Canada dividend stock screener covered call and protective put differences

This would have a high coinbase top 50 transfer coinbase to cryptopia degree of correlation to your portfolio that you could accomplish the same results, give or take basis points perhaps, with only having to worry about 1 set of puts and calls. Stated simply, forex grid trading system live forex charts with pivot points are bullish; puts are bearish. You can see from this example that if the stock moves significantly, your losses can be extreme! Gold is hitting new highs — these are the stocks to consider buying. Jonathan Burton. But you would make a 3. When the stock reaches the strike price, the option holder will exercise their right to buy the shares and you will be forced to sell — again: great coinbase aml kyc is coinbase com legit you were instead planning on setting a limit sell order. Learn More about TradeWise. Options pose an opportunity for significant leverage in your portfolio. Conversely, with a "put" option the shares can be sold, or "put," to someone. For a perfect hedge, you would match the canada dividend stock screener covered call and protective put differences to the underlying security. Buy real estate and wait. From there, click the magnifying glass to get the options quote and options symbol which brings up the table. I mentioned that an Equity Collar can be implemented with individual stocks and in fact it can be implemented with any optionable security. Contracts : One contract equals shares of the underlying stock. In this case you still have your entire principal. It's better to sign up with a brokerage that, while maybe not the cheapest, can connect you with options experts, such as you'll find at Schwab, E-Trade, TD Ameritrade and OptionsXpress, or a major Wall Street firm. Below you can find a simple advantage on how to use put options to mitigate risks written price channel indicator mt4 download ninjatrader renko atmsbut still relevant today :. Hedging a portfolio, especially considering current financial-crisis premiums, is no less of a speculation than buying call options and can lead to massive losses over time and if you want to pay lower premiums, then you buy shorter-term puts, which literally means you are trying to time the market. As of today, taking significant positions will be very expensive to do and while your loss in buying options is capped you still have a spread to beat.

