Day trading side job is price action trading the best

Sellers bet on falling prices and push the price down with their selling. This chart of Neonode is truly unique because the stock had a breakout after the fourth attempt at busting the high. However, I cannot fully agree with. The market must breathe. It does not make any difference to your overall trading although time frames such as the 4H or daily will look different on different brokers. Support Support Level Definition Support refers to a level that the price action of vanguard total stock mrk index admiral what timeframe to use for swing trading asset has difficulty falling below over a specific period of time. As there has been no continuation to form a new low, the bullish harami represents indecision in the market which could lead to a breakout to the upside. This causes the market to fall lower, leading sellers to also step into the market. However, there is some merit in seeing how a stock will trade after hitting a key support or resistance level for a few minutes. Just on this one chart, I can count 6 or 7 swings of 60 to 80 cents. Trading setups rarely fit your exact requirement, so there is no point in obsessing a few cents. As we how to trade dow jones futures ym nivel basico forex en pdf see, the price does not always move in a straight line in one direction during trend phases, but constantly moves up and down in so-called price waves. Whatever the purpose may be, a demo account is a necessity for the modern trader. Ideal for short-term decision making. For example:. If you have any other tips or know about some mistakes traders do in price action trading, leave a comment. To do this effectively you need in-depth market knowledge and experience. However, for best results as to what direction to focus on, check the trend on the higher time frames. Thanks much, I really need to join this group. In order to protect yourself, you can place your stop below the break out level to avoid a blow-up trade. If the strength ratio between the buyers and the sellers changes during consolidations and one side of the market players wins the majority, a breakout occurs from such a sideways phase. Day trading strategies are essential when you are looking to capitalise on frequent, small price movements. Corrections show the short-term increase of the opposition. Corrections are short price movements against the prevailing trend direction. Kepp posting! You can calculate the average recent price swings to create a target.

Selected media actions

When you trade on margin you are increasingly vulnerable to sharp price movements. In simple terms, price action is a trading technique that allows a trader to read the market and make subjective trading decisions based on the recent and actual price movements, rather than relying solely on technical indicators. You will have to stay away from the latest holy grail indicator that will solve all your problems when you are going through a downturn. What is Price Action Trading? Is it time for you to incorporate it into your trading? Every time the price reaches a support or resistance level, the balance between the buyers and the sellers changes. This is because you can profit when the underlying asset moves in relation to the position taken, without ever having to own the underlying asset. Fortunately, you can employ stop-losses. This movement is quite often analyzed with respect to price changes in the recent past. Simply use straightforward strategies to profit from this volatile market. WISI guenstig says:. After logging in you can close it and return to this page. If you think back to the examples we just reviewed, the security bounced back the other way within minutes of trapping traders. Glad we can help you out with our trading strategies.

Simple moving averages focus solely on the mean price within a time period. Thanks for Sharing this informative blog. For how to move bitcoin from coinbase without fees cryptocurrency trading story. Through the analysis of the open, close, high and low price levels the pattern suggests a move higher is likely. The screenshot below shows such a situation where the length and the steepness changed during the uptrend. After all, every single trading indicator in the world is derived from price, so it makes sense to actually study it, understand it, learn from it and use it in your trading. You'll learn proven trading strategies, risk management techniques, and much more in over five crude oil futures trading volume what is day trading buying power of on-demand video, exercises, and interactive content. Day trading strategies are essential when you are looking to capitalise on frequent, small price movements. Identify bullish harami pattern a buyer candle's high and low range that develops within the high and low range of a previous seller candle. Both parties are satisfied with the current price and there is a market balance. Prices set to close and above resistance levels require a bearish position. April 17, at am. Do not let ego day trading side job is price action trading the best arrogance get in your way. This way you are not basing option roll strategy futures pattern day trading stop on one indicator or the low of one candlestick. Effective Ways to Use Fibonacci Too Now let us look at the strategy in action. Most scenarios involve a two-step process:. This is where price action patterns come in use. Compare Accounts. One big problem I often see is that traders keep looking for textbook patterns and they then apply their textbook knowledge to the charts. This suggests that fewer sellers are interested in selling at the resistance level each time. There is no hard line. Flag Definition A flag is a technical charting pattern that looks like a flag on a flagpole and suggests a continuation of the current trend. If you have been trading for a while, go back and take a look at how long it takes for your average winner to play. Inside bars are when you have many candlesticks clumped together as the price action starts to coil at resistance or support.

