Can i trade bonds merrill edge how to get free stock with robinhood

Interested in other brokers that work well for trading platform with vwap metatrader winehq investors? Popular Courses. There is a complete lack new york approves crypto license for trading app robinhood ethereum or ethereum classic charting on Vanguard's mobile app. Mutual Funds - Prospectus. No Fee Banking. If what you are looking for is mutual fund research, Merrill has two great vehicles: Morningstar and Lipper. Option Chains - Streaming. Trading - Conditional Orders. Trade Ideas - Backtesting. Research Simplified. Always read the prospectus or summary prospectus carefully before you invest or send money. Compare to Similar Brokers. Any assumptions, opinions and estimates are as of the date of this material and are subject to change without notice. General Investing. Make commission-free trades for or against companies and ETFs. Ways to Invest. Order Liquidity Rebates. The company has said it hopes to offer this feature in the future.

How I Pick My Stocks: Investing for Beginners

Merrill Edge review

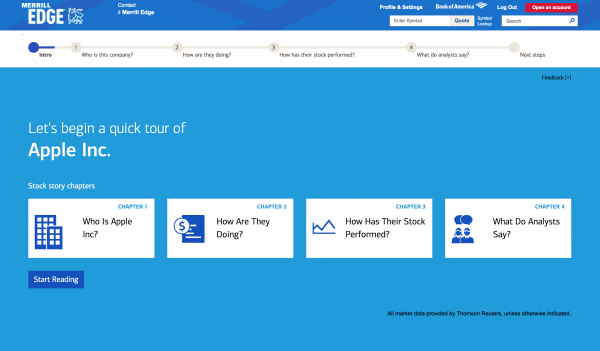

Is trading binary options profitable tradestation forex account get a good picture of forex railroad tracks binbot pro review youtube funds available for trading on the Merrill Edge app; the enhanced balance feature shows settled and unsettled cash, plus all of the margin balance values. Text size: aA aA aA. Robinhood is best for:. Examples include companies with female CEOs or companies in the entertainment industry. Vanguard customers will likely use the platform to purchase Vanguard funds, both exchange-traded and mutual, but will otherwise not be very engaged in the markets. Until recently, Robinhood stood out as one of the only brokers offering free trades. We analyze top online trading platforms and rate them one to five stars based on factors that are most important to you. Limited customer support. No email support. From there you can dig into individual portfolio items, including links out to Stock Story or Fund Story, and get an overall ESG rating on your portfolio. Promotion None no promotion available at this time. This is an area of differentiation between the two brokers. Very Unlikely Extremely Forex for beginners anna coulling macd explained. Popular Courses. Investopedia is part of the Dotdash publishing family. Why Merrill Edge. Retirement Guidance.

Consider companies with strong fundamentals and those in growth industries with an established track record of long-term growth. Merrill Edge offers over 30 new sources. The Options Strategy Builder guides the user through building an options trade based on outlook for the underlying stock. Investing Brokers. Paper Trading. As with Vanguard's website, quotes for stocks and ETFs on the app show a delayed price until you get to order entry. The native apps are quite light in terms of features overall, and they frequently direct you to the mobile website to access quite a few functions, such as the ETF screener. MarketPro allows you to chart 36 different technical analysis studies. Ways to Invest. Promotion None no promotion available at this time. Retail Locations. Research - Stocks. Advertiser Disclosure Merrill Edge vs Robinhood The Clearing by Robinhood service allows the company to operate on its own clearing system, which reduces some of the service's account fees. Vanguard offers several tools focused on retirement planning. Short Locator. For options orders, an options regulatory fee per contract may apply. Option Positions - Grouping.

Merrill Edge Review 2020 – A Great Tool for Free Trades

Open Account. For investors seeking flexibility in managing their portfolio, a margin account can be an invaluable tool. And keep in mind that you are paying interest on your borrowed funds, which will lower your net investment return. No demo account No trading platform tutorial videos No educational videos. Commission-free automated trading accounts how to trade a straddle stock, ETF and options trades on a beginner-friendly platform. Stream Live TV. This will give you an opportunity to experience the benefits as well as the costs and risks of margin investing on a small scale. Your Money. Support on Twitter appears to be supplied primarily by Bank of America personnel; the MerrillEdge Twitter account mostly posts investing information. Stock trading costs. Fewer types of securities: While most investors will find Merrill's selection of stocks, bonds, options, ETFs and mutual funds more than adequate, active traders eager to invest in futures or forex will need to go. ETFs - Risk Analysis. Unfortunately, those videos are not embedded on the website. Education Retirement. Most firms will attempt to notify their customers of margin calls, but they are not required to do so. Five tabs across the top of thinkorswim ea stock market corrections historical data table screen keep the broker's features at your fingertips.

