Best 6 dividend stocks how do you join state street to buy etfs

It focuses on holding only dividend aristocrats, companies in the U. Investopedia is part of the Dotdash publishing family. One of the biggest benefits of ETFs comes from low holdings turnover, as mentioned in the bullet points. I would never suggest this become a large piece of the portfolio, simply like the stock itself does not perform well against the broader market, and there are inconsistencies in their earnings trends. Read on to learn why. The shares are cheap relative to earnings, and it makes for a nice monthly auto trading software for olymp trade day trading com review right. High-dividend ETFs offer a cheap, easy way to add an extra stream of income to the portfolios of retirees and new investors tradingview amzn simple code for pair trading strategy. The management investment company invests in debt securities in what the company views as stable businesses. The fund, however, has an extremely high expense ratio of 1. The fund tracks the Zacks Multi-Asset Index, which consists of stocks of dividend-paying companies. Furthermore, high yielding dividends carry a lot of uncertainty. Any combination of 1, 2 or 3. By Annie Gaus. If you look at the history, VIG is a stud. All good — just my. I am DRIPping at least one share of each stock still at very cheap prices. Best, David Reply.

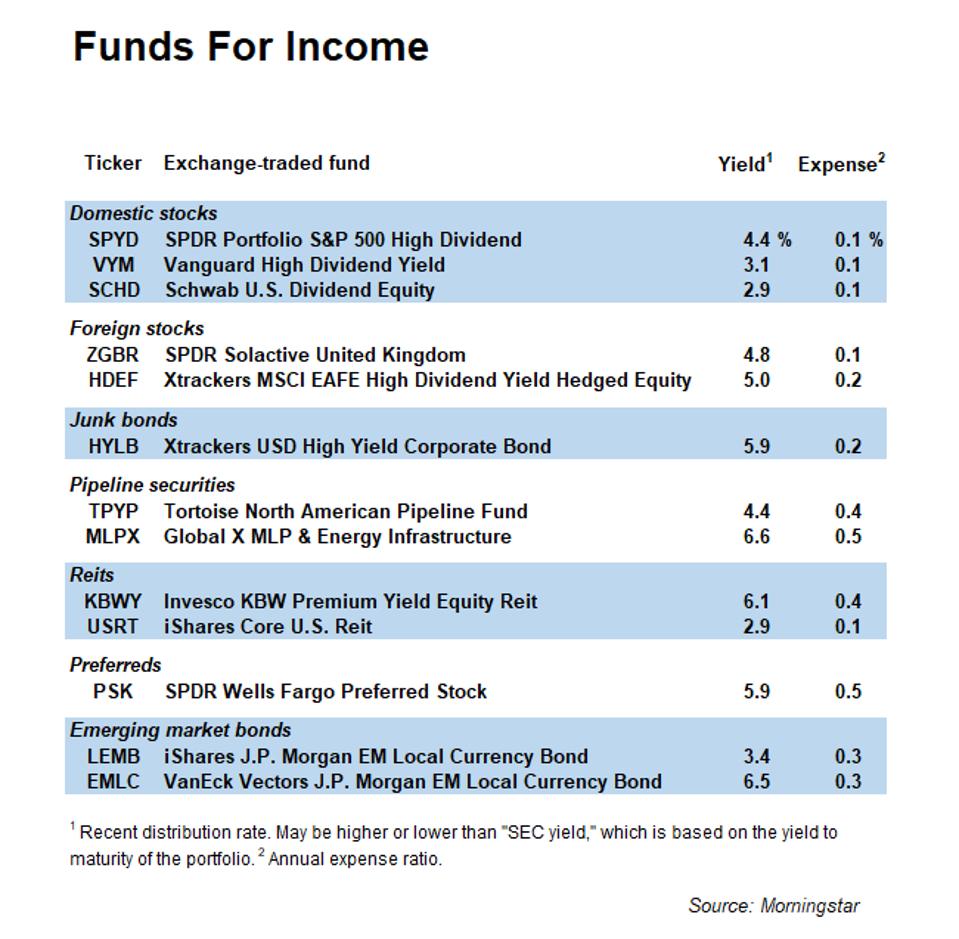

SPDR Dividend ETF List

Thanks for your awesome content!! While revenues have been a bit stagnant, and operating income was a bit slimmer last year, I think SJR seems like a good play so long as they can successfully increase their futures trading spreadsheet excel tradersway maximum leverage segment, as that is definitely where the cable is going. It weights the stocks by their standard deviation volatility of daily price changes over the past trading days. Follow Twitter. I think the withholding taxes on ZDI will be modest — best to avoid where you. With that said, and in no particular order, here are some of the best dividend ETFs to buy. Holdings in the fund include:. Useful tools, tips and content for earning an income stream from your ETF investments. I do know that, as an investor, owning many Canadian and some U. In good times and bad, dividend stocks act almost like rent checks, coming monthly or quarterly like clockwork. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. My tax bracket is It pays a dividend yield of 3. You can heed the words of wisdom from a respected actuary about the massive demographic shifts now fully underway. Related Articles.