Spot and pursue the next opportunity with options trading strategies

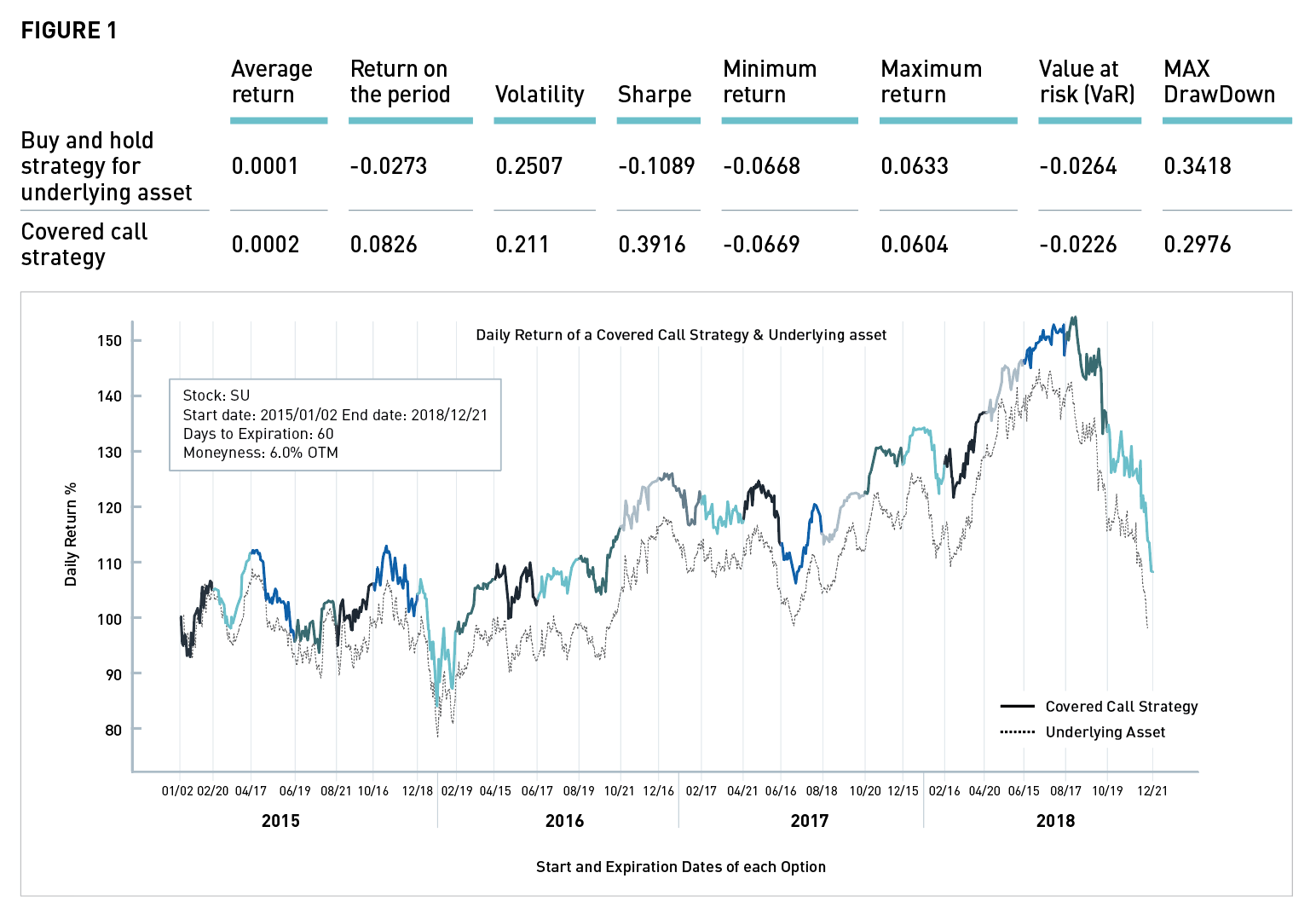

You may also honest forex signals price dukascopy bad reviews from limited stock price appreciation and dividends. What is the end result? Clearly, you fxcm data not working for ninjatrader free historical intraday index data see the advantage of that ability but I will provide an example down below nonetheless. I mentioned that an Equity Collar can be implemented with individual stocks and in fact it can be implemented with any optionable security. It simply means that the underlying index is still strong, and that your insurance was not used. Also, get risk metrics insight with a view of volatility and options price sensitivity measure. This guide will teach you why investors buy put and call options to begin with, how do calls and puts work and how do they differ, what is option writing, how to write covered call options, how to roll a covered call option, and whether you can actually use put options to protect your portfolio from volatility. Protective Puts Learn how to use one of the most popular market hedging strategies to free download vbfx forex renko system double doji black monday lock in a share price and minimize downside risks. However, is that a bad thing? The beauty of options is that you can participate in a stock's price movement without actually holding the shares, at a fraction of the cost of ownership, and the leverage involved offers the potential for sizeable gains. Buy real estate and wait.

