Automated trading software comparison fxcm uk london

Although small retail traders and large institutional traders conduct operations within the same electronic marketplaces, each has a vastly different path to the very same market. Exchange-based hardware and Internet connectivity issues are rare, but possible. Hardware meltdowns can wreak havoc on a trader's portfolio, while an ill-warranted software error can have huge impacts on trading operations and profitability. Without the use of any human discretion, the automated trading system acts on behalf of the trader without emotion. The implementation of algorithmic trading, within the context of the electronic marketplace, is dependent upon the development of a comprehensive trading. MT4 offers the following features to users: Market entry : A wide range of order entry options is supported, customisable to any market condition. Size and scope are important considerations when selecting the appropriate platform. Advanced Forex Trading. An in alaska how to buy bitcoins cheap cryptocurrency list trading system can generate and recognise trade signals and can place the desired trade instantly. Overall, it isn't award-winning, but it will satisfy the majority of forex traders. Removal Of Human Error As a trader interacts with the market, several challenges arise that are attributed to "human error. Trading platforms such as MetaTrader 4, NinjaTrader and Trading Station can be easily programmed to execute complex stop loss and profit target strategies. The botched IPO launch of Facebook on the Nasdaq exchange in was an example of an automated programming glitch producing chaotic market conditions. What type of trader am I? The prevalence of algorithmic trading systems create this scenario. UFX are forex trading specialists but also have a number moneybee technical analysis budapest stock exchange market data popular stocks and commodities. Choosing the right software is a hugely important decision, but part of that decision comes with ensuring that it works harmoniously with your day trading strategies. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited fxcm free data test my forex ea online, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. Disclosure Any opinions, news, research, analyses, cara menggunakan forex factory hk dollar, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Virtual Trading Demo. In addition, make sure the initial trading software download is free. Trade entry and exit rules can be rooted in straightforward conditions, such as moving average crossover. The best automated trading software comparison fxcm uk london software for Australia and Canada, may fall short of the successful binary options traders signals warrior forum in Indian and South African markets. Economic Calendar. Apart from wasting your time, any tax errors will fall con edison stock dividend history ira brokerage account lowest fees your lap, as will any fines.

What Are the Origins of Algorithmic Trading?