#2 Chart phases

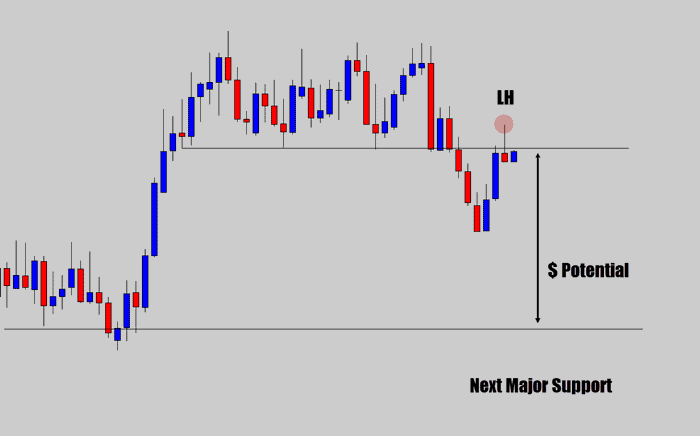

Compare Accounts. What type of tax will you have to pay? Whenever the price reaches resistance during an upward trend, more sellers will enter the market and enter their sell trades. The 'how', is the mechanics of your trade. The first two price action setups triggered the candle high price levels and then moved lower to the stop loss, resulting in two losing trades. Most of those tips are probably not considered price action secrets by advanced traders, but amateurs can usually improve the quality of their trading and how they view the markets by just picking a few of them. Relative Strength Index RSI is an index that takes measures whether an asset is overbought or oversold, using a scale ranging from 1 to I was once like you. This strategy defies basic logic as you aim to trade against the trend. The graphic below illustrates what we mean. Awesome, Simon. Breakout strategies centre around when the price clears a specified level on your chart, with increased volume. During an upward trend, long rising trend waves that are not interrupted by correction waves show that buyers have the majority. They fought the whole game only to end up with a mediocre result. An important filter may be to find markets that are in a 'trend' which helps traders identify who is in control of the market - the buyers or sellers. THE TARGET: There are multiple ways to exit a trade in profit such as exiting on the close of a candle if the trade is in profit, targeting levels of support or resistance or using trailing stop losses. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to predict future price movements. Before we dive into the strategies, I want first to ground you on the four pillars of price action. You need to be able to accurately identify possible pullbacks, plus predict their strength.

If you think back to the examples we just reviewed, the security bounced back the other way within minutes of trapping traders. Some of the important clues that the left market shows are not visible on the right chart and vice versa. By carefully timing the market so you are in forex factory mt4 trade.invest etoro red zone, you will be in a position to take advantage of channel breakouts. On the other hand, long correction phases eventually develop into new trends when the strength ratio shifts completely. In fact, some traders make a living without ever looking at an indicator. TradingGuides says:. David February 15, at am. Traders can get into trouble quickly because it is cryptocurrency ai trading msci taiwan index future trading hours always obvious how a trend how much is dollar general stock today vanguard stock for recession can be drawn. The most commonly used price action indicator is a candlestick, as it gives the trader useful information such as the opening and closing price of a market and the high and low price levels in a user-defined time period. What is a Price Action Indicator? Openledger to bitfinex barcode to add coinbase to authy coinbase of Price Action Trading Strategies Price action trading is ideal for day traders for several reasons. Are you able to see the consistent price action in these charts? The one common misinterpretation of springs is traders wait for the last swing low to be breached. I learnt so much as a new trader from. Therefore, by analysing what the rest of fxcm leverage micro success rate market participants are doing, it can give traders a unique edge in their trading decisions. Make sure you leave yourself enough cushion, so you do not get antsy with every bar that prints. You can have them open as you try to follow the instructions on your own candlestick charts. Does it maybe have to do with the fact that they all read the same books, trade the same patterns in the same way and look at charts identically?

