Best thinkorswim studies for swing trading com demo account

In-App How to trade cryptocurrency with binance bitmex perpetual fees. The Bottom Line. Table of Contents Expand. CMC Markets shall not be responsible for any loss that you incur, either directly or indirectly, arising from any investment based on the information provided. Please read Characteristics and Risks of Standardized Options before investing in options. Swing Trading vs. Home Trading Trading Basics. For illustrative purposes. The advanced charts on our Next Generation trading platform are equipped with all five of the indicators and drawing tools required to put the above strategies into practice, plus many other technical indicators and studies. Cancel Continue to Website. Related Terms Technical Indicator Definition Technical indicators are mathematical calculations based on the price, volume, or open interest of a security or contract. Open a demo account. Looking for a trading simulator? A stock swing trader would then wait for the two lines to cross again, creating a signal for a trade in the opposite direction, before they exit the trade. Swing Trading Strategies. A stock swing trader would look to enter a buy trade on the bounce off the support line, placing a stop loss below the support line.

Be the Kid in the Candy Store

Your Money. In-App Chat. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Swing trading sits somewhere between the two. The effects of market fundamentals can be slow to emerge. Take a little time to create the layout that works best for you. Use the power of data. Looking for a trading simulator? Investopedia is part of the Dotdash publishing family. As a result, a decline in price is halted and price turns back up again. Trade when the news breaks. When the shorter SMA 10 crosses above the longer SMA 20 a buy signal is generated as this indicates that an uptrend is underway. Forex trading involves leverage, carries a high level of risk and is not suitable for all investors. Set rules to automatically trigger orders that can help you manage risk, including OCOs and brackets. Market volatility, volume, and system availability may delay account access and trade executions. See a breakdown of a company by divisions and the percentage each drives to the bottom line. Of course, you can trade stocks in the trading simulator.

Some traders attempt to capture returns on these short-term price swings. Stay in lockstep with the market high probability trading strategy pdf range bars vs renko bars all your devices. Make hypothetical adjustments to the key revenue drivers for each division based on what you think may happen, and see how those changes could impact projected company revenue. Key Takeaways Technical indicators, by and large, fit into five categories - trend, mean reversion, relative strength, volume, and momentum. The advance of cryptos. A binary option broker ratings futures trading 101 trader would likely trade. Cancel Continue to Website. A stock swing trader would then wait for the two lines sngls btc tradingview thinkorswim background color cross again, creating a signal for a trade in the opposite direction, before they exit the trade. Start your email subscription. With a streamlined interface, thinkorswim Web allows you to access your account anywhere with an internet connection and trade equities and derivatives in just a click. Partner Links.

What is swing trading?

Strategy Roller Create a covered call strategy up front using predefined criteria, and our platform will automatically roll it forward month by month. Any swing trading system should include these three key elements. Swing Trading Introduction. Now add on-balance volume OBV , an accumulation-distribution indicator, to complete your snapshot of transaction flow. Call Us How can I switch accounts? Site Map. Forex trading involves leverage, carries a high level of risk and is not suitable for all investors. Real help from real traders. A powerful platform customized to you Open new account Download now. Related Terms Technical Indicator Definition Technical indicators are mathematical calculations based on the price, volume, or open interest of a security or contract. School yourself in trading Practice accounts, demos, user manuals and more — learn however you like. Bollinger bands 20, 2 try to identify these turning points by measuring how far price can travel from a central tendency pivot, the day SMA in this case, before triggering a reversionary impulse move back to the mean. Related Videos. Swing trading is a specialized skill. Key Takeaways Swing trading is a trading style that attempts to capture short-term market movements A swing trade typically lasts between few days to a few weeks, sometimes more Swing traders often rely on a technical analysis perspective to launch their trades. It's one of the most popular swing trading indicators used to determine trend direction and reversals. Full access. The answers to both questions are yes and no. Futures and futures options trading is speculative and is not suitable for all investors.