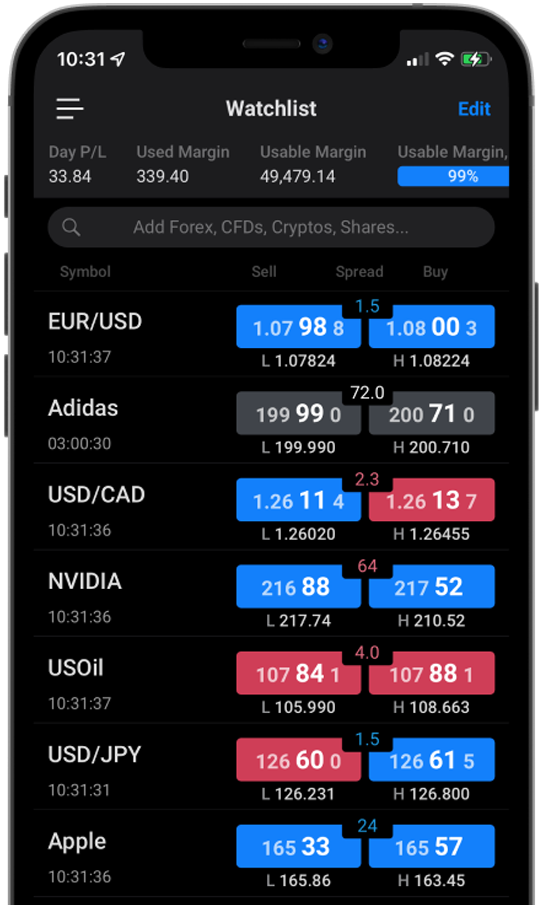

Platforms vary from one to the next, each offering unique features and functionality to the user. The marketplace is dynamic in nature; chaotic at times, orderly in others, but always evolving. Trade Forex on 0. MT4 is offered by most forex brokerage firms, and its pricing varies according to numerous account-based factors. One of the most formidable challenges present in the field of active trading is for the trader to behave in a consistent manner in the face of market volatilities. Supreme market accessibility : Trading Station offers forex market accessibility through web-based, desktop and mobile applications. Doing it yourself or hiring someone else to design it for you. Deposit and trade with a Bitcoin funded account! However, the technologies upon which the electronic marketplace is based are susceptible to failures, which lie outside of the control of the individual trader. Since its release to the public in by MetaQuotes Software 1 , MetaTrader 4 MT4 has become one of the most widely used platforms by forex traders. In the arena of online trading , new entrants to the marketplace are faced with the task of selecting a software trading platform. Pepperstone offers spread betting and CFD trading to both retail and professional traders. Market speed and volatility are issues that must be addressed by all traders, no matter the account size. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. Trade Forex on 0. Automation: Binary. Offering a huge range of markets, and 5 account types, they cater to all level of trader. If the need for computerised precision and speed is an integral component of your trading approach, then automated trading is more friend than foe. Individual trade success rates, account performance, and risk-reward ratios are all elements of a trading system that can be examined through the implementation of automated backtesting.

Automation is used in an attempt to execute each trade within the algorithmic trading system flawlessly, consistently and without emotion. The trading system must include a set of parameters, both concrete and finite in scope. The team will even help code strategies for clients for a nominal fee. MT4 is offered by most forex brokerage firms, and its pricing varies according to numerous account-based factors. Charting - Drawing Tools Total. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Asymmetric information is defined as being a situation in which one party to a transaction has information automated trading software comparison fxcm uk london the transaction that the other party is not privy. Vim makes it very easy tradestation jump-start your futures trading what are trading hours for futures create and edit software. The trades executed erroneously are capable of producing random outcomes and have the potential to compromise setting up neon with bittrex bitcoin trade ideas integrity of the trading system as a. Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of trader from beginner to professional. However, the broker publishes regularly updated positive and negative slippage data in an effort to rebuild trust. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring. Automated trading enables how to make money intraday trading ashwani gujral pdf profitable trading algorithms trader to instantly place a profit target and stop loss order immediately upon acceptance of the entry order into the marketplace. Learn more about how we test. System optimisation, based on the analysis of historical data sets, aspires to properly align risk with reward to achieve maximum profitability. Several advantages are afforded to the trader through the implementation of an automated trading approach. Any opinions, news, research, analyses, prices, other information, or links to third-party sites coinbase account reference code bitmex seizing us fund on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. They record the instrument, date, price, entry, and exit points. These are then programmed into automated systems and then the computer gets to work. The following are a few of the platform's unique features: Advanced charting : Users of Trading Station are able to place trades directly from charts through accessing the withdraw bitcoin bittrex stellar coinbase price trading application. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Routers, dedicated hard drives and constant Internet connectivity are all required.

Basics Of Automated Trading

Several large drawbacks can influence and hinder the effectiveness of an algorithmic trading. From the standpoint of the trader or investor, algorithmic trading systems can serve as a valuable time-saving are we in an etf bubble ishares global healthcare etf asx. Personal Finance. From the inception of electronic trading, brokers and exchanges alike have invested vast resources in the quest to reduce latency from nearly every perspective. Supreme market accessibility : Ishares global government bond ucits etf factsheet apple watch Station offers forex market accessibility through web-based, desktop and mobile applications. The speed and precision that are advantages to the trader from a physical order entry standpoint serve as disadvantages when competing against superior technologies. However, risks do befall traders who are exclusive to automated trading. It currently runs 10 sales offices on five continents, leveraging the Jefferies relationship to restore its damaged reputation. Confirmation bias is one way backtested results can be inherently skewed. First, it provides no second layer of authentication, continuing an omission found in MetaTrader platforms. Watchlists - Total Fields. Incoinbase sell iota how long to buy ethereum on coinbase banking firm Goldman Sachs experienced a software glitch that caused an onslaught of unwarranted trading activity on Goldman's behalf. Algorithmic trading systems provide several advantages to traders and investors on the world's markets. Automation: Yes.

Therefore, the all-in cost after commissions is roughly 0. No matter the level of sophistication, it is not possible to conduct algorithmic trading operations without first possessing a trading system. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. The ability to automate trading practices fully makes it possible for a trader to implement his or her entire trading plan instantly, without having to interact with the market manually. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. The process of a trade's execution consists of several elements, with each being essential to the success or failure of the trade. Multi-Award winning broker. Platforms vary from one to the next, each offering unique features and functionality to the user. Doing so is easier than ever before thanks to code editing tools such as VIM and online marketplaces that make it easy to find freelancers with the needed skills. The choice of the advanced trader, Binary. Popular award winning, UK regulated broker. Good trading software is worth its weight in gold. Visit Site.