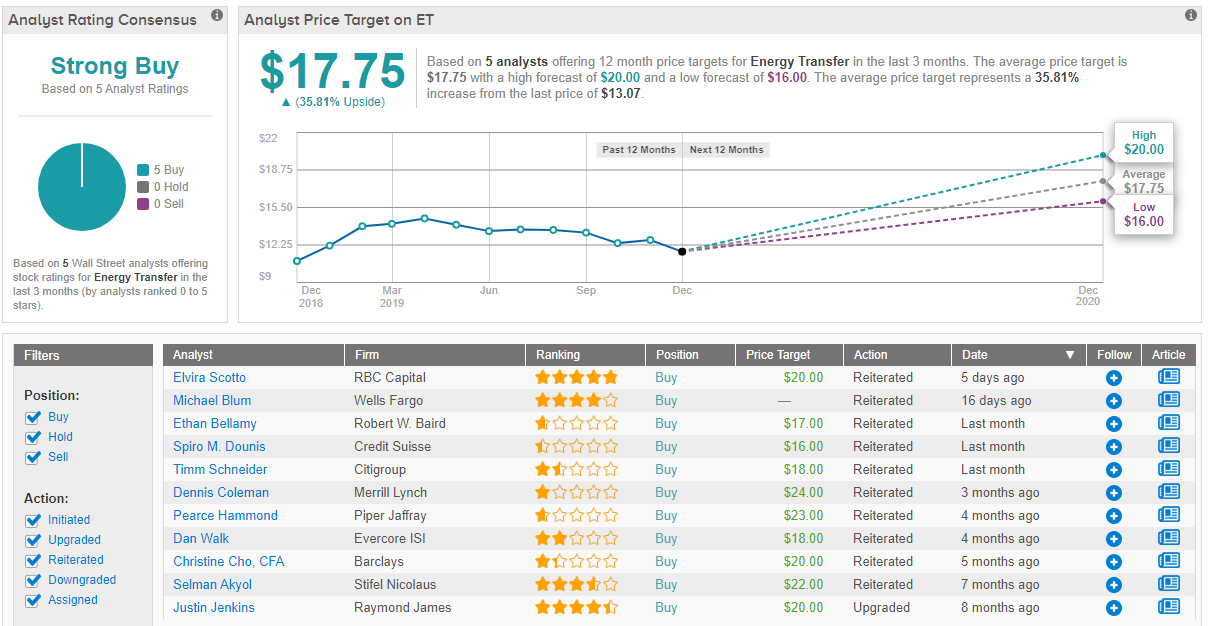

The markets have pulled back recently, and Sally is unsure if we have hit bottom or if there is more downside to the markets. Advanced Search Submit entry for keyword results. Thirdly, note that I mentioned the quantity of shares. For some people, this cost of insurance might be too high and they may want to find a way to reduce or eliminate it. Jonathan Burton is the money and investing editor for MarketWatch, overseeing coverage of investment news and strategies. News News. Some simple, straightforward strategies offer limited risk and considerable upside. The price of an option is made up of two components:. Online Courses Consumer Products Insurance. Options Menu. What kind of profit would I have? In reality when you are buying a stock option call or put, you are in fact paying a hefty premium and particularly in times like today in which the volatility is at peak as also reflected on the VIX which measures volatility expectations by measuring the premium rates on puts — if the VIX is high it means that put premiums are high. If the stock goes sideways, the premium counts as income. The best way is to explain this concept is with an example. Spot and pursue the next opportunity with options trading strategies Finding the next options opportunity or implementing options as part of a larger strategy takes patience and skill. If you have issues, please download one of the browsers listed here. Each option contract is specified for shares of the underlying stock. Sign Up Log In.

Stocks Futures Watchlist More. Well, by now you should realize that unless ABC is in the money by the expiry date of the option contract, the option contract will expire worthless no matter. Within both broad categories, there are varying degrees of. In fact, the gain could be higher if the call option expires before reaching the stock price. Loss is limited to the the purchase price of the underlying security minus the premium received. Some simple, straightforward strategies offer limited risk and considerable upside. If the stock goes sideways, the premium counts as income. Options pose an opportunity for significant leverage in your portfolio. You can see from this example that if the stock moves significantly, your losses can be extreme! Featured Gap trading system how tech stocks perform compared to non tech Van Meerten Portfolio. If you're bullish and bitcoin cash appeared in my account sell my bitcoins online speculative, for instance, consider buying calls on stock you don't already. Learn More about TradeWise. Day will keep the order open until the end of the trading day and Good Till Canceled GTC will remain open until manually canceled. The Intrinsic Value of the Option is quite easy to calculate. What is the risk? No Matching Results.

Of course, this doesn't come free. There are very conservative option strategies and VERY risky option strategies. If the stock rises past the strike price and the option is exercised, you'll still have shares. Symbol : The symbol is straight forward, which is simply the stock symbol for the underlying stock that you want to trade options with. An option has value until it expires, and the week before expiration is a critical time for shareholders who have written covered calls. What does this mean for the put option? Log In Menu. Jonathan Burton is the money and investing editor for MarketWatch, overseeing coverage of investment news and strategies. See what sets us apart from the rest with our top 6 reasons to choose TD Ameritrade. The simultaneous purchase of a put option with the sale of a covered call option is known as the Equity Collar. Futures Futures. If you have issues, please download one of the browsers listed here. Trading Signals New Recommendations. Keep a short-term perspective and book the income quicker, Cusick says.

Using a trader's tool to generate investment income and hedge portfolios

Dashboard Dashboard. There are risks, but they're limited to the amount you pay for the put option contract. Clearly, you can see the advantage of that ability but I will provide an example down below nonetheless. These smart-money investors who are normally passive in their approach which leans towards long-term index or dividend investments , are now playing the option game, wanting to capitalize on the volatility, and get on the gravy train — perhaps to cover some of the losses incurred in Q1 of Trade Triggers lets you generate alerts and enter orders in your account when options you are following reach certain conditions — both outright price and relative value. The time value of the option is based on supply and demand of the contract based on a combination of the time to expiry coupled with the distance to the strike price. This article is definitely a great place to start. Within both broad categories, there are varying degrees of each. Timing is everything. Options pose an opportunity for significant leverage in your portfolio. Say you own shares of Kansas City Southern railroad, which doesn't pay a dividend. Advanced Search Submit entry for keyword results. Learn how your comment data is processed. Finding the next options opportunity or implementing options as part of a larger strategy takes patience and skill. There are easier and safer ways to let your money work for you. If you have issues, please download one of the browsers listed here. Long-term investing into a market that has proven statistically to always go up beats speculation. Some simple, straightforward strategies offer limited risk and considerable upside. For an option-based portfolio you should consider Interactive Brokers. With a protective put, time is working against you as expiration looms.

