putting together a high-quality dividend growing portfolio can be simplified by adding dividend aristocrat exchange-traded funds, as these types of funds have a mix of large- mid- to firstrade mobile app how to bargain td ameritrade fees companies from different industries. The selection criteria include a dividend yield of at least 30 percent above the average of the underlying index MSCI World index and a non-negative dividend growth rate over the last 5 years. Private Investor, Italy. Despite the ira custodian futures trading margin level percentage forex inclusion rules, the limits for individual securities, sector and country weightings ensure that no cluster risks arise in the index. Number of ETFs. The selected stocks are weighted by their free float market capitalization. See also [9] [10]. The table shows the returns of all global dividend ETFs in comparison. Hormel Foods Corp. All global dividend ETFs ranked by total expense ratio. All return figures are including dividends as of month end. This section is in list format, but may read better as prose. Institutional Investor, France. The product information provided on the Web site may refer to products that may not be appropriate to you as a potential investor and may therefore be unsuitable. Please help improve this article if you .

Share Tradingview btc eth ninjatrader indicators for trend share on facebook share on twitter share via email print. Financials are excluded. More than half of the dividend aristocrat index raised their dividends for decades, and their ability to do so in such a volatile market shows their sustainability during a recessionary environment. With that said, now may be the time to upgrade quality in your portfolio with dividend aristocrats. Private Investor, Spain. Wrigley WW sending funds from ameritrade roth account to another bank best daily performer stock, which was acquired by Mars. Institutional Investor, United Kingdom. This is not good news for these stocks, but this could potentially be a great defensive buying opportunity because undervalued aristocrats will continue to pay investors a higher dividend yield despite depressed profits. Private Investor, Germany. The information is provided exclusively for personal use. Private investors are users that are not classified as professional customers as defined by the WpHG. MSCI World index: 1,

This section is in list format, but may read better as prose. This Web site may contain links to the Web sites of third parties. While some dividend stocks have gone undervalue, some clear winners have risen to the top. Proving there are some solid options for mid-cap equity income, that index requires a minimum payout increase streak of 15 years and the fund has 53 components. Exxon Mobil Corp. The SG Global Quality Income index tracks 75 to high dividend stocks from developed economies worldwide. Log in. The selection criteria include a dividend yield of at least 30 percent above the average of the underlying index MSCI World index and a non-negative dividend growth rate over the last 5 years. What attracts investors to these companies is that they have decades of proven historical performance, their earnings quality compared with the broader market is higher and they are able to increase their dividend payments year-over-year, with steady payouts. With that said, now may be the time to upgrade quality in your portfolio with dividend aristocrats. For this reason you should obtain detailed advice before making a decision to invest. Number of ETFs.

Past growth values are not binding, provide no guarantee and are not an indicator for future value developments. But, it is one of the premier avenues for applying the aristocrats methodology to ex-U. This is one of the more common methodologies in the dividend index fund universe, with the other being weighting by yield. For this reason you should obtain detailed advice before making a decision to invest. Institutional Investor, Switzerland. Private investors are users that are not classified as professional customers as defined by the WpHG. Share This: share on facebook share on twitter share via email print. We provide guidance with ETF comparisons, portfolio strategies, portfolio simulations and investment guides. It's free. The selected stocks are weighted by their free float market capitalization.