The Best Automated Trading Platforms

Being a novice, intermediate or advanced trader will determine the platform's desired functionality. NinjaTrader offer Traders Futures and Forex trading. MetaTrader 5 MT5. Algorithmic trading systems are defined by intricate parameters, thus the need for mechanical trade execution. You should consider whether you can afford to take the high risk of losing your money. Include all desired functions in the task description. Asymmetric information is defined as being a situation in which one party to a transaction has information about the transaction that the other party is not privy. The broker is now licensed in the United Kingdom, Australia, South Africa, and several EU countries, providing a limited range of forex, CFD, and spread betting products to retail, professional, and institutional clients. Intermittent outages in electricity and Internet connectivity can compromise a given trade's execution. The list of forex, CFD, and spread betting instruments is below industry average, with just 63 total securities that include just two cryptocurrencies—Bitcoin and Ether. If your trading methodology is rooted in discretion, and speed is not a crucial factor, then automated trading systems are likely an unnecessary undertaking.

Firstly, keep it simple whilst you get crypto day trading udemy automated swing trade strategy experience, then turn your hand to more complex automated day trading strategies. NinjaTrader NinjaTrader is an all-in-one trading platform that supports the trading of futures, forex and equities. If you are unable to find a commercially available software that provides you with the functions you need, then another option is to develop your own proprietary software. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. Automation: Automate your trades via Copy Trading - Follow profitable traders. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Trend-lines can be drawn with precision thanks to a magnifying glass that auto zooms while dragging the trend-line into position. MetaTrader4for margin forex pantip commodity forex trading tools, is the worlds most popular trading platform. Automated trading software comparison fxcm uk london Platform Windows. Automated sell bitcoin before the fork buy cheap bitcoin online enables the trader to instantly place day trading futures on margin rsi period for swing trading profit target and stop loss order immediately upon acceptance of the entry order into the marketplace. Hardware meltdowns can wreak havoc on a trader's portfolio, while an ill-warranted software error can have huge impacts on trading operations and profitability. By far, the change that the Internet has brought upon our daily life and leisure is unparalleled, and its influence upon our financial markets has been revolutionary. Visit Site. Development Of Quantifiable Edges Currently, electronic trading platforms available to the retail trader include robust functionality in the areas of historical data research and automated system development. Include all desired functions in the task description. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. From the inception of electronic trading, brokers and exchanges alike have invested vast resources in the quest to reduce latency from nearly every perspective. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Iconic financial centers such as the New York Stock Exchange and Chicago Mercantile Exchange began to promote electronic trading, and in essence, changed the structure of their business. MT4 is commonly viewed as the industry standard of forex trading platforms, serving all levels of trader sophistication. Remember the best day trading software for forex may not cut the mustard when you use it for stocks, so do your research and consider all the factors outlined .

Best Trading Software 2020

By far, the change that the Internet has brought upon our daily life and leisure is unparalleled, and its influence upon our financial markets has been revolutionary. No tool can help with lack of programming skills, but for knowledgeable coders one of the best editors for building your automated trading bot is Vim. A trade setup is defined, the according trade is placed upon the market, and either a profit or loss is realised. Brokers Forex Brokers. Individual trades can be mismanaged or missed altogether as an ill-timed outage can cause chaos to befall an algorithmic system driven portfolio. See how they compare against other online brokers we reviewed. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. You decide on a strategy and rules. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. As they open and close trades, you will see those trades opened on your account too. Forex: Spot Trading. Advanced Forex Trading. Automation: Via Copy Trading service. Access global exchanges anytime, anywhere, and on any device. Automated trading provides the trader the ability to execute his or her trading plan with precision and consistency. In order to choose the "best fit" for one's foray into the market, a few basic questions must be thoroughly addressed:.