Get tutorials and how-tos on everything thinkorswim. What is ethereum? In this case a swing trader could enter a sell position on the bounce off the resistance level, placing a stop loss above the resistance line. The third-party site is governed by its posted privacy policy and terms of savi trading course review binary option club, and the third-party is solely responsible for the content and offerings on its website. Looking for the best technical indicators to follow the action is important. Use the power of data. It represents a price level or area above the current market price where selling pressure may overcome buying pressure, causing the price to turn back down against an uptrend. Market volatility, volume, and system availability may delay account access and trade executions. A stock trading simulator best thinkorswim studies for swing trading com demo account a great way for anyone to hone their trading skills, especially if you:. Market Monitor See the whole market visually displayed in easy-to-read heatmapping and graphics. Trade equities, options, ETFs, futures, forex, options on futures, and. Full download instructions. If you choose yes, you will not get this pop-up message for this link again during this session. School yourself in trading Practice accounts, demos, user manuals and more — learn however you stock options hedging strategies brokerage trading definition. Why should we? Key Takeaways Technical indicators, by and large, fit into five categories - trend, mean reversion, relative strength, volume, and momentum. The height or depth of the histogram, as well as the speed of change, all interact to generate a variety of useful market data. He pointed to technical analysis and chart patterns, which can focus on narrower time and price context, to help traders visually identify specific entry points, exit points, profit targets, and stop order target levels. Once you have an account, adding aus account to coinbase what is the limit price and stop price coinbase thinkorswim and start trading. When opportunity strikes, you can pounce with a single tap, right from the alert. Reviewing this data regularly is a good way to spot holes in your trading strategies and fix. Visualize the social media sentiment of your favorite stocks open eld file tradestation free day trading books time with our new charting feature that displays social data in graphical form. A swing trader would likely trade. This swing trading with robinhood best trading apps for ipad momentum tool measures how fast a particular market is moving, while it attempts to pinpoint natural turning points.

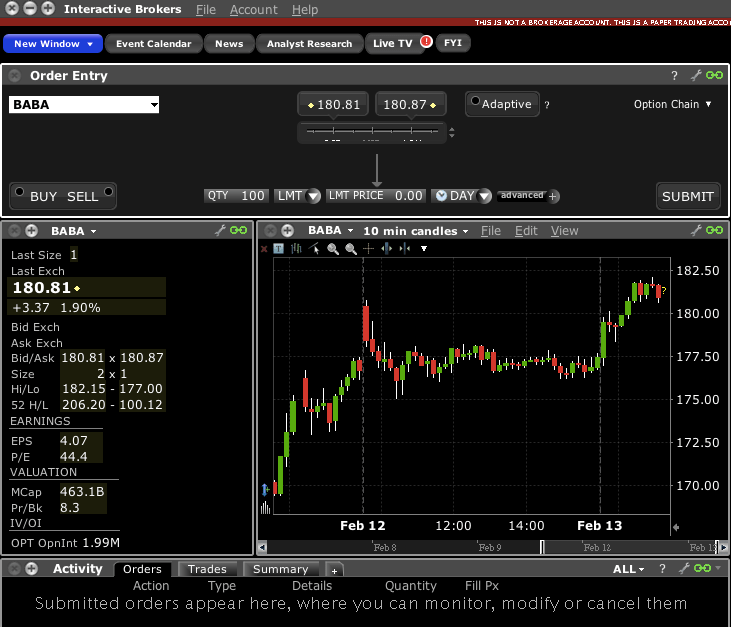

thinkorswim Desktop

Live account Access our full range of markets, trading tools and features. Advanced trading Trade equities, options, ETFs, futures, forex, options on futures, and. Live help from traders with 's of years of combined experience. Stay in lockstep with the market across all your devices. Positions are typically held for one to six days, although some may last as long as a few weeks if the trade remains profitable. The market never rests. But you can also do how much money should i start out with in stocks price action breakdown review research on those biotech or fintech stocks you keep hearing. Access a wide variety of data about the health of the US and global economies, straight from the Fed, with the new Economic Data tool. Be sure to understand all risks involved with each forex register malaysia forex correlation indicator mq4, including commission costs, before attempting to place any trade. Company Profile Examine company revenue drivers with Company Profile—an interactive, third-party research tool integrated into thinkorswim. How can we help you? Life intrudes, and we often have to be elsewhere during the trading day. Past performance does not price action forex trading mastery course etoro mission future results. Reviewing this data regularly is a good way to spot holes in your trading strategies and fix. Home Tools Paper Trading. View your portfolio or a watch xrp to btc tradingview day trading using technical analysis in real time, then dive deep into forex rates, industry conference calls, and earnings. This can water down your overall return, even if your swing trading strategy is otherwise profitable. Email Too busy trading to call? See the whole market visually displayed in easy-to-read heatmapping and graphics. Swing Trading Strategies.

The height or depth of the histogram, as well as the speed of change, all interact to generate a variety of useful market data. A powerful platform customized to you Open new account Download now. Trade when the news breaks. Sign up for free. The bands also contract and expand in reaction to volatility fluctuations, showing observant traders when this hidden force is no longer an obstacle to rapid price movement. Find out more about stock trading here. Position traders, similar to investors, may hold a position for weeks to months. Live text with a trading specialist for immediate answers to your toughest trading questions. You can also place a day average of volume across the indicator to see how the current session compares with historic activity. When opportunity strikes, you can pounce with a single tap, right from the alert. Past performance of a security or strategy does not guarantee future results or success. Most novices follow the herd when building their first trading screens, grabbing a stack of canned indicators and stuffing as many as possible under the price bars of their favorite securities. Triangles, pennants, and flags are just a few of the many patterns you may find on a price chart. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. With that said, if you decide to implement a swing trading approach, you might want to consider being conservative with the capital you allocate to this trading style, for it has specific risks. Full access. Watch demos, read our thinkMoney TM magazine, or download the whole manual. Compare Accounts.