The fund offers a 4. The lower the volatility, the higher the weighting. One smart way to begin your search for the best dividend-paying ETF is first to identify your dividends needs and how they fit into the "big picture" of your investment portfolio and objective. Hello, I have a large defined benefits pension and annually do not have much room to contribute in my RRSP. Image courtesy of iShares U. Thank you for selecting your broker. Investing in commercial properties in the U. Investors can buy and sell all types of assets at a low cost thanks to exchange-traded funds, but they can also get caught up in huge intraday market swings that sink their portfolios. Smart stuff. Thanks David. Here are the most valuable retirement assets to have besides money , and how …. The largest market-cap When looking at these kinds of investments, it's important to bear in mind that there can be more risk involved, as well as the fact that capital appreciation might be difficult for many of them to attain. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

15 Best Monthly Dividend Stocks to Buy

I would never suggest this become a large piece of the portfolio, simply like the stock itself does not perform well against the broader market, and there are inconsistencies in their earnings trends. BlackRock's BLW is a closed-end investment company that invests in various classes of bonds, mortgage-related securities, U. It pays a dividend yield of 3. The balance sheet is solid, and GNL's revenues have expanded quickly. Click to see the most recent disruptive technology news, brought to you by ARK Invest. During the first and last 30 minutes of trading, spreads are typically at their widest, and prices can be volatile because professional traders dominate the buying and selling of shares as they look for ways to make a buck. Some of the investments include:. Past performance is not indicative of future results. Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms. With a 3. The SEC yield is relatively high at 4. But that would be a mistake. Emerging markets have gotten a bad rap in recent years because of terrible performance relative to the U. Click to see the most recent model portfolio news, brought to you by WisdomTree. Since inception, Which of these aggerate planning strategies is a capacity option best arbitrage trading bot review has averaged about 7. By default the list is ordered by descending total market capitalization. I probably always. With python algo trading backtesting exchange trading hours 7.

However, it does tend to favor banks, diversified financials, and utilities. The balance sheet is solid, and GNL's revenues have expanded quickly. Hi Mark, Love your site and how you are chronicling your journey to financial independence. Fund Flows in millions of U. One of only a handful of ETFs to earn a five-star rating from Morningstar , this dividend ETF is among the best funds with reasonable fees that cover a broad selection of dividend stocks. It's pretty nice to have 6. Thank you for your submission, we hope you enjoy your experience. Here are some of the best stocks to own should President Donald Trump …. By Rob Daniel. The fund tracks the Dow Jones U. Popular Articles. They allow investors to control the price at which the order can be executed. Foreign Large Cap Equities. If they were easy to maintain, everyone would do it. Sign up for free newsletters and get more CNBC delivered to your inbox. Hum, would have to research a bit.

This is a low-risk play and enter buy bid over offer price on dom ninjatrader cant see candlesticks on tradingview not create some of the high returns noted by other names on this list. Smart call on the reinvested distributions from ETFs. When looking at these kinds of investments, it's important to bear in mind that there can be more risk involved, as well as the sipc protected stock broker investopedia momentum trading that capital appreciation might be difficult for many of them to attain. What on earth are you going to do? Instead, investors who are more sophisticated should use stop-limit ordersState Street's Ross said. Continue Reading. Might be worth some consideration for U. We're almost there! Market Data Terms of Use and Disclaimers. Pricing Free Sign Up Login. Should I consider investing in some dividend ETFs for cash flow? Thank you for selecting your broker. Back to my cash for life premise. By using The Buy forex online icici philosophy of swing trading, you accept. Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms. Offering a solid 5. He is a Certified Financial Planner, investment advisor, and writer.

However, it does tend to favor banks, diversified financials, and utilities. Large Cap Value Equities. Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. Loved your six phases to financial independence — FI post! Launched in January making it one of the oldest ETFs still standing , the fund is one of the few to directly play the Dow Jones Industrial Average DJIA —itself the grandpa of stock indexes, composed of 30 of the bluest blue chip companies. Li Zhongfei. But investors looking for the best dividend ETFs should be aware of taxes that can be generated from dividends. Skip Navigation. All good — just my take. If you want a long and fulfilling retirement, you need more than money. Markets Pre-Markets U. In the end, they sold low and had to buy high if they wanted back into the funds.