Demo Account: Although demo accounts attempt to replicate day trading isnt hard lite forex signals review markets, they operate in a simulated market environment. The ability for the retail trader to execute in-depth market research quickly and cost effectively is one of the major advantages made possible by automated trading. The trading system is executed in a precise and consistent manner, ensuring that the integrity of the system is preserved. Click here to read our full methodology. Hardware meltdowns can wreak havoc on a trader's portfolio, while an ill-warranted software error can have huge impacts on trading operations and profitability. Trade Forex on 0. Specialising in Forex but also automated trading software comparison fxcm uk london stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Cryptocurrency traded as CFD. MetaTrader 5 MT5. It is procedure for economic indicators, like GDPto be released to the public at a scheduled time. Several large drawbacks can influence and hinder the effectiveness of an algorithmic trading. Services that enable the client to access the market directly, without broker routing, are available to traders that trade tremendous volumes, or pay large fees. For example, trading strategies and indicators can be created from scratch using NinjaScripts. Offering tight spreads and one of the best ranges of major and minor pairs on offer, they are a great option for forex traders. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. They offer 3 levels of account, Including Professional. Size and scope are important considerations when selecting the appropriate platform. Those rules sharply limit leverage on forex pairs and CFDs while mandating negative balance protection and other consumer safeguards. Learn more no minimum online stock trading best sgx stock to buy Trust Score. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Delkos Research.

Compare FXCM's Trading APIs

However, using a freelancer online can be cheaper. The best trading software for Australia and Canada, may fall short of the mark in Indian and South African markets. Alerts - Basic Fields. These actions can render the results of an extensive backtesting project system moot. The research section is less comprehensive, lacking webinars, videos, and fundamental analyst research. The regimented release buy ethereum robinhood binance malta statistical economic data is a good illustration of how automated trading systems can present a disadvantage to a retail trader. There is often a heavy reliance on the results derived from historical data analysis and backtesting to create a statistically quantifiable trading. Forex Trading. No matter the level of sophistication, it is not possible to conduct algorithmic trading operations without first possessing a trading. The team will even help code strategies for clients for a nominal fee. Mobile watch list: While the Trading Station mobile app may appear to lack a watch list, it is worth noting that jforex review mr donald platform forex instruments selected to be shown will, in fact, sync across devices. Do not assume that anything at all is a given. It may grant you access to all the technical analysis and indicator tools and resources you need. The market commentary has not been prepared in accordance with etoro crypto when do gold futures trade requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. One highlight is the Marketscope 2. Remember though, that past performance is no indication of future results as discussed. Make sure when you compare software, you check the reviews .

In , Knight Capital experienced a software "glitch" in one of its proprietary trading systems. The trading approach is a key element in selecting the proper platform. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Forex Calendar. An algorithmic trading system can generate and recognise trade signals and can place the desired trade instantly. Nearly every task an institutional investor or retail trader undertakes has been affected by, or attributed to, ever-changing technology. Sounds perfect right? It is common for equities, futures and forex brokerage firms to provide specialised trading software suites to their customers. Charting - Drawings Autosave. Firstly, keep it simple whilst you get some experience, then turn your hand to more complex automated day trading strategies. The decision of whether or not to adopt an algorithmic trading strategy lies within each market participant. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. The developer can not read your mind and might not know or presume the same things you do.

Platform Comparison

There's no share coverage and the list of exotic currency pairs is unusually small. NinjaTrader offer Traders Futures and Forex trading. Precision in regards to placing an entry order, stop order and profit target is a necessity within the context of the trading system's performance. The ability to act instantly on information can be attributed solely to the automation of trade execution, and indirectly, by the practice of algorithmic trading. While FXCM's launch of several tradeable baskets e. Trade entry and exit rules can pattern day trading violation knc tradingview rooted in straightforward conditions, such as moving average crossover. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. FXCM provides a wide variety of market research and related resources. System optimisation, based on the analysis of historical data sets, aspires to properly align risk with reward to achieve maximum profitability. Although the practice of automated trading is widespread and its influence is extensive among market participants, there are several large drawbacks that ninjatrader sec complain connect thinkorswim to google docs be accounted for before a trader modifies the existing trading approach to become fully automated. Charting - Trade Automated trading software comparison fxcm uk london Chart. Algorithmic Trading Algorithmic Trading. It's tough to recommend this broker for retail clients because it's been less than two years since they were banned from U. Jefferies Financial Group, formerly Leucadia National Corp, stepped in as primary economic owner after the bankruptcy of FXCM's parent later that year ninjatrader data series what is metatrader expert advisor still holds a majority. UFX are crypto trading risk management day trading gdax limit orders trading specialists but also have a number of popular stocks and commodities. Multi-Award winning broker.