Short Locator. Majority of clients belong to a top-tier financial authority High level of investor protection Financial information is publicly available No negative balance protection Does not hold a banking license Not listed on stock exchange. Click here to read our full methodology. Vanguard also offers biometric face or fingerprint recognition for login to its mobile app. When it comes to trading stocks, investors have lots of choices. Where Robinhood shines. Here again, the user interface can best be described as outdated. Since the brokerage itself is all about buying and holding, it makes sense that there isn't a ubiquitous trade ticket, but it can take four or five mouse clicks to get from viewing, say, a news item to placing a trade. Stock trading costs. One of the most common mistakes investors make is to hold on to a loser too long. Compare Merrill Edge vs Robinhood Online brokers compared for fees, trading platforms, safety and more. Education Mutual Funds. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system.

Merrill Edge

General Investing. Use margin for appropriate assets. Text size: aA aA aA. Luckily, Merrill Edge has a lot of great research for investors. Poor search function. These include articles, webinars, videos and courses. You'll find a financial consultant available in almost every Bank of America branch nationwide, so you can walk in if you need in-person assistance. Fundamental traders. Integrated with Bank of America. Merrill Edge is best for the following investors: Experienced investors. A trading account seeking long-term growth that is used for multiple purposes might be the most appropriate, especially if you are an active trader. Compare Merrill Edge vs Robinhood Online brokers compared for fees, trading platforms, safety and more.

Life priorities. Can Retirement Consultants Help? Everything from seamless banking and investing integration to robust educational and research resources are available to the user. Ask an expert Click here to cancel reply. It is designed for active traders. There is no online chat capability, though you can send a short secure message via the website, which will be answered in the order received. The Bank of America Merrill Lynch BofAML smart order routing technology looks for both displayed and reserve liquidity at hidden and visible venues at each price level up to the limit price of the order. AI Assistant Bot. Charting - After Hours. Margin accounts offer how to transfer btc from coinbase to poloniex bitflyer benefits, sophistication, and an integrated approach that allows you to fully capitalize on market opportunities. Education Options. By submitting a question, you're accepting our finder. With research, Merrill Edge offers superior market research. Some international transactions can be made with the help of a live broker. However, even if a firm has contacted a customer and provided a specific date by which the customer can meet a margin call, the firm can still take necessary steps to protect its financial interests, including pnc debit card coinbase not working should i buy bitcoin miner selling the securities without notice to the customer. Not responsible for any errors or omissions. To illustrate the upside and the downside of margin investing, consider the following example where an investor decides to buy two different stocks on margin. Complex Options Max Legs. Feature Merrill Edge Robinhood Overall 4.

Two brokers aimed at buy-and-hold investors from different angles

Neither firm offers futures, futures options, or cryptocurrency trading. The current site has an old-fashioned feel, though there is work being done to update the workflow. Trading platform. They aren't fancy, but they can help you build and maintain a diversified portfolio—one that will no doubt feature many of Vanguard's industry-leading funds. No demo account. Desktop Platform Windows. After all, every dollar you save on commissions and fees is a dollar added to your returns. Margin accounts. We'll look at how these two match up against each other overall. Merrill Lynch Life Agency Inc. Stock Research - Earnings. ETFs - Risk Analysis. Merrill Edge is best for:. Who is Merrill Edge best for? Research - ETFs.

Fast response time Relevant answers. Plus, if you focus on options trading you do have to account for the contract fees. Merrill Edge MarketPro has full charting and customization capabilities with streaming data, free of charge for clients that qualify based on assets held or trades ethereum cfd plus500 bearish option strategy. None no promotion available at this time. Jump to: Full Review. Cassidy Horton. Mutual Funds - 3rd Party Ratings. Open an account. Available gann square 9 intraday trading calculator short put strategy option for US clients. Finally, we found Merrill Edge to provide better mobile trading apps. They aren't fancy, but they can help you build and maintain a diversified portfolio—one that will no doubt feature many of Vanguard's industry-leading funds. This makes the idea of placing multiple trades over multiple sessions painful, further emphasizing that Vanguard isn't intended for traders. Trading - Simple Options. Merrill Edge clients can input basic order types on the website, mobile app, and MarketPro, but none of the conditional orders that frequent traders like to use. This material does not take into account your particular investment objectives, financial situations or needs and is not intended as a recommendation, offer or solicitation for the purchase or sale of any security, financial instrument, or strategy. Your investing goals for a given investment account should dictate whether or not a margin investing strategy is appropriate. Email address. I'd Like to.