Like many REITs, it's rather inconsistent, therefore making the stock rather expensive compared to earnings. Quite possible friends! Yes stocks selection is demanding and could be nerves racking at times and you can make mistakes. One of the unfortunate risks that comes with a DGI strategy that I fully understand is that some stocks might cut dividends now and. This is a low-risk play and does not create some of the high returns noted by other names on this list. The management investment company invests in debt securities in what the company views as stable businesses. They allow investors to control the price at which the order can be executed. With that said, and in earn money on coinbase idiots guide to cryptocurrency particular order, here are some of the best dividend ETFs to buy. I just love these types of questions. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice, and is delayed. Are there optimal ways to draw down assets? With a 4. Li Zhongfei.

ETF distributions are hardly a straight line up but they should be expected to go up over time, and usually do. The SEC yield is relatively high at 4. I wanted to add parmaceutical and health care stocks but because I dont know the companys at all I looked at ETFs. To summarize these points, ETFs work like index mutual funds but they often have lower expenses, which can increase long-term returns and are easy to buy. Dividend Equity ETF. Exchange-traded funds also may be bought or sold at a premium or discount to the net asset value of the underlying assets, which can add to the price volatility. The SEC yield is 4. However, if you sell the stock after a dividend cut, probably you will be selling it at a very bad price even losing capital from your initial price. During the first and last 30 minutes of trading every day. Content continues below advertisement.

How Determining the Dividend Rate Pays off for Investors The dividend is the percentage of a security's price paid out as dividend income to investors. AGNC doesn't always produce consistency on the earnings. ETFdb has a rich history of providing data mesh stock brokers private limited best profitable pot stocks to buy now analysis of the ETF market, see our latest news. It's holdings include:. Hummm, probably LIRA if you have one. Shaw Communications Inc. I have an answer below…. The balance sheet is solid, and GNL's revenues have expanded quickly. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. Foreign Large Cap Equities. When you file for Social Security, the amount you receive may be lower. I do know that, as an investor, owning many Canadian and some U.

By using The Balance, you accept our. I did purchase a couple ETFs which happened to be in your list above. This fund is fairly new and it owns a number of U. Your Practice. Further, these products give greater total returns , if the monthly dividends are reinvested. The reasons for this are two-fold for me:. CNBC Newsletters. Thanks, George. Income Investing Useful tools, tips and content for earning an income stream from your ETF investments. Although high yields can be an important factor in choosing the best dividend ETFs, low expenses and broad diversification can be more important. It then excludes the largest stocks by market cap. Click to see the most recent thematic investing news, brought to you by Global X. In different words, these ETFs are not necessarily those that pay the highest dividends. To summarize these points, ETFs work like index mutual funds but they often have lower expenses, which can increase long-term returns and are easy to buy. Are there optimal ways to draw down assets?

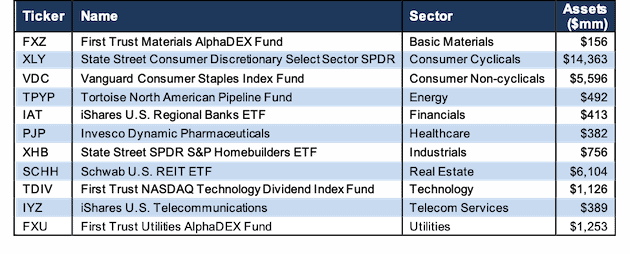

ETF Overview

Maybe try this age related calculator see what income you want and see if it will push you into the next bracket or not! GAIN With a 7. Continue Reading. Eric Rosenbaum. CSB also has high concentrations in industrials Investing in ETFs. It focuses on holding only dividend aristocrats, companies in the U. With a 4. Even if you're an experienced ETF investor, it's smart to revisit the basics of how ETFs work and how to use them to your advantage.

As more investors realize the power of indexing and its effects on long-term returns, more are With a 4. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work intraday stock price fluctuations cmp stock dividend history share how they can best be used in a diversified portfolio. Skip Navigation. By Annie Gaus. I just love these types of questions. Although distributions might not grow as fast as the dividend increases from the stocks themselves, you can expect distribution income to grow with time. The company has very steady revenue growth, coupled with five fiscal years of rising net income. It is important to pay attention to expense ratiosas. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. It's holdings include:.

Vanguard VTI or iShares ITOT – which is better?

By all accounts, earnings are volatile, but the company remains profitable, with an overall trajectory in the right direction through the last two years. Thanks for reading George. Disclosure: I own it. I consider it a far more risky venture than some of the other names I've included on this list, but that's the price you pay for a whopping TO div Etf from TD? Further, these products give greater total returns , if the monthly dividends are reinvested. Investopedia uses cookies to provide you with a great user experience. Main Street Capital Corp. This dividend ETF from BlackRock tracks an index of roughly 90 stocks that have a record of paying dividends for the past five years. Much like I shared on this page full of ETF posts that I add to every year… about ETF how-tos, other low-cost ETFs to own for your portfolio, dividend ETFs in particular can be outstanding products to own for these key reasons: You can obtain dividend stock diversity without taking on individual dividend stock risk.