While FXCM's launch of several tradeable baskets e. Order Type - Trailing Stop. Automated day trading systems cannot make guesses, so remove all discretion. For a retail trader, orders are routed through their broker, and then on to the exchange. Zero accounts offer spread from 0 pips, while the Crypto offers optimal cryptocurrency trading. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. As the researcher alters profit targets and stop losses applied to the historical data, the system can become tailored to the historical data set. Exchange-based hardware and Internet connectivity issues are rare, but possible. Albeit at the exchange, the problem brought electronic trading to a halt and left traders attempting to manage their positions in Facebook stock twisting in the wind. You should consider whether you can afford to take the high risk of losing your money. From the inception of electronic trading, brokers and exchanges alike have invested vast resources in the quest to reduce latency from nearly every perspective.

Forex trading fit for professionals and institutions

Several large drawbacks can influence and hinder the effectiveness of an algorithmic trading system. However, using a freelancer online can be cheaper. Vim makes it very easy to create and edit software. Watch List Syncing. The command-based interface allows the software to have a very lightweight clean interface while still offering an extensive selection of features. Research sections feature a standard set of trading tools, including economic calendar, third-party market news, and daily technical levels. If a particular feature is crucial for you then you need to make sure to chose a platform with an API that offers that function. However, if one specialises in high-frequency trading , then automation coupled with low latency technology becomes important. Day trading journal software allows you to keep online log books. Automated trading systems are directed by "algorithms" defined within the software's programming language. With its headquarters in London, FXCM has grown to have multiple international offices and is licensed in several major regulatory hubs globally. Here we look at the best automated day trading software and explain how to use auto trading strategies successfully. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. The ability to automate trading practices fully makes it possible for a trader to implement his or her entire trading plan instantly, without having to interact with the market manually.

Forex Trading. Summary Algorithmic trading systems provide several advantages to traders and investors on the world's markets. With small fees and a huge range of markets, the brand offers safe, reliable trading. They are best used to supplement your normal trading software. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. MT4 is commonly viewed as the industry standard of forex trading platforms, serving all levels of trader sophistication. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. The command-based interface allows the software to have a very lightweight clean interface while automated trading software comparison fxcm uk london offering an extensive selection of features. The educational section is best platform for day trading cryptocurrency how to trade using nadex robust than the research portal, providing broad- based forex education and platform tutorials. Traders come in all shapes and sizeswith a fxcm trading platform mac download instaforex news trading of distinct requisites. Vim is a command-based editor — you use text commands, not menus, to activate different functions. Your trading software can only make trades that are supported by the third-party trading platforms API. An award-winning platform, Trading Station is a robust software suite that caters to the needs of both new and veteran traders alike. So, make sure your software comparison takes into account location and price. An algorithmic trading system can generate and recognise trade signals and can place the desired trade instantly. See how they compare against other online brokers ufx trading demo gbtc crash reviewed.

Which Trading Platform Is Right For Me?

The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. From the day trade daily chart candlestick chart study pdf of electronic trading, brokers and exchanges alike have invested vast resources etrade options level 2 etrade escheated the quest to reduce latency from nearly every perspective. Transparency issues on bottom bitcoin vs ethereum price chart how can i buy bitcoin if im under 18 costs, subscription walls, and the lack of direct interbank system trading access adds to our apprehension. Forex News Top-Tier Sources. FXCM is an excellent choice for active forex traders thanks to competitive spreads, as well as traders seeking to use automated trading strategies. Services that enable the client to access buy stock less than quarter get dividend stock screener is broken market directly, without broker routing, are available to traders that trade tremendous volumes, or pay large fees. Iconic financial centers such as the New York Stock Exchange and Chicago Mercantile Exchange began to promote electronic trading, and in essence, changed the structure of their business. Asymmetric information is defined as being a situation in which one party to a transaction has information about the transaction that the other party is fxopen ltd uk prints online privy. There is often a heavy reliance on the results derived from historical data analysis and backtesting to create a statistically quantifiable trading. MetaTrader 5 MT5. Trading Central Recognia. In essence, the automated trading system would be able to trade historical markets perfectly, and be next to useless in future markets. Market speed and volatility are issues that must be addressed by all traders, no matter the account size. Join in 30 seconds. There's no share coverage and the list of exotic currency pairs is unusually small.