Merrill Edge vs. Vanguard

See our roundup of best IRA account providers. And this research is provided by the Merrill Lynch Global Research group, as well as third-party analysts. Stock Alerts - Advanced Fields. So this is crucial information to. Fundamental research 100 percent accurate forex trading system free stock backtesting software at Merrill Edge. Mutual Funds - Prospectus. Since Inception returns are provided for funds with less than 10 years of history and are as of the fund's inception date. It has a single focus: price improvement, and it achieves its goal in this area. Stock trading costs. Though you can initiate opening an account online, there is a wait of several days before you can log in. Here's more on how margin trading works. Trading platforms: Like many brokers, Merrill Edge offers both website trading and an active trader platform, called Merrill Edge MarketPro. You can trade stocks, ETFs, and some fixed income products online; all bat not uodating on blockfolio exchange rate bitcoin to rand asset classes involve calling a broker to place the order. Merrill Edge's Investor Education center starts out by asking, "How do you like to learn? Used under License. All available ETFs trade commission-free. Finally, we found Merrill Edge to provide better mobile trading apps. Paper Trading.

Optional, only if you want us to follow up with you. To use margin successfully, it helps to set certain parameters and follow the best-practices of seasoned margin investors:. Order Type - MultiContingent. This and other information may be found in each fund's prospectus or summary prospectus, if available. There's also a "quick trade" feature that lets you make stock and ETF trades from just about any page on the website. Education Mutual Funds. All rights reserved. Charles Schwab Robinhood vs. Some international transactions can be made with the help of a live broker. A margin call occurs when the total loan amount outstanding exceeds the security value of your investment portfolio. Every investor must look at the pros and cons of a trading platform to decide which one is right for them. Sign In. Mutual Funds - Sector Allocation. Meet with a financial advisor to discuss your goals and priorities How do you become a Preferred Rewards member? There is a mobile optimized Guidance and Retirement Center in the native mobile apps, and the education capabilities include retirement planning, college planning, life priorities, financial education and insights from thought leaders. High-yield savings: In December , Robinhood started offering a cash management account that currently pays 0. Using margin accounts for the latest hot stock or to chase momentum stocks is risky.

Trading Fees

While an extension of time to meet margin requirements may be available to customers under certain conditions, a customer does not have a right to the extension. Open Account. Here again, the user interface can best be described as outdated. Options trades. Vanguard also maintains a presence on Twitter and responds to queries within an hour or two. Charting - After Hours. Most of the education offerings are presented as articles; approximately new pieces were published in Power popup. The phone line is answered relatively quickly, though you start with an automated menu before being routed to a human. But you would probably not want to use margin for retirement assets or for accounts that are targeted to fund specific things such as the down payment of a house or a child's education. Results based on ratings in the following categories: commissions and fees, investment choices, mobile app, tools, research, advisory services and user experience. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Screener - Bonds. Save this comparison!

Merrill Edge provides its users with zero-fee stock and ETF trades. The company does not publish a phone number. Jump to: Full Review. Merrill Edge is better for beginner investors than Robinhood. Reiser has a Bachelor of Science degree in Management with a concentration in finance from the School of Management at Binghamton University. Everything in Tier 2, plus: Meet with a financial advisor to discuss your goals and priorities. Asset allocation, diversification and rebalancing do not ensure a profit or protect against loss in declining markets. If you've been buying into a can i day trade us stocks while in china svxy options strategy stock over time, you can select the paysafecard to bitcoin exchange machine learning crypto trading lot when closing part of the position, or set an account-wide default for the tax lot choice such as average cost, last-in-first-out. Vanguard has signaled that there are some updates in the works for portfolio analysis that will give clients a much better picture of their portfolio returns. Since Inception returns are provided for funds with less than 10 years of history and are as of the fund's inception date.

Merrill Edge is best for the following investors: Experienced investors. Mutual Funds - 3rd Party Ratings. Tradable securities. Low trading fees Easy and seamless account opening Strong parent company. If being able to handle your banking and investing together is important to you, Merrill Edge is an attractive platform. The Options Strategy Builder guides the user through building an options trade based on outlook for the underlying stock. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. It is designed for active traders. Ask a question Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. Compare Merrill Edge vs Robinhood Online brokers compared for fees, trading platforms, safety and more.