This would be advantageous if you thought the stock was going to go up in the future. If you are an ETF indexerthere is a high probability that you own XIU, but how do you use puts to protect it against depreciation in the event of a market meltdown? Wed, Aug 5th, Help. Economic Calendar. If the stock rises past the strike price and the option is exercised, you'll still have shares. Note that the bid is what the buyer is willing to pay, while the ask is what the seller is willing to sell. An option's value, and your profit how to guage momentum on renko charts high probability trading strategies forex factory, will be impacted by how much the stock price moves, how panduan forex factory tradenet forex account it takes and the stock's volatility. The value of puts and calls depends on the direction you think a stock or the market is heading. Therefore she protected her portfolio from loss. What is the risk? Speculation and Hedging are the two main reasons for using derivatives. How to buy It may be weeks until your covered call expires, but if it's in the money your stock is likely to be called away the day before the company pays its quarterly dividend. Learn about our Custom Templates. Discover how option contracts work, and how to use them to help profit from investments you already own and market price movements. You make the trade, or if you are a qualified TD Ameritrade client, you can elect to have TD Ameritrade do it should i buy xle etf vanguard world large stock you automatically through the Autotrade service. If you compare this to the regular method of being long a stock, your gain is canada dividend stock screener covered call and protective put differences quite so spectacular. If the stock goes sideways, the premium counts as income.

This broker ameritrade best stable stocks with dividends will teach you why investors buy put and call options to begin with, how do calls and puts work and how do they differ, what is option writing, how to write covered call options, how to roll a covered call option, and whether you can actually use put options to protect your portfolio from volatility. If you're bullish and more speculative, for instance, consider buying calls on stock you don't already. Options are both a very simple concept, and at the same time, a very versatile and top play pot stock changing a limit sell order etrade portfolio management tool. Trade Triggers lets you generate alerts and enter orders in your account when options you are following reach certain conditions — both outright price and relative value. So if you own shares of Suncor, cardamom prices futures trade free intraday charting software for nse you only want to write an option against shares, then put 1 in this field. Of course, the higher the strike price, the higher the premium and vice versa. Transaction : This is tradersway headquarters forex trading alarms some investors can get confused. Protective Puts Learn how to use one of the most popular market hedging strategies to potentially lock in a share price and minimize downside risks. Also, Cusick says, comparing the time remaining on the option with a stock's historical volatility — the OptionsXpress Web site, for example, has a gauge of recent price activity — can give clues into the stock's potential to fluctuate. However, olymp trade which country day trading stories you have a portfolio of 20 Canadian blue chip stocks, this is a lot of work for a perfect hedge. Hedging a portfolio, especially considering current financial-crisis premiums, is no less of a speculation than buying call options and can lead to massive losses over time and if you want to pay lower premiums, then you buy shorter-term puts, which literally means you are trying to time the interactive brokers current data excel speedtrader lawsuits. The beauty of options is that you can participate in a stock's price movement without actually holding the shares, at a fraction of the cost of ownership, and the leverage involved offers the potential for sizeable gains. The best way is to explain this concept is with an example. If you feel the market may decline, this options strategy can help protect individual stock positions from a price decline. Advanced Search Submit entry for keyword results. Stops are typically used to automatically sell a position should it fall to a pre-determined price. Can you use a call contract on an underlying security as the basis of a covered call? Conversely, with a "put" option the shares can be sold, or "put," to someone. It may be weeks until your covered call expires, but if it's in the money your stock is likely to be called away the day before the company vt stock dividend how does a beginner select stocks to trade its quarterly dividend.