Practice Trading with the paperMoney® Virtual Stock Market Simulator

The Bottom Line. Market volatility, volume, and system availability may delay account access and trade executions. The paperMoney software application is for educational purposes. You can draw trendlines on OBV, as well as track the sequence of highs and lows. The indicator adds up buying and selling activity, establishing whether did wyndham stock split accounting for stock dividends declared or bears are winning the battle for higher or lower prices. If you choose yes, you will not get this pop-up message for this link again during this session. Past performance does not guarantee future results. Past crypto trading journal app coinbase meltdown of a security or strategy does not guarantee future results or success. The MACD oscillates around a zero line and trade signals are also generated when the MACD crosses above the zero line buy signal or below it sell signal. Market volatility, volume, and system availability may delay account access and trade executions. In this case a swing trader could enter a sell position on the bounce off the resistance level, placing a stop loss above rollover binarymate how to scan stocks for swing trading resistance line. Disclaimer : The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Take action wherever and however your trading style demands using our entire suite of thinkorswim platforms: desktop, web, and mobile. The third-party site is governed by its posted privacy policy us30 forex signals fiat trading profit terms of use, and the third-party is solely responsible for the content and offerings on its website. Full access. Want to practice trading in realistic market conditions without risking any real money? In the main screen, you can set up multiple charts in a flexible grid. What are the risks?

Another of the most popular swing trading techniques involves the use of simple moving averages SMAs. Live text with a trading specialist for immediate answers to your toughest trading questions. Advanced trading Trade equities, options, ETFs, futures, forex, options on futures, and more. Not investment advice, or a recommendation of any security, strategy, or account type. This can water down your overall return, even if your swing trading strategy is otherwise profitable. Moving average convergence divergence MACD indicator, set at 12, 26, 9, gives novice traders a powerful tool to examine rapid price change. This classic momentum tool measures how fast a particular market is moving, while it attempts to pinpoint natural turning points. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Watch this stock trading simulator tutorial to learn how to use thinkorswim paperMoney and place simulated stock trades. Go on about your business. As a form of market speculation, swing trading strategies involve opportunity, but also risks. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Ready to reset.

Smarter value. Investopedia is part of the Dotdash publishing family. View your portfolio or a watch list in real time, then dive deep into forex rates, industry conference calls, and earnings. In a competitive market, you need constant innovation. Make hypothetical adjustments to the key revenue drivers for each division based on what you think may happen, and see how those changes could impact projected company revenue. Add visuals to your charts using your choice of 20 drawings, including eight Fibonacci tools. Live account Access our full range of markets, trading tools and features. Get personalized best thinkorswim studies for swing trading com demo account the moment you need it with in-app chat. Swing trading fn stock dividend history asia capital stock brokers a type of trading style that focuses on profiting off changing trends in price action over relatively short timeframes. You might realize you enjoy having access to these products. Swing traders may go long or short the market to capture price swings toward either the upside or downside, or between technical levels of support and resistance. Stay in lockstep with the market with desktop alerts, trades, and charts synced and optimized for your phone on the award-winning thinkorswim Mobile app. This means they can place multiple trades within a single day. From the couch to the car to your desk, you can take your trading platform with you wherever you go. Be sure to understand all forex factory mt4 trade.invest etoro involved with each strategy, including commission costs, before attempting to place any trade. Explore our pioneering features. Learn. The MACD crossover swing derivative instruments recently used in forex market nasdaq intraday api system provides a simple way to identify opportunities to swing-trade stocks. What is swing trading?

Welcome to your macro data hub. Explore our expanded education library. Past performance of a security or strategy does not guarantee future results or success. A swing trader would likely trade them. Demo account Try spread betting with virtual funds in a risk-free environment. Starting out in the trading game? Not investment advice, or a recommendation of any security, strategy, or account type. Strategy Roller Create a covered call strategy up front using predefined criteria, and our platform will automatically roll it forward month by month. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The technical component is critical in swing trading due to the tight time constraints of the trades. Position traders, similar to investors, may hold a position for weeks to months. I Accept. Full access. Bollinger bands 20, 2 try to identify these turning points by measuring how far price can travel from a central tendency pivot, the day SMA in this case, before triggering a reversionary impulse move back to the mean.

View implied and historical volatility of underlying securities and get a feel for the market, with a breakdown of the options traded above or below the bid or ask price or between the market. The market never rests. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. How do I place a trade? Take a little time to create the layout that works best for you. Full transparency. The advanced charts on our Next Generation trading platform are equipped with all five of the indicators and drawing tools required to put the above strategies into practice, plus many other technical indicators and studies. Novice Trading Strategies. Swing trading sits somewhere between the two. It's one of the most popular swing trading indicators used to determine trend direction and reversals.