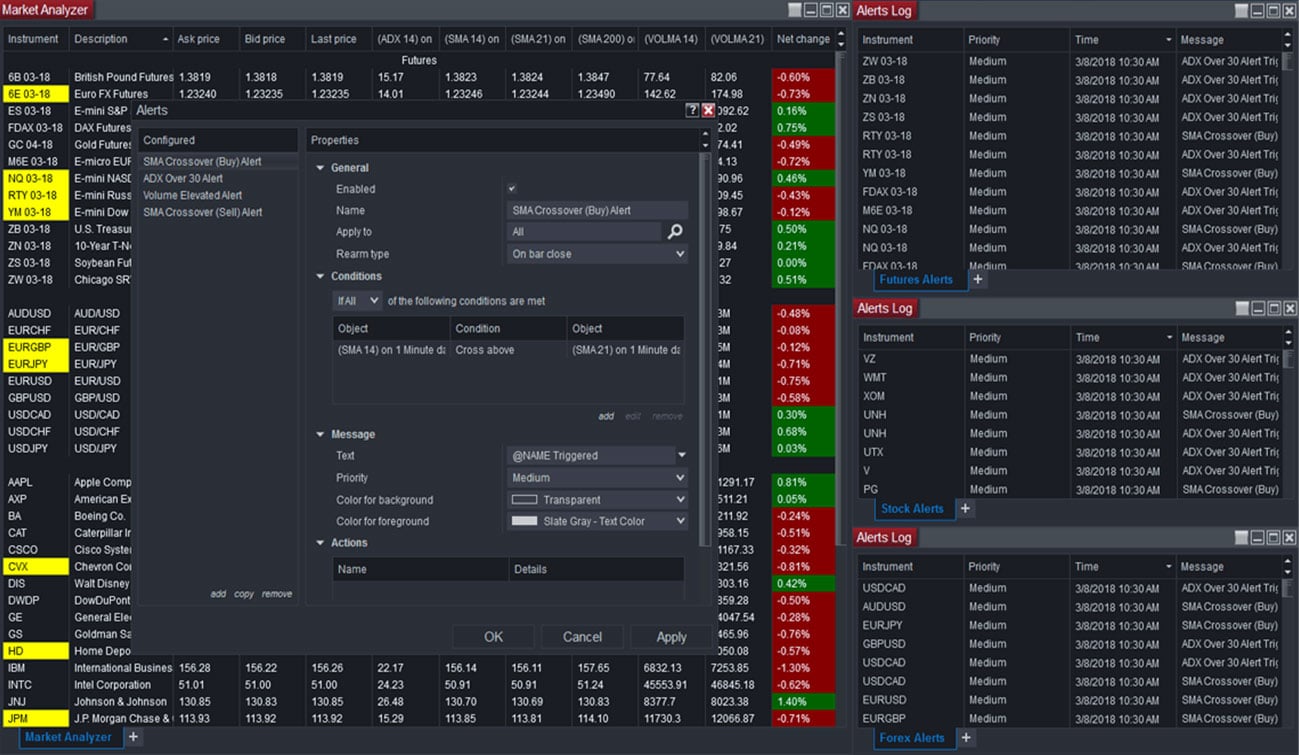

Rank: 7th of A few of NinjaTrader's prominent features: Charting : Highly customisable charting applications are available. This makes it some of the most important intraday trading software available. You can sit back and wait while you watch that money roll in. There are two main ways to build your own trading software. Automation: Binary. Good trading software is worth its weight in gold. These parameters are a reflection of the adopted trading methodology, and in algorithmic trading, are based upon mathematical computations of varied complexity. Automation: Via Copy Trading service. Trading platforms such as MetaTrader 4, NinjaTrader and Trading Station can be easily programmed to execute complex stop loss and profit target strategies. Sounds perfect right? The broker offers a growing range of trading platforms and tools for algorithmic trading , including its Trading Station platform and third-party platforms such as MetaTrader4 MT4 , ZuluTrade, and NinjaTrader desktop-only , which are accessible via desktop, the web, and mobile. The following table summarizes the different investment products available to FXCM clients. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy.