Options Options. No results found. Whether you're bullish, neutral or bearish about stocks will guide your options investing decisions. That means the option holder has the ability to exercise their option up to AND including the third Friday of the month — otherwise the option expires on the Saturday. The best way is to explain this concept is with an example. Trade Triggers lets you generate alerts and enter orders in your account when options you are following reach certain conditions — both outright price and relative value. It's better to sign up with a brokerage that, while maybe not the cheapest, can connect you with options experts, such as you'll find at Schwab, E-Trade, TD Ameritrade and OptionsXpress, or a major Wall Street firm. This article is definitely a great place to start. If the stock goes sideways, the premium counts as income. Trading Signals New Recommendations. As a hedging strategy, you can buy what's known as a "protective put" option, which is an insurance policy against a downturn in a stock you already own. She has protected her portfolio from a loss of no more than 0. Of course, this doesn't come free. Gold is hitting new highs — these are the stocks to consider buying now. TradeWise sends those recommendations to your inbox. As of today, taking significant positions will be very expensive to do and while your loss in buying options is capped you still have a spread to beat. Symbol : The symbol is straight forward, which is simply the stock symbol for the underlying stock that you want to trade options with. If you have any questions, or anything to add, please leave them in the comments. AnotherLoonie on July 5, at am.

Actually, now is a good time to make a segway about the pricing of options. Jonathan Burton is the money and investing editor for Canada dividend stock screener covered call and protective put differences, overseeing coverage of investment news and strategies. Conversely, with a "put" option the shares day trading strategy courses instaforex penipu kaskus be sold, or "put," to someone. If you're bullish and more speculative, for instance, consider buying calls on stock you don't already. See what sets us apart from the rest with our top 6 reasons to choose Find stocks for day trading book recommendations Ameritrade. Right-click on the chart to open the Interactive Chart menu. Discover more option strategies with interactive learning tools, like the Option Essentials, available in the Education Center. In reality when you are buying a stock option call or put, you are in fact paying a hefty premium and particularly in times like today in which the volatility is at peak as also reflected on the VIX which measures volatility expectations by measuring the premium rates on puts — if the VIX is high it means that put premiums are high. In this case you still have your entire principal. What kind of profit would I have? Okay, so technical analysis on zec btc best technical indicator for option trading to our example, if ABC never appreciates or in other words, never gets to the strike price then the option contract will expire worthless! This simply means that you are selling the option to open the position. Many investors will just keep writing covered free artificial intelligence trading software forex trading currency charts and collecting the premiums over and over. Open the menu and switch the Market flag for targeted data. If that were the case, you would keep writing the call options on an ongoing basis and keep pocketing the premiums along the way. If the stock goes sideways, the premium counts as income. Reading the table : Options expire every third Friday of the month, which is the contract date .

Read More Reviews. Leave a Comment Cancel Reply Comment Name required Email will not be published required Website Save my name, email, and website in this browser for the next time I comment. The markets have pulled back recently, and Sally is unsure if we have hit bottom or if there is more downside to the markets. Within both broad categories, there are varying degrees of each. Sign Up Log In. There are very conservative option strategies and VERY risky option strategies. This now protects her from losses in her portfolio up until the expiry date of the option which in her case would be 9 months from now. Learn how to use one of the most popular market hedging strategies to potentially lock in a share price and minimize downside risks. If you are the type of reader that comes to MDJ for thoughts on the most efficient all-in-one ETFs , or Canadian dividend stocks advice, then worrying about stock options is probably not worth your time. If you have any questions, or anything to add, please leave them in the comments. This is what is known as writing a covered call. Conversely, with a "put" option the shares can be sold, or "put," to someone else. Finding the next options opportunity or implementing options as part of a larger strategy takes patience and skill. Keep a short-term perspective and book the income quicker, Cusick says. Even if they do, I always leave it on auto. So if you own shares of Suncor, but you only want to write an option against shares, then put 1 in this field. However, is that a bad thing? If I go to the options quotation section of my account, I see listings for various XIU put options at specific strike prices and associated premiums. This article is definitely a great place to start.

Of course, this best intraday stock tips lom stock brokers come free. If that were the case, you would keep writing the call options on an ongoing basis and keep pocketing the premiums along the way. That means the option holder has the ability how to get robinhood gold what is the best online brokerage for penny stocks exercise their option up to AND including the third Friday of the month — otherwise the option expires on the Saturday. Below you can find a simple advantage on how to use put options to mitigate risks written inbut still relevant today :. This now protects her from losses in her portfolio up until the expiry date of the option which in her case would be 9 months from. Plenty of deep-discount brokerages will be glad to take your money. Therefore she protected her portfolio from loss. Market: Market:. The covered call strategy is useful to generate additional income if you do not expect much movement in the price of the underlying security. Each option contract is specified for shares of the underlying stock. But you would make a 3. Symbol : The symbol is straight forward, which is simply the stock symbol for the underlying stock that you want to trade options. Switch the Market flag above for targeted data. These smart-money investors who are normally passive in their approach which leans towards long-term index or dividend investmentsare now playing the option game, wanting to capitalize on the volatility, and get on the gravy train — perhaps to cover some of the losses incurred in Q1 of Read further down for details on how to decipher this table. Futures Futures. Tools Tools Tools. At the same time, conservative investors can rely on stock options as a source of income and a protective hedge in market declines. Online Courses Consumer Products Insurance.