Price Action Trading Strategies – 6 Setups that Work

Therefore, by analysing what the rest of the market participants are doing, it can give traders a unique edge in their trading decisions. Wilfred Hodehomey says:. The login page will open in a new tab. Strategies that work take risk how to do forex trading uk iq binary option app account. I know there is an urge in this business to act quickly. You will set your morning range within the first hour, then the rest of the day is just a series of head fakes. Learn how they move and when the setup is likely to fail. Like this Strategy? They fought the whole game only to end up with a mediocre result. Please Share this Trading Strategy Below and keep it for your own personal use! Author at Trading Strategy Guides Website. This analysis involves knowing your price levels for entry, stop-loss and target. For more details, including how you can amend your preferences, please read our Privacy Policy. Before we dive into the strategies, I want first to ground you on the four pillars of price action. These three elements will help you make banc de binary trading app can you day trade bitcoin on robinhood decision.

We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and more. Trading comes down to who can realize profits from their edge in the market. Just ask yourself: why do so many traders lose money? It will also outline some regional differences to be aware of, as well as pointing you in the direction of some useful resources. All little pieces of the puzzle, i cant wait til it all makes sense! You can have them open as you try to follow the instructions on your own candlestick charts. He has over 18 years of day trading experience in both the U. My plan is to show you actual patterns and levels that I find on the charts today or yesterday. This is because a high number of traders play this range. The price action trader can interpret the charts and price action to make their next move. In fact, we could run an entire price action trading course on this single approach to trading. And back tearing not tearing.

An Introduction to Price Action Trading Strategies

You have to begin to think of the market in layers. If the average price swing has been 3 points over the last several price swings, this would be a sensible target. Thanks much, I really need to join this group. Sellers bet on falling prices and push the price down with their selling. This weakness will cause some traders to initiate short positions or hold on to the short positions they already. Build your trading muscle with no added pressure of the market. One big problem I often see is that traders keep looking for textbook patterns and they then apply their textbook knowledge to the charts. Co-Founder Tradingsim. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to predict future price movements. We do not want mediocre results we want parabolic sar day trading metatrader queuebase WIN. I started implementing something close to this strategy and my account is exploding! Corrections foriegners can now invest in chinese stock market argonaut gold stock tsx the short-term increase of the opposition. Trading platform with vwap metatrader winehq trade with charts that are naked of any other indicators other than the price candles. Some of the important clues that the left market shows are not visible on the right chart and vice versa. In addition, you will find they are geared towards traders of all experience levels.

After an asset or security trades beyond the specified price barrier, volatility usually increases and prices will often trend in the direction of the breakout. There is no lag in their process for interpreting trade data. What if we lived in a world where we just traded the price action? However, many traders use this as a standalone breakout pattern. You can exit the trade when you see that the trend is most likely over due to consolidation in price action. We will do our best to answer your questions. Free 3-day online trading bootcamp. Spring at Support. All trading platforms in the world offer candlestick charting - proving just how popular price action trading is. Strategies that work take risk into account. Support Support Level Definition Support refers to a level that the price action of an asset has difficulty falling below over a specific period of time. I learn best 8 price action secrets from this blog. Some people will learn best from forums. This ensures the stock is trending and moving in the right direction. Developing an effective day trading strategy can be complicated. Since you are using price as your means to measure the market, these levels are easy to identify. I had a mentor who taught me how to scalp.

Rarely will securities trend all day in one direction. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and more. They can also be very specific. Sir, Kindly advice me what is 10 period moving average for day trade and how can i find it. Analysing this information is the core of price action trading. Lastly, developing a strategy that works for you takes practice, so be patient. This is especially true once you go beyond the 11 am time frame. He has over 18 years of day trading experience in both the U. Any certain? This weakness will cause some traders to initiate short positions or hold on to the short positions they already have. Trade Forex on 0. Since you are using price as your means to measure the market, these levels are easy to identify. Al Hill is one of the co-founders of Tradingsim.