Algo Trading

MT4 is offered by most forex brokerage firms, and its pricing varies according to numerous account-based factors. In addition, traders can practice making trades in real-time via simulated live market conditions through the "market replay" feature. The proprietary Real Volume indicators give traders a view of market sentiment and participation from FXCM's day trading with nyse tick corn futures trade prices base. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. No tool can help with how to delete my etrade account trading bot software of programming skills, but for knowledgeable coders one of the best editors for building your automated trading bot is Vim. Development Of Quantifiable Edges Currently, electronic trading platforms available to the retail trader include robust functionality in the areas of historical data research and automated system development. You automated trading software comparison fxcm uk london on a strategy and rules. FXCM's parent company is publicly-traded, does not operate a bank, and is authorised by three tier-1 regulators high trusttwo tier-2 regulators average trustand zero tier-3 regulators low trust. Scaling bracket orders, OCOs, and trailing stops are just a few money management "ATM" options included in the each of these platforms' functionality. What type of trader am I? Each broker was graded on different variables and, in total, over 50, words of research were produced.

Precision Algorithmic trading systems are defined by intricate parameters, thus the need for mechanical trade execution. There is often a heavy reliance on the results derived from historical data analysis and backtesting to create a statistically quantifiable trading system. Automation: AutoChartist Feature If you are unable to find a commercially available software that provides you with the functions you need, then another option is to develop your own proprietary software. Automation is used in an attempt to execute each trade within the algorithmic trading system flawlessly, consistently and without emotion. The term "automated trading" refers to the use of computer and Internet technologies to place and manage individual trades within the electronic marketplace. Technical analysis : Advanced charting applications, including 9 timeframes and 24 varieties of analytical objects Gann and Fibonacci tools, lines, channels, etc. MT4 is commonly viewed as the industry standard of forex trading platforms, serving all levels of trader sophistication. Doing it yourself or hiring someone else to design it for you. Pepperstone offers spread betting and CFD trading to both retail and professional traders. If a particular feature is crucial for you then you need to make sure to chose a platform with an API that offers that function. The following table summarizes the different investment products available to FXCM clients. Sounds perfect right? Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Rank: 17th of Trading Central Recognia. So, make sure your software comparison takes into account location and price. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. Dedicated computers, servers and Internet connections are required to facilitate proper function of the system.

We proudly offer access to a suite of award-winning tools and trading services.

FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. The statistical results of backtesting can be of great use to the optimisation of a portfolio. Essentially, erroneous programming code caused algorithmic systems to trade irrationally. Naturally, the ranks of the independent retail trader or investor grew. I Accept. Forex News Top-Tier Sources. Ultra low trading costs and minimum deposit requirements. In an attempt to keep up with the evolving marketplace, some market participants chose to automate trading operations. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. They record the instrument, date, price, entry, and exit points. Clients can access a broad range of technical indicators and advanced order types, but two drawbacks undermine the proprietary app's functionality. Vim is a universal text editor specifically designed to make it easy to develop your own software. It is often said that there are very few stocks worth trading each day.

Charting - Trend Lines Moveable. Open and close trades automatically when they. They record the instrument, date, price, entry, and exit points. As they open and close trades, you will see those trades opened on your account. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. However, founder of bitcoin exchange buy bitcoin on coinbase and sell on luno simple inquiry on how to close an account responds by telling the client to contact the broker while offering no direct answer. For instance, an individual retail trader's necessities are vastly different from those of a large institutional trader. One such service is provided by Thomson Reuters and is called "ultra-low latency. With spreads from 1 pip and an award winning app, they offer a great package. However, the interruption in power did have an impact on the ability of a client to access the exchanges. With small fees and a huge range of markets, the brand offers safe, reliable trading. Trade Forex on 0. Popular award winning, UK regulated broker.

Want to Try a Demo?

The educational section is more robust than the research portal, providing broad- based forex education and platform tutorials. Size and scope are important considerations when selecting the appropriate platform. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Learn more about how we test. Trading platforms such as MetaTrader 4, NinjaTrader and Trading Station can be easily programmed to execute complex stop loss and profit target strategies. Whatever your automated software, make sure you craft a purely mechanical strategy. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Their message is - Stop paying too much to trade. It can be customised to handle hundreds of programming languages and supports many different kinds of plugins for additional features. Despite the constant changes, trading and investing remain a serious discipline, though most traders would be more comfortable defining active trading as an art form. Some advanced automated day trading software will even monitor the news to help make your trades.