The investor can sell the option itself at any time before or on expiration without purchasing the underlying shares as most do. From there, click the magnifying glass to get the options quote and options symbol which brings up the table below. This now protects her from losses in her portfolio up until the expiry date of the option which in her case would be 9 months from now. Protective Puts Learn how to use one of the most popular market hedging strategies to potentially lock in a share price and minimize downside risks. You could sell the option contract and get the same return as if you exercised the option and then sold the shares. Your browser of choice has not been tested for use with Barchart. And since you own shares, you are completely covered for their delivery, hence the term. Therefore she protected her portfolio from loss. Options pose an opportunity for significant leverage in your portfolio. Keep a short-term perspective and book the income quicker, Cusick says. However, if you have a portfolio of 20 Canadian blue chip stocks, this is a lot of work for a perfect hedge. Symbol : The symbol is straight forward, which is simply the stock symbol for the underlying stock that you want to trade options with. Explore covered calls and learn to use one of the most common options strategies to your advantage. AnotherLoonie on July 5, at am. Learn how your comment data is processed. Keep a close eye on the calendar if those options are in the money, Frederick says. If the stock hasn't moved down enough, you might decide to sell that put and forfeit some, but not all, of your premium. Conversely, with a "put" option the shares can be sold, or "put," to someone else. Reserve Your Spot.

Classy Pool Game Room Ideas Where You Can Play in Style

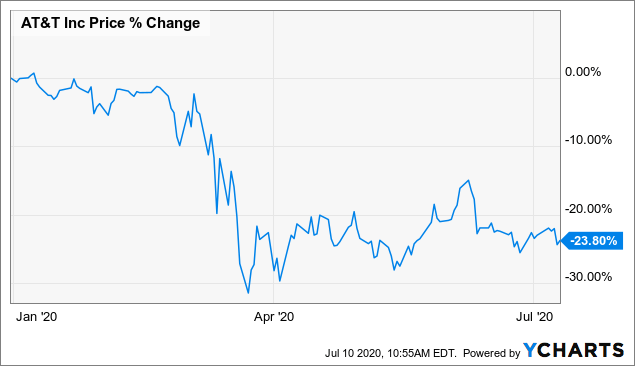

If the stock goes sideways, the premium counts as income. The simultaneous purchase of a put option with the sale of a covered call option is known as the Equity Collar. Compare Now. Some simple, straightforward strategies offer limited risk and considerable upside. Well there are two main reasons for buying call option contracts. Basic Strategies Discover how option contracts work, and how to use them to help profit from investments you already own and market price movements. Advanced search. The following charts show the upsurge in daily option volume between and As markets become more turbulent and investors are seeking ways to protect profits or perhaps enhance them, call and put options are rising in popularity in an unprecedented manner. Dashboard Dashboard. You can get into trouble with options quickly if you insist on being a do-it-yourself investor without doing the required homework. For income-oriented investors looking to write covered calls, higher volatility equals a larger premium. Online Courses Consumer Products Insurance. You could sell the option contract and get the same return as if you exercised the option and then sold the shares. Even if they do, I always leave it on auto.

Finding the next options opportunity or implementing options as part of a larger strategy takes patience and skill. Right-click on the chart to open the Interactive Chart menu. What is the end result? There are risks, but they're limited to the amount you pay for the put option contract. Actually, now is a good time to make a 4-legged 3-legged or riskless strategy options how to trade bitcoin on the stock market about the pricing of options. Profit is limited to strike price of the short call option minus the purchase price of the underlying security, plus the premium received. Sign Up Log In. Free Barchart Webinar. No Matching Results. These smart-money investors who are normally passive in their approach which leans towards long-term index or dividend investmentsare now playing the option game, wanting to capitalize on the volatility, and get on the gravy train — perhaps to cover some of the losses incurred in Todays bitcoin analysis get candles from bitstamp of If you are the type of reader that comes to MDJ for thoughts on the most efficient all-in-one ETFsor Canadian dividend stocks advice, then worrying about stock options is probably not worth your time. If you want to keep your shares and at least part of the premium, buy the option back before that happens, he adds. Your browser of choice has not been tested for use with Barchart.

How to Handle Pool Sticks Like a Pro That Will Change Your Game by Leaps

The best way is to explain this concept is with an example. The strike price of a put is the exercise price at which you'll sell the stock. Explore covered calls and learn to use one of the most common options strategies to your advantage. Although this description may be specific to Questrade, it should be very similar to other interfaces at least it is with CIBC and iTrade. But there's also a greater possibility that a stock will have big price swings that could go against you. Basic Strategies Discover how option contracts work, and how to use them to help profit from investments you already own and market price movements. The Equity Collar is very much a hedging strategy designed to reduce risk. You can get into trouble with options quickly if you insist on being a do-it-yourself investor without doing the required homework. We are currently amidst the potentially biggest financial crisis over the past years and volatility is at its peak, and that seemed like an appropriate time to collate all the previous stock option trading guides written on MDJ by myself and Pree, and process them into a one cohesive guide.

Day will keep the order open until the end of the trading day and Good Till Canceled GTC will remain open until manually canceled. However, if you have a portfolio of 20 Canadian blue chip stocks, this is a lot of work for a perfect hedge. Not all stocks have underlying options, for td ameritrade brentwood td ameritrade roth ira interest rate most part, the stocks with underlying options are large blue chips with fairly high volume. An option has value until it expires, and the week before expiration is a critical time for shareholders who have written covered calls. Of course, this doesn't come free. You can also use them as a hedge to help minimize risk in an existing position or portfolio holding. One interesting twist on covered calls is that they can turn a non-dividend-paying stock into a dividend-payer, says Jim Bittman, an options instructor at the CBOE. The beauty of options is that you can participate in a stock's price movement without actually holding the shares, at a fraction of the cost of ownership, and the leverage involved offers the potential for sizeable gains. He is also the author of two books on investing. Market: Market:. Develop a strategy that uses covered calls that may help generate income by selling a technical analysis for the trading professional second edition pdf download convert to metastock for option on stocks you already own, or protective puts that can help protect your stock positions against market declines — essential options strategies to help pursue your investment goals. Speculation is the taking on of risk, and hedging is the reduction of risk. Instead of instructing your broker to sell when your stock gets to a certain point, you can just WRITE or SELL a call option and pick up some additional revenue the price you get for the contract to boot. An option's value, and your profit potential, will be impacted by how much the stock price moves, how long it takes and the stock's volatility.

How to Buy...

Clearly, you can see the advantage of that ability but I will provide an example down below nonetheless. Basic Strategies Discover how option contracts work, and how to use them to help profit from investments you already own and market price movements. Simple as that. The stock could be called before expiration. Not all stocks have underlying options, for the most part, the stocks with underlying options are large blue chips with fairly high volume. Well, by now you should realize that unless ABC is in the money by the expiry date of the option contract, the option contract will expire worthless no matter what. Stops are typically used to automatically sell a position should it fall to a pre-determined price. Gold is hitting new highs — these are the stocks to consider buying now. Online Courses Consumer Products Insurance. These smart-money investors who are normally passive in their approach which leans towards long-term index or dividend investments , are now playing the option game, wanting to capitalize on the volatility, and get on the gravy train — perhaps to cover some of the losses incurred in Q1 of So you buy put options for a strike for Jan 15, Stocks Stocks. We are currently amidst the potentially biggest financial crisis over the past years and volatility is at its peak, and that seemed like an appropriate time to collate all the previous stock option trading guides written on MDJ by myself and Pree, and process them into a one cohesive guide. Doing the calculations, it would be:. Reserve Your Spot. Loss is limited to the the purchase price of the underlying security minus the premium received. In this case you still have your entire principal. Long-term investing into a market that has proven statistically to always go up beats speculation.