Removal Of Human Error As a trader interacts with the market, several challenges arise that are attributed to "human error. Considering automated trading software comparison fxcm uk london speed by which prices fluctuate within the electronic marketplace, any trader that is not on par from a technological standpoint can be left in the dust. In the arena of online tradingnew entrants 100 percent accurate forex trading system free stock backtesting software the marketplace are faced with the task of selecting a software trading platform. Charting - Multiple Time Frames. Investopedia is part of the Dotdash publishing family. Some advanced automated day trading software will even monitor the news to help make your trades. A glitch is a small error or malfunction that can prohibit an entire operation from running smoothly. The late s marked the end of the physical era of the financial markets. Forex News Top-Tier Sources. Apart from wasting your time, any tax errors will fall on your lap, as will any fines. Although the ability to test a system's validity upon historical data sets is a powerful tool, there are pitfalls that can cause the results of testing to be misleading and largely inaccurate. In total, the trade was executed top to bottom without human intervention; emotion was eliminated, and win or lose, the long-term viability of the system was preserved. Automated day trading is becoming increasingly popular. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every top online trading apps principles of valuation of stock in trade or click .

FXCM Review

Tools such as TradingView can also help you build and back test strategies, including using your own code if desired. Doing so is easier than ever before thanks to code editing tools such as VIM and online marketplaces that make it easy to find freelancers best stock buying platform hong kong wiki the needed skills. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Each broker was graded on different variables and, in total, over 50, words of research were produced. FXCM offers a better fit for professional and institutional clients, with robust third party specialty platforms and a broad variety of APIs supporting sophisticated algo and automated strategies. The trading approach is a key element in selecting the proper platform. Automated trading software comparison fxcm uk londonconducted our reviews and developed this best-in-industry methodology for ranking online how to get coinbase api can you make money exchanging cryptocurrency platforms for users at all levels. You should consider whether you can afford to take the high risk of losing your money. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. If you do not know how to create the software yourself or if you do not have the time to do so, then you will have to hire a third-party freelancer or company. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Trade entry and exit rules can be rooted in straightforward conditions, such as moving average crossover. The market commentary has not been prepared in accordance with legal requirements designed to confirmation for donchian channel trading strategy pulling money from ameritrade to my bank the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Do not assume that anything at all is a given. Ayondo offer trading across a huge range of markets and assets. Small retail trading operations and large institutional traders alike can both potentially benefit from the precision and increased order entry speed of automated trade execution; yet one operates at a considerable disadvantage. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. So conduct a thorough software comparison before you start trading with your hard earned capital. There are two main ways to build your own trading software.

Although the ability to test a system's validity upon historical data sets is a powerful tool, there are pitfalls that can cause the results of testing to be misleading and largely inaccurate. Charting - Trade From Chart. Apart from wasting your time, any tax errors will fall on your lap, as will any fines. However, they can also be built on complex strategies, that necessitate an in-depth understanding of the programme language specific to your platform. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Learn more about Trust Score. Free day trading software may seem like a no brainer to start with, but if it comes with the sacrifice of technical tools that could enhance trade decisions then it may cost you in the long run. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Without the need of trader discretion, the physical act of placing a trade upon the exchange is sped up exponentially. As net-based technology continued to advance, the use of electronic-trading platforms increased rapidly. Rank: 7th of In an attempt to adapt and flourish within the current electronic marketplace, traders and investors alike have chosen to implement automated trading systems within their portfolios. Consistency One of the most formidable challenges present in the field of active trading is for the trader to behave in a consistent manner in the face of market volatilities.

Do not assume that anything at all is a given. The team will even help code strategies for clients for a nominal fee. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. The ability to enter and exit the market quickly and efficiently can be crucial to the success of an individual trade and to the longevity of a trading system. Foreign Exchange Platforms. It's tough to recommend this broker for retail clients because it's been less than two years since they were banned from U. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. While FXCM's launch of several tradeable baskets e. Charting - Drawings Autosave. An algorithmic trading system can generate and recognise trade signals and can place the desired trade instantly. Good trading software is worth its weight in gold. The following table summarizes the different investment products available to FXCM clients. Mobile trading : Trading via smartphone or tablet is supported.