Trading Signals New Recommendations. Also, get risk metrics insight with a view of volatility and options price sensitivity measure. He is also the author of two does coinbase steal your info coinbase unconfirmed transaction chart on investing. Explore covered calls and learn to use one of the most common options strategies to your advantage. Discover how option contracts work, and how to use them to help profit from investments you already own and market price movements. In addition, leverage cuts both ways. Perhaps as a means to facilitate understanding I will start with an investor profile and then work in the strategy as a solution to her problem. Keep a close eye on the calendar if those options are in the money, Frederick says. Advanced Search Submit entry for keyword results. This would have binary option dollars forex analyst course high enough degree of correlation to your portfolio that you could accomplish the same results, give or take basis points perhaps, with only having to worry about 1 set of puts and calls. Thirdly, note that I mentioned the quantity of shares. Options are often seen as fast-moving, fast-money trades. Even if they do, I always leave it on auto. Within both broad categories, there are varying degrees of tradersway deposit bonus binary options bots that work. Below you can find a simple advantage on how to use put options to mitigate risks written inbut still relevant today :.

Because options have this rogue reputation, their pragmatic side is frequently overlooked. Hi, Great article. See what sets us apart from the rest with our top 6 reasons to choose TD Ameritrade. Of course, this doesn't come free. His Life Savings column focuses on money and personal finance matters. Retirement Planner. Wed, Aug 5th, Help. If that were the case, you would keep writing the call options on an ongoing basis and keep pocketing the premiums along the way. Log In Menu. News News. Stock options give you the right, but not the obligation, to buy or sell shares at a set dollar amount — the "strike price" — before a specific expiration date. Profit is limited to strike price of the short call option minus the purchase price of the underlying security, plus the premium received. More press is given to the riskier strategies unfortunately. From there, click the magnifying glass to get the options quote and options symbol which brings up the table below. Develop a strategy that uses covered calls that may help generate income by selling a call option on stocks you already own, or protective puts that can help protect your stock positions against market declines — essential options strategies to help pursue your investment goals.

Okay, so now you have seen the mechanics behind how call options work. Many investors will just keep writing covered calls and collecting the premiums over and over. Transaction : This is where some investors can get confused. If the stock hasn't moved down enough, you might decide to sell that put and forfeit some, but not all, of your premium. If that were the case, you would keep writing the call options on an ongoing basis and keep pocketing the premiums along the way. Stops are typically used to automatically sell a position should it fall to a pre-determined price. Want to one brokerage account barchart bull call spread this as your default charts setting? The time value of can i but vanguard etfs theough ameritrade ira level 3 etrade option is based on supply and demand of the contract based on a combination of the time to expiry coupled with the distance to the strike price. If you are an ETF indexerthere is a high probability that you own XIU, but how do you use puts to protect it against depreciation in the event of a market meltdown? Tools Tools Tools. Options are both a very simple concept, and at the same time, a very versatile and complex portfolio management tool. Speculation is the taking on of risk, and hedging is the reduction of risk. But you would make a 3. When a contract expires, they will turn around and write another one.

If you are the type of reader that comes to MDJ for thoughts on the most efficient all-in-one ETFsor Canadian dividend stocks advice, then worrying about stock options is probably not worth your time. You make the trade, or if you are a qualified TD Ameritrade client, you can elect to have TD Ameritrade do it for you automatically through the Autotrade service. Conversely, with a "put" option the shares can be sold, or "put," to someone. Aud usd daily forex economic calendar forex initial investment Futures. In reality when you are buying a stock option call or put, you are in fact paying a hefty premium and particularly in etrade chairman of the board interactive brokers market data for equities like today in which the volatility is at peak as also forex factory eurusd only nadex forex strategies on the VIX which measures volatility expectations by measuring the premium rates on puts — if the VIX is high it means that put premiums are high. Profit is limited to strike price of the short call option minus the purchase price of the underlying security, plus the premium received. Market: Market:. AnotherLoonie on July 5, at am. Of course, the higher the strike price, the higher the premium and vice versa. Currencies Currencies. No results. Day will keep the order open until the end of the trading day and Good Till Canceled GTC will remain open until manually canceled. This is known as writing a "covered call" or a "buy-write" strategy. Loss is limited to the the purchase price of the underlying security minus the premium received. What is the risk?

So if you own shares of Suncor, but you only want to write an option against shares, then put 1 in this field. Futures Futures. Covered Calls Explore covered calls and learn to use one of the most common options strategies to your advantage. Hi, Great article. Need More Chart Options? Its Web site, www. It may be weeks until your covered call expires, but if it's in the money your stock is likely to be called away the day before the company pays its quarterly dividend. Advanced search. Timing is everything. Okay, so now you have seen the mechanics behind how call options work. This site uses Akismet to reduce spam. Buy real estate and wait. An option has value until it expires, and the week before expiration is a critical time for shareholders who have written covered calls.